Score

長野證券

https://naganosec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

NAGANO SECURITIES Co.,LTD.

Abbreviation

長野證券

Platform registered country and region

Company address

Company website

https://naganosec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| Nagano Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Commissions | Varies based on contract amount |

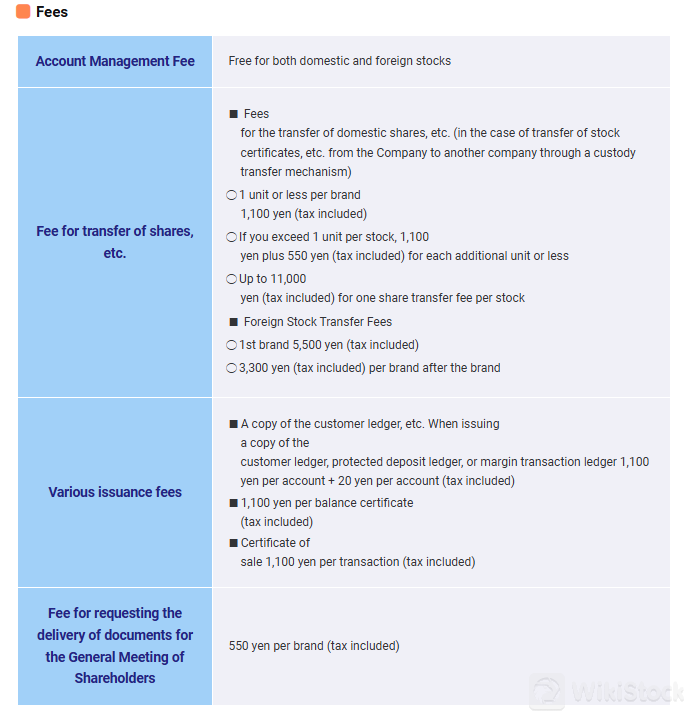

| Account Management Fee | Free for both domestic and foreign stocks |

| Margin Interest Rates | Not Mentioned |

| Mutual Funds Offered | Need to check the prospectus |

| App/Platform | Not Mentioned |

| Promotions | Unavailable |

Nagano Securities Information

Nagano Securities is a prominent financial services firm based in Japan, renowned for its comprehensive range of investment products and services. Regulated by the Financial Services Agency (FSA), Nagano Securities adheres to stringent standards that prioritize investor protection and market integrity. The firm offers a diverse array of trading options including stocks from global markets, bonds, investment trusts, ETFs, ETNs, and Real Estate Investment Trusts (J-REITs) with a transparent fee structure.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Margin Interest Rates Not Specified |

| Diverse Investment Products | Platform Information Not Provided |

| Transparent Fee Structure | |

| Comprehensive Investor Education | |

| Accessible Customer Support |

Regulated by FSA: Regulated by Japan's Financial Services Agency (FSA), ensuring adherence to strict standards that protect investor interests and maintain market integrity.

Diverse Investment Products: Offers a wide range of investment options including stocks (domestic and international), bonds, ETFs, ETNs, investment trusts, and J-REITs.

Transparent Fee Structure: Implements a clear and competitive fee schedule for various transactions, providing clarity and ensuring fair pricing for clients.

Comprehensive Investor Education: Provides robust educational resources, particularly aimed at beginners, to empower investors with fundamental financial knowledge and market insights.

Accessible Customer Support: Offers comprehensive customer service channels, including telephone and fax support during business hours.

ConsMargin Interest Rates Not Specified: Lack of specific information regarding margin interest rates requires investors to directly inquire or consult additional documentation for details on borrowing costs associated with margin trading.

Platform Information Not Provided: There is no detailed information about the trading platform, including its features, usability, and accessibility. This can be a significant disadvantage for traders who rely on robust and user-friendly platforms for their trading activities.

Is Nagano Securities Safe?

Nagano Securities is regulated by the oversight of the oversight of the Financial Services Agency (FSA). This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, Nagano Securities ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

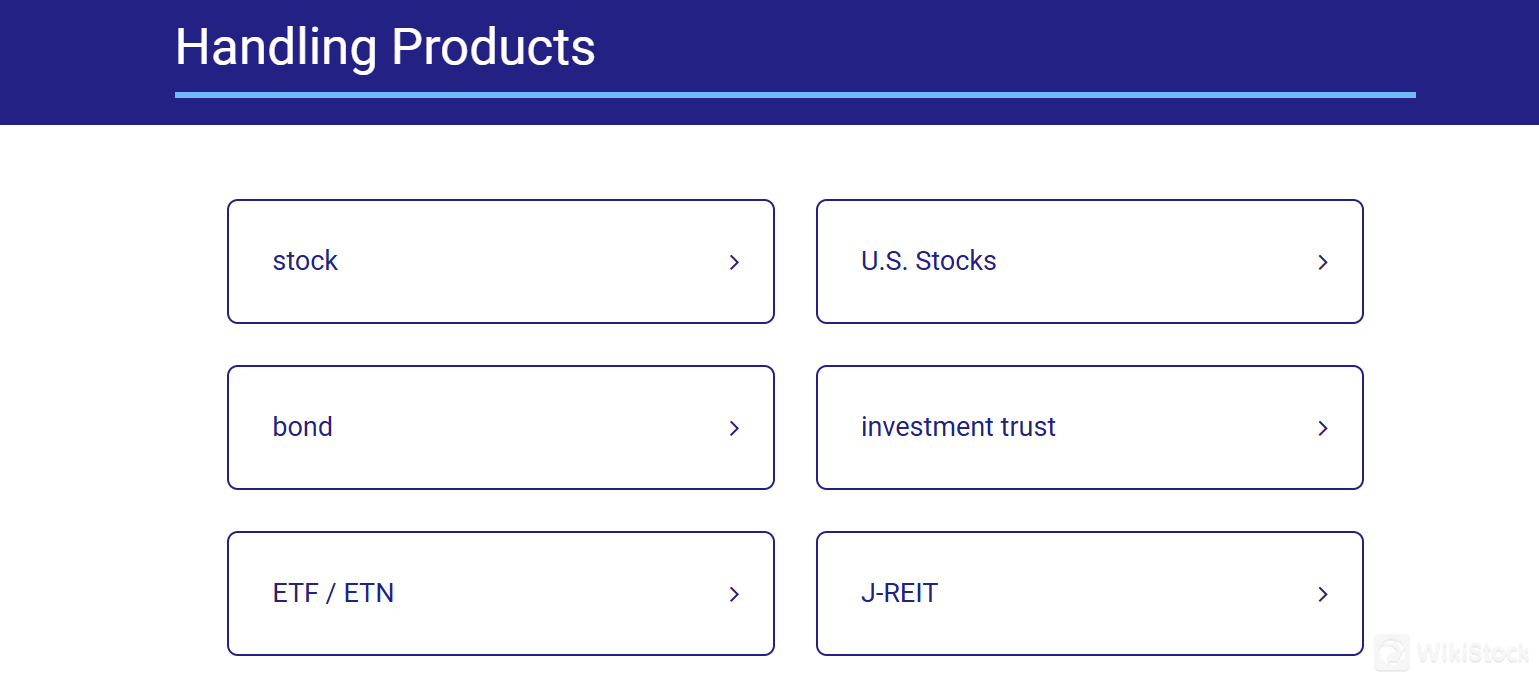

What are Securities to Trade with Nagano Securities?

Nagano Securities offers a diverse range of trading products.

Their stock trading platform provides access to a wide selection of stocks from both domestic and international markets, including U.S. Stocks, ensuring clients can participate in global investment opportunities. For those interested in fixed-income investments, Nagano Securities offers bonds, providing a stable income stream and diversification benefits to portfolios.

Investment trusts, another cornerstone of Nagano Securities' offerings, allow investors to access professionally managed funds that span different asset classes and regions. These trusts are designed to suit different risk appetites and investment goals, offering flexibility and expert management.

Additionally, the platform supports trading in Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs), which provide cost-effective exposure to various indices, commodities, or sectors. Furthermore, Nagano Securities facilitates investments in J-REITs (Real Estate Investment Trusts), allowing investors to benefit from income generated by real estate assets without direct ownership.

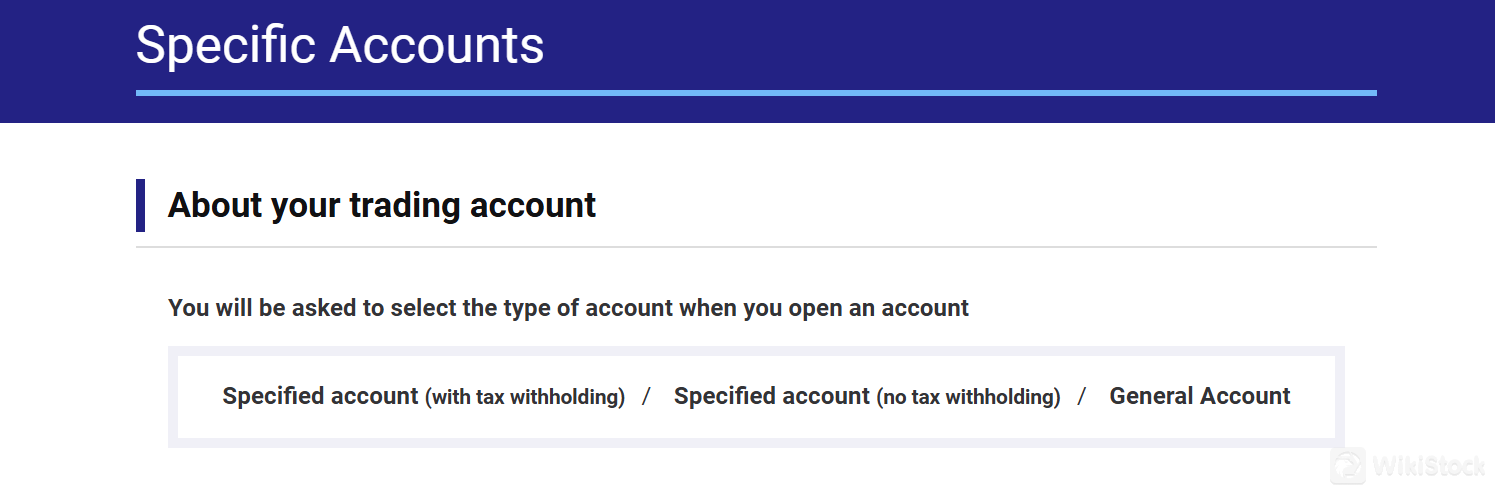

Nagano Securities Accounts

Nagano Securities provides a range of account options tailored to meet the diverse needs of investors.

For those looking to optimize their tax efficiency, Nagano offers Specified Accounts with and without tax withholding options. These accounts are ideal for investors seeking tax advantages on capital gains and dividends, depending on their individual tax circumstances.

Additionally, Nagano Securities offers a General Account, providing flexibility and convenience for investors who prefer a straightforward trading account without specific tax considerations.

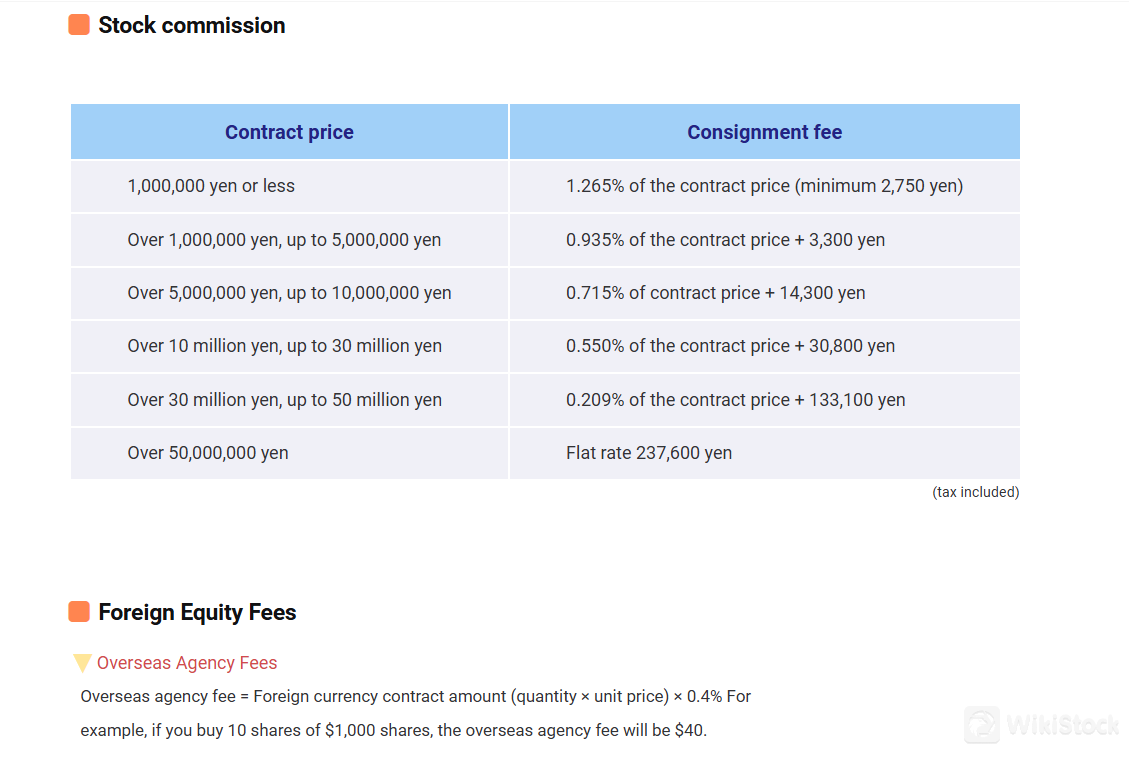

Nagano Securities Fees Review

Nagano Securities implements transparent and competitive pricing structures for its clients.

Stock Commission FeesFor Contracts (Tax Included):

- 1,000,000 yen or less:

- Consignment fee: 1.265% of the contract price (minimum 2,750 yen)

- Over 1,000,000 yen, up to 5,000,000 yen:

- Consignment fee: 0.935% of the contract price + 3,300 yen

- Over 5,000,000 yen, up to 10,000,000 yen:

- Consignment fee: 0.715% of the contract price + 14,300 yen

- Over 10 million yen, up to 30 million yen:

- Consignment fee: 0.550% of the contract price + 30,800 yen

- Over 30 million yen, up to 50 million yen:

- Consignment fee: 0.209% of the contract price + 133,100 yen

- Over 50,000,000 yen:

- Flat rate: 237,600 yen

For Domestic Fees (including Consumption Tax):

- 1,000,000 yen or less:

- Domestic fee: 1.265% of the trading price (minimum 2,750 yen)

- Over 1,000,000 yen, up to 5,000,000 yen:

- Domestic fee: 0.935% of the transaction price + 3,300 yen

- Over 5,000,000 yen, up to 10,000,000 yen:

- Domestic fee: 0.715% of the transaction price + 14,300 yen

- Over 10 million yen, up to 30 million yen:

- Domestic fee: 0.550% of the transaction price + 30,800 yen

- Over 30 million yen, up to 50 million yen:

- Domestic fee: 0.209% of the transaction price + 133,100 yen

- Over 50,000,000 yen:

- Flat rate: 237,600 yen

- Overseas Agency Fees:

- Overseas agency fee = Foreign currency contract amount (quantity × unit price) × 0.4%

Moreover, Nagano Securities distinguishes itself with a client-friendly approach to account management, offering free services for both domestic and foreign stocks, thus eliminating account management fees entirely.

Furthermore, Nagano Securities provides access to a variety of mutual funds, though details such as specific offerings, investment objectives, fees, and performance metrics can be obtained through prospectuses.

Research & Education

Nagano Securities provides comprehensive education resources tailored for beginners in the world of finance. The “For Beginners” section is designed to empower newcomers with fundamental knowledge and insights into investing, covering topics such as basic investment principles, market analysis techniques, and understanding financial instruments. With user-friendly content and accessible learning materials, Nagano Securities aims to equip individuals with the necessary skills and confidence to navigate the complexities of the financial markets effectively.

Customer Service

Nagano Securities provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

- Tel: 026-228-3003

- Fax: 026-228-3004

- Reception hours: 9:00 〜 17:00, closed on Saturdays, Sundays, national holidays, and year-end and New Year holidays

- Head Office Address: Kitaishidocho-1448, Nagano, 380-0826, Japan

Conclusion

In conclusion, Nagano Securities presents itself as a regulated and comprehensive trading platform, offering a diverse range of investment services with a transparent fee structure and comprehensive educational resources. However, the lack of specific information regarding margin interest rates and platform specifics can hinder a trader's decision-making process. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is Nagano Securities suitable for beginners?

Yes, Nagano Securities is suitable for beginners due to its user-friendly platform, educational resources, and comprehensive customer support.

Is Nagano Securities legit?

Yes, Nagano Securities is regulated by FSA.

What investment products does Nagano Securities offer?

Stocks (domestic and international), bonds, ETFs, ETNs, investment trusts, and Real Estate Investment Trusts (J-REITs).

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

2-5 years

Commission Rate

0.209%

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

内藤証券株式会社

Score

Ichiyoshi Securities

Score

広田証券

Score

丸八証券株式会社

Score

ひろぎん証券

Score

三木証券

Score

JTG証券

Score

JIA証券

Score

山和証券株式会社

Score

八十二証券

Score