At Spreadex Trading, we’ve always wanted to allow our customers to find a broker that genuinely values their personal trading experience. This means giving direct access to market experts and approachable, knowledgeable decision makers. We’ve lived and breathed the excitement and the moments of exhilaration and despair as the financial world has shifted, tilted, evolved and innovated over the last 20 years. And we’ve loved every minute of it.

What is Spreadex?

Spreadex is a experienced company,offers a wild range of common tradable securities.It's established in 1999 and based in the United Kingdom, is a versatile trading and betting platform regulated by the Financial Conduct Authority (FCA).

The company offers a variety of tradable securities, including indices, shares, forex, and commodities. Spreadex provides both financial trading services and sports betting, satisfying diverse client interests with different account types: Sportsbook Account, Sports Spread Betting Account, and Financial Trading Account.

The platform supports margin trading and new stock trading, accessible via the SpreadsEX Web Online Trading Platform and mobile apps for iOS and Android. Customer support is available through phone and email.

Additionally, Spreadex enhances user experience with educational resources such as news updates, analysis, an education hub, and a spread betting glossary.

Regulatory Status

Spreadex Limited is regulated by the Financial Conduct Authority (FCA) of the United Kingdom, with the license number 190941, effective from December 1, 2001.

Spreadex operates from its headquarters at 26-30 Upper Marlborough Road, St. Albans, Hertfordshire, AL1 3UU, United Kingdom. For further information or inquiries, they can be contacted via telephone at +4401727895000.

Pros & Cons

Pros:

Spreadex boasts over 20 years of proven expertise and is regulated by the FCA, ensuring reliability. The platform offers a broad array of tradable securities, multiple account types for diverse user needs, and combines sports betting with financial trading. It also provides various educational resources to support users.

Cons:

However, Spreadex lacks 24/7 live chat support and does not offer promotional incentives, which could limit its appeal to new users. Additionally, the absence of a transparent fee structure creates uncertainty regarding transaction costs for users.

Tradable Securities

Spreadex offers a variety of tradable securities that meet a wide range of investment preferences:

Indices: Spreadex allows traders to engage with major global indices, providing a way to speculate on the performance of a specific sector or the market as a whole. This can include indices like the FTSE 100, S&P 500, and others, offering diversification across different geographies and industries.

Shares: Traders at Spreadex can buy and sell shares from a wide range of companies listed on major stock exchanges. This allows for direct investment in individual companies, offering potential dividends and capital gains.

Forex: The platform provides access to the foreign exchange market, enabling traders to buy and sell currencies from around the world. This market is known for its high liquidity and 24-hour trading, allowing for significant opportunities in currency pair movements.

Commodities: Spreadex offers the ability to trade in various commodities such as gold, oil, and agricultural products. Trading commodities can help investors hedge against inflation or diversify their portfolios away from more traditional securities.

Services

Spreadex provides a various range of services that attracts both financial traders and sports betting enthusiasts:

Financial Trading: Spreadex offers trading in a diverse array of financial instruments such as indices, shares, forex, and commodities. This service attracts traders looking to engage in the global financial markets with a variety of investment options.

Sports Betting: In addition to financial trading, Spreadex operates a sports betting division where users can place bets on a wide range of sporting events. This includes traditional sportsbook betting as well as sports spread betting, which offers a unique way to bet on sports outcomes.

Account Types

Spreadex distinguishes itself by offering three distinct types of accounts, each tailored to different aspects of betting and trading, meeting a broad range of preferences:

Sportsbook Account: This account type allows users to engage in traditional fixed odds betting. It's suitable for those who prefer a straightforward approach to sports betting, where they can predict the outcome and receive a fixed return based on the odds provided.

Sports Spread Betting Account: For those looking for a more dynamic betting style, the sports spread betting account offers the opportunity to bet against spreads, which can provide larger wins or losses based on the accuracy of the bet. This type of betting involves more risk but can be more rewarding and engaging for experienced bettors.

Financial Trading Account: This account is designed for trading financial securities such as indices, shares, forex, and commodities. It attracts traders who are interested in the financial markets and offers tools and resources to trade on margin and participate in new stock offerings.

Trading Platform

Spreadex offers a powerful, proprietary trading platform that is fully customizable and designed to attract both beginner and advanced traders. The platform is accessible via the web, as well as through dedicated apps for iPad, iPhone, and Android devices, ensuring traders can manage their positions on the go. Key features of the Spreadex trading platform include:

Advanced Charting Tools: The platform comes equipped with advanced charting tools that feature automated pro trend lines, pattern recognition, and a wide range of technical indicators. These tools help traders analyze the markets effectively.

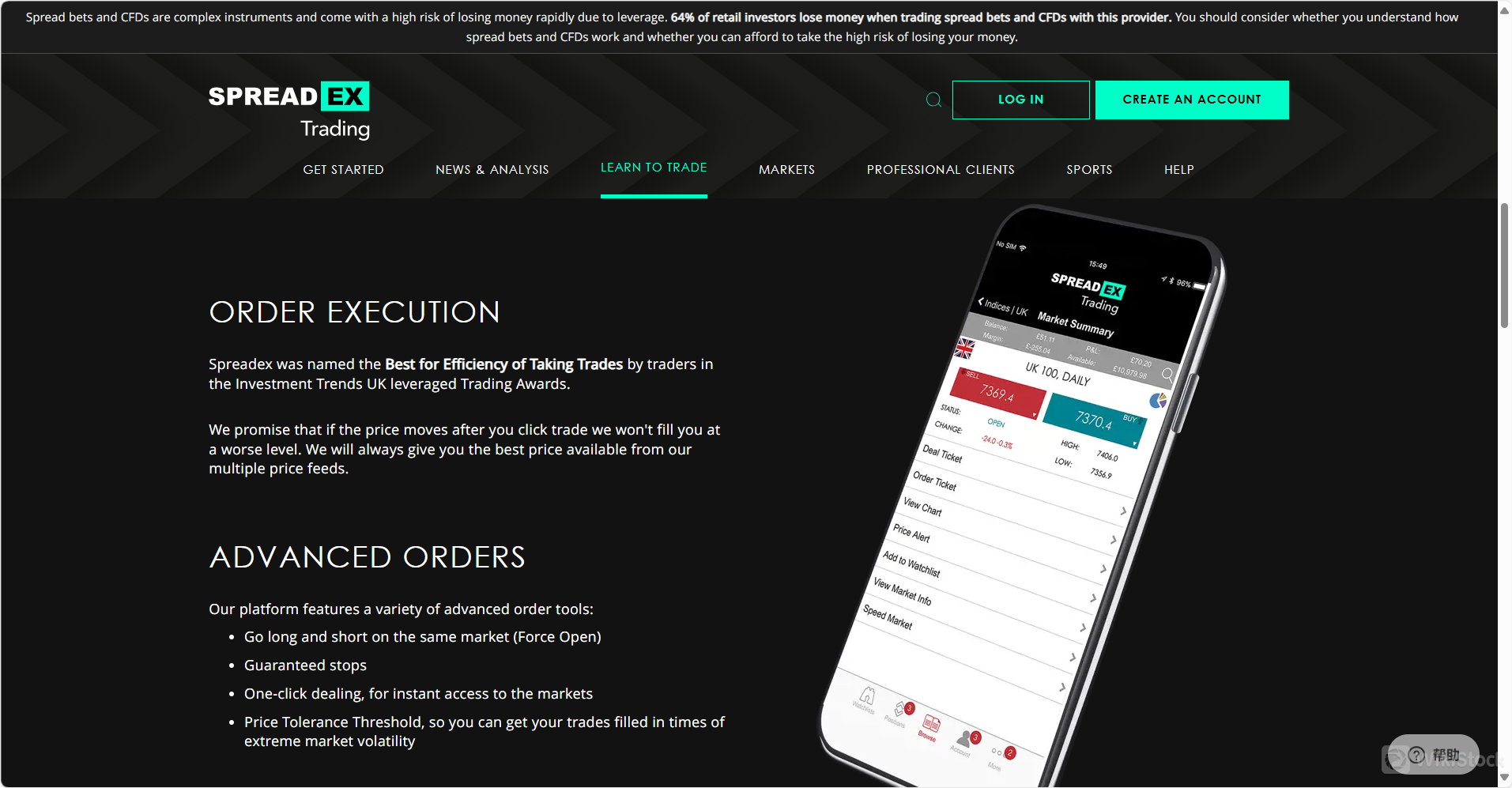

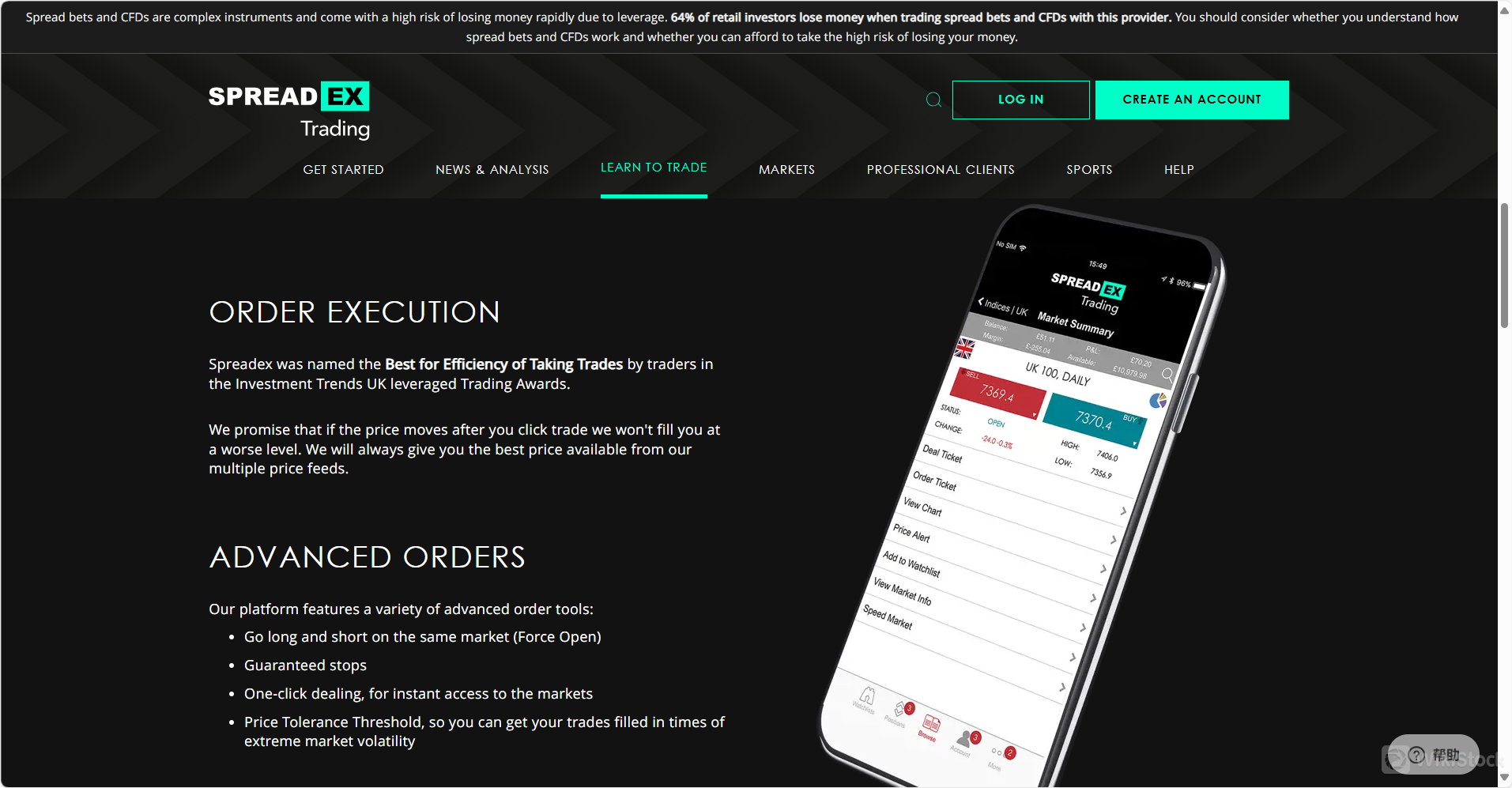

Order Execution: Recognized for its efficiency in taking trades, Spreadex ensures fair and fast trade execution. It promises not to fill trades at a worse level than the price seen when the trade is clicked, even in volatile market conditions.

Advanced Orders: The platform supports advanced order types including Force Opens, which allow traders to go long and short in the same market, and guaranteed stops to manage risks.

Price Alerts: Traders can set up price alerts via text, push notifications, or email, ensuring they never miss market opportunities.

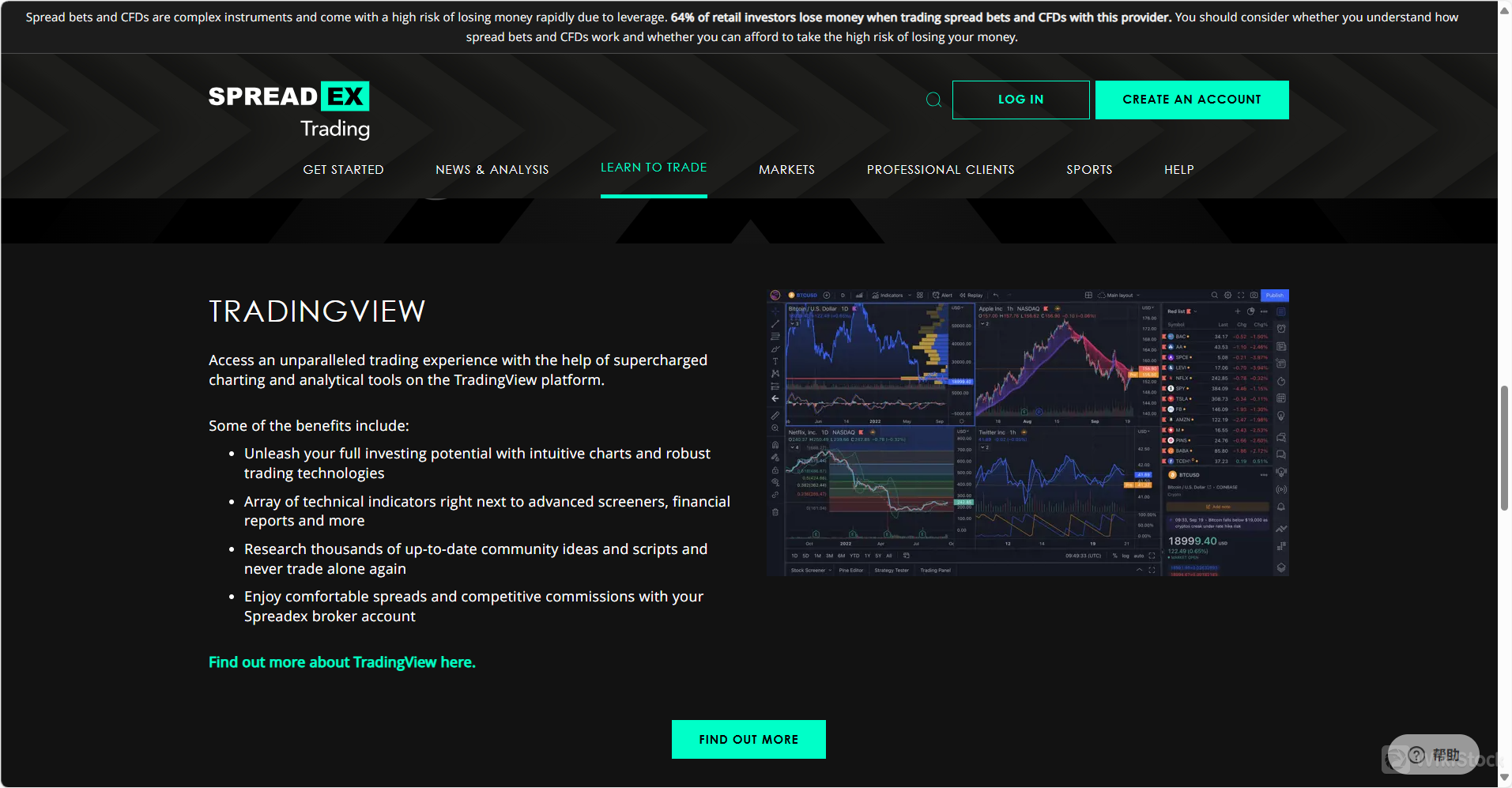

TradingView Integration: For an enhanced trading experience, Spreadex integrates with TradingView, offering expansive charting capabilities and a plethora of technical indicators next to advanced screeners and financial reports.

Deposit & Withdrawal

Spreadex offers a range of flexible options for depositing and withdrawing funds to satisfy different preferences of its clients:

Deposit Methods:

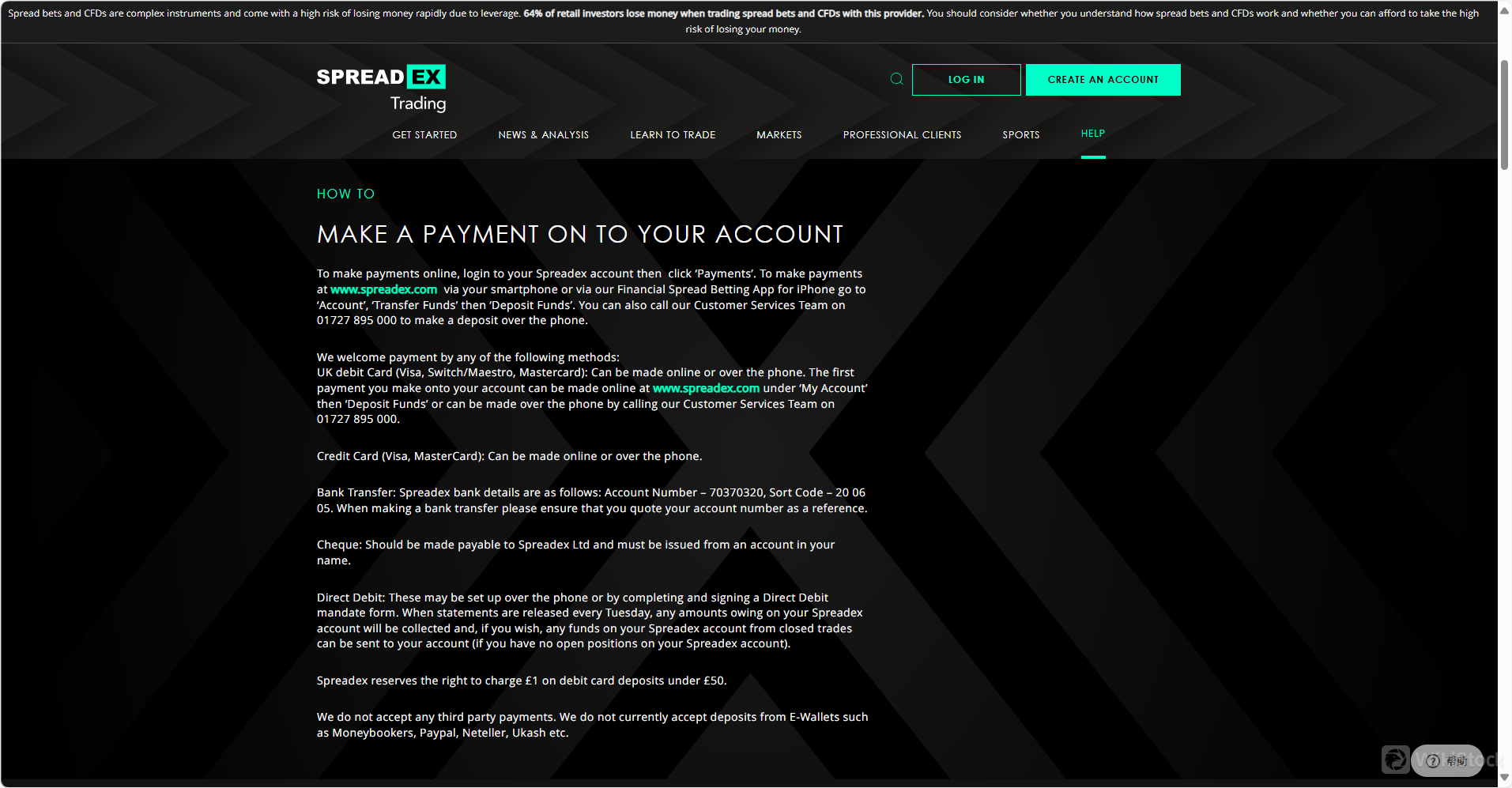

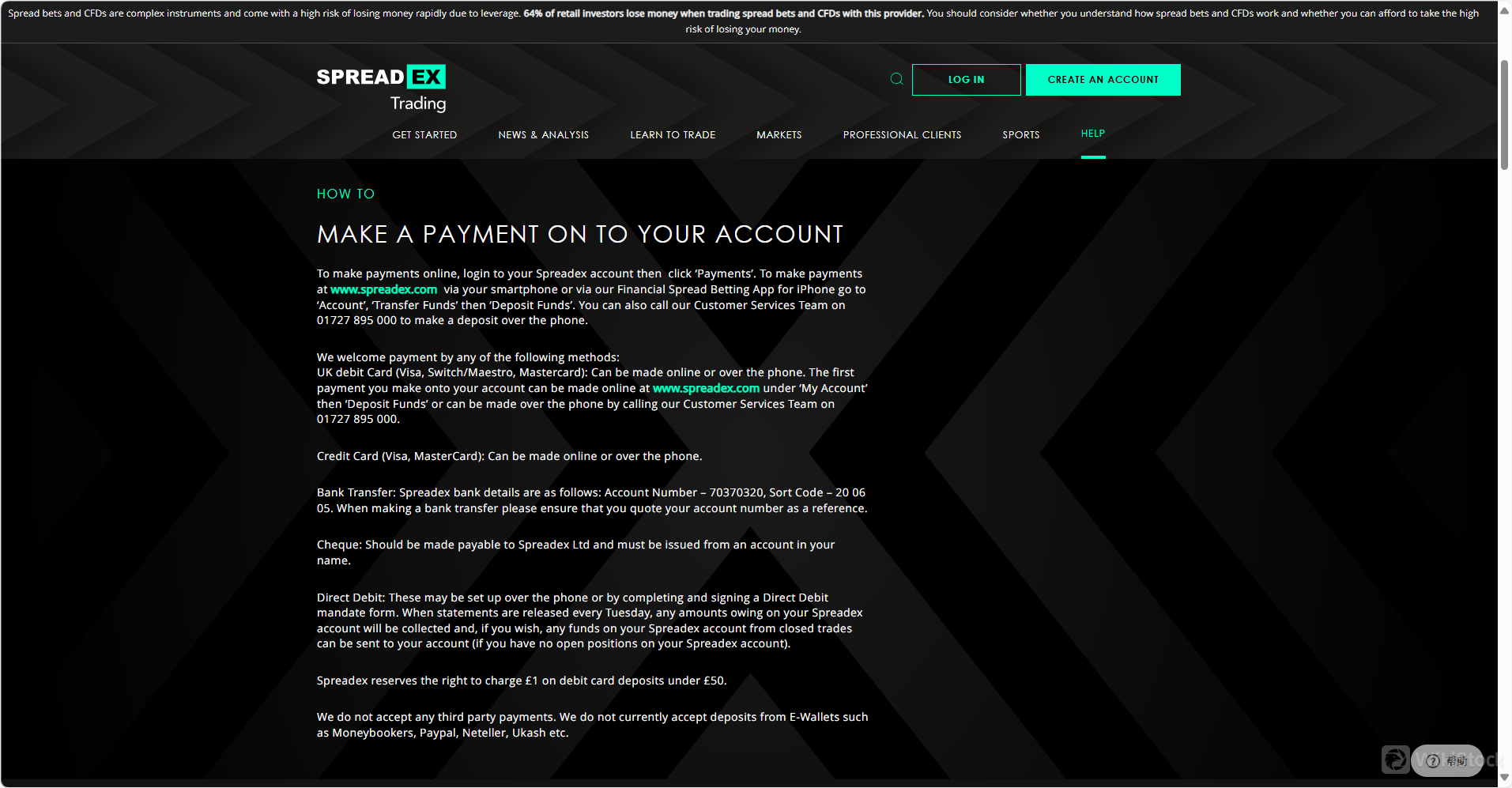

Debit Card: UK debit cards like Visa, Switch/Maestro, and Mastercard are accepted both online and over the phone. The first deposit can be made through the Spreadex website under ‘My Account’ then ‘Deposit Funds’ or over the phone by contacting customer services.

Credit Card: Deposits can also be made using Visa and MasterCard, either online or via telephone.

Bank Transfer: Funds can be transferred directly to Spreadexs bank account using the provided details (Account Number: 70370320, Sort Code: 20-06-05). It's important to use your account number as a reference.

Cheque: Payments by cheque should be made payable to Spreadex Ltd and issued from an account in your name.

Direct Debit: This option is available for setting up regular payments and can be arranged over the phone or by signing a Direct Debit mandate form.

Withdrawal Methods:

Card Withdrawal: Funds can be withdrawn back to the debit or credit card used for deposits. The maximum withdrawal amount for a card is £25,000, except for Mastercard, which is £2,500 at one time. However, multiple withdrawals can be made in one day.

Bank Transfer: Withdrawals can also be made via bank transfer, which will appear in your account within 2 working days.

Cheque: Spreadex can send a cheque upon request.

Fast Card Withdrawals: This newer method allows card withdrawals within 2 hours if approved, though not all card issuers accept this method.

Additional Information:

Spreadex charges a £1 fee for debit card deposits under £50.

Third-party payments are not accepted.

International bank transfers and transactions in currencies other than sterling may incur additional charges.

Customer Service

Spreadex provides various customer support with multiple contact options to address various inquiries and issues.

For financial-related questions, customers can contact the financial desk at 08000 526 570 or +44 (0)1727 895 151. For general inquiries, the number to call is +44 (0)1727 895 000.

Additionally, customers can reach out via email at info@spreadex.com for assistance with any questions or concerns.

Educational Resources

Spreadex offers a robust selection of educational resources tailored to enhance the trading and betting skills of both novices and experienced users:

Financial Spread Betting Glossary: This various glossary covers a wide array of terms used in financial spread betting, from basic terminology like “Bid” and “Offer” to more complex concepts such as “Gearing” and “Controlled Risk Bet.” This resource is invaluable for understanding the specific language and intricacies of spread betting.

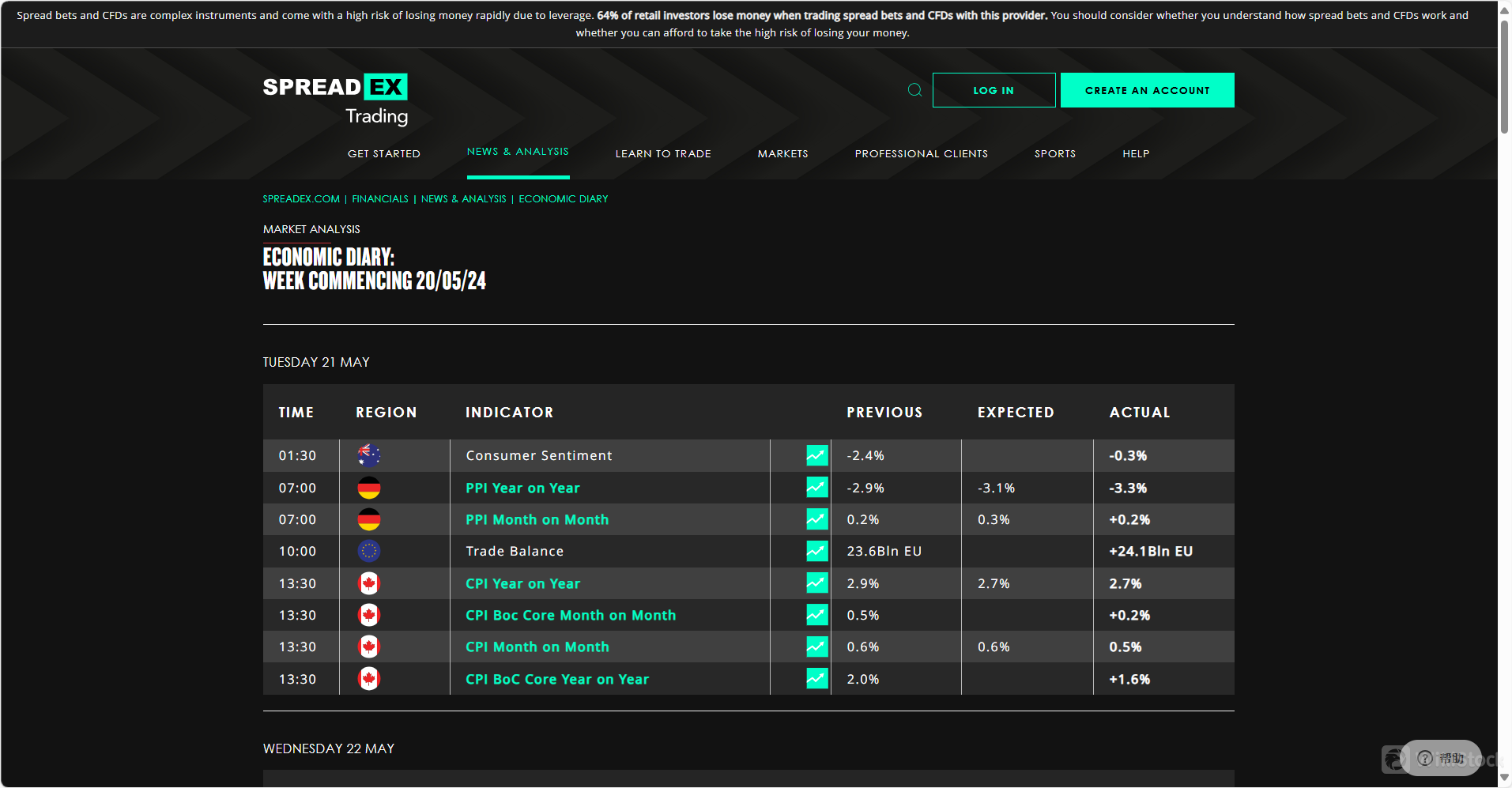

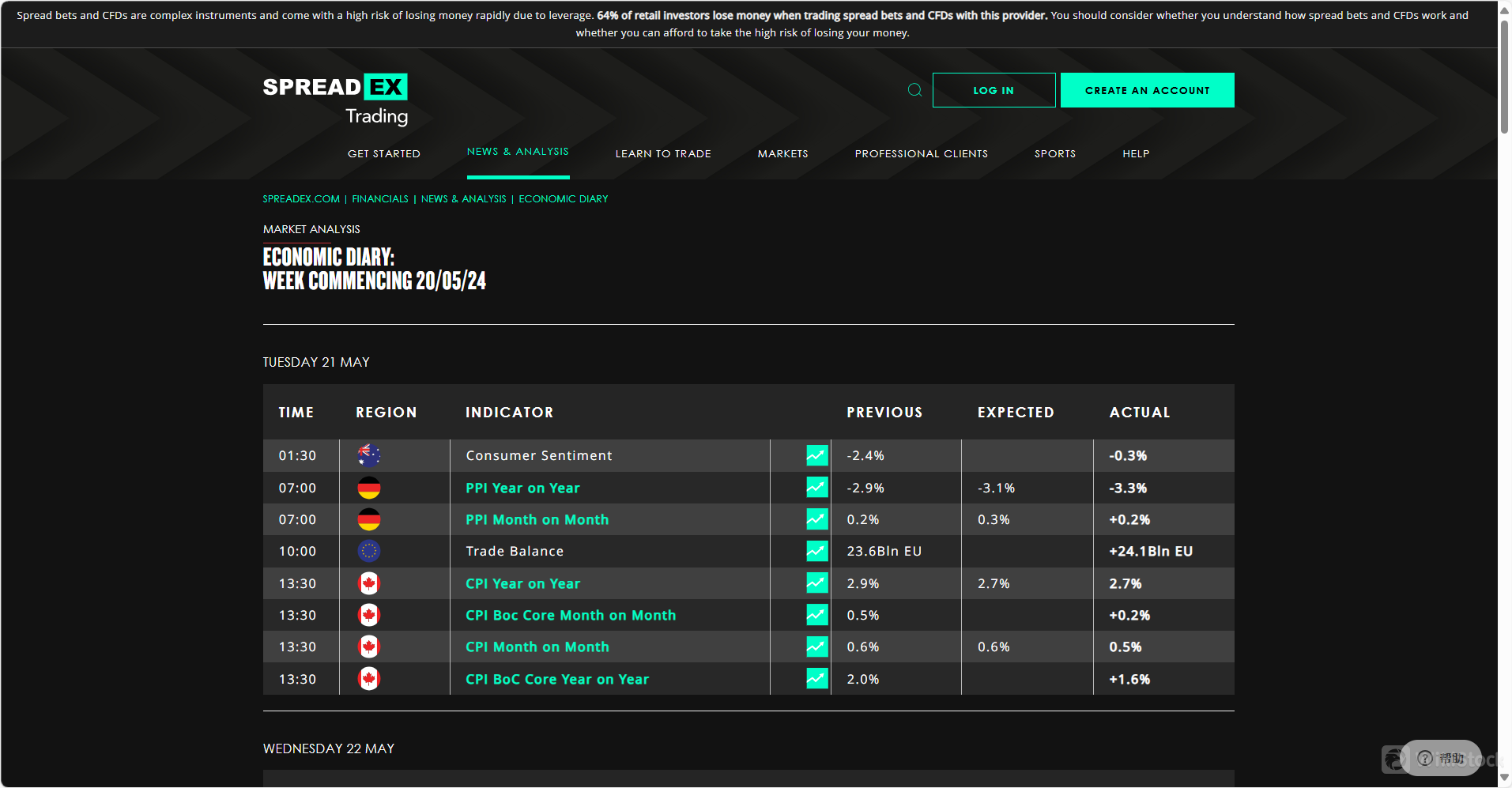

Economic Diary: Provides up-to-date information on important upcoming economic events, indicators, and data releases that can impact the financial markets. This tool is essential for traders who need to stay informed about factors that could affect their trading decisions.

Financial Trading Blog: Regular updates and articles that delve into market trends, individual stock performances, and broader economic insights. This blog is designed to provide deeper analysis and expert opinions to help traders refine their strategies.

Video Training Centre: Spreadex offers video tutorials and training sessions that meet various skill levels, offering visual and interactive ways to learn about trading and betting strategies, market analysis, and the platform's features.

Charting FAQs, Trading FAQs, and Account FAQs: These FAQs provide answers to common questions about using Spreadexs services, including how to interpret charts, execute trades, and manage accounts. This is particularly helpful for troubleshooting and gaining quick insights on how to use the platform effectively.

Conclusion

Spreadex offers a various trading and betting platform that integrates a wide range of markets including indices, shares, forex, and commodities with both financial spread betting and fixed odds sports betting.

Established and regulated by the Financial Conduct Authority, Spreadex provides an array of tools and features such as advanced charting, economic diaries, and a financial blog, designed to enhance the trading experience.

It also offers robust educational resources and responsive customer support, making it a reliable choice for both novice and experienced traders and bettors.

FAQs

Question: How can I register a new debit or credit card on Spreadex?

Answer: You can register a new card by logging into your account, navigating to 'Payments', entering your card details, and clicking 'submit'.

Question: What methods can I use to deposit funds into my Spreadex account?

Answer: You can deposit funds via UK debit cards, credit cards, bank transfer, or cheque. You can make these payments online or over the phone.

Question: How can I withdraw from my Spreadex account?

Answer: To make a withdrawal, go to ‘My Account’, select ‘Withdraw Funds’, and follow the on-screen instructions. You can also call the back office team or request via email at info@spreadex.com.

Question: Are there any fees for making small deposits at Spreadex?

Answer: Yes, Spreadex charges a £1 fee on debit card deposits under £50.

Question: What educational resources does Spreadex offer to help me learn more about trading and betting?

Answer: Spreadex provides a financial trading glossary, economic diary, financial trading blog, video training centre, and FAQs covering charting, trading, and account management.

United Kingdom

United KingdomObtain 1 securities license(s)