Score

静銀ティーエム証券

https://www.shizugintm.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

A

Influence Index NO.1

Japan

JapanProducts

6

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

SHIZUGIN TM SECURITIES CO.,LTD

Abbreviation

静銀ティーエム証券

Platform registered country and region

Company address

Company website

https://www.shizugintm.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| Shizugin TM Securities |  |

| WikiStock Rating | ⭐️⭐️⭐️⭐️ |

| Fees | Tiered fee structure |

| Account Fees | Free account opening fee |

| App/Platform | Online trading platform |

Shizugin TM Securities Infomation

Shizugin TM Securities is a regulated brokerage firm operating under the oversight of the Japan Financial Services Agency (FSA), specifically licensed by the 東海財務局長 (Chubu Local Finance Bureau). The firm offers a variety of investment opportunities including investment trusts, stocks, bonds, and Shizuoka bank wrap products.

Pros & Cons of Shizugin TM Securities

| Pros | Cons |

| Regulatory Oversight | Complex Fee Structure |

| Diverse Investment Options | |

| Comprehensive Research and Education | |

| Customer Support |

Pros:

Regulatory Oversight: Regulated by the Japan Financial Services Agency (JFSA), providing a level of trust and assurance regarding financial operations.

Diverse Investment Options: Offers a variety of investment products including investment trusts, stocks, bonds, and Shizuoka bank wrap products.

Comprehensive Research and Education: Prioritizes comprehensive research and education resources such as operation guidebooks and electronic delivery services, aiding clients in understanding the platform and making informed investment decisions.

Customer Support: Offers personalized customer support through its branches and online channels, assisting clients with account management and investment inquiries.

Cons:

Complex Fee Structure: The fee structure for transactions, including commissions and other charges, is complex and varies depending on transaction size and type.

Is Shizugin TM Securities Safe?

Regulation

Shizugin TM Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA), specifically licensed by the 東海財務局長 (Chubu Local Finance Bureau) under license number 第10号. This regulatory status signifies that Shizugin TM Securities complies with the financial regulations and standards mandated by the FSA, ensuring adherence to strict guidelines aimed at safeguarding investor interests, maintaining market integrity, and promoting financial stability.

What are Securities to Trade with Shizugin TM Securities?

Shizugin TM Securities offers a diverse array of securities for trading. Clients have access to investment trusts, which provide opportunities to invest in managed portfolios of stocks, bonds, and other assets, diversifying risk and enhancing returns. For those interested in direct equity investments, Shizugin TM Securities facilitates trading in stocks, enabling clients to buy and sell shares in companies listed on major stock exchanges. Additionally, the availability of bonds allows investors to participate in fixed-income securities. Shizuoka Bank wrap products are also featured, providing investment solutions that combine the bank's expertise with Shizugin TM Securities' brokerage services.

Shizugin TM Securities Accounts

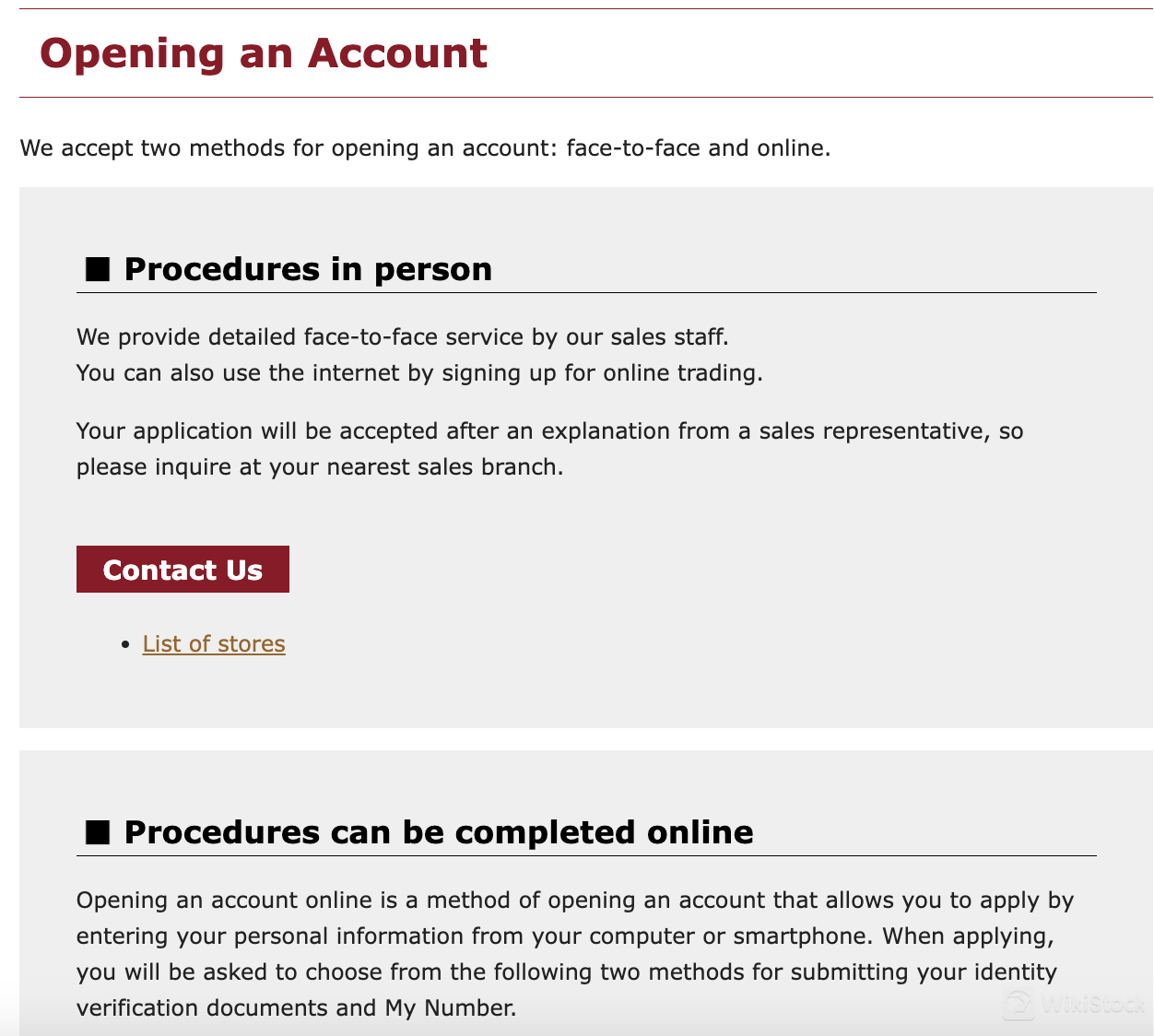

Shizugin TM Securities offers flexible options for opening accounts, including both face-to-face and online procedures. For face-to-face account openings, clients receive personalized service from sales staff at their nearest branch. Alternatively, the online account opening procedure allows applicants to submit their personal information via computer or smartphone. This method involves steps such as document collection, email registration, identity verification using My Number card authentication or document upload, and confirmation of registered details before receiving confirmation of account opening.

Shizugin TM Securities Fees Review

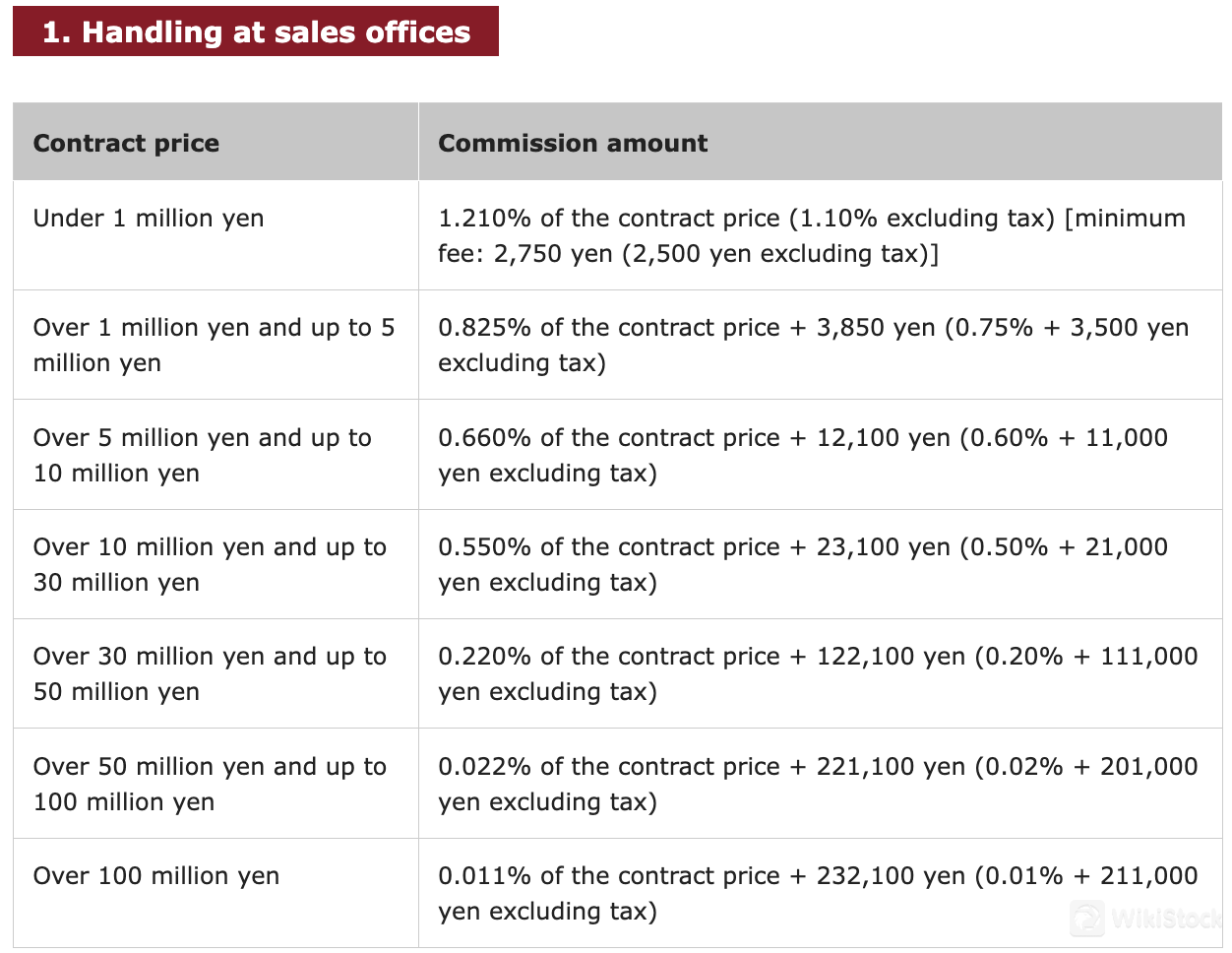

Shizugin TM Securities applies a tiered fee structure for handling transactions both at their sales offices and through online platforms. At sales offices, commission fees vary based on the contract price, starting from 1.210% for amounts under 1 million yen, with a minimum fee of 2,750 yen (2,500 yen excluding tax). As the contract price increases, the percentage-based commission decreases, but a fixed fee component also increases, designed to accommodate larger transactions efficiently.

For online transactions, excluding stock acquisition rights, fees are calculated differently, with a flat rate of 1,650 yen (1,500 yen excluding tax) for amounts under 1 million yen. For contracts over 1 million yen, fees are a combination of a percentage of the contract price and an additional fixed fee, decreasing in proportion to larger transaction amounts up to 50 million yen.

Shizugin TM Securities App Review

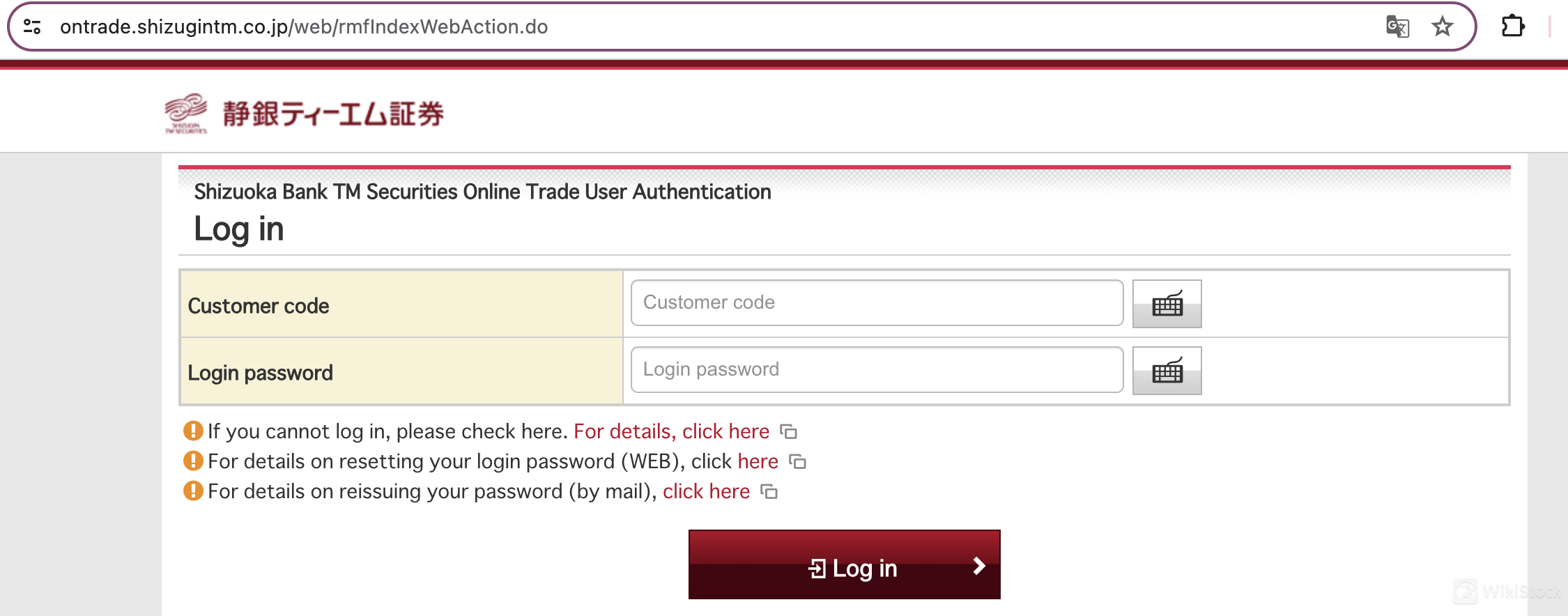

Shizugin TM Securities offers an online trading platform. The platform provides convenient access to a wide range of financial instruments including stocks, ensuring traders can execute transactions effectively. Users should be aware of scheduled maintenance periods during which access to the platform is temporarily unavailable.

Research & Education

Shizugin TM Securities prioritizes comprehensive research and education resources. Their operation guidebooks, including basic operations and trading editions, serve as foundational resources for clients to understand the functionalities of their trading platform and execute transactions. Additionally, Shizugin TM Securities offers electronic delivery services, allowing customers to view documents such as transaction reports that they currently deliver by mail through online trading.

Customer Service

Shizugin TM Securities is committed to providing customer service through its widespread branches, specifically the Head Office Sales Department located at 1-13 Oite-cho, Aoi-ku, Shizuoka City (Agora Shizuoka 2nd floor). Clients can reach out to them directly via telephone at 054-255-7511 for inquiries, assistance with account management, and support related to investment transactions. Communication can also be facilitated through fax at 054-205-0881 for documentation and correspondence needs.

Conclusion

Shizugin TM Securities distinguishes itself as a reliable brokerage firm committed to offering a comprehensive range of financial services and investment opportunities. With a focus on client satisfaction and accessibility, the company provides robust support through both traditional face-to-face interactions at its branches, exemplified by the Head Office Sales Department in Shizuoka Prefecture, and modern online platforms.

FAQs

Is Shizugin TM Securities a good platform for beginners?

The availability of operation guidebooks and electronic delivery services helps beginners understand their trading platform and access transaction documents.

Is Shizugin TM Securities legit?

Shizugin TM Securities is regulated by the Japan Financial Services Agency (FSA), licensed by the 東海財務局長 (Chubu Local Finance Bureau) under license number 第10号.

Is Shizugin TM Securities good for investing/retirement?

Shizugin TM Securities offers a range of investment options including investment trusts, stocks, bonds, and Shizuoka bank wrap products, which are suitable for investing and retirement planning purposes.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

More than 20 year(s)

Commission Rate

0.011%

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

寿証券

Score

Centrade

Score

めぶき証券

Score

浜銀TT証券

Score

おきぎん証券

Score

ワンアジア証券

Score

木村証券

Score

西日本シティTT証券

Score

Kuni Umi AI Securities

Score

香川証券

Score