Score

華業證券

http://grandchina.hk/tc/index.php#

Website

Rating Index

Brokerage Appraisal

Influence

D

Influence Index NO.1

China Hong Kong

China Hong Kong Products

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01949

Brokerage Information

More

Company Name

華業證券有限公司

Abbreviation

華業證券

Platform registered country and region

Company address

Company website

http://grandchina.hk/tc/index.php#Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.25%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Grand China Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | N/A |

| Fees | 0.25% based on the transaction amount of brokerage fees |

| Account Fees | HKD 1.5 per lot for Share Registration |

| Mutual Funds Offered | Yes |

| App/Platform | Grand China Hong Kong Stock Mobile Version and web-based platform |

| Promotions | Account Opening Bonus |

Grand China Securities Information

Grand China Securities is a licensed brokerage firm based in Hong Kong. They are regulated by the Securities and Futures Commission (SFC) of Hong Kong with license number AYX768. They offer a variety of investment services including trading in Hong Kong stocks, US stocks, and A-shares ( mainland China stocks). They also provide services like margin financing, asset management, and IPO subscriptions. Their website http://www.grandchina.hk/ lists their address as 50-52 Queen's Road Central, Central, Hong Kong with a phone number and email for inquiries. They also have a mobile app available for download.

Pros and Cons of Grand China Securities

| Pros | Cons |

| Regulated Brokerage | Limited Information Online |

| Variety of Investment Options | Focus on Brokerage Services |

| Mobile App Convenience | Unknown Account Minimum |

Pros

Licensed Brokerage: Grand China Securities is a licensed brokerage firm regulated by the Hong Kong Securities and Futures Commission (SFC). This offers a level of security and oversight for investors.

Variety of Investment Options: They offer trading in Hong Kong stocks, US stocks, and A-shares (mainland China stocks). This satisfies investors interested in these specific markets.

Mobile App Convenience: They have a mobile app for placing trades and managing your portfolio on the go.

Cons

Limited Information Online: Their website doesn't provide comprehensive information about some key details like interest on uninvested cash, margin interest rates, or mutual fund offerings. This can make it difficult to make informed decisions.

Focus on Brokerage Services: Their website primarily focuses on stock trading and other brokerage services. There isn't a strong emphasis on mutual funds or other investment products, so they might not be the best choice for investors seeking a wider variety of options.

Unknown Account Minimums: The minimum account balance required to open an account with Grand China Securities is not available on their website.

Is Grand China Securities safe?

Regulations

Grand China Securities operates under stringent regulations established by the Securities and Futures Commission (SFC) in Hong Kong, ensuring compliance with national financial laws and industry standards.

Funds safety

Hong Kong regulations require brokerages to segregate client money from their own funds. This means your cash and securities should be held in a separate account at a custodian bank, likely a large and reputable financial institution. This reduces the risk of your funds being used by the brokerage for its own purposes.

Safety Measures

Hong Kong has an Investor Protection Scheme (IPS) managed by the SFC. The IPS offers compensation to eligible investors in case of brokerage failure, but with limitations on the amount covered.

What are securities to trade with Grand China Securities?

Grand China Securities allows you to trade a variety of securities, with a focus on offerings in the Hong Kong and China markets.

Hong Kong Stocks: This is their primary focus, allowing you to trade stocks listed on the Hong Kong Stock Exchange (HKEX).

US Stocks: You can also trade stocks listed on major US stock exchanges through Grand China Securities.

A-Shares: These are stocks issued by companies incorporated in mainland China and traded on the Shanghai Stock Exchange (SSE) or the Shenzhen Stock Exchange (SZSE).

Mutual Funds: While their website doesn't explicitly advertise mutual funds, surveys show that it also provides mutual funds service.

Futures: Futures are complex financial instruments that can be used for hedging or speculation. They involve significant risks and require a good understanding of market dynamics.

Grand China Securities Accounts

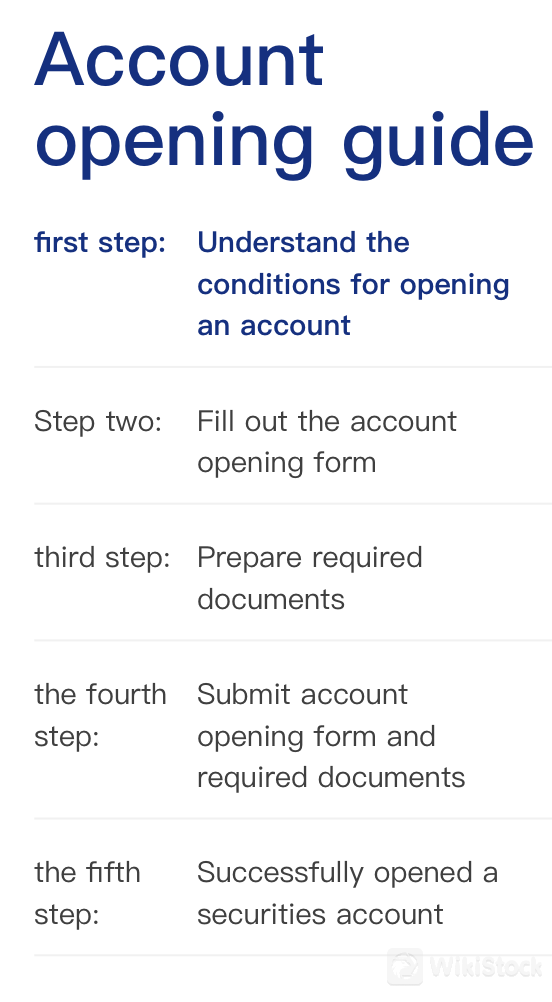

The website offers separate account opening forms for individual and corporate accounts, which means they support both retail and institutional investors. Here is a step-by-step method for opening an account with Grand China Securities:

Understand the conditions for opening an account.

Fill out the account opening form.

Submit account opening form and required documents.

Successfully opened a securities account.

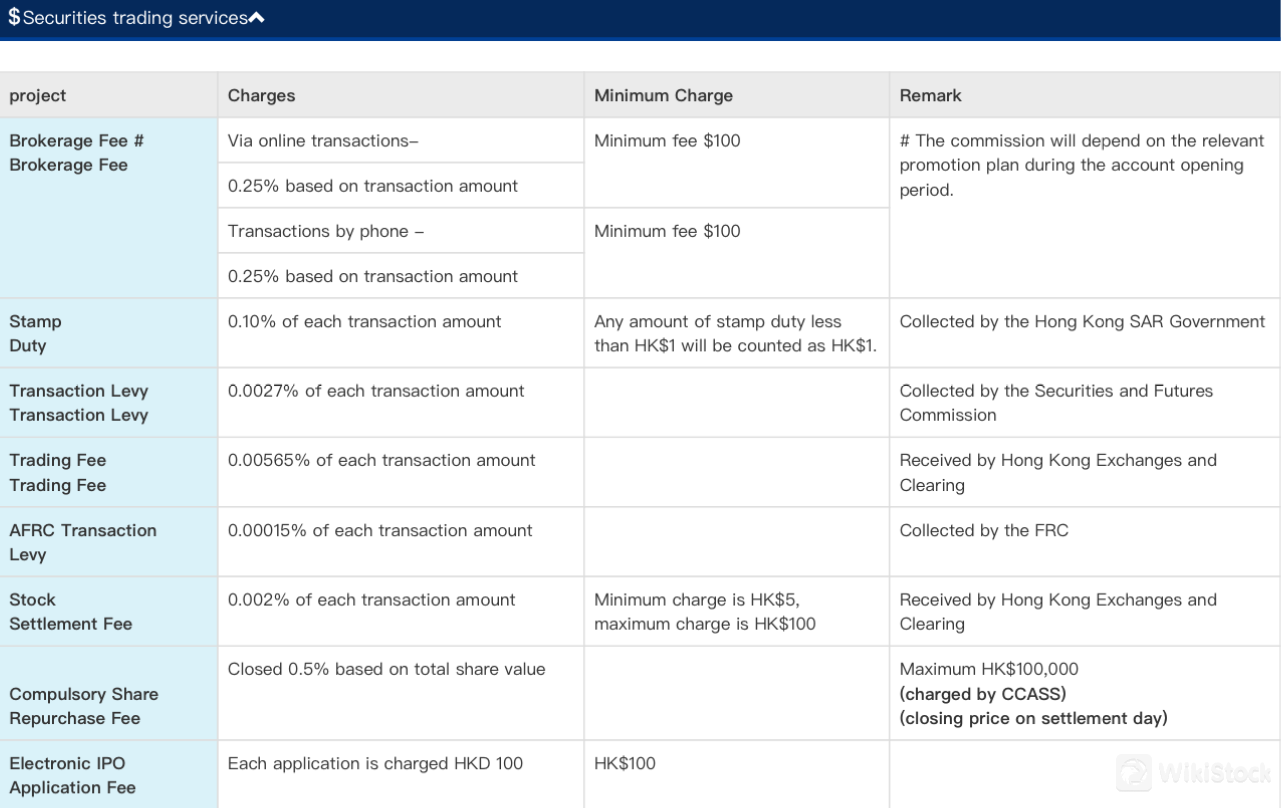

Brokerage Fee:

Minimum fee: $100

Fee structure: 0.25% of the transaction value. This fee may vary depending on any promotional offers available when you open your account.

Transaction Fees:

Stamp Duty: 0.10% of transaction amount(Any amount of stamp duty less than HK$1 will be counted as HK$1).

Trading Fee: 0.00565% of transaction amount.

Transaction Levy: 0.0027% of transaction amount.

AFRC Transaction Levy: 0.00015% of transaction amount.

Stock Settlement Fee: 0.002% of transaction amount, with a minimum of HKD 5 and a maximum of HKD 100.

Other fees:

There might be additional fees depending on your account type or specific services used. For example, there might be fees for depositing and withdrawing funds or physical stock certificates.

Simple and user-friendly interface for placing stock trades.

Access to real-time stock quotes and charts for Hong Kong stocks.

Ability to view financial news, company information, and new stock offerings.

Track your portfolio performance and holdings.

Third-Party Research Providers: Grand China Securities offers stock market research, analysis, and educational content. You can explore these resources to supplement any research you might do through Grand China Securities.

Various Guides: Grand China Securities provides various guides such as account opening guide, deposit and withdrawal guide, transaction guide, etc

Grand China Securities Fees Review

Grand China Securities App Review

Grand China Securities does offer a mobile app for trading convenience, alongside their web platform.

Mobile App: They have an app called “Grand China Hong Kong Stock Mobile Version”. It's available for download on the Google Play Store and App Store.

App Features:

Web Platform:

Grand China Securities also offers a web-based trading platform accessible through their website.

Research and Education

Grand China Securities doesn't offer a dedicated section for research and education resources. Here's a breakdown of what they provide:

Customer Service

Grand China Securities provides several basic channels for traders to contact them, including:

Tel: (852) 3979 6701

Email: css@grandchina.hk

Company Address: Room 503, Luk Yau Building, 50-52 Queen's Road Central, Central, Hong Kong

Conclusion

Grand China Securities is a Hong Kong brokerage offering access to trade Hong Kong stocks, US stocks, and potentially A-shares and futures contracts. While it provides leverage through margin accounts and accords with SFC regulations, their website lacks transparency on key details like account types, fees beyond brokerage commissions, and educational resources. This might be suitable for experienced Hong Kong investors comfortable conducting their own research and prioritizing lower fees, but if in-depth research tools or futures trading are important, consider exploring other brokerages.

FAQs

Is Grand China Securities safe to trade?

Trading with Grand China Securities has some built-in safety features due to regulations. However, the lack of transparency online makes a full safety assessment difficult.

Is Grand China Securities a good platform for beginners?

While Grand China Securities offers access to various markets and potential leverage, their lack of educational resources, unclear account details, and hidden fees make it a tricky platform for beginners.

Is Grand China Securities good for investing/retirement?

Grand China Securities, with its focus on active stock trading and margin accounts, might not be ideal for retirement planning. Building a retirement portfolio often involves a buy-and-hold strategy with diversified assets like bonds and ETFs, which their platform might not heavily support.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

瑞达国际

Score

Huajin International

Score

CLSA

Score

DL Securities

Score

Sanfull Securities

Score

嘉信

Score

GF Holdings (HK)

Score

China Taiping

Score

Capital Securities

Score

乾立亨證券

Score