Score

盛源

https://www.shengyuanhk.com/

Website

Rating Index

Brokerage Appraisal

Total assets data of all customers in have been included.

Influence

D

Influence Index NO.1

China Hong Kong

China Hong Kong Products

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 2 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Fund Management License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01909

Brokerage Information

More

Company Name

盛源控股有限公司

Abbreviation

盛源

Platform registered country and region

Company address

Company website

https://www.shengyuanhk.com/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

盛源 Earnings Estimates

- DateCycleEPS/Estimated

- 2023/03/222022/FY-0.015/0

- 2020/03/312019/FY-0.202/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Aspect | Information |

| Company Name | Shengyuan |

| Years in Business | 2-5 years |

| Registered Region | Hong Kong |

| Regulatory Status | Regulated by the Securities and Futures Commission (SFC) |

| Tradable Securities and Services | Stocks, bonds, options, futures, IPOs and assets management |

| Minimum Deposit | N/A |

| Margin Trading | Yes |

| New Stock Trading | Yes |

| Commissions | Zero commission fees |

| Platforms/Apps | “Shengyuan Securities Co., Ltd.” mobile app, Web platform |

| Customer Service | Phone +852 3192 8888, email enquiries@shengyuan.hk |

| Deposit & Withdrawal Methods | N/A |

| Bonus offer | No |

Overview of SHENGYUAN

Shengyuan, a brokerage firm based in Hong Kong, has been operating for 2-5 years. It offers a range of tradable securities and services, including stocks, bonds, options, futures, IPOs, and assets management, with zero commission fees.

The platform boasts a comprehensive suite of Hong Kong Stock Exchange products and trading services, complemented by flexible investment methods and professional strategies.

However, drawbacks include a website available only in Chinese, limited options for overseas assets, and a lack of educational resources.

Shengyuan is regulated by the Securities and Futures Commission (SFC), ensuring compliance with financial regulations.

Regulatory Status

SHENGYUAN holds two securities licenses, both regulated by the Securities and Futures Commission (SFC).

The first license is a Securities Trading License with the identification number AVO470, and the second license is a Fund Management License identified as AXC415.

These licenses signify that SHENGYUAN is authorized to engage in securities trading and fund management activities under the supervision and regulations of the SFC.

Pros and Cons

| Pros | Cons |

| Zero commission fees | Website available only in Chinese |

| Comprehensive Hong Kong Stock Exchange products and trading services | Lack of options for overseas assets |

| Flexible investment methods | Limited educational resources |

| Professional and authoritative investment strategies | |

| Regulated by SFC |

Pros:

Zero commission fees: Shengyuan imposes no commission fees on trades, allowing investors to save on transaction costs. This fee structure can be particularly advantageous for frequent traders or those operating with smaller investment amounts.

Comprehensive Hong Kong Stock Exchange products and trading services: Shengyuan offers a wide range of products and services related to the Hong Kong Stock Exchange. This includes access to various asset classes such as stocks, bonds, options, and futures.

Flexible investment methods: Clients can choose from different trading strategies, including day trading, swing trading, and long-term investing. Moreover, the platform supports various order types such as market orders, limit orders, and stop-loss orders, enabling investors to execute trades according to their specific requirements.

Professional and authoritative investment strategies: Shengyuan offers professional investment strategies developed by experienced financial experts. These strategies are based on thorough market research, fundamental analysis, and technical indicators.

Website available only in Chinese: This limitation restricts access to important information and resources for non-Chinese-speaking users, potentially hindering their ability to fully utilize the platform's features and services.

Lack of options for overseas assets: Shengyuan primarily focuses on the Hong Kong Stock Exchange, offering limited options for investing in overseas assets such as foreign stocks, bonds, or ETFs.

Limited educational resources: While the platform offers basic tutorials or market insights, comprehensive educational resources such as webinars, workshops, or educational courses are lacking.

Security

Corporate Financing

Asset Management

Question: What are Shengyuan's commission fees?

Answer: Shengyuan charges zero commission fees on trades.

Question: Can investors trade stocks listed on the Hong Kong Stock Exchange?

Answer: Yes, Shengyuan offers a wide range of tradable securities, including stocks listed on the Hong Kong Stock Exchange.

Question: Does Shengyuan offer margin trading?

Answer: Yes, Shengyuan provides margin trading facilities for eligible clients.

Question: Does Shengyuan provide customer support in English?

Answer: Shengyuan's customer support is primarily available in Chinese, with limited options for English-speaking users.

Cons:

Tradable Securities and Services

Shengyuan offers a range of securities trading services, including trading stocks listed on the Hong Kong Exchanges and Clearing Limited, along with related investment services such as securities custody, trading, and new stock subscriptions.

Listing Services:

Acting as a listing consultant, Shengyuan Securities assists in investor selection, underwriting, market recommendations, and post-market value management for listed companies.

Pre-IPO Planning and Investment:

Through Shengyuan Capital, the platform offers services such as private placement financing, listing feasibility analysis, and pre-IPO planning.

Post-Marketing Services:

In terms of mergers and acquisitions, refinancing, and strategic investments, Shengyuan Securities provides comprehensive services including mergers and acquisitions, sales, privatization, whitewash exemption applications, and various refinancing options.

Shengyuan offers private entrusted investment management and managing private equity funds, hedge funds, and other alternative investment funds.

Investment Advisory Services:

Individual investors and companies receive professional advice and suggestions tailored to their specific requirements.

Private Wealth Management:

As a third-party asset management company (EAM) of Global Private Silver Card, Shengyuan Securities offers flexible and personalized customer services for private wealth management.

Commissions and Fees

Shengyuan offers a commission rate of 0%, implying that customers do not incur any commission charges on their trades. While there are no explicit commission fees, other fees may still apply.

Comparatively, many popular brokers typically charge commission fees per trade, ranging from a few dollars to more significant amounts depending on the type and size of the trade. These fees can add up over time, especially for frequent traders. Shengyuan's zero-commission structure appeals to traders looking to minimize their trading costs, particularly those who engage in high-volume or frequent trading activities.

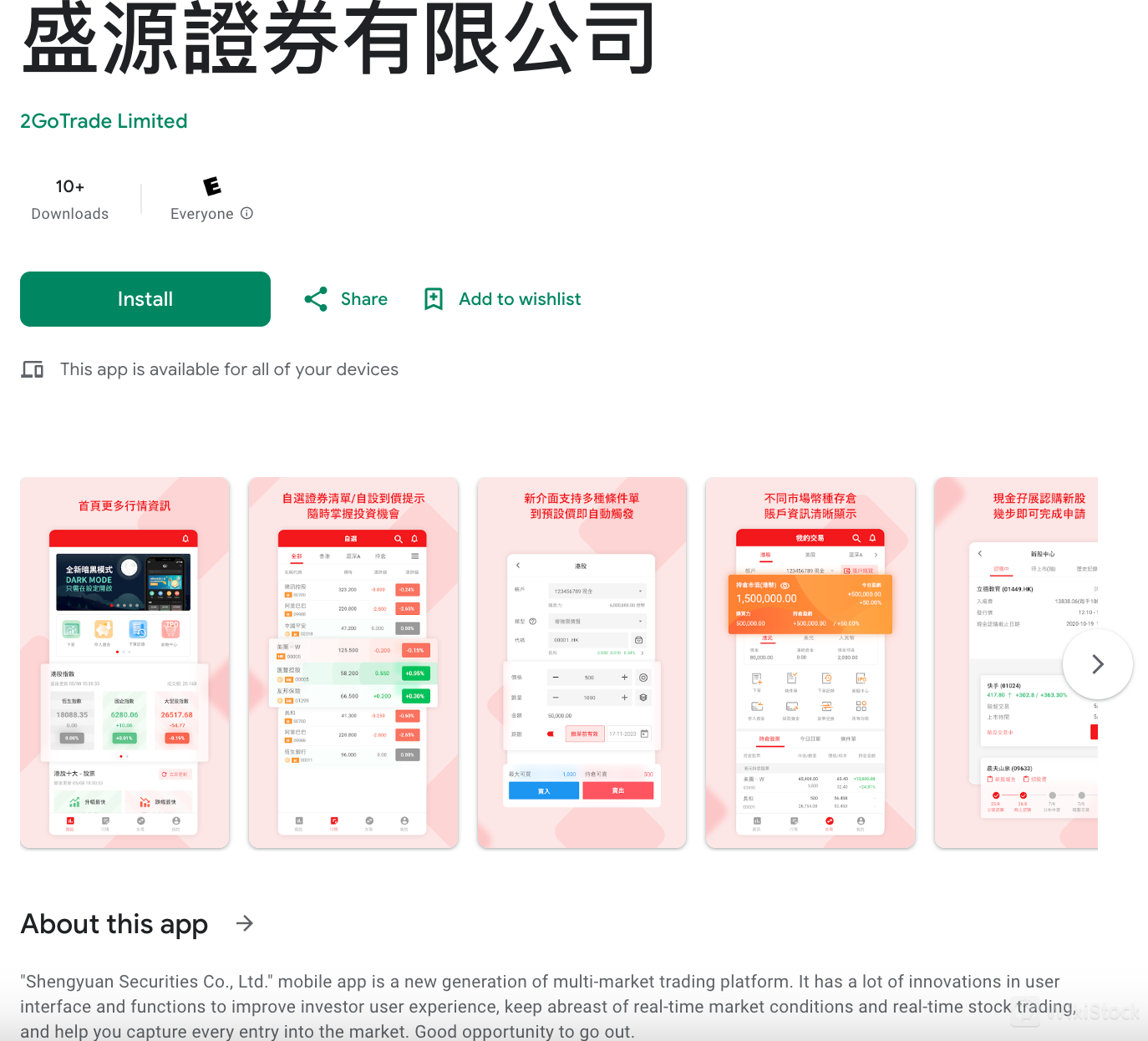

Platforms & Tools

The “Shengyuan Securities Co., Ltd.” mobile app presents itself as a new generation multi-market trading platform.

The platform boasts several innovations in user interface and functions to facilitate real-time stock trading and enable investors to stay updated on market conditions.

Key features include conditional order options such as two-way limit orders, conditional orders, and trigger market orders, allowing for flexible trading strategies.

Additionally, investors can conveniently subscribe to initial public offerings (IPOs) using either cash or margin in just a few steps directly through the app.

The platform also supports the downloading of daily and monthly statements for review and analysis purposes. Price reminder functionality is available for Hong Kong stock streaming, with support for four types of reminder conditions.

Furthermore, users can easily withdraw and deposit funds through various methods, with the eDDA fast deposit option promising funds to arrive in just five minutes.

Customer Service

Shengyuan provides comprehensive customer support through various channels.

For inquiries or assistance, customers can contact the service line at +852 3192 8888. Additionally, they can reach out via email at enquiries@shengyuan.hk. The company's office is located at Room 3208-09, COSCO Building, New Era Plaza, 183 Queen's Road Central, Hong Kong.

Conclusion

In conclusion, Shengyuan presents a compelling option for investors with its zero commission fees, potentially saving traders significant amounts annually.

However, the platform's limitations, such as the website available only in Chinese, lack of options for overseas assets, and limited educational resources, hinder accessibility and hinder the ability of non-Chinese-speaking users to fully utilize the platform.

Nevertheless, Shengyuan's comprehensive range of tradable securities, including stocks, bonds, options, and futures, along with its flexible investment methods and professional strategies, offer opportunities for investors to diversify their portfolios and optimize their returns.

FAQs

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

--

盛源资产管理有限公司

Group Company

--

盛源證券有限公司

Subsidiary

Download App

Review

No ratings

Recommended Brokerage FirmsMore

匯誠證券

Score

SDG Securities (HK)

Score

Siu On Securities

Score

Morton Securities

Score

KFS

Score

GMSL

Score

Wellfull

Score

Jimei Investment

Score

協聯證券

Score

BMI

Score