Geo Securities Limited is based in Hong Kong and a licensed corporation registered with Hong Kong Securities and Future Commission, under SFO Chapter 571, BAI, with licenses type 1, 4 and 9. We provide trading in listed securities, investment advice to clients, and asset management services. We have a professional team who provides first class investment service to our clients. We provide multi levels of service to clients, and we provide investment service to clients to allow them to increase their wealth.

GEO Securities Information

GEO Securities is a financial services provider known for its relatively low trading fees, charging 0.25% per trade with a minimum fee of HK $100, and offering a user-friendly trading app, the GEO Securities APP.

Additionally, the company offers an interest rate of 3.22% on uninvested cash and provides mutual funds. However, a potential drawback is the lack of promotions, which limits its appeal to customers seeking additional incentives.

Pros & Cons

Pros:

GEO Securities is regulated by the SFC, ensuring compliance with local financial regulations and increasing investor confidence. The firm offers a unique trading app available on both Google and iOS App Stores, which enhances accessibility and convenience for users. They offer a wide range of securities to trade, providing ample investment opportunities. Additionally, GEO Securities commits to transparency by disclosing the risks associated with all their products and keeps their users updated with the latest financial news.

Cons:

One significant downside of GEO Securities is the high commission fee of HK$100 per trade, which could be a deterrent for frequent traders or those with smaller investment amounts. Additionally, the focus remains narrow with a limited range of financial products, primarily centered on securities, potentially limiting investment options for diverse portfolios.

Is GEO Securities Safe?

Regulations:

GEO Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is a significant assurance for clients regarding the broker's compliance with financial regulations and standards. The license number of it is:BAI290.

Funds Safety:

GEO Securities Limited prioritizes the security of client funds by strictly adhering to regulatory guidelines which mandate the separation of client assets from company operational funds. This separation ensures that client funds are not used for any unauthorized purposes and are protected under the oversight of relevant financial regulatory authorities.

Safety Measures:

GEO implements rigorous safety measures to secure user transactions and access to services. Users must initially register using a password and account number, and can subsequently personalize their login credentials.

For enhanced security, GEO requires one-time passwords delivered via an electronic security device or SMS. Additional verification steps include the use of biometric sensors like fingerprint or facial recognition for device access, and an online activation code for certain transactions.

The GEOS Mobile Device function further integrates security by allowing users to generate necessary security codes directly through a mobile app, linking the device with a unique Mobile Security Key recognized by GEO for secure operations.

What are securities to trade with GEO Securities?

GEO Securities offers a diverse range of securities for trading, addressing various market sectors and risk profiles. Customers can engage in:

Shares Trading: This involves the buying and selling of equity shares, which can fluctuate significantly in price. This market offers potential for profit but also a risk of loss, especially if the market conditions are volatile.

Margin Trading: This service allows traders to buy securities by partially funding them with borrowed money, using the purchased securities as collateral. While it can amplify gains, it also increases the potential for losses, making it crucial for traders to manage risks carefully.

Growth Enterprise Market (GEM) Stocks: Aimed at sophisticated and professional investors, GEM stocks are from companies that will not necessarily have a track record of profitability. These stocks are known for their high volatility and risk but also present opportunities for significant returns.

Nasdaq-Amex Pilot Program Securities: These are tailored for experienced investors and involve higher risks and potential rewards. They are not regulated as primary or secondary listings, making them less secure but potentially more profitable under the right conditions.

IPO Trading: GEO Securities provides access to initial public offerings (IPOs), which can be a way to invest in a company from its early public phase. However, IPO investments carry the risk of unpredictable pricing and market response once they are publicly traded.

Warrants and Structured Products: These derivatives offer rights to buy or sell a security at a specific price before expiry. The market for warrants and structured products can offer high returns but also comes with high risk, including the risk of total investment loss.

Callable Bull/Bear Contracts (CBBCs): These are leveraged investment opportunities that allow investors to speculate on rising (bull) or falling (bear) markets with a built-in “knockout” feature, leading to high risks and potential for high returns or total loss.

GEO Securities Fee Review

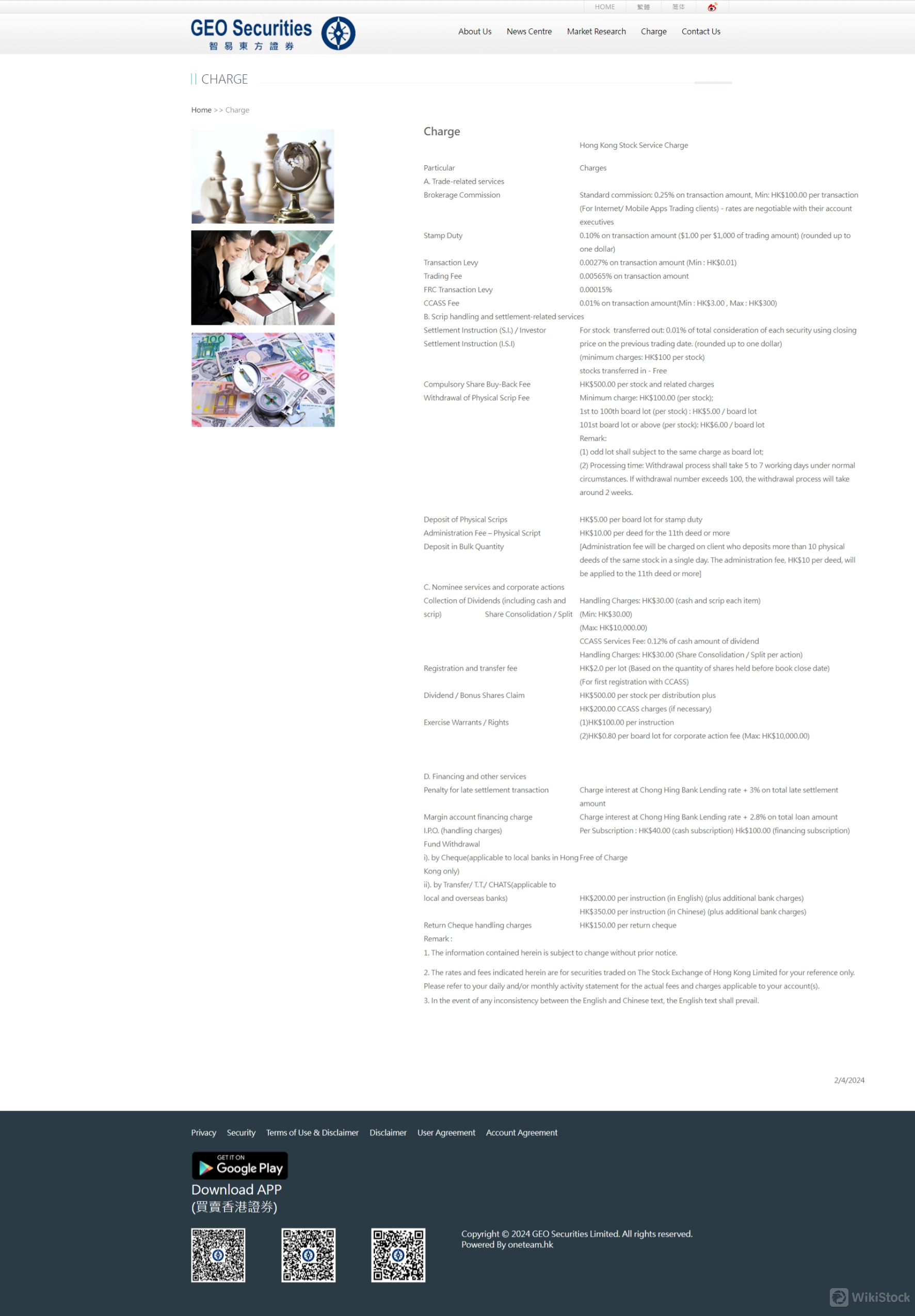

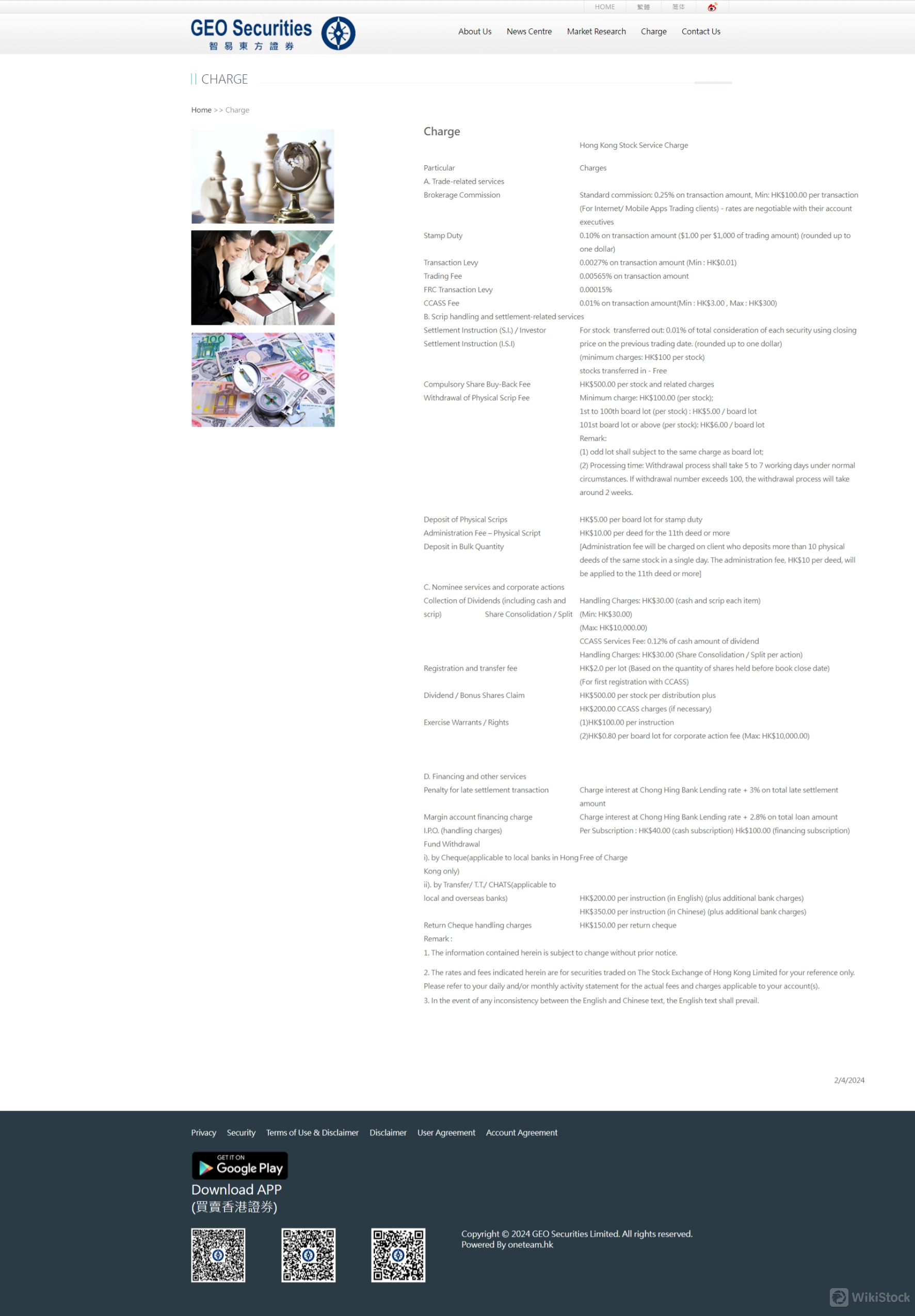

GEO Securities Limited charges a variety of fees, including a standard brokerage commission of 0.25% per transaction with a minimum of HK$100, along with specific charges for trade-related services, scrip handling, settlement-related services, nominee services, corporate actions, financing, and other services.

A. Trade-related services

Brokerage Commission: 0.25% on the transaction amount with a minimum charge of HK$100.00 per transaction. Rates are negotiable for Internet/Mobile Apps Trading clients through their account executives.

Stamp Duty: 0.10% on the transaction amount, rounded up to the nearest dollar ($1.00 per $1,000 of trading amount).

Transaction Levy: 0.0027% of the transaction amount with a minimum charge of HK$0.01.

Trading Fee: 0.00565% of the transaction amount.

FRC Transaction Levy: 0.00015%.

CCASS Fee: 0.01% of the transaction amount, with a minimum of HK$3.00 and a maximum of HK$300.

B. Script handling and settlement-related services

Settlement Instruction (S.I.) / Investor Settlement Instruction (I.S.I): For stocks transferred out, a fee of 0.01% of the total consideration of each security is charged using the closing price on the previous trading day, rounded up to one dollar, with a minimum charge of HK$100 per stock. Stocks transferred in are free of charge.

Compulsory Share Buy-Back Fee: HK$500.00 per stock and related charges.

Withdrawal of Physical Scrip Fee: A minimum charge of HK$100.00 per stock, HK$5.00 per board lot for the first to 100th board lot, and HK$6.00 per board lot for the 101st board lot or above. Processing time for withdrawals exceeding 100 lots will take around 2 weeks.

Deposit of Physical Scrips: HK$5.00 per board lot for stamp duty.

Administration Fee – Physical Script Deposit in Bulk Quantity: HK$10.00 per deed for the 11th deed or more when more than 10 physical deeds of the same stock are deposited in a single day.

C. Nominee services and corporate actions

Collection of Dividends (cash and scrip): Handling charges of HK$30.00 per item, with a minimum of HK$30.00 and a maximum of HK$10,000.00. CCASS Services Fee: 0.12% of the cash amount of the dividend.

Handling Charges for Share Consolidation / Split: HK$30.00 per action.

Registration and Transfer Fee: HK$2.0 per lot, applicable for the first registration with CCASS.

Dividend / Bonus Shares Claim: HK$500.00 per stock per distribution plus HK$200.00 CCASS charges if necessary.

Exercise Warrants / Rights: HK$100.00 per instruction and HK$0.80 per board lot for corporate action fee, with a maximum of HK$10,000.00.

D. Financing and other services

Penalty for Late Settlement Transaction: Interest charged at Chong Hing Bank Lending rate + 3% on the total late settlement amount.

Margin Account Financing Charge: Interest charged at Chong Hing Bank Lending rate + 2.8% on the total loan amount.

I.P.O. Handling Charges: HK$40.00 per subscription for cash subscriptions and HK$100.00 for financing subscriptions.

Fund Withdrawal: Free for cheques (local banks in Hong Kong only), HK$200.00 per instruction (in English) plus additional bank charges for transfers (local and overseas banks), and HK$350.00 per instruction (in Chinese) plus additional bank charges.

Return Cheque Handling Charges: HK$150.00 per returned cheque.

| Category |

Details |

Fees |

| A. Trade-related Services |

|

|

| Brokerage Commission |

Standard rate for transactions |

0.25% of transaction amount, Min: HK$100.00 per transaction |

| Stamp Duty |

|

0.10% on transaction amount ($1.00 per $1,000 of trading amount), rounded up |

| Transaction Levy |

|

0.0027% on transaction amount, Min: HK$0.01 |

| Trading Fee |

|

0.00565% on transaction amount |

| FRC Transaction Levy |

|

0.00% |

| CCASS Fee |

|

0.01% on transaction amount, Min: HK$3.00, Max: HK$300 |

| B. Scrip Handling and Settlement-Related Services |

|

|

| Settlement Instruction (S.I.) / Investor Settlement Instruction (I.S.I) |

For stocks transferred out |

0.01% of total consideration using closing price on the previous trading date, rounded up, Min: HK$100 per stock |

| Stocks transferred in |

|

Free |

| Compulsory Share Buy-Back Fee |

|

HK$500.00 per stock |

| Withdrawal of Physical Scrip |

|

Min charge: HK$100.00 per stock; HK$5.00 per board lot (1st to 100th), HK$6.00 per board lot (101st or above) |

| Deposit of Physical Scrips |

|

HK$5.00 per board lot for stamp duty |

| Administration Fee – Physical Script Deposit in Bulk Quantity |

More than 10 physical deeds of the same stock in a single day |

HK$10.00 per deed from the 11th deed onward |

| C. Nominee Services and Corporate Actions |

|

|

| Collection of Dividends (cash and scrip) |

|

HK$30.00 per item, Min: HK$30.00, Max: HK$10,000.00; CCASS Services Fee: 0.12% of cash dividend amount |

| Share Consolidation / Split |

|

HK$30.00 per action |

| Registration and Transfer Fee |

First registration with CCASS |

HK$2.0 per lot |

| Dividend / Bonus Shares Claim |

|

HK$500.00 per stock per distribution plus HK$200.00 CCASS charges if necessary |

| Exercise Warrants / Rights |

|

HK$100.00 per instruction, HK$0.80 per board lot, Max: HK$10,000.00 |

| D. Financing and Other Services |

|

|

| Penalty for Late Settlement Transaction |

|

Interest at Chong Hing Bank Lending rate + 3% on total late settlement amount |

| Margin Account Financing Charge |

|

Interest at Chong Hing Bank Lending rate + 2.8% on total loan amount |

| I.P.O. Handling Charges |

Cash subscription and financing subscription |

HK$40.00 (cash), HK$100.00 (financing) |

| Fund Withdrawal |

Cheque (local banks), Transfer/T.T./CHATS (local and overseas banks) |

Free for cheque; HK$200.00 per instruction (in English), HK$350.00 per instruction (in Chinese) plus additional bank charges |

| Return Cheque Handling Charges |

|

HK$150.00 per return cheque |

GEO Securities Trading Platform Review

The trading platform of GEO Securities Limited is accessed through the “GEO Securities APP,” which is available on both Google Play and the iOS App Store.

This platform allows clients to engage in online trading, providing a convenient and accessible way to manage transactions and monitor the Hong Kong stock market.

Research & Education

The research and education content at GEO Securities Limited includes market insights and trends as evidenced by their recent market research updates.

For instance, they have reported on significant movements in the European markets due to political changes, the impact of U.S. inflation rates on technology stocks, and specific sector performance in Hong Kong's financial and technology sectors.

These updates suggest a focus on current events affecting stock prices and market dynamics, providing valuable information for investors looking to understand market trends and make informed decisions.

Customer Service

GEO Securities Limited provides robust customer support from their office situated at Room 601-3, 6th Floor, Siu On Plaza, 482 Jaffe Road, Causeway Bay, Hong Kong.

For direct communication, customers can contact them through two dedicated telephone lines: (852) 3896-2008 and (852) 3896-2009, ensuring that inquiries are handled efficiently.

Additionally, they offer a fax service at (852) 3896-2004 for clients needing to send documents.

Conclusion

GEO Securities Limited is committed to enhancing customer value through superior financial services, aiming to drive the progress of the securities industry.

With a diverse range of products, top-tier services, and remarkable capabilities, GEO Securities strives to become a trusted and respected entity in the industry, priding itself on customer satisfaction and employee pride.

Their goal is to establish a distinguished enterprise recognized for its robust offerings and effective client solutions.

FAQs

1. What financial services does GEO Securities Limited offer?

2. How can I contact GEO Securities for support or inquiries?

Customers can contact GEO Securities Limited at their office on the 6th floor of Siu On Plaza, 482 Jaffe Road, Causeway Bay, Hong Kong, or by telephone at (852) 3896-2008 or (852) 3896-2009. Additionally, fax communications can be sent to (852) 3896 2004.

3. Does GEO Securities have any online platforms for trading?

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)