Launched in March 2019, Longbridge is a social-driven online brokerage platform designed for next-generation investors by perfecting the users' path on "Discovery” to “Learning” and “Trading". The core founding team hails from top-tier international technology giants such as Alibaba and ByteDance and is augmented by outstanding finance professionals from Singapore and Hong Kong.

What is Long Bridge?

Long Bridge shines with its regulation by the SFC and MAS, offering investors access to IPOs, no platform fees, and low margin rates, coupled with a lifetime commission-free account. However, its lack of support for forex trading and limited country availability may restrict diversification opportunities for some investors.

Pros and Cons of Long Bridge?

Long Bridge presents a blend of advantageous features and potential limitations for investors.

On the positive side, the platform stands out for its regulation by the Securities and Futures Commission (SFC) and the Monetary Authority of Singapore (MAS), ensuring adherence to regulatory standards and bolstering investor confidence. Additionally, Long Bridge provides access to initial public offerings (IPOs), allowing investors to tap into early-stage growth opportunities. The absence of platform fees and low margin rates further sweeten the deal, offering cost-effective trading solutions. Moreover, the provision of a lifetime commission-free account adds to the platform's appeal, enabling investors to execute trades without incurring commission charges indefinitely.

However, Long Bridge falls short in not supporting forex trading, limiting diversification opportunities for investors. Moreover, its limited country availability may hinder accessibility for investors outside specific regions.

Is Long Bridge safe?

Regulations

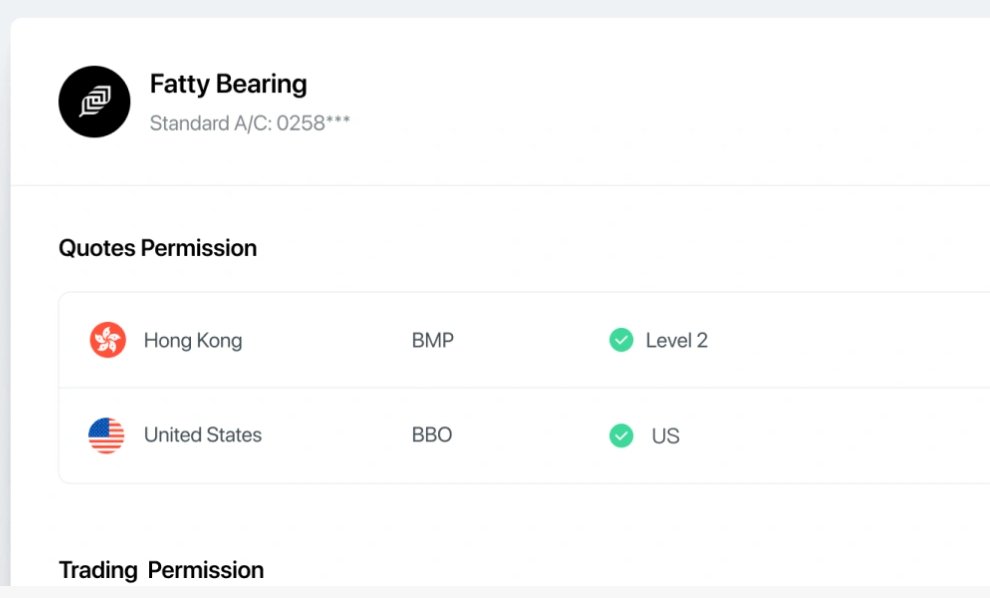

Long Bridge is licensed by the Securities and Futures Commission (SFC) under license number BPX066 and by the Monetary Authority of Singapore (MAS) under license number CMS101211.

What are securities to trade with Long Bridge?

Long Bridge provides a diverse array of trading instruments to cater to the diverse needs of investors. Firstly, investors can access U.S. stocks, allowing them to trade shares of companies listed on major American exchanges. Similarly, Long Bridge facilitates trading in Hong Kong stocks, providing access to companies listed on the Hong Kong Stock Exchange.

Furthermore, investors can engage in trading Chinese A-shares, gaining exposure to mainland China's domestic stock market. Additionally, Long Bridge extends its services to Singapore stocks, allowing investors to diversify their portfolios with exposure to companies listed on the Singapore Exchange (SGX) and access Southeast Asian markets.

Moreover, Long Bridge offers trading in futures and options, providing opportunities for speculation and hedging across various asset classes. Clients can also invest in Exchange-Traded Funds (ETFs), providing a convenient way to invest in specific sectors or markets.

Lastly, Long Bridge facilitates trading in mutual funds, enabling investors to pool their funds with others to invest in professionally managed portfolios of stocks, bonds, or other securities.

However, it's worth noting that Long Bridge does not provide services for forex and cryptocurrency trading, limiting options for investors interested in these asset classes.

Long Bridge Fees Review

For trading Hong Kong stocks, Long Bridge applies a commission fee of 0.03% of the transaction amount, with a minimum charge of 3 Hong Kong dollars per trade. Additionally, a fixed platform fee of 15 Hong Kong dollars per order is imposed.

Regarding trading U.S. stocks, Long Bridge levies a commission fee of 0.0049 per share, with a minimum charge of 0.99 U.S. dollars per trade. Alongside this, there's a fixed platform fee of 0.0050 U.S. dollars per share, with a minimum charge of 1 U.S. dollar per transaction.

For U.S. stock options, Long Bridge applies a commission fee of 0.5 U.S. dollars per contract, with a minimum charge of 1.6 U.S. dollars per trade. Additionally, a fixed platform fee of 0.3000 U.S. dollars per contract is incurred.

When it comes to funds, there are no subscription fees for currency fund subscriptions, and redemption fees are exempted. Management fees vary for each fund, as displayed on the fund's details page, ensuring transparency and clarity for investors.

Long Bridge App Review

Long Bridge offers a suite of trading platforms:

Longbridge App: Available on both iOS and Android, this mobile trading platform provides access to global news, trending discussions, real-time quotes, and detailed account and transaction information.

Longbridge Pro: This professional trading platform is tailored to meet advanced trading needs, featuring over 100 technical indicators and 12 multi-dimensional charting tools from Trading View, enabling users to enhance their trading strategies and maximize value.

Web Trade: Accessible via any browser without the need for downloads or installations, Web Trade offers global real-time quotes, account asset details, and transaction information, ensuring seamless access to trading data anytime, anywhere.

Customer Service

Long Bridge offers comprehensive customer service to cater to its clients' needs. The Customer Service Hotline is available at 400-071-2688. Clients can also utilize the online chat feature by clicking for inquiries on the website. For email support, customers can reach out to service@longbridge.global. Office hours are from 9 a.m. to 6 p.m. (GMT+8) on business days.

For assistance outside regular service hours, clients can contact the online customer service team. The online customer service operates 24 hours on business days and from 9 a.m. to 6 p.m. (GMT+8) on non-business days.

Conclusion

Long Bridge stands out for its robust regulation by the SFC and MAS, ensuring investor protection, along with offering access to IPOs and a lifetime commission-free account, making it particularly attractive for cost-conscious investors seeking diverse investment opportunities. However, Long Bridge's failure to support forex trading restricts investors' ability to diversify their portfolios fully, potentially limiting their potential for profit. Moreover, the platform's limited availability in certain countries may pose accessibility challenges for investors residing outside specific regions.

FAQs

Is Long Bridge a safe option for trading?

Long Bridge holds licenses from both the Securities and Futures Commission (SFC) and the Monetary Authority of Singapore (MAS). However, detailed information regarding fund safety and specific safety measures is not readily available.

Is Long Bridge suitable for beginner traders?

While Long Bridge offers versatile trading platforms, it lacks comprehensive educational resources, which may present challenges for novice traders seeking guidance and learning opportunities.

Is Long Bridge a legitimate brokerage?

Long Bridge is indeed a legitimate brokerage, licensed by the Securities and Futures Commission (SFC) under license number BPX066 and by the Monetary Authority of Singapore (MAS) under license number CMS101211.

Risk Warning

The details shared are derived from WikiStock's thorough assessment of the brokerage's website data, but they are subject to potential alterations. Additionally, engaging in online trading carries significant risks, including the possibility of losing all invested funds. Therefore, it is imperative for investors to fully grasp these risks before participating in trading activities.

China

ChinaObtain 3 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

United States

Singapore

New Zealand

Positive

Positive