Score

池田泉州TT証券

https://www.sittsec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

6

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

Senshu Ikeda Tokai Tokyo Securities Co.,Ltd.

Abbreviation

池田泉州TT証券

Platform registered country and region

Company address

Company website

https://www.sittsec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

池田泉州TT証券 Earnings Calendar

Currency: JPY

Cycle

Q3 FY2024 Earnings

2024/01/30

Revenue(YoY)

18.21B

-7.51%

EPS(YoY)

10.08

+352.02%

池田泉州TT証券 Earnings Estimates

Currency: JPY

- DateCycleRevenue/Estimated

- 2024/01/302024/Q320.393B/0

- 2023/07/302024/Q121.576B/0

- 2023/01/302023/Q322.807B/0

- 2022/07/262023/Q122.831B/0

- 2022/01/272022/Q321.254B/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

1.265%

New Stock Trading

Yes

Regulated Countries

1

Products

6

| Senshu Ikeda Tokai Tokyo Securities Co.,Ltd. |  |

| WikiStock Rating | ⭐ ⭐ ⭐ |

| Fees | Stocks, ETFs, and J-REITs: Commission starts at 1.2650% for contracts up to 1,000,000 yen (min 2,750 yen);Convertible bonds and bonds with stock acquisition rights: Commission starts at 1.1000% for contracts up to 1,000,000 yen (min 2,750 yen) |

| Mutual Funds Offered | No |

| Promotions | Not available yet |

What is Senshu Ikeda Tokai Tokyo Securities Co.,Ltd.?

Senshu Ikeda Tokai Tokyo Securities Co., Ltd., established on 30th January 2013, operates under the oversight of Japan's Financial Services Agency (FSA), ensuring adherence to stringent regulatory standards that enhance trust and reliability for investors. However, the firm's lack of support for forex and cryptocurrency trading restricts investment diversification options in rapidly evolving markets. Additionally, the predominant reliance on telephone communication and relatively basic educational resources may limit accessibility and comprehensive investor engagement.

Pros and Cons of Senshu Ikeda Tokai Tokyo Securities Co.,Ltd.?

Senshu Ikeda Tokai Tokyo Securities Co., Ltd. operates under the oversight of the Financial Services Agency (FSA) in Japan, ensuring adherence to stringent regulatory standards, which enhances trust and reliability for investors. The firm does not offer services for forex or cryptocurrency trading, limiting investment options in these burgeoning markets. However, the company offers a diverse range of products and implements decreasing fees for larger transactions. Additionally, Senshu Ikeda Tokai Tokyo Securities prioritizes data protection by implementing robust measures to safeguard personal information against unauthorized access and breaches.

Despite these strengths, customer interaction is primarily through telephone, which may pose challenges for those preferring digital or alternative communication methods. Moreover, while the company provides basic educational resources, the offerings may be perceived as limited compared to competitors, potentially impacting comprehensive investor education and engagement.

| Pros | Cons |

|

|

|

|

|

|

|

Is Senshu Ikeda Tokai Tokyo Securities Co.,Ltd. safe?

Regulations

Senshu Ikeda Tokai Tokyo Securities Co., Ltd. is licensed by the Financial Services Agency (FSA), under registration number 370 issued by the Kinki Local Finance Bureau (Kinsho).

Safety Measures

Regarding safety measures, the company implements comprehensive measures to safeguard against unauthorized access, data leakage, loss, damage, and other risks related to personal data. These measures include organizational security controls, personnel safety management, physical security controls, technical security measures, and ongoing awareness of external environmental factors.

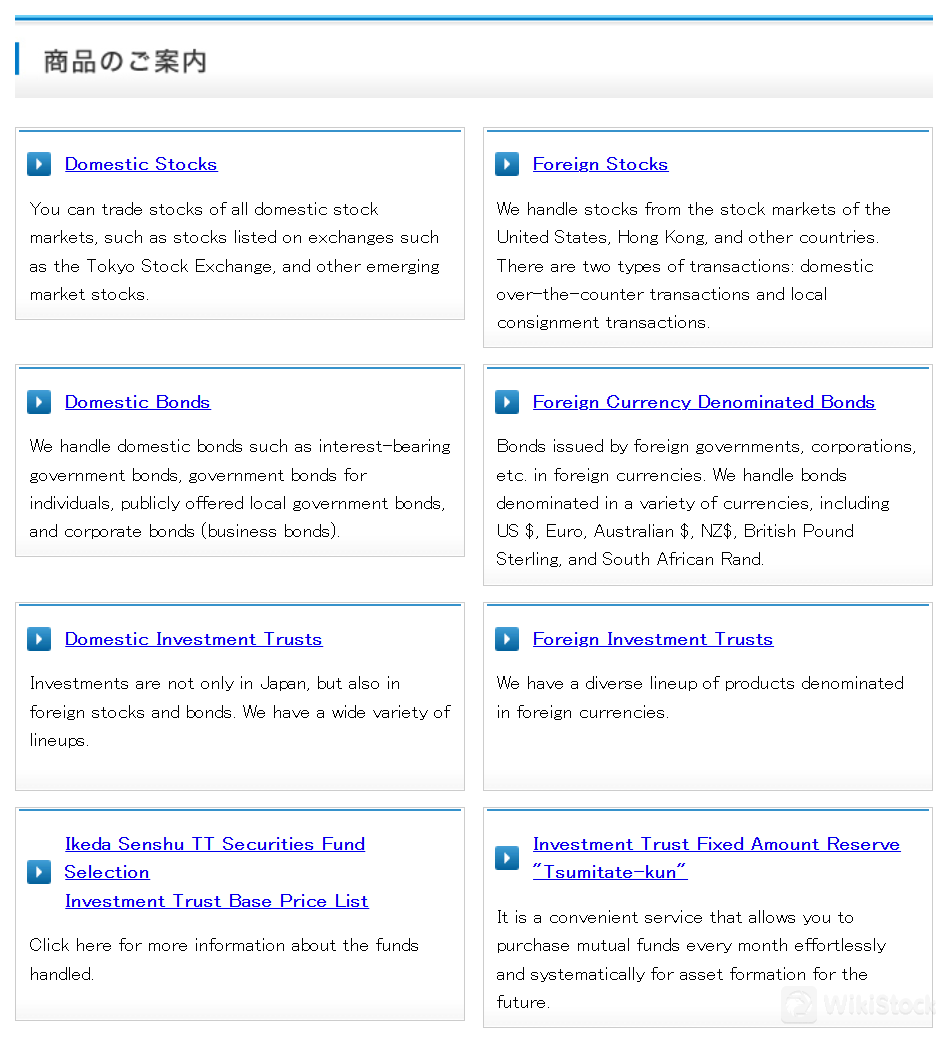

What are securities to trade with Senshu Ikeda Tokai Tokyo Securities Co.,Ltd.?

Senshu Ikeda Tokai Tokyo Securities Co., Ltd. offers a range of trading instruments, including domestic and foreign stocks, bonds, and investment trusts. However, the firm does not facilitate trading in forex or cryptocurrencies.

Domestic Stocks: Investors have access to stocks listed on all domestic markets, such as the Tokyo Stock Exchange and other emerging markets.

Foreign Stocks: The company handles stocks from international markets like the United States and Hong Kong, offering both domestic over-the-counter and local consignment transactions.

Domestic Bonds: They provide various domestic bonds, including interest-bearing government bonds, individual government bonds, publicly offered local government bonds, and corporate bonds.

Foreign Currency Denominated Bonds: This category includes bonds issued by foreign governments and corporations in currencies such as USD, Euro, AUD, NZD, GBP, and ZAR.

Domestic Investment Trusts: The firm offers a diverse selection of investment trusts that cover domestic and foreign stocks and bonds.

Foreign Investment Trusts: A range of products denominated in foreign currencies is available to investors.

Investment Trust Fixed Amount Reserve “Tsumitate-kun”: This service allows for the effortless and systematic monthly purchase of mutual funds, facilitating long-term asset accumulation.

Senshu Ikeda Tokai Tokyo Securities Co.,Ltd. Accounts

At Senshu Ikeda Tokai Tokyo Securities Co., Ltd., customers have the option of choosing between General Accounts and Specified Accounts, each offering distinct features tailored to different investment needs.

General Securities Accounts: The Securities General Account is a convenient and affordable account with services such as managing the funds of customers entrusted to them and regularly reporting on the status of the assets entrusted to them.

Specific Accounts: This account type is designed for more detailed and specialized management of specific financial assets. It includes two sub-types: the Withholding Account and the Simplified Tax Return Account.

Customers opening a Specified Account must select either a Withholding Account or a Simplified Tax Return Account, and this choice remains fixed for the tax year after the first sale is made.

Senshu Ikeda Tokai Tokyo Securities Co.,Ltd. Fees Review

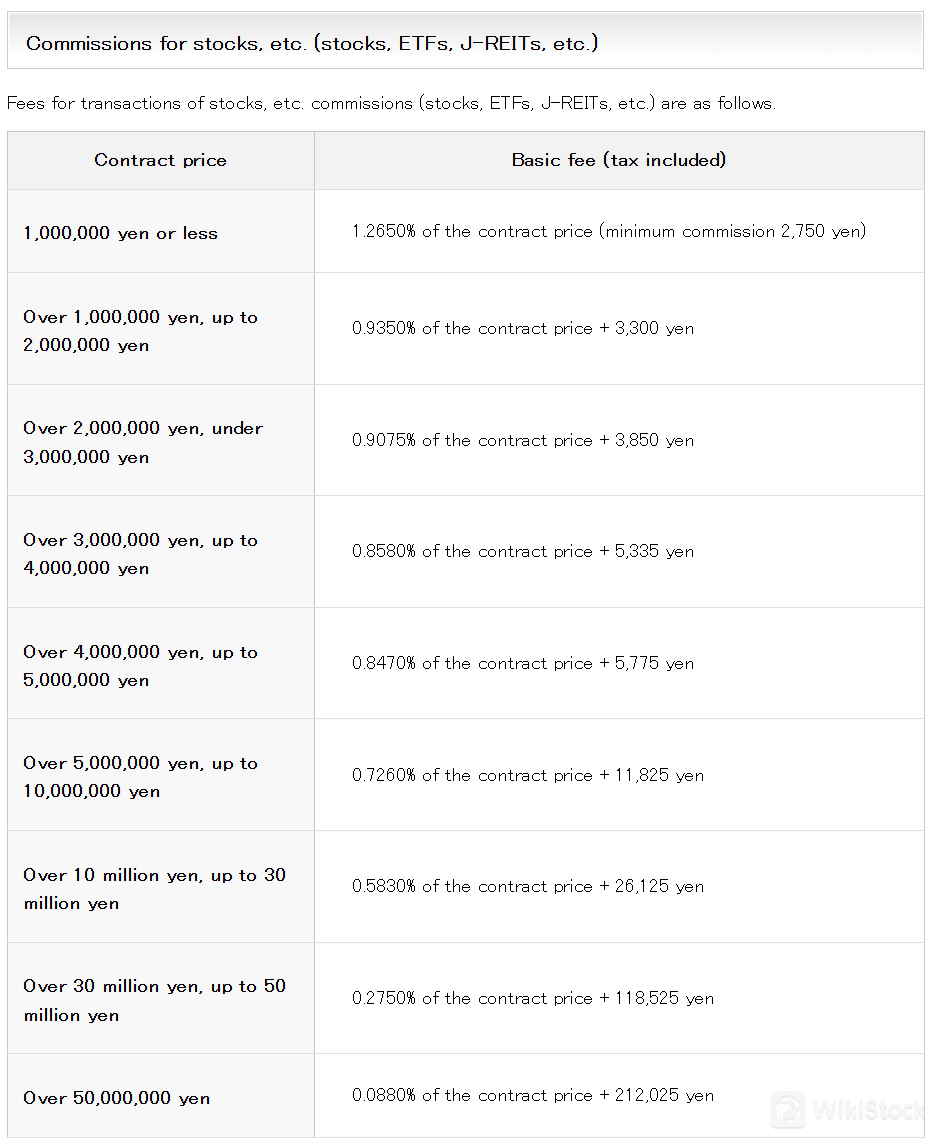

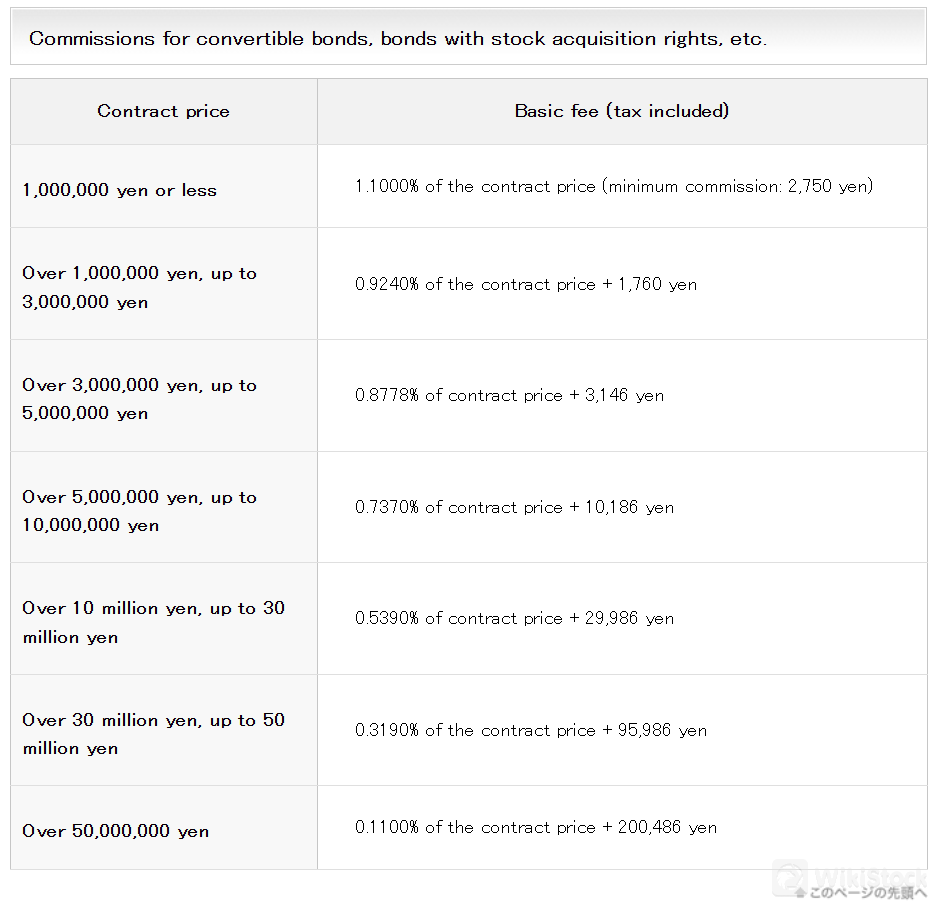

Senshu Ikeda Tokai Tokyo Securities Co., Ltd. applies a tiered commission structure for various financial instruments.

Transactions involving stocks, ETFs, and J-REITs are subject to fees based on the contract price, starting at 1.2650% for contracts up to 1,000,000 yen, with a minimum commission of 2,750 yen. As the contract price increases, the commission percentage decreases progressively, supplemented by additional flat fees to cover larger transactions, culminating in a minimum of 0.0880% plus 212,025 yen for contracts exceeding 50,000,000 yen.

Similarly, convertible bonds, bonds with stock acquisition rights, and similar products incur commission fees structured around the contract price, beginning at 1.1000% for contracts up to 1,000,000 yen, with a minimum commission of 2,750 yen. The fee percentage diminishes with higher contract values, combined with escalating flat fees to manage larger transactions, concluding at a minimum of 0.1100% plus 200,486 yen for contracts surpassing 50,000,000 yen.

Research and Education

Senshu Ikeda Tokai Tokyo Securities Co., Ltd. offers educational opportunities primarily through its “Fund Wrap Seminar,” available exclusively to account holders. This seminar provides participants with the convenience of joining sessions from their PC or smartphone.

Customer Service

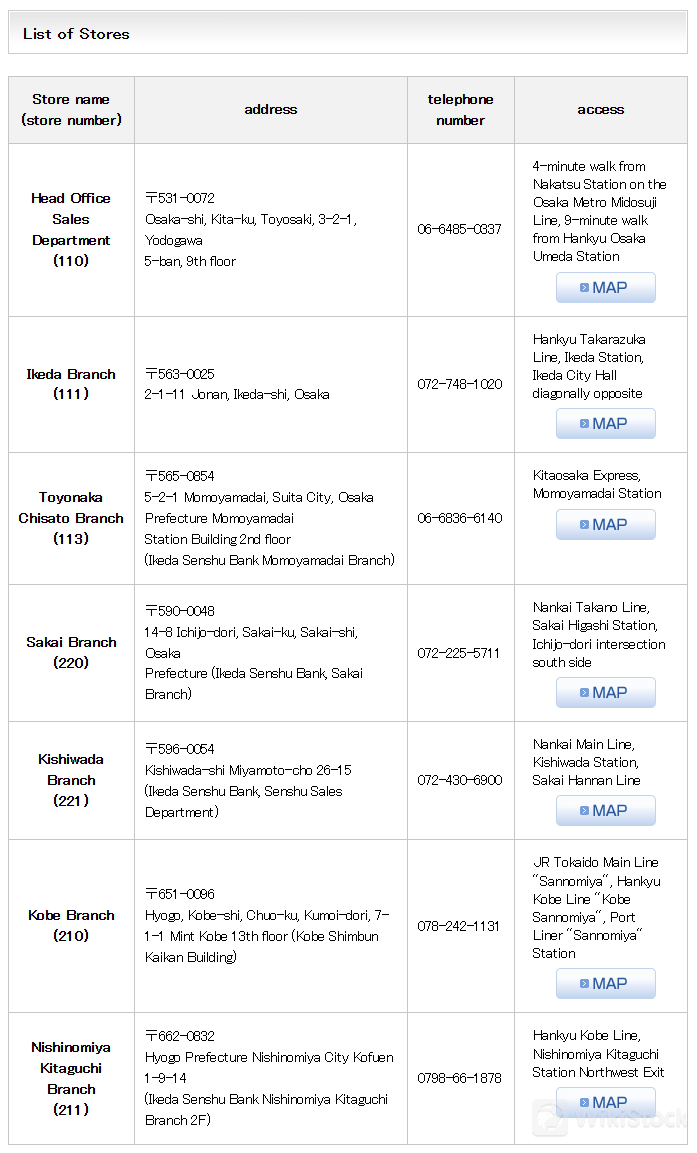

Senshu Ikeda Tokai Tokyo Securities Co., Ltd. operates several branches across Osaka and Hyogo prefectures, providing accessible customer service and support.

The Head Office Sales Department is located at 3-2-1 Toyosaki, Kita-ku, Osaka-shi, Osaka (Postal code: 531-0072), reachable at 06-6485-0337. Other key branches include Ikeda Branch at 2-1-11 Jonan, Ikeda-shi, Osaka (Postal code: 563-0025; Phone: 072-748-1020), and Toyonaka Chisato Branch at 5-2-1 Momoyamadai, Suita City, Osaka Prefecture (Postal code: 565-0854; Phone: 06-6836-6140). Additionally, branches like Sakai Branch (14-8 Ichijo-dori, Sakai-ku, Sakai-shi, Osaka; Phone: 072-225-5711), Kishiwada Branch (Miyamoto-cho 26-15, Kishiwada-shi, Osaka; Phone: 072-430-6900), Kobe Branch (7-1-1 Kumoi-dori, Chuo-ku, Kobe-shi, Hyogo; Phone: 078-242-1131), and Nishinomiya Kitaguchi Branch (1-9-14 Kofuen, Nishinomiya City, Hyogo; Phone: 0798-66-1878) provide localized support for clients' investment needs and inquiries.

Conclusion

Senshu Ikeda Tokai Tokyo Securities Co., Ltd. is distinguished by its rigorous regulatory oversight by Japan's Financial Services Agency (FSA), instilling confidence through adherence to stringent standards and ensuring a secure trading environment. This makes it an ideal choice for conservative investors who prioritize regulatory compliance and trustworthiness in their brokerage. However, the firm's lack of support for forex and cryptocurrency trading limits options for investors seeking exposure to these dynamic markets.

FAQs

Is Senshu Ikeda Tokai Tokyo Securities Co., Ltd. safe for trading?

Senshu Ikeda Tokai Tokyo Securities Co., Ltd. is licensed by the Financial Services Agency (FSA) and adheres to comprehensive security measures to protect against unauthorized access, data leakage, and other risks concerning personal data. These measures include organizational controls, personnel safety management, physical and technical security protocols, and ongoing monitoring of external threats.

Is Senshu Ikeda Tokai Tokyo Securities Co., Ltd. suitable for beginners?

Senshu Ikeda Tokai Tokyo Securities Co., Ltd. offers limited educational resources, which might present challenges for beginners seeking guidance and learning opportunities.

Is Senshu Ikeda Tokai Tokyo Securities Co., Ltd. legitimate?

Yes, Senshu Ikeda Tokai Tokyo Securities Co., Ltd. is a legitimate company licensed by the Financial Services Agency (FSA) and registered under number 370 by the Kinki Local Finance Bureau (Kinsho).

Risk Warning

The information presented is derived from WikiStock's expert analysis of the brokerage's website data and is subject to updates. It's important to note that online trading carries significant risks, including the potential for complete loss of invested capital. Understanding these risks thoroughly before participating is essential.

Others

Registered region

Japan

Years in Business

10-15 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

静銀ティーエム証券

Score

丸近證券

Score

光世証券

Score

第四北越証券

Score

ニュース証券

Score

百五証券

Score

山形證券

Score

Tachibana Securities Co., Ltd.

Score

北洋証券

Score

リテラ・クレア証券株式会社

Score