Score

おきぎん証券

https://www.okigin-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

Okigin Securities Limited

Abbreviation

おきぎん証券

Platform registered country and region

Company address

Company website

https://www.okigin-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

おきぎん証券 Earnings Calendar

Currency: JPY

Cycle

Q3 FY2024 Earnings

2024/02/08

Revenue(YoY)

11.94B

+4.14%

EPS(YoY)

68.98

+29.42%

おきぎん証券 Earnings Estimates

Currency: JPY

- DateCycleRevenue/Estimated

- 2024/02/082024/Q312.991B/0

- 2023/08/092024/Q113.657B/0

- 2023/02/092023/Q312.360B/0

- 2022/08/082023/Q114.331B/0

- 2021/08/052022/Q113.067B/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

1.210%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Okigin Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded | 1960 |

| Registered Region | Japan |

| Regulatory Status | FSA |

| Product & Services | Stocks, Investment Trusts, Bonds |

| Fees | Commissions for Japanese domestic stocks: 0.275-1.21% of contract price, min 2,750 yen, depending on trading volume |

| Foreign stocks trading fee: 0.990% + 4,400 yen, minimum 5,500 yen | |

| Investment trusts: up to 3.3% of application amount for application fees and other indirect costs | |

| Bond trading fees: 0.22-1.045% of contract price, min 2,750 yen, depending on trading volume | |

| Customer Service | Head office: 〒900-0033 2-4-16 Kume, Naha City; inquiry form |

Tel:

|

Okigin Securities Information

Founded in Okinawa in 1960, Okigin Securities provides a range of financial products including stocks, investment trusts, and bonds.

Commissions for Japanese domestic stocks range from 0.275% to 1.21% of the contract price, with a minimum fee of 2,750 yen, depending on trading volume. Trading fees for foreign stocks are set at 0.990% plus 4,400 yen, with a minimum fee of 5,500 yen.

For investment trusts, application fees can be up to 3.3% of the application amount, along with other indirect costs.

Bond trading fees range from 0.22% to 1.045% of the contract price, with a minimum fee of 2,750 yen, also dependent on trading volume.

Okigin Securities operates under the stringent regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Okinawa General Secretary General (Kinsho) No. 1, underscoring its commitment to maintaining high standards of integrity and credibility in all its financial operations.

For more detailed information, you can visit their official website: https://www.okigin-sec.co.jp/ or contact their customer service directly.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Complex Fee Structure |

| Comprehensive Product Range | |

| Support for Beginners |

- Regulatory Compliance: Operates under the stringent oversight of the Japan Financial Services Agency (FSA), ensuring high standards of integrity and credibility.

- Comprehensive Product Range: Offers a wide variety of financial products including stocks, investment trusts, and bonds.

- Support for Beginners: Provides professional advisors to guide beginners through their investment journey, offering personalized advice and support. Cons:

- Complex Fee Structure: Though transparent, the fee structure for various products is relatively complex and can be difficult for new investors to understand their trading costs.

- Is Okigin Securities regulated by any financial authority?

- What types of products does Okigin Securities provide?

- Is Okigin Securities suitable for beginners?

- What are the commission fees for Japanese domestic stocks at Okigin Securities?

- Are there any special services for beginners at Okigin Securities?

Is It Safe?

Regulation:

Okigin Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Okinawa General Secretary General (Kinsho) No. 1, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores Okigin Securities Limited's commitment to integrity and credibility in its services.

Funds Safety:

Okigin Securities is a member of the Japan Investor Protection Fund, in the unlikely event that the company faces bankruptcy and is unable to return assets deposited by individual investors, the Investor Protection Fund protects customer assets up to a maximum of 10 million yen per person, maintaining high standards of financial security.

Safety Measures:

Okigin Securities employs stringent security measures to safeguard customer assets in compliance with the Financial Instruments and Exchange Act. This includes segregated management, where customer assets such as securities and deposits are stored separately from the company's own assets. This separation ensures that client investments are securely preserved and remain unaffected, even in the unlikely event of the company's bankruptcy.

What are Securities to Trade with Okigin Securities?

Okigin Securities offers a diverse range of products and services. From traditional stocks to specialized investment vehicles like ETFs and ETNs, Okigin Securities provides opportunities for both domestic and foreign stock investing.

Stock investing with Okigin Securities involves accessing both Japanese domestic and foreign stocks such as US stocks, allowing clients to build diversified portfolios suited to their risk tolerance and investment goals. Clients can benefit from potential capital appreciation while navigating the associated risks and commission structures typical of equity investments.

Additionally, Okigin Securities offers investment trusts, including mutual funds, which provide pooled investments in various asset classes managed by professionals. These funds offer diversification benefits but involve fees and risks that clients should consider.

For fixed income investors, Okigin Securities provides options such as bonds, including government and foreign bonds, as well as structured bonds. These investments offer stable income streams with varying levels of risk depending on factors like credit quality and interest rate fluctuations.

Fees Review

Okigin Securities charges various fees depending on the type of financial product or service.

For Japanese domestic stock trading, commissions range from 1.210% of the contract price for amounts up to 1,000,000 yen to a flat fee of 234,300 yen for amounts over 50,000,000 yen, with a minimum fee of 2,750 yen.

| Contract Price | Commission Rate |

| 1,000,000 yen or less | 1.210% of the contract price |

| Over 1,000,000 yen, up to 3,000,000 yen | 0.880% of the contract price + 3,300 yen |

| Over 3,000,000 yen, up to 5,000,000 yen | 0.770% of the contract price + 6,600 yen |

| Over 5,000,000 yen, up to 10,000,000 yen | 0.704% of the contract price + 9,900 yen |

| Over 10,000,000 yen, up to 30,000,000 yen | 0.495% of the contract price + 30,800 yen |

| Over 30,000,000 yen, up to 50,000,000 yen | 0.275% of the contract price + 96,800 yen |

| Over 50,000,000 yen | 234,300 yen |

| Minimum Fee | 2,750 yen |

Foreign stock trading fees include a domestic trading fee of up to 0.990% + 4,400 yen, with a minimum of 5,500 yen.

| Domestic Trading Fee | Up to 0.990% + 4,400 yen (minimum 5,500 yen) |

Investment trusts may have application fees up to 3.3% of the application amount and various indirect costs, such as trust and management company fees.

| Application Fee | Up to 3.3% of the application amount |

| Indirect Costs | Trust fees, management company fees, etc. |

Bond trading fees range from 1.045% of the contract price for amounts up to 1,000,000 yen to a flat fee of 234,850 yen for amounts over 50,000,000 yen, with a minimum fee of 2,750 yen.

| Contract Price | Commission Rate |

| 1,000,000 yen or less | 1.045% of the contract price |

| Over 1,000,000 yen, up to 5,000,000 yen | 0.935% of the contract price + 1,100 yen |

| Over 5,000,000 yen, up to 10,000,000 yen | 0.660% of the contract price + 14,850 yen |

| Over 10,000,000 yen, up to 30,000,000 yen | 0.550% of the contract price + 25,850 yen |

| Over 30,000,000 yen, up to 50,000,000 yen | 0.220% of the contract price + 124,850 yen |

| Over 50,000,000 yen | 234,850 yen |

| Minimum Fee | 2,750 yen |

These fee structures ensure transparency and allow investors to understand the costs associated with their transactions at Okigin Securities. If you want the most updated fee info and more details in the trading fees of investment trust, you can contact Okigin Securities directly.

Research & Education

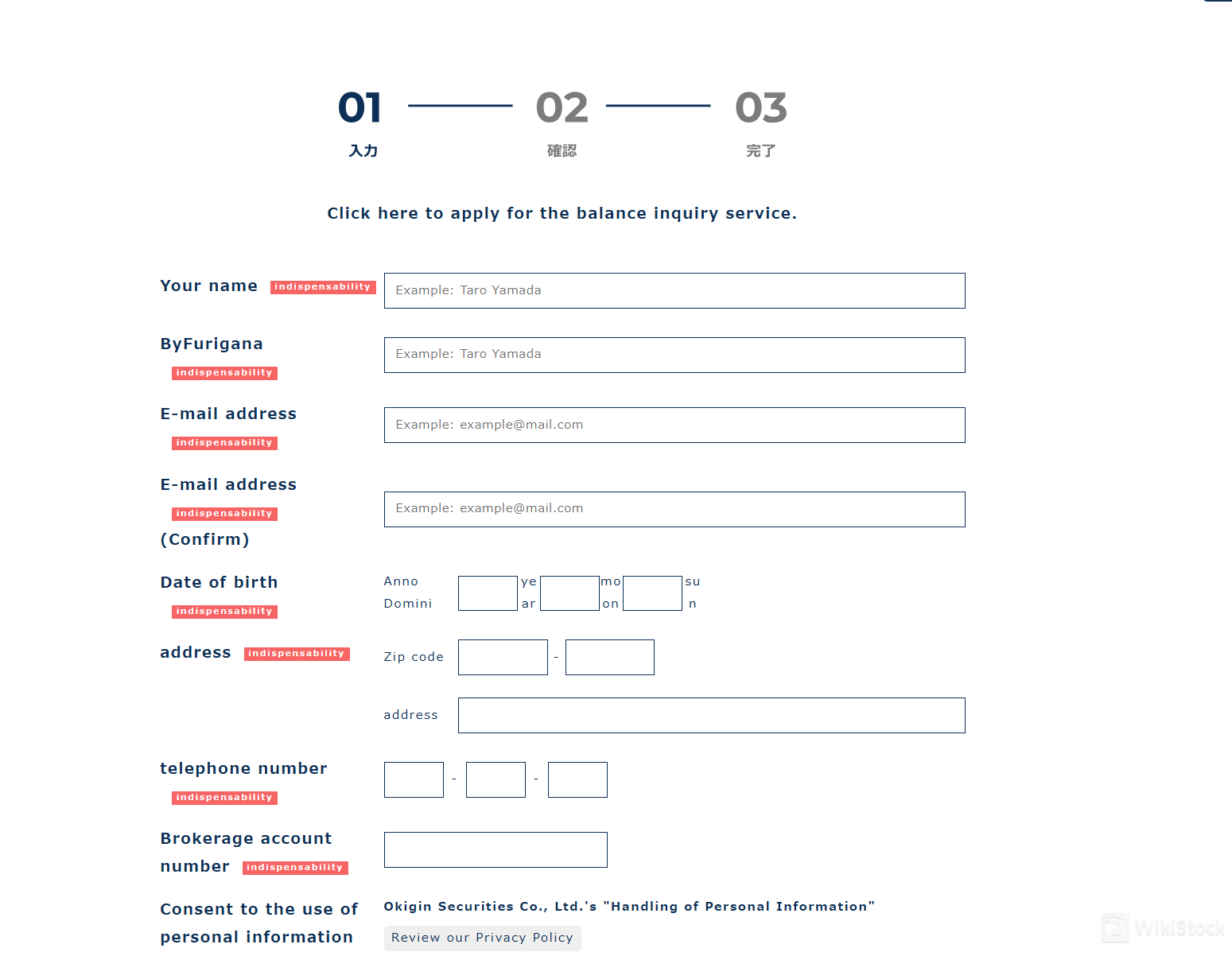

Okigin Securities offers educational resources tailored to beginners for a seamless entry into the world of investing.

Each customer is paired with a professional advisor who provides personalized advice through branch consultations and telephone support, making asset management accessible even for first-timers.

They provide detailed explanations of various financial products, including stock investments, mutual funds, and fixed income investments, highlighting their potential profitability and safety.

The company also guides new investors through the account opening process, detailing the required documentation and ensuring compliance with identity verification regulations.

This comprehensive support helps beginners confidently build and manage their assets.

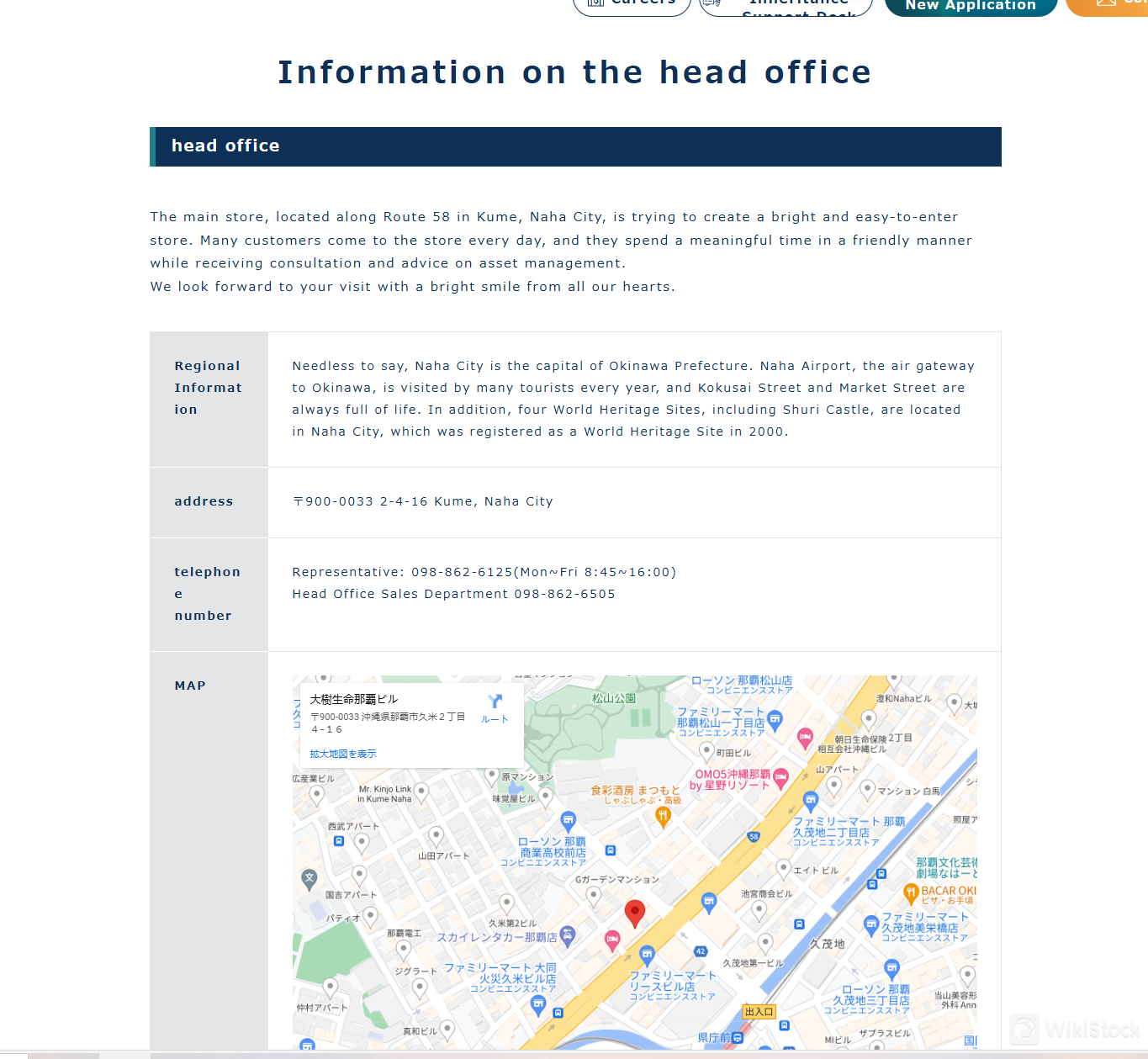

Customer Service

Okigin Securities provides exceptional customer service to ensure a smooth and supportive experience for its clients.

The head office, located at 2-4-16 Kume, Naha City, is easily accessible for in-person consultations.

Customers can reach out via telephone at 098-862-6125 from Monday to Friday between 8:45 and 16:00 for general inquiries, or contact the Head Office Sales Department directly at 098-862-6505 for more specialized assistance.

Additionally, an inquiry form is available for customers who prefer written communication, ensuring that support is always within reach.

Conclusion

Okigin Securities, established in 1960 in Okinawa, offers a comprehensive range of financial products, including stocks, investment trusts, and bonds. The company operates under the stringent regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Okinawa General Secretary General (Kinsho) No. 1, demonstrating its commitment to maintaining high standards of integrity and credibility in its financial operations and being a trusted brokers to its clients.

Frequently Asked Questions (FAQs)

Yes, Okigin Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Okinawa General Secretary General (Kinsho) No. 1.

Stocks, investment trusts, and bonds.

Yes, Okigin Securities is suitable for beginners. It is well regulated by FSA and offers educational resources and supports specialized for beginners.

The commission fees for Japanese domestic stocks range from 0.275% to 1.21% of the contract price, with a minimum fee of 2,750 yen.

Yes, Okigin Securities provides professional advisors to offer personalized advice and support.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

丸三証券

Score

今村証券

Score

三菱UFJモルガン・スタンレー証券

Score

Nissan Securities

Score

水戸証券

Score

東洋証券株式会社

Score

豊証券株式会社

Score

Kyokuto Securities

Score

あかつき証券

Score

ちばぎん証券

Score