China Rise Securities Asset Management Co. Ltd.(CE NO. ASZ577) is a wholly owned subsidiary of Hong Kong main board listed company Symphony Holdings (HKEX:1223). We focus on providing securities trading, asset management and related services.

What is China Rise?

China Rise Securities is a well-established brokerage firm that offers a comprehensive range of investment services, including global stocks, commodities, bonds, options, and futures. One of its key advantages is its extensive asset management services, which cater to both retail and professional investors. Additionally, clients benefit from low trading commissions through the use of Interactive Brokers. However, a notable drawback is the lack of cryptocurrency trading options, which may limit its appeal to investors seeking these products.

Pros and Cons of China Rise

China Rise Securities offers robust investment services, including comprehensive asset management, low trading commissions through Interactive Brokers, and access to a wide range of global securities such as stocks, commodities, bonds, options, and futures. However, the firm does not offer cryptocurrency trading or specific mutual fund options, which may limit its appeal to some investors.

Is China Rise safe?

China Rise Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong (License No. ASZ577). Client funds are held in segregated accounts to ensure they are separate from the company's assets.

What are securities to trade with China Rise

China Rise Securities offers a variety of trading securities and related services, including:

Offered Products:

- Stocks: Trade shares on the Hong Kong Securities market.

- Bonds: Access to various fixed-income securities.

- Options: Engage in market derivatives for strategic investment.

- Commodities: Trade in global commodities.

- ETFs: Exchange-traded funds.

- Securities Margin Financing: Borrow funds to invest in securities.

- IPO Financing: Participate in initial public offerings.

- Online Trading: Real-time price quote service and online trading platform.

- Asset Management: Discretionary account management for retail and professional investors.

Not Offered Products:

- Cryptocurrencies

- Futures

China Rise does not offer products such as cryptocurrencies and commodities. Their services include comprehensive asset management, real-time trading, and margin financing, ensuring clients have access to diverse investment opportunities and professional management.

China Rise Accounts

China Rise offers three main types of investment accounts:

1. Investment Management Service: Minimum investment of $600,000 for hedge fund-style asset management.

2. Regular Cash Distribution Portfolio: Invest $1,000,000 to receive an annual distribution of $60,000.

3. Global ETF Monthly Investment Service: Monthly investment starting at $5,000 with no management fees.

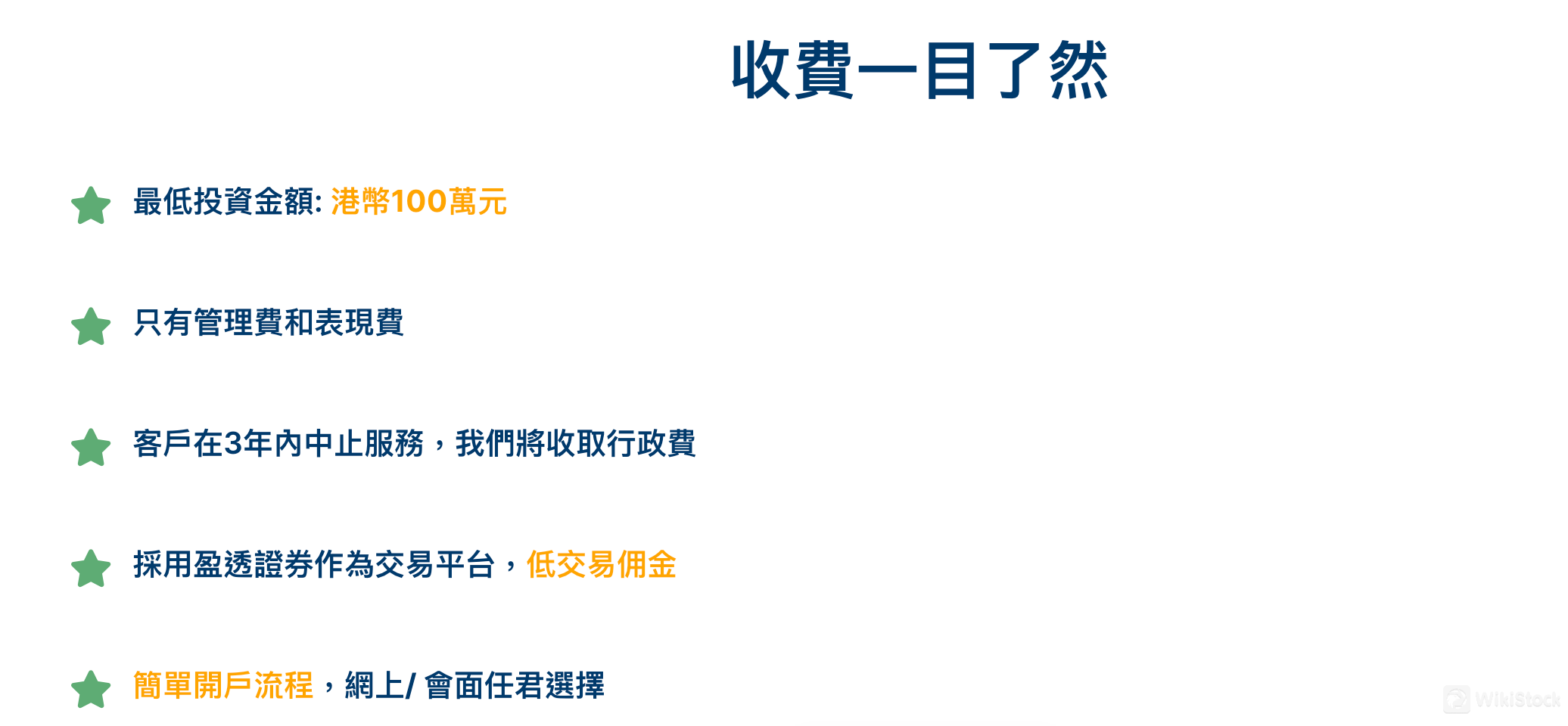

China Rise Fees Review

China Rise charges the following fees for its services:

1. Investment Management Service:

- Minimum investment: $600,000

- Fees: Only management fees and performance fees, no subscription fee

2. Regular Cash Distribution Portfolio:

- Minimum investment: HKD 1,000,000

- Fees: Only management fees and performance fees

- Additional fee: Administrative fee if the service is terminated within 3 years

- Platform: Uses Interactive Brokers with low trading commissions

3. Global ETF Monthly Investment Service:

- Minimum monthly investment: HKD 5,000

- Fees: Only performance fees, no management fees

- Platform: Uses Interactive Brokers with low trading commissions

China Rise App Review

China Rise uses Interactive Brokers (IB) as its trading platform. IB is one of the largest brokers globally, regulated by the Hong Kong Securities and Futures Commission and covered by the Hong Kong Investor Compensation Fund. The IB account is under the client's name, allowing clients to monitor all positions in real-time from anywhere.

Research and Eduation

China Rise offers concise research and education resources, including:

1. Article Sharing: Providing insightful articles on various financial topics.

2. Letters to Client Partners: Regular communications to keep clients informed.

3. Financial Programs: Educational financial shows and broadcasts.

4. Wind Control Seminars: Seminars focused on market trends and risk management.

Customer Service

China Rise offers comprehensive customer service:

- Telephone: +852-21589000

- Fax: +852-21589090

- Email: info@chinarisesec.com.hk

- Website: http://www.chinarisesec.com.hk

- Address: 10/F Island Place Tower, 510 Kings Road, North Point, Hong Kong

- Office Hours: 09:00 - 18:00 (Mon to Fri)

Conclusion

China Rise Securities is a reputable brokerage firm that offers a wide range of investment services, including comprehensive asset management, low trading commissions through Interactive Brokers, and access to global securities such as stocks, commodities, bonds, options, and futures. The firm's robust platform and extensive research and education resources make it suitable for both retail and professional investors. However, the lack of cryptocurrency trading and specific mutual fund offerings may limit its appeal to some investors. Overall, China Rise provides a secure and efficient environment for diversified investment opportunities.

FAQs

Is China Rise safe to trade?

Yes, China Rise Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong and holds client funds in segregated accounts, ensuring safety and compliance.

Is China Rise a good platform for beginners?

Yes, China Rise provides comprehensive research and education resources, making it suitable for beginners to learn and make informed investment decisions.

Is China Rise good for investing/retirement?

Yes, with a wide range of investment options and professional advisory services, China Rise is suitable for long-term investing and retirement planning.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

South Korea

South KoreaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--