Score

静岡東海証券

https://www.shizuokatokai-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Products

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

Shizuoka Tokai Securities

Abbreviation

静岡東海証券

Platform registered country and region

Company address

Company website

https://www.shizuokatokai-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

1.265%

Margin Trading

YES

Regulated Countries

1

Products

5

| Shizuoka Tokai Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded | 1944 |

| Registered Region | Japan |

| Regulatory Status | FSA |

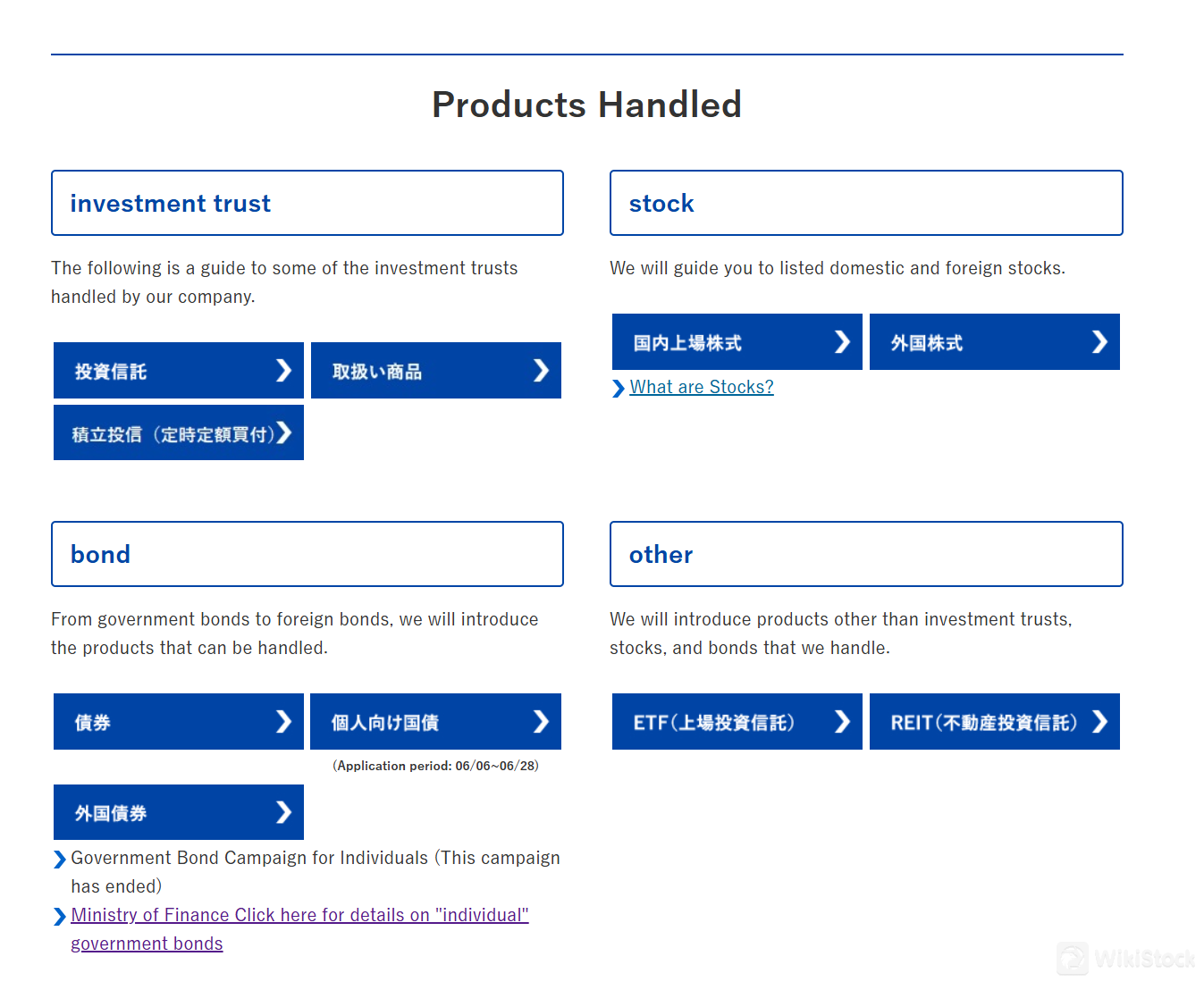

| Product & Services | Investment trust, stock, bond, ETF, REIT |

| Fees | Fees for stocks, ETFs, REITs, etc.: 0.33-1.265% of contract amount plus tiered fixed rate, depending on trading volume, min 2750 yen, max 256850 yen |

| Fees for convertible bonds: 0.165-1.1% of contract amount plus tiered fixed rate, depending on trading volume, etc. | |

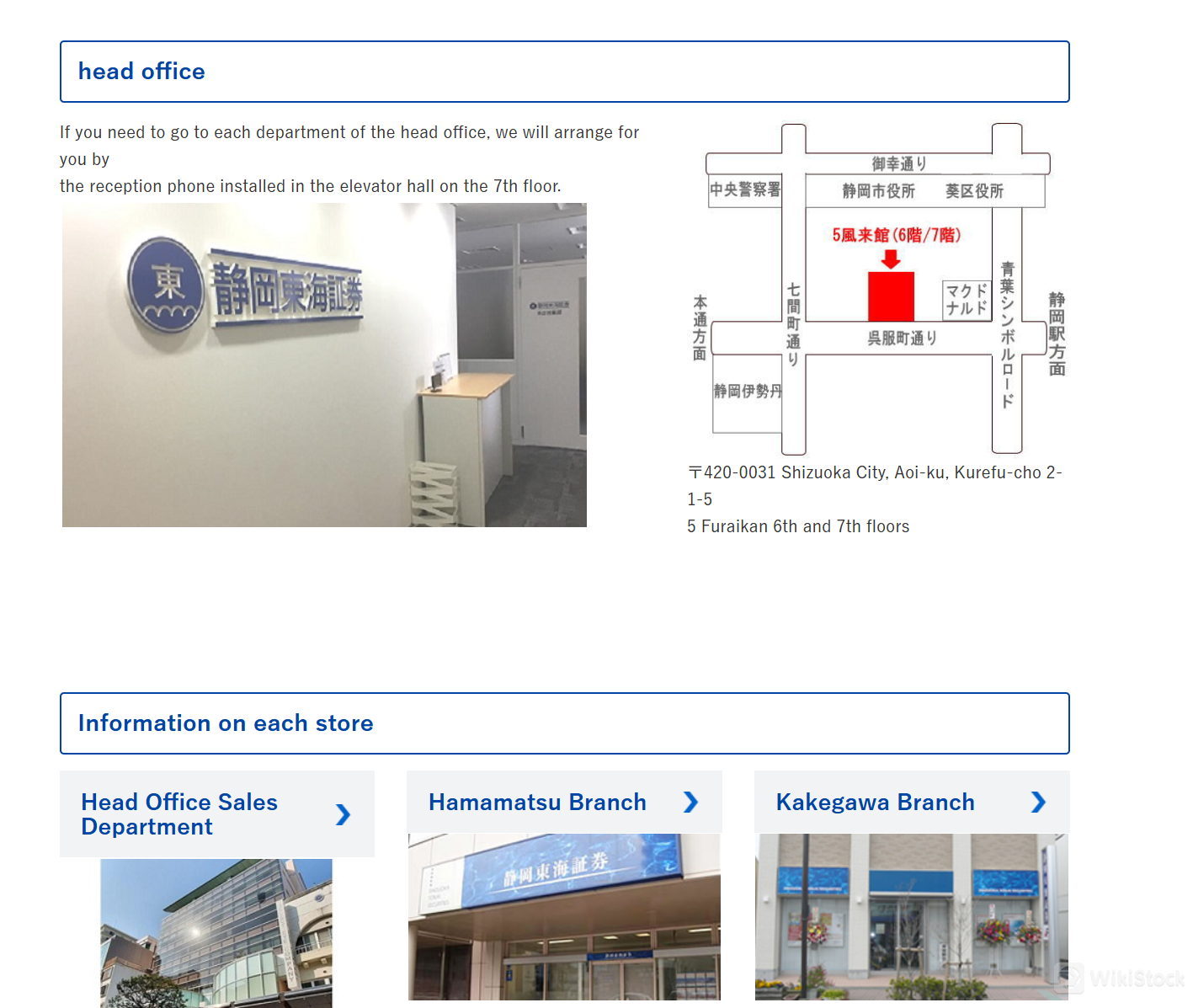

| Customer Service | Head office: 〒420-0031 Shizuoka City Aoi Ward Kure Fumachi 2-1-5, 5 Furaikan 6th and 7th floors |

| Tel: 054-255-3330; fax: 054-254-5186; inquiry form |

Shizuoka Tokai Securities Information

Established in 1944 with six offices across Japan, Shizuoka Tokai Securities offers a diverse range of investment products, including investment trusts, stocks, bonds, ETFs, and REITs. It provides Electronic Delivery Service and Online Inquiry Service, allowing users to check account information and download reports online instead of using paper media. Shizuoka Tokai Securities applies for the new NISA system for tax benefits and exemptions and offers transparent and tiered fee structures based on trading volume.

It is regulated by the Japan Financial Services Agency (FSA) under license number Director-General of the Tokai Finance Bureau (Kinsho) No. 8, maintaining high standards of integrity and credibility in its financial operations.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Limited Digital Support Channels |

| Diverse Range of Investment Products | |

| Support for New NISA System | |

| Established History |

- Regulatory Compliance: Regulated by Japan's FSA, ensuring adherence to stringent financial standards and investor protection.

- Diverse Range of Investment Products: Shizuoka Tokai Securities offers a variety of investment options including trusts, stocks, bonds, ETFs, and REITs.

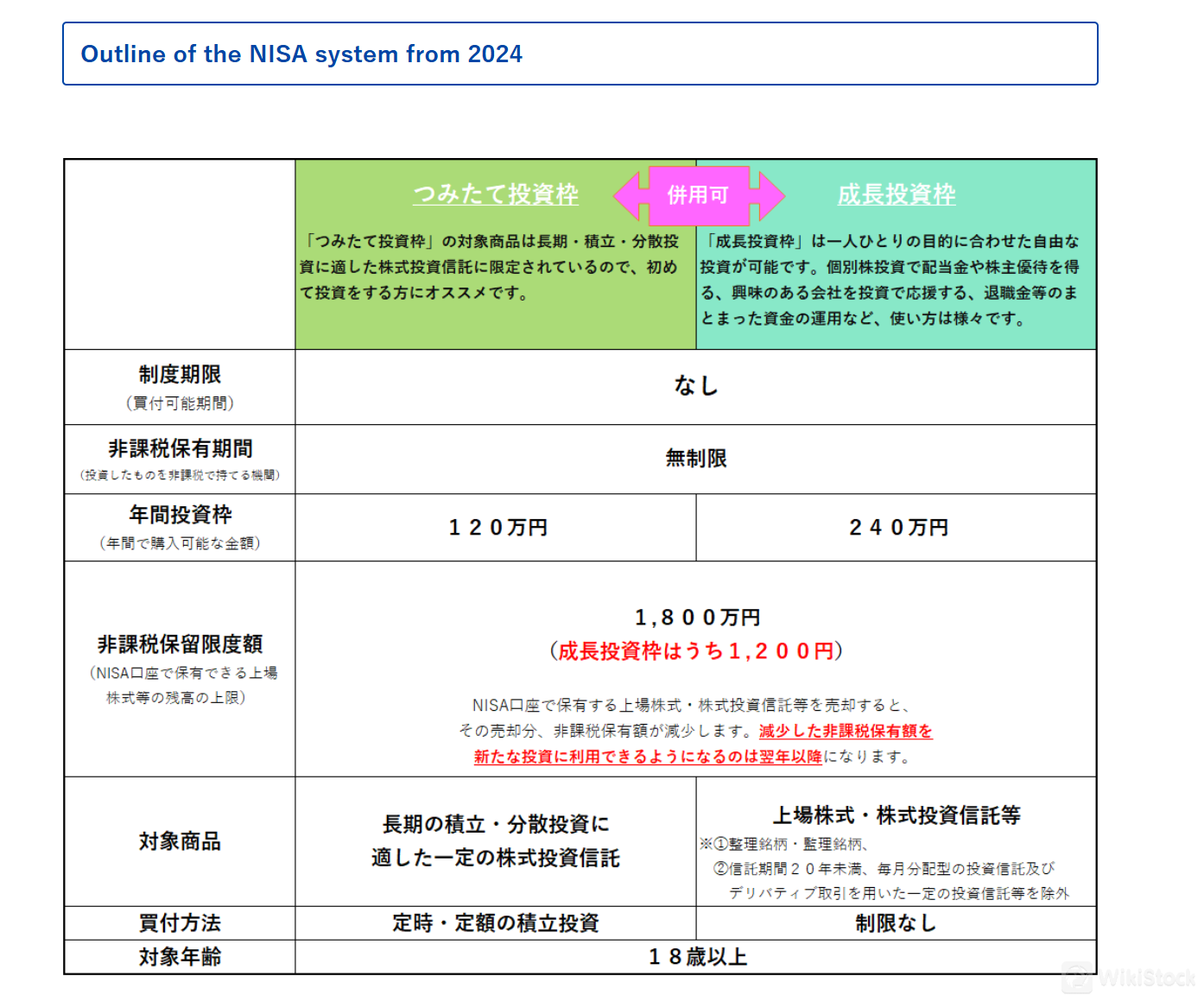

- Support for New NISA System: Enables tax-free, indefinite holding of investments with expanded investment limits, enhancing long-term savings potential.

- Established History: With a founding in 1944, it boasts a long-standing presence in the financial sector, signaling stability and experience. Cons:

- Limited Digital Support Channels: Lacks customer support through email, live chat, or social media, inconveniencing clients seeking digital interaction.

- Fees for Stocks, ETFs, REITs, Warrants, and Warrant Certificates

- Minimum fee is ¥2,750 if the amount equivalent to 1.265% of the contract amount is less than ¥2,750.

- For the sale of bankrupt company shares, a fee equivalent to 90.0% of the contract amount applies if the contract amount is less than the minimum fee. If the contract amount is ¥1, the fee is ¥1.

- Fractions of shares (odd-lot trading) are calculated by prorating the fee for 1 full unit of shares.

- Fees for Convertible Bonds

- Fees for TOPIX and Nikkei 225 Futures

- Fees for Nikkei 225 Options

- Minimum fee is ¥2,750.

- Fees for Foreign Stocks

- Contract amount refers to the amount converted to domestic currency, including fees and taxes incurred in the foreign financial market.

- Fees for Public and Corporate Bonds

- Miscellaneous Fees

- Issuance Fees

- Handling Fees

- Head office: 〒420-0031 Shizuoka City, Aoi-ku, Kurefu-cho 2-1-5, 5 Furaikan 6th and 7th floors

- Hamamatsu Branch: 〒430-0929, 3-7-1 Chuo, Chuo-ku, Hamamatsu-shi.

- Kakegawa Branch: 〒436-0079, 402-1, Kakegawa, Kakegawa City.

- Fujieda Branch: 〒426-0061, 1-30-15, Tanuma, Fujieda-shi

- Fuji Branch: 〒416-0954, Fuji City Honichimachi 816 Wing Building 1st Floor

- Numazu Branch: 〒410-0046, Umeda Building 2nd Floor, 2-29 Yoneyama-cho, Numazu City

- Is Shizuoka Tokai Securities regulated by any financial authority?

- Yes, it operates under the regulatory oversight of the Japan Financial Services Agency (FSA), with license no. Director-General of the Tokai Finance Bureau (Kinsho) No. 8.

- What types of products does Shizuoka Tokai Securities provide?

- Investment trusts, stocks, bonds, ETFs, and REITs.

- Is Shizuoka Tokai Securities suitable for beginners?

- Yes, it is suitable for beginners due to its FSA regulation and comprehensive range of investment products and transparent fee structures.

- What are the features of the new NISA system supported by Shizuoka Tokai Securities?

- The new NISA system, starting in 2024, allows for tax-free and indefinite holding of purchased listed stocks and stock investment trusts. It also features expanded tax-free investment limits, with up to ¥3.6 million per year.

Is It Safe?

Regulation:

Shizuoka Tokai Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of the Tokai Finance Bureau (Kinsho) No. 8, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores Shizuoka Tokai Securities's commitment to integrity and credibility in its services.

Safety Measures:

Shizuoka Tokai Securities ensures client confidentiality and regulatory compliance through rigorous privacy policies, safeguarding personal data from unauthorized access. Their robust AML policies include thorough customer verification, continuous monitoring, and reporting of suspicious activities to prevent financial crimes.

What are Securities to Trade with Shizuoka Tokai Securities?

Shizuoka Tokai Securities offers a diverse range of investment products tailored to meet various financial goals and preferences. These products include investment trusts, stocks, bonds, ETFs, and REITs.

Investment trusts provide a managed portfolio of securities, offering diversification and professional management.

Stocks offer ownership in companies, with potential for capital appreciation and dividends. Bonds provide fixed income and are suitable for conservative investors seeking stable returns.

ETFs combine the diversification of mutual funds with the trading flexibility of stocks, while REITs allow investors to gain exposure to real estate markets without directly owning properties..

Fees Review

Shizuoka Tokai Securities provides a detailed and transparent fee structure for trading various financial products which have been published since April, 2020.

| Contract Amount | Basic Rate (Incl. Tax) |

| ≤ ¥1 million | Contract Amount × 1.265% |

| > ¥1 million ≤ ¥3 million | Contract Amount × 0.935% + ¥3,300 |

| > ¥3 million ≤ ¥5 million | Contract Amount × 0.825% + ¥6,600 |

| > ¥5 million ≤ ¥10 million | Contract Amount × 0.660% + ¥14,850 |

| > ¥10 million ≤ ¥30 million | Contract Amount × 0.550% + ¥25,850 |

| > ¥30 million ≤ ¥50 million | Contract Amount × 0.330% + ¥91,850 |

| > ¥50 million | ¥256,850 |

| Contract Amount | Basic Rate (Incl. Tax) |

| ≤ ¥1 million | Contract Amount × 1.100% |

| > ¥1 million ≤ ¥5 million | Contract Amount × 0.990% + ¥1,100 |

| > ¥5 million ≤ ¥10 million | Contract Amount × 0.770% + ¥12,100 |

| > ¥10 million ≤ ¥30 million | Contract Amount × 0.605% + ¥28,600 |

| > ¥30 million ≤ ¥50 million | Contract Amount × 0.440% + ¥78,100 |

| > ¥50 million ≤ ¥100 million | Contract Amount × 0.275% + ¥160,600 |

| > ¥100 million ≤ ¥1 billion | Contract Amount × 0.220% + ¥215,600 |

| > ¥1 billion | Contract Amount × 0.165% + ¥765,600 |

| Contract Amount | Basic Rate (Incl. Tax) |

| ≤ ¥100 million | Contract Amount × 0.0880% |

| > ¥100 million ≤ ¥300 million | Contract Amount × 0.0660% + ¥22,000 |

| > ¥300 million ≤ ¥500 million | Contract Amount × 0.0440% + ¥88,000 |

| > ¥500 million ≤ ¥1 billion | Contract Amount × 0.0220% + ¥198,000 |

| > ¥1 billion | Contract Amount × 0.0110% + ¥308,000 |

| Contract Amount | Basic Rate (Incl. Tax) |

| ≤ ¥1 million | Contract Amount × 4.400% |

| > ¥1 million ≤ ¥3 million | Contract Amount × 3.300% + ¥11,000 |

| > ¥3 million ≤ ¥5 million | Contract Amount × 2.200% + ¥44,000 |

| > ¥5 million ≤ ¥10 million | Contract Amount × 1.650% + ¥71,500 |

| > ¥10 million ≤ ¥30 million | Contract Amount × 1.320% + ¥104,500 |

| > ¥30 million ≤ ¥50 million | Contract Amount × 0.990% + ¥203,500 |

| > ¥50 million | Contract Amount × 0.660% + ¥368,500 |

| Contract Amount | Basic Rate (Incl. Tax) |

| ≤ ¥1 million | Contract Amount × 1.430% |

| > ¥1 million ≤ ¥3 million | Contract Amount × 1.045% + ¥3,850 |

| > ¥3 million ≤ ¥5 million | Contract Amount × 0.880% + ¥8,800 |

| > ¥5 million ≤ ¥10 million | Contract Amount × 0.770% + ¥14,300 |

| > ¥10 million ≤ ¥30 million | Contract Amount × 0.605% + ¥30,800 |

| > ¥30 million ≤ ¥50 million | Contract Amount × 0.275% + ¥129,800 |

| > ¥50 million | Contract Amount × 0.110% + ¥212,300 |

| Face Value Total | National Bonds, Government-Guaranteed Bonds, Municipal Bonds, Yen-denominated Foreign Bonds (Per ¥100 face value) | Other Bonds (Per ¥100 face value) |

| ≤ ¥5 million | ¥0.44 | ¥0.88 |

| > ¥5 million ≤ ¥10 million | ¥0.39 | ¥0.72 |

| > ¥10 million ≤ ¥50 million | ¥0.33 | ¥0.55 |

| > ¥50 million ≤ ¥100 million | ¥0.28 | ¥0.39 |

| > ¥100 million ≤ ¥1 billion | ¥0.11 | ¥0.22 |

| > ¥1 billion | ¥0.06 | ¥0.17 |

| Item | Standard Fee (Incl. Tax) | Remarks |

| Balance Certificate | ¥1,100 per certificate | Excludes those related to inheritance |

| Customer Account Ledger | ¥1,100 per account | |

| Reissuance of Transaction Report | ¥1,100 per report | |

| Reissuance of Transaction Balance Report | ¥1,100 per report | |

| Reissuance of Specific Account Annual Transaction Report | ¥1,100 per report |

| Item | Standard Fee (Incl. Tax) | Remarks |

| Request for Disclosure of Personal Information | ¥550 per request | |

| Request for Purchase of Odd-lot Shares | ¥550 per stock | |

| Application for Individual Shareholder Notification | ¥550 per stock | |

| Name Change | ¥550 per stock | |

| Request for Disclosure of Registered Subscriber Information | ¥2,200 per request | Includes ¥1,650 for the Custodian |

NISA System

Shizuoka Tokai Securities is well-prepared to support investors under the new NISA system starting in 2024. This system offers significant changes, such as tax exemption on dividends and trading gains, and an indefinite tax-free holding period. With the ability to hold listed stocks and stock investment trusts tax-free indefinitely, investors can now trade larger amounts compared to the conventional NISA, allowing for more flexible and long-term asset building.

The new NISA system also features an expanded tax-free investment limit, with up to ¥1.2 million for the “Tsumitate Investment Quota” and ¥2.4 million for the “Growth Investment Quota,” totaling ¥3.6 million per year.

Shizuoka Tokai Securities provides comprehensive support to help investors create NISA accounts and choose suitable financial products, including listed stocks, ETFs, and REITs, available only through securities firms.

Customer Service

Shizuoka Tokai Securities provides customer service exclusively through phone contact, FAX, and physical addresses at their head office and five branches. An inquiry form is also available for clients who prefer a callback from the company.

However, this approach lacks support through email, live chat, or social media, which can limit accessibility and convenience for clients who are accustomed to digital communication channels. This traditional customer service model may not meet the expectations of modern investors seeking more immediate and flexible interaction options.

TEL: 054-255-3330; fax: 054-254-5186

FAX: 076-432-7181

TEL 053-453-4191

TEL 0537-22-3211

TEL 054-636-7555

TEL 0545-66-5555

TEL 055-927-1011

Conclusion

Shizuoka Tokai Securities, established in 1944, offers a wide range of investment products, including investment trusts, stocks, bonds, ETFs, and REITs. It supports the new NISA system, enabling tax-free and indefinite holding of investments.

Regulated by the Japan Financial Services Agency (FSA) under license number Director-General of the Tokai Finance Bureau (Kinsho) No. 8, Shizuoka Tokai Securities maintains high standards of integrity and credibility in its operations.

Despite its traditional approach to customer service, the company's regulatory compliance and extensive range of investment products make it a trusted and reliable choice for investors.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

10-15 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

播陽証券

Score

三縁証券

Score

ほくほくTT証券

Score

四国アライアンス証券

Score

三晃証券株式会社

Score

ワイエム証券

Score

池田泉州TT証券

Score

長野證券

Score

PayPay証券

Score

京銀証券

Score