At present, the group is registered with the Hong Kong SFC and is licensed to conduct securities-related businesses, including Type 1 (Dealing in securities), Type 4 (Advising on securities), Type 6 (Advising on Corporate Finance), and Type 9 (Asset Management) regulated activities in Hong Kong. It also holds money lender license in Hong Kong. Since its establishment, the group has grown steadily and has become a comprehensive financial service provider in Hong Kong. In addition, the group also grasps the development opportunities in the motherland. Its PRC domestic subsidiary holds QFLP and QDIE qualifications, this together with the family office wealth management business form the core business block to serve the cross-border financial needs between China and Hong Kong.

What is HKIFS?

HKIFS stands out for its regulated status under the Securities and Futures Commission (SFC) in Hong Kong and its provision of various means of contact for customer support, ensuring accessibility and accountability. However, it falls short in offering educational content and lacks support for forex and cryptocurrency trading, limiting options for users.

Pros and Cons of HKIFS?

HKIFS, regulated by the Securities and Futures Commission (SFC) in Hong Kong, ensures transparency and adherence to regulatory standards, instilling confidence in investors. While the platform offers various means of contact for customer support, facilitating ease of communication, it falls short in providing educational content to users, which may hinder knowledge acquisition and informed decision-making. Additionally, HKIFS does not support forex and cryptocurrency trading, limiting trading options for users. Furthermore, the platform offers a limited range of account types, which may restrict flexibility for investors seeking tailored solutions.

Is HKIFS safe?

Regulations HKIFS is currently licensed by the Securities and Futures Commission(SFC) in Hong Kong, with license numbers AAB856 and ABT748.

Safety Measures

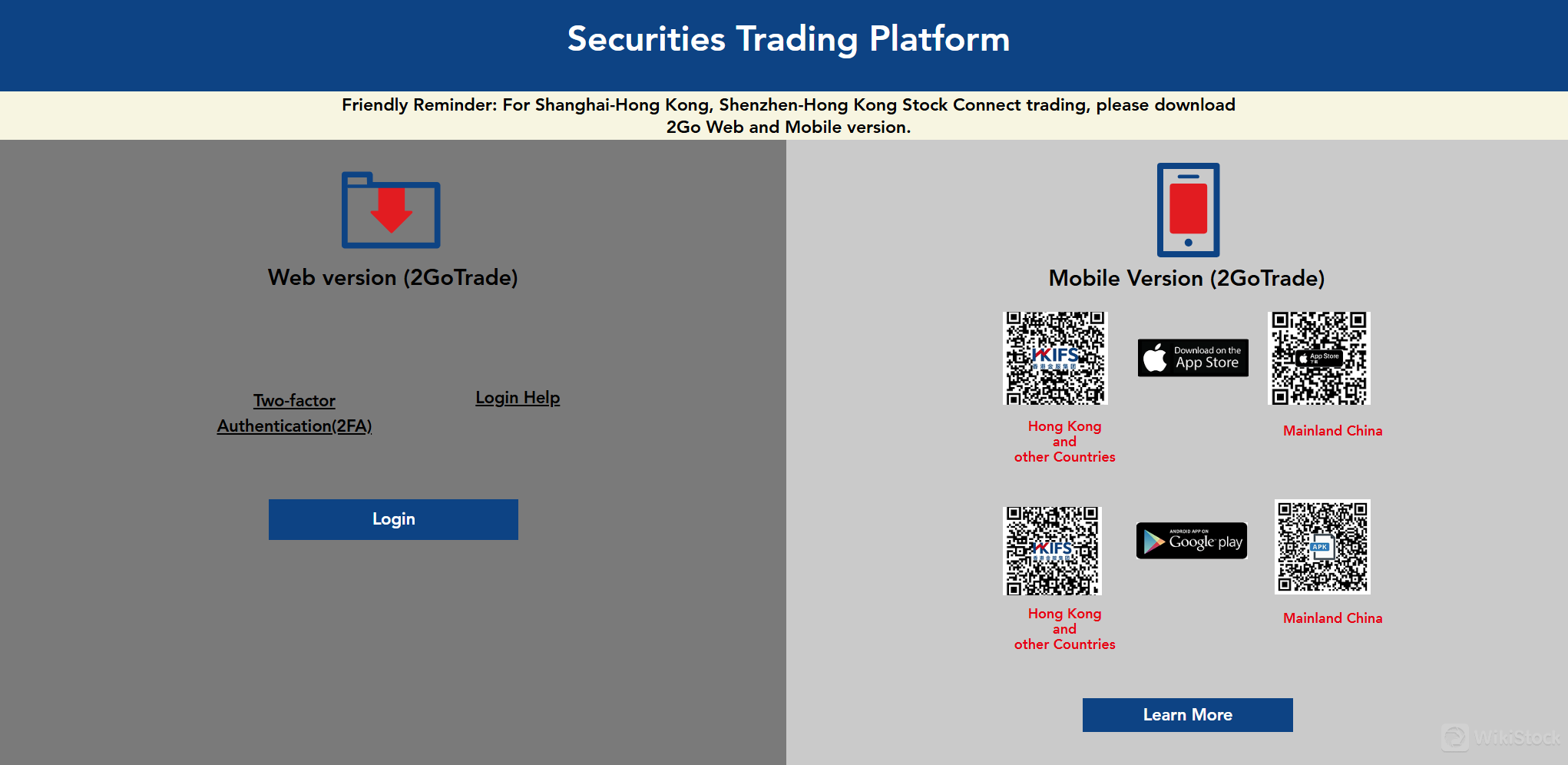

HKIFS employs safety measures, including Two-factor Authentication (2FA), to enhance security and prevent hacking. The Securities and Futures Commission (SFC) mandates the implementation of 2FA for client logins to online investment accounts.

What are securities to trade with HKIFS?

HKIFS offers stocks, including access to Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect. However, it does not provide options, futures, or cryptocurrency trading.

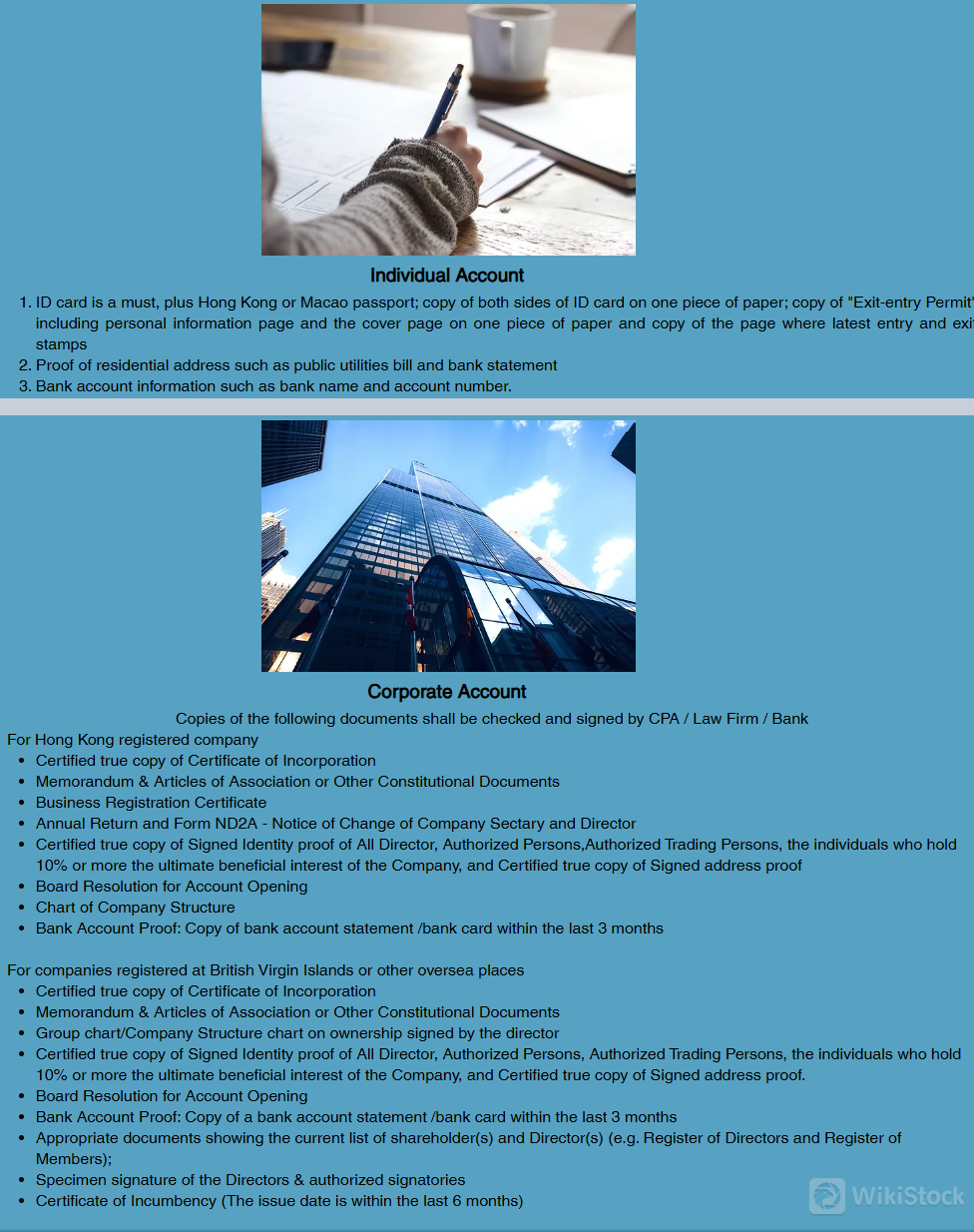

HKIFS Accounts

HKIFS offers two primary types of accounts: Individual Accounts and Corporate Accounts.Individual Accounts: Designed for personal investors, Individual Accounts provide access to stocks.Corporate Accounts: Tailored for businesses, Corporate Accounts offer options and financial services to meet the unique needs of corporate clients.

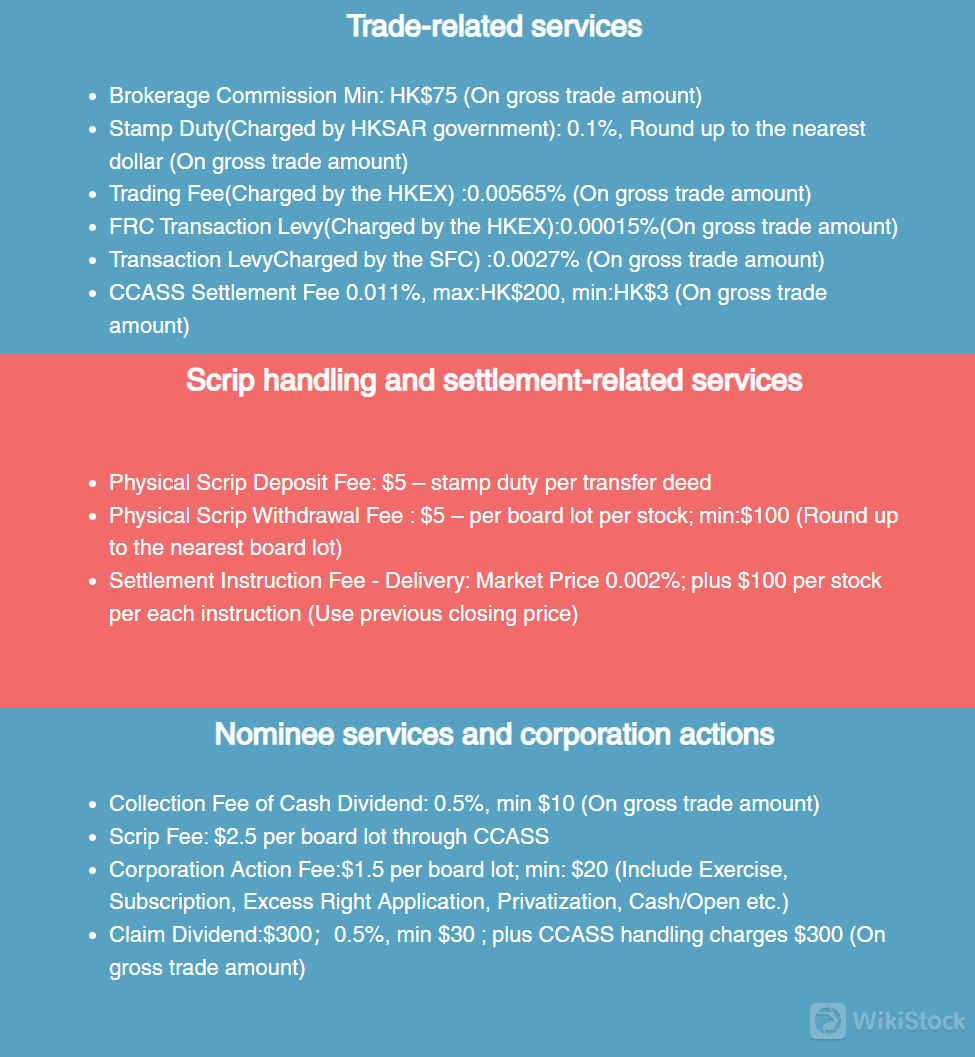

HKIFS Fees Review

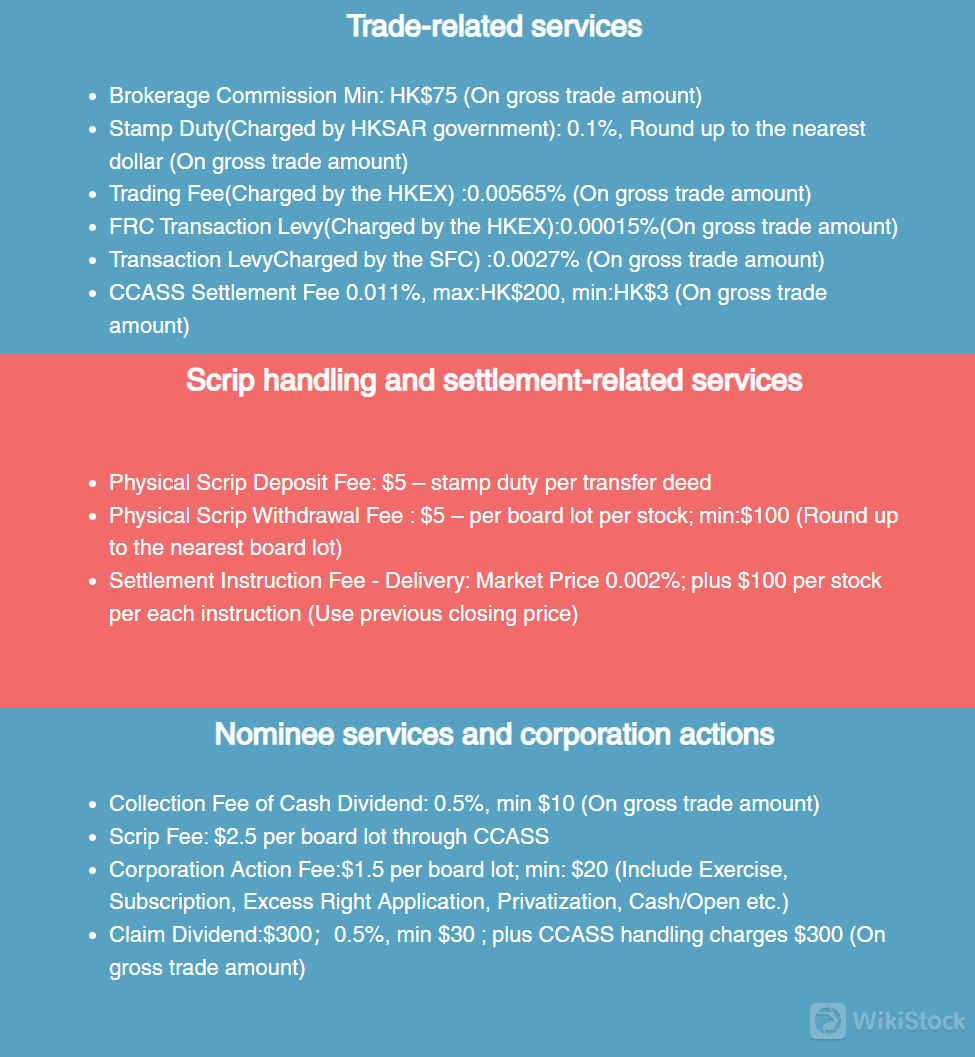

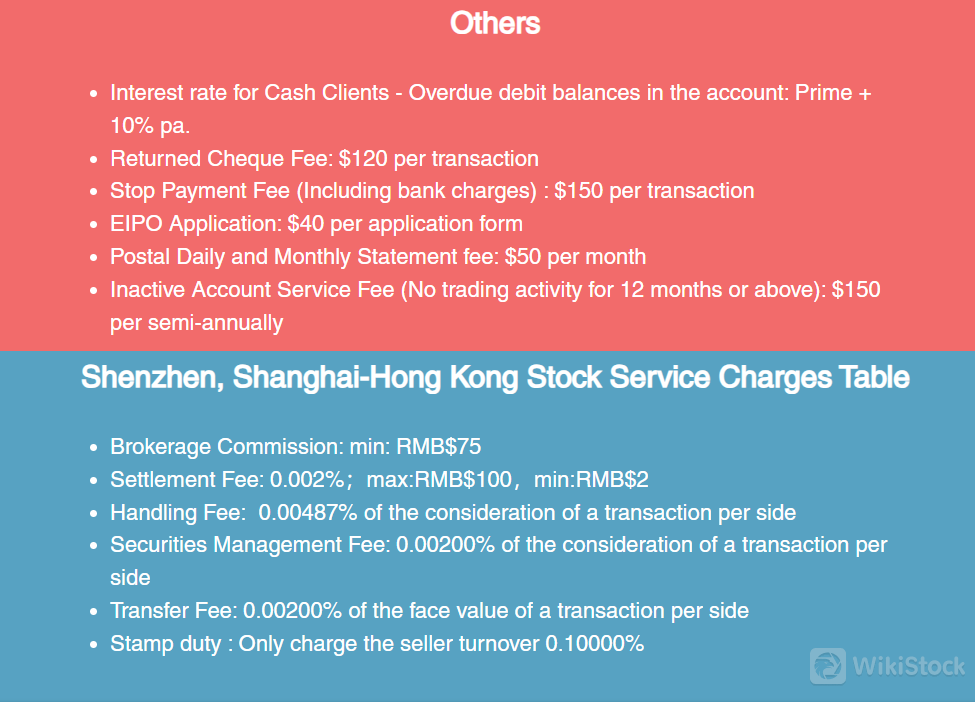

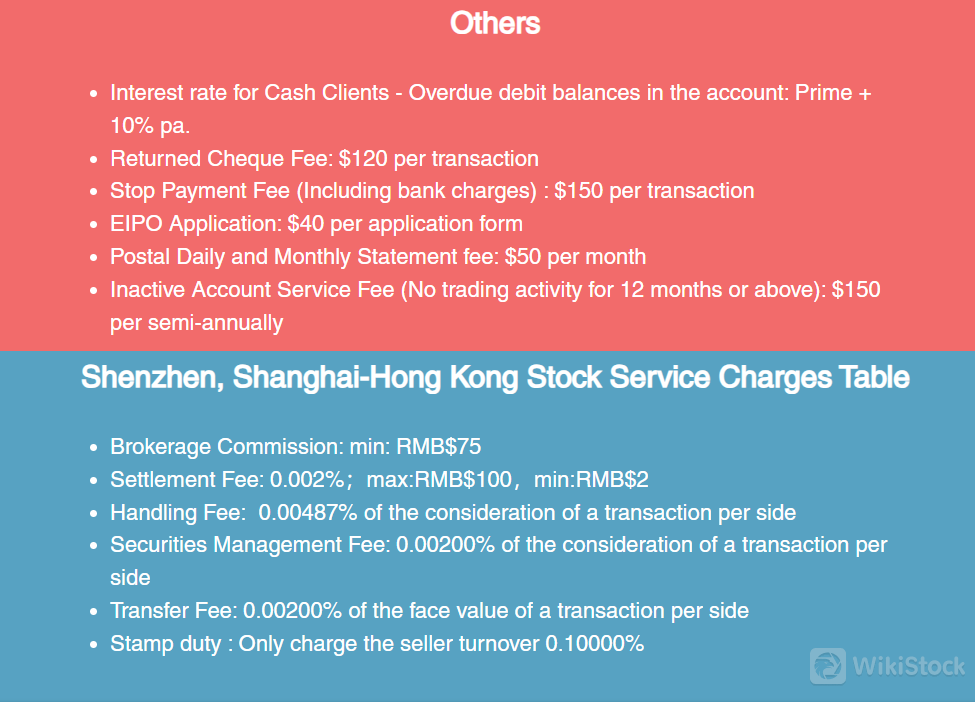

For Trade-related services, the brokerage commission is a minimum of HK$75 on the gross trade amount. The HKSAR government charges a stamp duty of 0.1%, rounded up to the nearest dollar, on the gross trade amount. Additional fees include a trading fee of 0.00565% and an FRC transaction levy of 0.00015%, both charged by the HKEX, as well as a transaction levy of 0.0027% charged by the SFC. The CCASS settlement fee is 0.011% of the gross trade amount, with a maximum of HK$200 and a minimum of HK$3. For Shenzhen and Shanghai-Hong Kong Stock Connect services, the brokerage commission is a minimum of RMB¥75. The settlement fee is 0.002% of the transaction amount, capped at RMB¥100 and with a minimum of RMB¥2. Other charges include a handling fee of 0.00487% of the transaction consideration per side, a securities management fee of 0.00200% per side, a transfer fee of 0.00200% of the face value per side, and a stamp duty of 0.10000% of the seller's turnover.

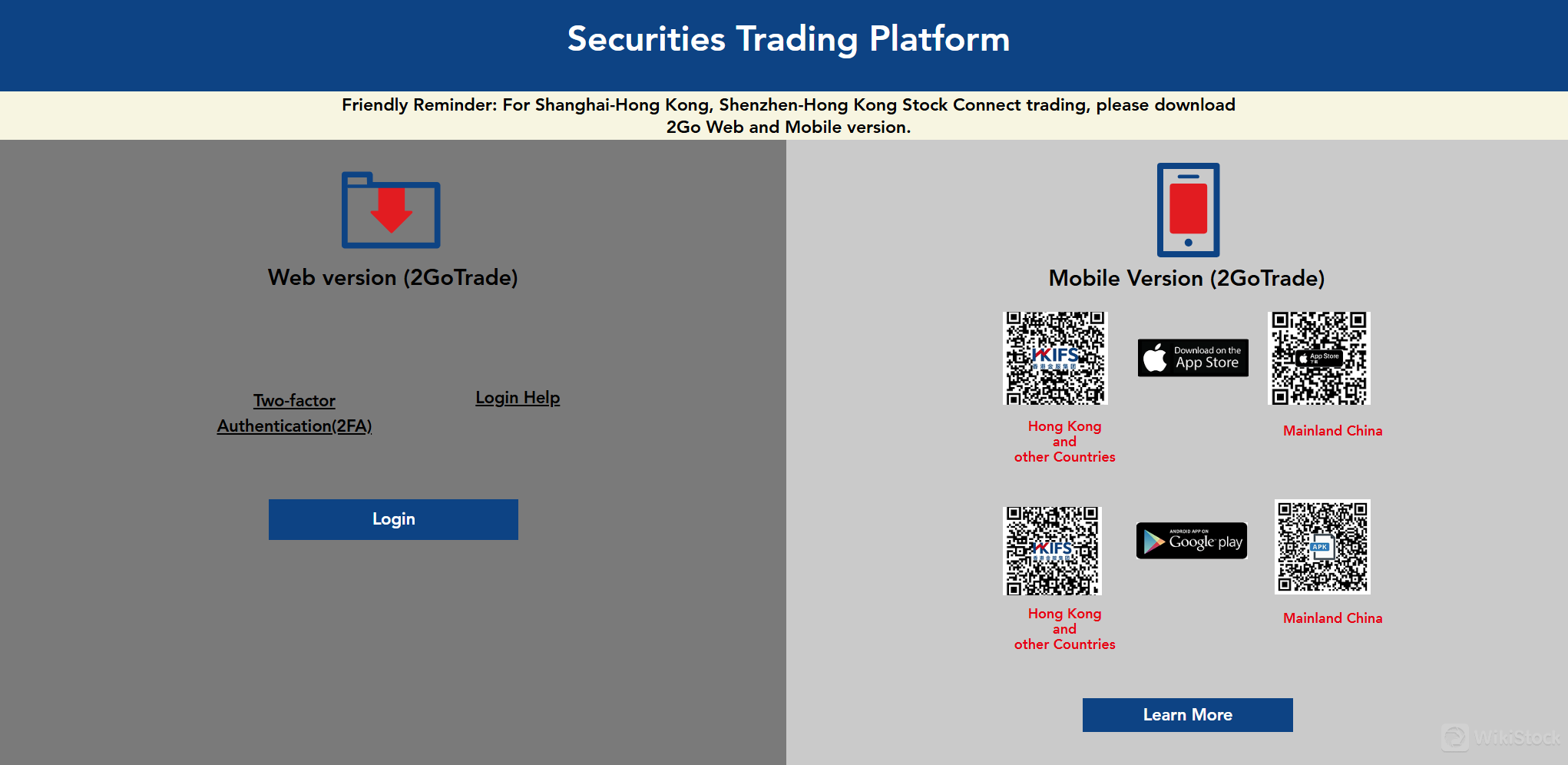

HKIFS App Review

HKIFS offers versatile trading platforms to suit different needs, including a web version and a mobile version, both powered by 2GoTrade.

Customer Service

HKIFS offers comprehensive customer service support across various aspects of trading and account management. For inquiries related to account opening and fee enquiries, individuals can contact HKIFS via telephone at (+852) 2853 8038 or (+852) 2853 8000, or through email at hkics@hkifsgroup.com. Additionally, for settlement and fund transactions, individuals can reach out to HKIFS at (+852) 2853 8084, (+852) 2853 8038, or (+852) 2853 8012, with further communication options available via fax at (+852) 2815 5652 or email athkics@hkifsgroup.com. For queries regarding securities trading, customers can connect with HKIFS via telephone at (+852) 2853 8027 or (+852) 2853 8030. In case of complaints or dissatisfaction with services provided, individuals are encouraged to contact HKIFS directly at (+852) 2853 8038 or through email at hkics@hkifsgroup.com. Alternatively, if resolution is not achieved, customers have the option to seek assistance from the Financial Dispute Resolution Center by telephone at (+852) 3199 5100 or via email at fdrc@fdrc.org.hk.

Conclusion

HKIFS stands out as a regulated brokerage under the Securities and Futures Commission (SFC) in Hong Kong, providing reliability and compliance assurance for investors. Offering a variety of contact options for customer support, it ensures accessibility and assistance for users. HKIFS is particularly suitable for investors who value regulatory oversight and seamless access to customer service.

FAQs

Is HKIFS safe for trading?

HKIFS is licensed by the Securities and Futures Commission (SFC) in Hong Kong, ensuring regulatory compliance. Safety measures such as Two-factor Authentication (2FA) are implemented to enhance security and protect clients' accounts.

Is HKIFS suitable for beginners?

While HKIFS offers versatile trading platforms, it lacks educational resources, which may pose challenges for beginners seeking guidance and learning opportunities.

Is HKIFS legitimate?

HKIFS is licensed by the Securities and Futures Commission (SFC) in Hong Kong, holding license numbers AAB856 and ABT748, thus confirming its legitimacy.

Risk Warning

The details presented are derived from WikiStock's proficient analysis of the brokerage's website data and are subject to potential updates. Furthermore, engaging in online trading carries significant risks, including the possibility of losing all invested funds. Therefore, it is essential to thoroughly understand the associated risks before participating in any trading activities.

China Hong Kong

China Hong Kong Obtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--

--

--