Established in 1991, GF Securities Co., Ltd. (the “Company”) is one of the first, full-service securities companies in China. The Company was successfully listed on the main boards of the Shenzhen Stock Exchange (Stock code: 000776.SZ), and the Hong Kong Stock Exchange (Stock code: 1776.HK), in 2010 and 2015, respectively.

The Company is a provider of comprehensive capital market services with industry-leading innovation capabilities focused on serving China’s quality enterprises and many investors with demand for financial products and services, possessing licenses for a full range of services involved in four business segments, including investment banking, wealth management, trading, and institution and investment management.

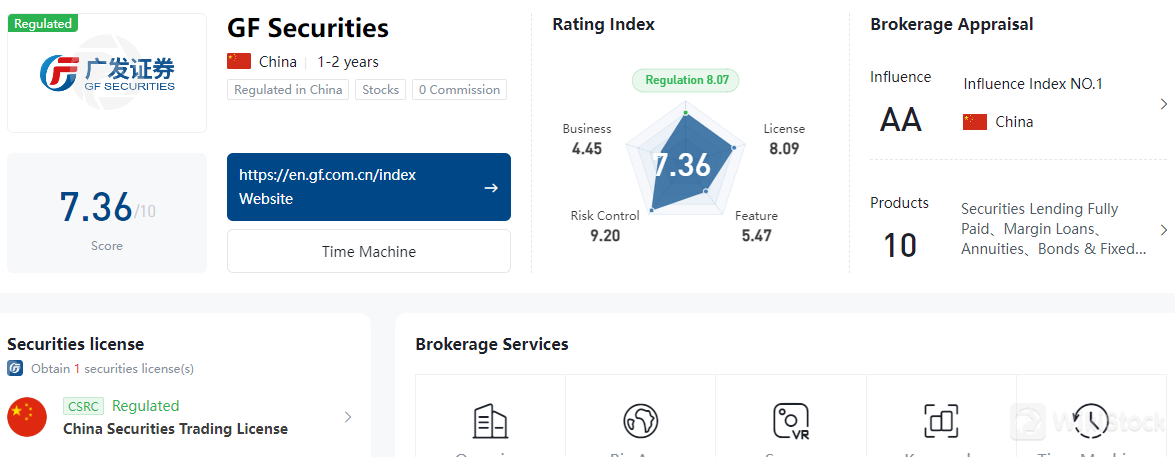

What is GF Securities?

GF Securities is a leading financial services provider known for its extensive range of trading products and user-friendly trading apps. It offers competitive fees and comprehensive customer support. However, specific insurance coverage details for client funds may vary.

Pros and Cons of GF Securities

GF Securities is a well-regulated and comprehensive financial services provider known for its wide range of trading products, user-friendly trading platforms, and robust customer support. It offers extensive educational resources and employs strong security measures to protect client funds and data. However, potential clients should be aware of the varying fees and specific insurance details for client funds, and the fact that educational and research materials are primarily available in Chinese. Overall, GF Securities is a reliable choice for both novice and experienced investors.

Is GF Securities safe?

GF Securities is considered safe based on the following dimensions:

Regulations

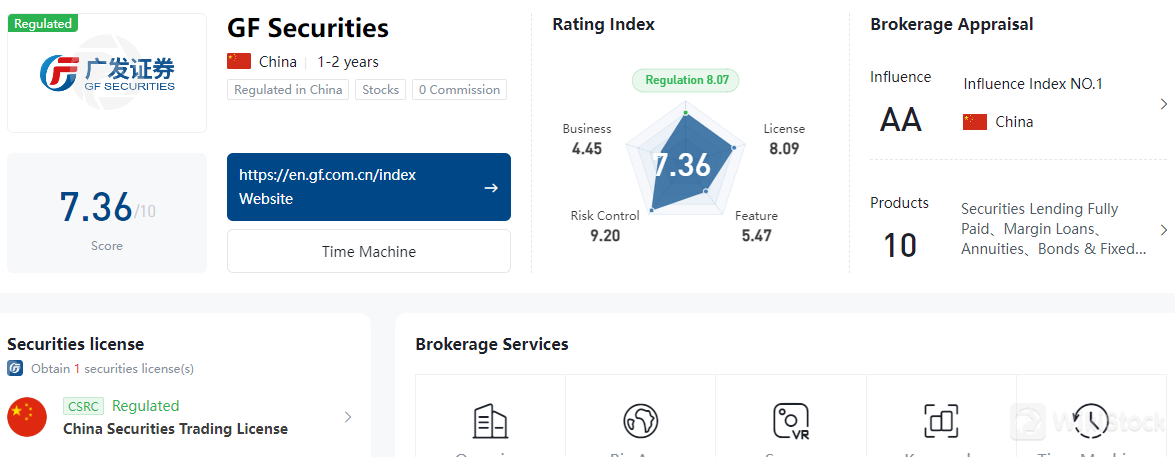

GF Securities is regulated by the China Securities Regulatory Commission (CSRC), ensuring compliance with stringent regulatory standards and guidelines to maintain market integrity and protect investors.

Funds Safety

GF Securities has measures in place to protect clients' funds, including insurance for account funds.

Safety Measures

The company employs robust encryption technologies to secure funds and protect data. Additionally, it implements strict account security measures to prevent unauthorized access and information leaks, ensuring clients' data and funds are secure.

What are securities to trade with GF Securities?

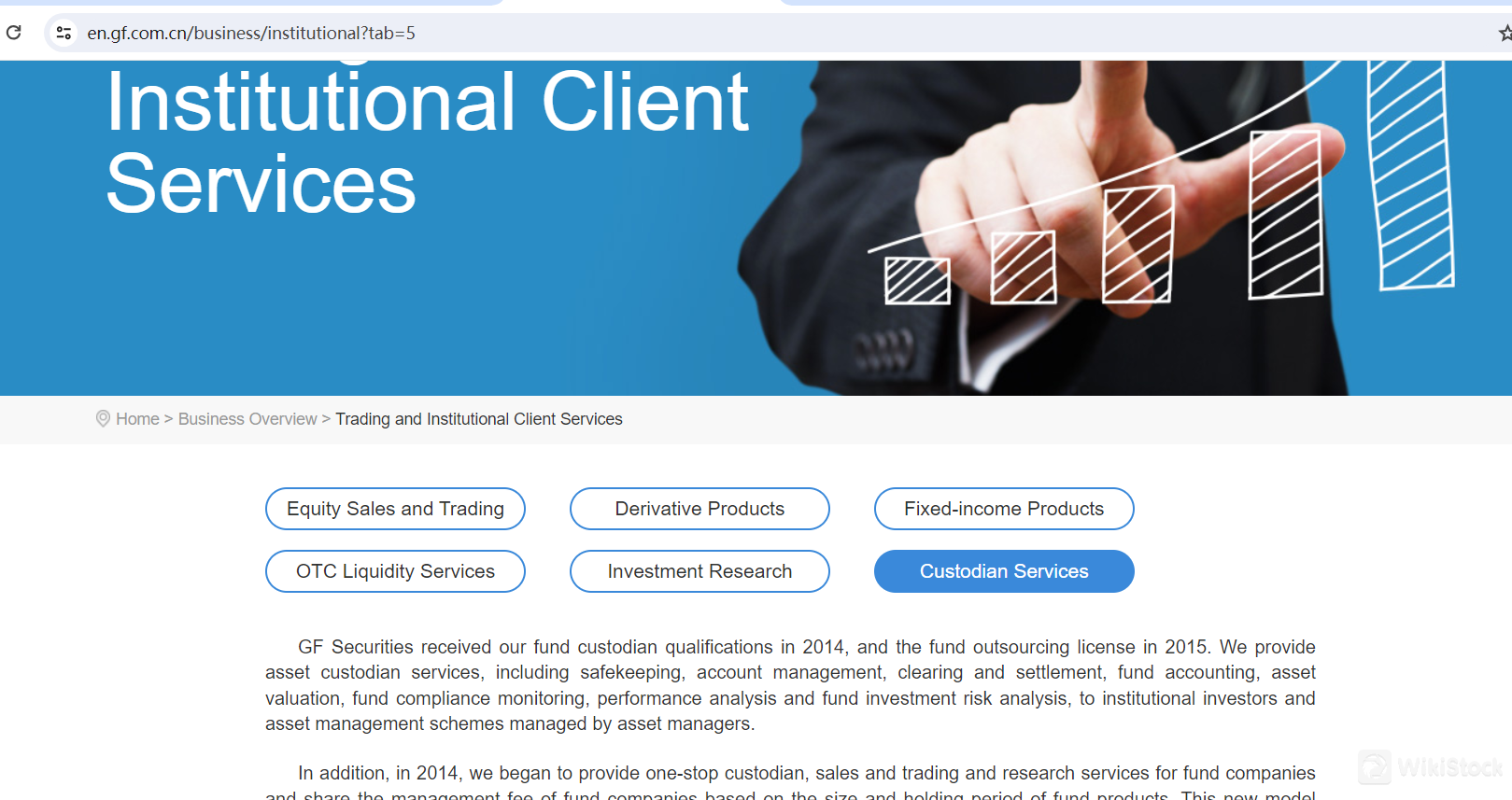

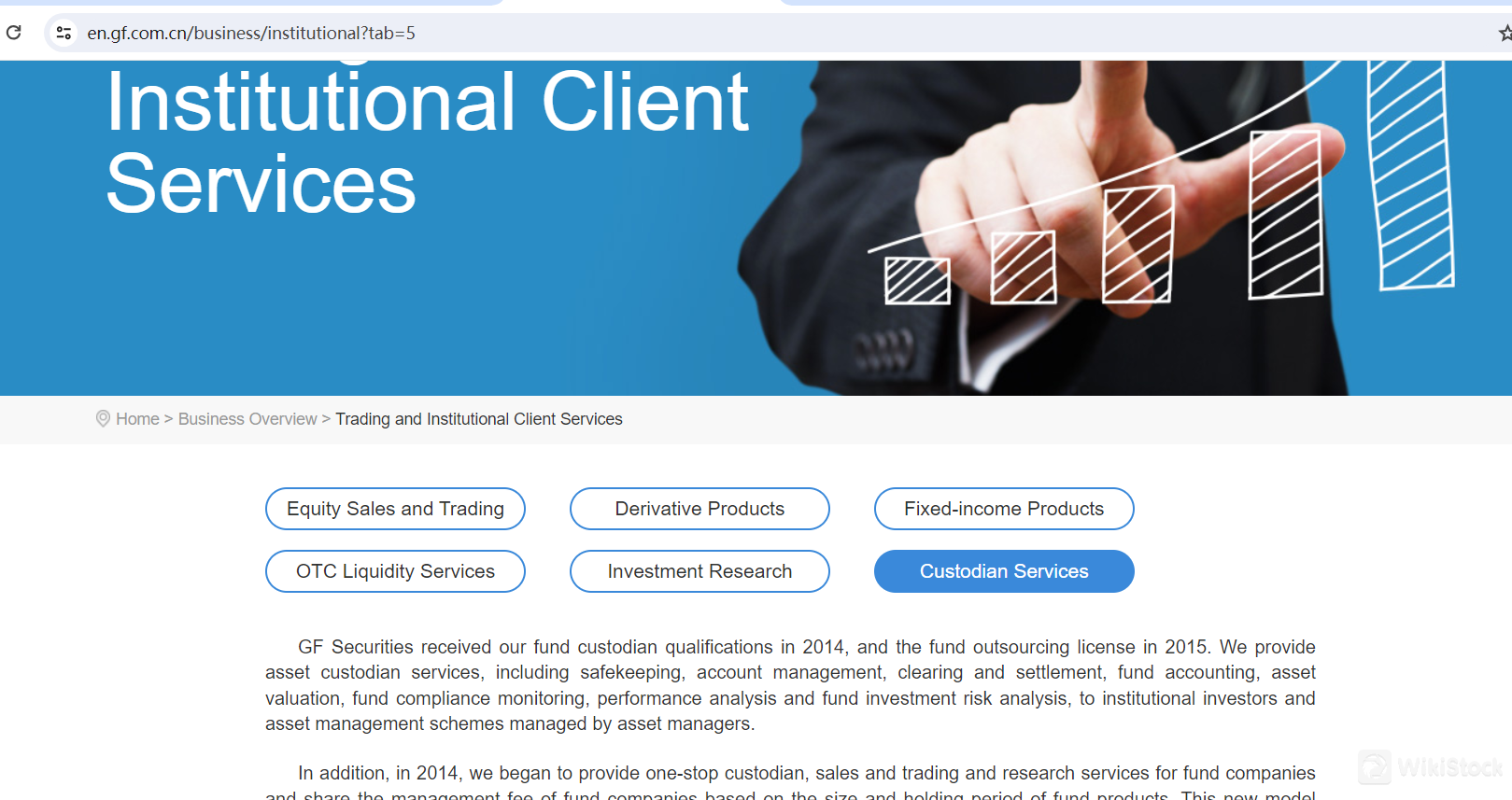

GF Securities, a comprehensive financial services provider, offers a broad range of trading products catering to institutional clients. Here is a detailed overview of its main trading products:

Equity Sales and Trading

GF Securities provides a wide array of institutional client services including securities trading, OTC markets, leasing trading seats, investment research, and custodian services. Their clientele includes significant institutional investors such as the National Social Security Fund, commercial banks, insurance companies, and more. The company is also involved in selling equity placements underwritten by its investment banking team, trading equity derivatives, and engaging in market-making activities. Furthermore, GF Securities bridges domestic and international markets by providing mainland Chinese institutional clients access to Hong Kong's capital markets and vice versa through QFII and RQFII plans.

Derivative Products

GF Securities offers extensive derivative advisory and execution services, focusing on equity and fixed-income derivatives in China's interbank bond market and exchanges. This includes equity derivatives, interest rate swaps, and treasury bond futures. The company has established a global commodity futures and derivatives platform, positioning itself as a leading intermediary between PRC clients and international markets. This platform leverages memberships at major commodity futures exchanges and adheres to international risk management practices.

Fixed-income Products

In the fixed-income space, GF Securities provides advisory and execution services for bonds and engages in market-making and proprietary trading of a wide range of fixed-income and derivative products. These include treasury bonds, policy financial bonds, corporate bonds, and more. The company actively participates in international FICC (Fixed Income, Currencies, and Commodities) business through its subsidiary, GF Global Capital, with investments spread across various countries and regions. GF Securities is also a key player in the market-making services on China's interbank bond market and is expanding its capabilities in trading precious metals and other commodities.

OTC Liquidity Services

GF Securities designs and sells various OTC products, including financial derivatives, equity income swaps, OTC options, and private equity fund trust products. These products are tailored to meet the unique investment needs of institutional clients, featuring diverse structures like binary and embedded European style options. The company has issued thousands of OTC products with a significant market value, maintaining a leading position in the industry. Additionally, GF Securities excels in the NEEQ/New OTCBB market-making business, offering market-making services to numerous enterprises and enhancing their capital frameworks and market value management.

Through these comprehensive trading products and services, GF Securities caters to the diverse needs of institutional investors, ensuring robust market participation and financial growth.

GF Securities Fees Review

For A-Shares, the fee structure includes several components. The trading handling fee charged by the exchange is 0.0341% of the transaction amount, applied to both sides of the trade. Additionally, there is a securities regulation fee imposed by the China Securities Regulatory Commission (CSRC), which is 0.02% of the transaction amount, also applied to both sides. The China Securities Depository and Clearing Corporation Limited charges a transfer fee of 0.01% of the transaction amount, applied to both sides as well. Lastly, there is a stamp duty of 0.5% of the transaction amount, which is a single-sided fee paid by the seller.

For B-Shares, the fee structure is slightly different but similarly comprehensive. The trading handling fee charged by the exchange is 0.0341% of the transaction amount, applied to both sides. The securities regulation fee by the CSRC is 0.02% of the transaction amount, also applied to both sides. There are additional costs such as a settlement fee, which is capped at 50 dollars per transaction, and a transfer fee capped at 500 Hong Kong dollars per transaction. The stamp duty for B-Shares is 0.5% of the transaction amount, paid by the seller.

For trading funds such as closed-end funds, ETFs, and LOFs, GF Securities charges a trading handling fee of 0.04% of the transaction amount, applied to both sides. Debt securities, including corporate bonds, enterprise bonds, and other types of bonds, have a trading handling fee which varies by bond type. For example, corporate bonds and enterprise bonds are currently exempt from trading handling fees. Convertible bonds incur a trading handling fee of 0.004% of the transaction amount, applied to both sides. The settlement fee for these bonds is also waived, except for specific types of transactions.

GF Securities' comprehensive fee structure also extends to ETF options, where the transaction handling fee is 0.0341% of the transaction amount, applied to both sides. Additionally, there is a registration transfer fee of 0.02% of the transaction amount, applied to both sides. For ETF options, an exercise settlement fee of 0.6 yuan per contract is charged to the exercising party.

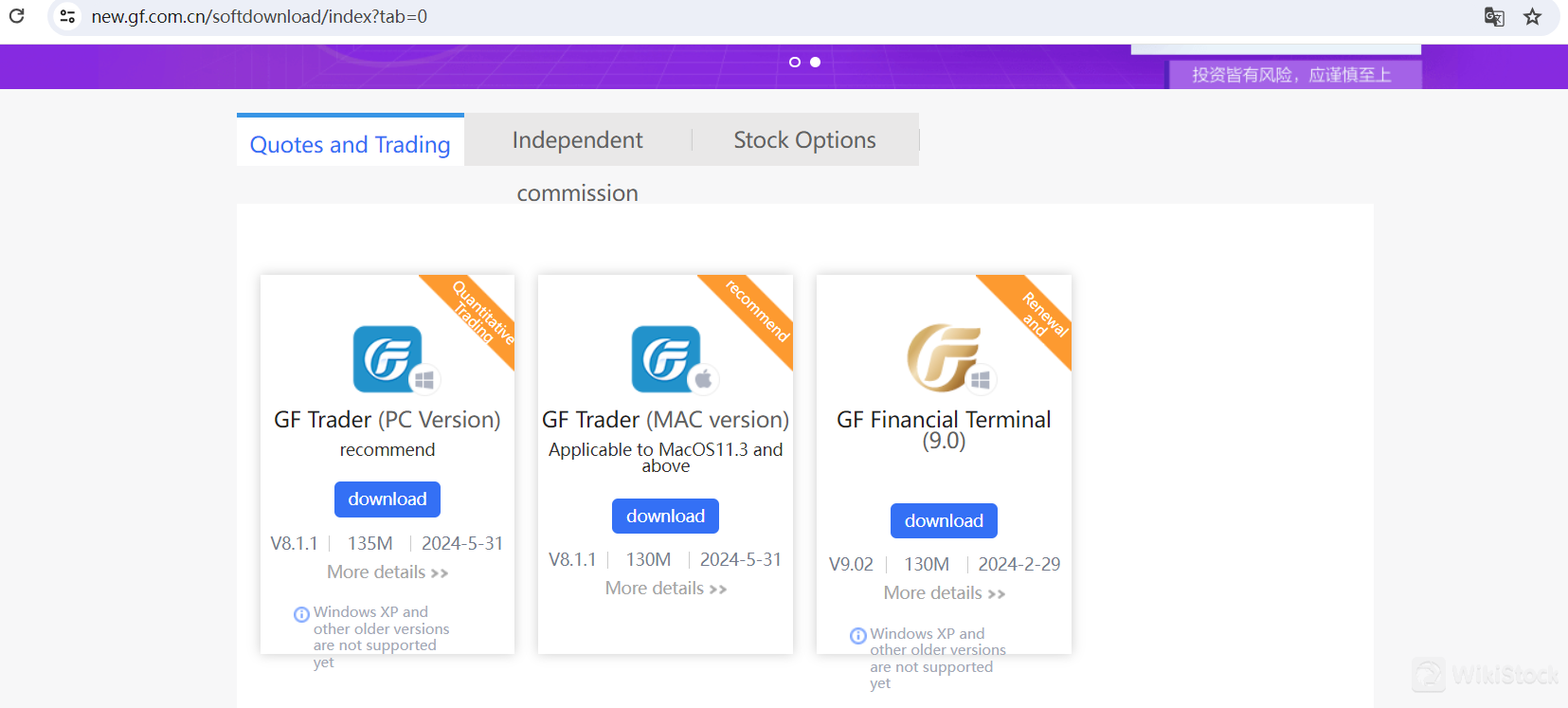

GF Securities App Review

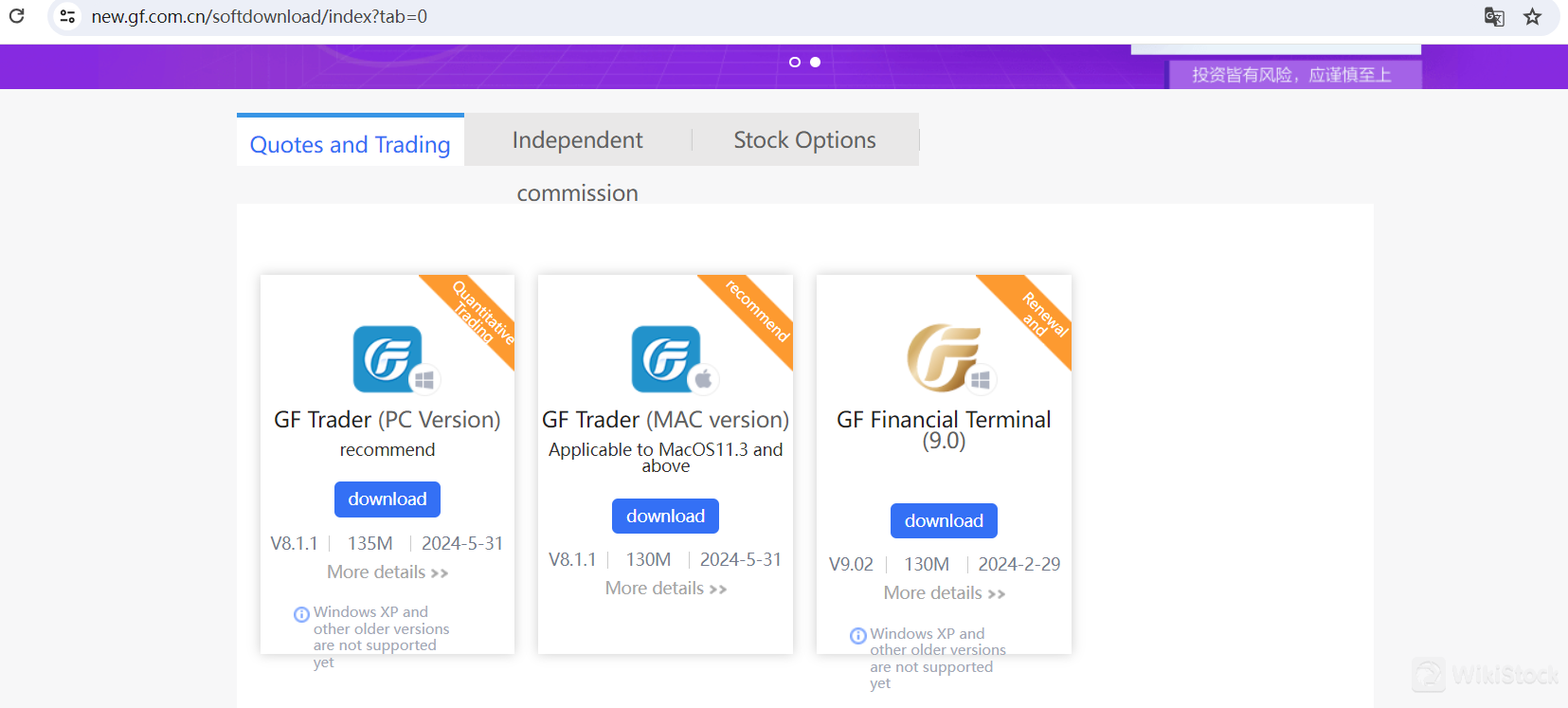

GF Securities offers a suite of trading software designed to cater to the needs of various types of investors:

- GF Trader (PC and Mac versions): This software is designed for both PC and Mac users, with the latest versions offering enhanced performance and a range of features. The PC version, GF Trader V8.1.1, supports modern Windows operating systems, while the Mac version is compatible with MacOS 11.3 and above. The software provides functionalities such as real-time trading, market analysis, and the ability to manage both cash and margin accounts. Users can set up quick trades and manage their portfolios with ease.

- GF Financial Terminal (Version 9.0): This is an advanced trading terminal offering comprehensive features for serious traders. It includes tools for in-depth market analysis, real-time data, and robust trading capabilities. The software is frequently updated to ensure compatibility with the latest operating systems and to incorporate new trading features.

- Independent Trading Terminal: Known as the “Independent Trader,” this platform is tailored for users who need standalone trading capabilities. It supports various trading activities including regular buy/sell orders, margin trading, and financing operations. The terminal allows for quick trade execution without the need for confirmation, making it ideal for high-frequency traders.

- GF Options Pro (Version 2.0): This specialized platform is focused on options trading, offering integrated market data, strategy planning, and trading execution. The latest version includes features like line drawing for order placement, specialized modules for options strategies, and educational resources through the “Options Academy.” It supports keyboard trading and provides comprehensive market updates.

- GF Mobile Trading Apps: GF Securities also offers mobile applications that enable traders to manage their investments on the go. These apps are available for both Android and iOS platforms and include features such as real-time market quotes, trading execution, and portfolio management. They are designed to be user-friendly and provide all essential trading functionalities.

- GF Simulated Trading: For those looking to practice their trading strategies without risking real money, GF Securities provides a simulated trading environment. This includes both a simulated options trading platform and a comprehensive stock trading simulation app. These tools allow users to test their strategies in a risk-free environment using real-time market data.

Key Features Across Platforms

GF Securities' trading platforms are designed with key features that cater to both novice and experienced traders. All platforms provide real-time market data, ensuring users have the most current information for making informed trading decisions. They include advanced trading tools such as charting features and automated trading strategies, which help traders analyze the markets and execute trades effectively. Security is a top priority, with robust features like SSL encryption and regular updates to meet the latest regulatory standards. Despite the advanced capabilities, the platforms maintain a user-friendly interface, making them intuitive and accessible for all levels of traders.

GF Securities' trading software is designed to meet the diverse needs of its clients, offering powerful tools and flexible features to support efficient and effective trading.

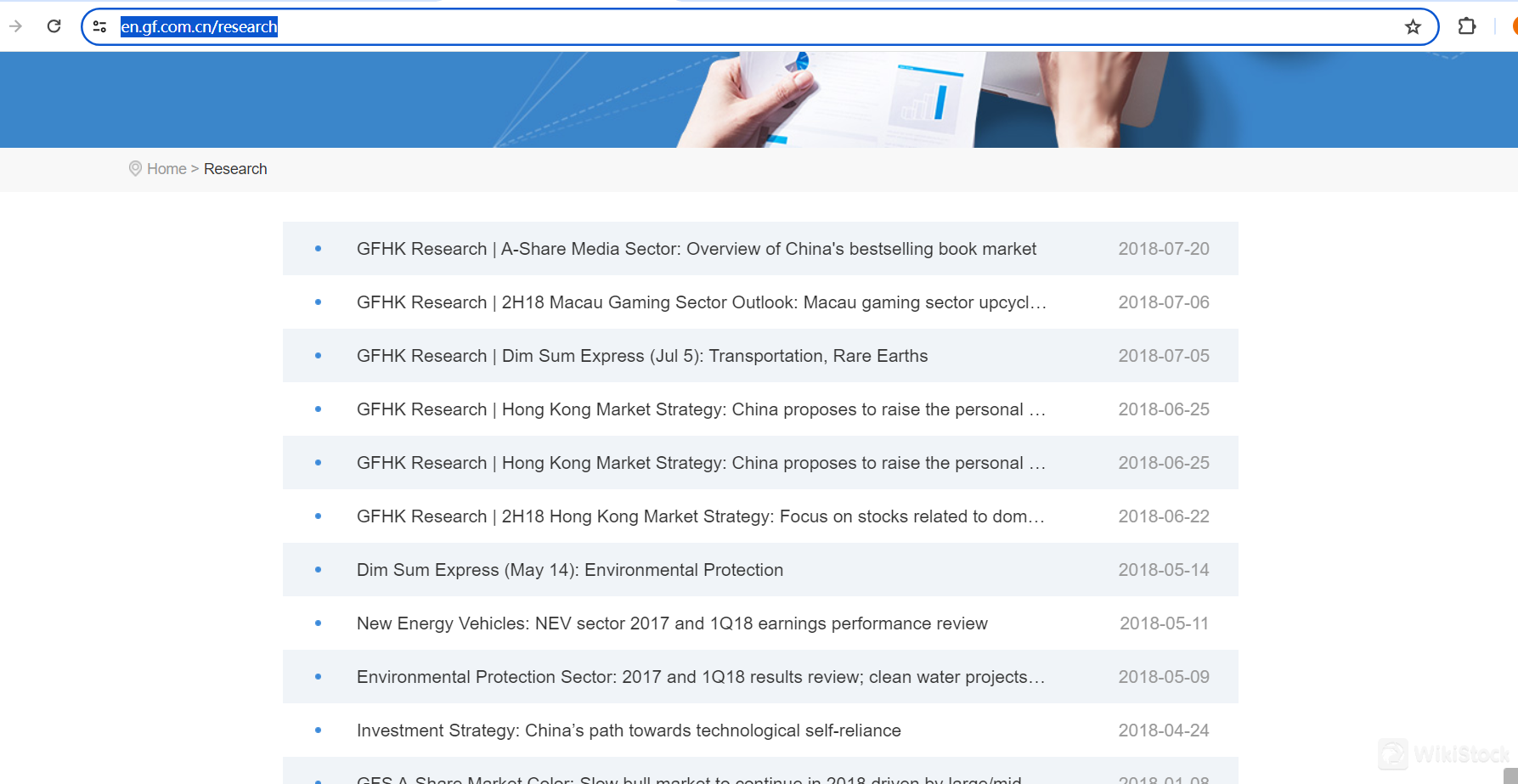

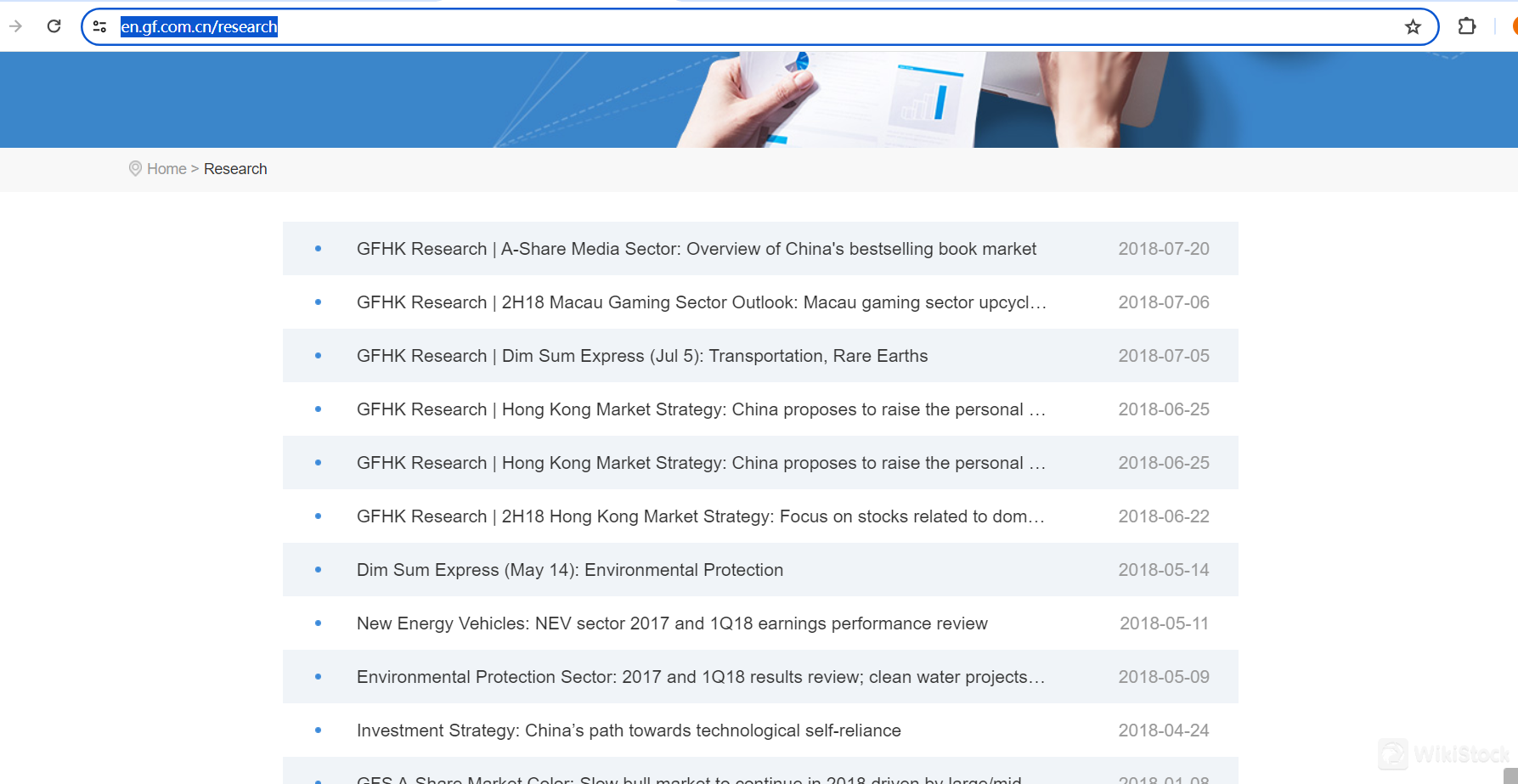

Research and Eduation

GF Securities offers an extensive range of research and educational resources accessible through their research portal. The platform features detailed research reports covering various market sectors, economic trends, and industry insights. These reports provide in-depth analyses of A-share listed companies, market strategies, and more, supporting investors in making informed decisions. Additionally, the portal includes educational materials designed to enhance investor knowledge, ranging from fundamental investment principles to advanced trading strategies, ensuring clients are well-equipped to navigate the financial markets.

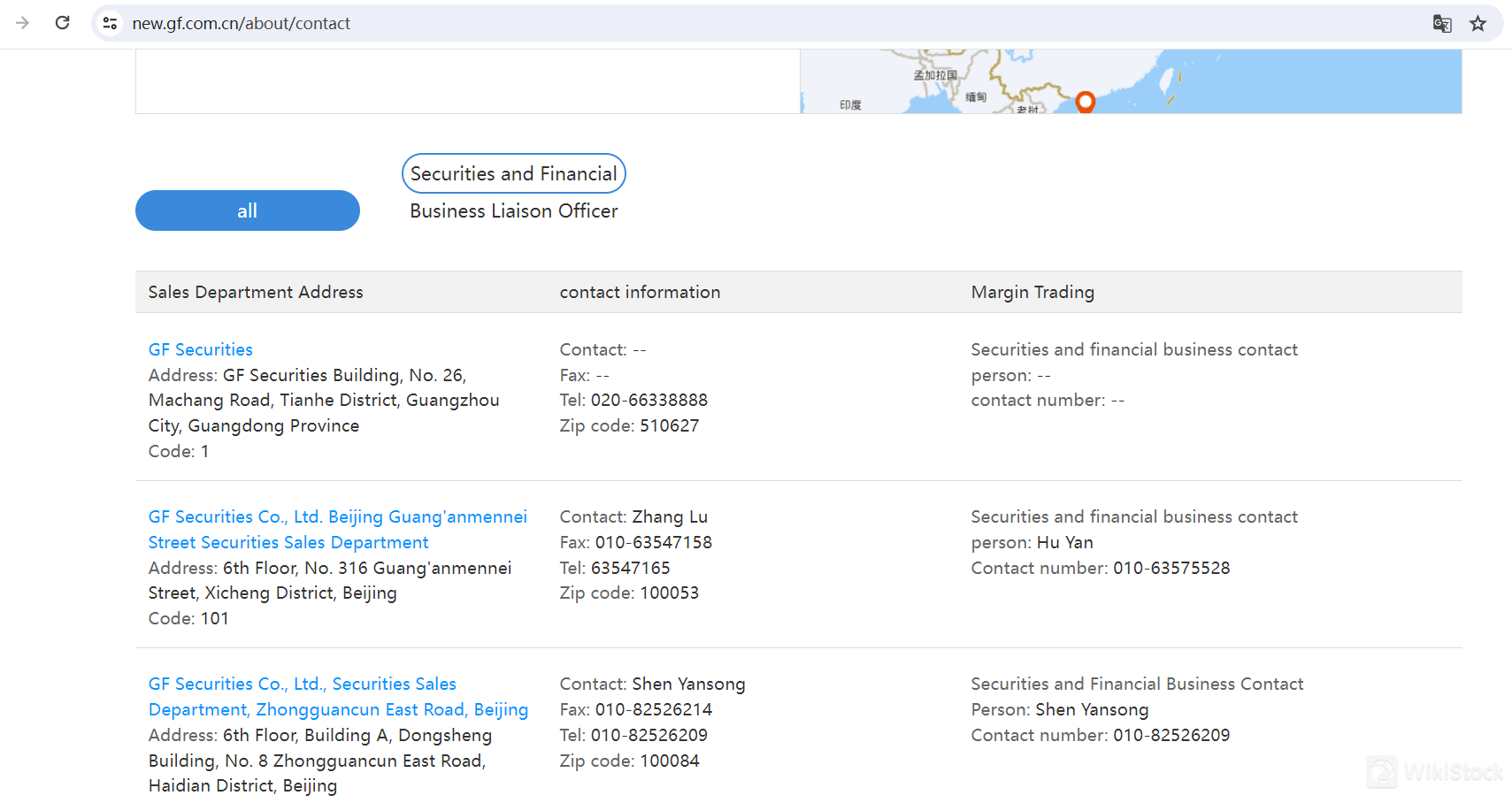

Customer Service

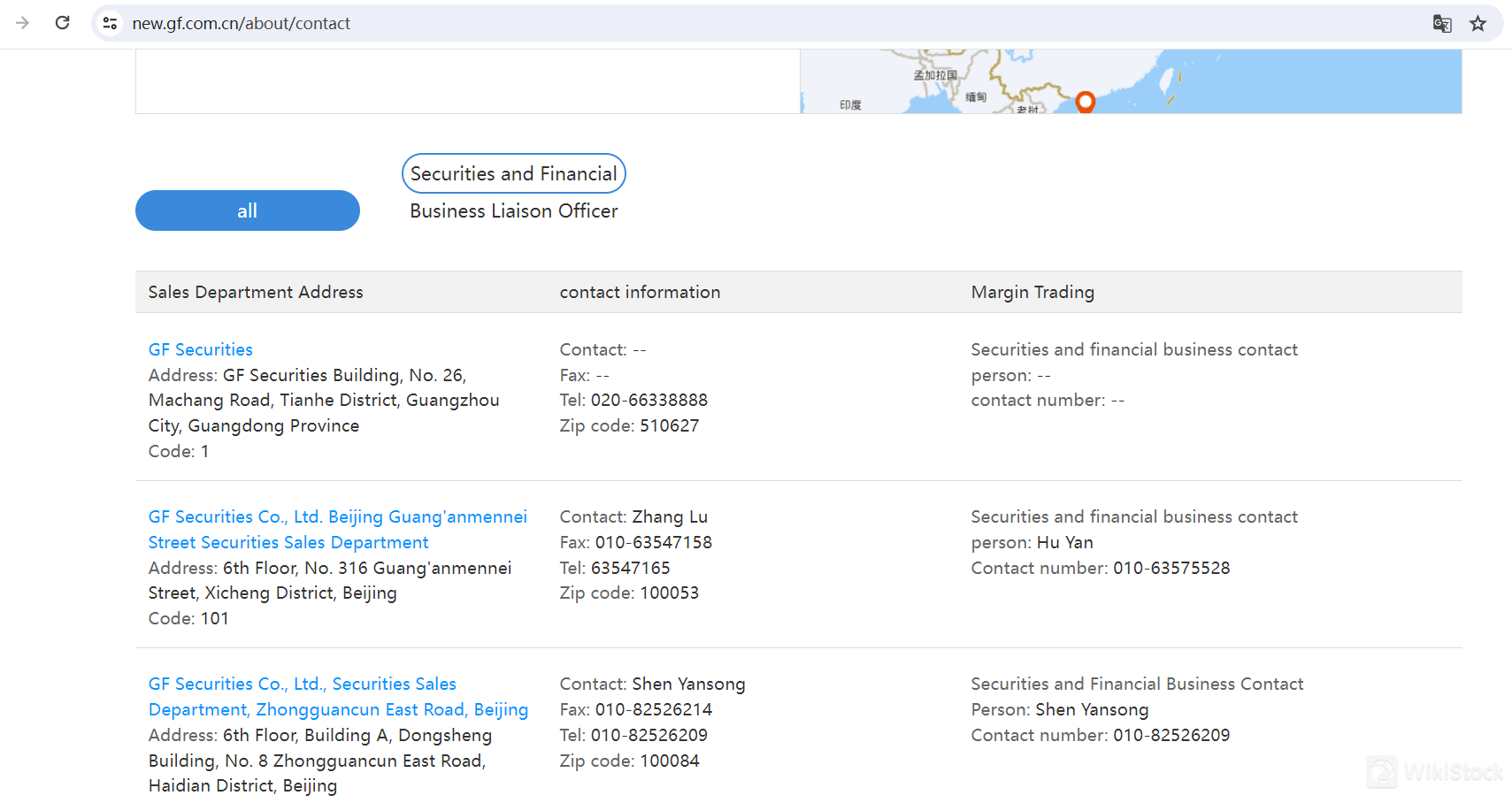

GF Securities provides robust customer support to its clients through a variety of channels. Clients can access assistance via phone, email, and in-person at numerous branch locations across China. The main customer service phone number is 020-66338888, and for media and advertising inquiries, they provide dedicated email contacts (PR@gf.com.cn and AD@gf.com.cn). Additionally, GF Securities offers 24-hour online financial advisory services, with a team of consultants ready to assist with inquiries and provide personalized advice. Their extensive network and multiple contact points ensure comprehensive support for all client needs.

Conclusion

GF Securities is a leading financial services provider in China, known for its comprehensive range of trading products, including equities, derivatives, and OTC products. It offers user-friendly trading platforms and robust customer support. The company is regulated by the China Securities Regulatory Commission (CSRC), ensuring compliance and safety for investors. While it provides competitive fees and extensive educational resources, potential clients should be aware of varying fees and specific details regarding fund insurance coverage. GF Securities remains a reliable choice for both novice and experienced investors.

FAQs

Is GF Securities safe to trade?

Yes, GF Securities is considered safe to trade. It is regulated by the China Securities Regulatory Commission (CSRC), ensuring compliance with stringent regulatory standards. The company also employs robust encryption technologies and strict account security measures to protect client funds and data.

Is GF Securities a good platform for beginners?

GF Securities offers user-friendly trading platforms with a wide range of educational resources and research reports, making it suitable for beginners. The intuitive interfaces and comprehensive customer support further enhance its accessibility for new investors.

Is GF Securities good for investing/retirement?

GF Securities is a robust option for investing and retirement planning due to its regulatory compliance, diverse product range, advanced trading platforms, and strong customer support. However, potential investors should be mindful of the complex fee structure and the language barrier for non-Chinese speakers when accessing educational and research materials.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China

ChinaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--

--

--

--