Approval from the CSRC to establish Hong Kong office engaging in SFC regulated activities was granted to our parent, Changjiang Securities, in 2010. Changjiang Securities International Financial Group Limited is a company incorporated in Hong Kong, whereas its wholly-owned subsidiaries are established as licensed corporations to carry out SFC regulated activities.

What is Changjiang Securities?

Changjiang Securities offers competitive commission fees starting from 0.2% and provides a relatively high interest rate of 5.14% on uninvested cash, which can be attractive for investors holding significant cash balances.

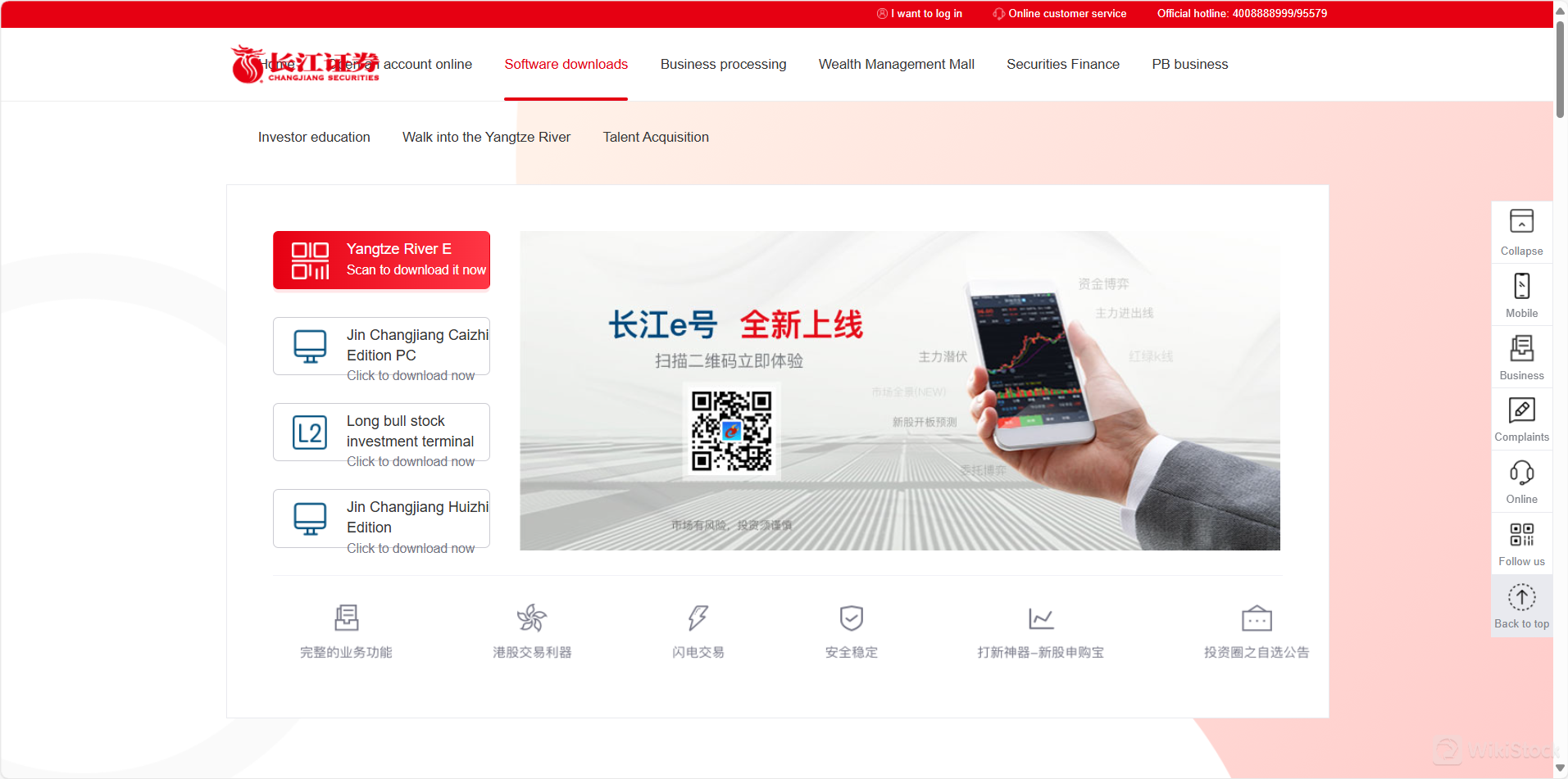

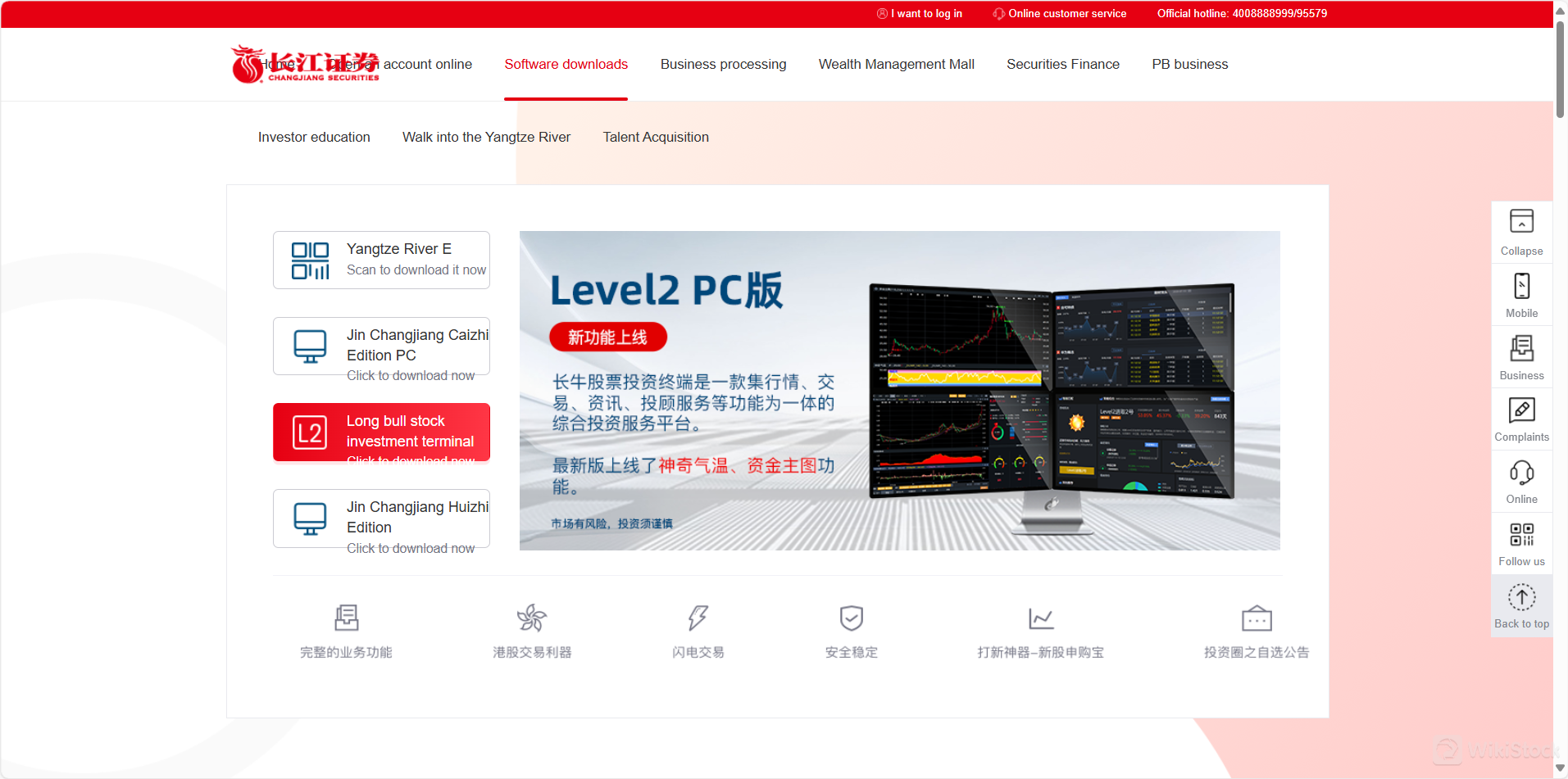

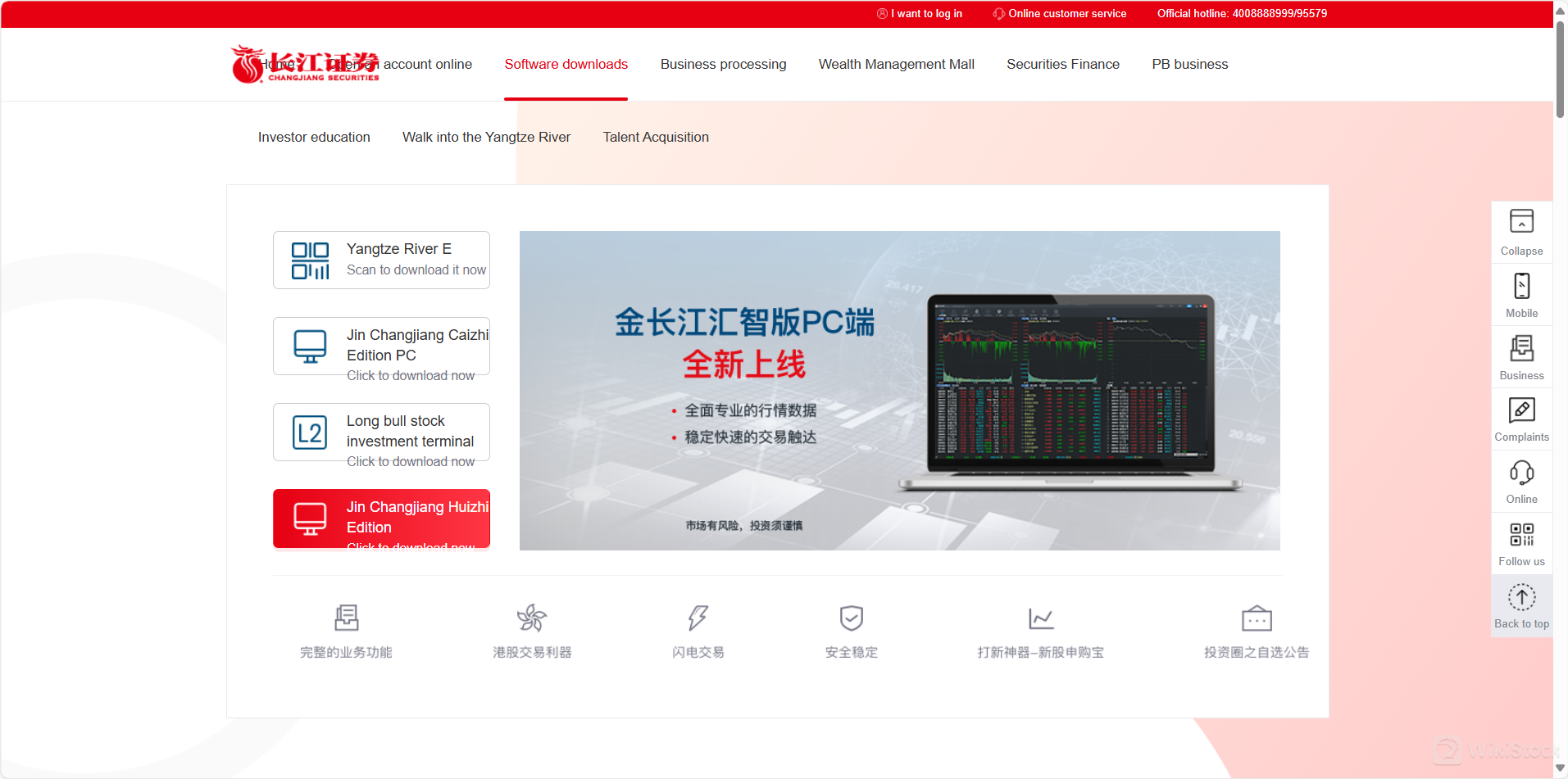

The company supports a variety of platforms and applications tailored for different user preferences, such as the Yangtze River EScan and Jin Changjiang Caizhi Edition PC. However, it does not provide a margin trading option, which limits some investors who seek leverage in their trading strategies.

Pros & Cons

Pros:

Changjiang Securities offers a diverse portfolio of tradable securities including stocks, options, bonds, and ETFs, suited for various investor needs. It is well-regulated by the SFC, enhancing its credibility and reliability. The firm boasts multiple unique trading platforms, each with different versions tailored to specific trading preferences. Additionally, its low fee structure, starting from 0.2%, makes it economically appealing. Founded in 1991, the institution has a lengthy history and experience in the financial market.

Cons:

However, the company does not provide analysis tools, which can hinder traders who depend on such resources for making informed decisions. Deposits are limited to bank transfers only, restricting flexibility in funding accounts. The fee structure, although low, is complex and might confuse new users. Furthermore, the services are mainly geared towards traders within mainland China, which could be less convenient for international traders.

Is Changjiang Securities Safe?

Regulations:

Changjiang Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong under the license number AXY608. The SFC is a respected independent statutory body responsible for overseeing the securities and futures markets in Hong Kong since 1989.

It operates independently from the Hong Kong Special Administrative Region Government and is primarily funded through transaction levies and licensing fees.

Funds Safety:

Being regulated by a reputable body like the SFC generally involves stringent requirements on capital adequacy and client fund segregation. These regulations ensure that client funds are held separately from the companys own funds, reducing the risk of misuse. However, without explicit confirmation, it's unclear if there is an insurance scheme like the Securities Investor Protection Corporation (SIPC) in the U.S. that protects client assets up to a certain limit.

Safety Measures:

Changjiang Securities is likely to employ industry-standard security measures to protect the integrity and privacy of client accounts and transactions.

These measures typically include encryption technologies for data transmission, secure storage of client information, and advanced authentication procedures to prevent unauthorized access.

Additionally, routine security audits and compliance checks help ensure that safety protocols are continually upheld. Such practices are common among regulated financial institutions and are essential for maintaining client trust and safeguarding against information leakage and other security threats.

What are securities to trade with Changjiang Securities?

At Changjiang Securities, investors can engage in various types of securities trading:

Stocks: Investors have the opportunity to buy shares in publicly traded companies. Owning stock means holding a slice of a company, with potential gains from both dividends and capital appreciation as the company grows.

Options: These financial instruments grant the buyer the right, but not the obligation, to buy or sell a stock at an agreed-upon price within a specific time frame. Options are used for hedging against market fluctuations or speculating on future price movements with a relatively lower initial investment.

Bonds: Bonds represent a loan made by the investor to a borrower (typically corporate or governmental). They are a more stable investment choice, providing regular income through interest payments until the bond matures, at which point the initial investment is returned.

ETFs (Exchange Traded Funds): ETFs are investment funds traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds and generally operate with an arbitrage mechanism designed to keep trading close to its net asset value, though deviations can occasionally occur.

Mutual Funds: Unlike ETFs, mutual funds are not traded on an exchange and are typically purchased directly from fund companies. They also consist of a diversified portfolio managed by financial professionals, allowing investors to buy a variety of assets with a single transaction.

Futures: Futures contracts are agreements to buy or sell a particular asset or financial instrument at a predetermined future date and price. They are commonly used by investors to hedge against price changes or to speculate on market movements.

Changjiang Securities Fee Review

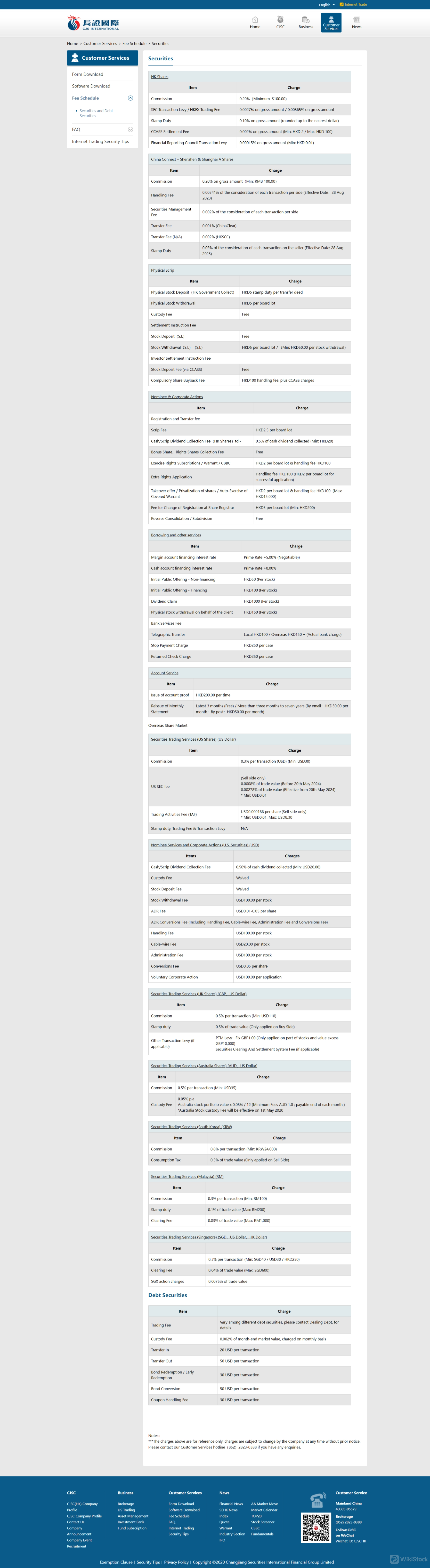

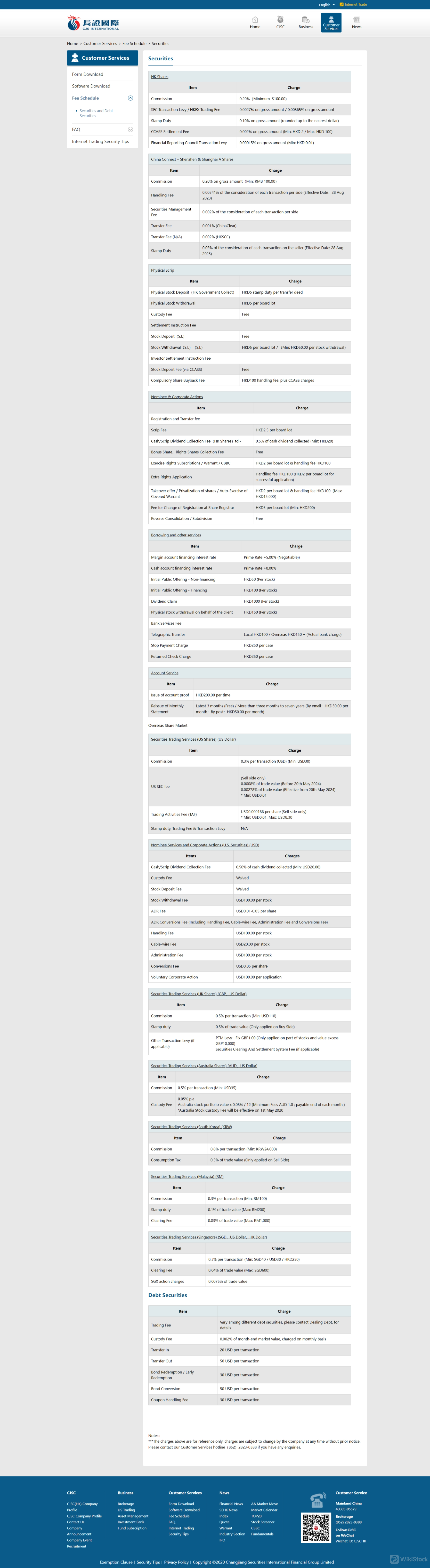

At Changjiang Securities, the complex fee structure for trading securities is outlined below, categorized by region and type of security:

Hong Kong Shares:

Changjiang Securities applies a 0.20% commission on Hong Kong shares with a minimum fee of $100. Additional costs include SFC Transaction Levy and HKEX Trading Fee, Stamp Duty at 0.10%, CCASS Settlement Fee, and a minimal Financial Reporting Council Transaction Levy.

China Connect – Shenzhen & Shanghai A Shares:

For A Shares through China Connect, the commission is 0.20% (minimum RMB 100), with handling and securities management fees per transaction, Transfer Fees for ChinaClear and HKSCC, and a Stamp Duty of 0.05% on the seller.

US Shares:

Trading US shares incurs a 0.3% commission per transaction (minimum USD 30). The SEC fee changes post-May 20, 2024, and a Trading Activities Fee applies per share on the sell side.

UK and Other International Markets:

UK share trades have a 0.5% commission (minimum USD 110) and a 0.5% Stamp Duty. Australian shares have a similar commission with a monthly calculated custody fee. Trades in South Korea and Malaysia feature specific commissions and taxes, while Singapore trades include a commission and a clearing fee.

Debt Securities:

Debt securities involve varying trading fees and a monthly custody fee of 0.002% of the market value. Charges for transactions like bond redemption, conversion, and coupon handling are explicitly stated per action.

Changjiang Securities Trading Platform Review

Changjiang Securities offers a variety of trading platforms tailored to meet the needs of different types of investors, each with unique features and capabilities:

Indonesia

IndonesiaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--

--