To achieve the goal of internationalization and to participate in various financial activities in the Asian Pacific region, Capital Group set up a Hong Kong subsidiary in 1993. With the full support of its parent company, CSC Securities (HK) Ltd. has successfully developed various businesses and established itself well in the competitive Hong Kong financial market, becoming the springboard of the Group in the international arena.

Overview of Capital Securities

Established for 5-10 years in China and Hong Kong, Capital Securities offers a wide range of tradable securities and services, including stocks, futures, and options.

Regulated by the Securities and Futures Commission (SFC), the brokerage imposes a commission of 0%, with negotiable brokerage fees for stocks, subject to a minimum charge of HK$100. While some fees are competitive, such as trading-related charges and select account maintenance fees, others, like corporate action fees and information service fees, are relatively higher compared to those of other brokers.

Accessible customer support and multiple deposit methods are notable advantages, yet limited international assets may hinder diversification opportunities for investors.

Regulatory Status

Capital Securities is regulated by the Securities and Futures Commission (SFC) and holds two securities licenses. The first license is a Securities Trading License with the license number AFD052, and the second license, also a Securities Trading License, bears the license number ACC324.

Pros and Cons

Pros:

Wide range of tradable securities and services: Capital Securities offers a wide selection of tradable securities and services, allowing investors to access various asset classes such as stocks, futures, and options.

Accessible customer support through phone: Clients can easily reach Capital Securities' customer support team via phone, providing a convenient channel for assistance with inquiries, account-related matters, and technical support.

Multiple deposit methods available: Capital Securities provides clients with multiple deposit methods, including cheque, promissory note, bank transfer, and telegraphic transfer (TT).

User-friendly trading platforms: Capital Securities offers user-friendly trading platforms, such as iTrader for securities trading and Sharp Point's Futures Trading System for futures and options trading. These platforms feature intuitive interfaces and advanced functionalities, enabling clients to execute trades efficiently and monitor market developments effectively.

Regulated by the SFC: As a regulated brokerage firm, Capital Securities operates under the supervision of the Securities and Futures Commission (SFC) in Hong Kong. This regulatory oversight helps ensure compliance with industry standards and provides clients with a level of trust and confidence in the company's operations.

Cons:

Corporate action fees and information service fees apply: Clients incur fees for certain services such as corporate actions and information services. These fees could potentially impact overall trading costs for clients, particularly those who frequently utilize these services.

Focus mainly on Hong Kong and China assets: Capital Securities' focus on Hong Kong and China assets limit the diversity of investment opportunities available to clients, particularly those seeking exposure to global markets beyond the Asia-Pacific region.

Tradable Securities and Services

Capital Securities provides a variety of tradable securities and services to investors, including Securities, Futures & Options, and Funds.

Within the realm of securities, clients have access to a broad range of stocks listed on major stock exchanges. This enables investors to diversify their portfolios and capitalize on various market opportunities.

Additionally, Capital Securities offers futures and options trading, allowing investors to engage in derivative markets such as Hang Seng Index Futures and options products. These instruments provide avenues for hedging, speculation, and portfolio management strategies.

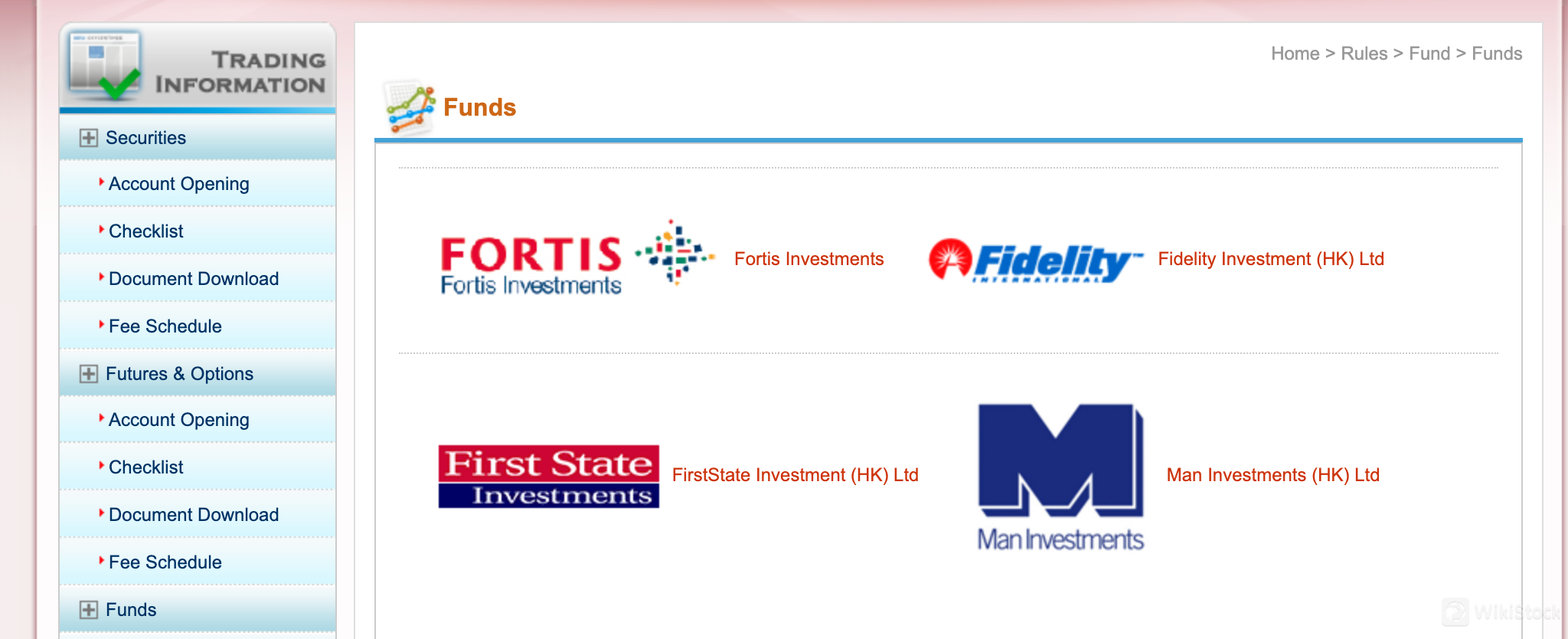

Furthermore, Capital Securities facilitates access to funds managed by renowned investment firms such as Fortis Investments, Fidelity Investment (HK) Ltd, FirstState Investment (HK) Ltd, and Man Investments (HK) Ltd. These funds offer investors exposure to professionally managed portfolios across different asset classes, including equities, bonds, and alternative investments.

Commissions and Fees

Capital Securities presents a detailed fee structure for both securities and futures trading.

In securities trading, clients encounter various charges: brokerage fees, which are negotiable but subject to a minimum charge of HK$100; a transaction levy of 0.004% on the transaction amount; a trading fee of 0.005% on the transaction amount; and a stamp duty of 0.1% on the transaction amount.

Additionally, fees related to scrip handling and settlement services include a CCASS fee of 0.002% on the transaction amount, with a minimum charge of HK$2 and a maximum charge of HK$100, as well as a physical scrip withdrawal fee of HK$5 per lot, subject to a minimum charge of HK$30.

Information services, such as real-time price quotes via AAStock, incur a monthly fee of HK$360 for access in Hong Kong and HK$210 for access in China. Account maintenance fees comprise a dormant account maintenance fee of HK$100 each in March and September for accounts with no transactions and a stock and cash balance below HK$100, as well as a stock segregated account service fee of HK$50 per month.

In futures trading, fees are structured differently, with commissions, exchange fees, SFC levies, and exercise fees varying based on the specific futures product traded.

For instance, trading Hang Seng Index Futures incurs a commission of $50.00 per contract during the day and $90.00 per contract at night, an exchange fee of $10.00, an SFC levy of $0.54, and an exercise fee of $10.00 per contract. Mini-Hang Seng Index Futures, H-shares Index Futures, and Mini-H-shares Index Futures entail similar fees but with different values.

Options products also come with fees, such as a commission of 1% on the premium, with a minimum of $30 and a maximum of $100, along with exchange fees, SFC levies, and exercise fees that vary depending on the specific option traded.

When comparing these fees with popular brokers, it's evident that Capital Securities offers a varied fee structure. While some fees are competitive, such as the trading-related fees and some account maintenance charges, others, like certain corporate action fees and information service fees, are higher than those of other brokers.

Account Types

Capital Securities provides Securities Trading Account and Futures and Options Trading Account for traders.

Securities Trading Account:

A securities trading account with Capital Securities provides investors with the ability to buy and sell various securities, including stocks listed on major exchanges. These accounts are suitable for individual investors, institutional investors, and traders who seek to build and manage a portfolio of stocks.

Futures and Options Trading Account:

A futures and options trading account with Capital Securities enables investors to trade derivatives contracts, such as futures and options, on various underlying assets. These accounts are suitable for sophisticated investors, including institutional investors, hedge funds, and experienced traders, who are comfortable with leveraging and managing risk in derivative markets.

Platforms & Tools

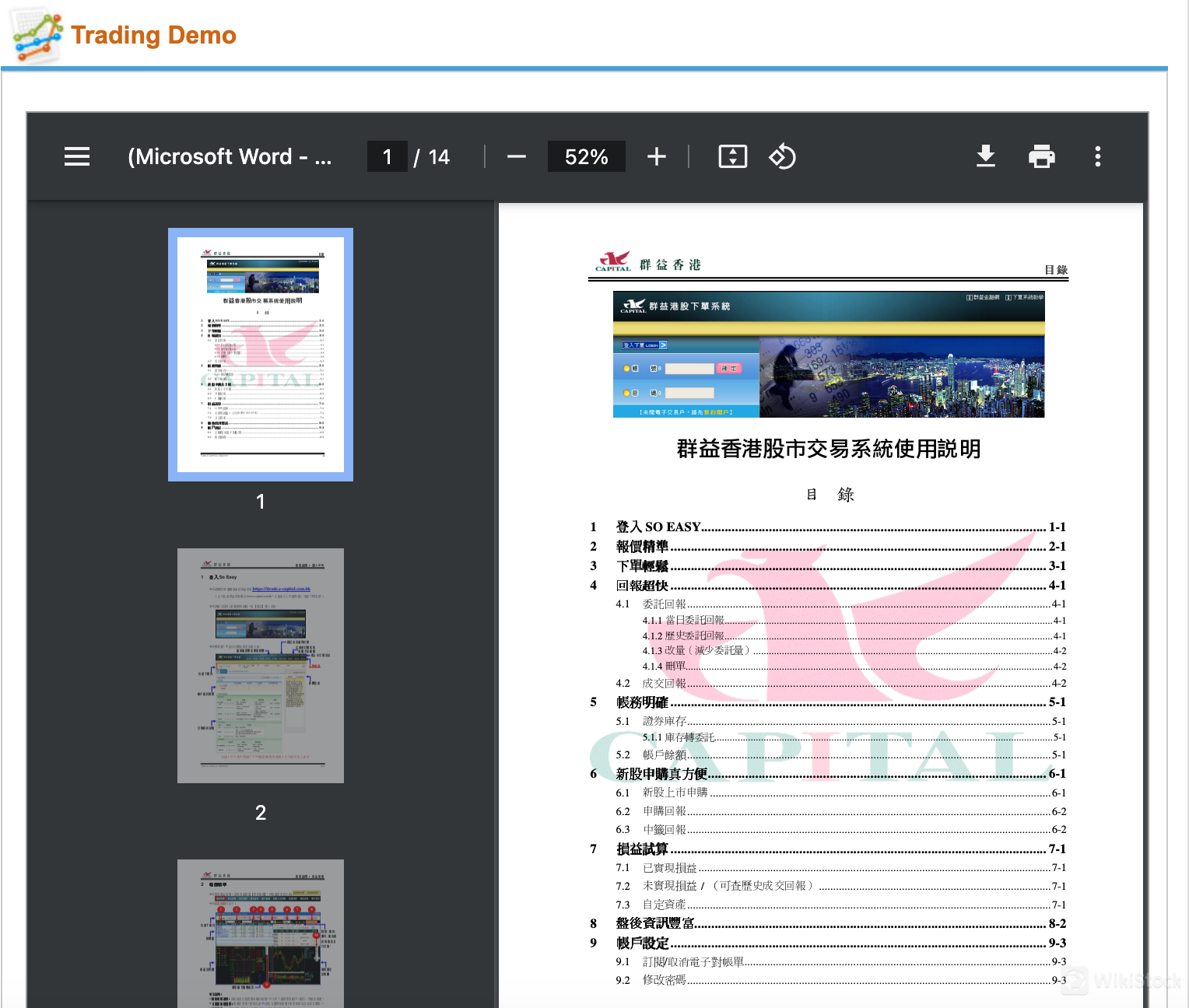

Capital Securities offers two distinct trading platforms for online trading, each tailored to specific market segments:

1. iTrader (Securities Trading Platform):

iTrader serves as Capital Securities' online trading platform for securities trading. Key features of iTrader include:

User-Friendly Interface: iTrader provides a user-friendly interface, making it easy for clients to navigate and execute trades efficiently.

Real-time Market Data: Clients have access to real-time market data, including stock prices, market depth, and trading volumes, enabling informed decision-making.

Order Execution: iTrader offers fast order execution capabilities, allowing clients to execute trades swiftly to capitalize on market opportunities.

Account Management: The platform enables clients to manage their accounts effectively, including monitoring portfolio performance, reviewing transaction history, and accessing account statements.

Multi-Language Support: iTrader supports multiple languages, including Traditional Chinese, Simplified Chinese, and English.

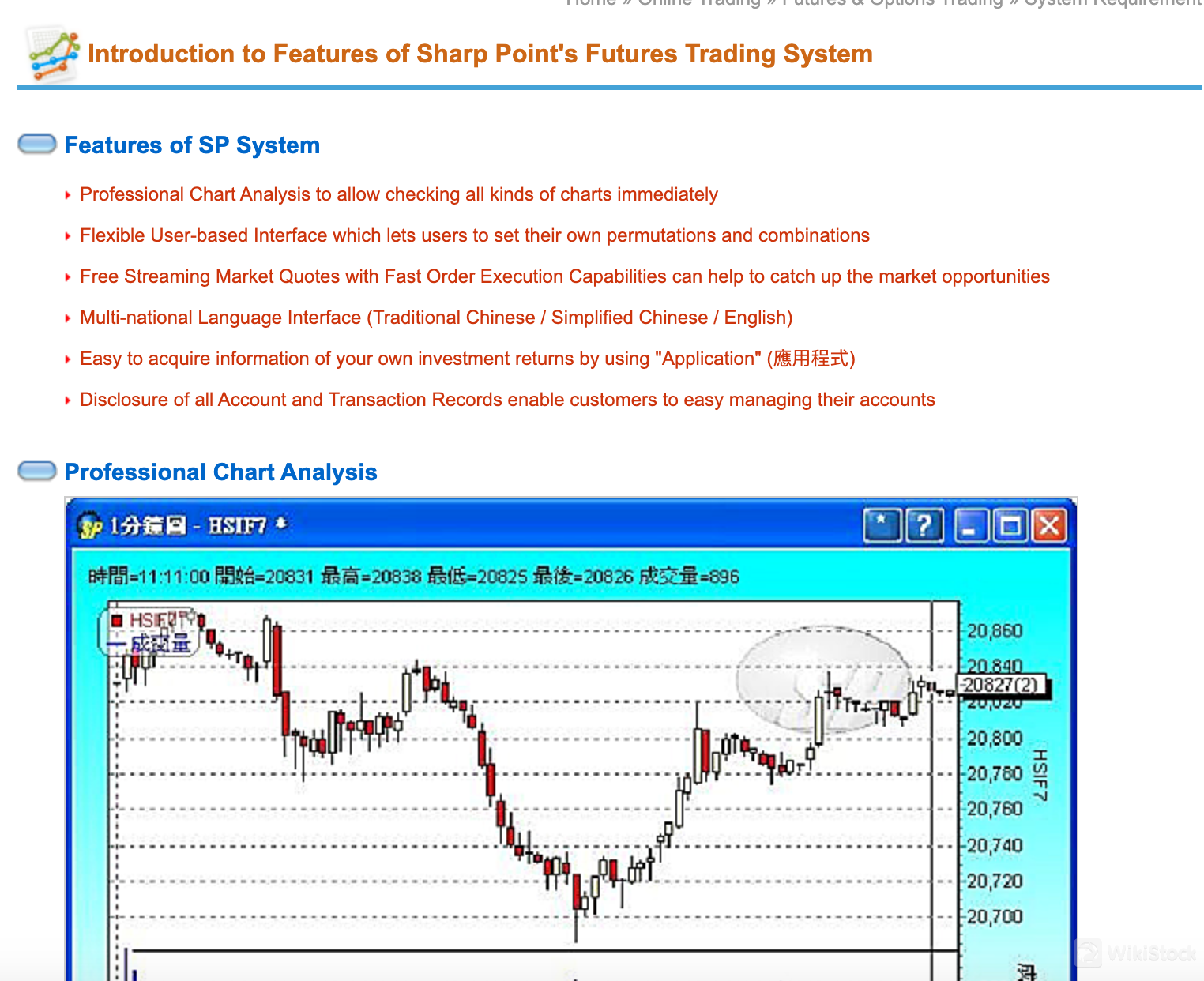

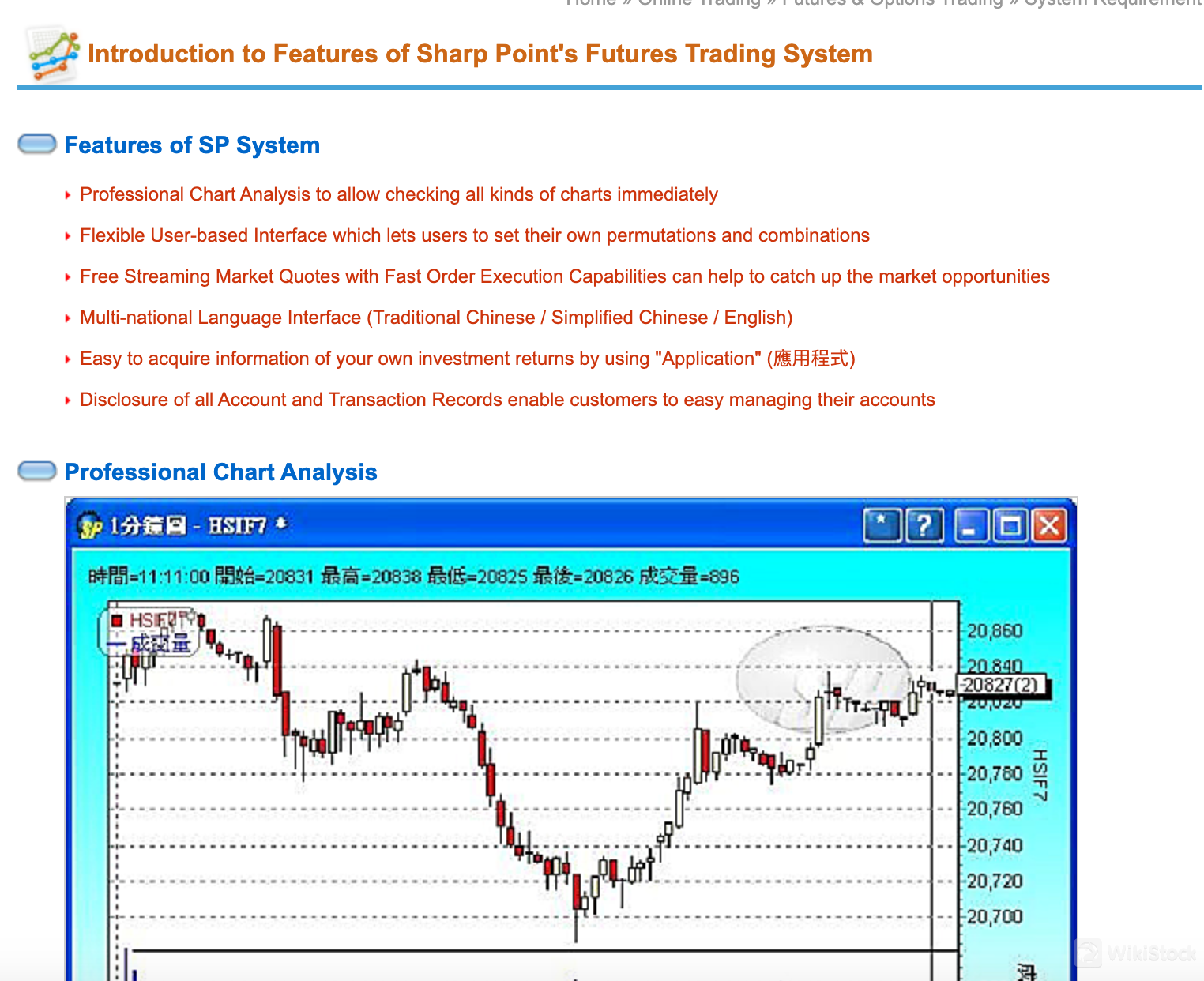

2. Sharp Point's Futures Trading System:

For futures and options trading, Capital Securities utilizes Sharp Point's Futures Trading System.

Professional Chart Analysis: The platform offers advanced charting tools for professional technical analysis, allowing users to analyze various charts promptly.

Customizable Interface: Sharp Point's Futures Trading System provides a flexible user-based interface, enabling users to customize their trading environment according to their preferences.

Streaming Market Quotes: Clients have access to free streaming market quotes, coupled with fast order execution capabilities, facilitating timely trade execution.

Multi-Language Interface: Similar to iTrader, Sharp Point's Futures Trading System supports multiple languages, enhancing accessibility for users across different regions.

Account Management Tools: The platform enables users to easily manage their accounts by providing access to account and transaction records, facilitating transparent and efficient account management.

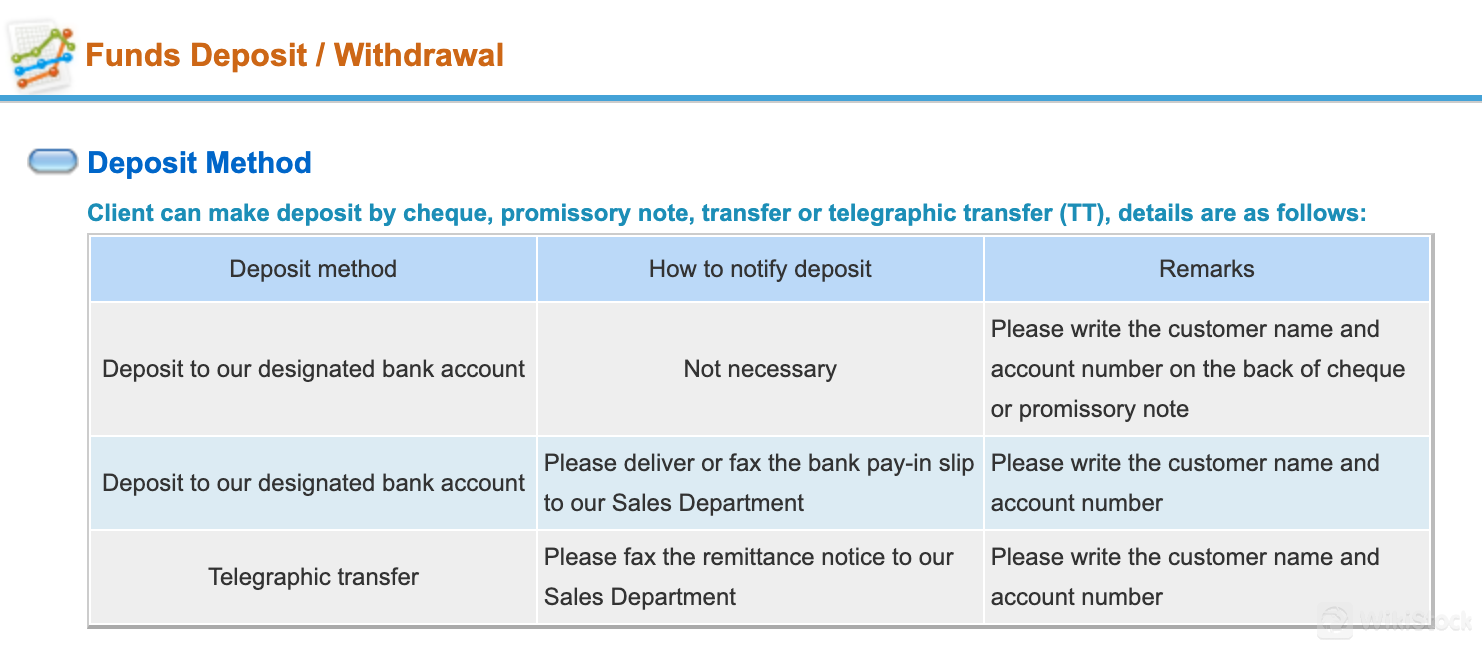

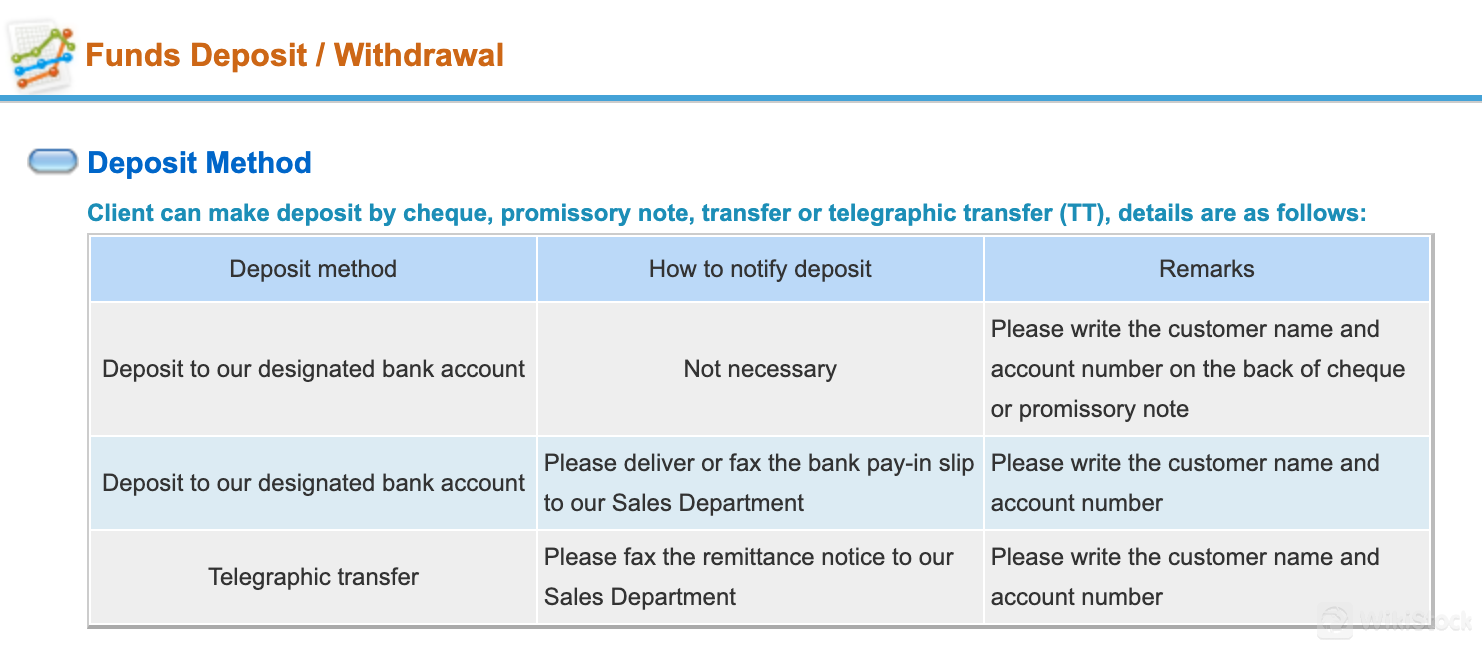

Deposit & Withdrawal

Clients of Capital Securities have various options to deposit funds into their trading accounts. These methods include cheque, promissory note, bank transfer, and telegraphic transfer (TT).

Capital Securities typically does not charge fees for depositing funds into trading accounts. The specific minimum deposit amount of is Capital Securities not provided in the official website.

Customer Service

Capital Securities offers customer support through phone assistance. Clients can reach their representatives at (852)2530-9966 for inquiries, account-related matters, and technical support.

Educational Resources

Capital Securities offers a range of educational resources to help investors stay informed and make well-informed decisions.

These resources include access to Hong Kong news, research materials, daily market updates, IPO summaries, individual stock reports, and CSC's views on market trends.

Conclusion

In conclusion, Capital Securities presents a compelling option for investors seeking exposure to the China and Hong Kong markets, offering a wide range of tradable securities and services. Its accessible customer support and user-friendly trading platforms enhance the overall trading experience.

However, clients should be mindful of the varying commissions and fees, including brokerage fees for stocks with a minimum charge of HK$100, and additional charges like transaction levies and stamp duty fees.

While its regulation by the Securities and Futures Commission ensures regulatory oversight, the focus primarily on regional assets llimits diversification opportunities for international investors.

FAQs

Question: What tradable securities does Capital Securities offer?

Answer: Capital Securities offers a range of securities including stocks, futures, and options.

Question: Does Capital Securities offer margin trading?

Answer: Yes, Capital Securities offers margin trading services to eligible clients.

Question: Is there a bonus offer available for new clients?

China Taiwan

China TaiwanObtain 2 securities license(s)

--

--