Score

PayPay証券

https://www.paypay-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

A

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Surpassed 79.66% brokers

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

PayPay Securities Corporation

Abbreviation

PayPay証券

Platform registered country and region

Company address

Company website

https://www.paypay-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.5%

Minimum Deposit

$0.769

Margin Trading

YES

Long-Short Equity

YES

| PayPay Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Fees | Transfer Fees:110 yen |

| Interests on uninvested cash | 4.98% |

| Margin Interest Rates | 10% |

| Mutual Funds Offered | Japan Stocks(Individual Stocks,ETFS,REITs),Investment trust,10x CFD,U.S.Stocks(Individual Stocks and ETFs),Japan Stocks CFDs,iDeCo,NISA |

| App/Platform | PayPay Asset Management,PayPay Securities App |

What is PayPay Securities?

PayPay Securities offers a range of investment options including individual stocks, ETFs, REITs, investment trusts, and CFDs in both Japan and the U.S.

They attract investors through their mobile-friendly platforms, PayPay Asset Management and PayPay Securities App. However, the 10% margin interest rate might deter frequent leveraged traders, despite other perks like a 4.98% interest in uninvested cash and a modest transfer fee of 110 yen.

Pros & Cons

| Pros | Cons |

| Multiple Tradable Assets(Across Japan and U.S Stocks) | No 24/7 Live Chat |

| Regulated by FSA | No Promotion For Users |

| Different Trading Platform For Trading and Management | No Diverse Accounts |

| Popular Brands From 100 yen | Ask For Transfer Fee As 110 yen |

| Offering PayPay Points For Investment. |

Pros:

PayPay Securities offers a broad range of assets across Japanese and U.S. markets, regulated by Japan's FSA. The platforms are tailored for different trading and management needs, with investments starting from 100 yen and additional benefits like PayPay points for investments.

Cons:

The service lacks 24/7 live chat support and does not offer promotional incentives for users. It also falls short in providing diverse account options and charges a transfer fee of 110 yen.

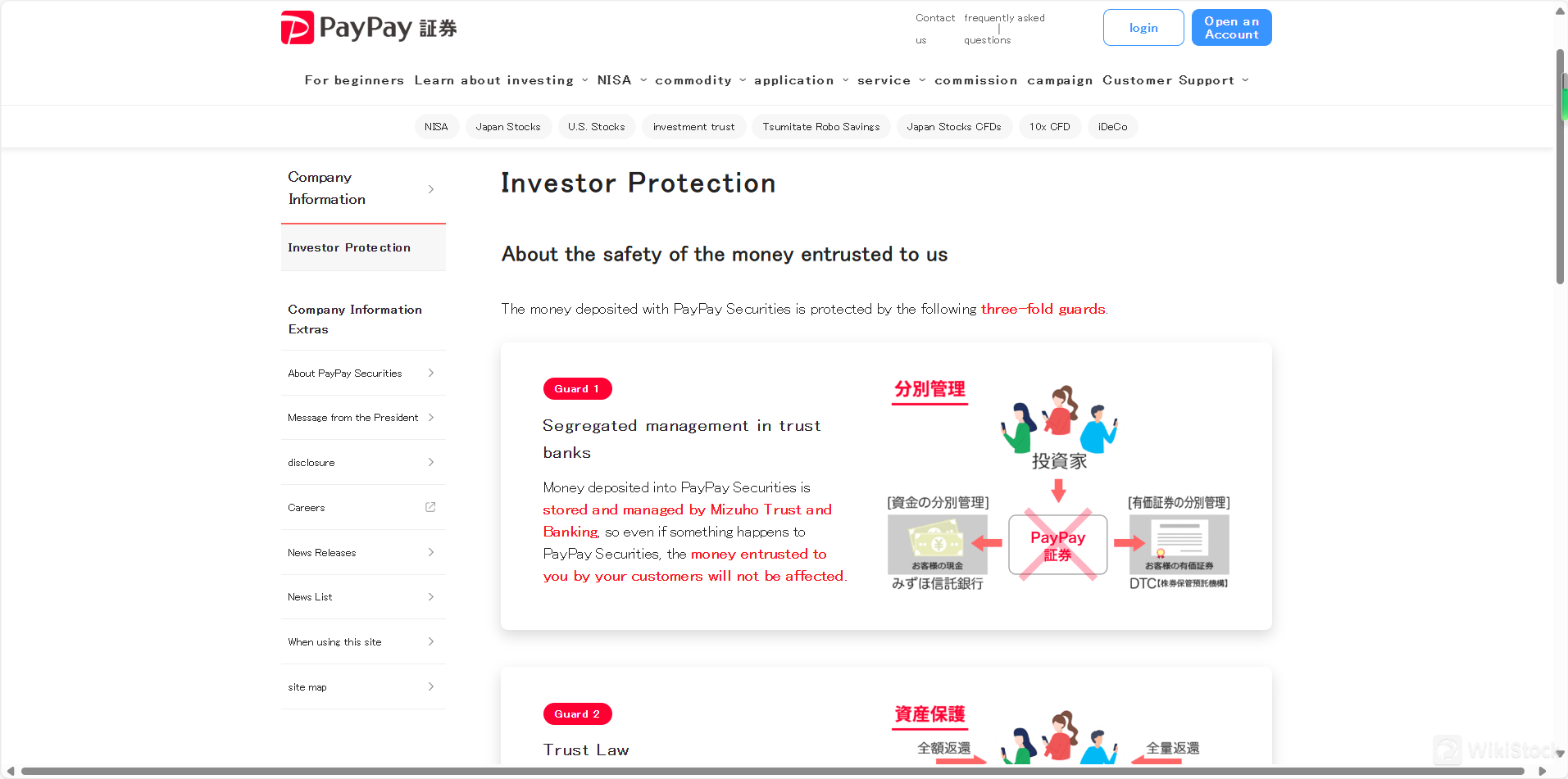

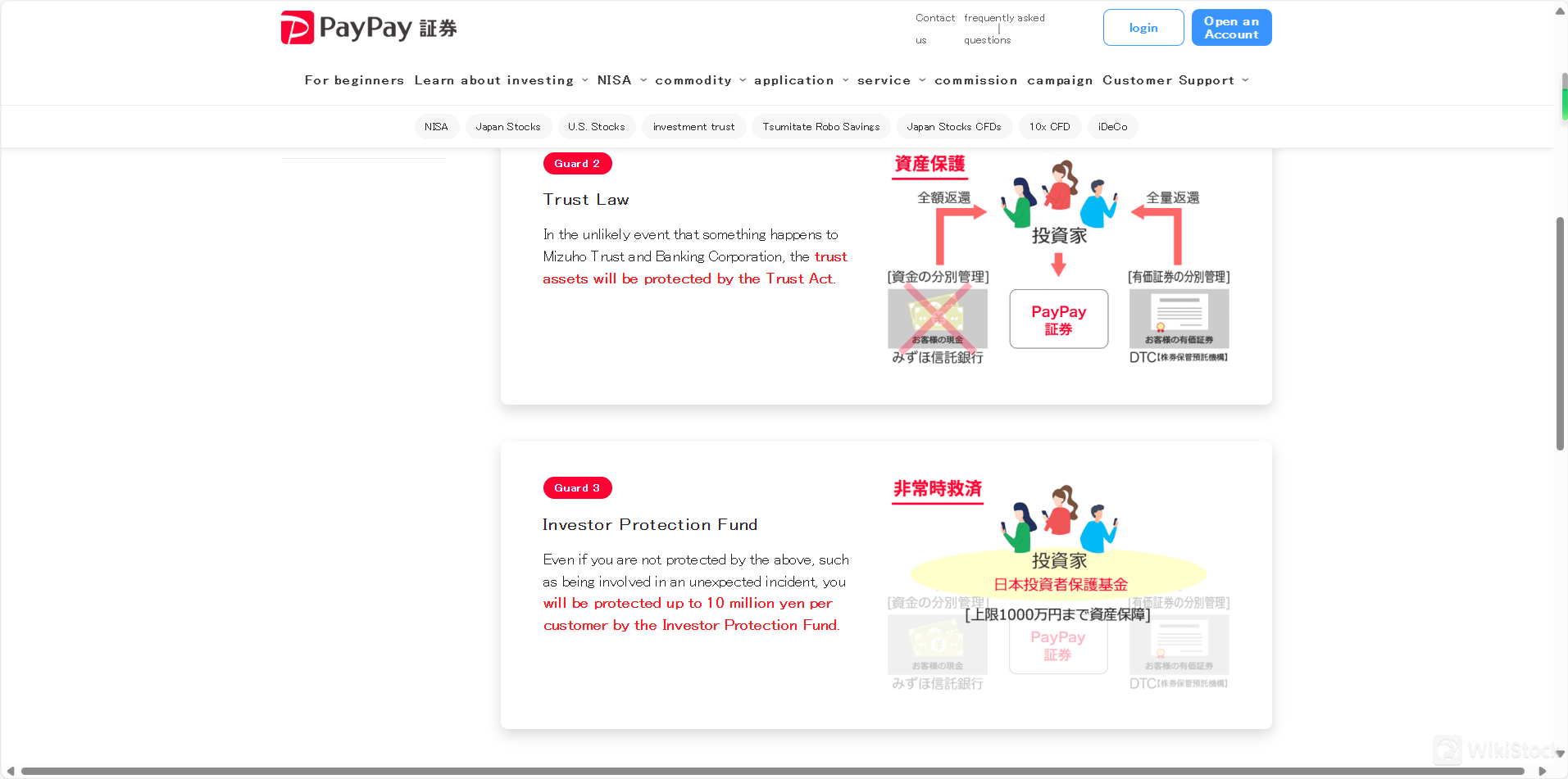

Is PayPay Securities Safe?

Regulations:

PayPay Securities is regulated by the Japan Financial Services Agency (FSA), holding a license with number 関東財務局長(金商)第2883号.

Funds Safety:

PayPay Securities prioritizes the safety of client funds by enforcing strict rules against accepting third-party deposits and withdrawals. All transactions must pass compliance checks and adhere to Anti-Money Laundering (AML) regulations, ensuring all fund handling meets legal standards.

Safety Measures:

PayPay Securities has implemented robust safety measures to protect client assets and ensure transaction security:

Clients are advised against giving their money to third parties for depositing to reduce fraud risk.

Maintaining open and timely communication with clients through deposit confirmations and customer service hotlines enhances transparency and security.

Verification processes for deposits and withdrawals to confirm the identity of depositors and the legitimacy of the funds.

Rejection of suspicious transactions and the right to return funds to the source if discrepancies are suspected.

Japanese Stocks (Individual Stocks and ETFs): Investors can trade in a broad selection of Japanese stocks, including leading and smaller companies, as well as Exchange Traded Funds (ETFs) that track various indices and sectors.

U.S. Stocks (Individual Stocks and ETFs): PayPay Securities also provides access to U.S. markets, allowing traders to invest in individual stocks of major American companies and ETFs.

Investment Trusts: These are available for those looking to invest in diversified portfolios managed by professionals, which can include a mix of stocks, bonds, and other securities.

CFDs (Contract for Difference):

Japan Stocks CFDs: Enables trading on the price movements of Japanese stocks without the need for actual ownership.

10x CFD: Offers higher leverage options, up to 10 times, allowing significant exposure to market movements with a smaller capital outlay.

REITs (Real Estate Investment Trusts): Provides an opportunity to invest in real estate markets through publicly traded REITs, which offer potential income from dividends and property appreciation.

iDeCo (Individual Defined Contribution Pension Plan): A personal pension scheme in Japan that allows individuals to contribute to their retirement savings, benefiting from tax advantages.

Deposits: There are no charges for depositing funds into PayPay Securities accounts if done via bank transfer. However, the customer bears any transfer fees charged by their bank.

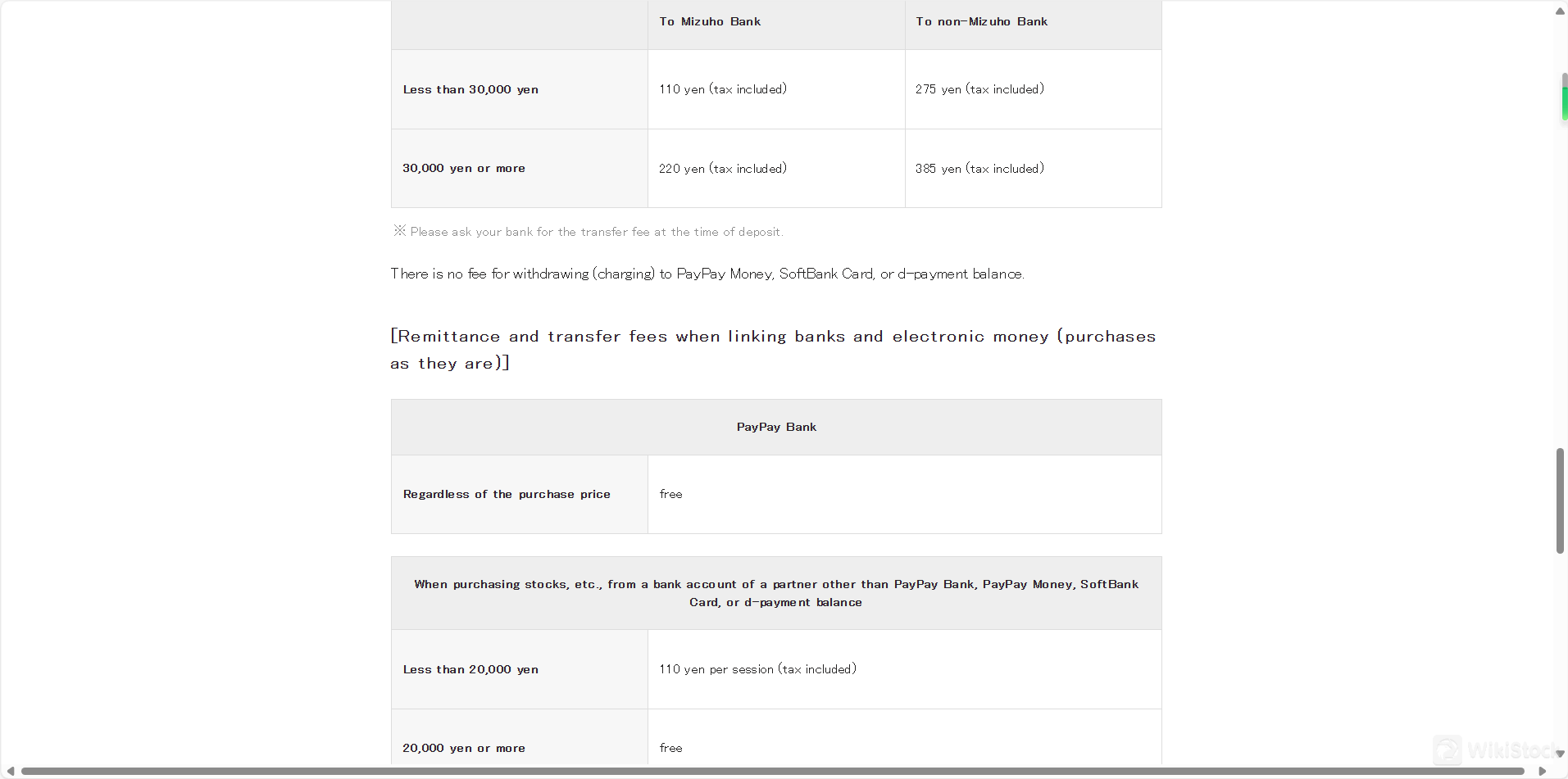

Withdrawals to Registered Bank Accounts:

Below 30,000 yen: 110 yen (tax included) for withdrawals to Mizuho Bank; 275 yen (tax included) for other banks.

30,000 yen and above: 220 yen (tax included) for withdrawals to Mizuho Bank; 385 yen (tax included) for other banks.

Electronic Money Transfers: There is no charge for transferring funds to electronic money formats like PayPay Money, SoftBank Card, or D payment balances.

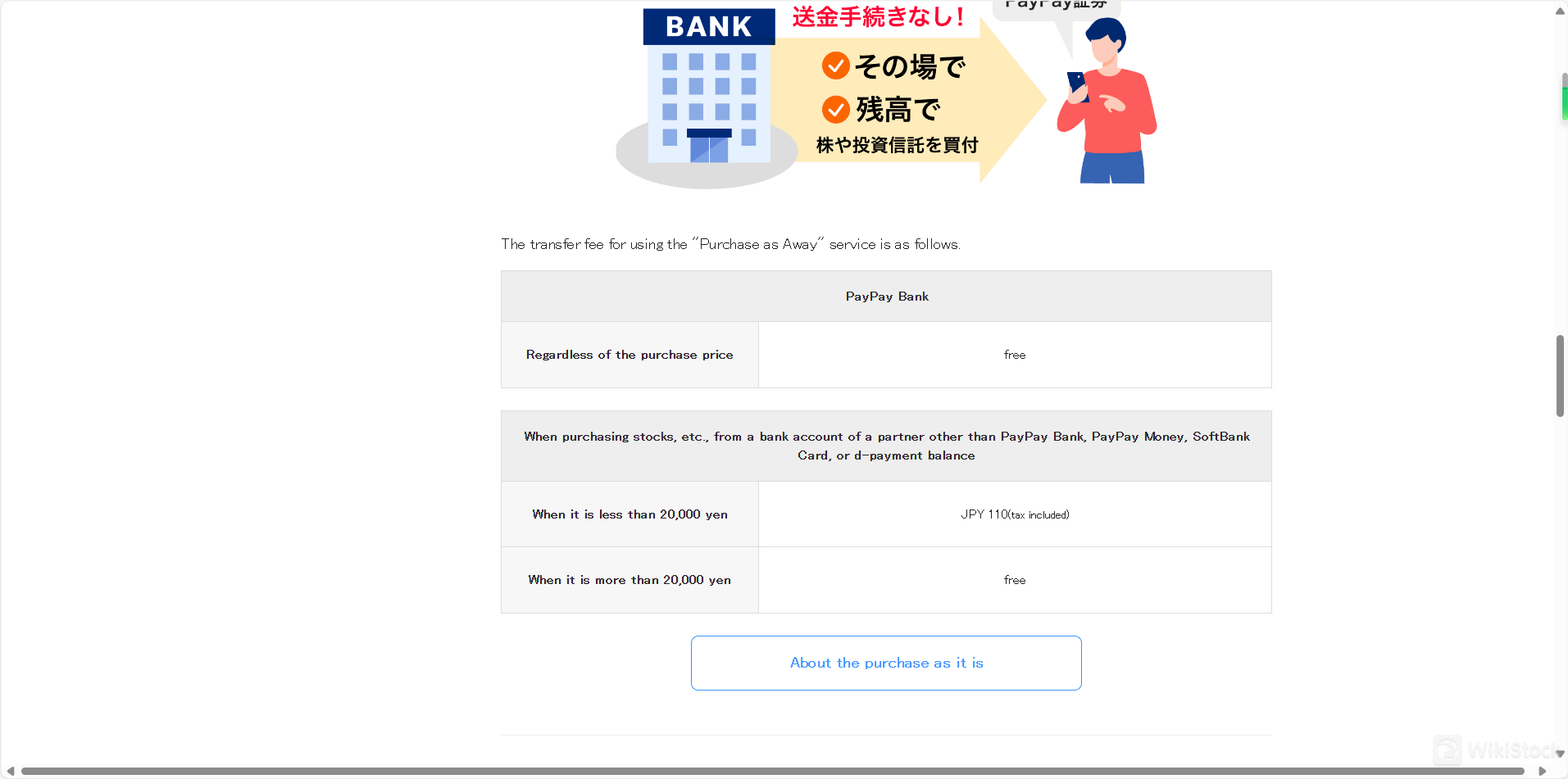

Stocks and Investment Trusts: Trading fees for stocks and investment trusts depend on the transaction amount and the method of purchase. For transactions under 20,000 yen using non-PayPay bank accounts, a fee of 110 yen (tax included) is charged. Transactions of 20,000 yen or above are free of charge.

CFDs and Leveraged ETFs: Specific fees associated with CFDs and leveraged ETF transactions were not detailed, implying that they could vary based on the product or market conditions.

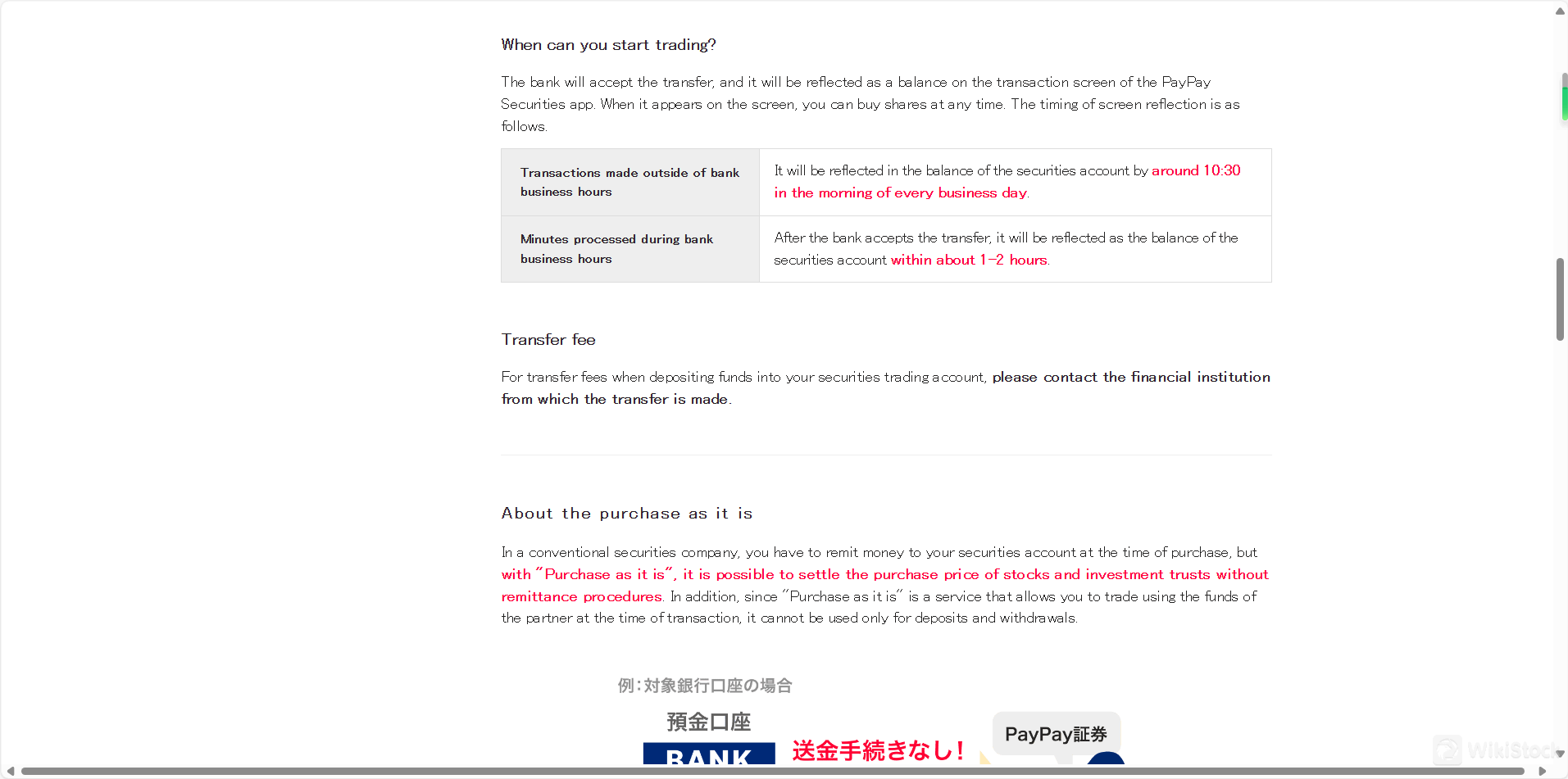

“Buy as it is” Purchases: This service allows users to trade without needing to transfer funds beforehand. It utilizes funds directly from linked bank accounts or PayPay balances. There are no additional fees for this service when using PayPay Bank.

Between Trading Accounts: Transfers between CFD and securities trading accounts are free of charge.

Handling of Dividends and Corporate Actions: Specific fees related to the handling of dividends and corporate actions are not mentioned, suggesting they may be included in the service without additional costs or handled through standard transaction fees.

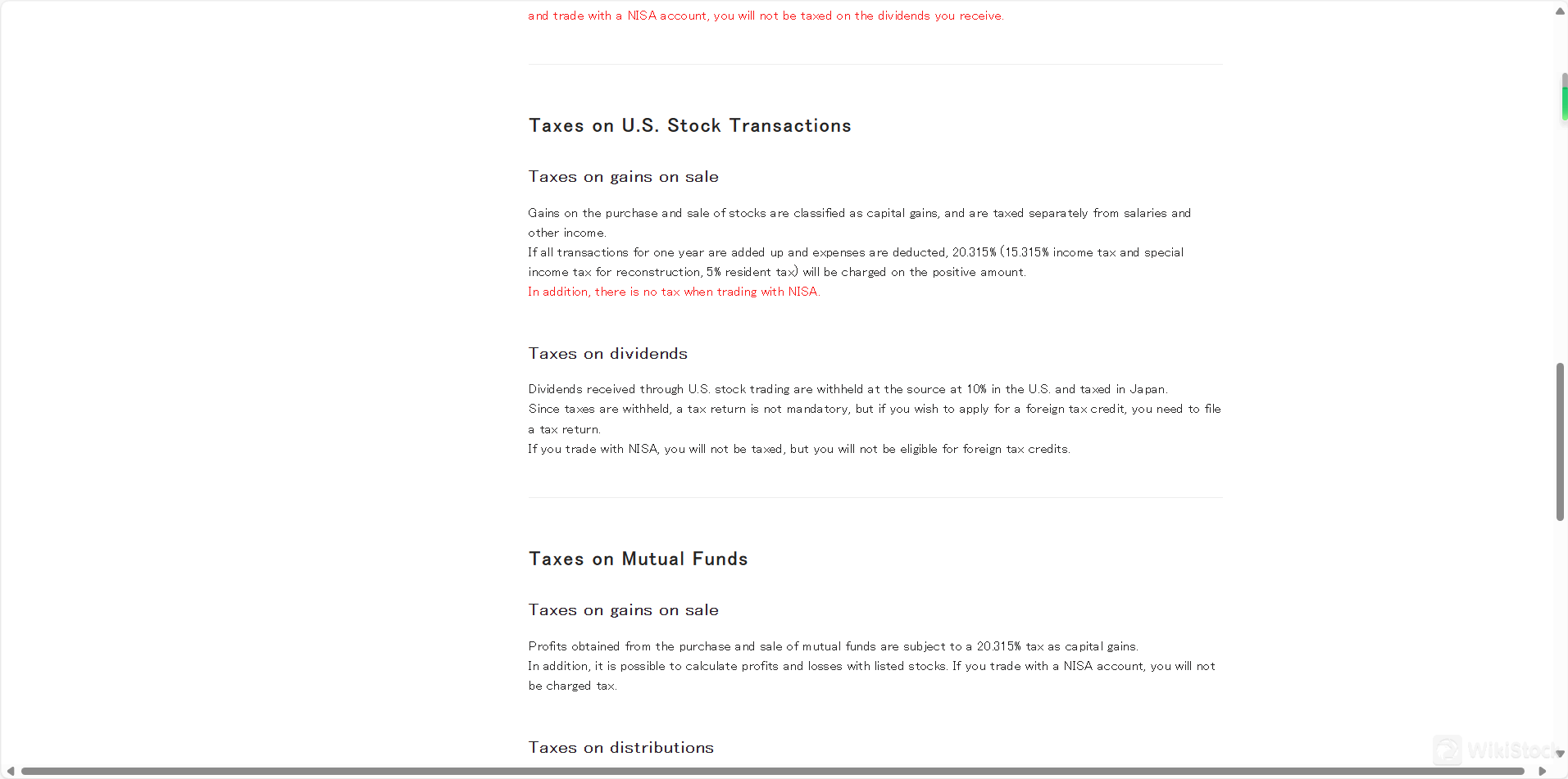

Capital Gains and Dividends: For securities trading, a tax rate of 20.315% applies to capital gains and dividends, which is withheld at the source. NISA accounts, however, are exempt from these taxes.

PayPay Asset Management App:

Target Audience: Current PayPay users.

Features: Designed to integrate into the PayPay ecosystem, this app provides an easy and familiar environment for PayPay users to start investing. Ideal for those already accustomed to the PayPay interface, it aims to simplify the transition from using PayPay for daily transactions to managing investments.

Availability: Downloadable from the App Store and Google Play.

PayPay Securities App:

Target Audience: Individuals not currently using PayPay.

Features: This app is crafted to offer a comfortable and efficient investment experience even for those who are new to PayPay. It focuses on providing a user-friendly interface that supports new investors in navigating the complexities of the securities market with ease.

Availability: Also available on the App Store and Google Play.

For Beginners: The platform provides introductory resources that help new investors learn about investing basics, different types of securities, and how to start building their investment portfolios.

Investment Trusts and Stock Analysis: Detailed information on various investment trusts and stocks, including performance analyses and trust asset retention specifics, helps investors make informed decisions.

Tsumitate Robo Savings: This service includes educational content on how automated investments work, the benefits of regular investing, and how to set up and manage a Tsumitate investment plan.

Risks and Fees Education: PayPay Securities educates its users about the potential risks associated with trading and detailed explanations of the fee structures for different investment options.

Market Research: The platform offers access to market research and financial news, enabling investors to stay updated with the latest market trends and economic developments.

The FSA's oversight ensures that PayPay Securities adheres to strict guidelines protecting investors and maintaining the integrity of the financial markets. This regulation provides a reliable and secure environment for investors.

What are securities to trade with PayPay Securities?

PayPay Securities offers a diverse range of securities for trading, meeting various investment preferences and strategies. Here are the key types of securities available:

Services

PayPay offers 2 unique services to its users.

1. Point Investment:

PayPay Securities offers a unique service called “Point Investment,” which allows users to invest using PayPay Points earned through everyday activities and transactions within the PayPay ecosystem.

This service enables investors to start with as little as 1 point (equivalent to 1 yen), making it an accessible option for beginners and those cautious about investing cash.

Investments can be made in a variety of products, including stocks and investment trusts, without the need for cash, utilizing accumulated PayPay Points. This feature supports the accumulation of wealth in small increments, easily integrating investment opportunities into daily financial activities.

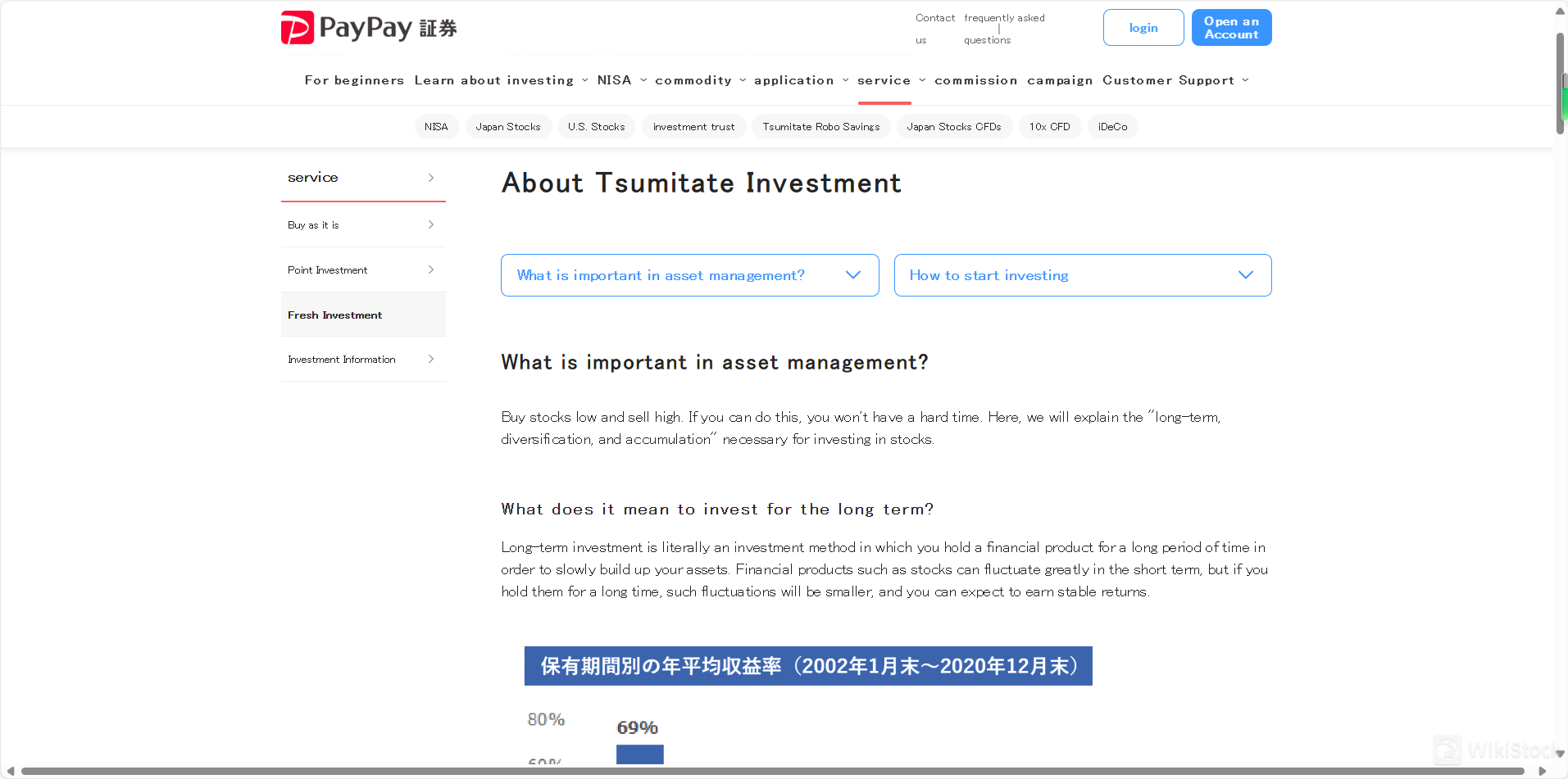

2. Tsumitate Investment (Accumulative Investment):

The Tsumitate Investment service provided by PayPay Securities allows users to set up regular investment plans directly through the app. Starting from as little as 100 yen per stock, users can schedule daily, weekly, or monthly investments in financial products like investment trusts and U.S. stocks.

This automated investment strategy is designed to encourage long-term, diversified, and systematic investing, reducing the impact of market volatility by averaging purchase costs over time (dollar-cost averaging).

PayPay Securities Fees Review

PayPay Securities provides a detailed fee structure for various transactions and services, emphasizing transparency for its users. Here's a summary of the key fee components:

| Service | Fee |

| Deposits | Free (Customer bears bank charges) |

| Withdrawals to Mizuho Bank | Below 30,000 yen: 110 yen |

| 30,000 yen and above: 220 yen | |

| Withdrawals to Other Banks | Below 30,000 yen: 275 yen |

| 30,000 yen and above: 385 yen | |

| Electronic Money Transfers | Free |

| Stocks and Investment Trusts | Transactions <20,000 yen: 110 yen |

| Transactions ≥20,000 yen: Free | |

| CFDs and Leveraged ETFs | Variable (based on product) |

| Fund Transfers Between Accounts | Free |

| “Buy as it is” Service | Free when using PayPay Bank |

| Capital Gains and Dividends Tax | 20.315% (withheld at source) |

| NISA Account Transactions | Tax-exempt |

Deposit and Withdrawal Fees

Trading Fees

Special Features

Fund Transfer Fees

Miscellaneous Fees

Taxes

PayPay Securities App Review

The PayPay Securities App offers two distinct versions tailored to meet different user needs:

Research & Education

PayPay Securities offers a range of research and educational resources aimed at enhancing the investing knowledge and capabilities of its clients. These resources are designed to support both novice and experienced investors:

Customer Service

PayPay Securities offers customer support through an online messaging system accessible via their app and website, primarily during Tokyo Stock Exchange hours.

While this system allows for quick query handling and provides support for account management, trading issues, and technical assistance, it does have limitations.

Support is not available 24/7, which may not accommodate all users, especially those trading in different time zones or needing immediate help outside of standard market hours.

Conclusion

PayPay Securities provides a securities focused trading platform with a focus on Japanese and U.S. stocks, offering a unique feature set that includes zero transaction fees for investment trusts, competitive spreads on stocks and CFDs, and innovative services like Tsumitate Robo Savings for automated investments.

While the platform attract extensively to both novice and experienced traders with its educational resources and market research, the limitation of its customer support hours and the lack of 24/7 assistance could be a drawback for some investors.

FAQs

Question: How can I open an account with PayPay Securities?Answer: You can open an account by downloading the PayPay Securities App from the App Store or Google Play, following the registration prompts, and completing the necessary identity verification process.

Question: What are the fees for trading U.S. stocks with PayPay Securities?Answer: PayPay Securities charges a transaction fee equivalent to 0.5% of the base price during U.S. stock market hours, with no additional fee outside these times, the fee increases to 0.7%.

Question: Can I trade on PayPay Securities using PayPay points?Answer: Yes, PayPay Securities allows you to use PayPay points to invest in stocks and mutual funds, enabling cashless investments starting from as low as one point.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Relevant Enterprises

Countries

Company name

Associations

Japan

PPSCインベストメントサービス株式会社

Subsidiary

Review

Positive

PositiveRecommended Brokerage FirmsMore

寿証券

Score

Centrade

Score

めぶき証券

Score

浜銀TT証券

Score

おきぎん証券

Score

ワンアジア証券

Score

木村証券

Score

西日本シティTT証券

Score

Kuni Umi AI Securities

Score

香川証券

Score