Score

第四北越証券

https://www.dh-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

Daishi Hokuetsu Securities Co., Ltd

Abbreviation

第四北越証券

Platform registered country and region

Company address

Company website

https://www.dh-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| Daishi Hokuetsu Securities |  |

| WikiStock Rating | ⭐️⭐️⭐️⭐️ |

| Fees | Face-to-face trading fees and internet trading fees |

| Account Fees | No account management fees |

| App/Platform | Online trading platform |

| Promotions | Special account with withholding tax |

Daishi Hokuetsu Securities Infomation

Daishi Hokuetsu Securities is a reputable financial institution based in Japan, regulated by the Japan Financial Services Agency. The firm offers a broad range of investment products including stocks, bonds, ETFs, and investment trusts. While it provides competitive fees and comprehensive research and educational resources, it lacks 24/7 customer support and a dedicated trading application.

Pros & Cons of Daishi Hokuetsu Securities

| Pros | Cons |

| Formal regulation | Not 24/7 support |

| Broad product range | No trading application |

| Research and education | Limited geographic focus |

Formal regulation: Daishi Hokuetsu Securities is regulated by the Japan Financial Services Agency, ensuring compliance with financial regulations.

Broad product range: Daishi Hokuetsu Securities offers a wide array of investment products including domestic and foreign stocks, bonds, ETFs, and investment trusts.

Research and education: The firm provides comprehensive research insights and educational seminars, empowering investors with knowledge to make informed investment decisions and fostering financial literacy.

Cons:Not 24/7 support: Daishi Hokuetsu Securities does not offer round-the-clock customer support, which limits immediate assistance outside regular business hours.

No trading application: The firm currently lacks a dedicated trading application, which may inconvenience clients seeking mobile or online trading capabilities.

Limited geographic focus: Daishi Hokuetsu Securities' services are primarily focused within Japan, limiting accessibility for international investors or those outside major metropolitan areas.

Is Daishi Hokuetsu Securities Safe?

Regulation

Daishi Hokuetsu Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA), ensuring compliance with the country's stringent financial regulations. The firm is licensed by the Kanto Local Finance Bureau, holding License No. 関東財務局長(金商)第128号 (Kanto Zaimu Kyokuchō (Kinshō) Dai 128-gō), which authorizes it to engage in securities-related activities. This regulatory framework mandates adherence to the Financial Instruments and Exchange Act (FIEA), which governs the conduct of securities firms in Japan, ensuring transparency, investor protection, and the maintenance of fair and orderly financial markets.

What are Securities to Trade with Daishi Hokuetsu Securities?

Daishi Hokuetsu Securities offers a comprehensive range of securities for trading. For domestic listed stocks, ETFs (Exchange Traded Funds), and J-REITs (Listed Real Estate Investment Trusts), the firm provides opportunities for investors to participate in Japan's equity and real estate markets.

They also facilitate trading in foreign stocks, allowing clients to diversify their portfolios globally. Daishi Hokuetsu Securities emphasizes transparency and educates clients about the risks involved in transactions, ensuring informed decision-making.

In the realm of bonds, they offer government bonds for individuals, foreign bonds, Niigata Prefecture Public Bonds, and bonds issued by entities like Tohoku Electric Power Company, broadening investment options in fixed income securities.

Additionally, the firm provides access to domestic and foreign investment trusts, enabling clients to invest in professionally managed portfolios suited to their risk profiles and investment goals. Through services like cumulative stock investments, Daishi Hokuetsu Securities supports clients in building long-term investment strategies.

Daishi Hokuetsu Securities Accounts

Clients can apply to open accounts at any branch of the firm, where their documents are carefully reviewed to initiate the account opening process. Minors are also eligible to open trading accounts with parental consent, ensuring responsible oversight of their investment activities.

One notable offering is the special account, designed to simplify tax reporting for capital gains and losses on listed stocks and margin trading. By opening a special account with Daishi Hokuetsu Securities, investors can choose a “special account with withholding tax” option, allowing the firm to withhold taxes on capital gains automatically, thereby streamlining the tax filing process.

Daishi Hokuetsu Securities Fees Review

The firm does not charge management fees for domestic stocks or foreign securities accounts, offering a cost-effective solution for investors.

For domestic stock trading, there are two types of fees depending on the method: face-to-face trading and internet trading, ensuring flexibility based on client preferences.

Depositing funds into Daishi Hokuetsu Securities via bank transfer is fee-free when conducted at the head office or branches of Daishi Hokuetsu Bank, with specific details available upon inquiry at any branch. Additionally, the firm covers the remittance fee for transferring funds to a client's bank account, further enhancing convenience.

However, while transfers to family members' accounts are not permitted, clients can specify their own account for transactions, reflecting the firm's commitment to efficient and client-focused service delivery.

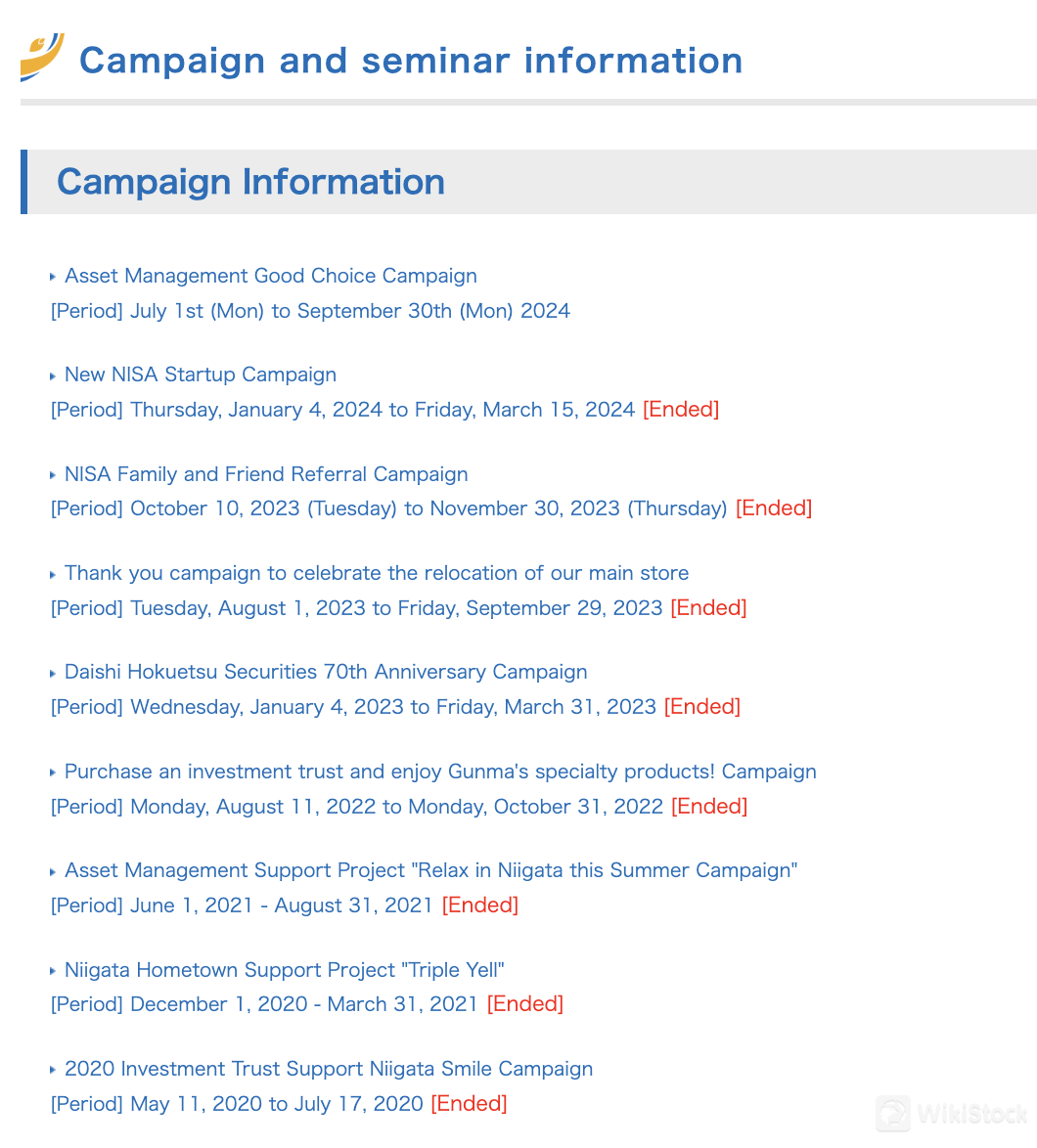

Research & Education

Daishi Hokuetsu Securities organizes informative seminars and lectures, such as the Taiyo Koki IR Briefing & Daishi Hokuetsu Securities Economic Lecture, held on February 27, 2024, which provide valuable insights into economic trends and company-specific information. Additionally, events like the 5th Niigata Prefecture Listed Company IR Forum 2023, held on September 14, 2023, foster dialogue and transparency between listed companies and investors.

Customer Service

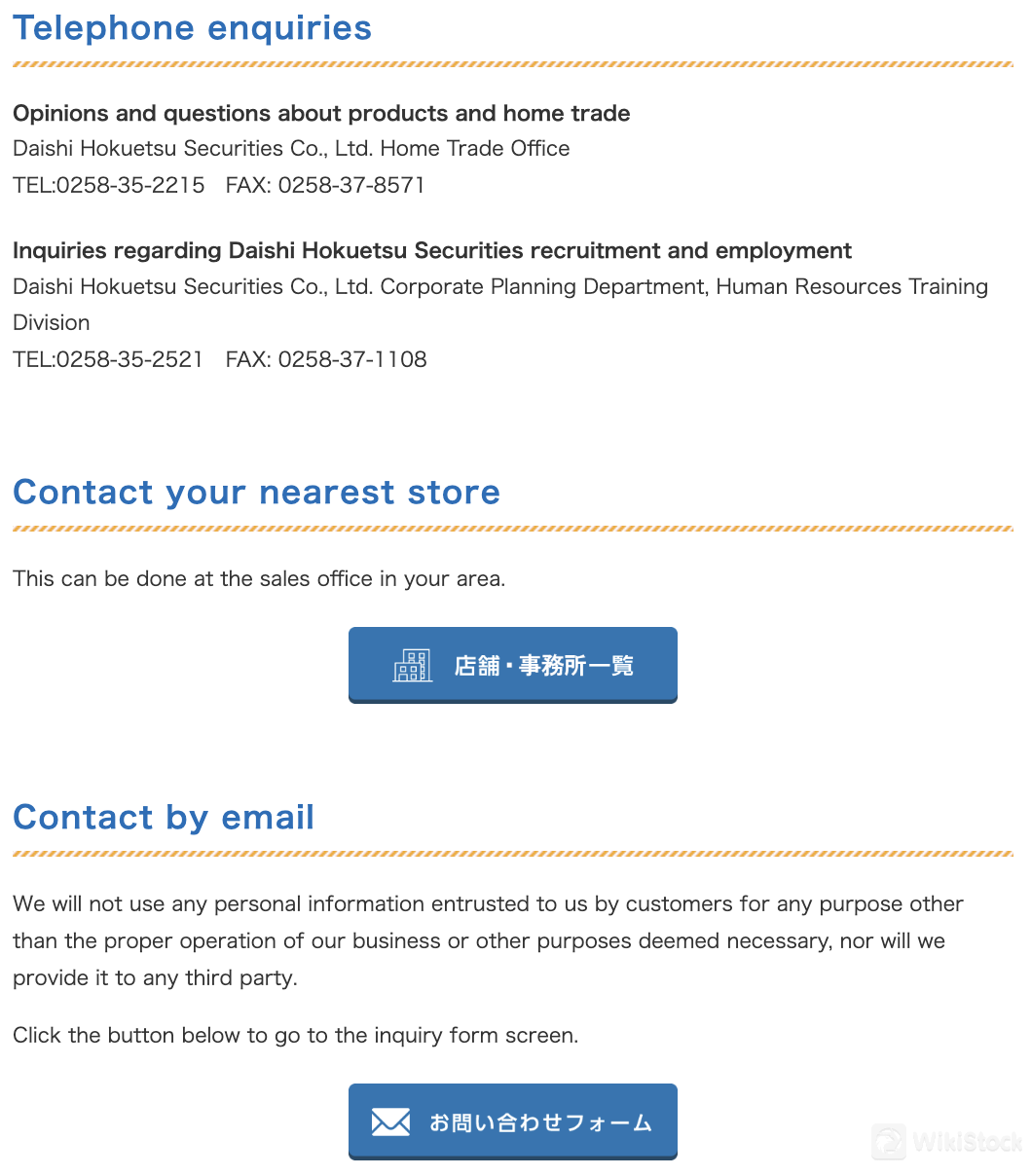

Daishi Hokuetsu Securities prioritizes customer service through multiple accessible channels, ensuring clients receive attentive support for their inquiries and feedback. Clients can reach out via telephone to the Home Trade Office for assistance with product queries and home trading inquiries at 0258-35-2215, with fax communication available at 0258-37-8571.

For those interested in career opportunities or seeking information on recruitment, the Corporate Planning Department's Human Resources Training Division can be contacted directly at 0258-35-2521, with fax services available at 0258-37-1108.

Additionally, clients can conveniently locate and contact their nearest sales office for personalized service and assistance specific to their region. For general inquiries or additional information, Daishi Hokuetsu Securities offers email contact at info@dh-sec.co.jp.

Conclusion

Daishi Hokuetsu Securities exemplifies a commitment to excellence in the financial services sector through its comprehensive range of investment products, and transparent fee structures. With a focus on investor education and engagement, evidenced by its informative seminars and campaigns, the firm empowers clients to make informed decisions in their financial endeavors. By upholding rigorous regulatory standards and fostering transparent communication, Daishi Hokuetsu Securities continues to build trust and reliability among its clientele.

FAQs

Is Daishi Hokuetsu Securities safe to trade?

Daishi Hokuetsu Securities is regulated by the Japan Financial Services Agency (FSA), ensuring compliance with stringent financial regulations.

Is Daishi Hokuetsu Securities a good platform for beginners?

Daishi Hokuetsu Securities provides personalized customer service and educational resources, making it a suitable platform for beginners looking to enter the financial markets.

Is Daishi Hokuetsu Securities good for investing/retirement?

Daishi Hokuetsu Securities offers a range of investment options and retirement planning services, making it a viable choice for individuals looking to invest for retirement goals.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

5-10 years

Commission Rate

0.38%

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

寿証券

Score

Centrade

Score

めぶき証券

Score

浜銀TT証券

Score

おきぎん証券

Score

ワンアジア証券

Score

木村証券

Score

西日本シティTT証券

Score

Kuni Umi AI Securities

Score

香川証券

Score