Score

ひろぎん証券

https://www.hirogin-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

A

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

HIROGIN SECURITIES CO., LTD

Abbreviation

ひろぎん証券

Platform registered country and region

Company address

Company website

https://www.hirogin-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

ひろぎん証券 Earnings Calendar

Currency: JPY

Cycle

Q3 FY2024 Earnings

2024/02/04

Revenue(YoY)

35.15B

+11.78%

EPS(YoY)

22.11

+67.12%

ひろぎん証券 Earnings Estimates

Currency: JPY

- DateCycleRevenue/Estimated

- 2024/02/042024/Q346.755B/0

- 2023/08/022024/Q146.507B/0

- 2023/02/052023/Q341.580B/0

- 2022/08/022023/Q138.046B/0

- 2022/02/062022/Q335.924B/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.6325%

Funding Rate

3.5%

New Stock Trading

Yes

Margin Trading

YES

| Hirogin Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

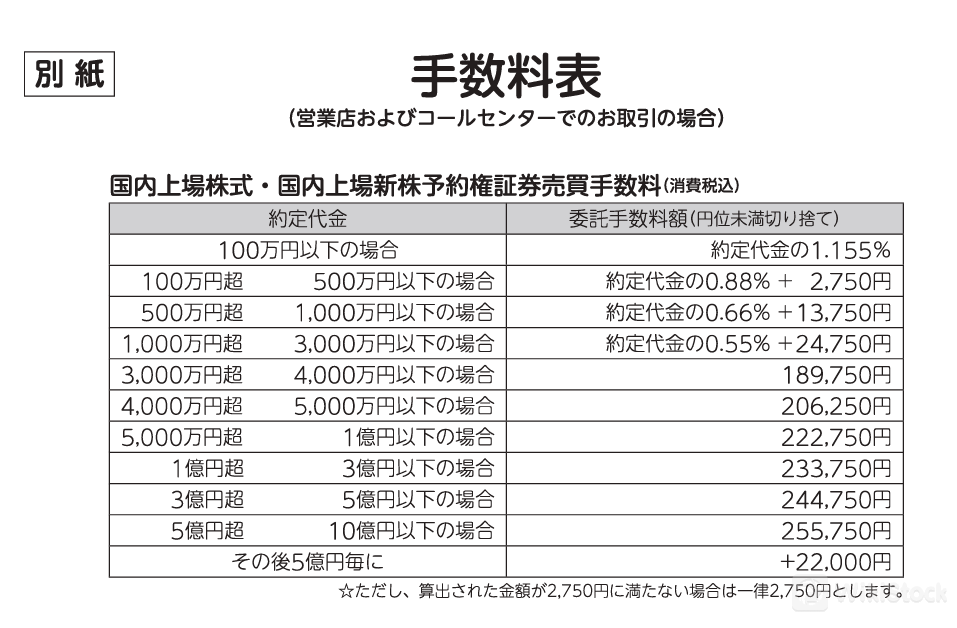

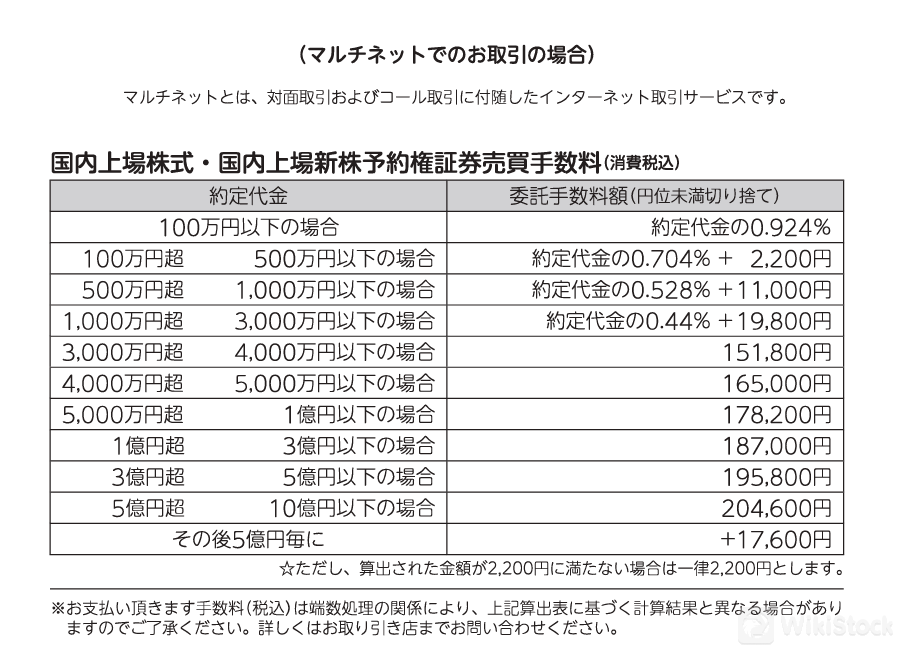

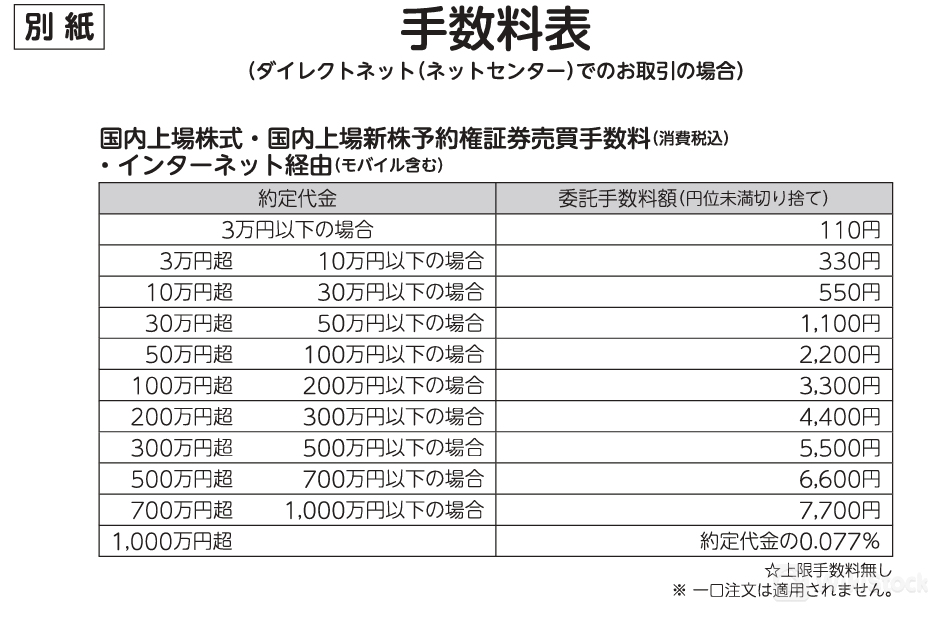

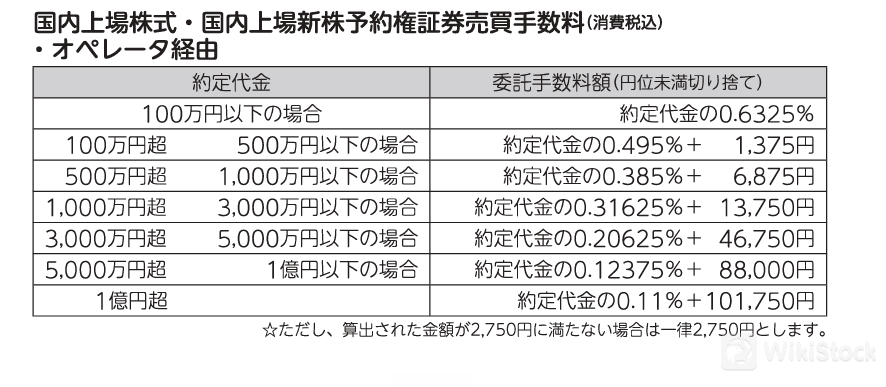

| Fees | Commission rates vary based on transaction amount, from 0.924% for amounts under 1,000,000 yen to flat fees for transactions above 30,000,000 yen |

| Mutual Funds Offered | Yes |

| App/Platform | Supports online trading through various devices, including PCs, tablets, and smartphones |

Hirogin Securities Information

Hirogin Securities is a Japanese financial services firm offering multi-channel trading options, including online trading through various devices. The firm provides a range of investment products and continuously updates their clients with market news and investment information. The company does not accept new accounts for call trading at this time.

Pros & Cons of Hirogin Securities

| Pros | Cons |

| Good Reputation and Regulation | Limited Trading Categories |

| Multiple Devices Supported | |

| Rich Research and Resources |

- Good Reputation and Regulation: Hirogin Securities has a professional online presence and a good reputation. It is regulated by FSA, ensuring a certain level of safety and security for clients.

- Multiple Devices Supported: Hirogin Securities supports online trading through multiple devices, including PCs, tablets, and smartphones.

- RichResearch and Resources: Hirogin Securities is dedicated to investor education, offering a wealth of information and market insights that empower clients to make informed investment decisions. Cons:

- Limited Trading Categories: There is no mention of margin trading, IPOs, or OTC opportunities, which could be a limitation for some investors.

- Domestic Stocks: Available for trading through various types such as Prime, Standard, Growth, and Regional Exchanges.

- ETFs (Exchange-Traded Funds): Offered for trading across all methods.

- ETNs (Exchange-Traded Notes): Including index-linked securities, available for trading.

- REITs (Real Estate Investment Trusts): Tradable through the platform.

- Unit Stocks: Available with certain restrictions for online trading.

- Foreign Stocks: Can be traded but with specific limitations as noted for online trading.

- IPOs (Initial Public Offerings) and Public Offerings (PO): Available for over-the-counter trading but not for online trading.

- Futures Trading: Offered over-the-counter but not available for online or call trading.

- Options Trading: Available over-the-counter but not for online or call trading.

- Investment Trusts: Can be traded online from PCs, smartphones, and tablets but not from mobile phones.

- Domestic and Foreign Bonds: Available for trading with some restrictions noted for online trading.

- Multi-channel Service Account: An account that allows trading through various platforms and services.

- Face-to-Face Trading Account: An account designed for investors who prefer personalized service and trading assistance in person.

- Online Trading Account: An account for investors who wish to conduct trades and manage their investments online.

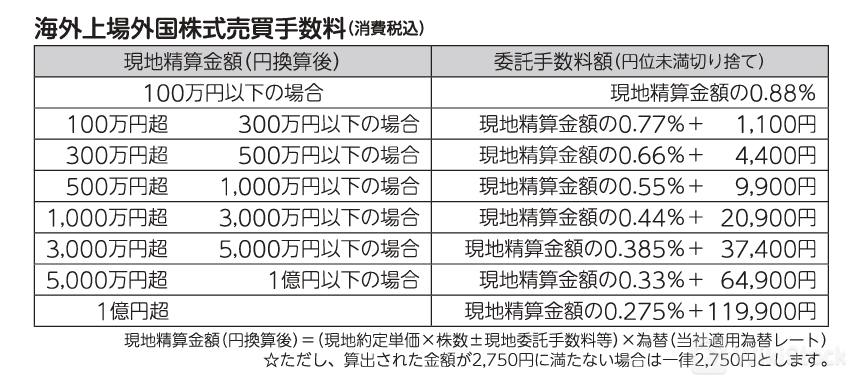

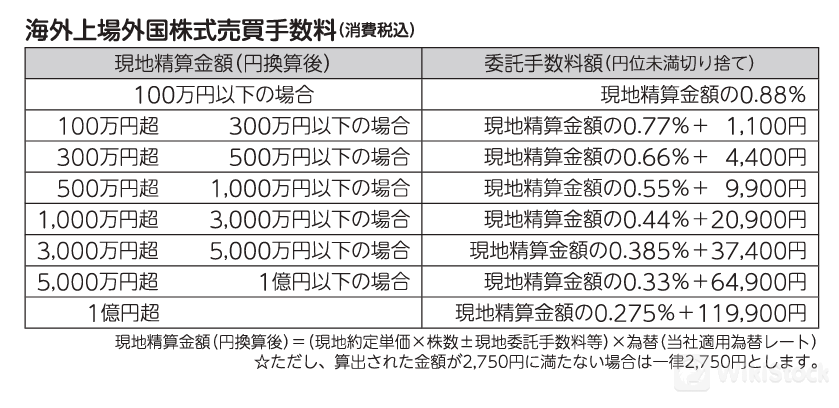

- Overseas Stock Trading: Commissions range from 0.88% for transactions under 1 million yen to 0.275% plus a base fee for amounts exceeding 1 billion yen.

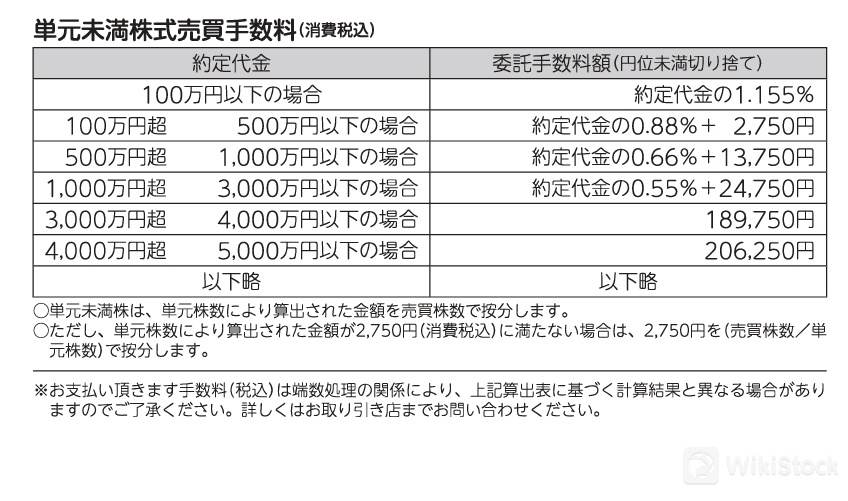

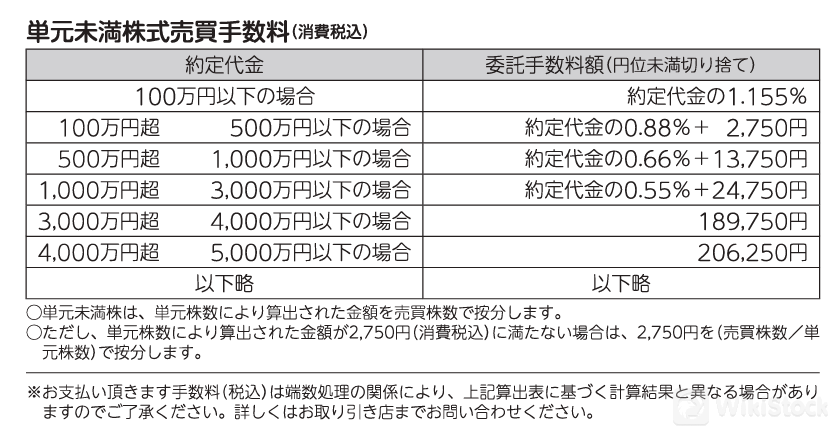

- Fractional Share Trading: Starts at 1.155% for transactions under 1 million yen, with tiered rates and additional fees for higher amounts, capped at a fixed fee for trades over 5 million yen.

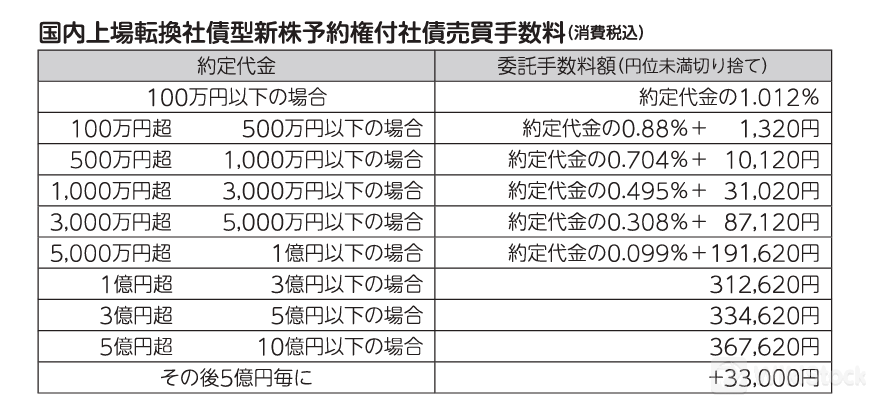

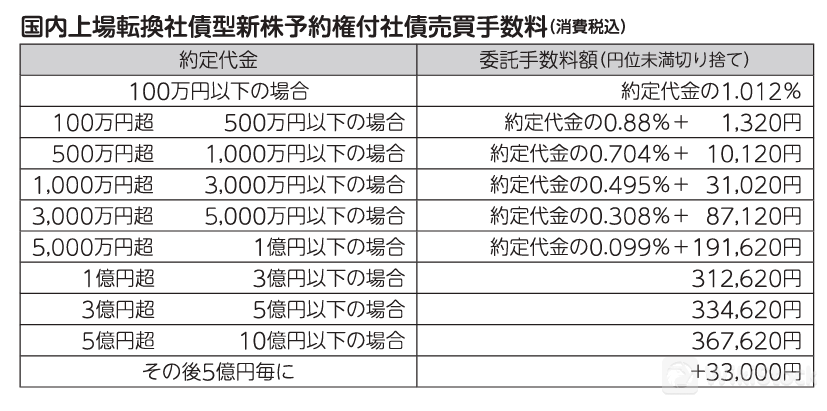

- Convertible Bond Trading: Initial rate of 1.012% for transactions under 1 million yen, descending to a fixed fee structure for larger transactions.

- Domestic Stock Trading: Commissions begin at 0.924% for transactions under 100 million yen, with tiered rates and caps for higher values.

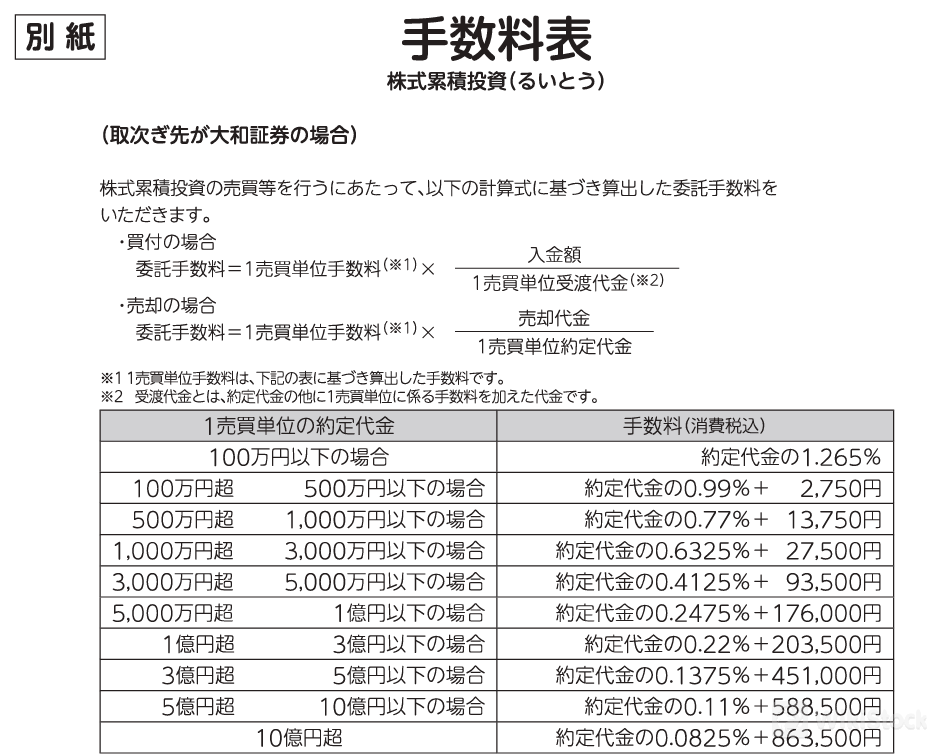

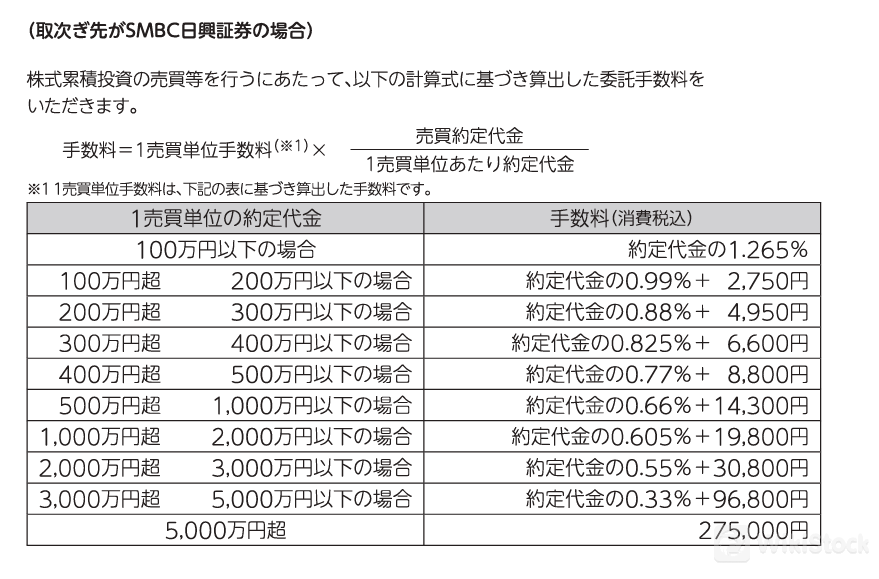

- Investment Trust Fee: Calculated on a sliding scale, with rates starting at 1.265% and decreasing for larger investment amounts.

- Foreign Stock Trading: Commissions are calculated similarly to overseas stock trades, with a tiered structure and base fees.

Is Hirogin Securities Safe?

Regulation:

Hirogin Securities is regulated by the Japan Financial Services Agency (FSA, No. 中国財務局長(金商)第20号), which is the primary regulatory body overseeing financial service providers in Japan, including Forex brokers. The FSA ensures that all regulated entities comply with strict financial standards and consumer protection laws. This regulatory oversight contributes to the safety and reliability of Hirogin Securities as a financial services provider.

Hirogin Securities is a regulated brokerage offering a wide array of financial services includingstocks, options, futures, and investment advisory, as confirmed by its licensing under the Japan Financial Services Agency since November 12, 2007, which has had a long-standing presence in the industry.

What are Securities to Trade with Hirogin Securities?

Hirogin Securities provides a variety of securities for trading, including:

Hirogin Securities Accounts

Hirogin Securities Fees Review

Hirogin Securities App Review

Hirogin Securities' online trading capabilities span across multiple devices, including PCs, tablets, and smartphones. These platforms are equipped with robust features that empower users to execute trades swiftly and securely, providing real-time market data, advanced charting tools, and customizable interfaces.

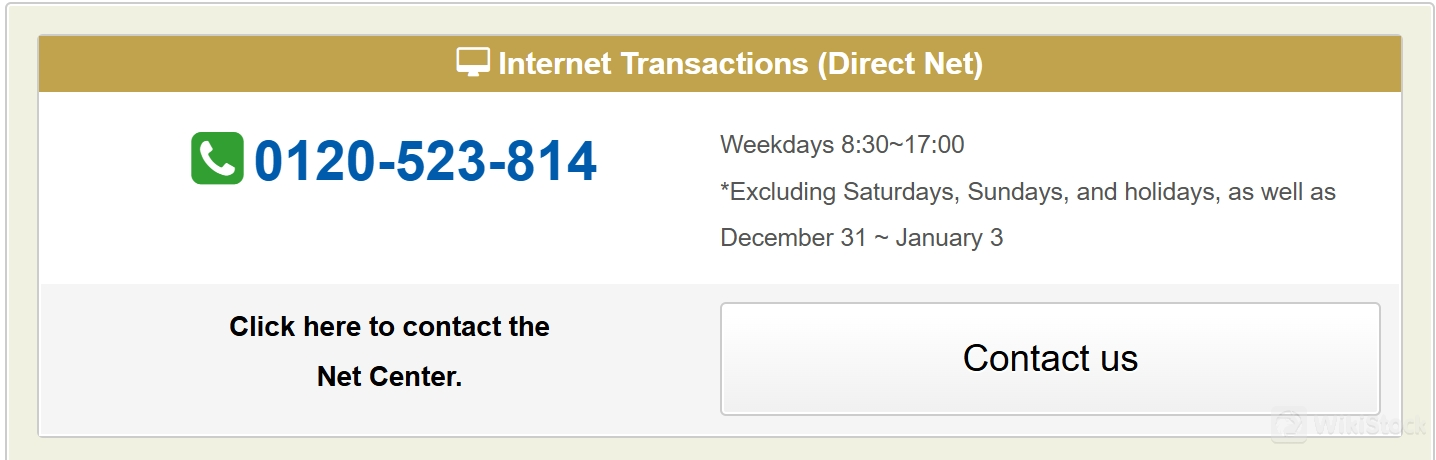

Customer Service

Hirogin Securities offers customer service on weekdays from 8:30 AM to 5:00 PM, excluding weekends, holidays, and the period from December 31 to January 3. Clients can reach out to their support team via phone at 0120-523-814 for assistance with their financial inquiries and services.

Conclusion

Hirogin Securities is a regulated brokerage with a focus on multi-channel trading, combining online convenience with personalized face-to-face support. Its core strengths lie in providing a secure trading environment and a variety of investment options, making it suitable for investors who value both digital accessibility and personal service.

FAQs

Is Hirogin Securities safe to trade?

Yes, Hirogin Securities is regulated by the Japan Financial Services Agency (FSA).

Is Hirogin Securities a good platform for beginners?

While the website does not specifically target beginners, the availability of multi-channel support, including face-to-face transactions, could be beneficial for new investors seeking guidance.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

東海東京証券

Score

Mita Securities

Score

GMOクリック証券

Score

Matsui

Score

Okasan Securities

Score

丸三証券

Score

安藤証券

Score

アイザワ証券

Score

SMBC

Score

今村証券

Score