Score

东莞证券

http://dgzq.com.cn/

Website

Rating Index

Brokerage Appraisal

Influence

A

Influence Index NO.1

China

ChinaProducts

10

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Surpassed 75.27% brokers

Securities license

Obtain 1 securities license(s)

CSRCRegulated

ChinaSecurities Trading License

Global Seats

![]() Owns 2 seat(s)

Owns 2 seat(s)

China BSE

Seat No. 000018

China SZSE

Seat No. 000184

Brokerage Information

More

Company Name

东莞证券股份有限公司

Abbreviation

东莞证券

Platform registered country and region

Company address

Company website

http://dgzq.com.cn/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.2%

Funding Rate

8.6%

New Stock Trading

Yes

Margin Trading

YES

| Dongguan Securities |  |

| WikiStock Rating | ⭐ ⭐ ⭐ |

| Mutual Funds Offered | Yes |

| App/Platform | Wealth Management V7.10, Youcai Financial Terminal (V20240418), Dongzheng Options Easy, Zhang Zheng Bao 6.2.3, and more |

| Promotions | Not available yet |

What is Dongguan Securities?

Dongguan Securities stands out for its regulatory compliance under the China Securities Regulatory Commission (CSRC) and its provision of diverse educational resources. The brokerage offers multiple trading platforms and access to IPOs, catering to various investor needs. However, the lack of support for forex and cryptocurrency trading and limited information on account types and fees may pose challenges for some clients.

Pros and Cons of Dongguan Securities?

Dongguan Securities, regulated by the China Securities Regulatory Commission (CSRC), offers a range of trading platforms for investors. While it provides access to initial public offerings (IPOs) and various educational resources, the brokerage does not support forex and cryptocurrency trading. However, there are limitations in terms of information available on account types and associated fees, which could potentially hinder prospective clients from making informed decisions.

| Pros | Cons |

|

|

|

|

|

|

|

Is Dongguan Securities safe?

Regulation

Dongguan Securities is currently licensed by the China Securities Regulatory Commission (CSRC).

What are securities to trade with Dongguan Securities?

Dongguan Securities offers a variety of trading instruments, including stocks, bonds, options, and other derivatives. However, they do not provide commodities, cryptocurrencies, or forex trading.

Dongguan Securities allows investors to trade stocks through the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect.

In addition to stocks, Dongguan Securities offers trading in stock options, enabling investors to hedge or speculate on stock price movements. They also provide intermediary services for futures trading, assisting clients in accessing futures markets.

For equity financing, the company offers a range of services including Initial Public Offerings (IPOs), follow-on offerings, convertible bonds, mergers and acquisitions, and corporate restructuring advisory. Their bond financing services encompass underwriting and issuance of corporate bonds, municipal bonds (including general and special-purpose bonds), convertible bonds, and asset-backed securities.

Dongguan Securities App Review

Dongguan Securities provides a range of PC and mobile software platforms designed to meet various trading and investment needs.

PC Software:

Wealth Management V7.10: This online trading system integrates market data, standard trading, margin trading, extensive information, self-service analysis, interactive communication, information push notifications, and personalized services.

Youcai Financial Terminal (V20240418): This newly designed terminal offers comprehensive market and trading services across various financial instruments, supported by professional information services and a wide range of financial products.

Dongzheng Options Easy: Tailored for options traders, this platform includes real-time market data, trading, query, exercise, and transfer functions, providing a faster, more professional, and simpler trading experience.

Dongguan Securities PTrade Quantitative Strategy Trading System V202301-45: This professional investment software is designed for investors with high-speed and quantitative trading needs. It offers tools for standard trading, basket trading, algorithmic trading, quantitative research, backtesting, and live trading, enhancing trading efficiency across various scenarios.

Dongguan Securities QMT High-Speed Strategy Trading System V1.0.0.33935: This advanced platform is customized for quantitative hedge funds, discretionary long funds, professional investors, and high-net-worth individuals who engage in active trading. It integrates market data display, investment research, strategy development, automated trading, high-speed trading, intelligent algorithmic trading, basket trading, and compliance risk management.

Mobile Apps:

Zhang Zheng Bao 6.2.3: This all-in-one app offers market data, trading, intelligent investment tools, business processing, investment products, information services, and interactive games, providing a seamless user experience.

Cai Guan Jia 6.2.0: Designed for comprehensive wealth management, this app offers brokerage financial products, public funds, and high-end wealth management products. It leverages financial technology to offer curated, intelligent investment options and automated investment plans, making it an ideal partner for investors seeking efficient and convenient wealth management solutions.

Research and Education

Dongguan Securities provides a robust investor education program, structured into several key areas:

Youcai Classroom: Youcai Classroom offers essential reading for account opening, beginner guides, advanced learning, understanding the registration system, skill enhancement, margin trading, interpreting company reports, and general financial education.

Video Center: The Video Center features educational videos on risk management, rational investment, mutual funds, bonds, stock options, Hong Kong Stock Connect, margin trading, investment suitability, basic knowledge, futures, and short investment lessons.

Investment Education Dynamics: Investment Education Dynamics provides updates on educational events and thematic activities.

Risk Education: Risk Education focuses on risk disclosure, delisting information, real-world risk cases, and futures risk cases.

Investor Protection: Investor Protection provides resources on securities law, internet finance security, investor rights, dispute mediation, policies, futures market, pandemic support, constitutional promotion, and Party history.

Trading Supervision: The Trading Supervision column informs investors about trading regulations, surveillance securities, and abnormal trading education.

Market Dynamics: Market Dynamics provides updates on market news, business trends, and regulatory information.

Simulation Experience: Simulation Experience offers interactive tools for risk assessment, Hong Kong Stock Connect, financial calculators, and stock options simulation.

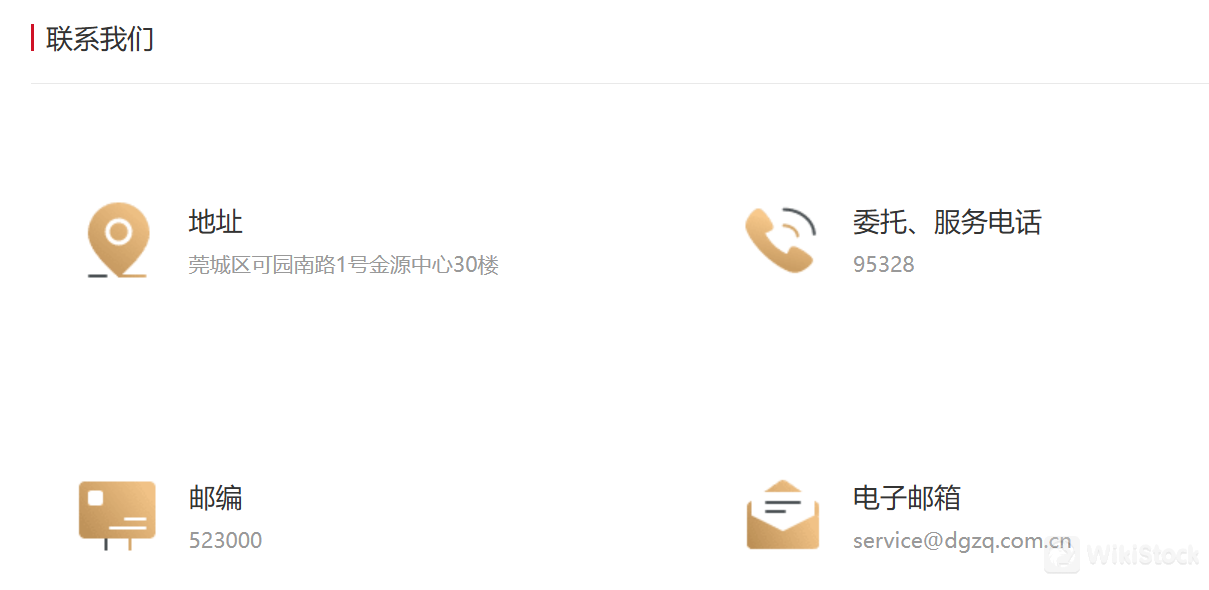

Customer Service

Customers can reach the service team via the hotline at 95328 for inquiries and support. For email communication, clients can contact the team at service@dgzq.com.cn. Additionally, an online customer service chat is available for real-time assistance, ensuring quick and efficient resolution of issues. For written correspondence, the postal code is 523000.

Conclusion

Dongguan Securities shines with its regulatory compliance under the China Securities Regulatory Commission (CSRC) and its provision of diverse educational resources. This makes it suitable for investors who prioritize regulatory oversight and value extensive learning opportunities in their investment journey.

FAQs

Is Dongguan Securities safe to trade?

Dongguan Securities is currently licensed by the China Securities Regulatory Commission (CSRC). However, specific information regarding fund safety and safety measures is not readily available, which may raise concerns for some traders.

Is Dongguan Securities suitable for beginners?

Yes, Dongguan Securities offers a variety of trading platforms and educational resources, making it suitable for beginners who are looking to learn and trade in the financial markets.

Is Dongguan Securities legitimate?

Dongguan Securities is licensed by the China Securities Regulatory Commission (CSRC).

Risk Warning

The information presented is derived from WikiStock's expert assessment of the brokerage's website data and may be subject to updates or modifications. Additionally, it's essential to recognize that online trading involves significant risks, including the potential for complete loss of invested capital. Therefore, it is imperative to thoroughly understand and assess the associated risks before engaging in any trading activities.

Others

Registered region

China

Years in Business

More than 20 year(s)

Products

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

万和证券

Score

东方财富证券

Score

华创证券

Score

爱建证券

Score

东海证券

Score

江海证券

Score

世纪证券

Score

上海证券

Score

川财证券

Score

GF Securities

Score