Zhongrong PT Securities Limited ("ZRPTS") is a subsidiary of Zhongrong International Trust Co., Ltd ("Zhongrong Trust"). Headquartered in Hong Kong, ZRPTS specialized in providing innovative cross-border financial services and solutions.

What is ZRPTS?

Zhongrong PT Securities (ZRPTS) provides comprehensive trading services with a focus on securities and futures, leveraging advanced platforms that require Microsoft .NET Framework and Java Runtime Environment. The firm maintains competitive trading fees and a variety of account services but does not disclose specific details regarding interests on uninvested cash and mutual funds offered, potentially limiting information accessibility for prospective clients.

Pros and Cons of ZRPTS

Zhongrong PT Securities (ZRPTS) is a regulated and reputable brokerage known for its strong security measures and effective customer support. However, the firm lacks transparency regarding its account types and falls short in providing educational resources and a broad range of mutual fund offerings and promotions. These shortcomings could restrict its appeal to new and diverse investors looking for comprehensive trading support and varied investment opportunities.

Is ZRPTS safe?

ZRPTS is a regulated entity under the Securities and Futures Commission of Hong Kong, with license number AAV553. This indicates that ZRPTS adheres to the financial regulations set by the local authority in Hong Kong.

ZRPTS insures its clients' account funds for up to HK$1 million per client. The insurance is underwritten by an approved insurance company and covers losses to client account funds due to fraud, theft, or negligence.

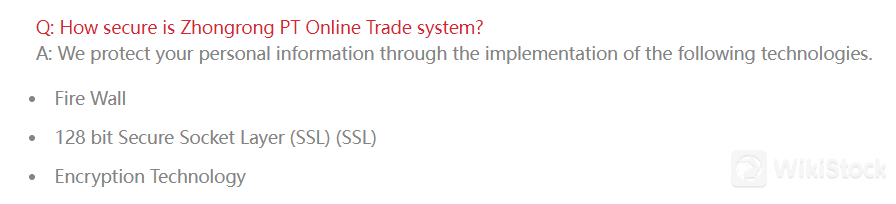

Zhongrong PT Online Trade system employs several security measures including a firewall, 128-bit SSL (Secure Socket Layer) encryption, and encryption technology to protect personal information, indicating a robust approach to cybersecurity.

What are securities to trade with ZRPTS?

ZRPTS offers trading in securities and futures. However, it does not provide options, forex, or cryptocurrencies. The available products, securities, and futures, allow traders to invest in various stock instruments and to speculate on the future value of financial assets or commodities, respectively.

Securities: This category includes tradable financial assets such as stocks, bonds, and mutual funds. Investors purchase these to own a share of a corporation, receive regular interest payments, or benefit from diversified investment management.

Futures: Futures are standardized contracts to buy or sell a specific asset at a predetermined price at a specified time in the future. These are used primarily for hedging risk or speculating on price movements of commodities, currencies, or financial instruments.

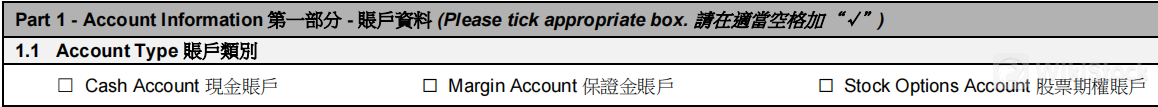

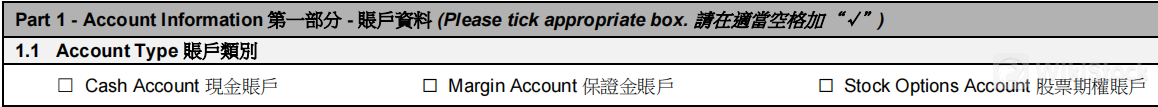

ZRPTS Accounts

The trading accounts offered by ZRPTS include:

Cash Account: Requires payment in full for securities purchased and does not allow borrowing against the value of securities.

Margin Account: Allows investors to borrow money from the broker to purchase securities, providing the capability to leverage investments.

Stock Options Account: Designed for trading options, providing the ability to engage in more complex strategies like hedging and speculation with potential for higher returns or protection against losses.

ZRPTS Fees Review

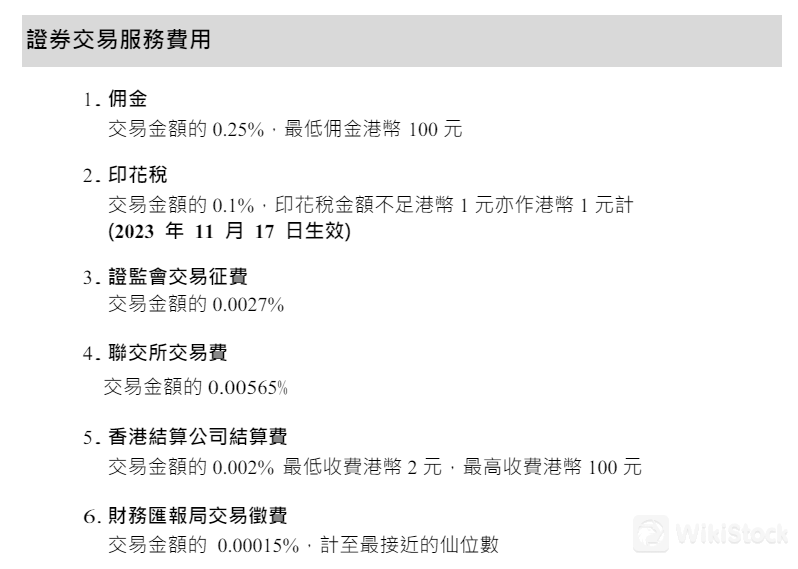

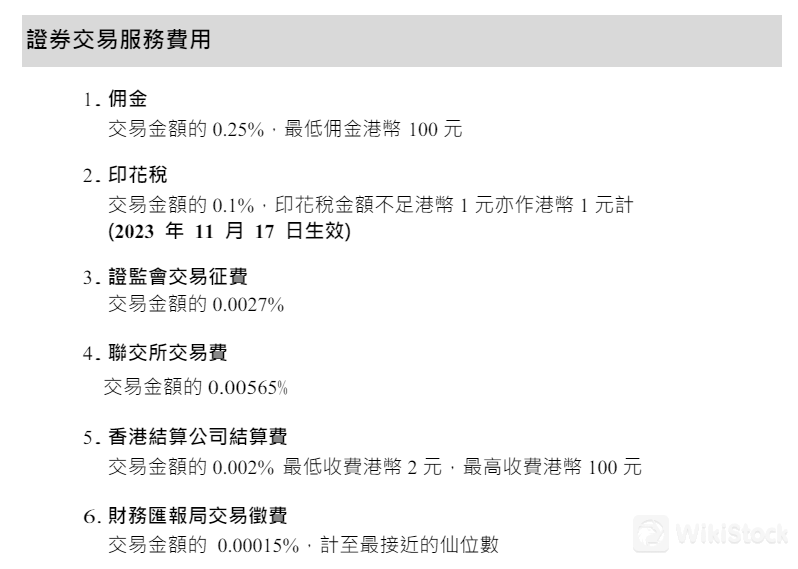

Securities Trading Service Fees

Commission: 0.25% of the transaction amount, minimum commission HKD 100.

Stamp Duty: 0.1% of the transaction amount, with a minimum charge of HKD 1.

Securities and Futures Commission Transaction Levy: 0.0027% of the transaction amount.

Hong Kong Exchange Trading Fee: 0.00565% of the transaction amount.

Hong Kong Clearing House Settlement Fee: 0.002% of the transaction amount, minimum HKD 2, maximum HKD 100.

Financial Reporting Council Transaction Levy: 0.00015%, rounded to the nearest cent.

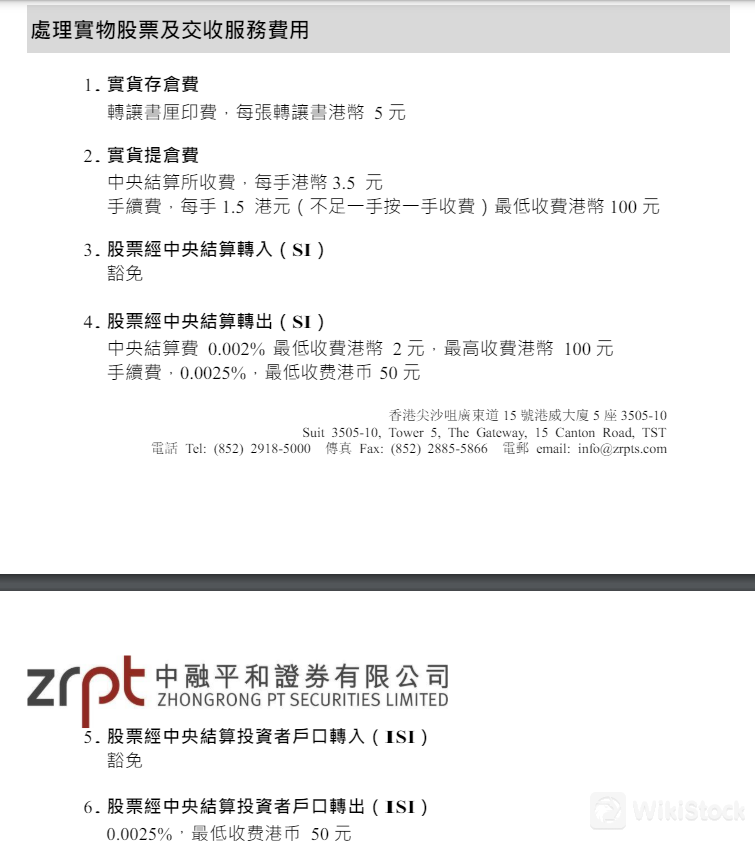

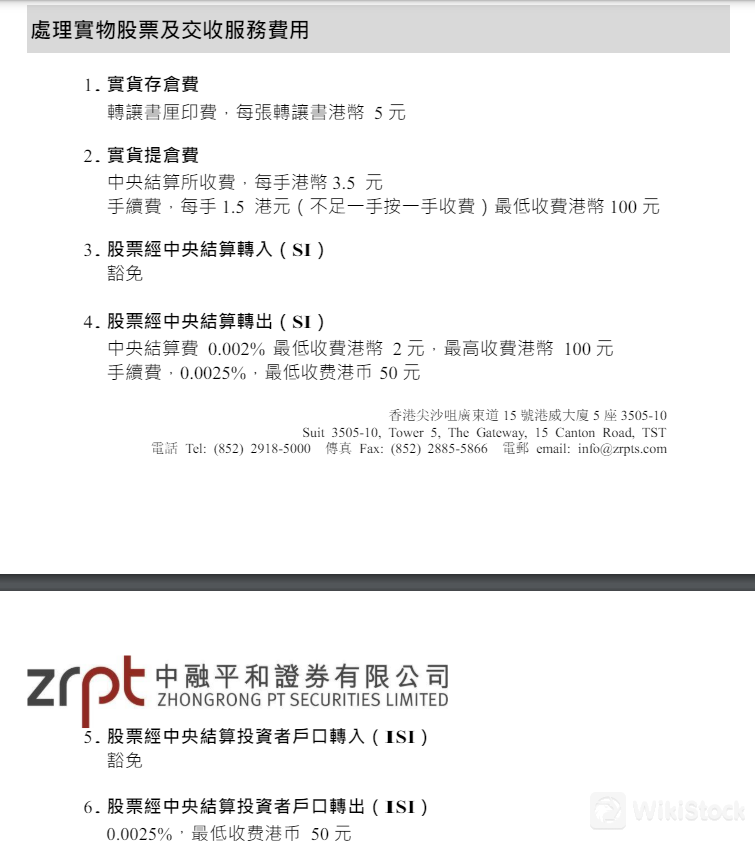

Handling Physical Stock and Settlement Service Fees

Physical Stock Custody Fee: Transfer book duty fee, HKD 5 per transfer book.

Physical Stock Withdrawal Fee: Central Clearing fee, HKD 3.5 per lot; Handling fee, HKD 1.5 per lot, minimum charge HKD 100.

Stock Transfer Out via Central Clearing: Clearing fee 0.002%, minimum HKD 2, maximum HKD 100; Handling fee 0.0025%, minimum HKD 50.

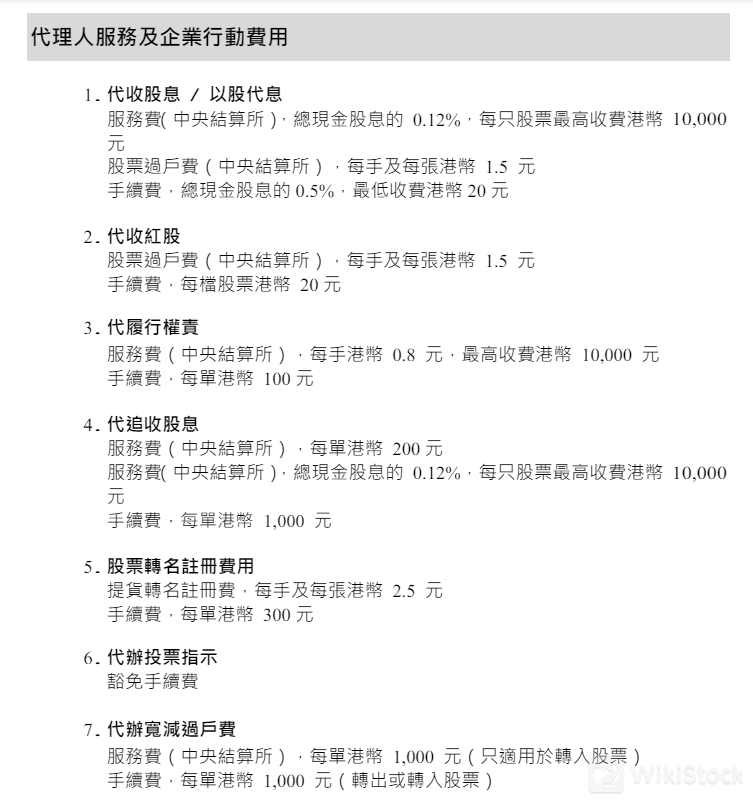

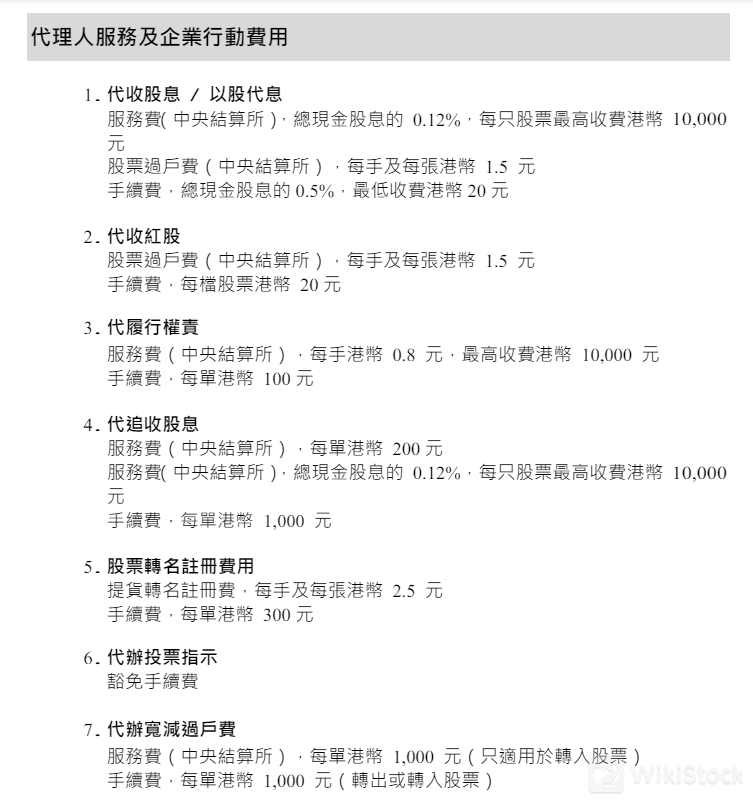

Agency Services and Corporate Action Fees

Dividend Collection/Stock Dividend: Service fee, 0.12% of the total cash dividend, maximum HKD 10,000 per stock; Transfer fee, HKD 1.5 per lot and per transfer book; Handling fee, 0.5% of the total cash dividend, minimum HKD 20.

Bonus Shares Collection: Transfer fee, HKD 1.5 per lot and per transfer book; Handling fee, HKD 20 per stock.

Exercise of Rights: Service fee, HKD 0.8 per lot, maximum HKD 10,000; Handling fee, HKD 100 per order.

Dividend Recovery: Service fee, HKD 200 per order; Service fee, 0.12% of the total cash dividend, maximum HKD 10,000 per stock; Handling fee, HKD 1,000 per order.

Account Service Fees

Custody Fee: HKD 0.012 per share, minimum charge HKD 1.

Application for Investor Stock Sub-account (for cash accounts only): Handling fee, HKD 60 per month per account.

Inactive Account Fee for 6 months without trading: HKD 100 every six months.

Account Balance Certificate Issuance: HKD 350 per account.

Reprint of Daily/Monthly Statement: HKD 10 within 3 months, HKD 20 within 2 years, HKD 50 for older than 2 years.

Mailing Monthly Statements: HKD 10 per month.

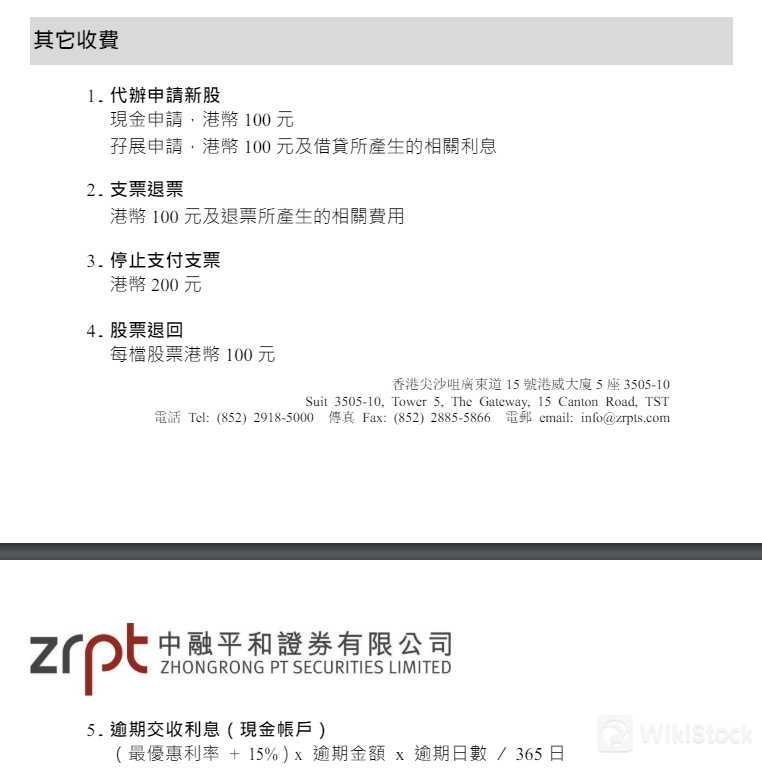

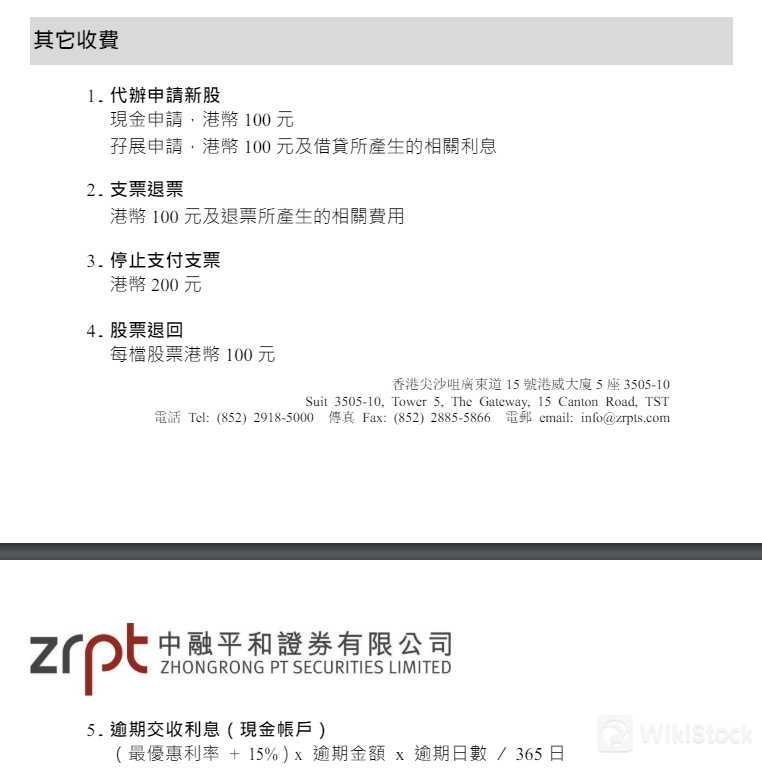

Other Charges

New Shares Application Fee: HKD 100 for cash applications; HKD 100 plus related interest for margin applications.

Cheque Return Fee: HKD 100 plus related costs.

Stop Payment on Cheque: HKD 200.

Stock Return: HKD 100 per stock.

Overdue Settlement Interest: Charged as (most favorable rate + 15%) x overdue amount x days overdue / 365 days.

ZRPTS App Review

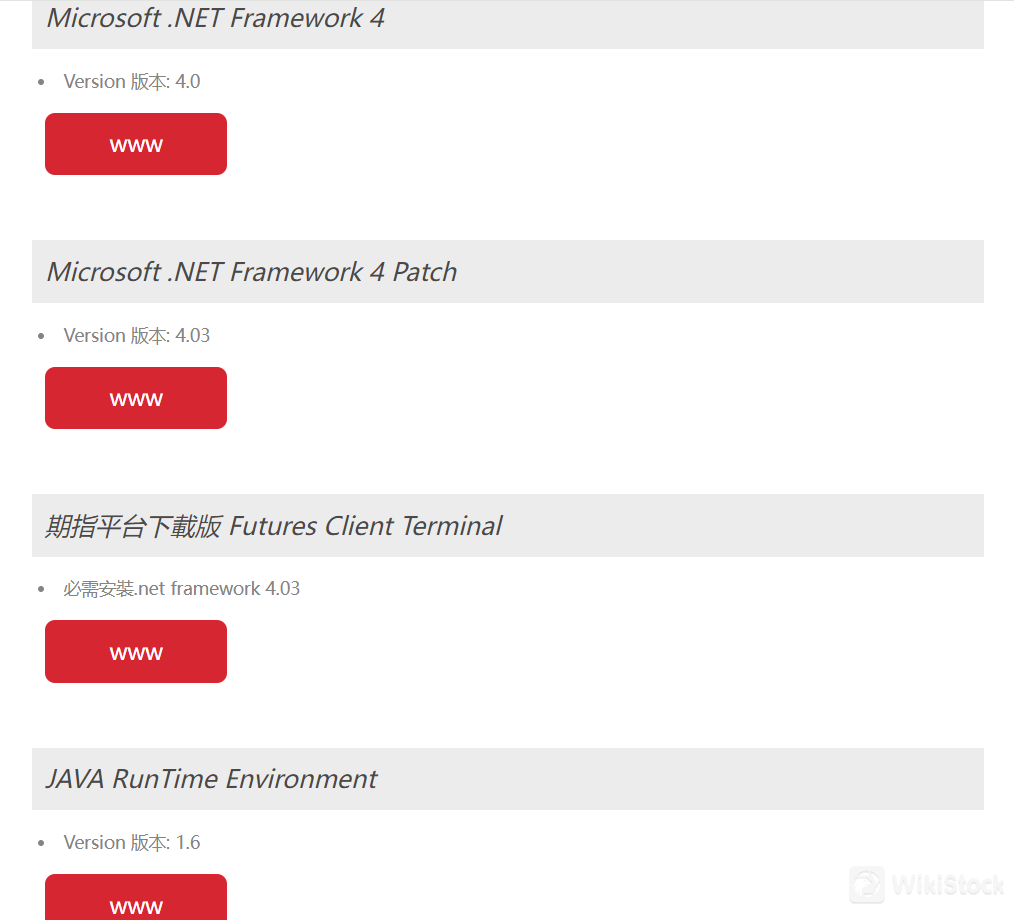

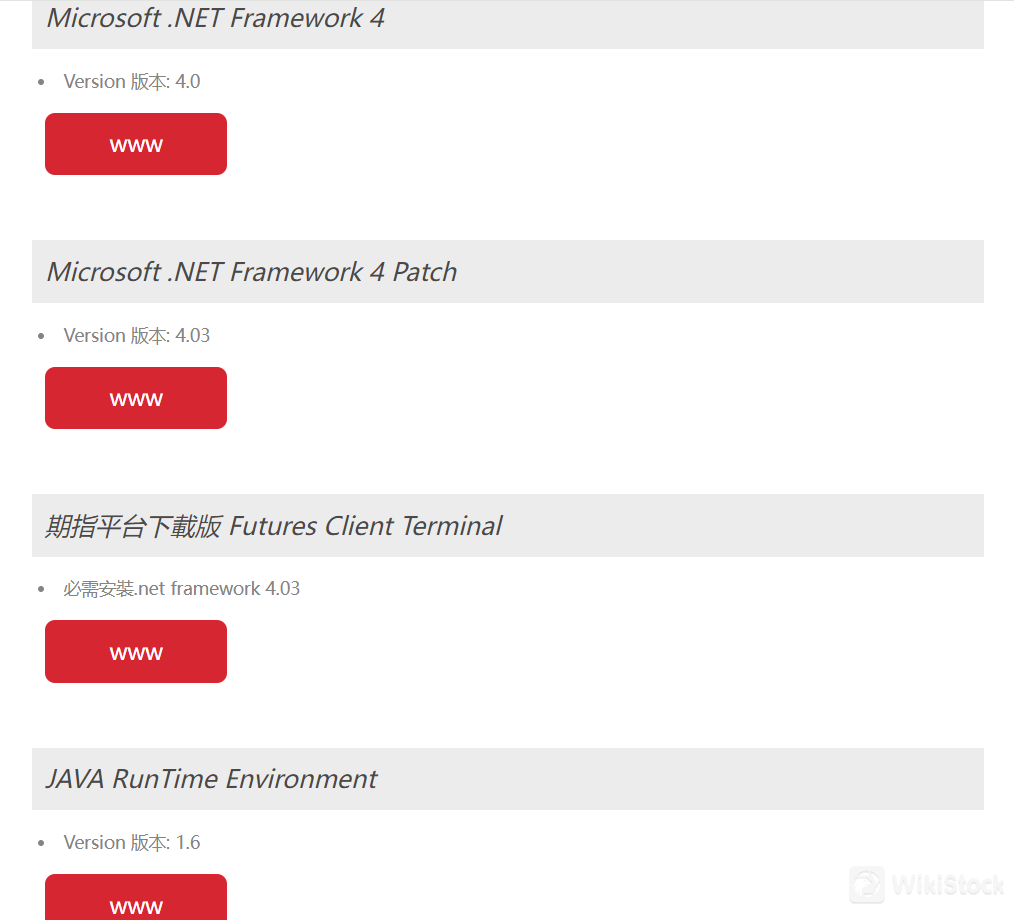

The ZRPTS application utilizes multiple software frameworks to ensure compatibility and performance:

Microsoft .NET Framework 4: A software framework developed by Microsoft that supports the creation and execution of applications on Windows platforms.

Microsoft .NET Framework 4 Patch (Version 4.03): An updated version of the .NET Framework which includes patches and improvements to enhance stability and performance.

Futures Client Terminal: Specifically designed for futures trading, this client terminal relies on .NET Framework 4.03 to function effectively, facilitating real-time market data processing and trading operations.

JAVA Runtime Environment (Version 1.6): Supports applications that are developed in Java, ensuring that they run smoothly and efficiently on a variety of systems.

Research and Eduation

ZRPTS provides an extensive archive of weekly market reports. These reports, available in PDF format, cover a range of dates and are updated regularly. Each report includes detailed market analysis and insights pertinent to the given week, helping traders and investors stay informed about market trends and potential investment opportunities. The regular updates suggest a commitment to providing timely and relevant information to users.

Customer Service

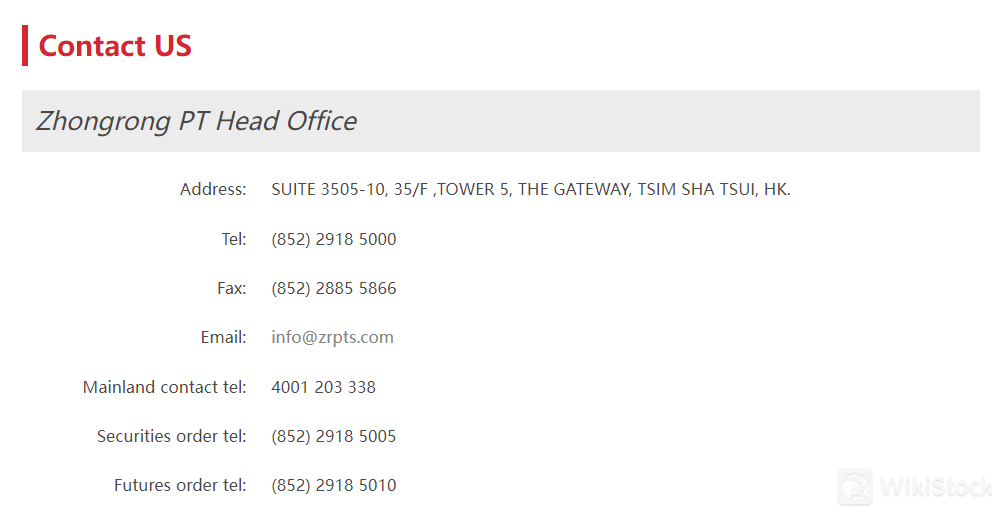

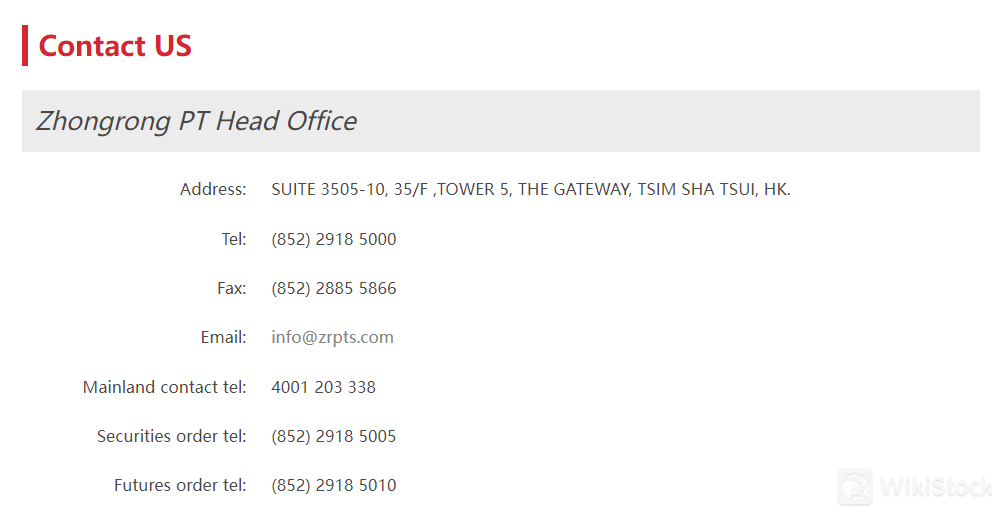

The customer service of Zhongrong PT (ZRPTS) includes multiple contact options to cater to various needs:

Head Office Address: Suite 3505-10, 35/F, Tower 5, The Gateway, Tsim Sha Tsui, Hong Kong.

Telephone: General inquiries can be made at (852) 2918 5000.

Fax: (852) 2885 5866.

Email: Inquiries can also be directed to info@zrpts.com.

Mainland Contact Number: 4001 203 338 for customers in Mainland China.

Securities Orders: Direct securities trading inquiries or orders can be placed at (852) 2918 5005.

Futures Orders: Futures trading inquiries or orders can be placed at (852) 2918 5010.

Conclusion

Zhongrong PT Securities (ZRPTS) stands out for its rigorous regulatory compliance and robust security infrastructure, making it a reliable choice for investors who prioritize safety and regulatory oversight. The firm's effective customer service further ensures a supportive trading experience. Given its strengths, ZRPTS is particularly suitable for experienced investors who focus primarily on securities and futures trading and value a secure and professionally supported trading environment. However, it may be less appealing to beginners or those seeking extensive educational resources and a wide range of investment products.

FAQs

How secure is trading with ZRPTS?

Trading with ZRPTS is secure due to its robust security measures, including advanced encryption technologies and adherence to stringent regulatory standards by the Securities and Futures Commission of Hong Kong.

Is ZRPTS a suitable platform for novice traders?

While ZRPTS offers strong support and secure trading environments, it may not be ideal for beginners due to its limited educational resources and lack of comprehensive guides for new investors.

Is ZRPTS a legitimate brokerage firm?

Yes, ZRPTS is a legitimate brokerage, fully regulated by the Securities and Futures Commission of Hong Kong, ensuring compliance with all necessary financial regulations and standards.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--