Score

宏滙證券

http://www.gvsec.hk/home/tc/index.html

Website

Rating Index

Brokerage Appraisal

Influence

D

Influence Index NO.1

China Hong Kong

China Hong Kong Products

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 2 securities license(s)

SFCRevoked

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Fund Management License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 02051

Brokerage Information

More

Company Name

Grand View Securities Limited

Abbreviation

宏滙證券

Platform registered country and region

Company address

Company website

http://www.gvsec.hk/home/tc/index.htmlCheck whenever you want

WikiStock APP

Previous Detection: 2024-12-25

- The regulatory status of China Hong Kong Securities and Futures Commission of Hongkong (License No.: BIG377) is abnormal, the official regulatory status is Revoked, please be aware of the risk!

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 19894

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

Others

1572858.13%Estonia

127712.83%Nepal

9949.99%Cambodia

9809.85%Egypt

9159.20%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Commission Rate

0.25%

Funding Rate

4%

New Stock Trading

Yes

Margin Trading

YES

| Grand View Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | Not Mentioned |

| Fees | 0.25% |

| Interests on Uninvested Cash | Not Mentioned |

| Margin Interest Rates | Not Mentioned |

| Mutual Funds Offered | Not Mentioned |

| App/Platform | Gotrade |

| Promotions | Not Mentioned |

Grand View Securities Information

Grand View Securities Limited is a regulated financial services firm based in Hong Kong, offering a comprehensive range of services including securities trading, margin financing, new share subscription, and fund management. The company is licensed by the China Hong Kong Securities and Futures Commission, ensuring compliance with regulatory standards. Grand View Securities prioritizes client support, providing round-the-clock assistance through multiple channels such as telephone, email, fax, and a contact form.

Pros & Cons of Grand View Securities

| Pros | Cons |

| Regulated | Commission charge |

| Offers individual and joint accounts | |

| Transparent fee structure | |

| Multiple client support channels |

Regulated: Being regulated by a reputable regulatory authority ensures that Grand View Securities adheres to regulatory standards.

Offers individual and joint accounts: Grand View Securities caters to the needs of both individual traders and those who prefer joint investments.

Transparent fee structure: The company's commitment to transparency is demonstrated through its detailed fee structure, allowing clients to understand and assess the costs associated with their trading activities.

Multiple client support channels: Grand View Securities offers multiple channels of communication, such as telephone, email, fax, and a contact form.

ConsCommission charge: One of the drawbacks of Grand View Securities' platform is the commission charge incurred for transactions. While commission fees are a common practice in the brokerage industry, they can add up and impact overall investment returns for customers. Some users may find this additional cost to be a disadvantage when using the platform.

Regulatory Sight: Grand View Securities is regulated by the China Hong Kong Securities and Futures Commission of Hong Kong, holding a Securities Trading License (No.BIG377). Additionally, it is regulated by the same authority for its Fund Management License(No.BIX320). These regulatory licenses signify compliance with the regulatory framework established by the China Hong Kong Securities and Futures Commission, ensuring adherence to standards and guidelines governing securities trading and fund management activities within Hong Kong.

User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

Security Measures: So far we haven't found any information about the security measures for this broker.

Telephone: Clients can call their number at +852 3520 0350 for any queries.

Email: The firm offers assistance through email at cs@gvsec.hk.

Fax: Clients can fax them at +852 3568 5037.

Contact Form

Is Grand View Securities Safe?

What are Securities to Trade with Grand View Securities?

Grand View Securities offers a range of services which include securities trading services, margin financing services, and margin subscription of new shares and allotment services.

The securities trading services provided by Grand View Securities allow clients to buy and sell various financial instruments in the stock market.

Additionally, margin financing services offer clients the opportunity to leverage their investments and potentially increase their buying power.

The margin subscription of new shares and allotment services enable clients to participate in new share offerings and subscription activities.

Grand View Securities Accounts

Grand View Securities provides Individual and Joint Account options for traders.

An Individual Account is designed for single traders who wish to manage their investments independently. This account type allows individuals to make trading decisions and execute transactions on their own.

On the other hand, a Joint Account is suitable for multiple individuals who want to jointly invest in the stock market. Joint Account holders share ownership of the account and must make investment decisions together.

Grand View Securities Fees Review

Grand View Securities discloses a detailed fee structure to its clients. The fee schedule outlines charges applicable to various transactions and services offered by the company. This transparency allows traders to make informed decisions based on understanding the financial implications of their activities with Grand View Securities. Here are some of the major transaction fees.

Brokerage Commission: 0.25% of the transaction value, with a minimum fee of $100.00.

SFC Transaction Levy: 0.0027% of the transaction value.

HKEx Trading Fee: 0.005% of the transaction value.

Stamp Duty: 0.13% of the transaction value, with a minimum charge of $1.00 per $1,000.

CCASS Clearing Fee: 0.002% of the transaction value, with a minimum fee of $2.00.

Grand View Securities App Review

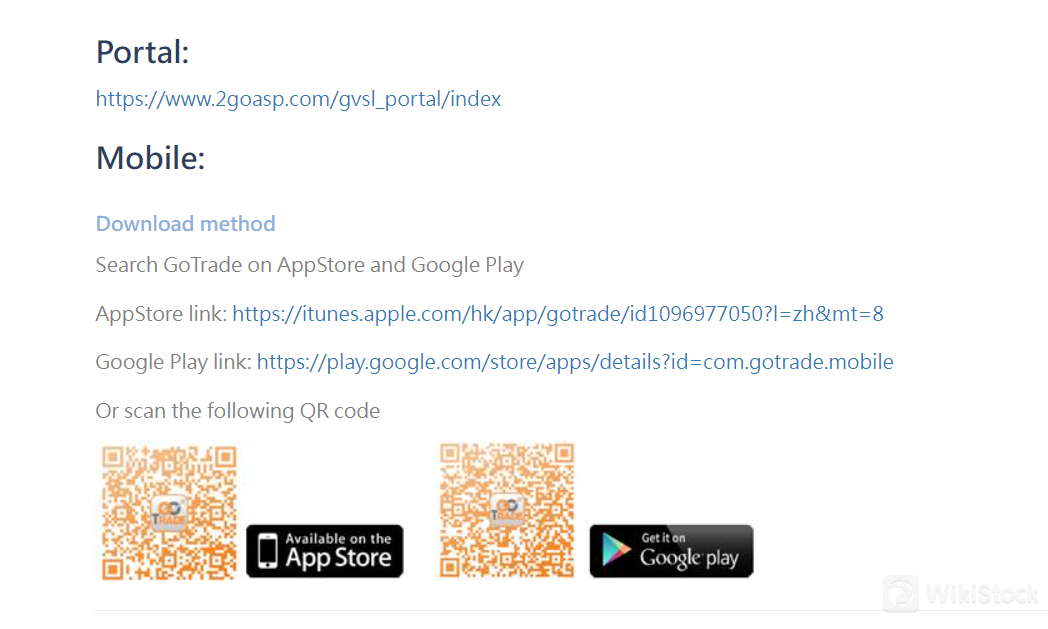

Grand View Securities offers a trading application known as Gotrade, which can be accessed and downloaded from the App Store for Apple devices and Google Play for Android devices. The Gotrade app provides users with a platform to engage in trading activities, monitor market trends, and manage their investment portfolios conveniently through their mobile devices. Traders can access real-time market information, execute trades, and stay updated on their investments using the features offered within the Gotrade app.

Research & Analysis

Grand View Securities provides research and analysis services to assist traders in making informed investment decisions. Through their research and analysis offerings, traders can access market insights, trends, and data that may impact their investment strategies.

Customer Service

Clients can reach out to Grand View Securities 24 hours a day, 5 days a week through various channels.

The company also provides its physical address, Room 2401, 50 Bonham Strand, Sheung Wan, Hong Kong.

Conclusion

In summary, Grand View Securities is a regulated financial services firm based in Hong Kong, offering a diverse range of services including securities trading and fund management. With 24/5 customer support and regulatory licenses from the China Hong Kong Securities and Futures Commission, the company exemplifies professionalism and transparency in serving its clients' investment needs.

FAQs

What financial services does Grand View Securities offer?

It offers securities trading, margin financing, and fund management services.

Is Grand View Securities regulated?

Yes, it is regulated by the China Hong Kong Securities and Futures Commission to ensure compliance with industry standards.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

潮商金融控股有限公司

Score

弘业国际金融

Score

MGHL

Score

Open Securities

Score

DA International

Score

Bluemount Financial

Score

盛源

Score

Yunfeng Financial Group

Score

Forwin Holding Limited

Score

中國公平集團

Score