We’re more than a bank. We’re members of the community who are proud to use our knowledge and expertise to support you on your financial journey—now and in the future. We strive to make our communities better places to live and work. For everyone.

Amerant Information

Amerant Bank offers a flexible banking experience with no specified account minimums and a range of fee structures from free for new accounts to variable fees based on transaction types. While details on interest rates for uninvested cash and margin rates are unspecified, the bank provides access to mutual funds and operates on iOS, Android, and web platforms for convenient account management. Additionally, promotions are available to enhance customer benefits. Amerant positions itself as a versatile option for clients seeking diverse financial services, though potential customers should consider the variable fee structure and lack of specified interest rates when making banking decisions.

Pros and Cons of Amerant

Amerant Bank distinguishes itself with stringent adherence to financial regulations and a diverse portfolio of assets accessible across multiple platforms including iOS, Android, Mac, Windows, and web. However, potential drawbacks include a complex fee structure that may be challenging for clients to navigate, as well as unspecified details regarding interest rates on uninvested cash and margin interest rates. These factors could impact transparency and clarity in financial planning and decision-making for customers. Despite these considerations, Amerant Bank remains a robust choice for comprehensive banking and investment services, particularly for those prioritizing regulatory compliance and asset variety.

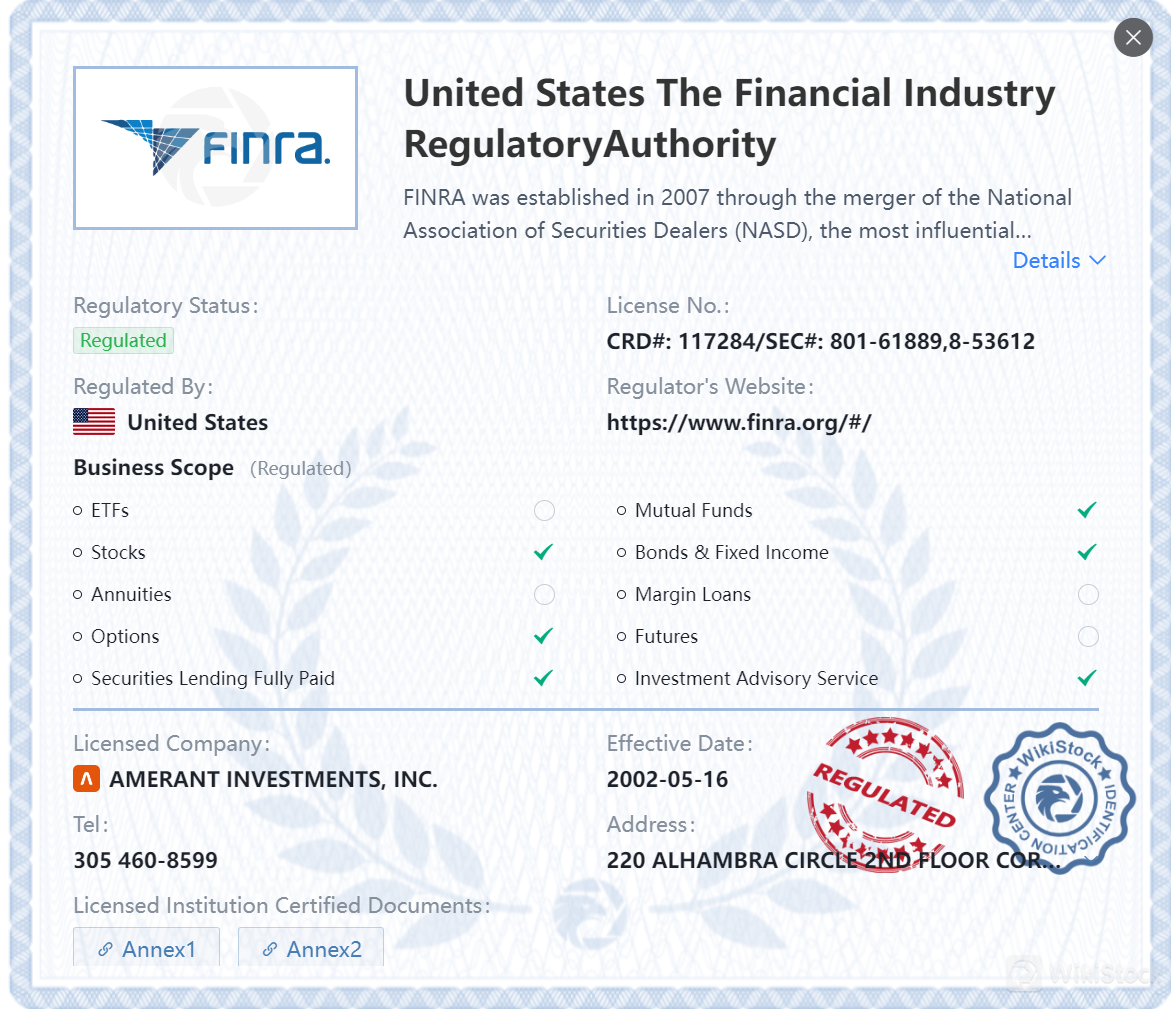

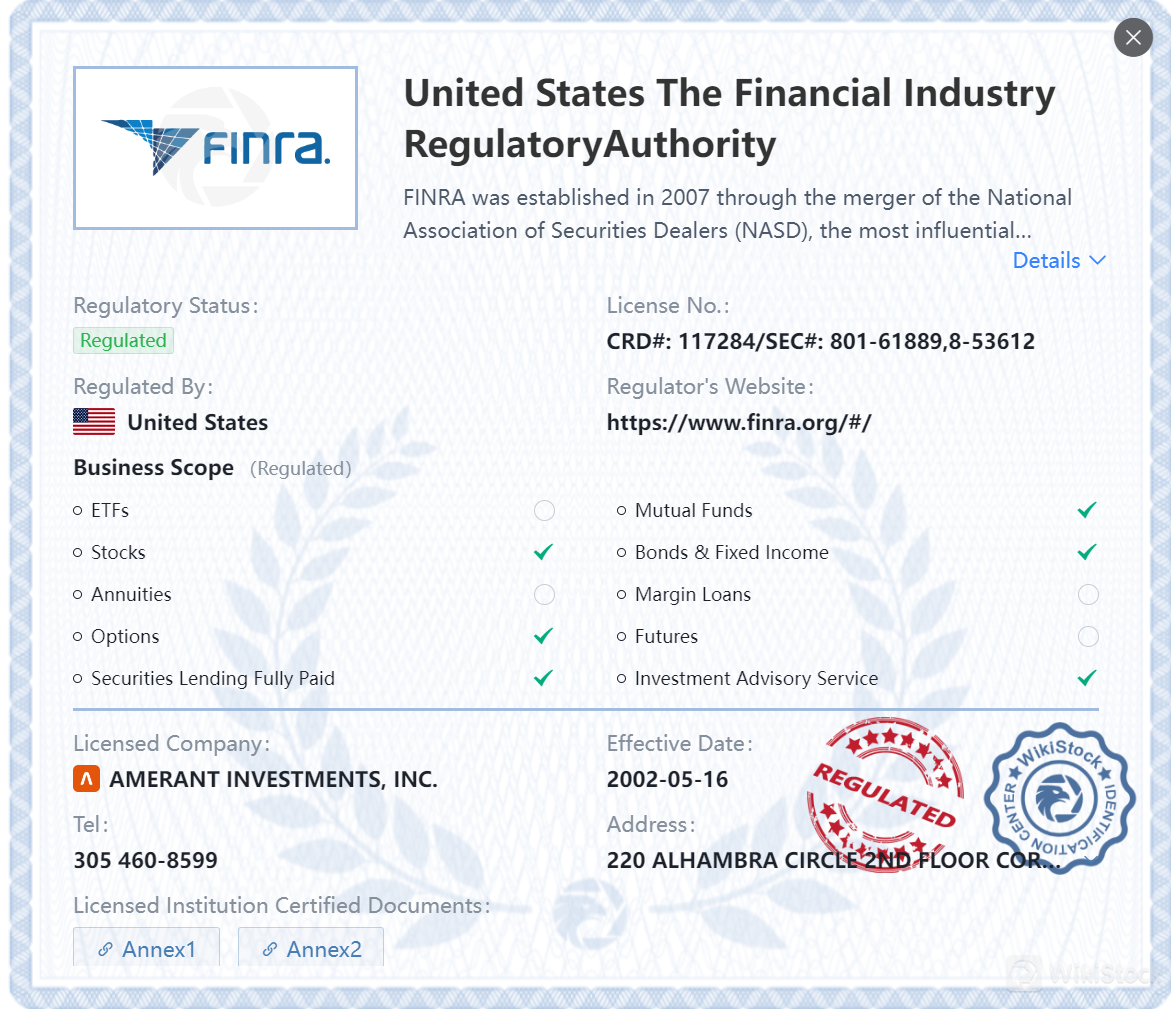

Is Amerant safe?

AMERANT INVESTMENTS, INC. is a broker-dealer registered with the United States The Financial Industry Regulatory Authority (FINRA).

AMERANT INVESTMENTS, INC. is a registered broker-dealer and investment advisor that is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). SIPC membership provides protection for up to $500,000 of securities, including $250,000 for cash claims, for each customer's accounts in the event of the firm's failure.

In addition to SIPC protection, AMERANT INVESTMENTS, INC. also employs various measures to safeguard client funds, including:

- Segregation of Client Funds: Client funds are held in segregated bank accounts separate from the company's own funds.

- Regular Audits: AMERANT INVESTMENTS, INC.'s accounts are regularly audited by independent auditors to ensure compliance with regulatory requirements and the proper safeguarding of client funds.

- Insurance Coverage: AMERANT INVESTMENTS, INC. maintains professional indemnity insurance to protect clients from losses arising from errors or omissions by the company.

What are securities to trade with Amerant?

Amerant offers a variety of investment tools, including stocks, options, exchange-traded funds (ETFs) and Cryptocurrencies. These products help investors achieve diversified portfolios and select different risk-reward options. However, it does not provide products like commodity futures and forex.

- Stocks: These represent ownership shares in individual companies.

- ETFs (Exchange-Traded Funds): These are baskets of securities that trade on stock exchanges like stocks.

- Options: These are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price by a certain date.

- Cryptocurrencies: These are digital assets designed to work as a medium of exchange that use cryptography for security.

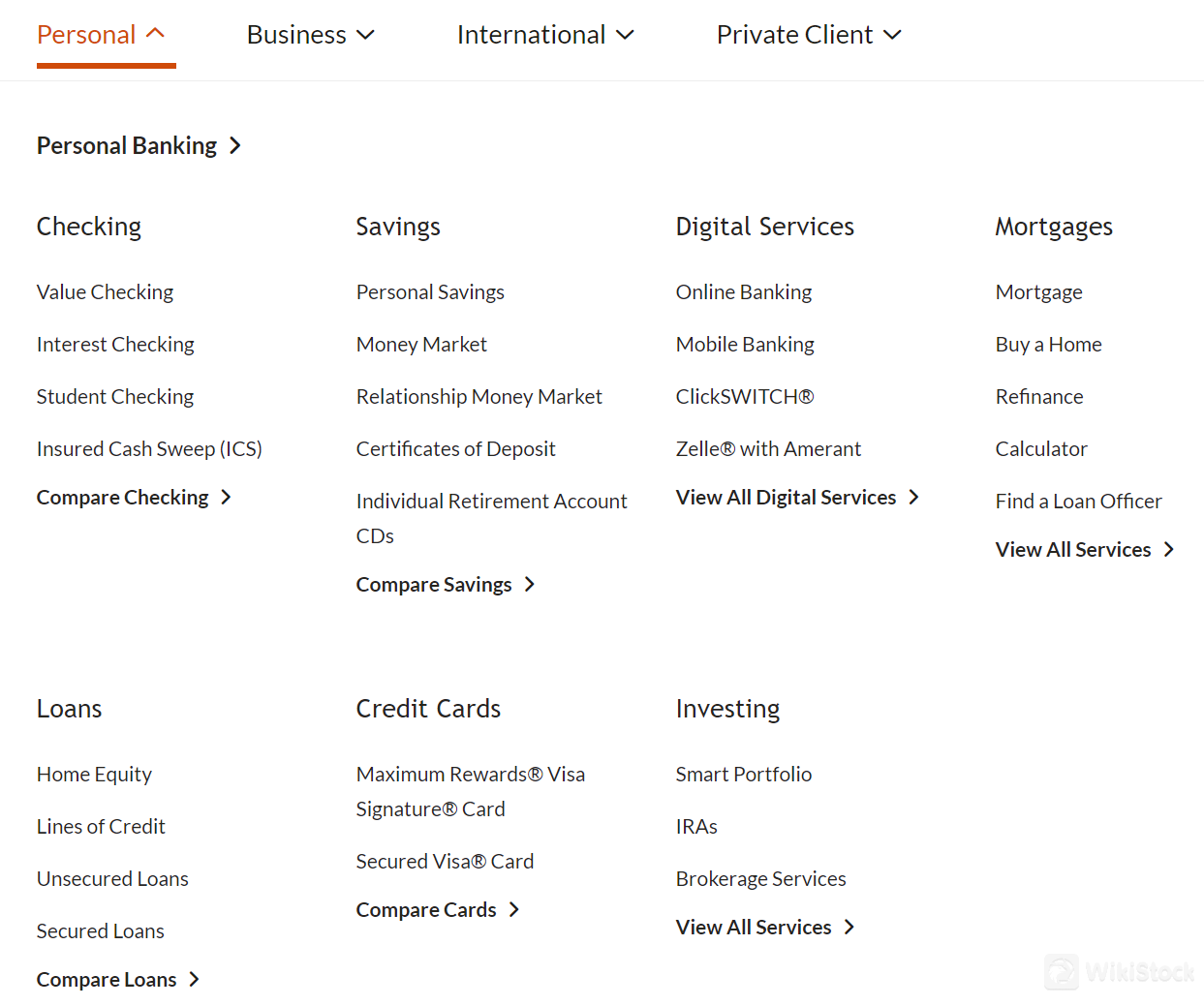

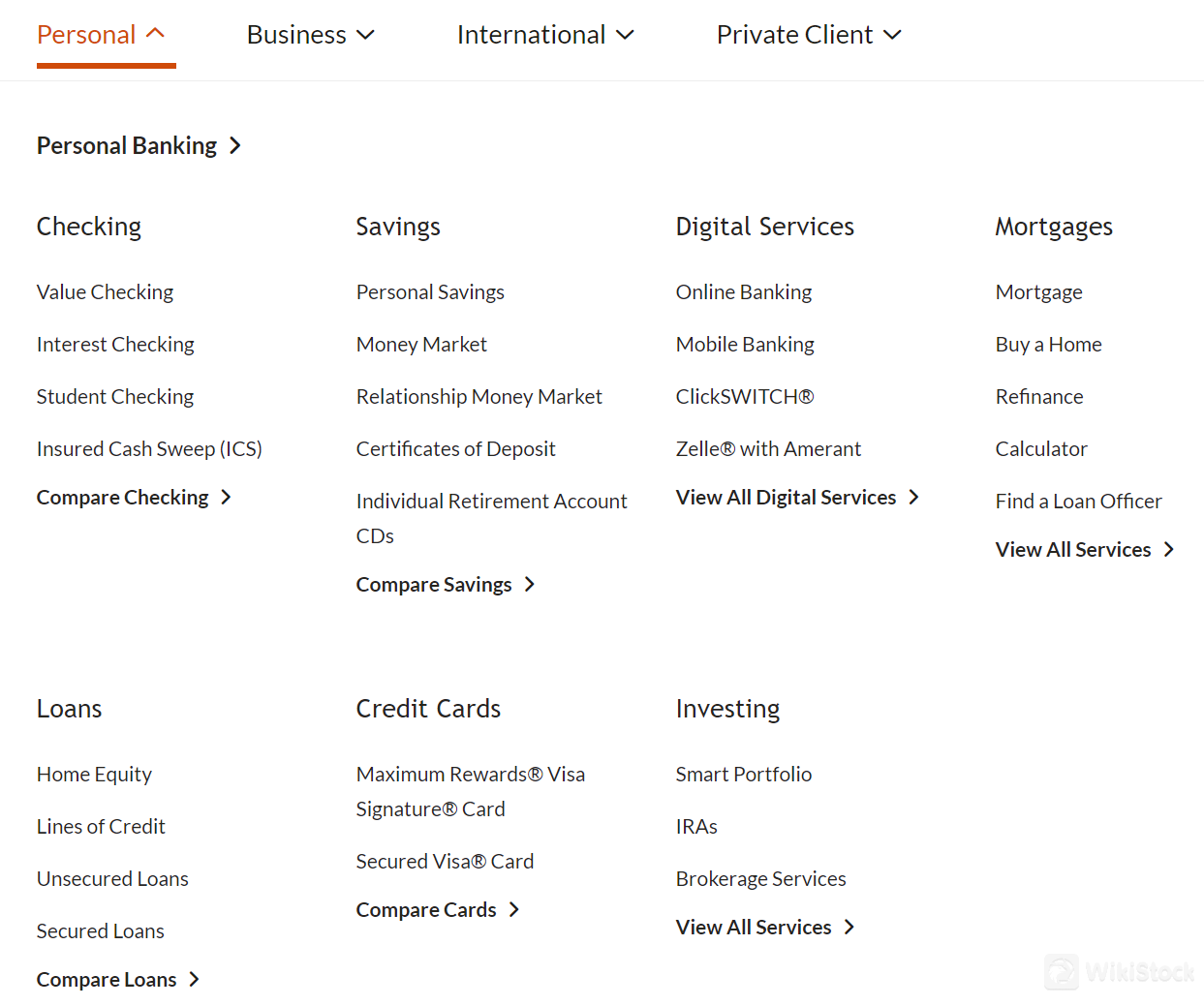

Amerant Accounts

Amerant Bank offers a range of specialized account services tailored to diverse customer needs. For personal banking, they provide comprehensive solutions designed to enhance financial management and convenience. Business clients benefit from specialized accounts under the TreasuryConnectSM program, catering to corporate financial needs with extended service hours to support business operations effectively. International banking services ensure seamless transactions and support for clients across borders, facilitating global financial interactions with personalized assistance. Private clients receive exclusive services designed to meet sophisticated financial goals and personalized wealth management needs, ensuring discretion and comprehensive support. Each account type is backed by Amerants commitment to quality service and tailored financial solutions.

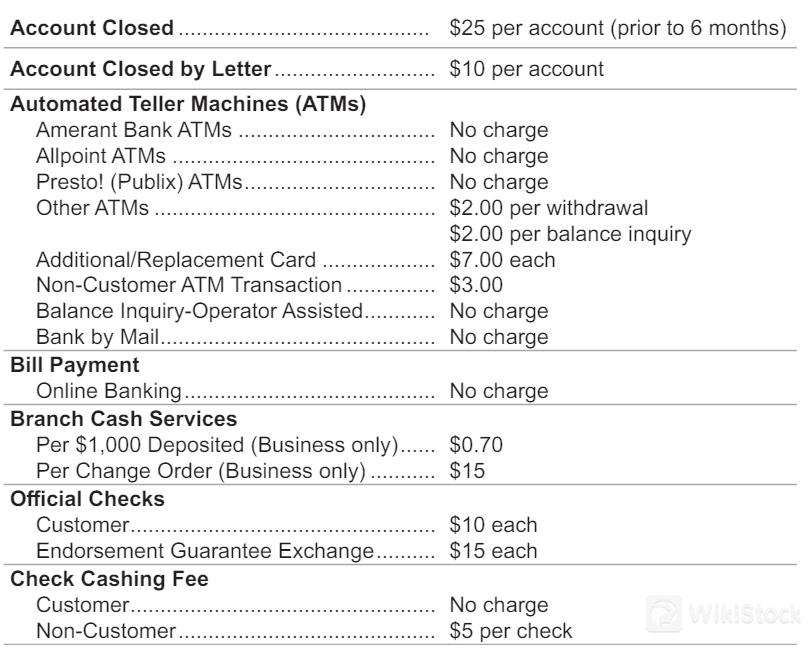

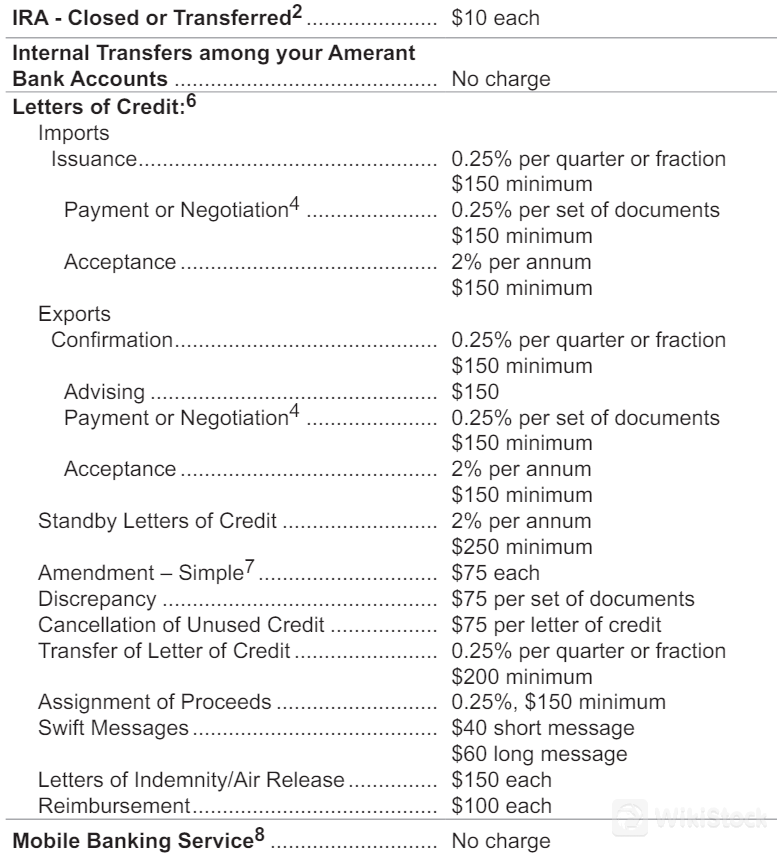

Amerant Fees Review

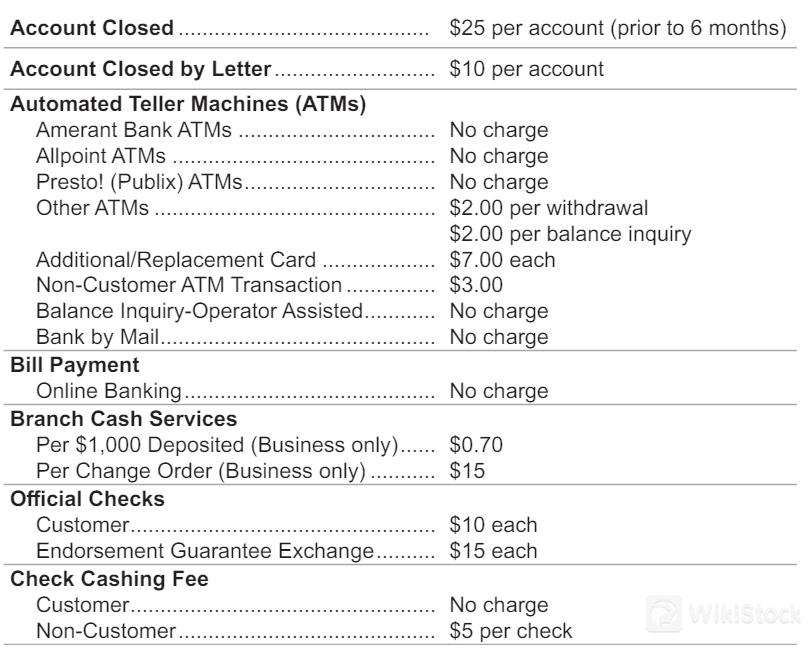

Account Closed: $25 per account (if closed for less than 6 months)

Account Closed by Letter: $10 per account

Additional/Replacement Card: $7.00 each

Non-Customer ATM Transaction: $3.00

Customer Checks:

- No charge for checks drawn on the account holder's own account

- $5.00 per check for non-customers

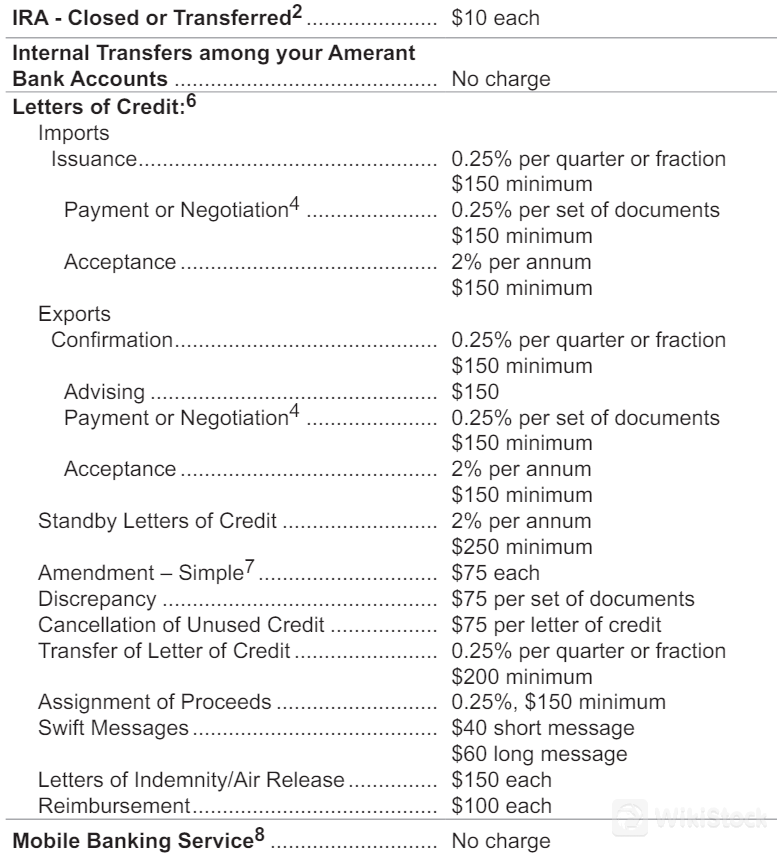

Issuance:

- Payment or Negotiation: $150 minimum + 0.25% per set of documents

- Acceptance: $150 minimum + 2% per annum

Imports: 0.25% per quarter or fraction

Exports: 0.25% per quarter or fraction

Standby Letters of Credit: $150 minimum + 2% per annum

Amendment - Simple: $250 minimum + $75 each

Cancellation of Unused Credit: $75 per letter of credit

Transfer of Letter of Credit: 0.25% per quarter or fraction + $200 minimum

Amerant App Review

Amerant's mobile app is a cutting-edge and intuitive trading platform designed for on-the-go traders. It provides a comprehensive trading experience, available on iOS and Android devices, facilitating easy access to markets anytime, anywhere. In addition to the mobile app, Amerant also offers a versatile range of platforms and tools for different devices and operating systems, including Web Trading platforms, as well as dedicated applications for Mac and Windows. This variety ensures that all users, regardless of their preferred device, can access the trading services seamlessly.

Research and Education

Amerant Bank's Editor's Choice, curates top expert information to address various banking inquiries. This resource provides authoritative insights and expert advice on banking topics, serving as a comprehensive guide for customers seeking informed decisions about their financial needs. Whether exploring investment strategies, understanding market trends, or learning about banking innovations, “Editor's Choice” offers curated content to empower customers with valuable knowledge and facilitate informed financial choices. This initiative underscores Amerant's commitment to providing educational resources that enhance financial literacy and support customer success in navigating their banking journey.

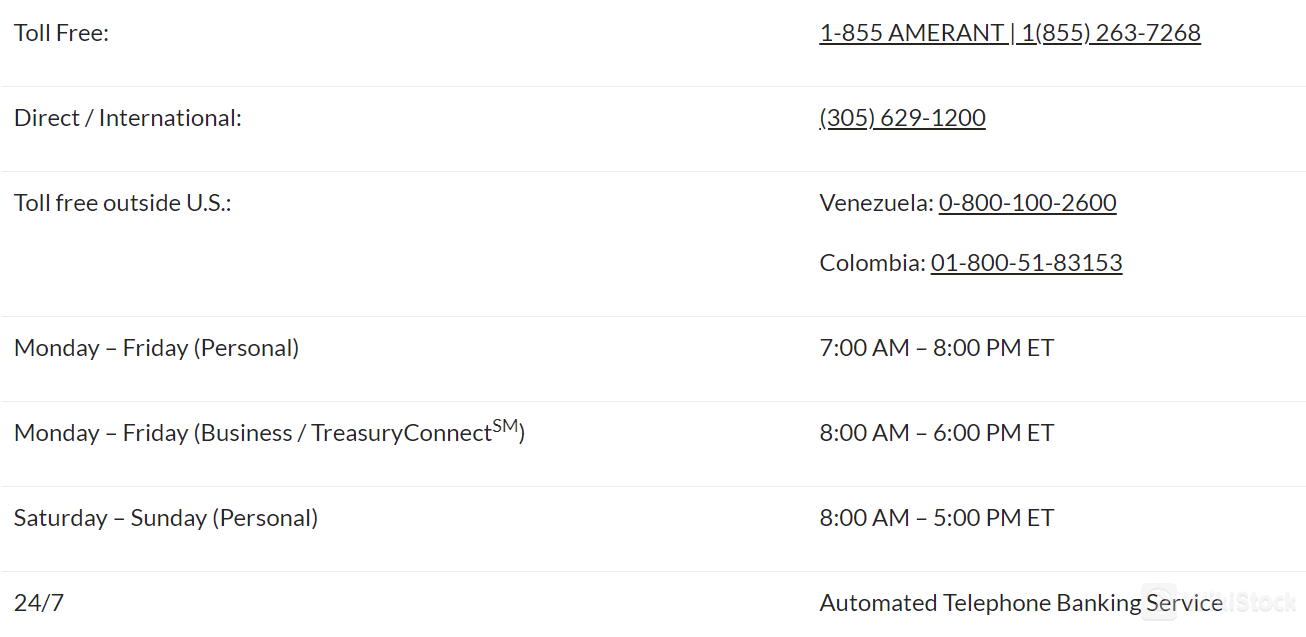

Customer Service

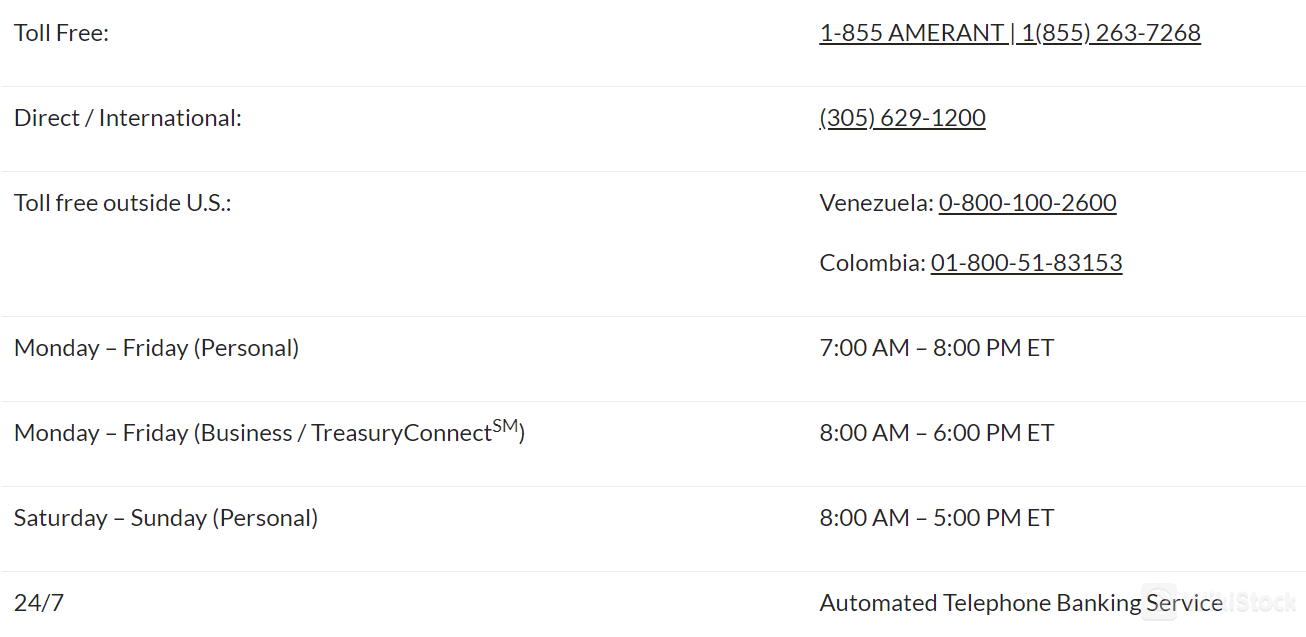

Amerant Bank offers comprehensive customer support through multiple contact channels and service hours to cater to diverse needs. Customers can reach them toll-free within the U.S. at 1-855-263-7268 or internationally at (305) 629-1200. Additionally, specific toll-free numbers are provided for Venezuela and Colombia. Support hours are tailored for personal and business banking needs, spanning Monday to Friday from 7:00 AM to 8:00 PM ET for personal banking and 8:00 AM to 6:00 PM ET for business and TreasuryConnectSM services. Weekend support is available from 8:00 AM to 5:00 PM ET for personal banking. For continuous assistance, an automated telephone banking service operates 24/7.

Conclusion

Amerant Bank stands out for its robust offerings in banking and investment services, emphasizing flexibility and accessibility. With no specified account minimums and a range of fee structures, including promotions for new accounts, Amerant caters to a broad spectrum of clients. The bank provides access to mutual funds and operates on iOS, Android, and web platforms, ensuring convenient account management. However, potential clients should consider the complex fee structure and unspecified details on interest rates as factors for decision-making. Amerant's commitment to regulatory compliance and comprehensive customer support further strengthens its appeal, making it a suitable choice for individuals and businesses seeking versatile financial solutions backed by reliable service and extensive support options.

FAQs

Is Amerant Bank safe to bank with?

Amerant Bank is registered with the Federal Deposit Insurance Corporation (FDIC), providing deposit insurance up to the maximum allowable limit. Additionally, Amerant Investments, Inc., its broker-dealer arm, is registered with FINRA and is a member of SIPC, offering further protection for securities up to $500,000 per customer account.

Is Amerant Bank a good platform for beginners?

Amerant Bank offers a user-friendly experience with its mobile apps and web platforms, catering to both personal and business banking needs. However, beginners should consider the complex fee structure and potential challenges in understanding the specifics of certain transactions.

Is Amerant Bank legit?

Yes, Amerant Bank is a legitimate banking institution regulated by the FDIC, ensuring compliance with banking laws and regulations. Its broker-dealer, Amerant Investments, Inc., is also regulated by FINRA and SIPC, providing additional credibility for its investment services.

Is Amerant Bank good for investing/retirement?

Amerant Bank offers access to a variety of investment tools including stocks, options, ETFs, and cryptocurrencies through its brokerage services. It caters to diverse financial needs, although potential investors should note the unspecified details on interest rates and certain fees when considering it for investing or retirement planning.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)