Score

ワイエム証券

https://www.ymsec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

6

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

YM Securities Co.,Ltd

Abbreviation

ワイエム証券

Platform registered country and region

Company address

Company website

https://www.ymsec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| YM Securities Co.,Ltd |  |

| WikiStock Rating | ⭐ ⭐ ⭐ |

| Fees | Stocks, ETFs, and J-REITs: 2,750 yen(minimum commission fee);Convertible bonds and bonds with stock acquisition rights: 2,750 yen(minimum commission fee) |

| Mutual Funds Offered | Yes |

| Promotions | Not available yet |

What is YM Securities Co.,Ltd?

YM Securities Co., Ltd. is regulated by the Financial Services Agency (FSA) in Japan and offers valuable educational resources for investors. However, it does not support forex or cryptocurrency trading and has limited contact options.

Pros and Cons of YM Securities Co.,Ltd?

YM Securities Co., Ltd. is a regulated entity under the Financial Services Agency (FSA) in Japan, ensuring a secure and compliant trading environment. The company offers valuable educational resources for investors, enhancing their knowledge and investment strategies. However, YM Securities does not support forex or cryptocurrency trading, which may be a limitation for some traders. Additionally, the firm provides limited contact options, and the information about its trading platform is not clearly outlined, which could be a drawback for potential clients seeking comprehensive platform details.

| Pros | Cons |

|

|

|

|

|

Is YM Securities Co.,Ltd safe?

Regulation

YM Securities Co., Ltd. is currently licensed under the authorization of the Financial Services Agency (FSA) in Japan, with license number 中国財務局長(金商)第8号.

What are securities to trade with YM Securities Co.,Ltd?

YM Securities Co., Ltd. offers a diverse range of trading instruments, including stocks, bonds, investment trusts, mutual funds, and Fund Wrap. However, they do not provide certain key products such as options, futures, and cryptocurrency trading.

Stocks

YM Securities allows trading in domestic stocks, real estate investment trusts (REITs), exchange-traded funds (ETFs), initial public offerings (IPOs), and publicly listed shares on major Japanese exchanges. Additionally, they offer access to stocks from European, American, and Asian markets.

Bonds

The company handles various types of bonds, including individual government bonds, foreign bonds, and corporate bonds.

Investment Trusts

YM Securities provides a range of domestic investment trusts that invest in both Japanese and international stocks and bonds. These can be traded online via computer or smartphone.

Mutual Funds

Customers can start investing in mutual funds with small amounts, benefiting from the diversification effects of monthly fixed-amount purchases. Funds are conveniently withdrawn via direct debit from accounts at Yamaguchi Bank, Momiji Bank, and Kitakyushu Bank.

Fund Wrap

Fund Wrap is a personalized asset management service that collaborates with clients to develop a tailored investment strategy.

YM Securities Co.,Ltd Fees Review

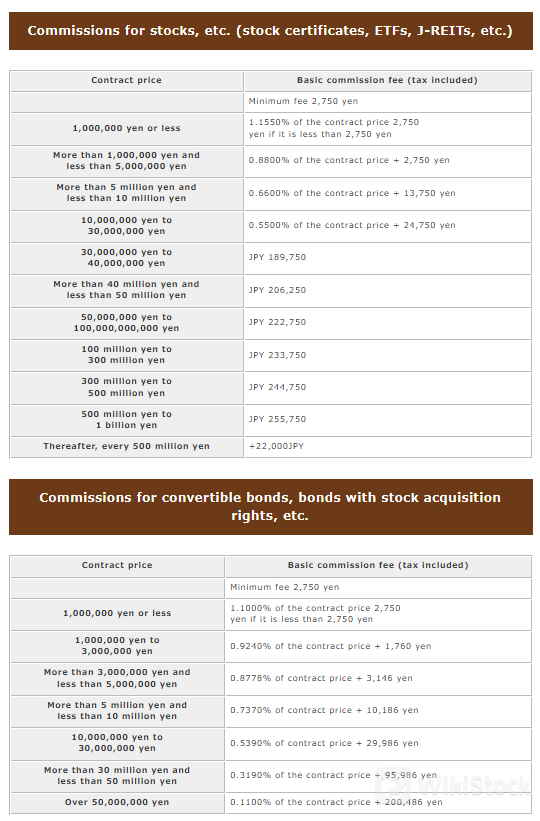

YM Securities Co., Ltd. implements a detailed fee structure for various financial products.

For stocks, ETFs, and J-REITs, the minimum commission fee is 2,750 yen (tax included). For contract prices up to 1,000,000 yen, the fee is 1.1550% of the contract price, with a minimum of 2,750 yen. For contract prices between 1,000,000 yen and 5,000,000 yen, the fee is 0.8800% of the contract price plus 2,750 yen. For contract prices between 5,000,000 yen and 10,000,000 yen, the fee is 0.6600% of the contract price plus 13,750 yen. For contract prices between 10,000,000 yen and 30,000,000 yen, the fee is 0.5500% of the contract price plus 24,750 yen. Fixed fees are applied for larger contract prices: 189,750 yen for 30,000,000 yen to 40,000,000 yen, 206,250 yen for 40,000,000 yen to 50,000,000 yen, 222,750 yen for 50,000,000 yen to 100,000,000 yen, 233,750 yen for 100,000,000 yen to 300,000,000 yen, 244,750 yen for 300,000,000 yen to 500,000,000 yen, and 255,750 yen for 500,000,000 yen to 1,000,000,000 yen. An additional 22,000 yen is charged for every increment of 500,000,000 yen beyond that.

For convertible bonds and bonds with stock acquisition rights, the minimum commission fee is also 2,750 yen (tax included). For contract prices up to 1,000,000 yen, the fee is 1.1000% of the contract price, with a minimum of 2,750 yen. For contract prices between 1,000,000 yen and 3,000,000 yen, the fee is 0.9240% of the contract price plus 1,760 yen. For contract prices between 3,000,000 yen and 5,000,000 yen, the fee is 0.8778% of the contract price plus 3,146 yen. For contract prices between 5,000,000 yen and 10,000,000 yen, the fee is 0.7370% of the contract price plus 10,186 yen. For contract prices between 10,000,000 yen and 30,000,000 yen, the fee is 0.5390% of the contract price plus 29,986 yen. For contract prices between 30,000,000 yen and 50,000,000 yen, the fee is 0.3190% of the contract price plus 95,986 yen. For contract prices over 50,000,000 yen, the fee is 0.1100% of the contract price plus 200,486 yen.

Mutual fund fees vary depending on the specific product. While customers may be responsible for a prescribed application fee, this fee cannot be displayed as it differs from product to product.

Research and Education

YM Securities Co., Ltd. offers a variety of educational seminars designed to enhance asset management and lifestyle. These seminars are led by experienced instructors who provide easy-to-understand explanations of essential knowledge and practical know-how.

Customer Service

YM Securities Co., Ltd. offers customer service to handle inquiries and complaints related to personal information. Customers can reach out for assistance by calling 083-223-0190 during business hours from 9:00 to 17:30, excluding holidays. For general complaints and consultations, the dedicated desk can be contacted at 083-223-0186.

Conclusion

YM Securities Co., Ltd. is regulated by the Financial Services Agency (FSA) in Japan and offers valuable educational resources for investors. It is ideal for investors seeking a secure and educational environment for trading traditional assets, though it may not suit those interested in forex or cryptocurrency trading.

FAQs

Is YM Securities Co., Ltd. safe to trade with?

YM Securities Co., Ltd. is currently licensed under the authorization of the Financial Services Agency (FSA) in Japan. However, information about funds safety and specific safety measures is not available.

Is YM Securities Co., Ltd. a good platform for beginners?

YM Securities offers a beginner-friendly interface. Their face-to-face consulting service ensures that experts who understand the customer's situation will work with them to design a personalized asset management plan.

Is YM Securities Co., Ltd. legit?

YM Securities Co., Ltd. is currently licensed under the authorization of the Financial Services Agency (FSA) in Japan, with license number 中国財務局長(金商)第8号.

Risk Warning

The information provided is derived from WikiStock's expert evaluation of the brokerage's website data and is subject to change. Additionally, online trading carries significant risks and may result in the complete loss of invested funds. Therefore, it is essential to fully understand these risks before participating.

Others

Registered region

Japan

Years in Business

15-20 years

Commission Rate

0.55%

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

静銀ティーエム証券

Score

丸近證券

Score

光世証券

Score

第四北越証券

Score

ニュース証券

Score

百五証券

Score

山形證券

Score

Tachibana Securities Co., Ltd.

Score

北洋証券

Score

リテラ・クレア証券株式会社

Score