Incorporated in June 2014, Zhongcai Securities Limited (“ZSL”) is the second financial services subsidiary of Zhongcai Merchants Investment Group (after Zhongcai Asset Management Limited) that is based in Hong Kong and licensed by the Securities and Futures Commission (“SFC”)

ZSL Information

Incorporated in June 2014, Zhongcai Securities Limited (“ZSL”) is a key subsidiary of Zhongcai Merchants Investment Group headquartered in Hong Kong. ZSL is notable for its stringent regulatory oversight by the SFC in Hong Kong and its specialized access to IPOs, offering investors direct participation in initial public offerings. However, the brokerage does not facilitate forex or cryptocurrency trading, and its customer service lacks live chat support. Moreover, while ZSL provides access to IPOs, its educational resources are relatively limited, which may pose challenges for new investors seeking comprehensive guidance.

Pros and Cons of ZSL

ZSL, regulated by the Securities and Futures Commission (SFC) in Hong Kong, offers a secure trading environment for investors. It provides access to IPOs, allowing clients to participate in initial public offerings directly through their securities accounts. However, ZSL does not support forex and cryptocurrency trading, which may limit diversification options for some traders. Additionally, the platform lacks live chat support, potentially impacting immediate customer assistance. Moreover, there are limited educational resources available, which could pose challenges for beginners seeking comprehensive guidance and learning materials.

Is ZSL safe?

Regulation

ZSL is licensed and regulated by the Securities and Futures Commission (SFC) under license number BED053.

What are securities to trade with ZSL?

ZSL offers a range of trading products including stocks such as Hong Kong, Australia, Singapore, and US stocks. They also provide IPO services where clients can subscribe for IPO shares through Zhongcai Securities, facilitating direct crediting of allotted shares to their securities account on listing day. IPO margin financing is available, enabling clients to increase their investment capacity by borrowing up to 90% of subscribed share value.

However, ZSL does not offer trading services for forex, cryptocurrencies, and other derivative products.

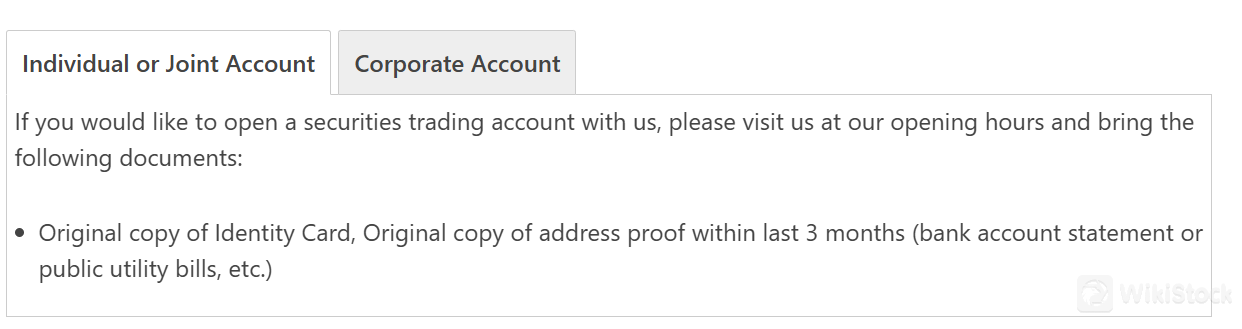

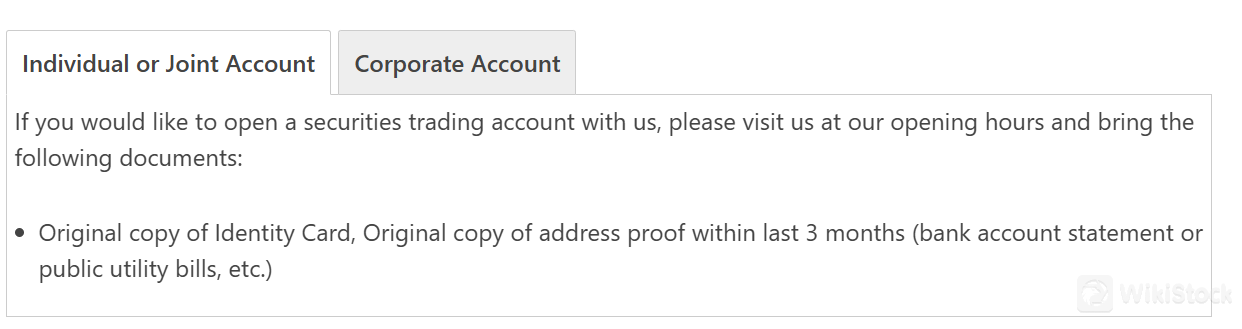

ZSL Accounts

ZSL offers a variety of account types to accommodate different client needs:

1. Individual or Joint Account: Individual or joint accounts are suitable for individual investors or multiple individuals who wish to jointly manage their investments. These accounts provide flexibility and personalization in managing financial assets.

2. Corporate Account: Corporate accounts are tailored for businesses and corporate entities looking to manage investments and conduct trading activities. These accounts typically offer specialized services and may require specific documentation to establish ownership and authorization for trading.

ZSL imposes fees for various account services. Specifically, the issuance of transaction statements older than three months incurs a charge of HKD 25 per statement. Additionally, each account audit confirmation costs HKD 50.

ZSL Fees Review

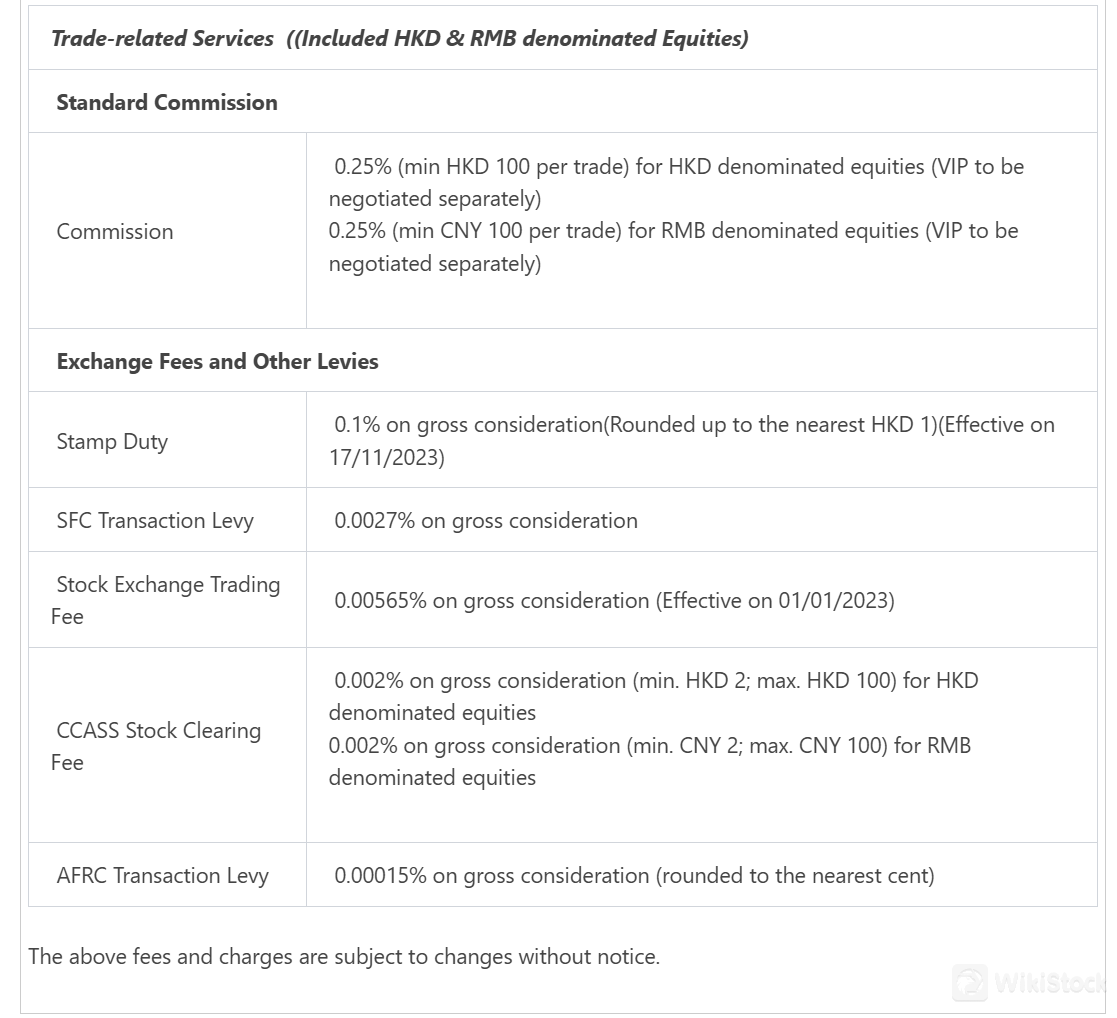

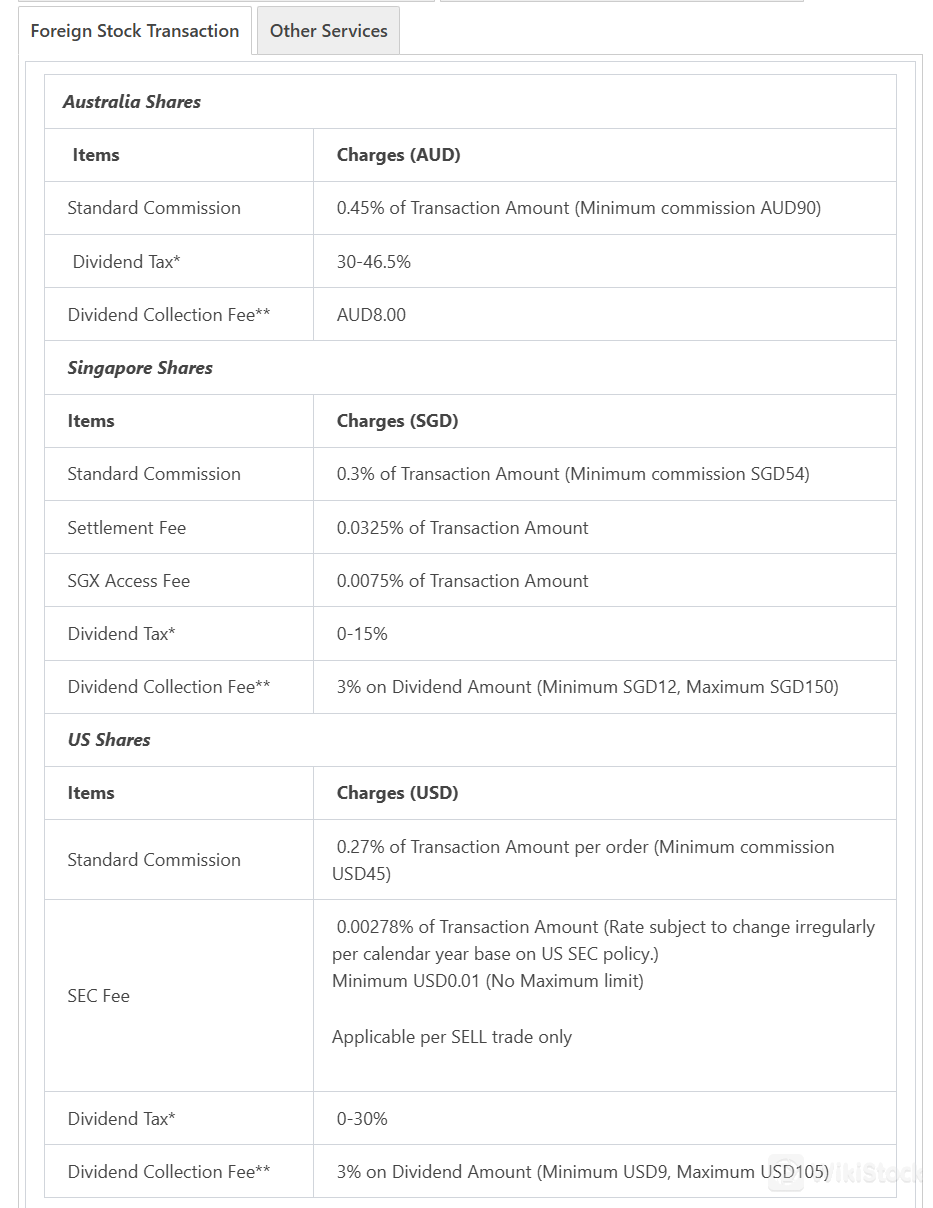

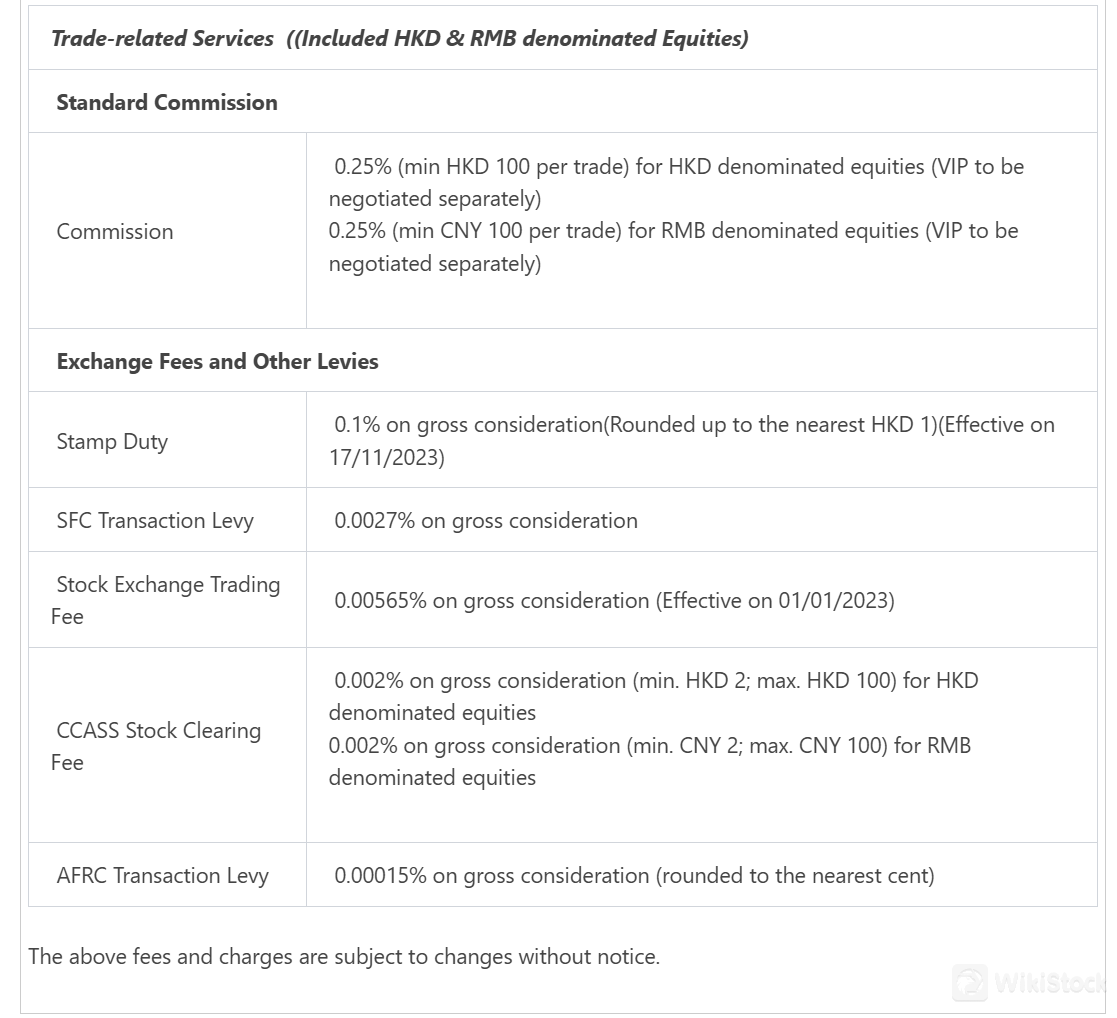

ZSL offers detailed fee structures for trading various types of equities.

For HKD and RMB denominated equities, the standard commission is set at 0.25% of the transaction amount, with a minimum charge of HKD 100 per trade for HKD denominated equities and CNY 100 per trade for RMB denominated equities. Rates for VIP clients are negotiable.

Additional exchange fees and levies include a stamp duty of 0.1% on the gross consideration, rounded up to the nearest HKD 1, effective from 17/11/2023. The SFC transaction levy is 0.0027% of the gross consideration. The stock exchange trading fee is 0.00565%, effective from 01/01/2023. The CCASS stock clearing fee is 0.002% of the gross consideration, with a minimum of HKD 2 and a maximum of HKD 100 for HKD denominated equities, and a minimum of CNY 2 and a maximum of CNY 100 for RMB denominated equities. Additionally, the AFRC transaction levy is 0.00015% on gross consideration, rounded to the nearest cent.

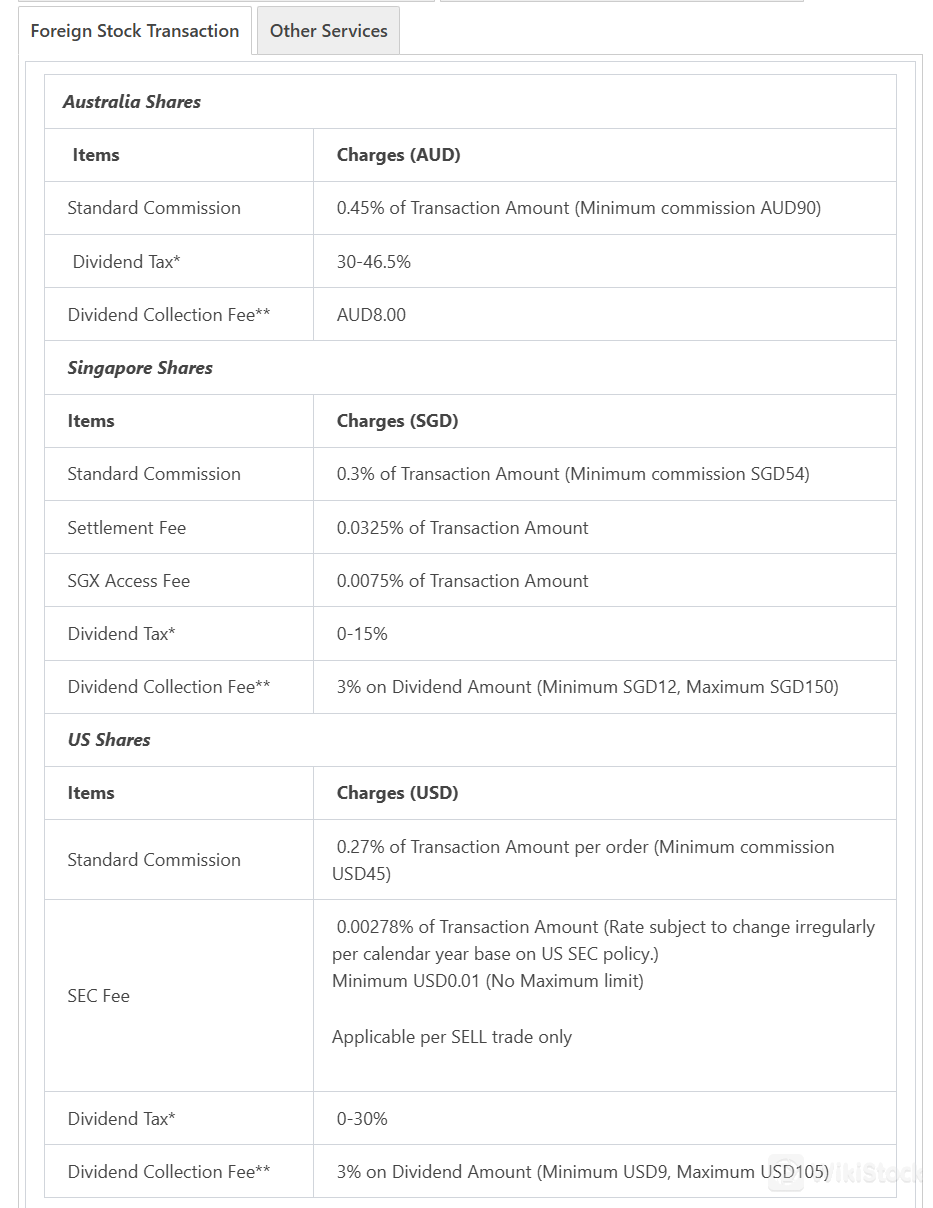

For trading Australian shares, the standard commission is 0.45% of the transaction amount, with a minimum commission of AUD 90. Dividend tax ranges from 30% to 46.5%, and the dividend collection fee is AUD 8.00.

For Singapore shares, the standard commission is 0.3% of the transaction amount, with a minimum commission of SGD 54. There is also a settlement fee of 0.0325% and an SGX access fee of 0.0075% of the transaction amount. Dividend tax ranges from 0% to 15%, and the dividend collection fee is 3% of the dividend amount, with a minimum of SGD 12 and a maximum of SGD 150.

For US shares, the standard commission is 0.27% of the transaction amount per order, with a minimum commission of USD 45. The SEC fee is 0.00278% of the transaction amount, with a minimum of USD 0.01, applicable only per SELL trade. Dividend tax ranges from 0% to 30%, and the dividend collection fee is 3% of the dividend amount, with a minimum of USD 9 and a maximum of USD 105.

ZSL App Review

ZSL offers secure and efficient trading platforms, ZSL Hong Kong Stocks Security Encoder and ZSL International Stocks Security Encoder, for both Hong Kong and international stocks, available on Android and Apple devices.

Customer Service

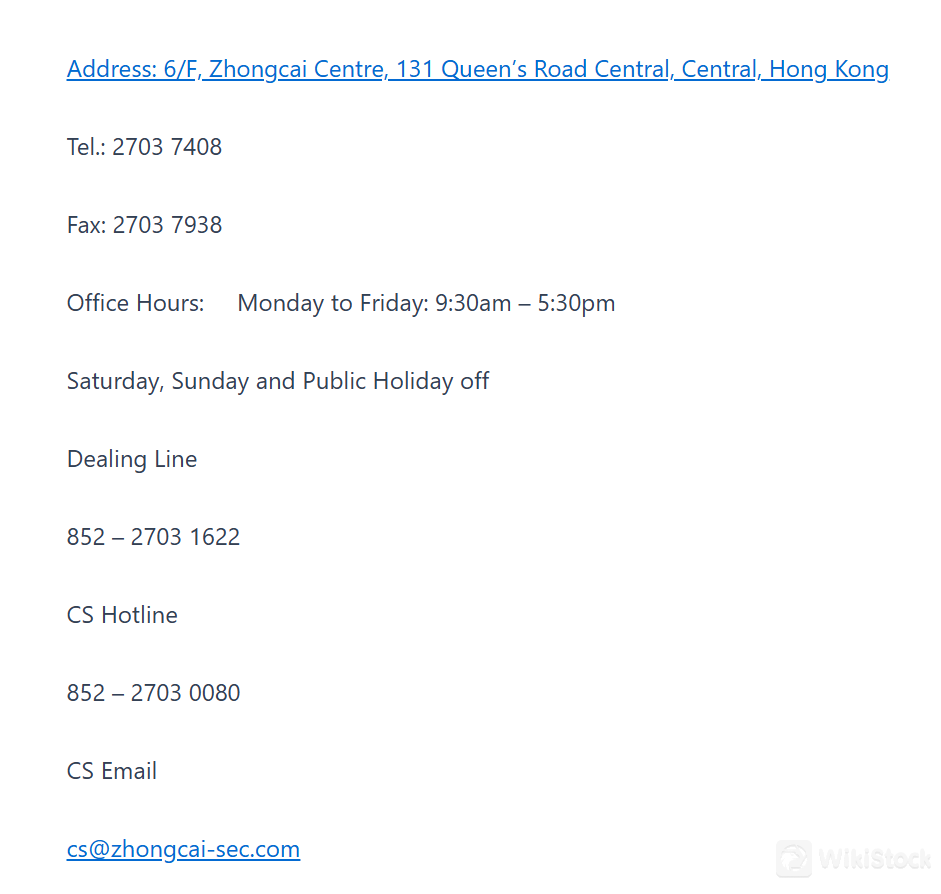

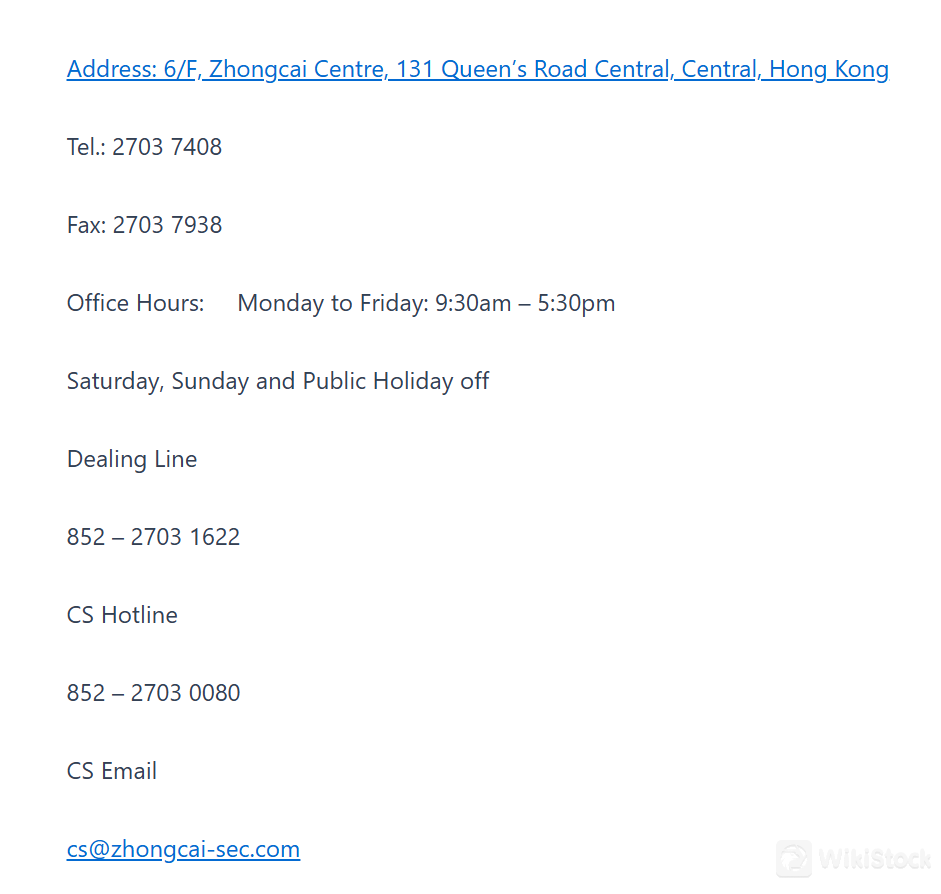

ZSL provides a comprehensive customer service experience, ensuring accessibility and support for its clients. The office, located on the 6th floor of the Zhongcai Centre at 131 Queens Road Central, Central, Hong Kong, is open from Monday to Friday, 9:30 am to 5:30 pm, and closed on Saturdays, Sundays, and public holidays. Clients can reach the customer service team via telephone at 2703 7408 or fax at 2703 7938. For trading-related inquiries, a dedicated dealing line is available at 852-2703 1622. Additionally, customer service support can be accessed through the hotline at 852-2703 0080 or via email at cs@zhongcai-sec.com.

Conclusion

ZSL is distinguished by its strong regulatory backing from the SFC in Hong Kong and its specialized access to IPOs, making it an appealing choice for investors interested in initial public offerings. This brokerage is well-suited for active traders seeking opportunities in the IPO market. However, potential drawbacks include the absence of forex and cryptocurrency trading options, as well as limited customer support features like live chat, which may impact immediate assistance availability for clients.

FAQs

Is ZSL safe to trade?

ZSL is licensed and regulated by the Securities and Futures Commission (SFC). However, detailed information regarding fund safety and specific safety measures is not readily available, which may be a consideration for potential traders.

Is ZSL a good platform for beginners?

While ZSL provides trading platforms, it lacks comprehensive educational resources. This may present challenges for beginners who require structured guidance and learning opportunities to navigate the complexities of trading effectively.

Is ZSL legit?

ZSL is duly licensed and regulated by the Securities and Futures Commission (SFC) under license number BED053, confirming its legitimacy and adherence to regulatory requirements in Hong Kong.

Risk Warning

The details presented are derived from WikiStock's expert analysis of the brokerage's website information and are subject to updates. Additionally, online trading carries significant risks that could result in the complete loss of invested funds. Therefore, it is essential to fully understand these risks before deciding to participate in trading activities.

China

ChinaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--