Tai Shing Stock Investment Company Limited offers several advantages, including strong regulatory compliance and security measures, competitive fees for many services, and accessibility on iOS, Android, and web platforms. However, some drawbacks include a complex fee structure, potentially low interest on uninvested cash, and the fact that not all customer service is available 24/7. Despite the competitive fees, these aspects may require careful consideration by potential clients.

Tai Shing Stock Investment Co. Ltd. is a broker-dealer registered with the Securities and Futures Commission (SFC) of Hong Kong. The firm is fully regulated with license number #AEX212, ensuring compliance with financial regulations.

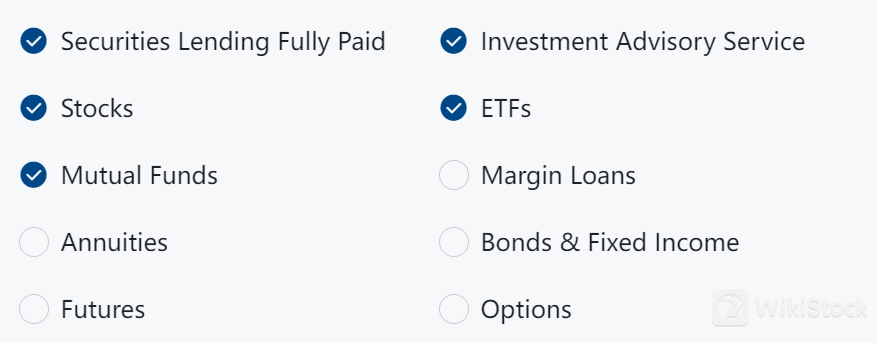

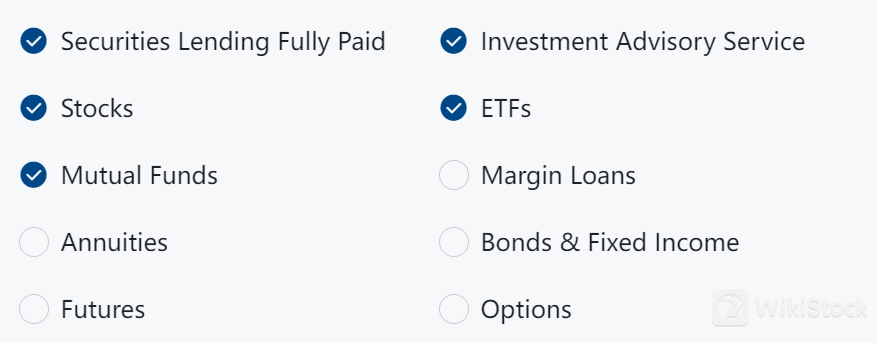

Tai Shing Stock Investment Company Limited provides a range of products and services, including Securities Lending Fully Paid, Investment Advisory Service, Stocks, ETFs, and Mutual Funds. However, it does not offer Bonds & Fixed Income, Futures, or Options. Clients can benefit from securities lending for fully paid assets, receive investment advice, trade stocks, ETFs, and mutual funds through their platform. This array of offerings caters to various investment preferences while focusing on core investment instruments.

Stocks: Direct investment in publicly listed companies, suitable for investors seeking capital appreciation and dividends.

ETFs: Funds that invest in a variety of assets, typically tracking a specific index, offering immediate market exposure and liquidity.

Mutual Funds: Professionally managed, these funds invest in a wide range of stocks, bonds, and other assets, facilitating risk diversification.

Securities Lending Fully Paid: Utilize fully paid securities for short selling or hedging purposes, enhancing portfolio flexibility.

Investment Advisory Service: Receive personalized investment strategies and recommendations from experienced advisors, tailored to individual financial goals.

Tai Shing Accounts

Tai Shing Stock Investment Co. Ltd. offers different account types for different client needs. These include Cash and Margin Accounts, which provide flexibility for trading and investing with leverage. They also offer Individual and Joint Accounts for personal and shared investments, as well as Corporate Accounts designed for business entities. The account opening process is streamlined to provide efficient and comprehensive support for all clients.

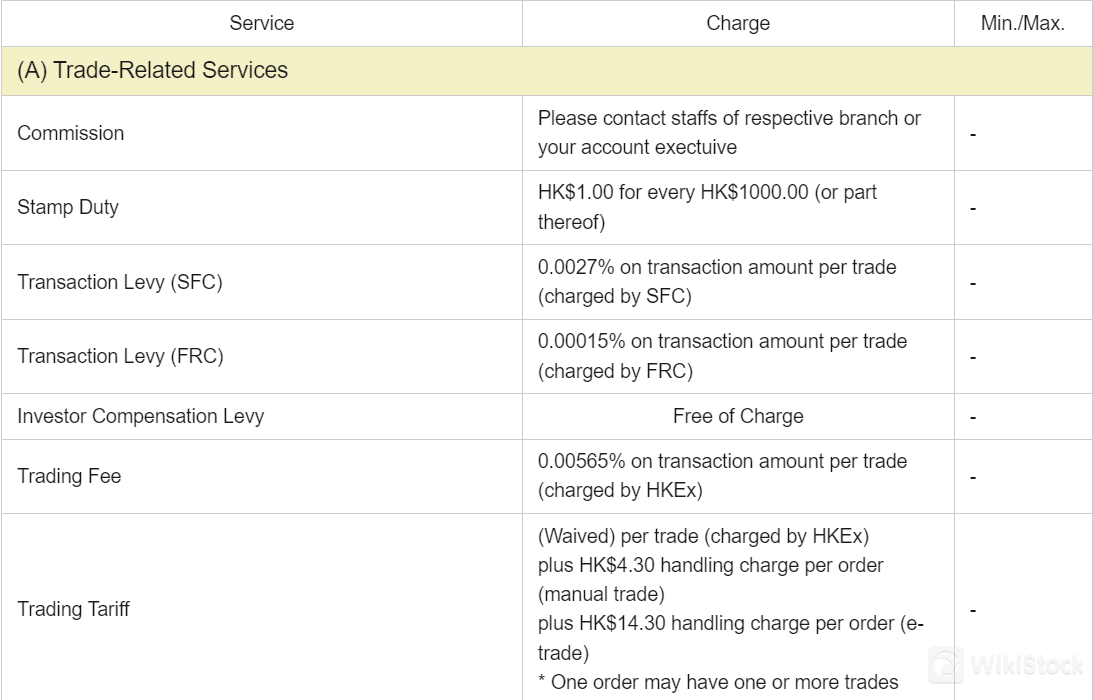

Tai Shing Fees Review

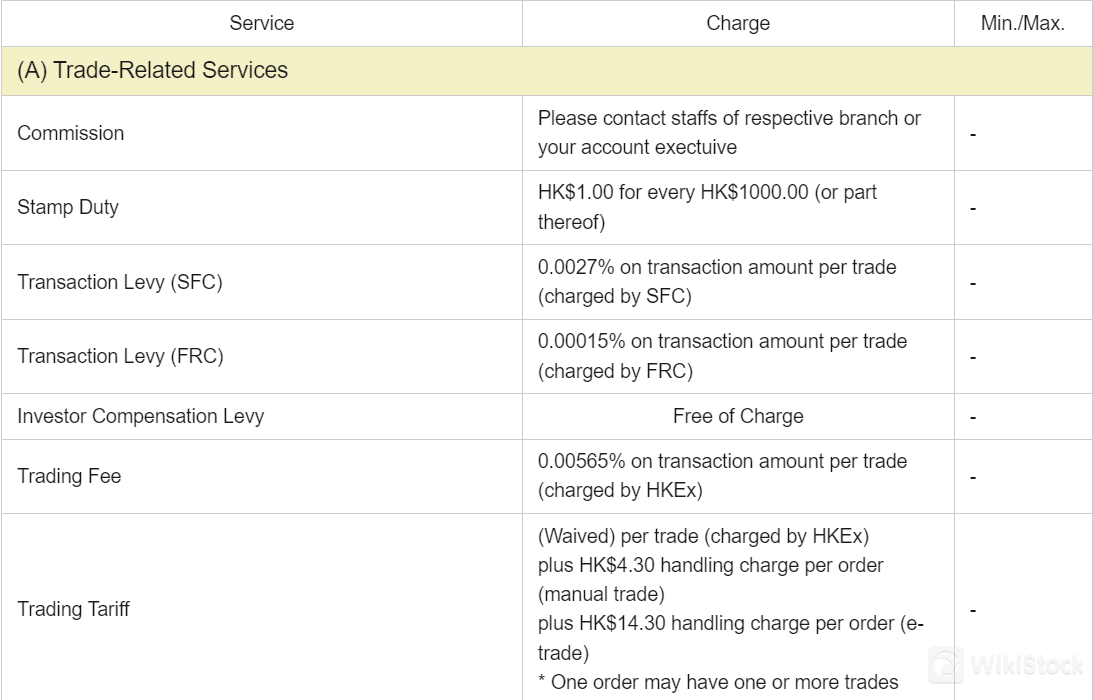

Tai Shing offers the following detailed fee structure for Trade-Related Services, Scrip Handling and Settlement-Related Services, and Information Services:

Trade-Related Services

Commission: Contact the respective branch staff or your account executive for details.

Stamp Duty: HK$1.00 for every HK$1,000.00 (or part thereof).

Transaction Levy (SFC): 0.0027% on the transaction amount per trade.

Transaction Levy (FRC): 0.00015% on the transaction amount per trade.

Investor Compensation Levy: Free of charge.

Trading Fee: 0.00565% on the transaction amount per trade.

Trading Tariff: Waived per trade, charged by HKEx. Additionally, HK$4.30 handling charge per order for manual trades, and HK$14.30 handling charge per order for e-trades.

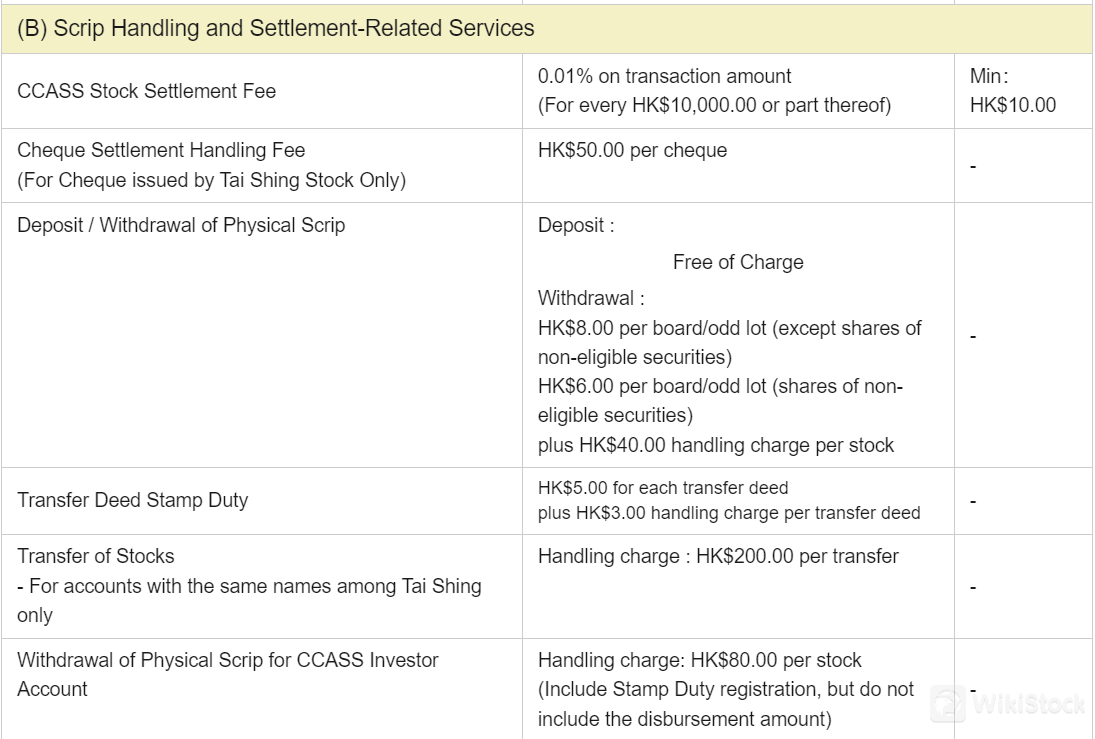

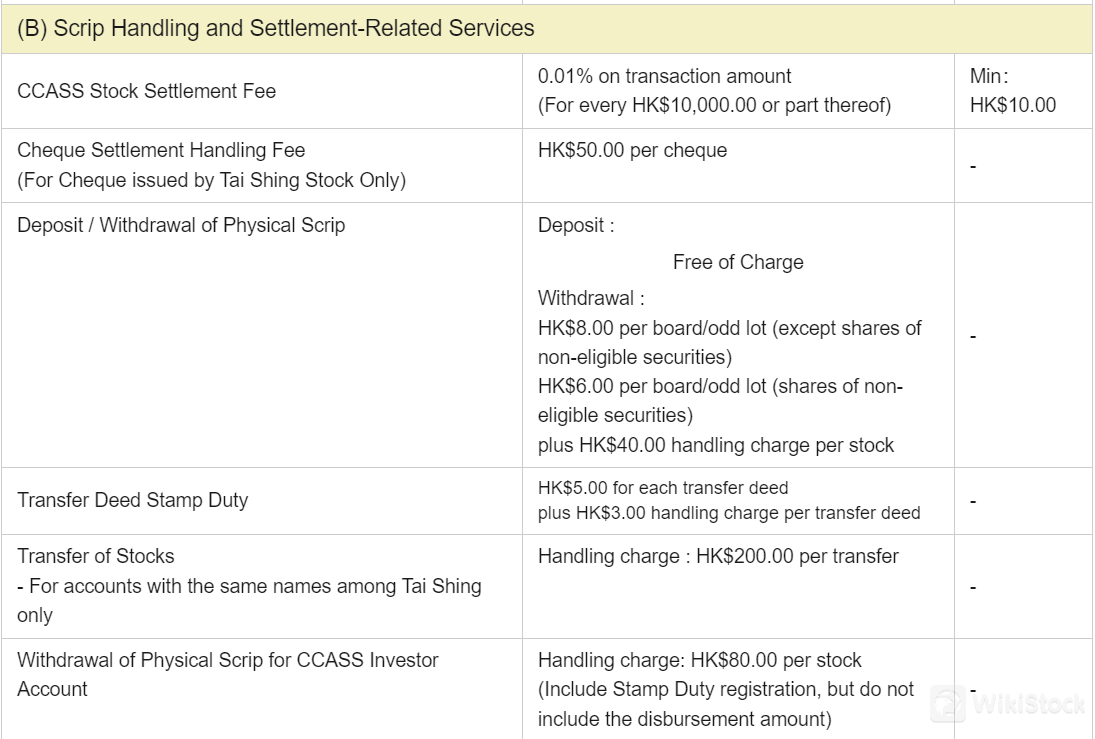

Scrip Handling and Settlement-Related Services

CCASS Stock Settlement Fee: 0.01% on transaction amount (Minimum: HK$10.00 for every HK$10,000.00 or part thereof).

Cheque Settlement Handling Fee: HK$50.00 per cheque (only for cheques issued by Tai Shing Stock).

Deposit Withdrawal of Physical Scrip:

Deposit: Free of charge.

Withdrawal:

HK$8.00 per board/odd lot (except shares of non-eligible securities).

HK$6.00 per board/odd lot (shares of non-eligible securities).

Plus HK$40.00 handling charge per stock.

Transfer Deed Stamp Duty:

Transfer of Stocks (for accounts with the same names among Tai Shing only): HK$200.00 per transfer.

Withdrawal of Physical Scrip for CCASS Investor Account: HK$80.00 per stock (includes Stamp Duty registration, but does not include the disbursement amount).

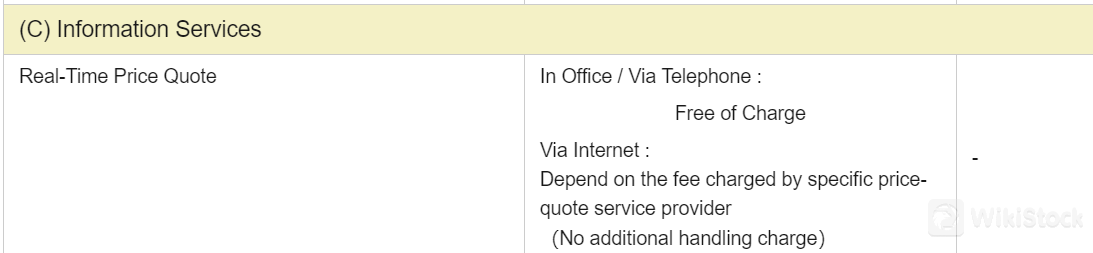

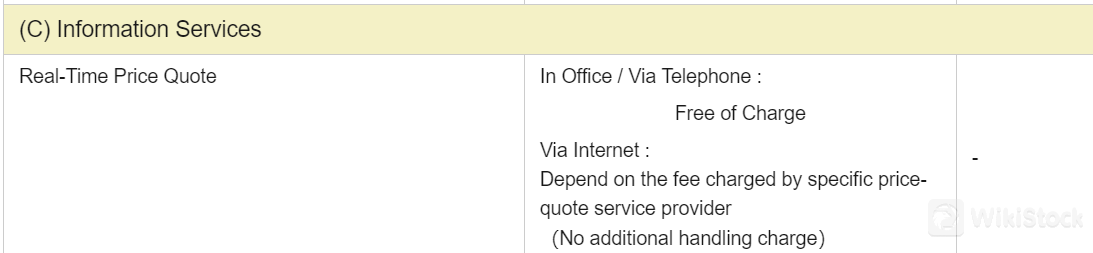

Information Services

Real-Time Price Quote (In Office Via Telephone): Free of Charge

Real-Time Price Quote (Via Internet): Dependent on the fee charged by the specific price-quote service provider (no additional handling charge)

Margin Interest Rate:

The annual Margin Rate is 9%. This rate is applied to the funds borrowed to purchase securities on margin, influencing the total cost for traders who use leverage in their trading strategies.

Tai Shing App Review

Tai Shing's mobile app is a cutting-edge and intuitive trading platform designed for on-the-go traders. It provides a comprehensive trading experience, available on iOS and Android devices, facilitating easy access to markets anytime, anywhere. In addition to the mobile app, Tai Shing also offers a versatile range of platforms and tools for different devices and operating systems, including Web Trading platforms. This variety ensures that all users, regardless of their preferred device, can access Tai Shing's trading services seamlessly.

Research and Eduation

Tai Shing offers robust research and education services, including access to Dow Jones News and SEHK News. These services provide clients with timely and comprehensive market insights, financial news, and analysis to support informed decision-making. The inclusion of reputable sources ensures that clients stay updated with the latest market trends and developments, enhancing their investment strategies and knowledge base.

Customer Service

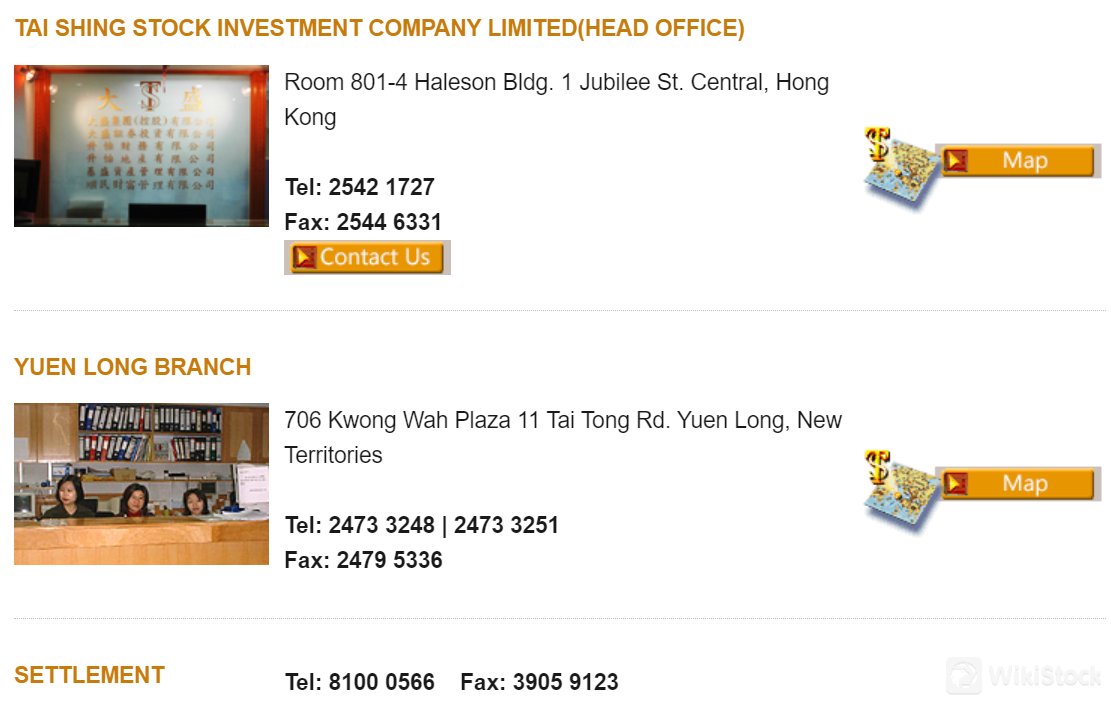

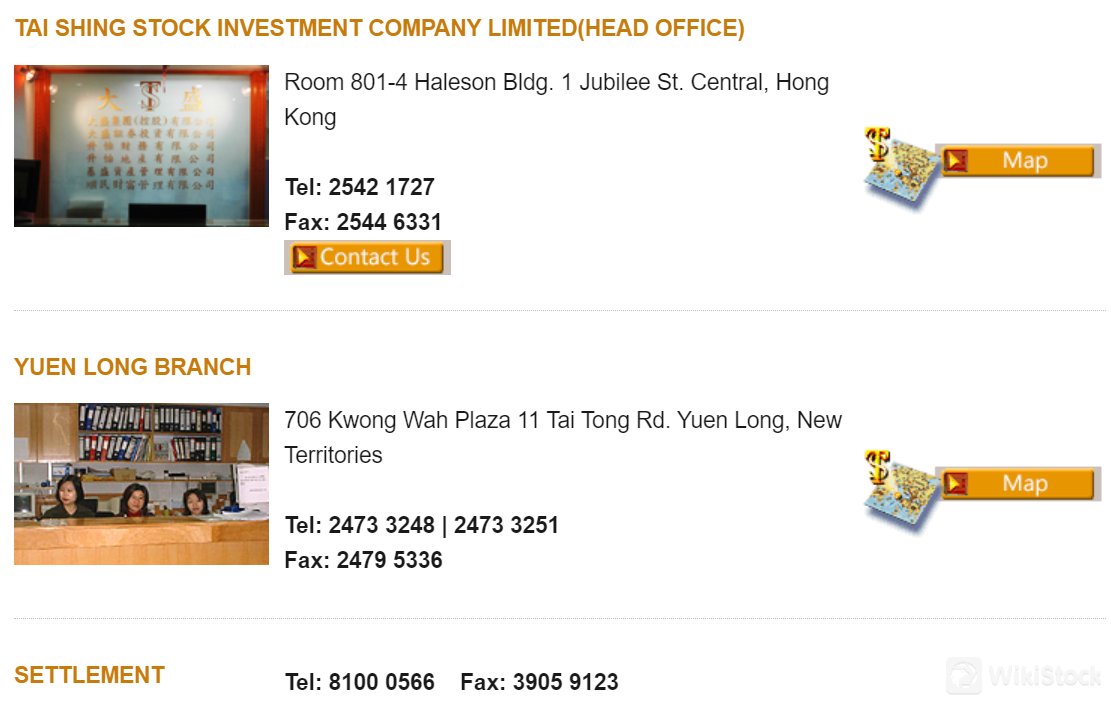

Tai Shing Stock Investment Company Limited offers comprehensive customer support through its head office in Central, Hong Kong, and a branch in Yuen Long, New Territories. Clients can reach the head office via telephone at 2542 1727, and the Yuen Long branch via telephone at 2473 3248 or 2473 3251, and fax at 2479 5336. For settlement inquiries, customers can contact the dedicated settlement team at 8100 0566 or fax at 3905 9123. This multi-channel support ensures that clients receive prompt and efficient assistance for their investment needs.

Conclusion

Tai ShingStock Investment Company Limited stands out with its flexible account options, ranging from free to variable fees, and accessibility across iOS, Android, and web platforms. Its offerings include mutual funds and promotions, catering to diverse investors. Tai Shing is suitable for investors seeking customizable investment solutions and the convenience of a user-friendly digital platform.

FAQs

Is Tai Shing safe to trade?

Yes, Tai Shing is safe for trading. It employs robust security measures such as two-factor authentication, trading passwords, and phone and email verification for new devices. Additionally, the platform is registered with relevant financial authorities, ensuring compliance with security standards.

Is Tai Shing a good platform for beginners?

Tai Shing is an excellent platform for beginners. With no minimum account balance required, a user-friendly interface, and educational resources, it provides new traders with a supportive environment to start their investment journey.

Is Tai Shing legit?

Yes, Tai Shing is a legitimate trading platform. It is fully regulated, complying with the rules and regulations of major financial oversight bodies such as the SFC. This assures users of the platform's integrity and reliability.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)