Score

丸近證券

http://www.maruchika-shoken.co.jp/

Website

Rating Index

Brokerage Appraisal

Products

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

MARUCHIKA SECURITIES CO.,LTD

Abbreviation

丸近證券

Platform registered country and region

Company address

Company website

http://www.maruchika-shoken.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

1.012%

Margin Trading

YES

Regulated Countries

1

Products

5

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| Maruchika Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Application Fee for Mutual Funds | less than 50 million yen, 3.3% (tax included) |

| 50 million yen or more and less than 200 million yen, 2.2% (tax included) | |

| 200 million yen or more and less than 500 million yen, 1.65% (tax included) | |

| 500 million yen or more, 1.1% (tax included) | |

| Trust Fees | 1.584% per annum (tax included) |

| Margin Interest Rates | Not Mentioned |

| Mutual Funds Offered | Available |

| App/Platform | Not Mentioned |

| Promotions | Unavailable |

Maruchika Securities Information

Maruchika Securities is a regulated financial services company based in Japan. The company provides access to domestic stocks listed on major Japanese exchanges, investment trusts managed by leading asset managers like Nomura Asset Management, and various popular mutual fund products. Additionally, Maruchika Securities offers a wealth of educational resources, including market updates, and company notice.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Margin Interest Rates Not Mentioned |

| Diverse Financial Services | Platform Information Not Provided |

| Educational Resources | |

| Comprehensive Fee Structure |

- Regulated by FSA: Maruchika Securities is regulated by theFinancial Services Agency (FSA), ensuring adherence to stringent financial standards and investor protection.

- Diverse Financial Services: Offers domestic stocks, investment trusts, and mutual funds.

- Educational Resources: Provides extensive educational resources, including market updates and company notices, to inform investors.

- Comprehensive Fee Structure: Transparent fee structure with application fees and trust fees clearly outlined.

- Margin Interest Rates Not Mentioned: Lack of information on margin interest rates can hinder decision-making for margin trading.

- Platform Information Not Provided: Absence of details about trading platforms or apps can be a drawback for tech-savvy investors.

Is Maruchika Securities Safe?

Maruchika Securities is regulated by the oversight of the oversight of the Financial Services Agency (FSA). This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, Maruchika Securities ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with Maruchika Securities?

Maruchika Securities offers a comprehensive suite of trading products, including domestic stocks, investment trusts, and popular mutual fund products.

In the domestic stock market, they handle listed stocks across multiple Japanese exchanges such as the Tokyo Stock Exchange, Nagoya Stock Exchange, Fukuoka Stock Exchange, and Sapporo Stock Exchange. Their investment trust options, managed primarily by Nomura Asset Management, combine investor funds to manage diverse portfolios in bonds, stocks, and other assets, distributing profits based on investment performance.

Among their notable mutual fund offerings are the Nomura Global Industry Investment Series, Nomura Japan Open, and the Nomura Global AI Equity Fund.

Maruchika Securities Fees Review

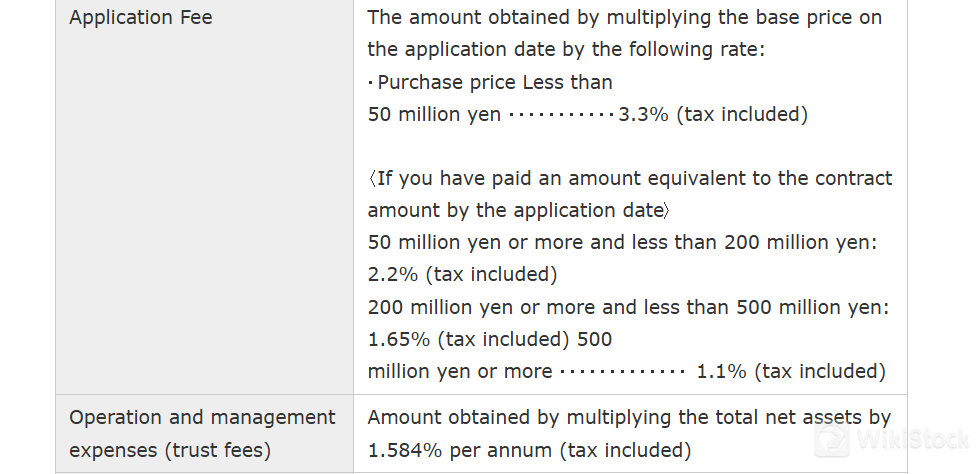

Maruchika Securities applies a structured fee system for their mutual funds.

The application fee is calculated based on the purchase price at the application date. For purchase prices less than 50 million yen, the fee is 3.3% (tax included). For amounts between 50 million yen and less than 200 million yen, the fee decreases to 2.2% (tax included). For amounts between 200 million yen and less than 500 million yen, the fee is further reduced to 1.65% (tax included), and for amounts of 500 million yen or more, the fee is 1.1% (tax included).

Additionally, Maruchika Securities charges operation and management expenses, or trust fees, which are 1.584% per annum (tax included) of the total net assets.

Research & Education

Maruchika Securities provides a robust selection of educational resources to keep investors informed about the stock market situation and important notices. These resources are designed to help both novice and experienced investors understand market dynamics, investment strategies, and the latest developments in the financial world. The company offers regular market updates, detailed analysis reports, and insightful commentary from industry experts.

Customer Service

Maruchika Securities provides an accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

- Tel: 075-341-5110, 075-351-0059 (workdays 9:00~17:00)

- Address: 526, Ebisuno-cho, Teramachi-dori, Shimogyo-ku, Kyoto-shi, Kyoto TEL

Conclusion

In conclusion, Maruchika Securities presents itself as a regulated and comprehensive trading platform, offering a diverse range of investment services with transparent fee structure and comprehensive educational resources. However, the lack of information on margin interest rates and platform specifics can hinder a trader's decision-making process. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is Maruchika Securities suitable for beginners?

Yes, Maruchika Securities is suitable for beginners due to its user-friendly platform, educational resources, and comprehensive customer support.

Is Maruchika Securities legit?

Yes, Maruchika Securities is regulated by FSA.

What types of investment products does Maruchika Securities offer?

Maruchika Securities offers domestic stocks listed on major Japanese exchanges (Tokyo, Nagoya, Fukuoka, Sapporo), investment trusts managed by firms like Nomura Asset Management, and various mutual funds.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

More than 20 year(s)

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

寿証券

Score

Centrade

Score

めぶき証券

Score

浜銀TT証券

Score

おきぎん証券

Score

ワンアジア証券

Score

木村証券

Score

西日本シティTT証券

Score

Kuni Umi AI Securities

Score

香川証券

Score