Score

中州國際

https://www.ccnew.com.hk/tc/home

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China

ChinaProducts

2

Investment Advisory Service、Stocks

Securities license

Obtain 2 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01982

Brokerage Information

More

Company Name

中州國際金融控股有限公司

Abbreviation

中州國際

Platform registered country and region

Company address

Company website

https://www.ccnew.com.hk/tc/homeCheck whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 408

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

Macao

28168.87%China

9924.27%Bahamas

143.43%Zambia

143.43%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Commission Rate

0.1%

Funding Rate

3%

New Stock Trading

Yes

Margin Trading

YES

| Central China International |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees | Brokerage: 0.1%-0.15% (min HKD 30) |

| Account Fees | Various transaction fees; specific amounts depend on services used |

| Margin Interest Rates | Prime rate + 3% |

| App/Platform | Web platform, mobile apps on Google Play and Apple Store |

| Promotions | No |

Central China International Information

Central China International (CCI) is a regulated financial services firm by the Securities and Futures Commission (SFC) of Hong Kong, offering low-fee trading and user-friendly mobile and web trading platforms. It provides extensive research and educational resources to investors. However, its complex fee structure and specific insurance coverage details may require direct confirmation.

Pros and Cons of Central China International

Central China International (CCI) is a well-regulated and secure trading platform offering a range of services, including comprehensive research and education resources, multiple trading platforms, and robust customer support. However, it has a complex fee structure with various transaction and service fees, and specific insurance details may need direct confirmation. The platform also has some restrictions on trading low-value stocks and certain transaction types.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Is Central China International safe?

Regulations: Central China International (CCI) is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with stringent financial regulations and standards.

Safety Measures: CCI employs encryption technologies to ensure the security of funds. They also implement robust account security measures to prevent unauthorized access and protect user information from breaches and leaks.

What are securities to trade with CENTRAL CHINA INTERNATIONAL?

Central China International (CCI) offers a range of securities trading services through the “Shanghai-Hong Kong Stock Connect” mechanism, which facilitates mutual access between the stock markets of Shanghai and Hong Kong. This mechanism allows investors from both regions to trade and settle shares listed on each other's markets through their respective exchanges and clearing houses. The “Shanghai-Hong Kong Stock Connect” includes two main components: “Northbound Trading” and “Southbound Trading.”

“Northbound Trading” allows investors from outside mainland China, such as those in Hong Kong, to entrust Hong Kong brokers to submit buy and sell orders for shares listed on the Shanghai Stock Exchange through a securities trading service company established by the Hong Kong Stock Exchange. This enables the trading of a designated range of stocks listed on the Shanghai Stock Exchange.

“Southbound Trading” enables mainland Chinese investors to entrust mainland securities firms to submit buy and sell orders for shares listed on the Hong Kong Stock Exchange through a securities trading service company established by the Shanghai Stock Exchange. This facilitates the trading of a designated range of stocks listed on the Hong Kong Stock Exchange.

According to the rules, certain individuals are not considered mainland investors and can continue to trade “China Connect Securities” through the “Shanghai and Shenzhen Stock Connect” mechanisms. These individuals include those holding a travel permit to Hong Kong and Macau (commonly known as the One-way Permit) or those who have obtained permanent residency outside mainland China. Additionally, branches or subsidiaries of mainland-registered legal entities and non-legal entities established in Hong Kong or overseas are also eligible.

Through this arrangement, trading services with Central China International (CCI) can involve:

Using Hong Kong brokers to buy and sell shares listed on the Shanghai Stock Exchange (Northbound Trading).

Using mainland securities firms to buy and sell shares listed on the Hong Kong Stock Exchange (Southbound Trading).

This mechanism allows investors from both regions to participate more flexibly in cross-border securities trading, thereby enhancing market liquidity and investment opportunities.

CENTRAL CHINA INTERNATIONAL Fees Review

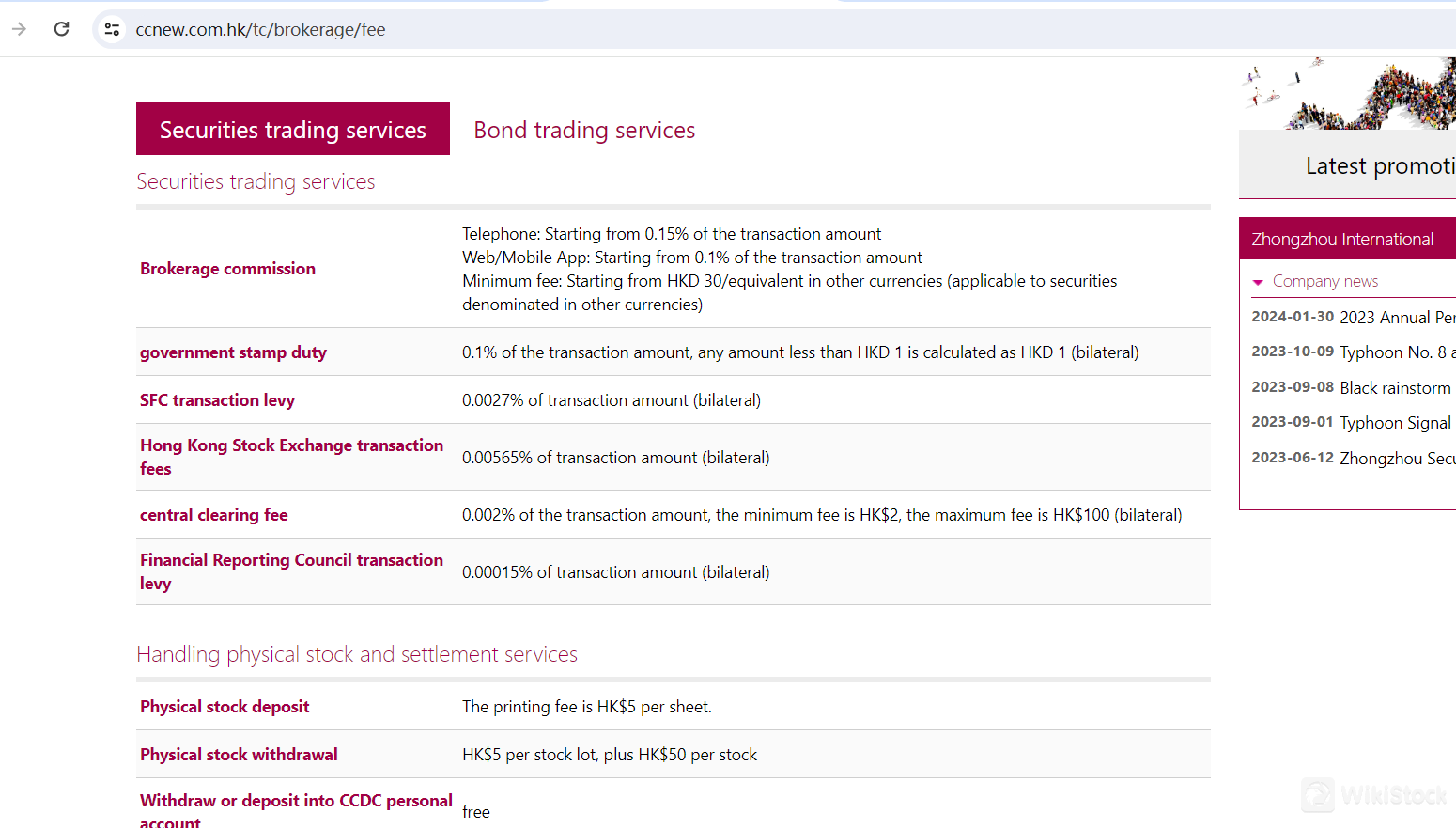

Central China International (CCI) offers a variety of securities trading services, each with associated fees.

Brokerage Commission: For telephone trades, the fee is 0.15% of the transaction amount, while online or mobile app trades start at 0.1%. The minimum charge is HKD 30 or its equivalent in other currencies.

Government Stamp Duty is levied at 0.1% of the transaction amount, rounded up to the nearest dollar, and applies to both the buyer and the seller.

SFC Transaction Levy is 0.0027%, and the HKEx Trading Fee is 0.00565%, both applicable to both sides of the transaction.

The CCASS Settlement Fee is 0.002% of the transaction amount, with a minimum charge of HKD 2 and a maximum of HKD 100.

For physical stock handling, the deposit fee is HKD 5 per certificate, and the withdrawal fee is HKD 5 per lot plus HKD 50 per stock. Depositing or withdrawing stocks from a personal CCASS account is free. The stock delivery fee (SI) is HKD 10 per lot, with a minimum charge of HKD 100 per stock, while stock deposit (SI) is free of charge. There is a forced buy-in fee of 0.25% of the transaction amount, plus related transaction fees.

Agent Services and Corporate Actions include a dividend collection fee of 0.5% of the dividend amount, with a minimum charge of HKD 50 or USD 6.5. Collecting right issues is free, while bonus share collection costs HKD 30 per transaction. Cash, special, election, or restricted acquisitions are charged at HKD 50 per transaction. The fee for right issue, warrant, or covered warrant subscription is HKD 0.8 per lot, plus a handling fee of HKD 30. Transfer fees are HKD 2 per lot.

For lending and other services, the margin account loan interest rate is the prime rate plus 3% per annum, and overdue interest for cash accounts is the prime rate plus 8% per annum. Additional services include handling fees for physical stock and cash transactions, with various charges based on the transaction type.

CENTRAL CHINA INTERNATIONAL App Review

Central China International (CCI) offers multiple trading platforms for convenience and accessibility. Users can access their trading services via the web platform at CCI Trading Platform(https://etrade2.ccnew.com.hk/mts.web/Web2/login/ccint/index.html#big5), which provides comprehensive tools for trading securities. Additionally, CCI's mobile trading applications are available for download on Google Play and the Apple App Store, enabling users to trade on-the-go. These platforms are designed to be user-friendly and provide real-time market data, ensuring efficient and seamless trading experiences for their clients.

Research and Eduation

Central China International (CCI) offers a comprehensive Research Center section within their trading platform. This includes:

Hong Kong Stock Morning News: Daily updates on the Hong Kong stock market.

Research Reports: Detailed analyses and insights on various securities.

Investment Academy: Educational resources and tutorials for investors.

Exchange: Information and updates on various stock exchanges.

Market Comments: Expert commentary on market trends and movements.

Global Index: Information on international market indices.

New Stock News: Updates on newly listed stocks.

New Stock Archives: Historical data on new stock listings.

Additionally, their Financial Information section provides:

Customer Service

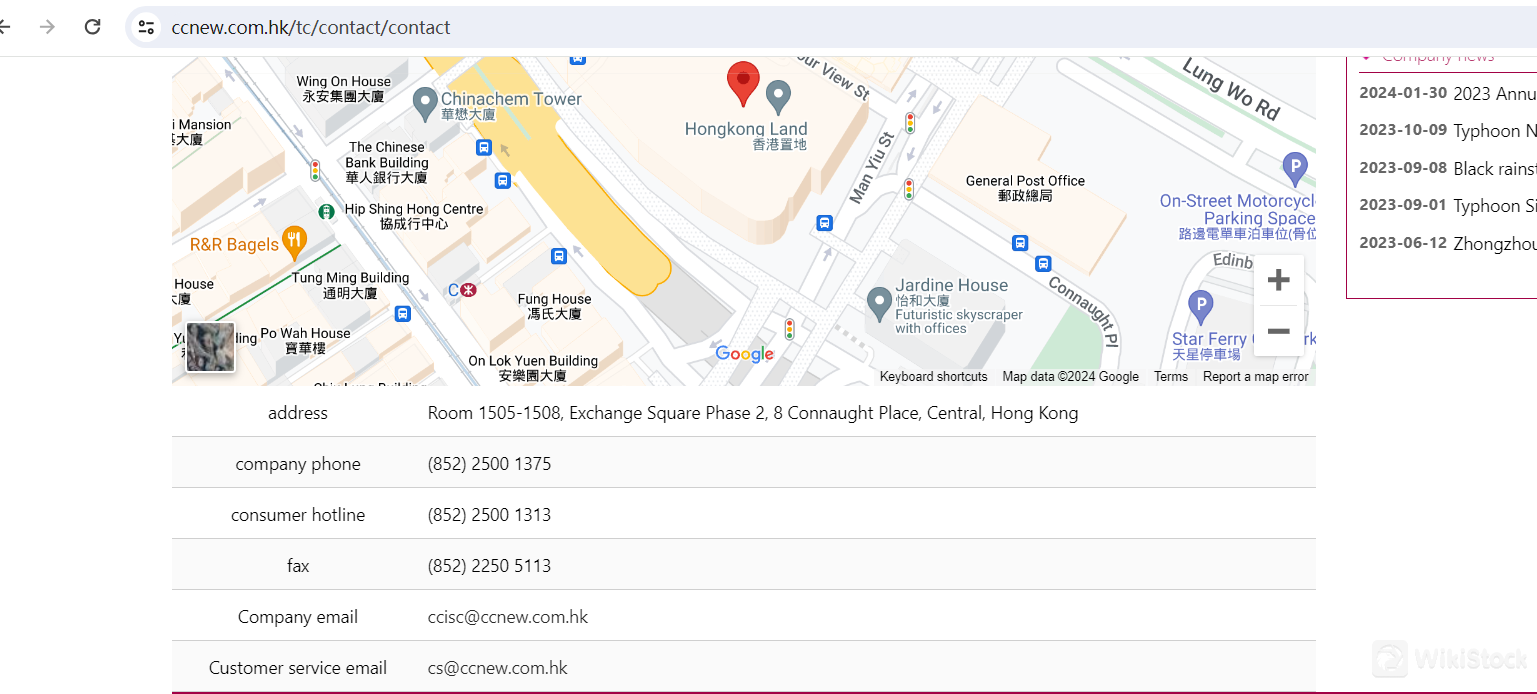

Central China International (CCI) provides robust customer support through various channels. Their office is located at Suite 1505-1508, 15/F, Two Exchange Square, 8 Connaught Place, Central, Hong Kong.

For general inquiries, you can call the company at (852) 2500 1375. For customer service, the hotline is (852) 2500 1313. They also offer support via fax at (852) 2250 5113.

For email inquiries, the company email is ccisc@ccnew.com.hk, and customer service can be reached at cs@ccnew.com.hk.

These multiple channels ensure that clients receive prompt and effective support.

Conclusion

Central China International (CCI) is a well-regulated financial services firm under the Securities and Futures Commission (SFC) of Hong Kong, known for offering low-fee trading and user-friendly mobile and web trading platforms. It provides extensive research and educational resources, making it a solid choice for informed investors. However, its complex fee structure and the need for direct confirmation of specific insurance details might be seen as drawbacks for some users.

FAQs

Is Central China International safe to trade?

Yes, Central China International is safe to trade as it is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with stringent financial regulations and standards. They also employ encryption technologies and robust account security measures to protect client funds and information.

Is Central China International a good platform for beginners?

Yes, CCI is a good platform for beginners. It offers user-friendly mobile and web trading platforms, as well as extensive research and educational resources, including daily market news, research reports, and an investment academy.

Is Central China International legit?

Yes, Central China International is a legitimate trading platform, regulated by the Securities and Futures Commission (SFC) of Hong Kong, providing a secure and compliant environment for investors.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Investment Advisory Service、Stocks

Relevant Enterprises

Countries

Company name

Associations

--

中州國際投資有限公司

Group Company

--

中州國際融資有限公司

Group Company

--

中州國際證券有限公司

Group Company

--

中原證券股份有限公司

Parent company

Review

No ratings

Recommended Brokerage FirmsMore

Ever-Long

Score

VC

Score

Funderstone

Score

国都香港

Score

Cinda International

Score

瑞达国际

Score

恒大證券

Score

GoFintech

Score

寶新金融

Score

Anuenue

Score