Score

嘉信

https://www.kaisergroup.com.hk/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China Taiwan

China TaiwanProducts

2

Futures、Stocks

Surpassed 18.81% brokers

Securities license

Obtain 2 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Derivatives Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01469

Brokerage Information

More

Company Name

Kaiser Fintech Group Limited

Abbreviation

嘉信

Platform registered country and region

Company address

Company website

https://www.kaisergroup.com.hk/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 10084

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

Others

261925.97%Ireland

256625.45%China Hong Kong

256125.40%Slovenia

118011.70%New Zealand

115811.48%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Commission Rate

0.15%

Funding Rate

1%

New Stock Trading

Yes

Margin Trading

YES

| Aspect | Information |

| Company Name | KAISER |

| Years in Business | More than 20 years |

| Registered Region | China, Hong Kong |

| Regulatory Status | Regulated by the SFC |

| Tradable Securities and Services | Stocks, derivatives, mutual funds, bond, ETFs, futures, options, precious metals, asset management, family office, immigration consultancy |

| Minimum Deposit | N/A |

| Margin Trading | Yes |

| New Stock Trading | Yes |

| Commissions | Securities: 0.2% (HK) / 0.15% (US) |

| Platforms/Apps | LongPort App (Android, iOS), E-Sunny (Windows, iOS, Android), SPTrader (Web, iPad) |

| Customer Service | Phone +852 2215 8373,+852 2215 8330Fax +852 2215 8372WeChat at +852 9237 1570WhatsApp at +852 6430 2118Email cs@kaisergroup.com.hk |

| Deposit & Withdrawal Methods | Bank transfer, wire transfer, FPS (Hong Kong only) |

Overview of KAISER

KAISER, operating for over 20 years in China and Hong Kong, offers a wide range of tradable securities including stocks, derivatives, mutual funds, bonds ETFs, futures, and options.

With competitive commission rates (Securities: 0.2% (HK) / 0.15% (US)), it provides cost-effective trading. Regulated by the SFC, it ensures compliance and investor protection.

Advantages include low commission rates, easy global investment access, user-friendly platforms, real-time market data, and various services.

However, the absence of research reports, a Chinese-only website, and limited app availability (Chinese and Hong Kong only) are notable drawbacks, potentially limiting accessibility and support for international investors.

Regulatory Status

KAISER holds two securities licenses issued by the Securities and Futures Commission (SFC).

The first license is a Securities Trading License bearing the identification number ABT487, while the second is a Derivatives Trading License identified as ADB079. Both licenses are regulated by the SFC, ensuring compliance with the relevant regulations governing securities trading activities.

Pros and Cons

| Pros | Cons |

| Low commission rates(Securities: 0.2% (HK) / 0.15% (US) ) | No research reports |

| Easy global investment | Official website in Chinese only |

| User-friendly trading platform | Trading app available in Chinese and Hong Kong only |

| Real-time market data | |

| Regulated by the SFC | |

| Various services provided |

Pros:

Low commission rates: KAISER offers competitive commission rates, making it cost-effective for traders. For securities trading, the commission rate is 0.2% in Hong Kong and 0.15% in the US, which is lower compared to many other brokers.

Easy global investment: KAISER provides easy access to global investment opportunities, enabling investors to diversify their portfolios across different markets.

User-friendly trading platform: The platform boasts a user-friendly interface, simplifying the trading process for both novice and experienced investors. Its intuitive design and layout make it easy to navigate, execute trades, and access essential market information, enhancing the overall trading experience.

Real-time market data: KAISER offers real-time market data, enabling traders to make informed decisions based on the latest market developments.

Regulated by the SFC: As a regulated broker under the Securities and Futures Commission (SFC), KAISER adheres to strict regulatory standards, providing investors with a sense of security and trust.

Various services provided: These services include asset management, family office solutions, and immigration consultancy, providing additional value and support to clients beyond traditional brokerage services.

Cons:

No research reports: KAISER does not provide research reports to assist investors in making informed decisions. Lack of research reports hinder investors who rely on comprehensive analysis and insights to guide their investment strategies.

Official website in Chinese only: The official website of KAISER is available in Chinese only, potentially limiting access for non-Chinese-speaking investors.

Trading app available in Chinese and Hong Kong only: The trading app provided by KAISER is available only in Chinese and for users in Hong Kong. This limitation poses challenges for international investors or those who prefer to access the platform in other languages.

Tradable Securities and Services

KAISER provides a comprehensive range of tradable securities and services.

Securities Business encompasses a variety of options including stocks, derivative warrants, and redeemable bull/bear certificates. The platform also facilitates trading through initiatives such as the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, enhancing accessibility to international markets. Additionally, investors can explore listed equity linked notes, unit trusts/mutual funds, bonds, and exchange-traded funds (ETFs) for diversified investment opportunities.

In the Futures Business, KAISER offers a broad spectrum of futures trading options, including Hong Kong futures, stock index futures, and individual stock futures. Clients can also engage in trading RMB futures, gold futures, and various other commodities and indices through Global Futures.

Furthermore, the platform extends its services to encompass index futures, foreign exchange futures, agricultural and food futures, precious metal and energy futures, and bond futures.

Moreover, KAISER provides Asset Management services and operates a Family Office, offering tailored solutions to high-net-worth individuals. The platform also facilitates trading in precious metals and offers immigration consultancy services.

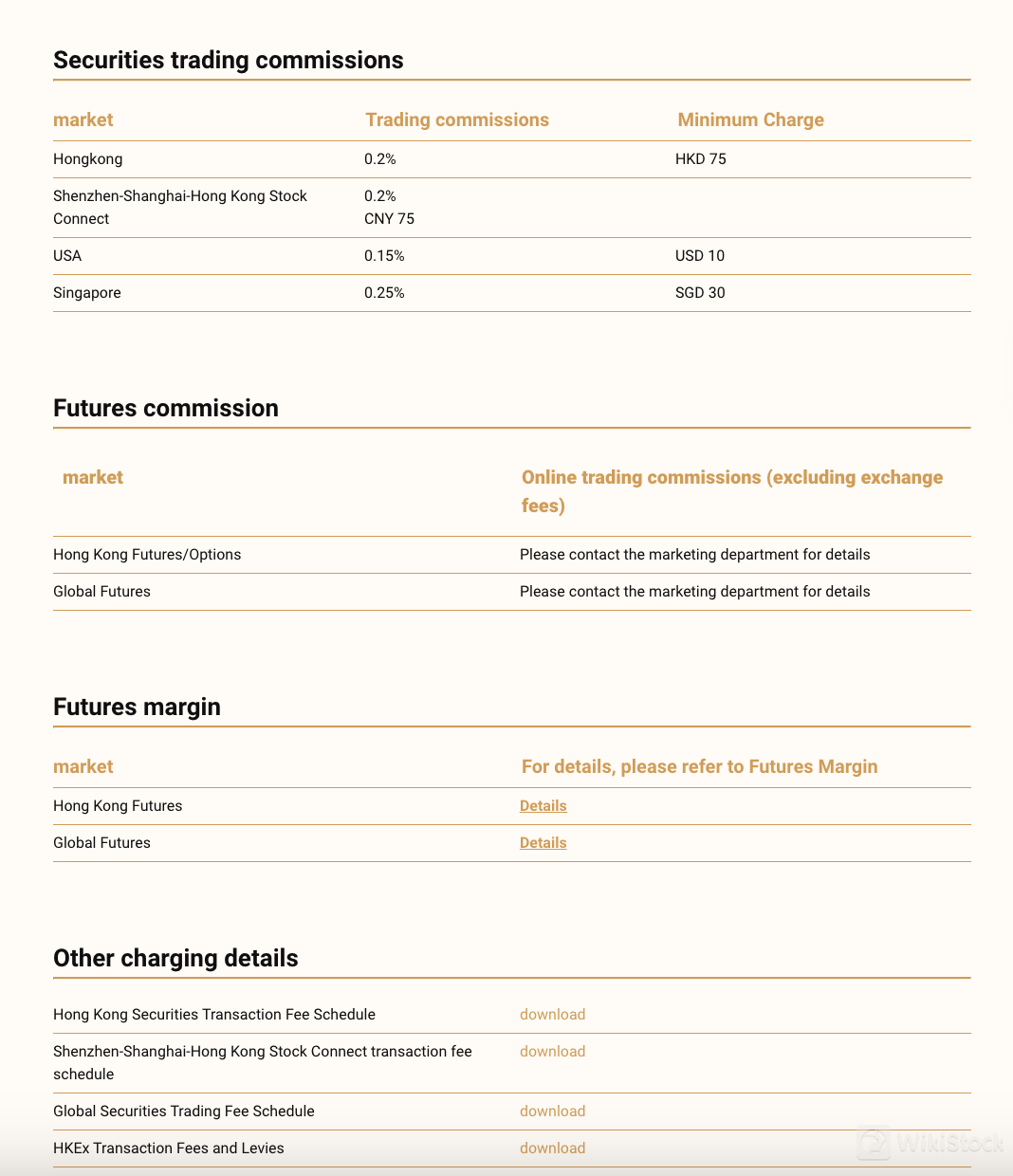

Commissions and Fees

For market trades conducted through KAISER, the platform charges a commission based on the region and currency involved. In Hong Kong, the commission rate stands at 0.2% of the transaction value, with a minimum charge of HKD 75. Similarly, for trades executed via the Shenzhen-Shanghai-Hong Kong Stock Connect, the commission rate is also 0.2%, with a minimum charge of CNY 75. For transactions in the USA, KAISER applies a commission rate of 0.15%, with a minimum charge of USD 10. In Singapore, the commission rate is slightly higher at 0.25%, with a minimum charge of SGD 30.

Comparing these fees with those of popular brokers, KAISER's commissions appear to be competitive, particularly in markets such as the USA and Hong Kong where the minimum charges are relatively low.

| Region | Trading Commission | Minimum Charge |

| Hong Kong | 0.20% | HKD 75 |

| Shenzhen-Shanghai-Hong Kong Connect | 0.20% | CNY 75 |

| USA | 0.15% | USD 10 |

| Singapore | 0.25% | SGD 30 |

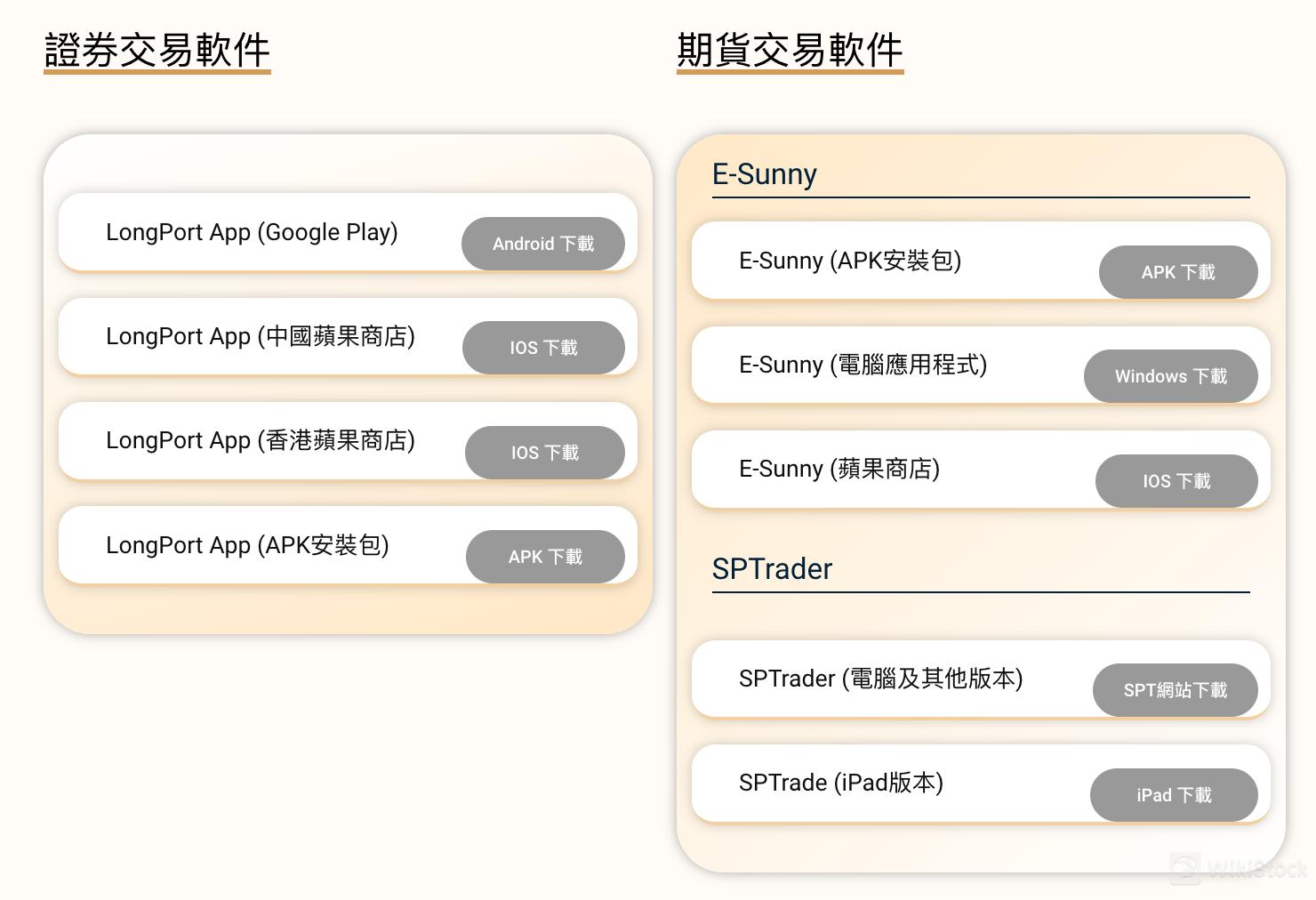

Platforms & Tools

For securities trading, KAISER offers the LongPort App available for Android and iOS devices, including versions specific to the Chinese and Hong Kong Apple App Stores.

Additionally, an APK installation package is provided for users who prefer this method. The LongPort App boasts features such as a easy global investment experience, quick account opening within approximately one minute, access to various global markets including US, Hong Kong, and mainland China stocks, advanced real-time market data including Level-2 for Hong Kong stocks, and a community feature for sharing investment insights.

On the futures trading front, KAISER provides the E-Sunny platform with options for both Android and iOS devices through APK installation and Apple App Store respectively. For desktop users, there's a Windows application available. Another platform offered is the SPTrader, accessible via the SPT website and iPad versions. Unfortunately, specific features and functionalities of E-Sunny and SPTrader are not elaborated upon in the provided information.

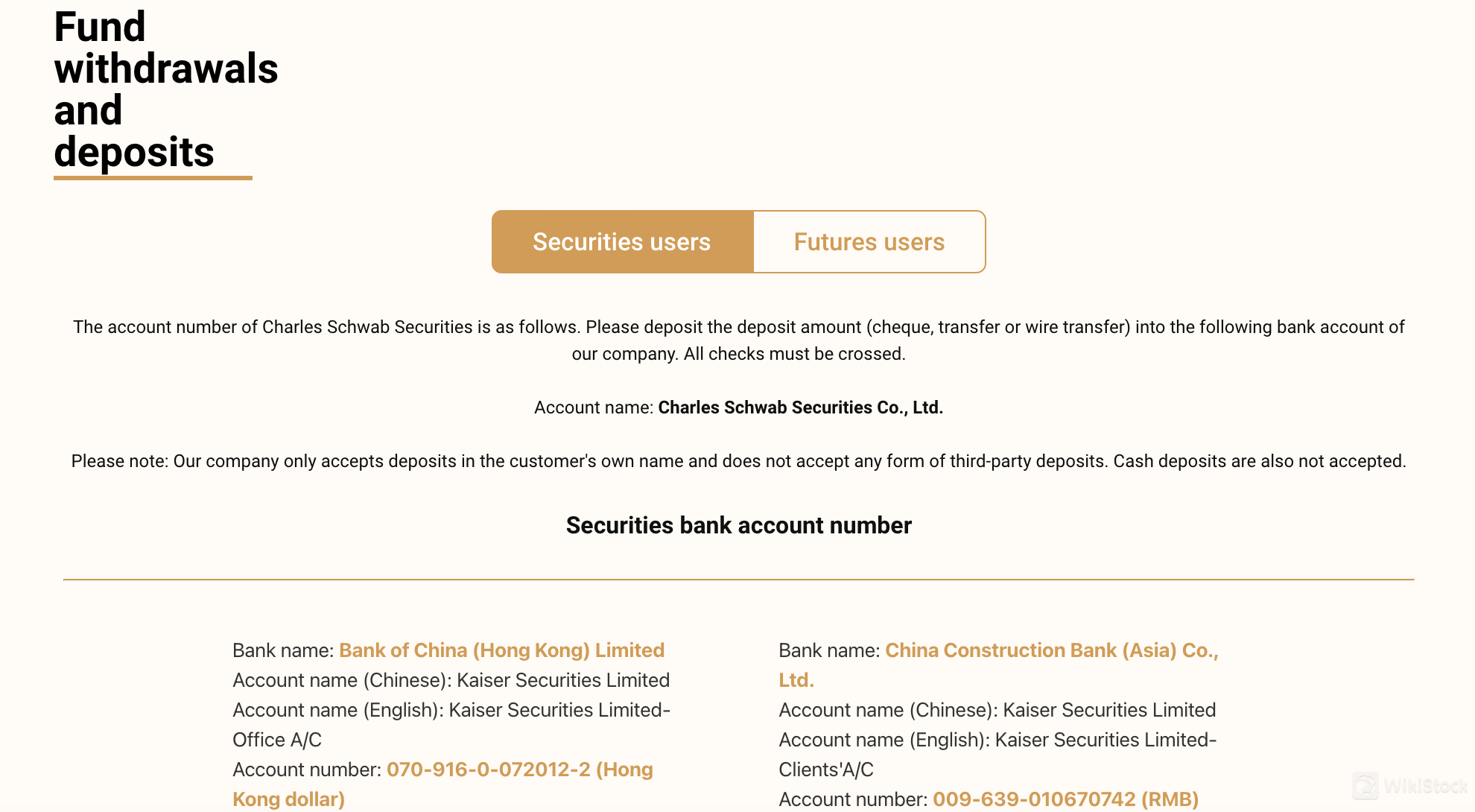

Deposit & Withdrawal

For fund withdrawals and deposits, KAISER offers various payment methods tailored for both securities and futures users. Securities users can deposit funds through cheque, bank transfer, or wire transfer into designated bank accounts.

Minimum deposit requirements and are not specified.

Customer Service

For customer support at KAISER, assistance is readily available via various channels.

Customers can reach out through the telephone host at +852 2215 8373 or the dedicated customer service hotline at +852 2215 8330.

Alternatively, inquiries can be made via fax at +852 2215 8372, WeChat at +852 9237 1570, or WhatsApp at +852 6430 2118. For email communication, customers can contact cs@kaisergroup.com.hk.

The office is located at Room 3102-05, 31/F, West Tower, Shun Tak Centre, 168-200 Connaught Road Central, Sheung Wan, Hong Kong, and operates from Monday to Friday, 9 am to 6 pm.

Educational Resources

KAISER offers a range of educational resources, including latest news updates, important notices, new stock information, trading schedules, and futures margin details.

Compared to competitors, KAISER's educational offerings may appear somewhat basic. However, the platform's focus on providing timely updates and essential trading information could still benefit active traders who prioritize staying informed about market developments.

Conclusion

In conclusion, KAISER presents a robust platform for traders, offering a wide range of securities and services across global markets.

With over 20 years in business and regulated status by the SFC, it provides a trusted environment for investors. Advantages include competitive commission rates (Securities: 0.2% (HK) / 0.15% (US)), easy global investment access, and user-friendly platforms.

However, limitations such as the absence of research reports, a Chinese-only website, and limited app availability impede accessibility for international investors.

Despite these drawbacks, KAISER's strengths in low commissions and comprehensive trading options position it favorably in the brokerage landscape.

FAQs

Question: What are KAISER's commission rates for securities trading?

Answer: KAISER's commission rates for securities trading are 0.2% for Hong Kong stocks and 0.15% for US stocks.

Question: Does KAISER offer margin trading?

Answer: Yes, KAISER provides margin trading facilities for investors.

Question: What deposit methods does KAISER accept?

Answer: KAISER accepts deposits via bank transfer, wire transfer, and FPS (Hong Kong only).

Question: Can traders access real-time market data on KAISER's platform?

Answer: Yes, KAISER provides real-time market data to assist traders in making informed decisions.

Question: Is KAISER regulated by any financial authority?

Answer: Yes, KAISER is regulated by the Securities and Futures Commission (SFC).

Question: Does KAISER offer new stock trading opportunities?

Answer: Yes, KAISER provides access to new stock trading opportunities for investors.

Others

Registered region

China Hong Kong

Years in Business

More than 20 year(s)

Products

Futures、Stocks

Relevant Enterprises

Countries

Company name

Associations

--

嘉信貴金屬有限公司

Group Company

--

嘉信資本管理有限公司

Group Company

--

嘉信期貨有限公司

Group Company

--

嘉信証券有限公司

Group Company

Review

No ratings

Recommended Brokerage FirmsMore

偉祿亞太證券

Score

鴻昇金融集團

Score

东兴证券

Score

IISL

Score

Elstone

Score

Hooray Securities

Score

SBI China Capital

Score

Sorrento

Score

Sanston

Score

弘业国际金融

Score