Score

Rating Index

Brokerage Appraisal

Influence

D

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSASuspicious Clone

JapanSecurities Trading License

Brokerage Information

More

Company Name

AIOI SECURITIES Co.,Ltd.

Abbreviation

相生証券

Platform registered country and region

Company address

Company website

http://aioi-sec.com/Check whenever you want

WikiStock APP

Previous Detection: 2025-01-02

- The Japan Financial Services Agency regulation (License No.: 近畿財務局長(金商)第1号) claimed by the brokerage firm is suspected to be a clone firm, please be aware of the risks!

- It has been verified that this brokerage firm currently has no effective regulation, please be aware of the risk!

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.375%

Margin Trading

YES

Regulated Countries

1

Products

5

| Aioi Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees | Domestic Stocks: 0.375% - 1.150% |

| Free Withdrawals | |

| Account Fees | Free Opening |

| Mutual Funds Offered | Country Fund, MMF, MRF |

Aioi Securities Information

Aioi Securities was established in 1949 as a community-based securities company. The company provides investment services in domestic and foreign stocks, investment trusts, and bonds. The company offers online webinars to educate and support its clients. The company is regulated by the Financial Services Agency of Japan.

Pros & Cons of Aioi Securities

| Pros | Cons |

|

|

|

|

|

Wide range of products: Aioi Securities offers a wide range of investment products, including domestic and foreign stocks, investment trusts, and bonds.

Regulatory compliance: Aioi Securities is regulated by Japan's Financial Services Agency (FSA) and adheres to strict financial regulations.

Educational support: In addition to investment advice, Aioi Securities also provides support services for investment seminars.

Cons:Limited online services: The company lacks a well-developed online trading and digital platform.

Small size: With only 17 employees, Aioi Securities lacks the resources and infrastructure of a large securities company.

Is Aioi Securities Safe?

Aioi Securities is considered safe. It is regulated by the Financial Services Agency (FSA) of Japan with a regulatory license number of Kinki Finance Bureau (Kinsho) No. 1. Aioi Securities adheres to strict regulatory requirements that require client assets to be separated from the company's operating funds. In the event of bankruptcy or insolvency of Aioi Securities, client funds and securities will be separated and protected.

What are Securities to Trade with Aioi Securities?

Aioi Securities offers a variety of trading options, including domestic and foreign stocks, mutual funds, bonds, and money market funds. Customers can trade domestic stocks listed on major Japanese exchanges and engage in margin trading for increased leverage.

Foreign stocks can be traded either through foreign consignment transactions or domestic listings on the Tokyo Stock Exchange. Mutual funds provide diversified investment opportunities managed by professionals, while bonds include secure government bonds and convertible bonds that combine the benefits of stocks and bonds.

Additionally, Aioi Securities offers Money Management Funds (MMF) and Money Reserve Funds (MRF) for stable, low-risk returns, though principal is not guaranteed.

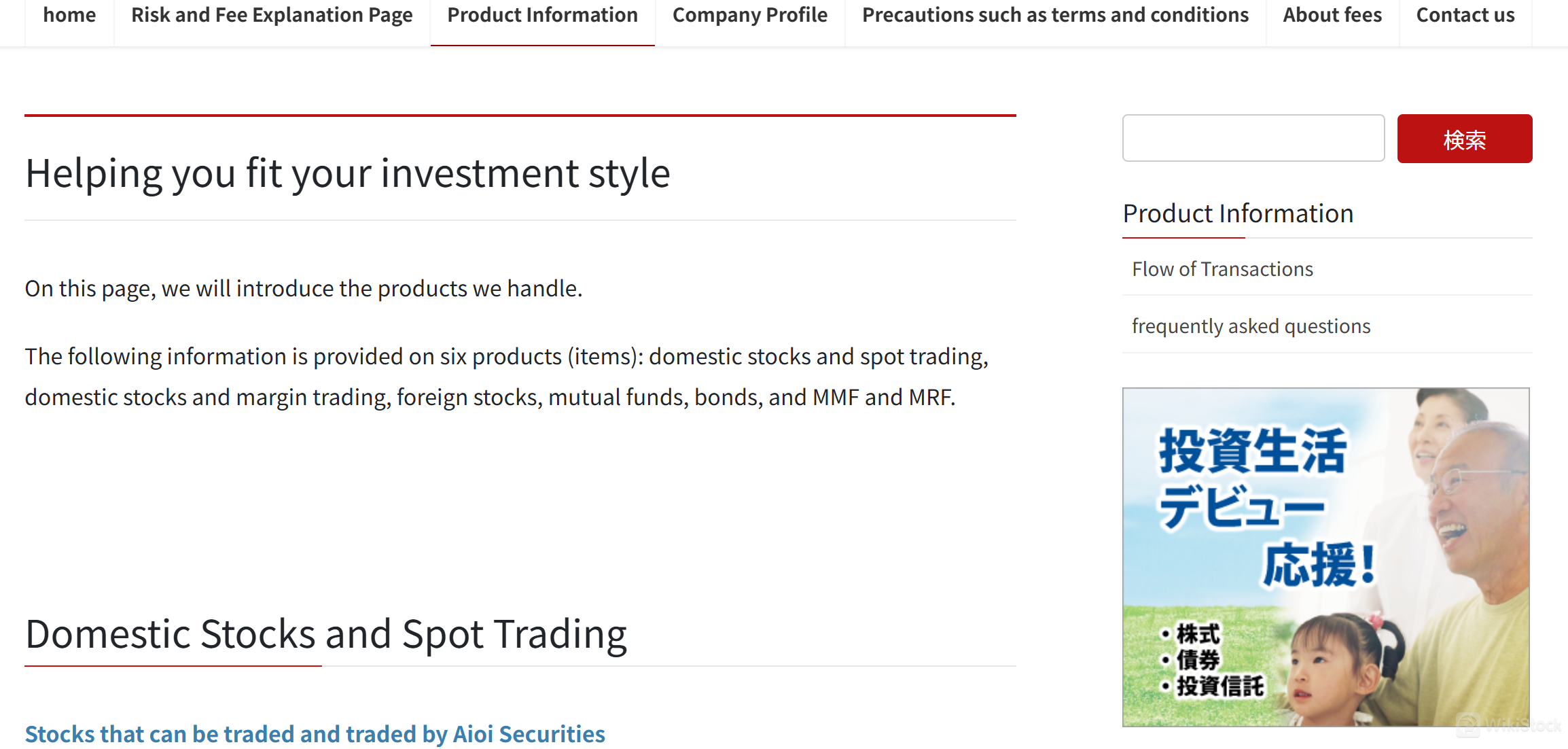

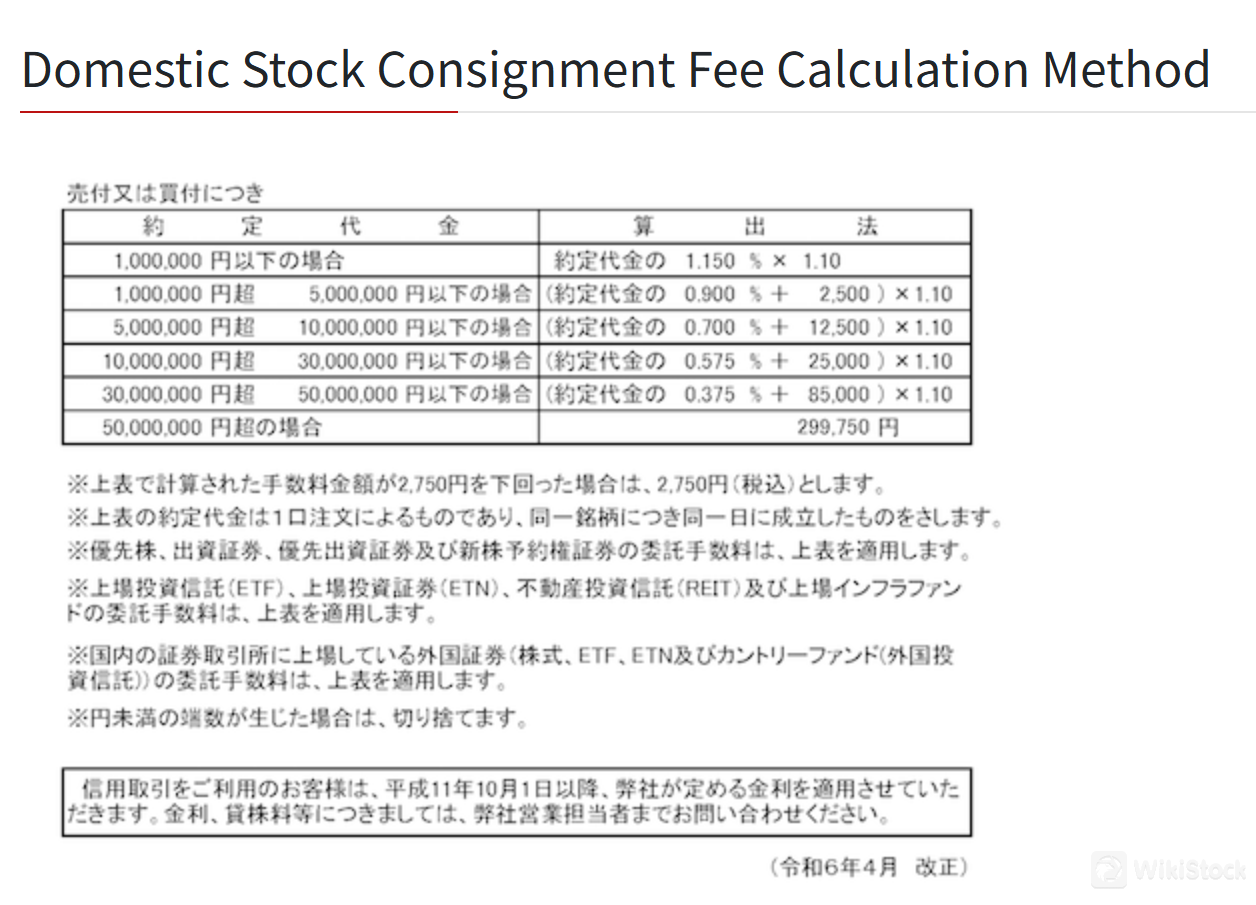

Aioi Securities Fees Review

Aioi Securities offers a tiered commission structure for domestic and foreign securities trading. For domestic stocks, the commission ranges from 1.150% for transactions up to ¥1,000,000 to a minimum of ¥299,750 for transactions over ¥50,000,000. Fees are subject to a minimum of ¥2,750 if the calculated commission falls below this threshold.

For bonds with stock acquisition rights, the commission varies similarly, starting at 1.000% for transactions up to ¥1,000,000 and decreasing with larger transaction sizes, reaching a minimum of ¥298,100 for transactions exceeding ¥50,000,000.

Foreign stock trading commissions are structured similarly, starting at 1.250% for transactions up to ¥1,000,000 and reducing progressively with larger transactions, with a minimum commission of ¥196,500 for transactions over ¥50,000,000.

In addition to trading commissions, Aioi Securities charges various other fees, including fees for specific services such as stock acquisition rights exercises and margin trading.

Note: Please refer to this link for fee details: http://aioi-sec.com/fee-2/

Research & Education

Aioi Securities' investment life debut support is aimed at newcomers who want to start their investment journey safely and confidently. They introduce various investment products, investment concepts, and investment strategies.

Aioi Securities offers comprehensive educational lectures. These courses cover basic trading concepts and investment strategies. They focus on imparting practical knowledge, including understanding market dynamics, risk management techniques, and effective asset allocation strategies.

Customer Service

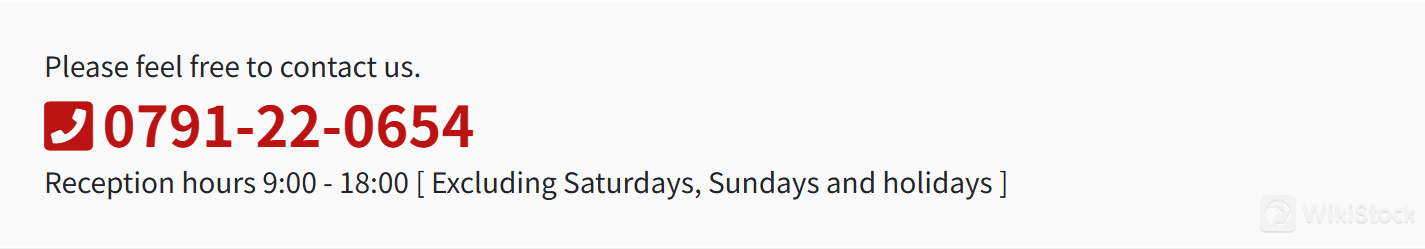

For inquiries or assistance, individuals may contact Aioi Securities by calling the Aioi Securities headquarters at (0791) 22-0654 during reception hours (9:00 to 18:00, excluding Saturdays, Sundays and holidays). Headquarters fax: (0791) 23-5116. In addition, the Ako office telephone: (0791) 42-0456, fax: (0791) 43-8368.

Conclusion

Aioi Securities offers a comprehensive range of investment services, covering domestic and foreign stocks, mutual funds, bonds, and margin trading. The company operates under strict regulation by Japan's Financial Services Agency. Aioi Securities still offers educational support via webinars. Aioi Securities' trading commissions are also structured on a tiered fee structure. However, it is worth noting that it is small in size and has limited online services.

Q&A

Is Aioi Securities regulated?

Yes, Aioi Securities is a registered financial instruments business operator with a license from the first director of the Kinki Local Finance Bureau (Kinsho). It is also a member of the Japan Securities Dealers Association.

Is Aioi a good platform for beginners?

Yes, Aioi Securities offers comprehensive support and educational resources. They offer seminars, online materials to help new investors understand investment concepts and strategies.

What types of investments can I trade with Aioi Securities?

Domestic and foreign stocks, mutual funds (investment trusts), bonds, and margin trading.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

15-20 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

Centrade

Score

JIA証券

Score

山和証券株式会社

Score

寿証券

Score

めぶき証券

Score

浜銀TT証券

Score

木村証券

Score

おきぎん証券

Score

ワンアジア証券

Score

西日本シティTT証券

Score