Established upon approval from the China Securities Regulatory Commission (CSRC) on June 14, 2006, GF Holdings (Hong Kong) Corporation Limited (GF Holdings (HK) is a Hong Kong-based wholly-owned subsidiary of GF Securities Co., Limited (stock code: 000776.SZ, 1776.HK), and is responsible for managing its businesses in Hong Kong and overseas markets. GF Holdings (HK), through its subsidiaries, is registered with the Hong Kong Securities and Futures Commission and is licensed to conduct type 1, 4, 6 and 9 regulated activities. It offers comprehensive cross-border financial services including brokerage and wealth management, corporate finance, asset management and investment management to corporate, institutional and retail clients in Hong Kong and overseas.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

What is GF Holdings (HK)?

GF Holdings (HK) is a prominent financial services provider based in Hong Kong, offering a diverse range of investment products and services to clients. Established in 2006, the company operates under the regulatory oversight of the Securities and Futures Commission of Hong Kong (SFC), ensuring adherence to stringent financial standards. GF Holdings (HK) prides itself on its comprehensive suite of offerings, which include equity trading, global equity trading, stock connect, mutual funds, bonds, structured notes, insurance services, wealth management solutions, and much more.

With a commitment to providing personalized advice and tailored solutions, GF Holdings (HK) aims to help clients achieve their long-term financial goals while navigating the complexities of the global financial markets.

Pros & Cons

Pros:

Comprehensive Range of Services: Offers diverse financial products and services, including equity trading, bonds, mutual funds, insurance, and wealth management.

Regulatory Compliance: Regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring adherence to high standards of financial operations.

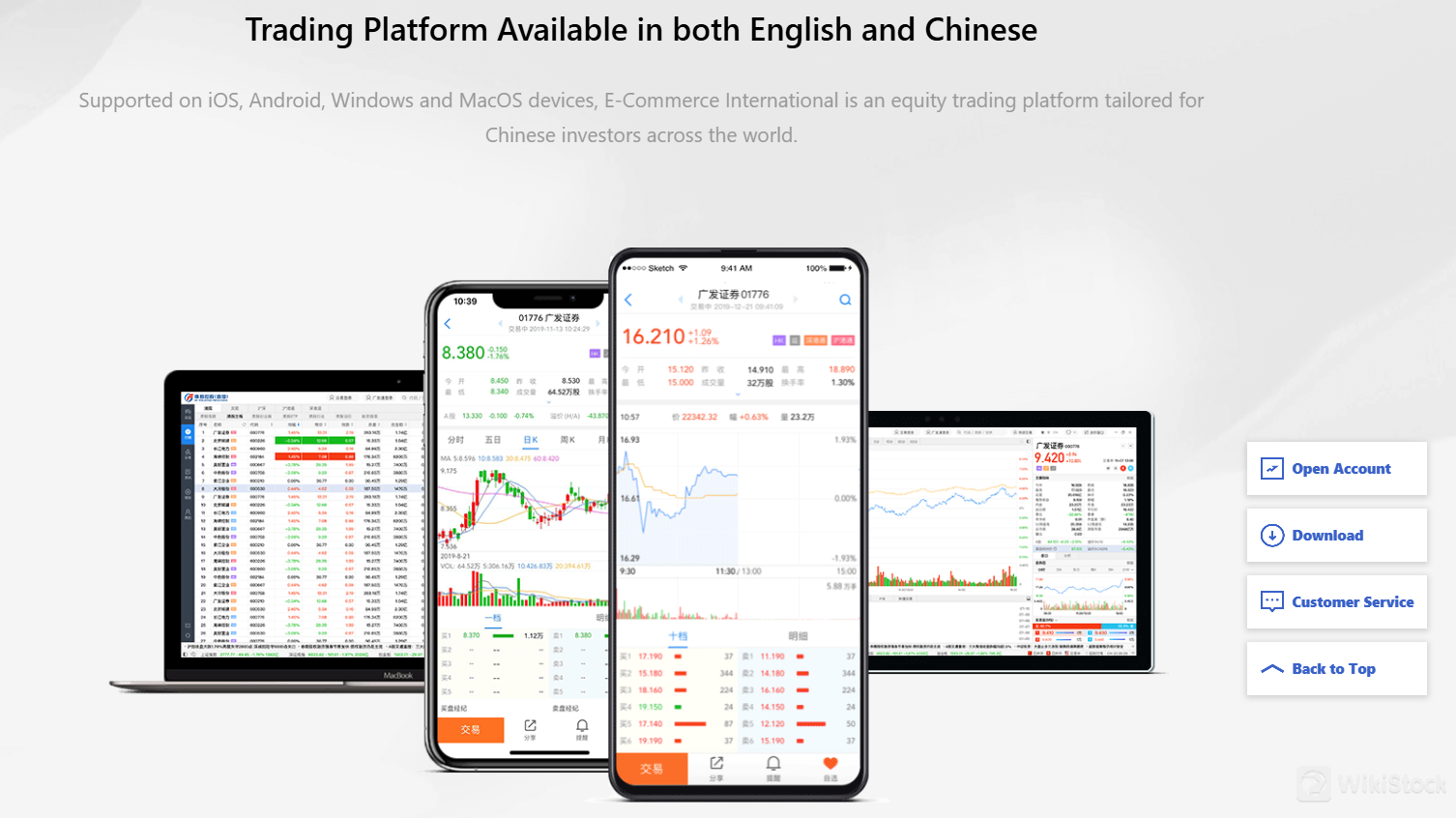

Advanced Trading Platform: Provides a versatile trading platform accessible on multiple devices (iOS, Android, Windows, MacOS), available in both English and Chinese.

Extensive Customer Support: Offers multiple channels for customer support including phone, fax, email, and physical address.

Cons:

Unspecified Leverage and Minimum Deposit: Key trading details such as leverage and minimum deposit requirements are not mentioned.

Lack of Promotional Offers: No mention of promotional offers or incentives for new clients.

Regulatory Status

GF Holdings (HK) operates under the regulatory jurisdiction of several prominent global financial authorities.

In China Hong Kong, it is regulated by the Securities and Futures Commission of Hongkong (SFC) under license No. AOB364.

Furthermore, it holds a license (No. APV768) from the Securities and Futures Commission of Hongkong (SFC).

This extensive regulatory background indicates GF Holdings (HK)' commitment to adhering to the highest standards of financial operations, providing a reliable trading environment for its clients.

Tradable Securities

Investment Opportunities:

Equity Trading: Access both Hong Kong and global equity markets through their platforms, allowing you to trade stocks from various countries and regions.

Stock Connect: Invest seamlessly in mainland China's A-shares through the Stock Connect program, providing exposure to a vast and dynamic market.

Mutual Funds and Bonds: Choose from a wide selection of mutual funds and bonds to diversify your portfolio and manage risk.

Structured Notes: Gain access to structured investment products tailored to specific risk and return objectives.

Wealth Management and Insurance:

Wealth Management Services: Benefit from personalized wealth management advice and solutions designed to help you achieve your long-term financial goals.

Hong Kong Insurance: Secure your future and protect your loved ones with a range of insurance products, including life, health, and property insurance.

Trust Services: Establish trusts for wealth preservation, inheritance planning, and charitable giving.

Additional Services:

Capital Investment Entrant Scheme (ClES): Facilitate your immigration process to Hong Kong through the ClES program.

HK Stock Options: Trade options on Hong Kong stocks for advanced investment strategies.

Research Services: Stay informed with in-depth market research and analysis provided by GF Holdings (HK)'s team of experts.

Margin Financing Services: Access leverage to amplify your investment potential.

Commissions & Fees

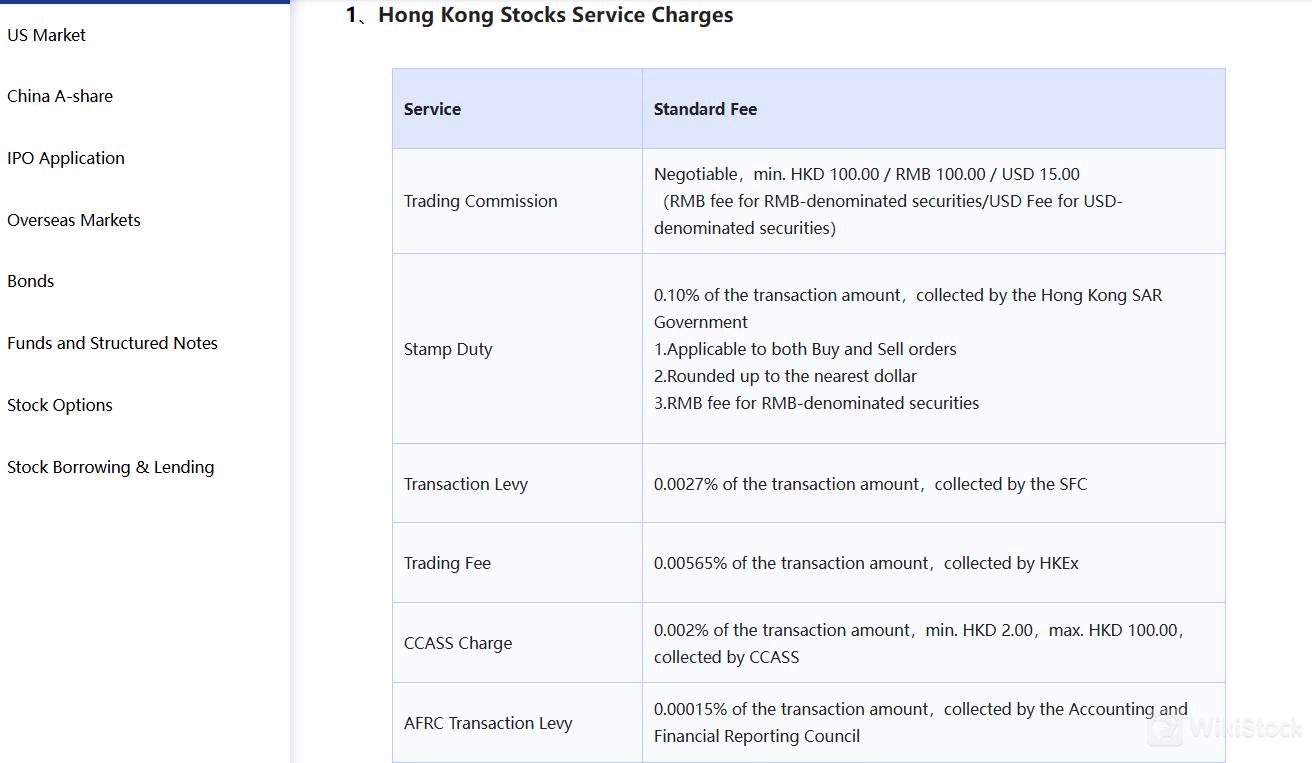

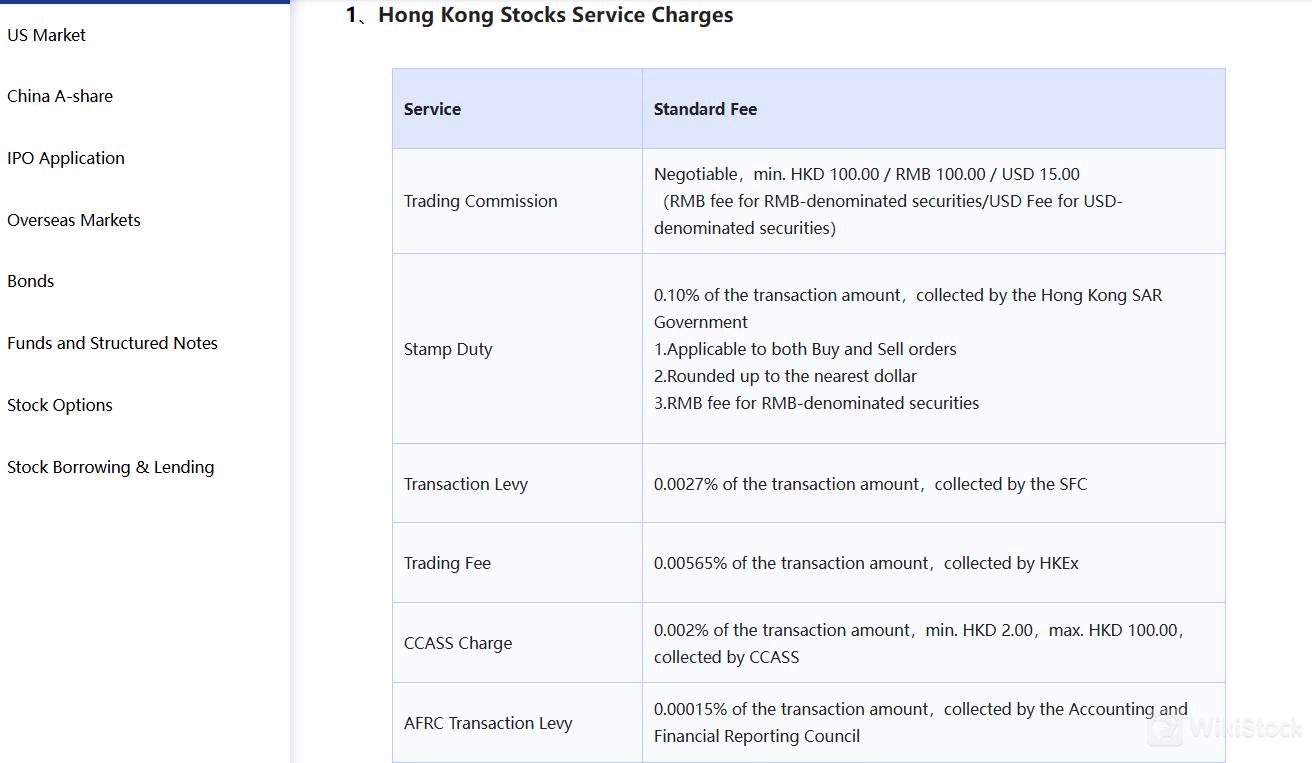

GF Holdings (HK) offers competitive commission rates for trading Hong Kong stocks. Their commission structure is negotiable, but there is a minimum fee of HKD 100, RMB 100, or USD 15, depending on the currency of the traded security. This ensures transparency and predictability for clients.

Beyond the broker commission, several other fees apply when trading Hong Kong stocks.

Trading Fee: A fee of 0.00565% of the transaction amount is collected by the Hong Kong Exchanges and Clearing Limited (HKEx).

Stamp Duty: The Hong Kong SAR Government levies a stamp duty of 0.10% on the transaction amount.

Applies to both buy and sell orders.

Rounded up to the nearest dollar.

RMB fee for RMB-denominated securities.

Transaction Levy: The Securities and Futures Commission (SFC) collects a transaction levy of 0.0027% of the transaction amount.

CCASS Charge: The Central Clearing and Settlement System (CCASS) charges a fee of 0.002% of the transaction amount, with a minimum of HKD 2.00 and a maximum of HKD 100.00.

AFRC Transaction Levy: The Accounting and Financial Reporting Council (AFRC) collects a transaction levy of 0.00015% of the transaction amount.

Note:

The commission rates listed are for reference only and may be subject to change at any time without prior notice.

For the most accurate and up-to-date information on commission fees, it's recommended to contact GF Holdings (HK) directly.

GF Holdings (HK) supports combined-trades, which can offer cost savings for multiple orders placed simultaneously.

More specific fee structures can be found on their official website through the provided link: https://gfse.gfgroup.com.hk/en/fee/stock.

Platforms

GF Holdings (HK) provides a versatile and user-friendly trading platform, designed to cater to a broad range of trading preferences and technical needs. Their E-Commerce International trading platform is accessible on multiple devices, including iOS, Android, Windows, and MacOS, ensuring that clients can manage their investments seamlessly across different operating systems.

The platform is available in both English and Chinese, making it accessible to a diverse global audience. With its intuitive interface and robust features, the GF Holdings (HK) trading platform offers real-time market data, advanced charting tools, and a variety of order types, empowering traders to make informed decisions and execute trades efficiently from virtually any device.

Customer Service

GF Holdings (HK) offers a comprehensive and accessible customer service network designed to assist clients with their trading needs and inquiries.

The customer service team is available by phone at +852 3719 1111, providing direct assistance for urgent matters. For written communication, clients can send faxes to +852 2907 6171 or emails to seccs@gfgroup.com.hk, ensuring that all types of queries and issues can be addressed promptly. Additionally, the physical address of the company is 27/F, GF Tower, 81 Lockhart Road, Wan Chai, Hong Kong, where clients can also direct their correspondence.

Conclusion

In conclusion, GF Holdings (HK) presents itself as a well-rounded financial services provider with a wide range of products and services, from equity trading to wealth management and insurance. The company is regulated by the SFC, ensuring compliance with high standards of financial operations. However, clients need to be aware of the commission fees and the lack of certain services, such as a demo account. For those looking for a reliable and diversified investment platform, GF Holdings (HK) offers a robust option, though it is always advisable to consider all aspects and conduct thorough research before making any investment decisions.

Frequently Asked Questions (FAQs)

Is GF Holdings (HK) regulated by any financial authority?

Yes, it is regulated by SFC.

What types of securities can I invest in with GF Holdings (HK)?

GF Holdings (HK) offers HK Equity Trading, Global Equity Trading, Stock Connect, Mutual Funds, Bonds, Structured Notes, Hong Kong Insurance, Trust Services, Capital Investment EntrantScheme (ClES), HK Stock Options, Wealth Management Services, Research Services, Margin Financing Services, ESOP, and eSave, etc.

What is the minimum commission fee for trading Hong Kong stocks with GF Holdings (HK)?

The minimum commission fee for trading Hong Kong stocks is HKD 100, RMB 100, or USD 15, depending on the currency of the traded security. Commission rates are negotiable.

Is GF Holdings (HK) suitable for beginners?

GF Holdings (HK) may not be the most suitable option for beginners due to its extensive range of services and the complexity of its financial products.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

United States

United StatesObtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--

--

--

--

--

--

--