Score

Rating Index

Brokerage Appraisal

Influence

AA

Influence Index NO.1

Japan

JapanProducts

8

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Surpassed 81.43% brokers

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

INVAST Securities Co.,Ltd.

Abbreviation

インヴァスト証券

Platform registered country and region

Company address

Company website

https://www.invast.jp/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

インヴァスト証券 Earnings Calendar

Currency: JPY

Cycle

Q3 FY2024 Earnings

2023/04/27

Revenue(YoY)

1.72B

+4.95%

EPS(YoY)

13.06

-16.92%

インヴァスト証券 Earnings Estimates

Currency: JPY

- DateCycleRevenue/Estimated

- 2023/04/272023/FY701.000M/0

- 2022/04/272022/FY588.000M/0

- 2020/05/112020/FY3.156B/0

- 2019/04/252019/FY3.157B/0

Internet Gene

Gene Index

APP Rating

| Invast Securities |  |

| WikiStock Rating | ⭐️⭐️⭐️⭐️ |

| Fees | No trading fees, no exchange fees |

| Account Fees | No account management fees or annual fees |

| App/Platform | Tryauto app |

| Promotions | New account opening bonus (up to 52,000 yen) |

Invast Securities Infomation

Invast Securities is a Japanese securities firm that provides brokerage services to individual and institutional clients. They offer a variety of financial products including stocks, bonds, investment trusts, and foreign exchange trading. Invast Securities is regulated by the Japan Financial Services Agency (JFSA) and is known for its online trading platforms and research tools.

Pros & Cons of Invast Securities

| Pros | Cons |

| Formal regulation | Language Barrier |

| Fee-Free Trading | Customer Service Hours |

| User-Friendly Platform | |

| Global Market Access |

Pros:

Formal regulation: Regulated by the Japan Financial Services Agency (FSA), ensuring adherence to strict regulatory standards and providing a secure trading environment.

Fee-Free Trading: No trading fees, exchange fees, or account management fees, allowing investors to trade without additional costs.

User-Friendly Platform: Offers a user-friendly trading app with intuitive navigation and comprehensive educational resources.

Global Market Access: Provides access to a wide range of financial products including global stock indexes, ETFs, and a variety of currency pairs.

Cons:

Language Barrier: Some services and resources primarily are available in Japanese, which is challenging for non-Japanese speaking clients.

Customer Service Hours: Limited availability during weekends and public holidays for customer service, which inconveniences clients needing immediate assistance during these times.

Is Invast Securities Safe?

Regulation

Invast Securities operates under the regulatory oversight of the Japan Financial Services Agency (JFSA), ensuring compliance with rigorous standards set forth for financial institutions in Japan. The firm is licensed with license number 関東財務局長(金商)第26号 (Kanto Finance Bureau Director (Financial Instruments Business) No. 26), which authorizes them to conduct various financial services including securities brokerage, investment advisory, and trading of financial instruments.

What are Securities to Trade with Invast Securities?

Invast Securities provides a comprehensive range of securities for trading for global investors seeking diverse investment opportunities. Clients can access global stock indexes and ETFs, allowing them to diversify their portfolios with assets from around the world. The firm supports trading in all major currency pairs, encompassing 20 currency pairs in total, which enables investors to participate in forex markets with flexibility. Additionally, Invast Securities offers specialized range-traded currency pairs such as AUD/NZD and EUR/GBP, providing further options for strategic trading.

Invast Securities Accounts

Invast Securities Co., Ltd. offers a structured approach to opening both individual and corporate accounts, ensuring compliance with regulatory requirements and facilitating seamless transactions for clients.

For individual accounts, applicants are required to submit both their “My Number Verification Document” and an “Identification Document,” which verify personal identity and compliance with legal standards. This process helps ensure security and regulatory compliance in managing individual investments.

Corporate account applications necessitate the submission of specific documents including a recent copy of the registry or a certificate of registered matters, a corporate registration seal certificate issued within the past six months, and identification documents of the designated person for transactions.

Invast Securities Fees Review

For manual orders, there are no fees charged. For automated trading, fees vary based on transaction volume.

For transactions involving fewer than 10,000 currencies, there is a fee of 2.0 points per 1,000 currencies, amounting to 20 yen per trade. As the number of transactions increases, the fees decrease progressively: between 10,000 and 100,000 currencies incurs a fee of 1.0 point per 1,000 currencies (10 yen per trade), while transactions between 100,000 and less than 500,000 currencies are charged at 0.5 points per 1,000 currencies (5 yen per trade). Transactions exceeding 500,000 currencies are free of charge.

These fee structures aim to provide cost-effective trading options for investors, with lower costs as transaction volumes increase, encouraging higher trading volumes with reduced fees.

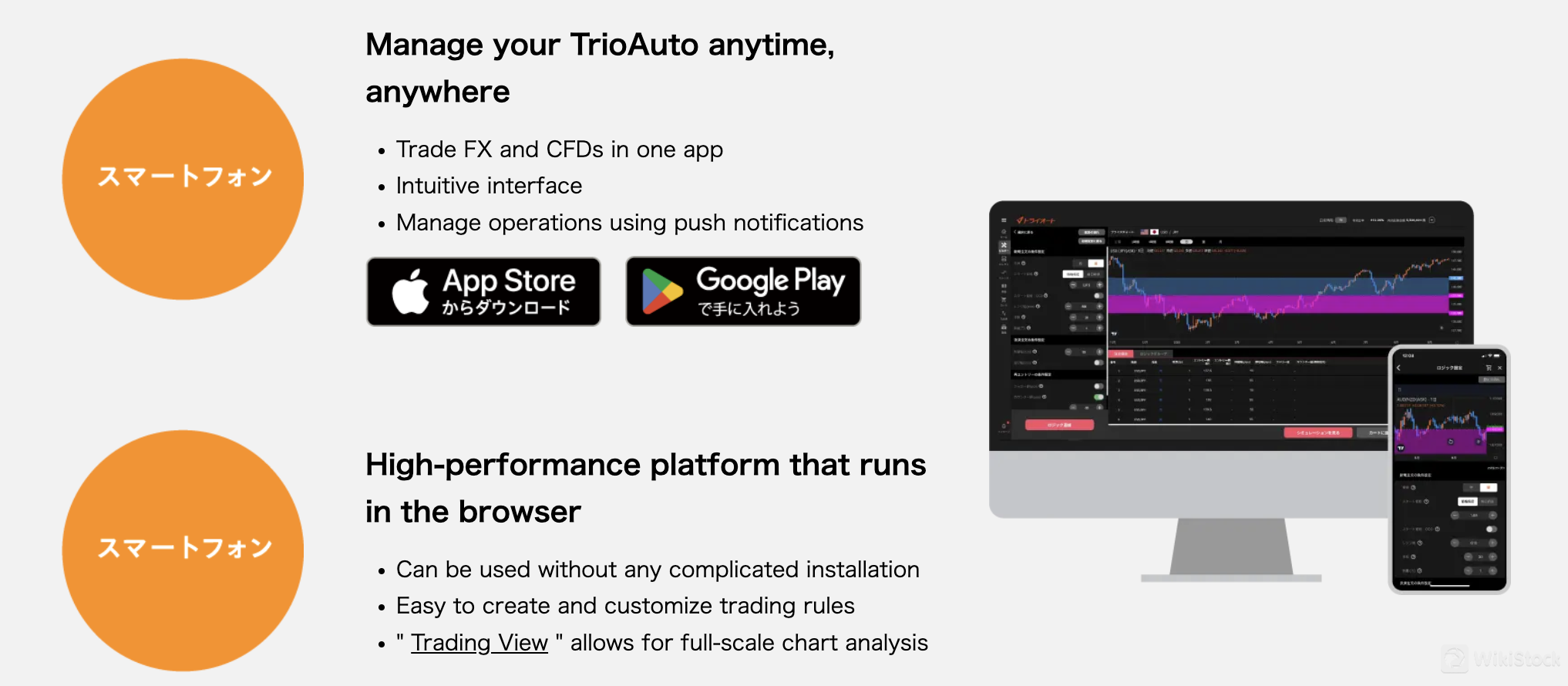

Invast Securities App Review

Invast Securities offers a user-friendly platform for trading FX and CFDs through its Tryauto app and high-performance browser-based interface. The Tryauto app allows clients to manage their investments conveniently, providing intuitive navigation and operational management through push notifications. Available on Google Play and the Apple Store, it ensures accessibility across various devices without the need for complex installations. The platform supports comprehensive trading functionalities, including the ability to create and customize trading rules. Integrated with “Trading View,” users can conduct in-depth chart analysis, enhancing their decision-making process.

Research & Education

Invast Securities offers a comprehensive suite of resources to empower investors across various aspects of financial markets. Their educational offerings cover fundamental Forex basics, providing clients with essential knowledge of currency trading strategies and market dynamics. Exchange rate forecasts and analysis are regularly updated to assist clients in making informed decisions. Additionally, their coverage of US market conditions and broader global insights equips investors with valuable perspectives for navigating international markets. Frequently Asked Questions (FAQs) address common queries.

Customer Service

Invast Securities offers a toll-free telephone hotline at 0120-659-274, available from 9:00 AM to 5:00 PM on weekdays (excluding Saturdays, Sundays, and New Year's Day), with extended hours on public holidays.

For added convenience, Invast Securities also provides an online contact form for inquiries, allowing clients to submit questions or requests at their convenience.

A standout feature of their customer support is the Remote Support service, which enables live assistance for troubleshooting issues with trading platforms.

Conclusion

Invast Securities stands out as a reliable and client-focused brokerage firm dedicated to providing robust financial services and support. With a commitment to transparency and accessibility, Invast Securities offers a fee-free trading environment. Their emphasis on education and research equips clients with the knowledge and tools necessary to navigate global financial markets effectively.

Frequently Asked Questions (FAQs)

Is Invast Securities a good platform for beginners?

Yes, Invast Securities provides a user-friendly platform with educational resources, making it suitable for beginners to start trading.

Is Invast Securities legit?

Yes, Invast Securities is a legitimate brokerage firm regulated by the Japan Financial Services Agency (FSA).

What financial products can I trade with Invast Securities?

Global stock indexes, ETFs, and 20 major currency pairs for forex trading.

What are the fees for trading with Invast Securities?

Manual orders incur no fees. Automated trading fees vary: transactions under 10,000 currencies are charged 2.0 points per 1,000 currencies (20 yen per trade), decreasing as transaction volume increases.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

15-20 years

Margin Trading

YES

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

寿証券

Score

Centrade

Score

めぶき証券

Score

浜銀TT証券

Score

おきぎん証券

Score

ワンアジア証券

Score

木村証券

Score

西日本シティTT証券

Score

Kuni Umi AI Securities

Score

香川証券

Score