Tat Lee Securities Co. Ltd does not provide insurance coverage for customer account balances.

Safety Measures:

Tat Lee Securities Co. Ltd implements several security measures to safeguard clients' accounts and personal information. These measures include encryption protocols to protect data during transmission, robust firewalls to prevent unauthorized access, and regular security audits to identify and address potential vulnerabilities.

What are Securities to Trade with Tat Lee Securities Co. Ltd?

Tat Lee Securities Co. Ltd. provides a targeted selection of tradable securities focused on the Hong Kong financial market. Their offerings include Hong Kong-listed stocks and key indices like the Hang Seng Index (HSI).

Additionally, they facilitate trading in Hang Seng Index Futures (HSIF) and the next month contracts (HSIF Next Month) for those looking to manage exposure to market movements. For smaller contract sizes, the Mini Hang Seng Index Futures (MiniHSI) are available.

This limited range ensures clients can engage with major segments of the Hong Kong market efficiently and effectively.

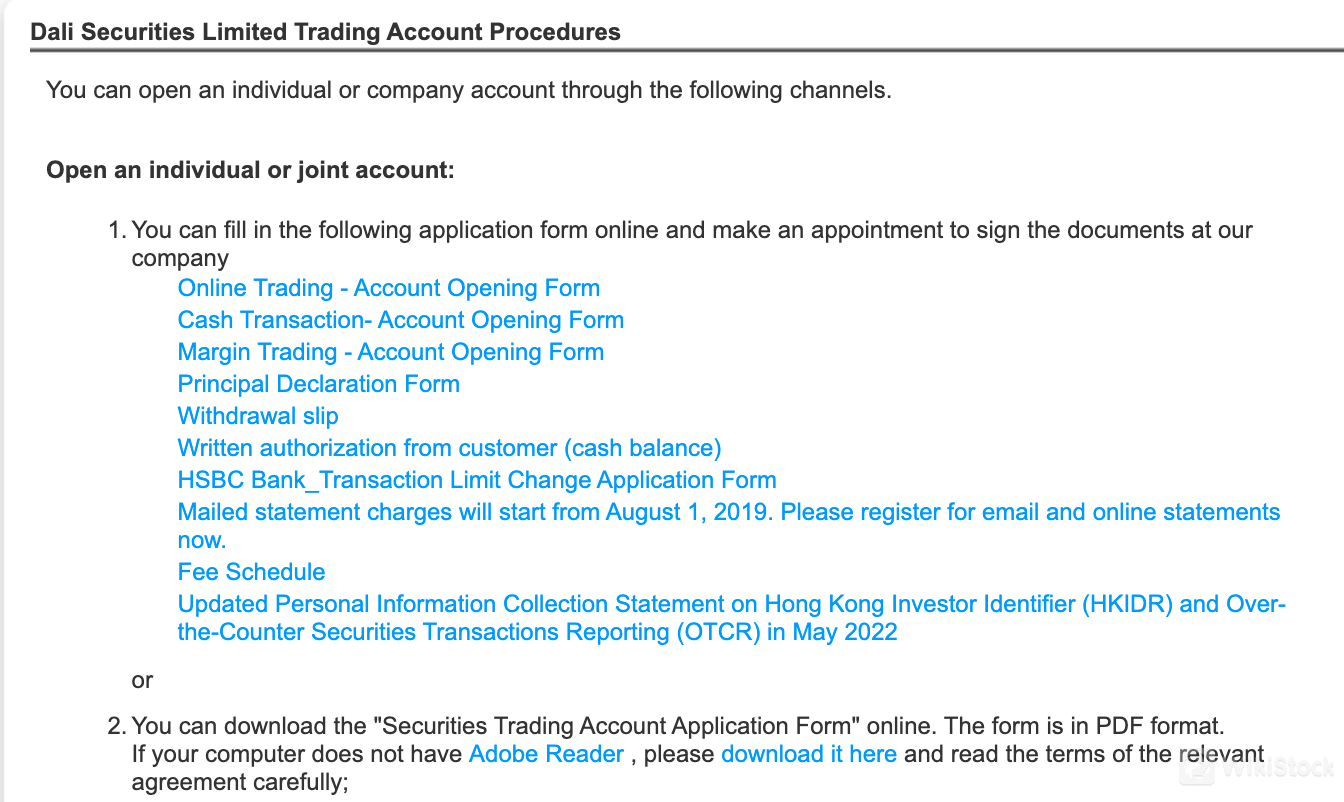

Tat Lee Securities Co. Ltd Accounts

Tat Lee Securities Co. Ltd. Provides both Individual account and Company account for users.

Individual or Joint Account

Tat Lee Securities Co. Ltd. provides individual and joint accounts tailored for retail investors. An individual account is designed for solo traders who want to manage their own portfolio independently. This account type is suitable for those seeking direct control over their trading activities and investment decisions. Joint accounts, on the other hand, are ideal for two or more individuals who wish to collectively manage their investments. This option suits family members, partners, or friends who prefer shared control over a single account.

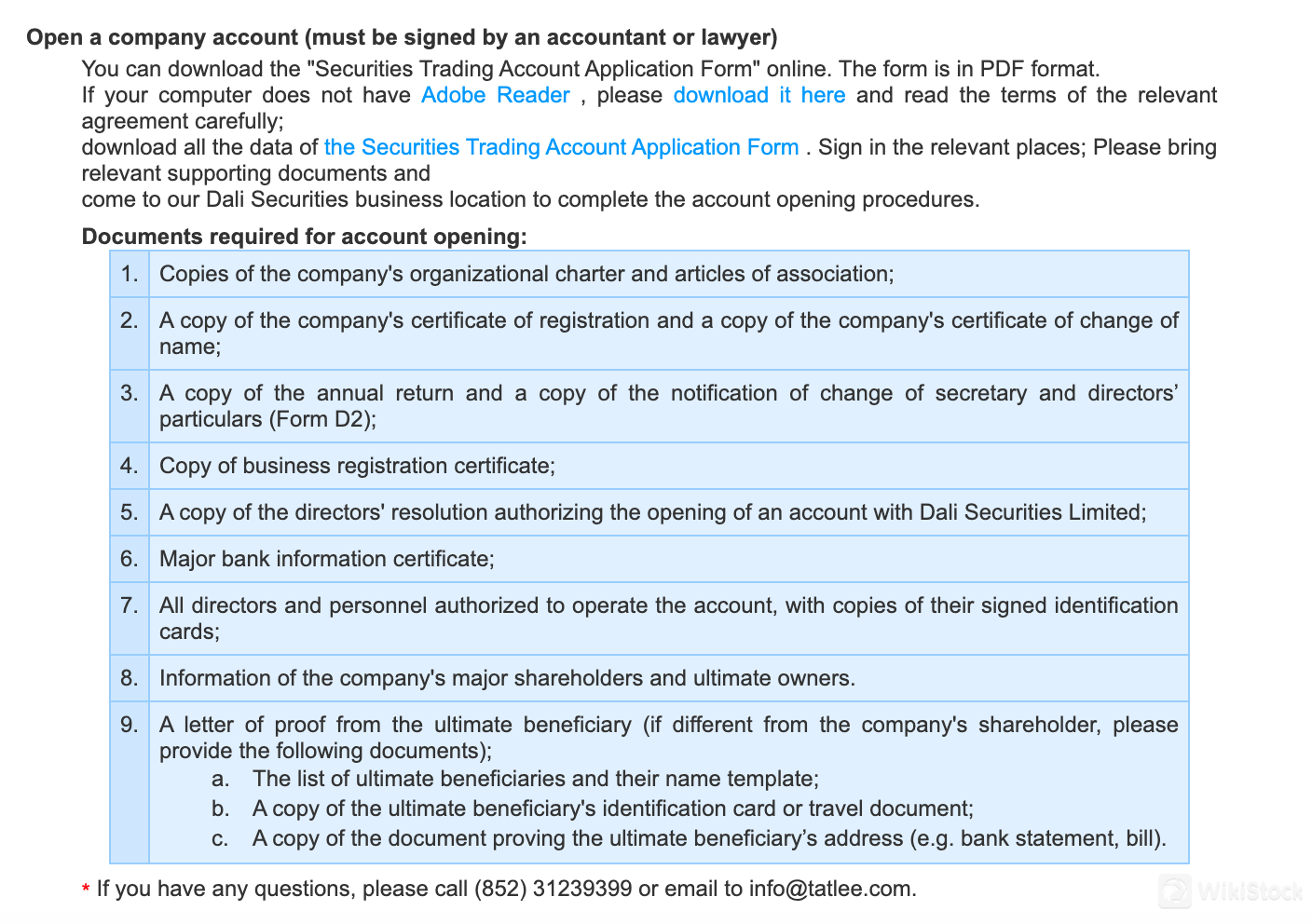

Company Account

For corporate clients, Tat Lee Securities Co. Ltd. offers a company account that accommodates the needs of businesses and institutional investors. This account type is structured to support the complex requirements of corporate entities, such as higher trading volumes and more sophisticated financial operations. Suitable for companies, financial institutions, and professional investors, the company account provides tools and services that align with corporate governance and regulatory compliance.

Tat Lee Securities Co. Ltd Fees Review

Commissions and Fees

Tat Lee Securities Co. Ltd. charges commissions based on the transaction amount, with rates and minimum fees varying by the method of trading and whether the trade is a day trade or not.

Phone/In-Person Trades: For standard transactions, the commission is 0.25% of the transaction amount, with a minimum charge of USD 100. For same-day buy and sell trades of the same stock in the same quantity, the rate drops to 0.18%, with the same minimum fee.

Mobile Online Trading: Commission is set at 0.25% per transaction with a minimum charge of USD 100. For same-day trades, the rate is reduced to 0.18%, with a lower minimum fee of USD 80.

Desktop Online Trading: Standard trades have a commission rate of 0.18% with a minimum fee of USD 80. For same-day trades, the commission is reduced to 0.15%, with a minimum fee of USD 50.

Government and Regulatory Fees

Trading on Tat Lee Securities platforms involves several regulatory and government-imposed fees:

Financial Reporting Council (FRC) Transaction Levy: 0.00015% of the transaction amount, rounded to the nearest cent.

Government Stamp Duty: 0.13% of the transaction amount, with a minimum charge of USD 1.

Securities and Futures Commission (SFC) Transaction Levy: 0.0027% of the transaction amount.

Hong Kong Exchange (HKEX) Trading Fee: 0.00565% of the transaction amount.

Central Clearing and Settlement System (CCASS) Fee: 0.003% of the transaction amount, with a minimum of USD 3 and a maximum of USD 200.

Account-Related Fees

Tat Lee Securities imposes various fees related to account management and stock handling:

Stock Withdrawal (SI/ISI): Free for deposit instructions, but withdrawing stocks costs USD 100 per stock for Settlement Instructions (SI) and USD 20 per stock for Investor Settlement Instructions (ISI).

Physical Stock Transfer: Charges include USD 5 for stamp duty per document, plus additional handling fees ranging from USD 2.50 to USD 150 depending on the urgency of the service.

Dividend Collection and Other Services: For each stock, collecting dividends costs USD 30 plus 0.12% of the dividend amount (minimum USD 5, maximum USD 10,000). Handling rights issues, stock subscriptions, and other corporate actions typically cost USD 30 per event, with various additional fees for different services.

Compared to other brokers in the market, Tat Lee Securities' commission rates are on the higher end for some trading methods.

Tat Lee Securities Co. Ltd offers a margin interest rate of USD 2.50 per lot with a minimum charge of USD 20. This rate applies to margin accounts, allowing clients to borrow funds for trading purposes, with interest calculated based on the borrowed amount and duration of the loan.

Tat Lee Securities Co. Ltd Trading Platform Review

Tat Lee Securities Co. Ltd. offers the iTrader as its primary internet trading platform for securities trading which is available on both desktop and phone. It provides users with a robust interface for executing trades in the Hong Kong market.

iTrader supports real-time trading of Hong Kong-listed stocks and various indices, offering users comprehensive tools for market analysis and order execution. The platform features live market data feeds, advanced charting tools, and customizable watchlists to help traders monitor their portfolios and market conditions effectively.

Customer Service

Tat Lee Securities Co. Ltd. offers comprehensive customer support through various channels.

For general inquiries or online trading questions, clients can call (852) 3123 9399 or email info@tatlee.com.

For technical issues, the support team is available at the same number or via email at support@tatlee.com. A

dditionally, career-related inquiries can be directed to (852) 3123 9399 or recruit@tatlee.com.

Their customer support team is available Monday to Friday, from 9:00 AM to 5:30 PM (Hong Kong Time), ensuring assistance during regular business hours.

Conclusion

In conclusion, Tat Lee Securities Co. Ltd. presents both advantages and disadvantages for investors.

Its regulated status provides a sense of security, while its iTrader platform offers comprehensive trading tools. However, high commissions for certain trades and limited tradable securities deter some users.

The platform is suitable for experienced traders who prioritize advanced charting tools and real-time market data. Novice investors might find the fees prohibitive and the platform's complexity overwhelming.

FAQs

Obtain 1 securities license(s)