Score

FFG証券

https://www.ffg-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

A

Influence Index NO.1

Japan

JapanProducts

8

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

Japan FSE

FFG証券株式会社

Brokerage Information

More

Company Name

FFG Securities Co.,Ltd

Abbreviation

FFG証券

Platform registered country and region

Company address

Company website

https://www.ffg-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

FFG証券 Earnings Calendar

Currency: JPY

Cycle

Q3 FY2024 Earnings

2024/02/08

Revenue(YoY)

66.48B

-9.33%

EPS(YoY)

168.24

+1571.78%

FFG証券 Earnings Estimates

Currency: JPY

- DateCycleRevenue/Estimated

- 2024/02/082024/Q3101.443B/0

- 2023/08/032024/Q194.171B/0

- 2023/01/302023/Q394.205B/0

- 2022/08/042023/Q175.122B/0

- 2022/02/032022/Q372.840B/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.11%

Funding Rate

1.69%

Regulated Countries

1

Products

8

| FFG Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded | 1940 |

| Registered Region | Japan |

| Regulatory Status | FSA |

| Product & Services | Stocks: both Japanese domestic stocks and overseas stocks; Margin Trading; Initial Public Offering (IPO) and Off-the-Counter Sale; Exchange Traded Funds (ETFs); Real Estate Investment Trusts (REITs); Bonds (national, municipal, corporate, and foreign bonds); Investment Trusts |

| Fees | Japanese Domestic Stock Trading Fee: 0.11-1.265% of contact price, min 275 yen, based on trading volume and order type |

| Margin Trading: 1.53% for purchase and 0 for selling | |

| Stock Lending Fee: 1.15% of contract amount | |

| Domestic Agency Fee: vary based on transaction amount, 0.33-1.10% of the sale price, plus additional fixed fees depending on transaction size | |

| Customer Service | Head office: 18 Kyriacou Matsi Ave, Victory Tower, 1st floor, Nicosia 1082, Japan |

| Tel: 092-741-2361; FAQ; inquiry form |

FFG Securities Information

Founded in Fukuoka in 1940, FFG Securities became a wholly-owned subsidiary of Fukuoka Financial Group in 2022. The company offers a wide range of financial products and services, including Papanese domestic and overseas stocks, margin trading, IPOs, ETFs, REITs, various bonds, and investment trusts.

It implements comprehensive and transparent fee structures. For example, trading fees for Japanese domestic stocks range from 0.11% to 1.265%, with a minimum of 275 yen. Margin trading fees are 1.53% for purchases and 0% for sales.

It's noteworthy that FFG Securities operates under the stringent regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Fukuoka Finance Bureau Chief (Kinsho) No. 5, highlighting its commitment to maintaining high standards of integrity and credibility in all its financial operations.

For more detailed information, you can visit their official website: https://www.ffg-sec.co.jp/ or contact their customer service directly.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Complex Fee Structure |

| Comprehensive Financial Services | |

| No Brokerage Fees for Retail Investors |

- Regulatory Compliance by FSA: FFG Securities operates under the stringent oversight of the Japan Financial Services Agency (FSA), ensuring high standards of integrity and credibility.

- Wide Range of Products and Services: Offers a comprehensive selection of financial products including domestic and overseas stocks, margin trading, IPOs, ETFs, REITs, bonds, and investment trusts.

- No Account Management Fees:Provides free management for both domestic and foreign accounts, reducing overall costs for investors. Cons

- Complex Fee Structure: The fee structure for various services is relatively complex and can be difficult for new investors to understand their trading costs.

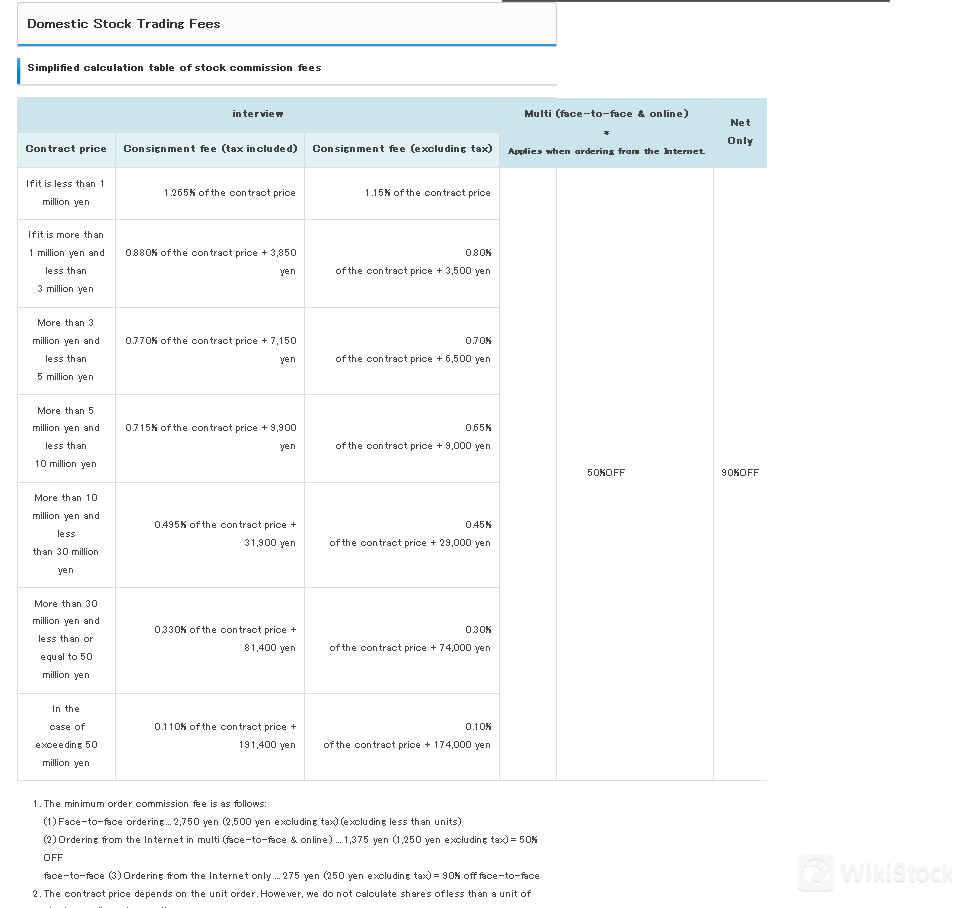

- Domestic Stock Trading Fees

- Less than 1 million yen: 1.265% of contract price (tax included), 1.15% (tax excluded), with a minimum of 2,750 yen (tax included), 1,375 yen (tax excluded).

- 1 million to less than 3 million yen: 0.880% + 3,850 yen (tax included), 0.80% + 3,500 yen (tax excluded).

- 3 million to less than 5 million yen: 0.770% + 7,150 yen (tax included), 0.70% + 6,500 yen (tax excluded).

- 5 million to less than 10 million yen: 0.715% + 9,900 yen (tax included), 0.65% + 9,000 yen (tax excluded).

- 10 million to less than 30 million yen: 0.495% + 31,900 yen (tax included), 0.45% + 29,000 yen (tax excluded).

- 30 million to 50 million yen: 0.330% + 81,400 yen (tax included), 0.30% + 74,000 yen (tax excluded).

- Exceeding 50 million yen: 0.110% + 191,400 yen (tax included), 0.10% + 174,000 yen (tax excluded).

- Tax included: 2,750 yen (2,500 yen excluding tax).

- Tax excluded (multi): 1,375 yen (1,250 yen excluding tax) = 50% off tax included.

- Tax excluded (net-only): 275 yen (250 yen excluding tax) = 90% off tax included.

- Margin Trading

- Purchases: 1.53%.

- Selling: 0%.

- 1.15% of contract amount.

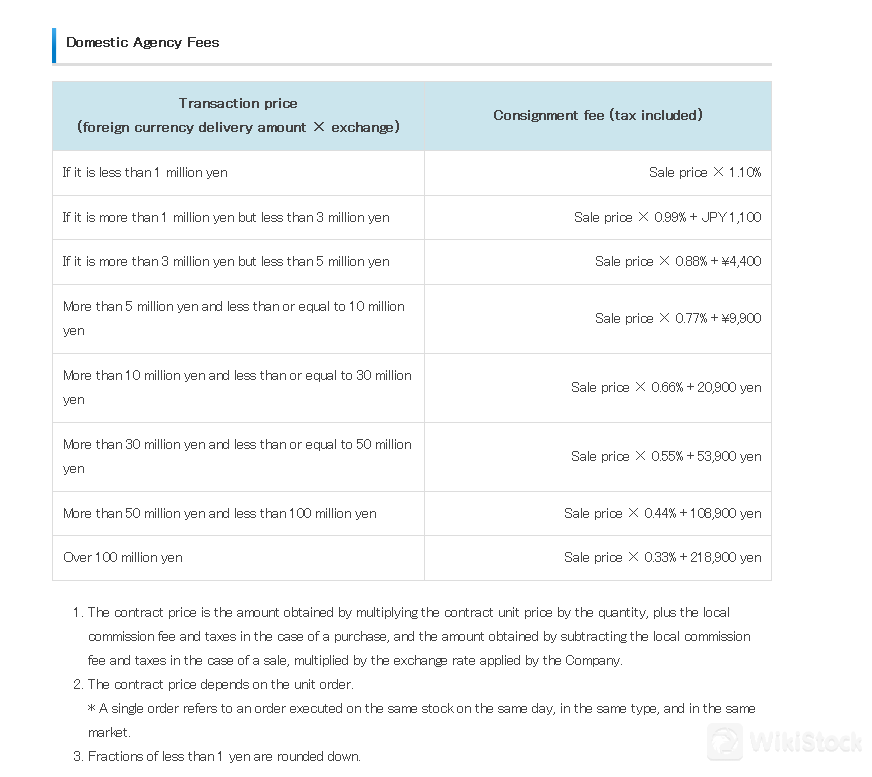

- Foreign Stock Trading Commissions

- Vary based on transaction amount, ranging from 1.10% to 0.33% of sale price, plus additional fixed fees depending on transaction size.

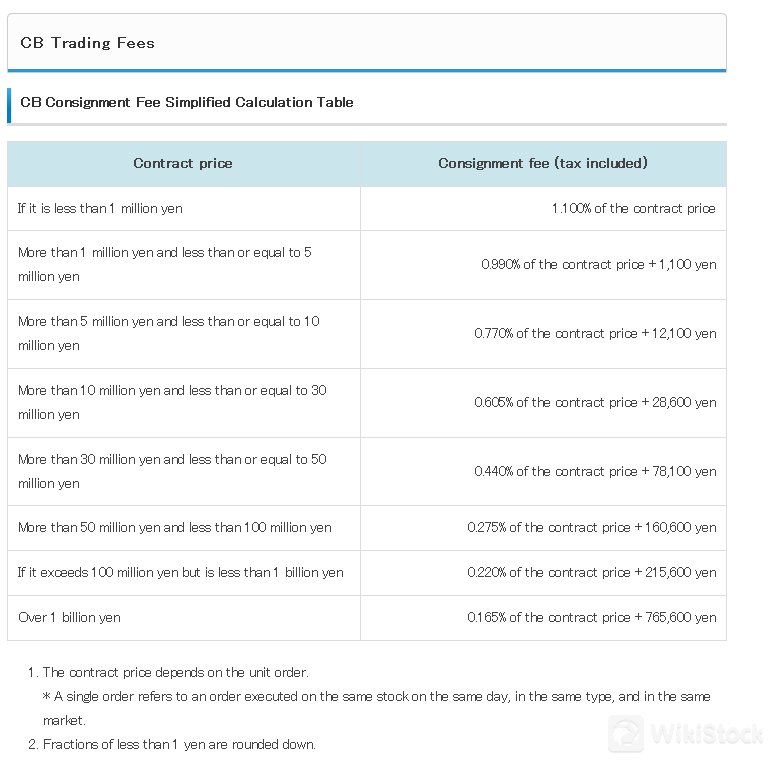

- CB Trading Fees

- Vary based on contract price, ranging from 1.100% to 0.165% of contract price, plus additional fixed fees depending on transaction size.

- Investment Trust

- Fees vary per product; internet trading offers a 10% discount compared to face-to-face transactions.

- Other Fees

- Domestic Account Management Fee: Free.

- Foreign Account Management Fee: Free.

- Transfer Fee (Shares): 1,100 yen per unit or less (up to 6,600 yen maximum).

- General Meeting of Shareholders Materials

- Request for Issuance of Documents: 660 yen per stock.

- Is FFG Securities regulated by any financial authority?

- What types of products and services does FFG Securities provide?

- Is FFG Securities suitable for beginners?

- What are the fees for trading Japanese domestic stocks?

- How can I participate in an Initial Public Offering (IPO) through FFG Securities?

Is It Safe?

Regulation:

FFG Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Fukuoka Finance Bureau Chief (Kinsho) No. 5, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores FFG Securities's commitment to integrity and credibility in its services.

Safety Measures:

FFG Securities employs robust security measures through a stringent privacy policy including encryption protocols, firewall protection, and regular security audits to safeguard client information. Access controls and strict data handling procedures ensure compliance with stringent privacy standards and protect against unauthorized access or breaches.

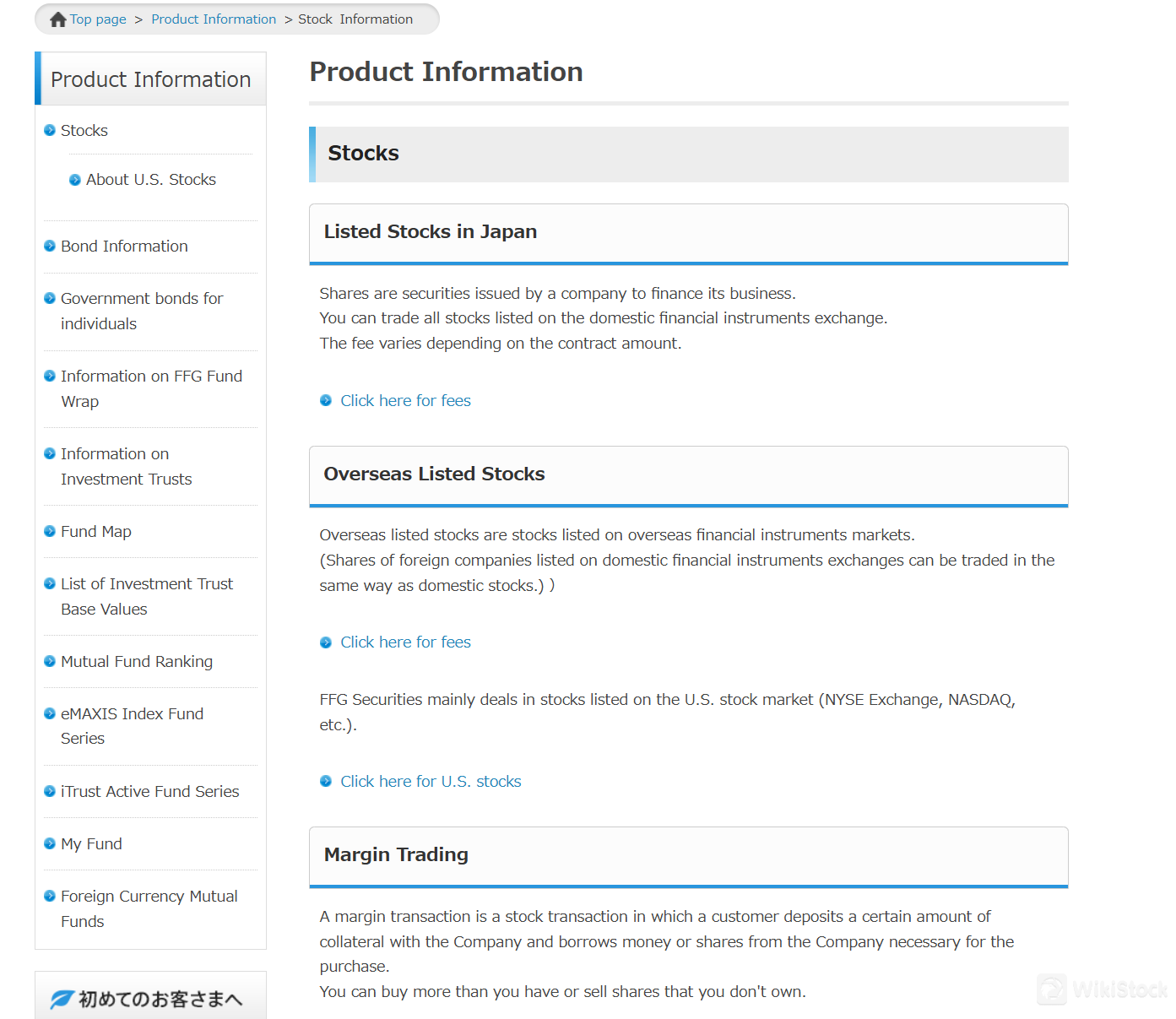

What are Securities to Trade with FFG Securities?

FFG Securities offers a comprehensive range of financial products and services.

Listed Stocks: Investors can trade all stocks listed on Japanese domestic financial exchanges, with fees varying based on the contract amount. Overseas listed stocks, particularly from U.S. markets like NYSE and NASDAQ, are also available.

Margin Trading: Customers can engage in margin trading, allowing them to buy more shares than they have funds for, or sell shares they do not own, by depositing collateral with the company.

Initial Public Offering (IPO) and Off-the-Counter Sale: FFG Securities facilitates the purchase of newly listed stocks through public offerings or off-the-counter sales, where shares from major shareholders are sold at a discounted price outside regular trading hours.

Exchange Traded Funds (ETFs): These funds track indices such as the Nikkei 225 and TOPIX, offering a way to invest in specific market segments or commodities, and are traded like regular stocks.

Real Estate Investment Trusts (REITs): REITs allow investment in real estate through managed funds, distributing rental and sales profits to investors, and are traded on the stock exchange.

Bonds: FFG Securities offers various bonds including national, municipal, corporate, and foreign bonds, with specific offerings such as the 461st Two-Year Interest Bond and Fukuoka City Public Offering Bonds.

Investment Trusts: Mutual funds managed by investment specialists, with options for regular investments, foreign currency mutual funds, and specific growth investment funds under the new NISA system. The company provides resources such as a fund map, base value lists, and rankings.

Services

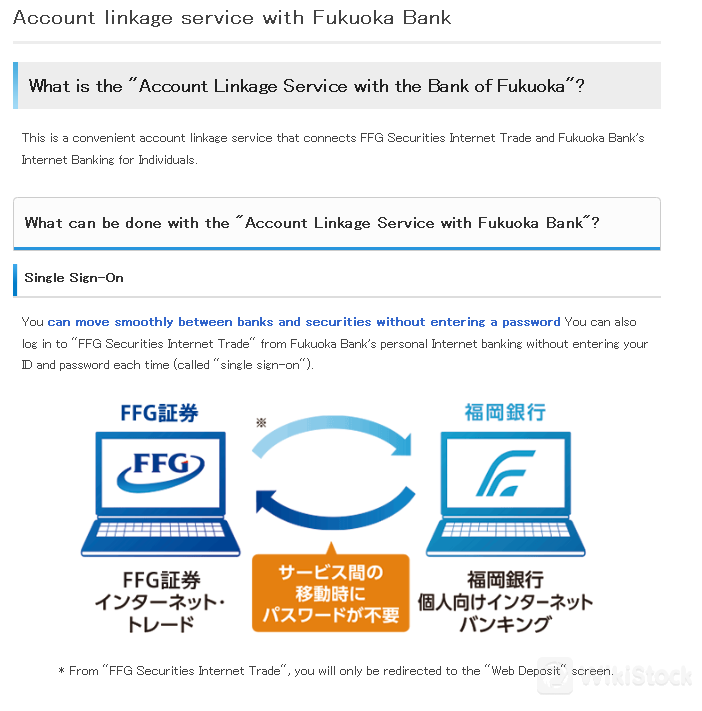

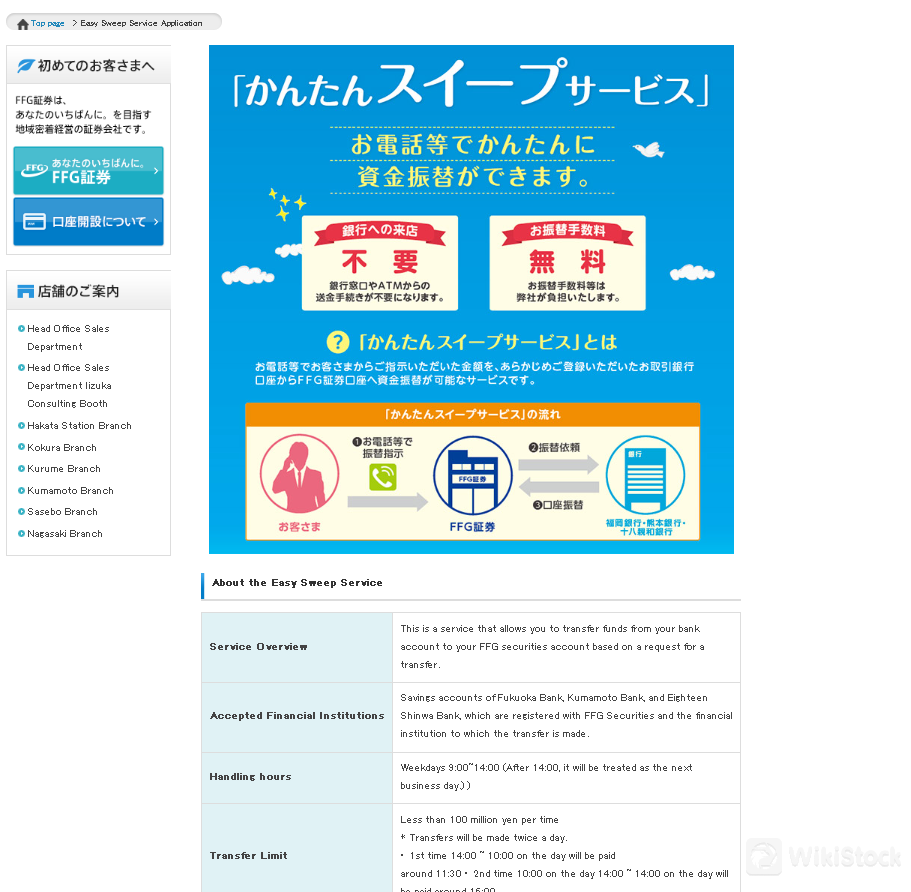

FFG Securities provides a range of convenient services designed to streamline financial transactions for clients.

The Transfer Fee Refund Service allows customers to recover transfer fees incurred when moving securities from other institutions, provided they submit an application form along with relevant receipts and statements within three months of the transfer. Once approved, the equivalent amount, inclusive of consumption tax, is credited back to the customer's account promptly.

Their Account Linkage Service with Fukuoka Bank facilitates seamless integration between bank and securities accounts, offering single sign-on capabilities for easy navigation.

Additionally, the Easy Sweep Service automates fund transfers between registered bank accounts and FFG Securities' general securities account, catering especially to managing regular investment trusts with no handling fees, transfer limit is less than 100 million yen per time.

Fees Review

FFG Securities offers a structured fee schedule for various types of trading and services:

Consignment Fees (Tax Included)

Minimum Order Commission Fee

Interest Rates (Institutional Margin Transactions)

Stock Lending Fee

Domestic Agency Fees

Consignment Fees (Tax Included)

FFG Securities provides detailed fee structures tailored to different transaction types and sizes, ensuring transparency and clarity for investors. If you want to keep updated with lastest and detailed fees for each product, you can visit https://www.ffg-sec.co.jp/service/commission/.

Customer Service

FFG Securities' head office locates at Fukuoka Prefecture Fukuoka City Chuo-ku Tenjin 2-13-1, Fukuoka Bank Head Office Building 2F and their sales department can be reached by phone at 092-741-2361.

The company also offers an inquiry form on their wesite for callback from a representative from the company.

An FAQ page is also available for quick checking of answers to general inquiries.

Besides head office, FFC Securities has another 6 branch offices across Japan in Hakata, Kokura, Kurume, Kumamoto, Sasebo and Nagasaki. Address and phones office of these offices can be found through page https://www.ffg-sec.co.jp/branch/, you can visit and look up for the one convenience you most.

Conclusion

FFG Securities, established in Fukuoka in 1940 and a subsidiary of Fukuoka Financial Group since 2022, offers a comprehensive range of financial products and services including domestic and overseas stocks, margin trading, IPOs, off-the-counter sales, ETFs, REITs, bonds, and investment trusts.

The company operates under the stringent oversight of the Japan Financial Services Agency (FSA), emphasizing its commitment to integrity and credibility.

FFG Securities also offers various customer-centric services such as transfer fee refunds, account linkage with Fukuoka Bank, and automated fund transfers.

With a transparent and structured fee schedule, FFG Securities caters to diverse investment needs while ensuring high standards in financial operations.

Frequently Asked Questions (FAQs)

Yes, FFG Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Fukuoka Finance Bureau Chief (Kinsho) No. 5.

Japanese domestic stocks, overseas stocks, margin trading, initial public offerings (IPOs), off-the-counter sales, exchange-traded funds (ETFs), real estate investment trusts (REITs), various bonds, and investment trusts.

Yes, FFG Securities is suitable for beginners. It is well regulated by FSA and offers a range of products and services that cater to various levels of investment experience.

Fees for trading Japanese domestic stocks with FFG Securities range from 0.11% to 1.265% of the contract price, with a minimum fee of 275 yen. The specific fee depends on the trading volume and order type.

To participate in an IPO through FFG Securities, you need to apply during the bookbuilding process. FFG Securities facilitates the purchase of newly listed stocks through public offerings or off-the-counter sales.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

静銀ティーエム証券

Score

丸近證券

Score

光世証券

Score

第四北越証券

Score

ニュース証券

Score

百五証券

Score

山形證券

Score

Tachibana Securities Co., Ltd.

Score

北洋証券

Score

リテラ・クレア証券株式会社

Score