Score

富册国际证券期货

https://www.alphainthk.com/index.php

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China

ChinaProducts

3

Futures、Investment Advisory Service、Stocks

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01910

Brokerage Information

More

Company Name

FTFT International Securities and Futures Limited

Abbreviation

富册国际证券期货

Platform registered country and region

Company address

Company website

https://www.alphainthk.com/index.phpCheck whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 831

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

Hungary

70985.32%Cambodia

829.87%China

404.80%Others

00.01%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Trading Fee

$1.95

Platform Service Fee

HK$15

Commission Rate

0.03%

Funding Rate

6.8%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

Products

3

| FTFT International Securities and Futures |  |

| WikiStock Rating | ⭐⭐⭐ |

| Fees | 0.01 USD per share or 0.5% of commission for U.S. stock |

| 0.00565% of trading fee for Hong Kong Stock | |

| Account Fee | HKD 50 + postage for monthly account statements |

| App/Platform | Fuce Securities APP |

| Customer Support | Phone, email, fax and online messaging |

FTFT Introduction

FTFT International Securities and Futures, established in 2010 and part of the Fuce Financial Technology Group, has evolved from a traditional Hong Kong equity brokerage into a comprehensive financial services platform. Specializing in internet securities business, as well as investment banking services in the debt capital markets (DCM) and equity capital markets (ECM), FTFT is committed to delivering robust financial solutions.

Pros & Cons of FTFT

| Pros | Cons |

| Regulated by SFC | Complex Fee Structure |

| Strong Security Measures | Limited Physical Presence (Only Hong Kong) |

| Comprehensive Financial Services | |

| Experienced Management Team |

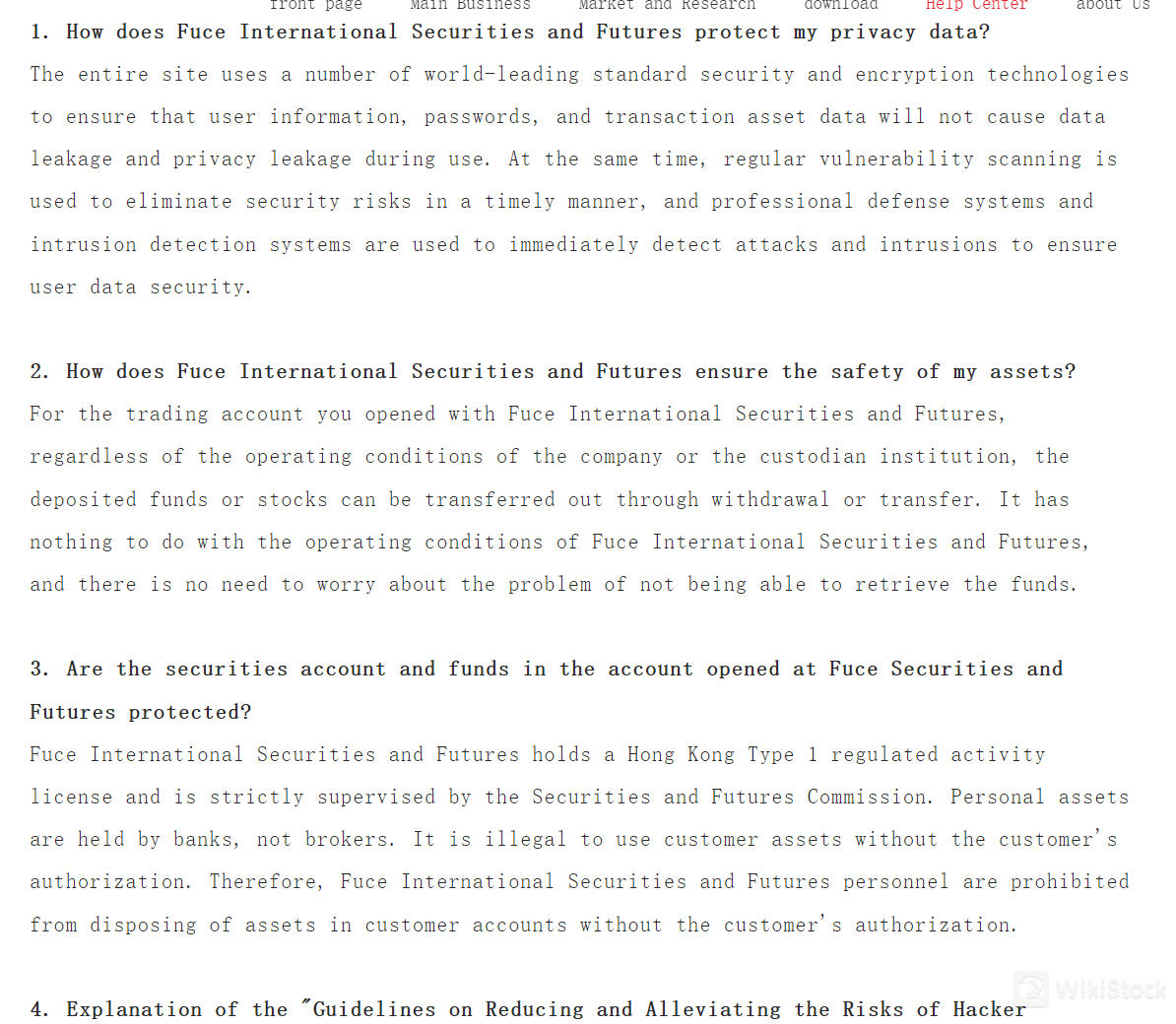

Regulated by SFC: Being regulated by the Securities and Futures Commission (SFC) ensures that FTFT operates under strict compliance with regulatory standards, offering clients assurance of reliability and adherence to financial regulations.

Strong Security Measures: FTFT prioritizes the security of client data and transactions with robust encryption technologies, regular vulnerability scans, and professional defense systems. This commitment helps safeguard client assets against potential cyber threats.

Comprehensive Financial Services: FTFT provides a wide range of financial services including A-share, Hong Kong, and U.S. stock trading, futures, CBBC trading, new share subscriptions, and margin trading. This breadth of services allows clients to diversify their investment portfolios conveniently.

Experienced Management Team: With a leadership team boasting extensive experience in international finance and technology from prestigious firms like UBS, PwC, Tencent, and Alibaba, FTFT leverages expertise to enhance service quality and innovation in financial products.

Cons:Complex Fee Structure: FTFT's fee structure, while competitive, can be complex and require careful understanding by clients. This complexity could potentially lead to confusion or higher costs if not managed effectively.

Limited Physical Presence (Only Hong Kong): FTFT primarily operates from Hong Kong, which limits accessibility for clients seeking face-to-face interactions or localized services outside of Hong Kong. This can affect convenience for customers who prefer physical office access or local support.

Is FTFT Safe?

FTFT International Securities and Futures places paramount importance on the security and privacy of client data through robust measures. Utilizing encryption technologies and adhering to stringent global security standards, they ensure that client information, passwords, and transactional data remain protected from any potential leaks or breaches.

Regular vulnerability scans are conducted to promptly identify and mitigate security risks, complemented by professional defense and intrusion detection systems that swiftly detect and respond to any unauthorized access attempts, thereby ensuring the utmost security of client data.

In terms of asset security, FTFT International Securities and Futures provides reassurance that funds and securities deposited into client trading accounts can be withdrawn or transferred independently of the firm's operational status or custodian institution.

Furthermore, client securities accounts and funds are safeguarded under the rigorous oversight of the Securities and Futures Commission (SFC). Holding a Type 1 regulated activity license in Hong Kong (License No. ATR516), FTFT International Securities and Futures operates under strict regulatory scrutiny.

Client assets are securely held by banks, not by the brokerage, ensuring compliance with legal requirements that prohibit unauthorized access or use of client assets without explicit client authorization. This commitment underscores their dedication to maintaining the security and integrity of client investments at all times.

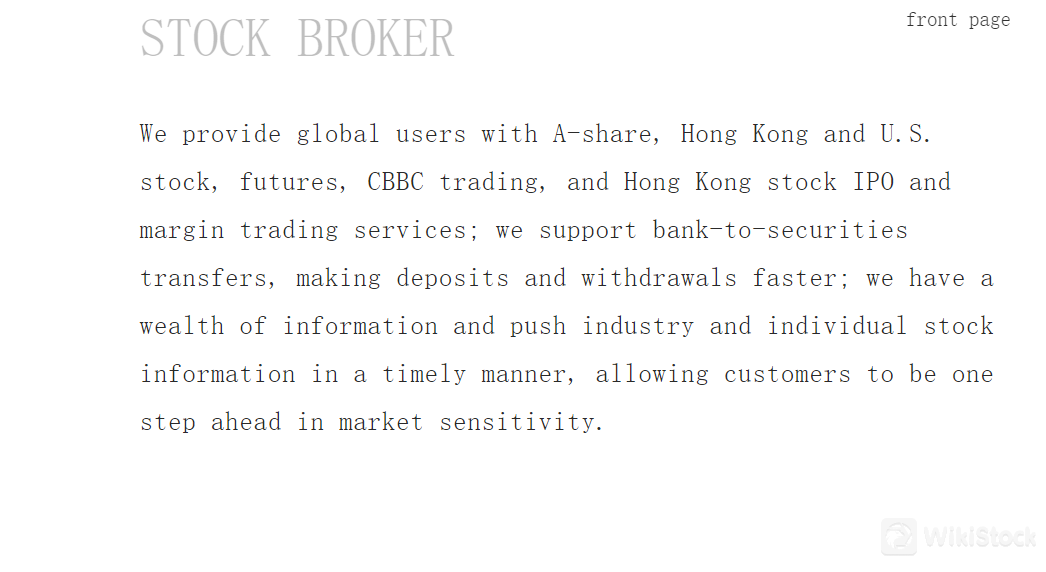

FTFT Services Review

FTFT International Securities and Futures offers A-share, Hong Kong and U.S. stock, futures, CBBC trading, and Hong Kong stock IPO and margin trading services.

A-share Trading: This refers to trading of stocks listed on the Shanghai and Shenzhen stock exchanges in mainland China, denominated in Chinese yuan (CNY).

Hong Kong Stock Trading: Involves buying and selling stocks listed on the Hong Kong Stock Exchange (HKEX), which includes a diverse range of companies from various sectors.

U.S. Stock Trading: Enables clients to trade stocks listed in major U.S. stock exchanges such as the New York Stock Exchange (NYSE) and NASDAQ.

Futures Trading: Involves trading contracts to buy or sell commodities or financial instruments at a predetermined price in the future, providing opportunities for speculation and hedging.

CBBC Trading (Callable Bull/Bear Contracts): CBBCs are structured products traded in Hong Kong that offer leveraged exposure to underlying stocks or indices, allowing investors to profit from both rising (bull) and falling (bear) markets.

Hong Kong Stock IPO Services: Involves facilitating Initial Public Offerings (IPOs) of Hong Kong-listed companies, allowing investors to participate in new stock offerings.

Margin Trading: Allows clients to borrow funds from the brokerage to leverage their investments in Hong Kong stocks, potentially amplifying both gains and losses based on market movements.

FTFT Fees Review

FTFT International Securities and Futures offers a fee structure tailored for both Hong Kong and U.S. stock trading, as well as additional services such as new share subscriptions and margin account loans.

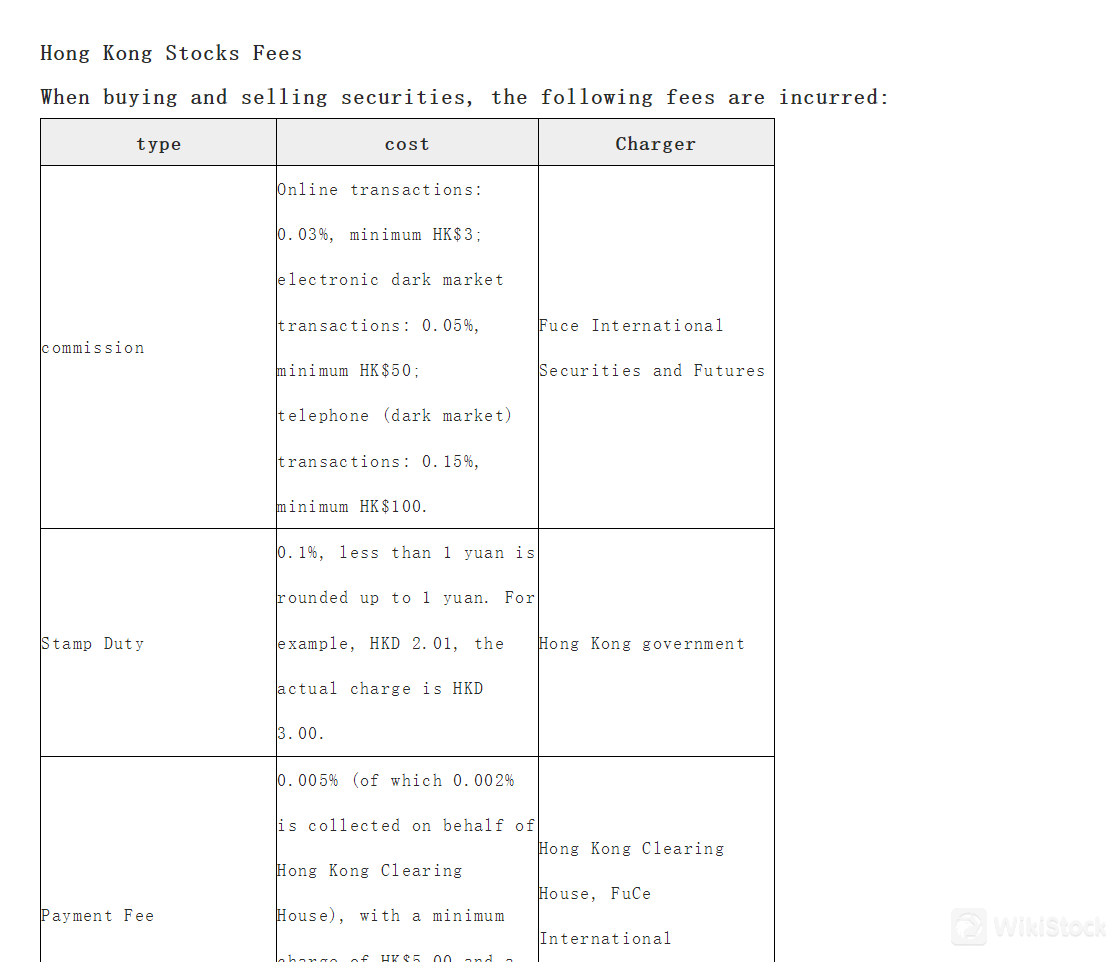

Hong Kong Stock Trading Fees:

For trading on Hong Kong stock exchanges, FTFT charges competitive commissions based on transaction type—online, electronic dark pool, and phone trading—each with varying percentages and minimum charges. Stamp duty, transaction levy, and trading fees are also applied, alongside a platform usage fee per order. Additional fees include charges for stock transfers, returned checks, and account statement mailings.

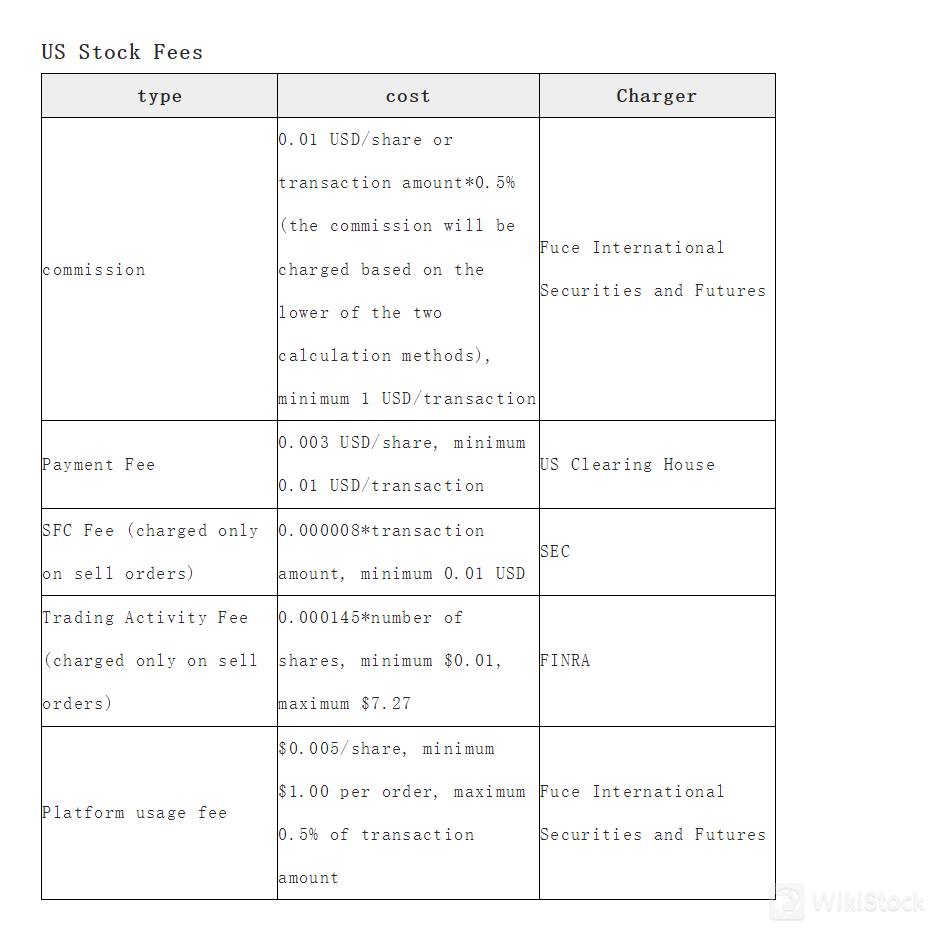

U.S. Stock Trading Fees:

Trading U.S. stocks incurs fees per share or as a percentage of transaction amounts, with minimum charges ensuring cost predictability. Clearing fees, SEC fees on sales, and trading activity fees further complement these costs. Platform usage fees are structured to balance affordability with transaction size sensitivity.

New Share Subscription Fees:

Subscribing to new shares involves minimal cash fees, though margin subscriptions incur fixed charges regardless of application success. Transaction levies and broker commissions may apply upon successful subscription.

Margin Account Loan Fees:

Interest rates for margin account loans vary based on collateral values. Lower rates apply when loans are less than collateral values, whereas loans exceeding market values incur higher annual interest rates.

Additional Services for Hong Kong Stocks:

FTFT provides supplementary services like stock transfers and account services, though physical stock deposit and withdrawal services are not supported.

| Service | Detail |

| Hong Kong Stock Trading Fees | |

| Commission | Online Trading: 0.03% (min. 3 HKD) |

| Electronic Dark Pool Trading: 0.05% (min. 50 HKD) | |

| Phone (Dark Pool) Trading: 0.15% (min. 100 HKD) | |

| Stamp Duty | 0.1%, min. 1 HKD for amounts < 1 HKD |

| Transaction Levy | 0.0027% |

| Trading Fee | 0.00565% |

| Platform Usage Fee | 15 HKD per order |

| Other Fees | Handling Fee for Stock Transfers: 10 HKD per lot (min. 50 HKD) |

| Returned Check Fee: 200 HKD per check | |

| Mailing Account Statements: 50 HKD + postage | |

| U.S. Stock Trading Fees | |

| Commission | 0.01 USD per share or 0.5% (min. 1 USD per transaction) |

| Clearing Fee | 0.003 USD per share (min. 0.01 USD per transaction) |

| SEC Fee (sales only) | 0.000008 times transaction amount (min. 0.01 USD) |

| Trading Activity Fee (sales only) | 0.000145 USD per share (min. 0.01 USD, max. 7.27 USD) |

| Platform Usage Fee | 0.005 USD per share (min. 1 USD per order, max. 0.5% of transaction amount) |

| New Share Subscription Fees | |

| Subscription Fee | Cash Subscription: 0.00 HKD |

| Margin Subscription: 80 HKD (charged regardless of success) | |

| Transaction Levy, Trading Fee, Broker Commission | 1.0077% if subscription is successful |

| Margin Account Loan Fees | |

| Interest Rate for Margin Account Loans | Loans < collateral value: 6.8% annual |

| Loans > market value: 30% annual | |

FTFT Platforms Review

Fuce Securities APP stands out as a premier platform for stock investment and trading. It provides a comprehensive suite of professional services tailored for trading in Hong Kong and US stocks. The app ensures a seamless global trading experience, empowering users with rapid transaction execution and extensive market access. Investors can stay ahead of market trends with real-time updates on hot spots and a panoramic view of global information. For traders prioritizing speed and reliability, Fuce Securities APP delivers with millisecond order placement facilitated by a dedicated network infrastructure.

Deposits & Withdrawals Review

For FTFT International Securities and Futures, managing deposits and withdrawals involves adhering to national foreign exchange policies and guidelines. Clients can conveniently deposit funds using Hong Kong bank cards or the Velo bank card from the United States. Common questions regarding deposits include procedures for transferring funds from China Merchants Wing Lung Bank and inquiries about FPS (Faster Payment System) for depositing funds quickly. For withdrawal inquiries, clients can manage their banking details for fund transfers.

Research & Education

FTFT International Securities and Futures offers research in Hong Kong and US stock markets, as well as Chinese dollar bonds. Their research capabilities span macroeconomics, offering insights into global economic trends and their impact on financial markets. This includes detailed analysis of key economic indicators, policy changes, and geopolitical developments that may influence investment strategies.

In terms of stock market trends, FTFT International Securities and Futures offers in-depth analysis and forecasts, helping investors navigate dynamic market conditions. Their research covers various sectors, market segments, and specific stock performances, providing clients with timely information to make informed trading decisions.

For investors interested in Chinese dollar bonds, FTFT International Securities and Futures provides specialized research focusing on bond market trends, yield analysis, credit ratings, and regulatory updates. This enables investors to evaluate risk and return potential in the fixed income market effectively.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: (Mainland China) 400-969-0852 (Hong Kong) 852-21141970

Fax: 852-21141973

Email: cs@alphahkint.com

Address: Room C, 18/F, Commercial Centre, 235 Wing Lok Street, Sheung Wan

FTFT International Securities and Futures offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform.

Conclusion

FTFT International Securities and Futures distinguishes itself as a trusted financial services provider under the regulatory oversight of the SFC in Hong Kong. With a comprehensive range of services spanning stock trading, futures, CBBCs, and investment banking, FTFT caters to a diverse clientele seeking robust investment opportunities in Hong Kong and international markets, including the U.S. While primarily operating online, FTFT's accessibility and educational resources make it a choice for both seasoned investors and newcomers.

Frequently Asked Questions (FAQs)

Is FTFT regulated?

Yes. It is regulated by SFC.

Can I trade on international markets through FTFT?

Yes, FTFT facilitates trading on international markets including U.S. stocks.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

10-15 years

Products

Futures、Investment Advisory Service、Stocks

Relevant Enterprises

Countries

Company name

Associations

--

富册金融科技集团

Parent company

Review

No ratings

Recommended Brokerage FirmsMore

瑞达国际

Score

Huajin International

Score

CLSA

Score

DL Securities

Score

Sanfull Securities

Score

嘉信

Score

GF Holdings (HK)

Score

China Taiping

Score

Capital Securities

Score

乾立亨證券

Score