My GM Rewards Mastercard: Earn rewards on purchases that can be redeemed towards GM purchases, including vehicle purchases, parts, and accessories.

GM Business Mastercard: Designed for business owners, offering rewards and benefits tailored to business expenses.

GM Extended Family Mastercard: Ideal for family members of GM employees, providing rewards and benefits on everyday purchases.

Investment Accounts (no longer available from the second quarter of 2024): While investment accounts were previously offered, Marcus has ceased offering them as of the second quarter of 2024. However, Marcus continues to provide accessible options for individuals looking to grow their wealth through other secure and rewarding investment avenues.

Fees Review

When it comes to fees, Marcus by Goldman Sachs prioritizes transparency and customer-friendly structures across its financial products.

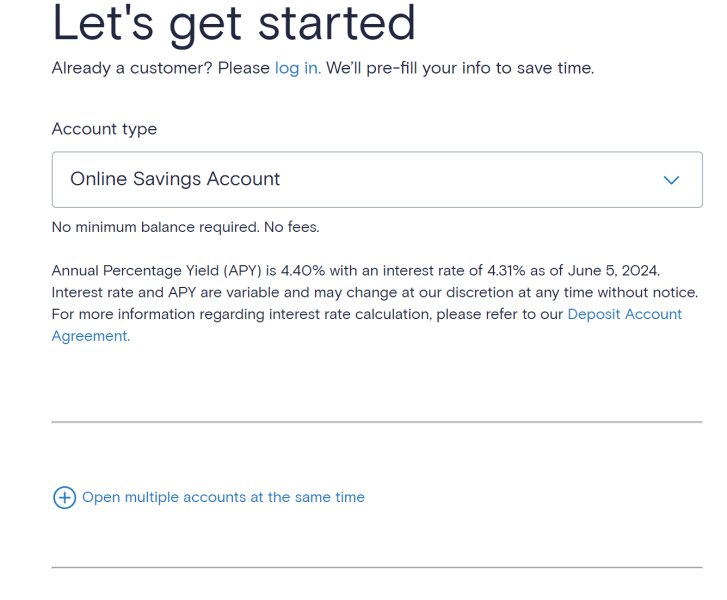

High-Yield Savings Account:

Annual Percentage Yield (APY): 4.40%

Minimum Balance to Open: $0

Withdrawals: Unlimited withdrawals

Fees & Penalties: No fees

High-Yield CD (12 Months):

Annual Percentage Yield (APY): 5.00%

Minimum Balance to Open: $500

Withdrawals: Principal amount is locked until term ends. Interest earned can be withdrawn at any time.

Fees & Penalties: Early withdrawal penalty if balance is withdrawn before term ends

No-Penalty CD (7 Months):

Annual Percentage Yield (APY): 4.7%

Minimum Balance to Open: $500

Withdrawals: Interest earned can be withdrawn at any time. Full balance (principal and interest) can be withdrawn beginning 7 days after funding.

Fees & Penalties: No early withdrawal penalty beginning 7 days after funding

Rate Bump CD (20 Months):

Annual Percentage Yield (APY): 4.40%

Minimum Balance to Open: $500

Withdrawals: Principal amount is locked until term ends. Interest earned can be withdrawn at any time.

Option to change rate during term

Fees & Penalties: Early withdrawal penalty if balance is withdrawn before term ends

For credit cards:

These transparent fee structures ensure that clients can make informed decisions while managing their finances with Marcus by Goldman Sachs.

For more detailed and most updated information regarding fees for informed decision making, you can visit respective page of each product for checking and acknowlegding.

Marcus by Goldman Sachs App Review

The Marcus by Goldman Sachs mobile app offers convenient access to all your financial accounts in one place, providing a seamless and user-friendly experience for managing your finances on the go.

Available for both iOS and Android devices, the app allows you to check your High-Yield Savings account balances, monitor your Certificate of Deposit (CD) investments, track your credit card transactions, and more, all from the palm of your hand.

With intuitive navigation and real-time updates, the Marcus app empowers you to stay in control of your finances wherever you are, making it easier than ever to stay on top of your financial goals.

Trading Tools

Marcus by Goldman Sachs offers a suite of financial calculators designed to empower users in making informed decisions about their finances.

The Savings Interest Calculator allows individuals to compare the potential interest earnings of a Marcus Online Savings Account with those of other banks, providing transparency into savings growth.

The No-Penalty CD Calculator enables users to estimate interest earnings from a Marcus No-Penalty CD, offering flexibility without sacrificing returns.

For those seeking higher returns, the High-Yield CD Calculator helps visualize the growth potential of investments through Marcus by Goldman Sachs' High Yield CD offerings.

Additionally, the Savings Goal Calculator assists in setting realistic savings targets by estimating the time needed to reach specific financial objectives.

Moreover, the Retirement Calculator aids individuals in assessing their retirement readiness, ensuring they are on track to achieve their desired lifestyle post-employment.

Alongside these calculators, Marcus by Goldman Sachs provides robust trading tools that offer comprehensive insights and analysis, empowering users to make informed investment decisions aligned with their financial goals and risk tolerance.

Research & Education

Marcus by Goldman Sachs offers a comprehensive array of educational resources covering key financial topics to empower individuals in achieving their financial goals.

Through detailed guides and resources, Marcus provides valuable insights and knowledge on saving, retirement planning, investing, and lifestyle management. Whether users are looking to build an emergency fund, plan for retirement, delve into investment strategies, or optimize their lifestyle choices, Marcus offers accessible and informative content to help users make informed decisions about their finances.

These resources are designed to demystify complex financial concepts, offering practical advice and tips to enhance financial literacy and confidence.

Customer Service

Marcus by Goldman Sachs's customer service is readily accessible and committed to providing support to investors worldwide. Whether you're in the US or abroad, you can reach them via toll-free numbers during office hours, ensuring prompt assistance.

Additionally, inquiries can be made through web live chat, accommodating various communication preferences.

You can also reach out via WhatsApp for prompt and personalized assistance.

They also maintain an active presence on social media platforms such as Facebook, Twitter, Instagram, YouTube, LinkedIn, allowing clients to engage and seek support through those channels.

For general queries, the FAQ section offers comprehensive guidance, reflecting Marcus by Goldman Sachs' dedication to delivering exceptional customer support.

Address: Marcus by Goldman Sachs, PO Box 70321, Philadelphia, PA 19176-0321.

Tel: U.S. Toll Free: 1-855-730-7283; 1-833-720-6468; 1-833-906-2224; 1-833-773-0988; 1-833-773-0990

Web chat: Savings and Insights (24 hours a day / 7 days a week); Marcus Invest (Mon-Fri 9 am - 6:30 pm ET

GM Rewards Cards: 24 hours a day / 7 days a week);

Conclusion

In conclusion, Marcus by Goldman Sachs stands out as a leading financial services provider committed to transparency, security, and customer satisfaction. Regulated by esteemed authorities like FINRA and the SEC, Marcus ensures adherence to the highest standards of financial operations, providing a reliable trading environment.

Through stringent safety measures, including encryption, firewalls, and multi-factor authentication, Marcus prioritizes the protection of user data and accounts. The diverse range of financial products, from high-yield savings accounts to credit cards, caters to various savings, investment, and credit needs.

Transparent fee structures empower clients to make informed decisions while managing their finances. The Marcus mobile app offers seamless access to accounts, enhancing convenience and control. Robust trading tools and educational resources further empower users to make informed financial decisions aligned with their goals.

With accessible customer service channels and comprehensive support, Marcus by Goldman Sachs epitomizes a trusted partner in financial well-being, dedicated to helping individuals achieve their long-term financial aspirations.

Frequently Asked Questions (FAQs)

Is Marcus by Goldman Sachs regulated by any financial authority?

Yes, it is regulated by FINRA and SEC with license no. CRD#: 361/SEC#: 801-16048,8-129.

What types of products can I invest in with Marcus by Goldman Sachs?

Marcus by Goldman Sachs offers a diverse array of financial products, including High-Yield Savings accounts, No-Penalty CDs, High-Yield CDs, and Rate Bump CDs. Additionally, they provide credit cards tailored to different consumer needs, such as the My GM Rewards Mastercard, GM Business Mastercard, and GM Extended Family Mastercard. Investment accounts, however, are no longer available as of the second quarter of 2024.

What are the fees offered by Marcus by Goldman Sachs?

Marcus by Goldman Sachs prioritizes transparency in its fee structures. For its savings accounts and CDs, there are typically no monthly maintenance fees or transaction fees.

Is Marcus by Goldman Sachs suitable for beginners?

Yes, Marcus by Goldman Sachs offers straightforward savings accounts and CDs, making it suitable for beginners looking for simple and accessible ways to start saving and investing.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

United States

United StatesObtain 2 securities license(s)

![]() Owns 2 seat(s)

Owns 2 seat(s)

--

--

Neutral

Neutral