Score

香川証券

https://www.kagawa-sc.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

KAGAWA Securities Co., Ltd

Abbreviation

香川証券

Platform registered country and region

Company address

Company website

https://www.kagawa-sc.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

1.166%

Margin Trading

YES

Regulated Countries

1

Products

5

| Kagawa Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees | Range from 1.166% for contracts ≤ 1 million yen to 0.110% + 166 |

| 100 yen for contracts > 50 million yen (for domestic stocks) | |

| Account Fees | 2200 yen per year or 5280 yen every three years for protected deposit account maintenance fee |

| 2200 yen per year for foreign securities account management fee | |

| Mutual Funds Offered | REIT, ETF |

| App/Platform | Net de Rakuda |

What is Kagawa Securities?

Kagawa Securities Co., Ltd. is a financial services firm based in Japan, regulated by the Japan Financial Services Agency. Specializing in both individual and corporate financial needs, Kagawa Securities offers a diverse range of products and services including wealth consulting, business matching, and IR support. They also provide tailored investment solutions, manage investment trusts, and advise on M&A activities and IPOs.

Pros & Cons of Kagawa Securities

| Pros | Cons |

|

|

|

|

|

Pros:

Regulatory Oversight: As a regulated entity under the Japan Financial Services Agency, Kagawa Securities adheres to strict regulatory standards, ensuring investor protection and financial stability.

Wide Range of Services: Kagawa Securities offers a comprehensive suite of financial products and services, including wealth consulting, investment management, and corporate advisory services.

Market Expertise: With a focus on market information dissemination and asset management, Kagawa Securities leverages its expertise to provide clients with informed investment decisions.

Cons:

Complex Fee Structure: Kagawa Securities is noted for having a complex fee structure. This complexity can make it challenging for investors to fully understand the costs associated with their investments.

Limited Educational Resources: Compared to some competitors, Kagawa Securities offers limited educational resources for investors. As a result, investors may need to seek out external sources for comprehensive financial education and guidance.

Is Kagawa Securities Safe?

Kagawa Securities Co., Ltd. is regulated by the Japan Financial Services Agency (FSA) with a license of Kinsho No.3, which is known for its stringent oversight of financial institutions in Japan. As a regulated entity, Kagawa Securities is required to adhere to strict regulatory standards aimed at protecting investors and maintaining financial stability. This regulatory oversight helps ensure that Kagawa Securities operates within established guidelines, safeguards client funds, and maintains transparency in its operations.

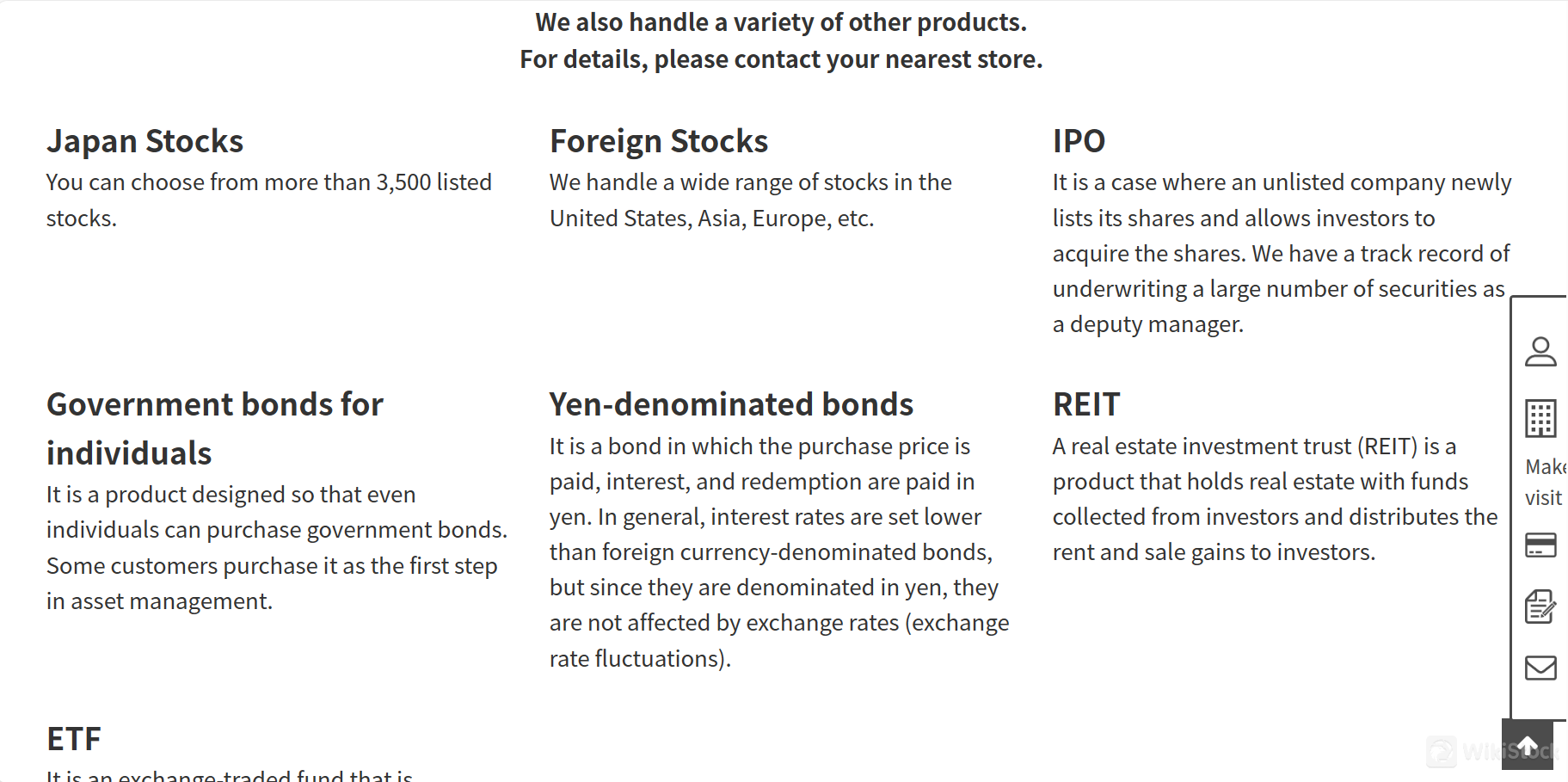

What are Securities to Trade with Kagawa Securities?

Kagawa Securities Co., Ltd. provides a comprehensive range of financial products and services tailored to corporate customers. These offerings include domestic stocks, convertible bonds with stock acquisition rights, foreign stocks, index futures, index options, securities options, and government bond futures. This extensive range allows investors to customize their portfolios according to various investment strategies and risk preferences.

Domestic stocks and foreign stocks enable exposure to both local and international markets, while convertible bonds and options provide opportunities for strategic hedging and capital appreciation. Index futures and options further enhance portfolio flexibility by offering exposure to broader market indices, while government bond futures provide avenues for fixed income investments.

Kagawa Securities' diverse product lineup underscores its commitment to meeting the varied investment objectives of its clientele.

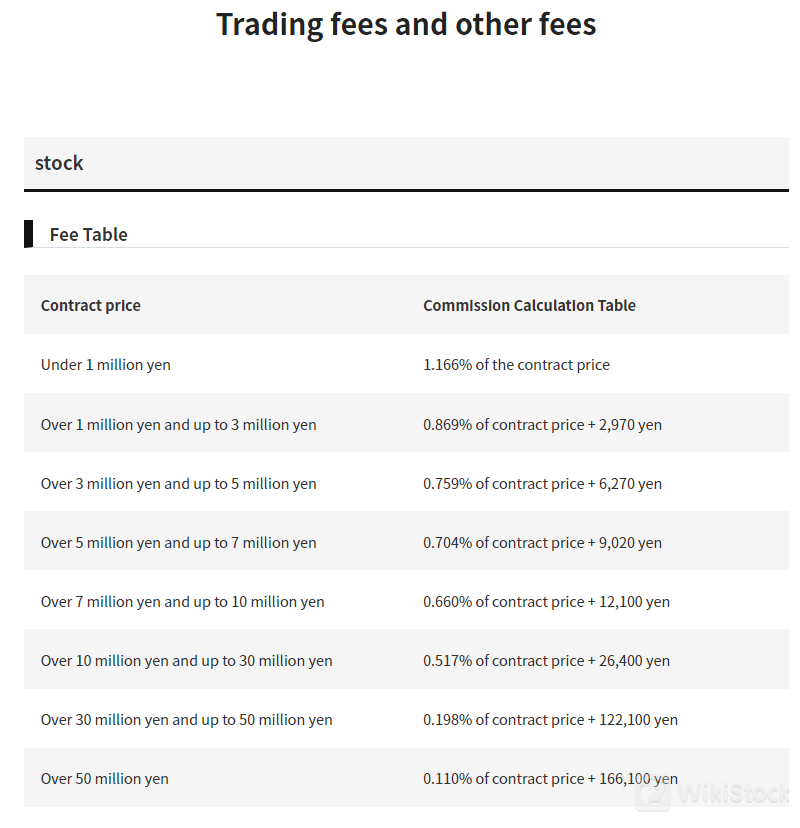

Kagawa Securities Fees Review

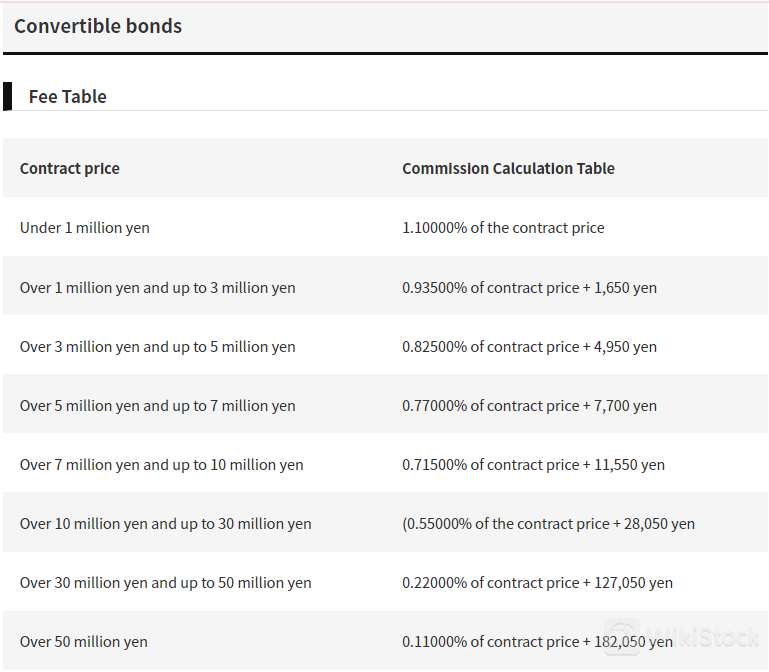

For domestic stocks, fees are calculated as a percentage of the contract price, ranging from 1.166% for contracts up to 1 million yen to 0.110% plus 166,100 yen for contracts exceeding 50 million yen. Convertible bonds with stock acquisition rights incur fees starting from 1.10000% for contracts up to 1 million yen to 0.11000% plus 182,050 yen for contracts exceeding 50 million yen.

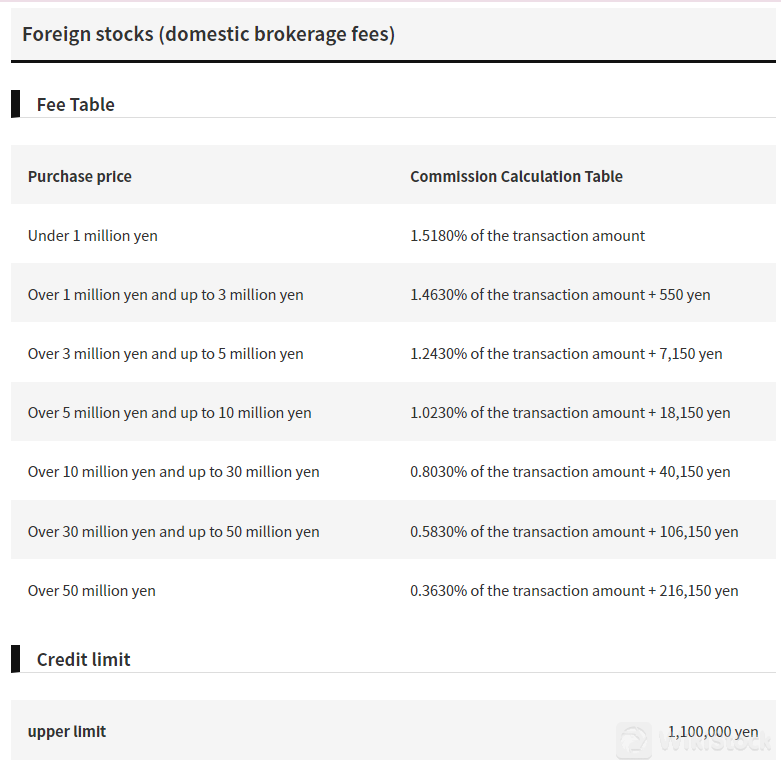

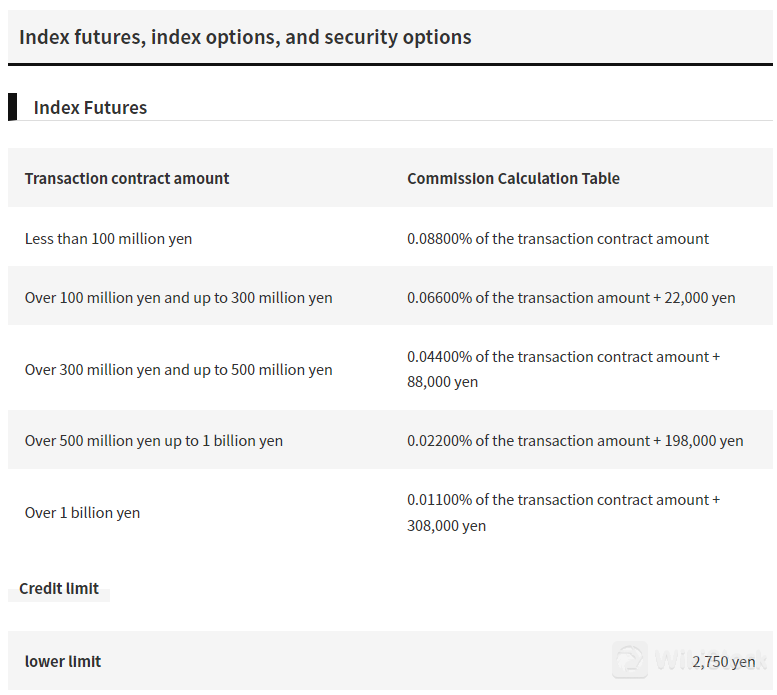

Foreign stocks traded on domestic exchanges have fees ranging from 1.5180% for contracts up to 1 million yen to 0.3630% plus 216,150 yen for contracts exceeding 50 million yen. Index futures transactions involve fees starting at 0.08800% of the contract amount for transactions up to 100 million yen, with additional fixed fees ranging up to 308,000 yen for contracts exceeding 1 billion yen.

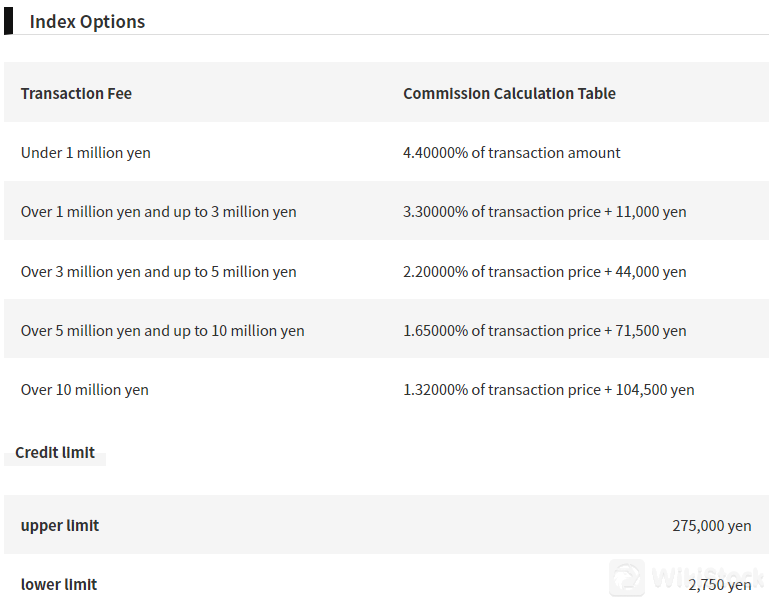

Index options and securities options are also subject to tiered fees based on transaction amounts, with rates ranging from 4.40000% for transactions up to 1 million yen in index options to 0.66000% plus 36,850 yen for securities options exceeding 50 million yen. Government bond futures fees start at 0.01650% of the contract face value for transactions up to 500 million yen and go up to 0.00275% plus 220,000 yen for contracts exceeding 5 billion yen.

In addition to transaction fees, Kagawa Securities charges maintenance fees for protection deposit accounts and account transfer fees based on the number of units transferred.

Kagawa Securities App Review

Kagawa Securities Co., Ltd. offers Net de Camel, an online inquiry service accessible via PCs and smartphones. This service allows clients to monitor their asset status anytime and anywhere, providing convenience and peace of mind. To use “Net de Camel,” clients need to open a general securities account with Kagawa Securities and sign a specific contract. The service supports various operating systems and browsers, though specific system requirements must be met for optimal use.

Research & Education

Kagawa Securities offers several resources to help investors navigate the market.

Market Reports & Weekly Updates: They provide regular reports with market analysis and updates on the holdings of their asset management partners.

Corporate IR & Branch Seminars: They organize seminars featuring industry leaders and investment professionals. These seminars can cover valuable topics like investment strategies, different asset classes, and market outlooks.

Customer Service

You can contact Kagawa Securities by phone through your nearest store. They accept inquiries via phone, ensuring you can reach out directly for assistance or information. For example, the head office is located at 4-8 Mamiya-cho, Takamatsu-shi, Kagawa 760-8607, Japan, reachable via phone at 087-851-8181. Kagawa Securities also encourages you to use their online form. You can input your details and specify your inquiry or request.

Conclusion

Kagawa Securities, a regulated Japanese firm, offers a wide range of financial services for individuals and corporations. They provide wealth management, investment products, and business consulting, and offer a user-friendly online platform. Overall, Kagawa Securities is a good option for Japanese investors seeking a comprehensive financial partner with personalized service, but cost-conscious investors can consider alternatives.

Frequently Asked Questions (FAQs)

What services does Kagawa Securities offer?

Wealth consulting, investment management, corporate advisory, and various investment products like stocks, bonds, and derivatives.

Is Kagawa Securities regulated?

Yes, Kagawa Securities is regulated by the Japan Financial Services Agency (FSA).

What are the fees associated with trading at Kagawa Securities?

Fees vary depending on the type and size of transactions. For example, domestic stock transactions range from 1.166% to 0.110% of the contract amount, plus additional fees for larger contracts.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

More than 20 year(s)

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

三菱UFJモルガン・スタンレー証券

Score

Nissan Securities

Score

水戸証券

Score

東洋証券株式会社

Score

豊証券株式会社

Score

Kyokuto Securities

Score

ちばぎん証券

Score

あかつき証券

Score

Money Partners

Score

岩井コスモ証券

Score