Score

西日本シティTT証券

http://www.nctt.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

6

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

Japan FSE

西日本シティTT証券株式会社

Brokerage Information

More

Company Name

Nishi-Nippon City Tokai Tokyo Securities Co.,Ltd.

Abbreviation

西日本シティTT証券

Platform registered country and region

Company address

Company website

http://www.nctt.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.7590%

New Stock Trading

Yes

Regulated Countries

1

Products

6

| West Japan City TT Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | N/A |

| Fees | Variable |

| Account Fees | N/A |

| Interests on uninvested cash | N/A |

| Margin Interest Rates | N/A |

| Mutual Funds Offered | Yes |

| App/Platform | Mobile trading app |

| Promotions | Not available yet |

West Japan City TT Securities Information

West Japan City TT Securities is a Japanese brokerage firm, offers a diverse range of financial services tailored to meet the needs of various investors. They cater to both novice and experienced traders, providing educational resources and research tools to enhance trading knowledge and performance.

NCTT's offerings include a competitive trading fees, and a robust trading platform. Their customer service is readily available to assist clients with any inquiries, ensuring a smooth trading experience.

Pros and Cons of West Japan City TT Securities

West Japan City TT Securities offers a range of advantages that make it an attractive choice for traders. The broker provides access to a wide array of tradable securities, including stocks, bonds, forex, mutual funds, and derivatives, allowing investors to diversify their portfolios easily. Its competitive trading fees ensure that clients can maximize their returns without being burdened by high costs. The trading platform itself is robust and user-friendly, catering to both novice and experienced traders. Additionally, West Japan City TT Securities excels in offering extensive research and educational resources, such as market analysis reports, educational articles, webinars, and video tutorials.

However, one notable limitation is that phone support is only available during business hours, which can be inconvenient for traders who need assistance outside of these times.

| Pros | Cons |

| Wide range of tradable securities | Phone support only available during business hours |

| Competitive trading fee | |

| Robust and user-friendly trading platform | |

| Extensive research and educational resources | |

| Responsive customer service |

Is West Japan City TT Securities safe?

Regulations

West Japan City TT Securities is officially licensed and regulated by The Japan Financial Services Agency (FSA) under license number 福岡財務支局長(金商)第75号 for a wide range of business activities.

Funds Safety

West Japan City TT Securities places a high priority on the safety of client funds. They segregate client funds from the companys operational funds, ensuring that clients' money is protected even if the company faces financial difficulties. This segregation of funds complies with regulatory standards, providing an additional layer of security for investors. Additionally, West Japan City TT Securities employs financial institutions to hold client funds, further enhancing their safety.

Safety Measures

To safeguard client information and transactions, West Japan City TT Securities employs advanced security measures. They utilize state-of-the-art encryption technologies to protect data transmission between clients and their servers. The broker also implements rigorous authentication processes to prevent unauthorized access to accounts. Regular security audits and compliance checks are conducted to maintain a high standard of security, ensuring that clients can trade with confidence.

What are securities to trade with West Japan City TT Securities?

West Japan City TT Securities offers a wide array of securities for trading, catering to the diverse needs of its clients. These include:

Stocks: Investors can trade stocks from various markets, including major exchanges like the Tokyo Stock Exchange. West Japan City TT Securities provides access to a broad selection of companies, allowing investors to build a diversified portfolio.

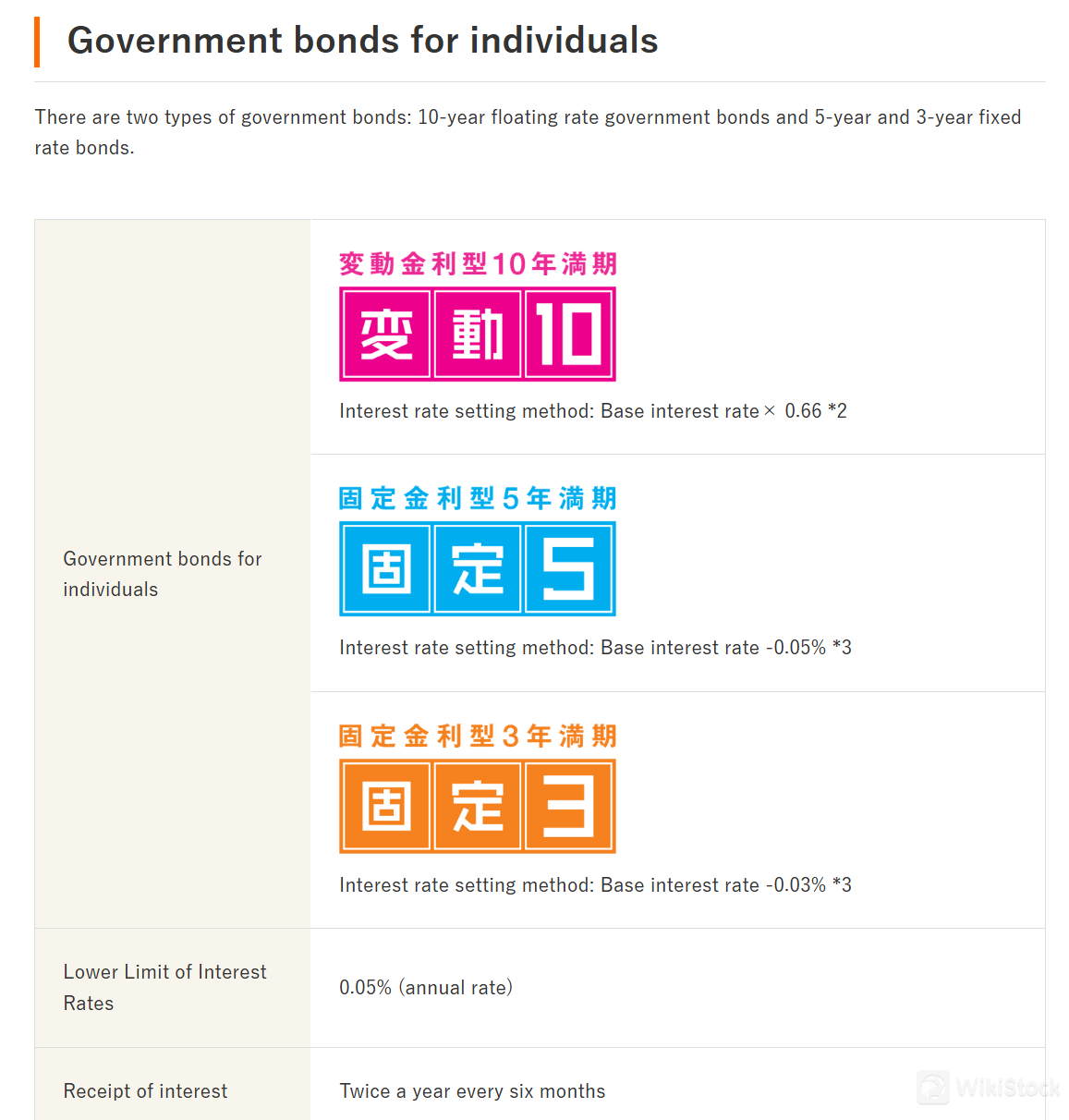

Bonds: The broker offers government and corporate bonds, providing stable investment options for those seeking fixed-income securities.

Forex: West Japan City TT Securities allows trading in major and minor currency pairs, enabling investors to participate in the global forex market. Their platform supports competitive spreads and leverage options.

Commodities: Clients can trade commodities such as gold, silver, and oil. These assets provide opportunities for diversification and hedging against inflation.

Indices: West Japan City TT Securities offers trading on major global indices, including the Nikkei 225 and the S&P 500. Trading indices allows investors to speculate on the performance of a group of stocks, rather than individual shares.

ETFs: Exchange-Traded Funds (ETFs) are available, providing exposure to various asset classes and sectors. ETFs offer a flexible and cost-effective way to diversify portfolios.

Options: For those interested in derivatives, West Japan City TT Securities provides options trading. This allows investors to hedge their positions or speculate on market movements with defined risk.

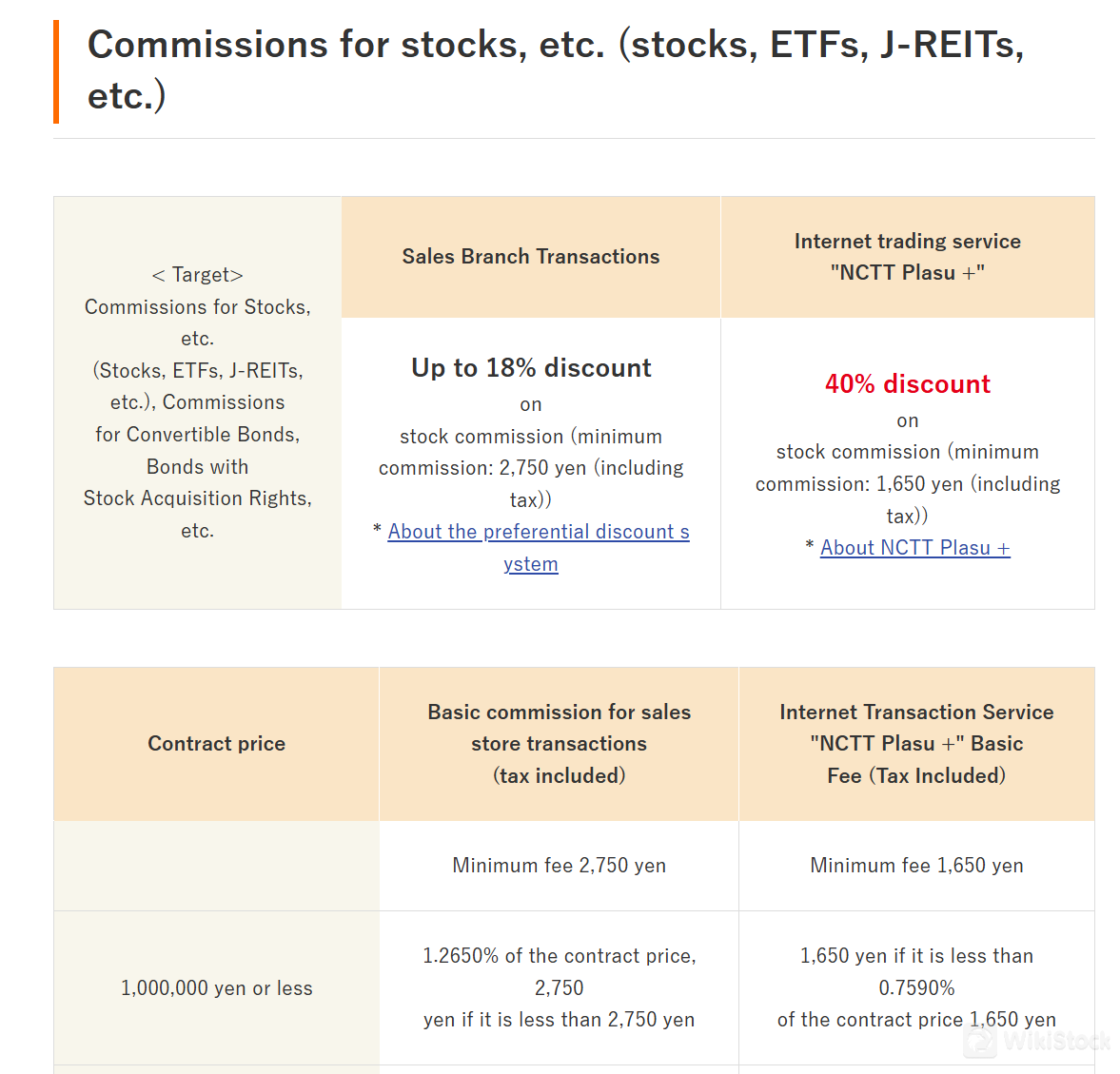

West Japan City TT Securities Fees Review

West Japan City TT Securities offers a clear fee structure for trading domestic and international stocks. For domestic stocks, the commission is 0.09% plus 90 JPY for trades up to 1 million JPY, with incremental increases for larger trades. International stock trades incur a 0.45% commission, with a minimum fee of 1,500 JPY.

West Japan City TT Securities uses a simple fee structure for bonds. Domestic bond transactions have a 0.02% commission fee, which is competitively low. For foreign bonds, the commission is 0.5%, reflecting the additional costs of international trading.

West Japan City TT Securities's forex trading fees are based on spreads, starting from 0.2 pips for major currency pairs like USD/JPY and EUR/USD, with no extra commissions for standard accounts. Professional accounts may have tighter spreads with a small commission per lot.

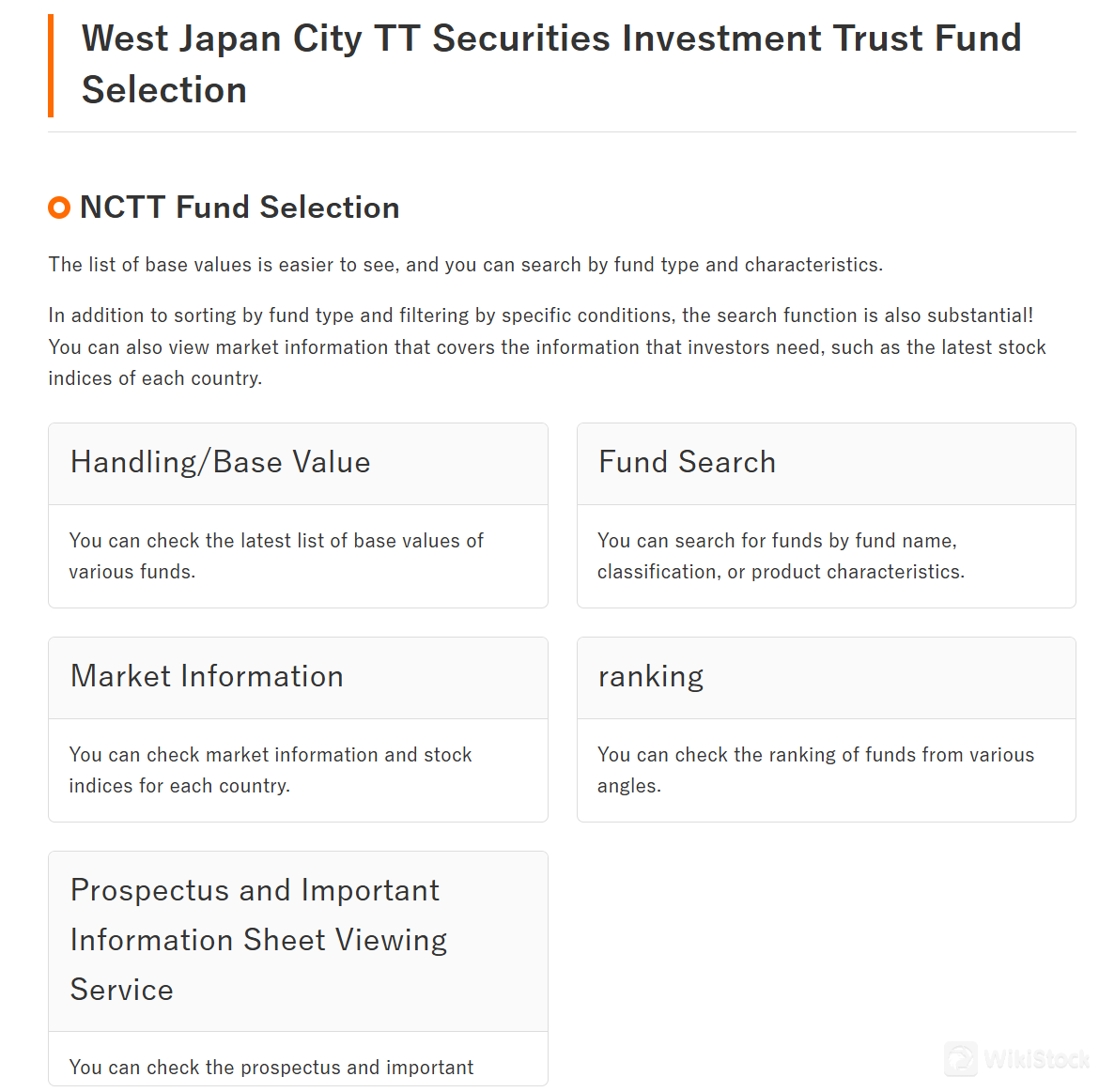

West Japan City TT Securities charges a sales commission for mutual funds, ranging from 0.2% to 3% of the investment, depending on the fund. There is also an annual management fee, known as the Total Expense Ratio (TER), which covers ongoing expenses and is deducted from the funds assets.

For derivatives, West Japan City TT Securities charges a commission based on the type. Futures incur a 0.1% commission of the transaction value, while options have a fixed fee per contract.

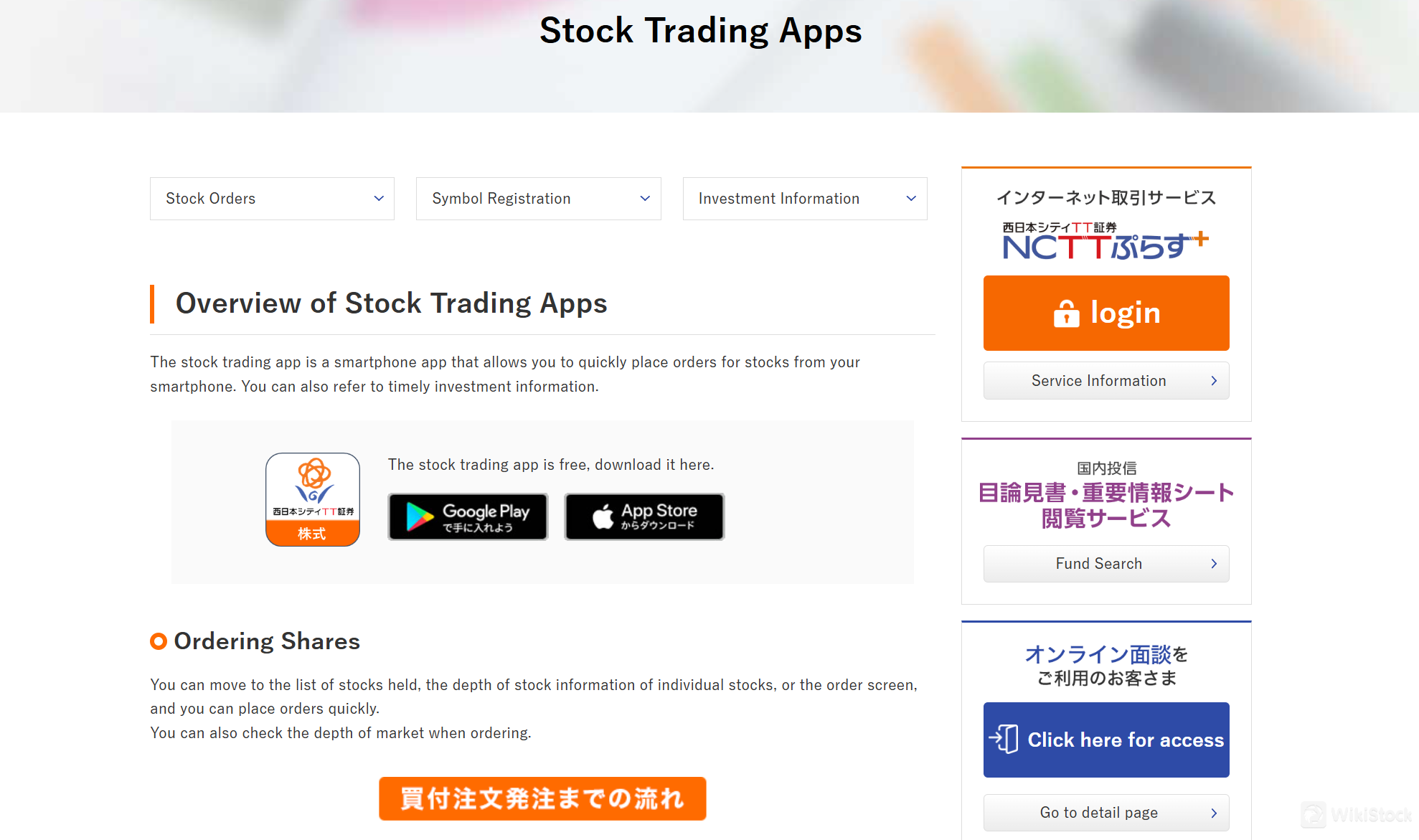

West Japan City TT Securities App Review

West Japan City TT Securitiess trading platform is robust and user-friendly, catering to both novice and experienced traders. West Japan City TT Securities offers a mobile trading app that provides full functionality on the go. The app is available for both iOS and Android devices, ensuring that traders can monitor and manage their positions from anywhere. The platform offers a range of features designed to enhance the trading experience:

West Japan City TT Securities's platform is user-friendly with a customizable interface. Traders can tailor charts, watchlists, & dashboards. It has advanced charting tools for in-depth analysis & supports various order types for flexible trading strategies. It also caters to algo-trading with access to APIs & algorithms. A mobile app is available for on-the-go trading. Integrated research & news features provide real-time market info. The platform uses strong security measures to protect user data & transactions.

Research and Education

West Japan City TT Securities places a strong emphasis on providing quality research and educational resources to its clients. The broker offers an array of materials designed to help traders enhance their knowledge and make informed decisions. This includes regular market analysis reports prepared by experienced analysts, covering various asset classes and market trends. Additionally, West Japan City TT Securities's website features a wealth of educational articles on topics such as trading strategies, technical analysis, and risk management, catering to both beginners and advanced traders.

WJC TT Securities provides webinars & seminars by pros for interactive learning on various topics. It has trading guides with instructions on the platform, trading & portfolio management, especially good for newbies. Video tutorials cover trading & platform functions for visual learning. It also offers a demo account for beginners to practice risk-free trading.

Customer Service

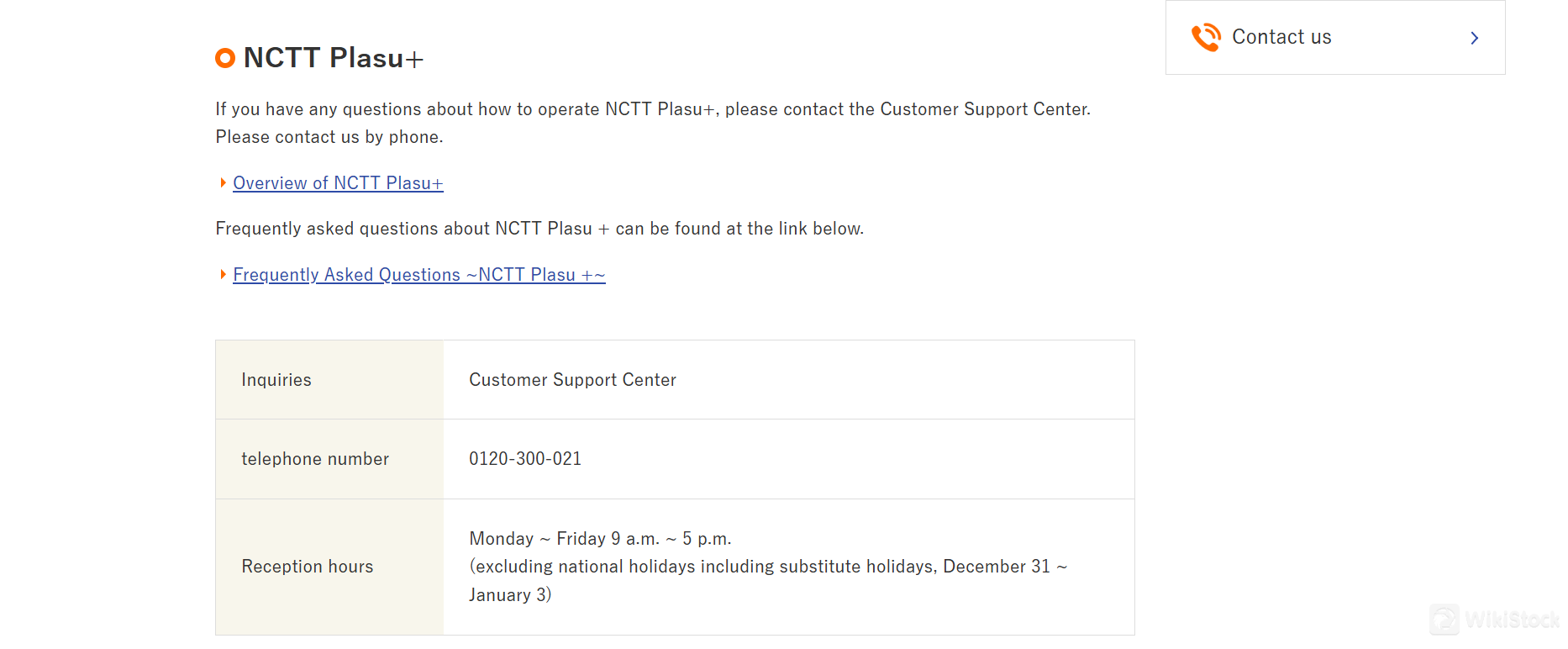

West Japan City TT Securitiess customer service is dedicated to providing prompt and efficient support to its clients. The broker offers several channels for customer assistance:

Phone Support: West Japan City TT Securities offers phone support (0120-300-021) for clients who prefer to speak directly with a representative. This service is available during business hours, ensuring that clients can get timely assistance.

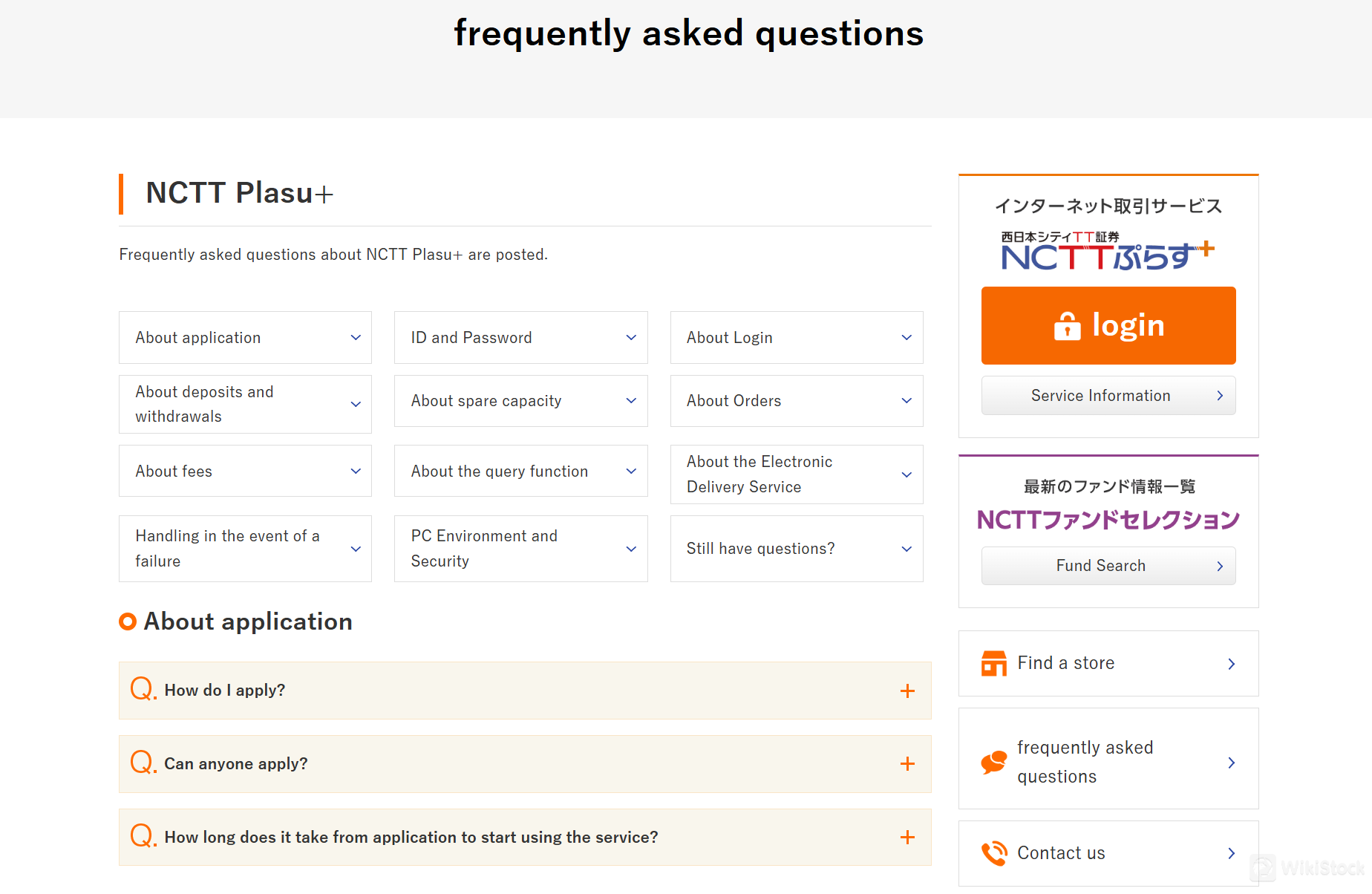

FAQ Section: The brokers website features an extensive FAQ section that addresses common questions and issues. This resource is helpful for clients who prefer to find answers independently.

Account Managers: For professional and corporate clients, West Japan City TT Securities provides dedicated account managers who offer personalized support and advice. This service ensures that high-value clients receive tailored assistance.

Conclusion

West Japan City TT Securities is an extensive brokerage firm offering a diverse range of securities, competitive fees, and a robust trading platform. The brokers commitment to safety, research, and customer support makes it a strong choice for traders of all levels. While there are a few drawbacks, such as inactivity fees and limited phone support hours, the overall advantages make West Japan City TT Securities a well-rounded broker.

FAQs

How does West Japan City TT Securities ensure the safety of client funds?

West Japan City TT Securities segregates client funds from company funds and uses financial institutions to hold these funds, ensuring their safety.

What trading platform does West Japan City TT Securities provide?

West Japan City TT Securities provides a robust and user-friendly trading platform with advanced charting tools, automated trading capabilities, and mobile app support.

Are there educational resources available for new traders?

Yes, West Japan City TT Securities offers a variety of educational resources including articles, webinars, video tutorials, and a demo account for new traders.

Risk Warning

WikiStock's expert assessment of the brokerage's website data is subject to change and should not be taken as financial advice. Online trading carries substantial risks, including the potential loss of all invested capital, and it's crucial to fully understand these risks before investing.

Others

Registered region

Japan

Years in Business

10-15 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

Rakuten Trade

Score

auカブコム証券

Score

東海東京証券

Score

Mita Securities

Score

GMOクリック証券

Score

Matsui

Score

Okasan Securities

Score

丸三証券

Score

安藤証券

Score

アイザワ証券

Score