Score

協聯證券

http://cblhk.com/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China Hong Kong

China Hong Kong Products

1

Futures

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Derivatives Trading License

Brokerage Information

More

Company Name

CORPORATE BROKERS LIMITED

Abbreviation

協聯證券

Platform registered country and region

Company address

Company website

http://cblhk.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 15299

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

Others

983528.52%China Hong Kong

258133.77%Mali

108614.21%Macao

101313.25%Cameroon

78410.25%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

Products

1

| Corporate Brokers |  |

| WikiStocks Rating | ⭐⭐⭐ |

| Interests on uninvested cash | Commissions:HK Stocks:Negotiated(Minimum:HK$100);ShenZhen Stock:Negotiated(Minimum:100 yuan);Index:Minimum as $12;Options:Minimum as $10 |

| Account Fees | Inactive Account Fees:$50 per year |

| Interests on uninvested cash | 3.20% |

| Mutual Funds Offered | Yes |

| Platform/APP | Corporate Brokers Online Trading Platfom/Mobile APP |

| Promotion | Mobile/online trading promotions(Will get 0 Depository Fee and 0 transaction processing fee) |

Corporate Brokers Information

Corporate Brokers is a financial services provider featuring a unique online trading platform, offering competitive, negotiated commission rates with a focus on Hong Kong and Shenzhen stocks, as well as indices and options trading.

They satisfy various investment preferences with services such as mutual funds and benefits like zero depository and transaction processing fees for mobile/online trading.

While their platform is robust and user-friendly, enhancing access to diverse markets, a potential drawback is the inactive account fee, which will be a concern for less active investors.

Pros & Cons

| Pros | Cons |

| Regulated by SFC | Negotiated Commissions |

| Unique Trading Platform(Corporate Brokers Online Trading Platform/Mobile APP) | Asking For Transaction Fees |

| Multiple Securities to Trade(Stocks,Futures,Bonds) | Limited Customer Support(No Email) |

| Promotion For Users | Complex Fee Structure |

Pros:

Corporate Brokers is regulated by the SFC, offering a unique trading platform accessible via mobile and web, which supports a variety of securities including stocks, futures, and bonds. They also provide enticing promotions to reduce trading costs.

Cons:

The fee structure at Corporate Brokers is complex, with negotiable commissions that will result in unpredictable trading costs. They also impose transaction fees and have limited customer support options, lacking email communication, which could deter some users.

Is Corporate Brokers Safe?

Regulations:

Corporate Brokers is regulated by the Securities and Futures Commission (SFC) of Hong Kong, a reputable financial regulatory authority established in 1989. The broker's regulatory status under SFC license with the number AAK110.

Funds Safety:

Corporate Brokers, regulated by the Securities and Futures Commission (SFC) of Hong Kong, is required to adhere to stringent financial and operational standards that include maintaining adequate financial resources and implementing measures to safeguard client funds.

Safety Measures:

The broker is implementing standard industry practices for the security of funds and client information, such as employing encryption technologies for data transmission and storage. However, no explicit details regarding encryption or other specific account safety measures to prevent information leakage are mentioned in the provided information.

What are securities to trade with Corporate Brokers?

Corporate Brokers offers a diverse range of securities trading options for its clients.

Hong Kong Stocks: Corporate Brokers enables trading in a wide array of Hong Kong stocks, meeting investors interested in participating in one of Asias premier financial markets. This offers clients a pathway to diversify their portfolios by investing in various sectors represented on the Hong Kong Stock Exchange.

Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect: These programs allow Corporate Brokers' clients to trade stocks listed on the Shanghai and Shenzhen stock exchanges directly through their Hong Kong platform. This cross-border arrangement broadens investment opportunities and provides exposure to Mainland Chinas economic growth.

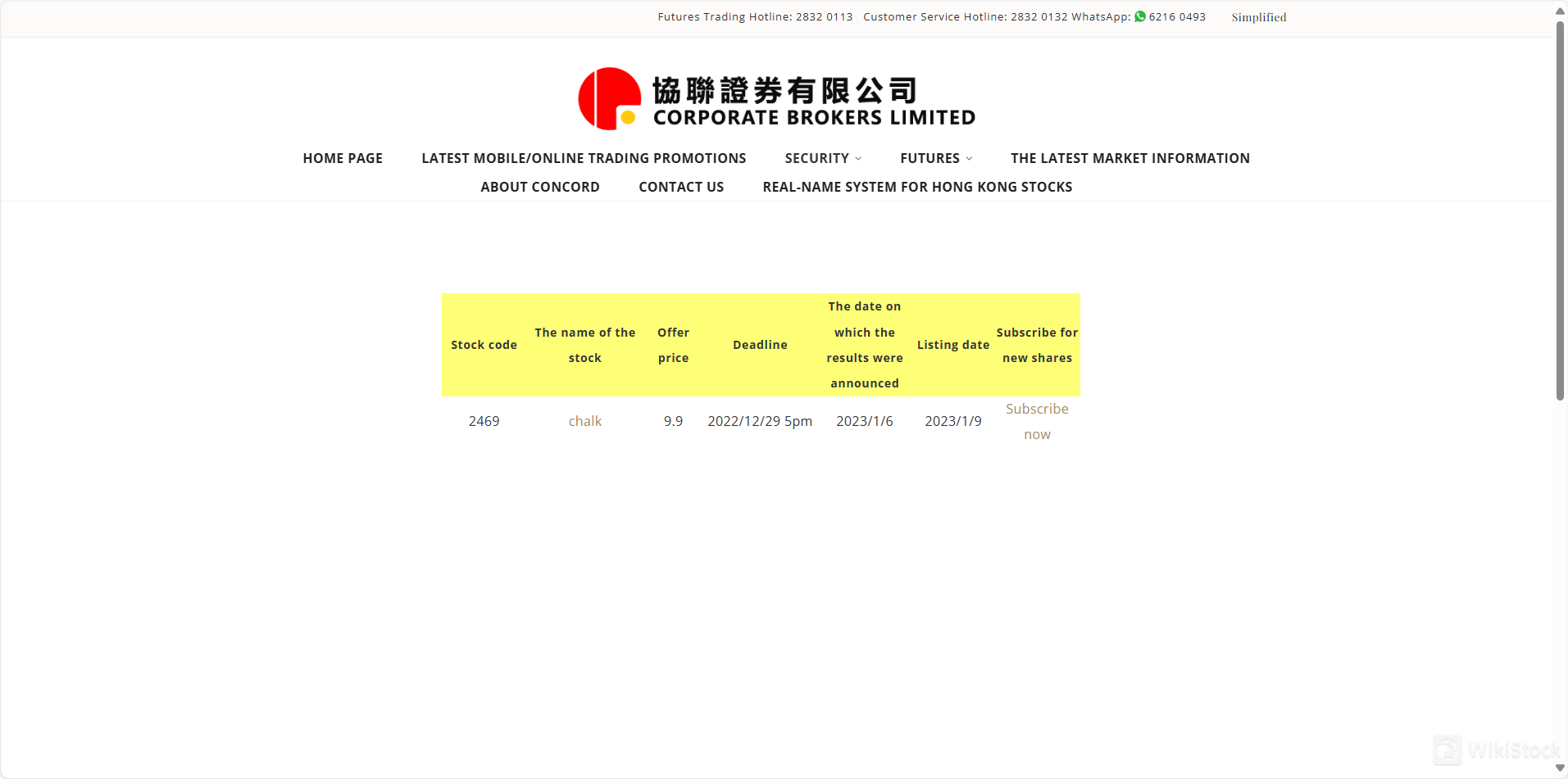

IPO Subscription: Corporate Brokers offers its clients the chance to invest in initial public offerings (IPOs), providing access to shares of newly listed companies on the stock market. This service allows investors to potentially buy stocks at an early stage of a company's public lifecycle.

Cash and Stock Deposits: The firm supports straightforward deposit services for both cash and stock, enabling efficient management of trading accounts and flexibility in funding investment activities.

Margin Trading: Corporate Brokers provides margin trading services, detailing clear requirements and handling margin calls diligently. This facility allows clients to trade larger amounts than they have in cash, potentially increasing their investment returns while also increasing risk.

Corporate Brokers Account Review

Concord Securities offers two primary types of accounts tailored to meet different trading needs:

Cash Trading Account: This account type is suitable for clients who prefer to trade securities using the funds available in their account without borrowing. Clients must ensure sufficient funds are in the account before trading.

Margin Trading Account: This account allows clients to borrow funds from the brokerage to purchase securities, offering the potential to control a larger position than with a cash account alone, which could potentially increase returns on investment.

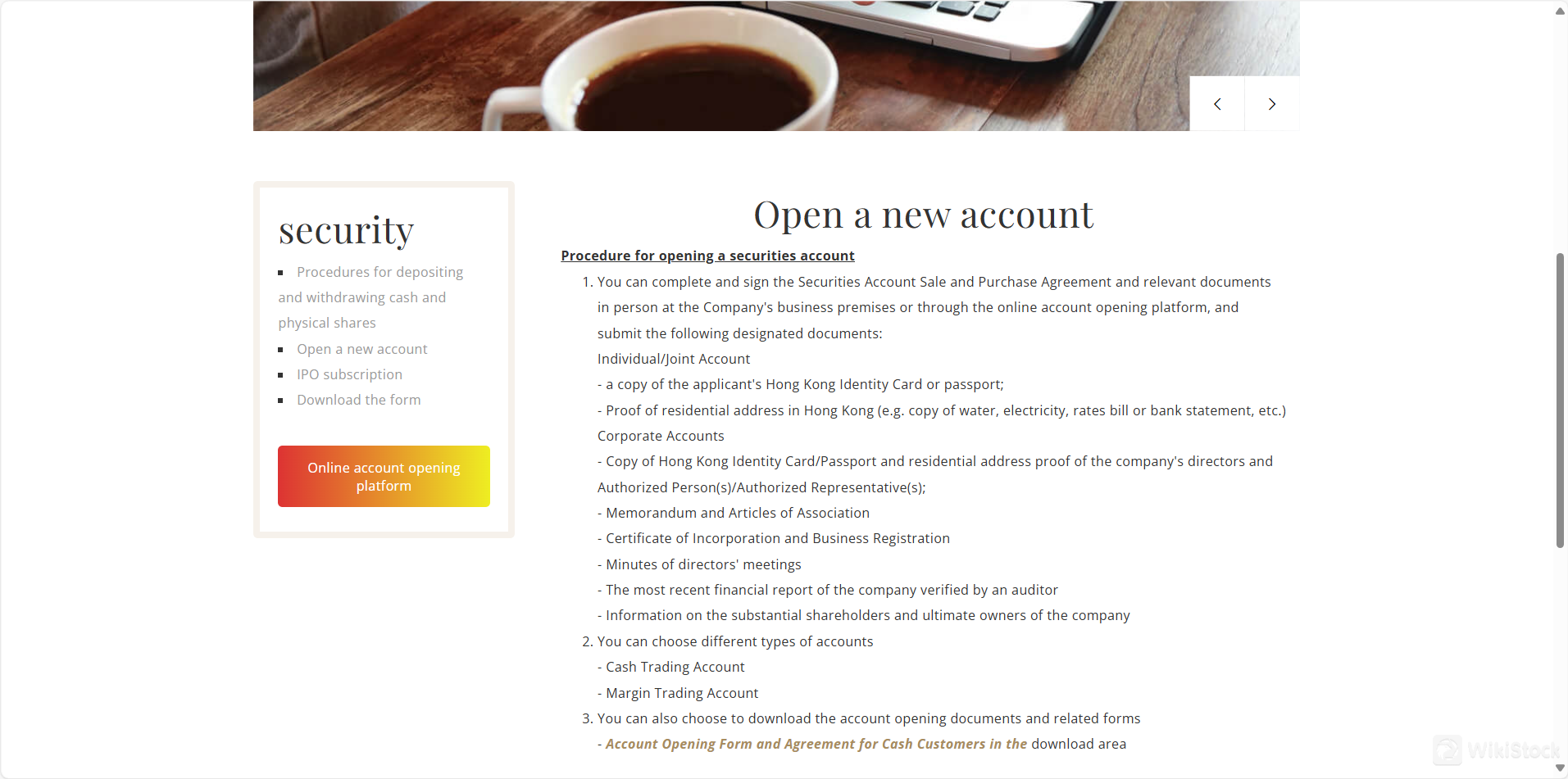

Securities Trading Accounts: These are suitable for individual and corporate clients looking to engage in securities trading. For individuals or joint accounts, the required documents include a copy of the Hong Kong Identity Card or passport and proof of residential address. For corporate accounts, additional documents such as the Certificate of Incorporation, Business Registration, and recent audited financial statements are needed.

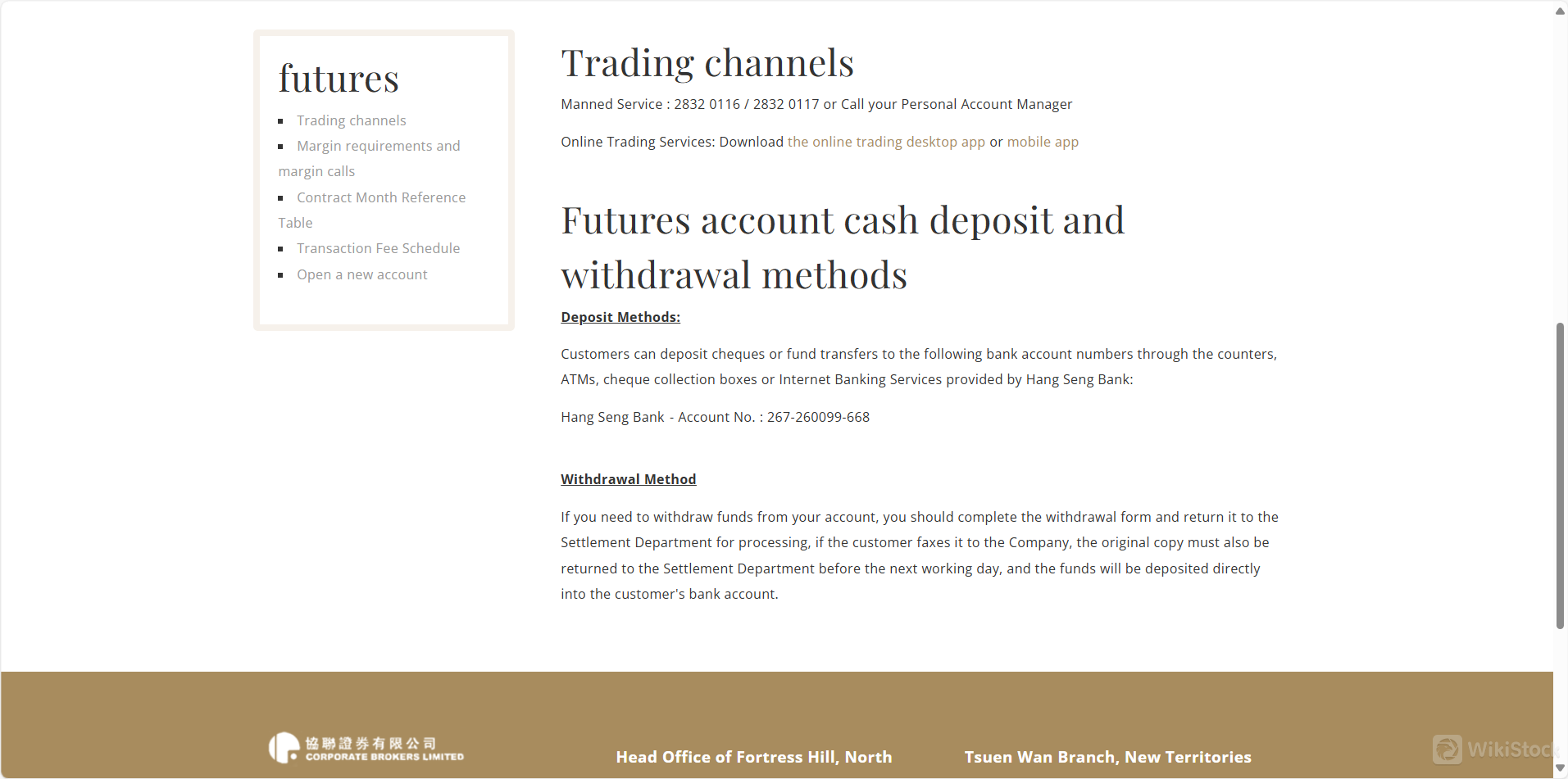

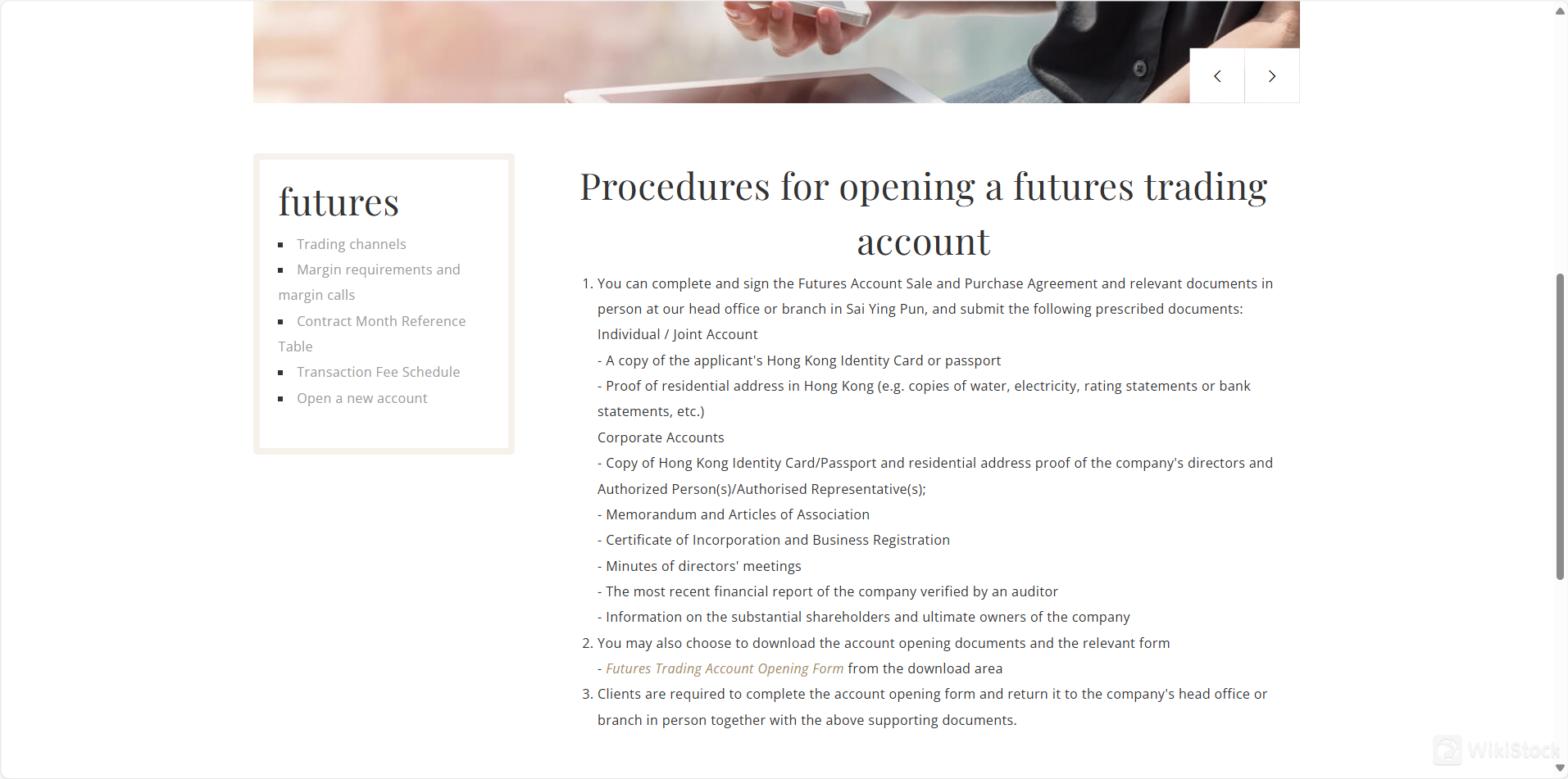

Futures Trading Accounts: For those interested in futures trading, the procedure involves completing and signing a futures account trading agreement at Concord Securities' office, with required documents similar to those for securities accounts. These include identification and proof of address for individuals, and corporate documentation for company accounts.

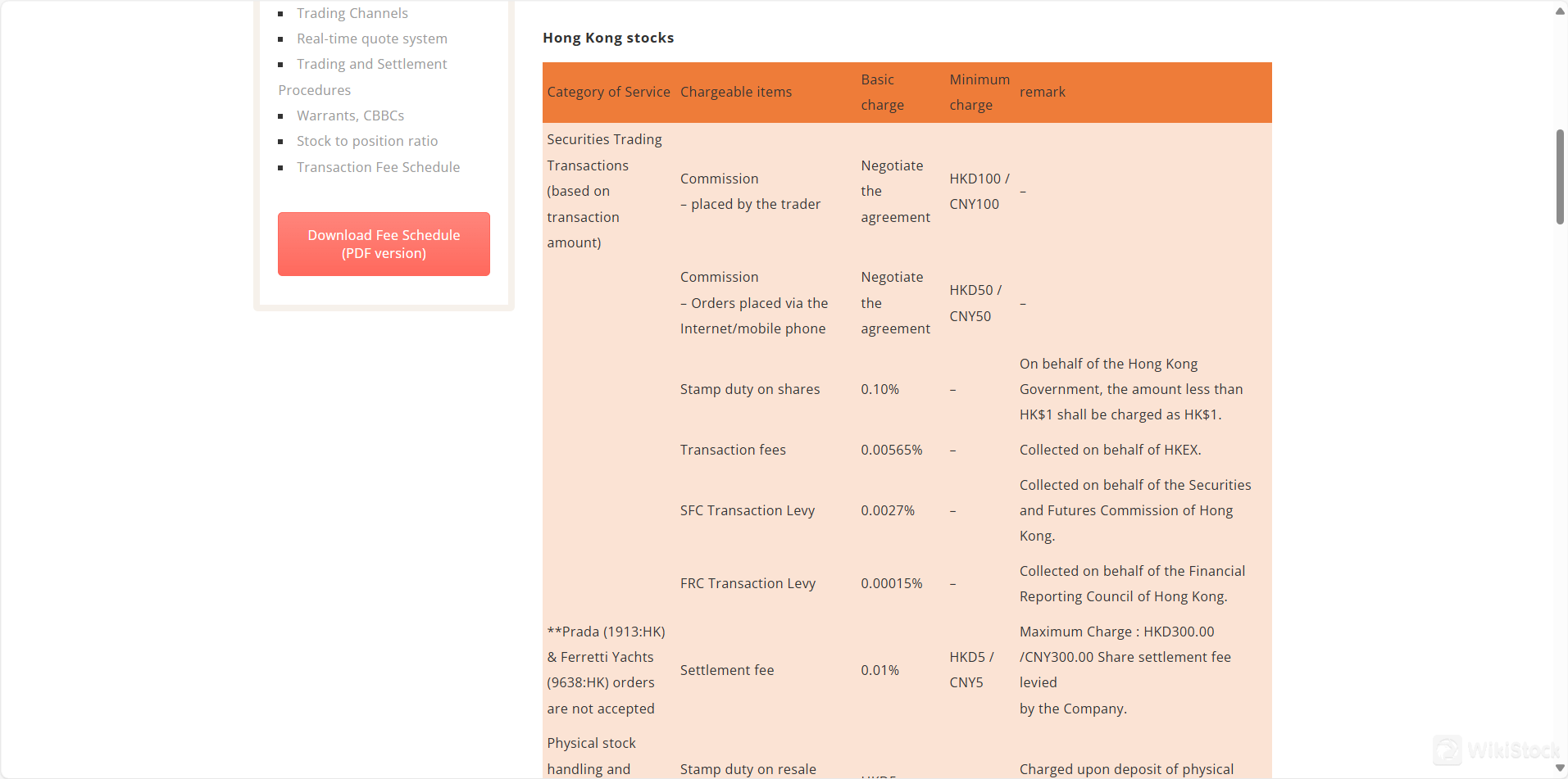

Commission: Negotiated based on the method of placing the order, with a minimum charge of HKD100 / CNY100 for trades placed by the trader and HKD50 / CNY50 for trades placed via the Internet or mobile phone.

Stamp Duty on Shares: Charged at 0.10% of the transaction amount. If it is less than HK$1, the charge is rounded up to HK$1, collected on behalf of the Hong Kong Government.

Transaction Fees: Imposed at 0.00565% of the transaction amount, collected on behalf of the Hong Kong Stock Exchange.

SFC Transaction Levy: A 0.0027% fee on the transaction amount, collected on behalf of the Securities and Futures Commission of Hong Kong.

FRC Transaction Levy: Charged at 0.00015% of the transaction amount, on behalf of the Financial Reporting Council of Hong Kong.

Settlement Fee: A 0.01% fee on the transaction amount with a minimum of HKD5 / CNY5 and a maximum of HKD300 / CNY300, collected by Concord Securities.

Physical Share Withdrawal: HKD5 per board lot, with an odd lot considered as one lot.

Settlement Instructions: A 0.05% fee based on the total value of the previous day's closing price, with a minimum charge of HKD200.

Investor Settlement Instruction (ISI): A 0.01% fee, also based on the total value from the previous day's closing, with a minimum charge of HKD20.

Multi-Counter Transfer Instructions: A flat fee of HKD50 per application.

Registration and Transfer of Physical Shares: HKD5 per stock with a minimum charge of HKD200.

Brokerage Commission: Individually negotiated for both telephone and online trading.

Stamp Duty: 0.10% of the transaction amount, with a minimum of $1.00 collected by the Hong Kong government if the transaction amount is less than $1.00.

Transaction Levy: 0.0027% of the transaction amount, collected by the Securities and Futures Commission (SFC).

FRC Transaction Levy: 0.00015% of the transaction amount, collected by the Accounting and Financial Reporting Council.

Transaction Fees: 0.005% of the transaction amount, collected by the Hong Kong Stock Exchange.

Central Settlement Processing Fee: 0.005% of the transaction amount, collected by the Central Clearing House and Kam Fai Securities.

Dividend/Bonus Transfer Fees: $50 handling fee for the collection of dividends/bonus shares; $2.50 per lot for the first time, waived from the second time onwards unless there is a net increase in shares, in which case $1.50 per lot is charged if over 400 lots.

Chase Dividends or Bonus Shares: Individually negotiated, plus other relevant service charges such as stamp duty, performance fee, and transfer fee.

Listed Company Action Fees: $0.80 per board lot, covering activities like share exchange, rights issue, privatization, and acceptance of acquisition.

Wire Transfer: Individually negotiated and subject to bank charges.

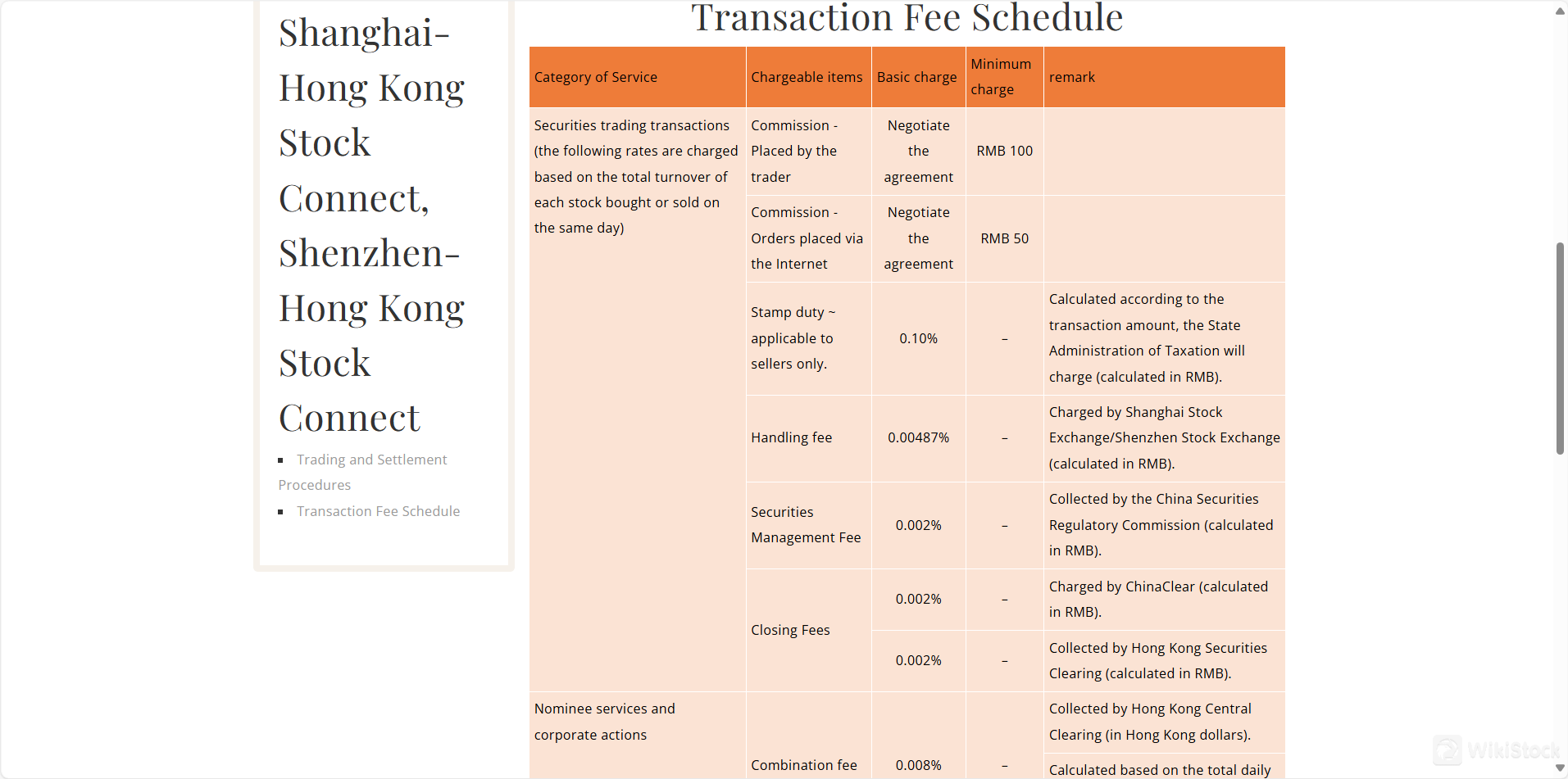

Commission:

For trades placed by the trader: Charges are negotiated per agreement with a minimum charge of RMB 100.

For orders placed via the Internet: Charges are also negotiated per agreement with a minimum charge of RMB 50.

Stamp Duty:

Applicable only to sellers at a rate of 0.10%, calculated based on the transaction amount. This fee is collected by the State Administration of Taxation.

Handling Fee:

Charged at 0.00487% of the transaction amount by the Shanghai Stock Exchange or Shenzhen Stock Exchange.

Securities Management Fee:

Collected at a rate of 0.002% by the China Securities Regulatory Commission.

Closing Fees:

A fee of 0.002% is charged, collected by ChinaClear and Hong Kong Securities Clearing.

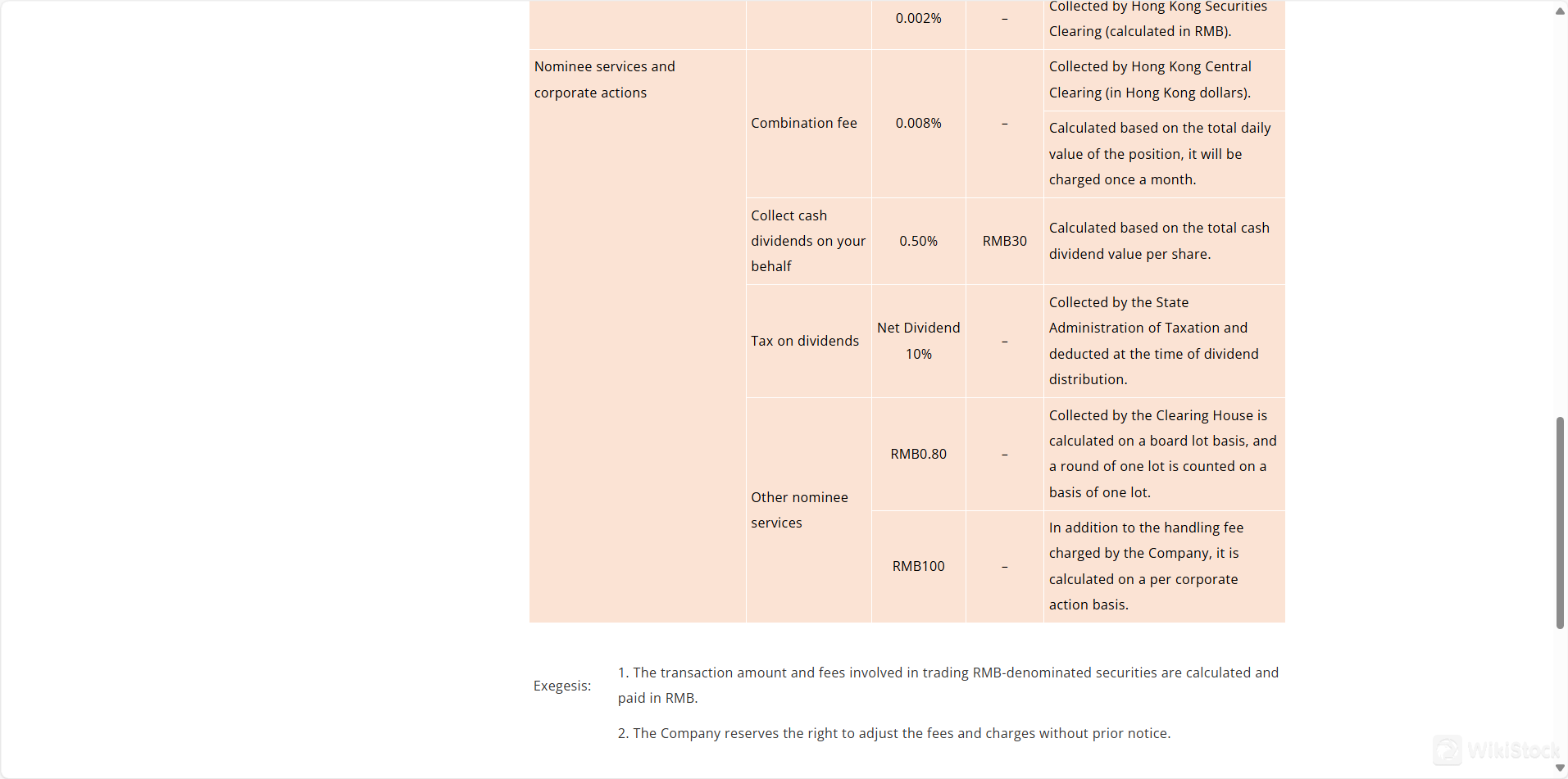

Combination Fee:

Charged at 0.008% of the total daily value of the position, collected monthly by Hong Kong Central Clearing.

Dividend Collection Fee:

A fee of 0.50% of the total cash dividend value per share is charged, with a minimum fee of RMB 30.

Tax on Dividends:

A net dividend tax of 10% is deducted at the time of dividend distribution by the State Administration of Taxation.

Other Nominee Services:

A standard charge of RMB 0.80 is collected by the Clearing House on a board lot basis.

An additional RMB 100 fee is charged per corporate action, in addition to the handling fee charged by the company.

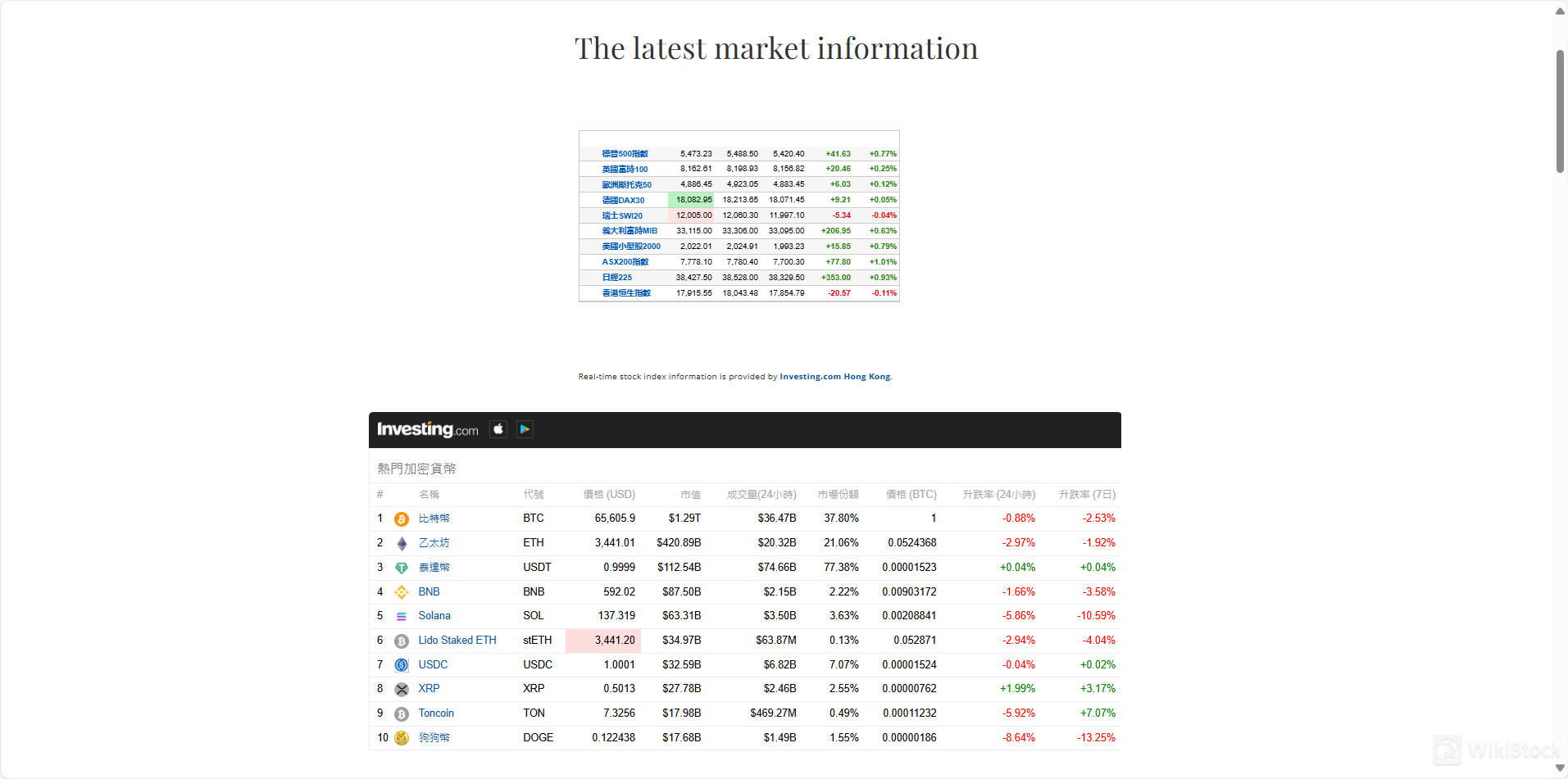

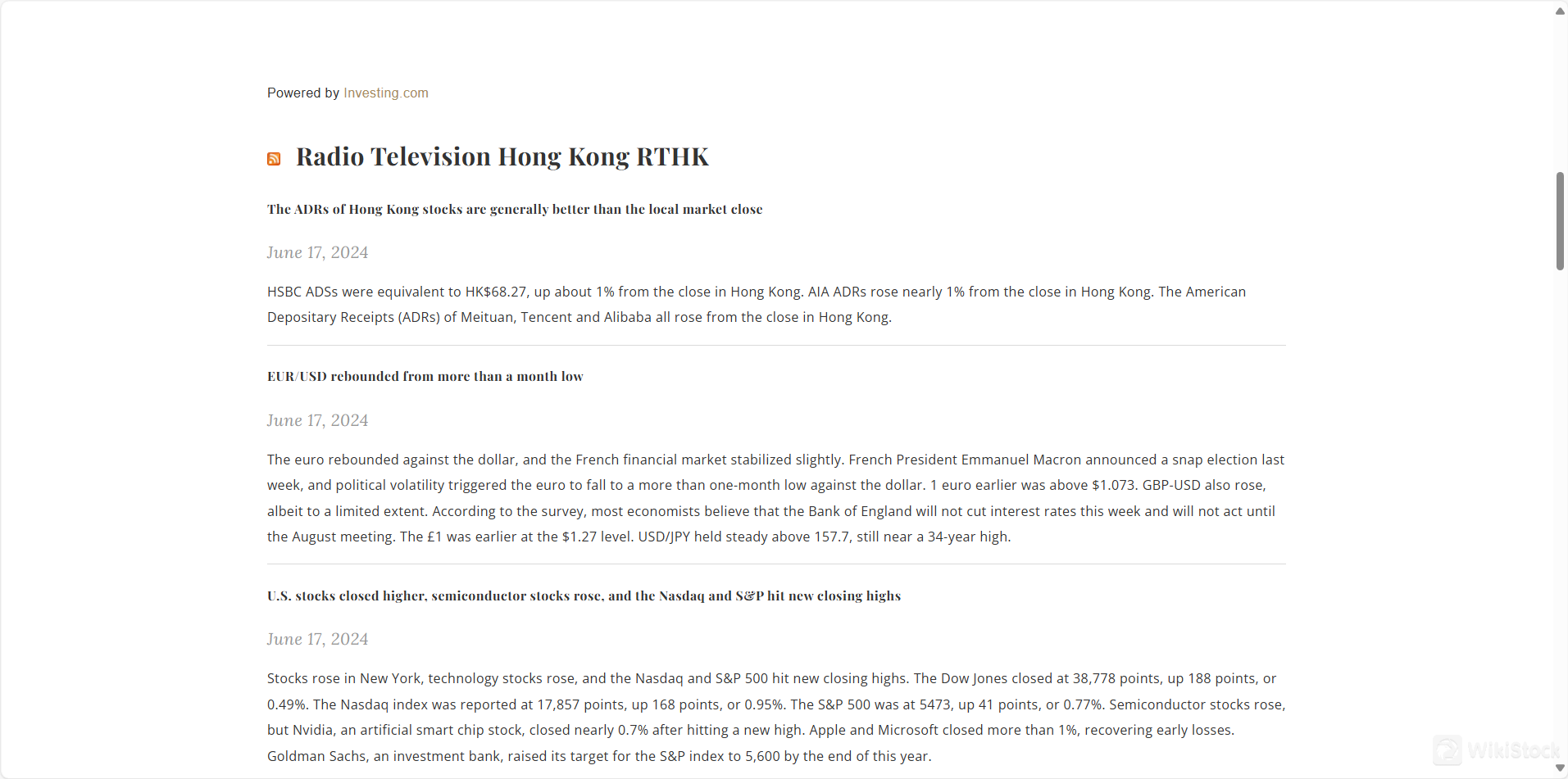

Real-time Market Information: Offers real-time stock index updates and market trends via partnerships with Investing.com Hong Kong and RSS feeds from Radio Television Hong Kong (RTHK).

Global Market Performance Updates: Tracks and reports on the performance of American Depositary Receipts (ADRs) and their comparison to local market closes.

Currency Movements: Provides insights into significant currency pair movements, including EUR/USD and GBP/USD, with updates on economic events affecting these currencies.

Stock Market Trends: Delivers daily updates on U.S. stock markets, highlighting movements in major indices and sectors, including technology and semiconductors.

Economic and Corporate News: Shares timely news on economic data releases, corporate developments, and geopolitical events that will impact markets.

Educational Content: Through detailed news articles and analyses, the platform educates its users about the implications of market movements and investment strategies.

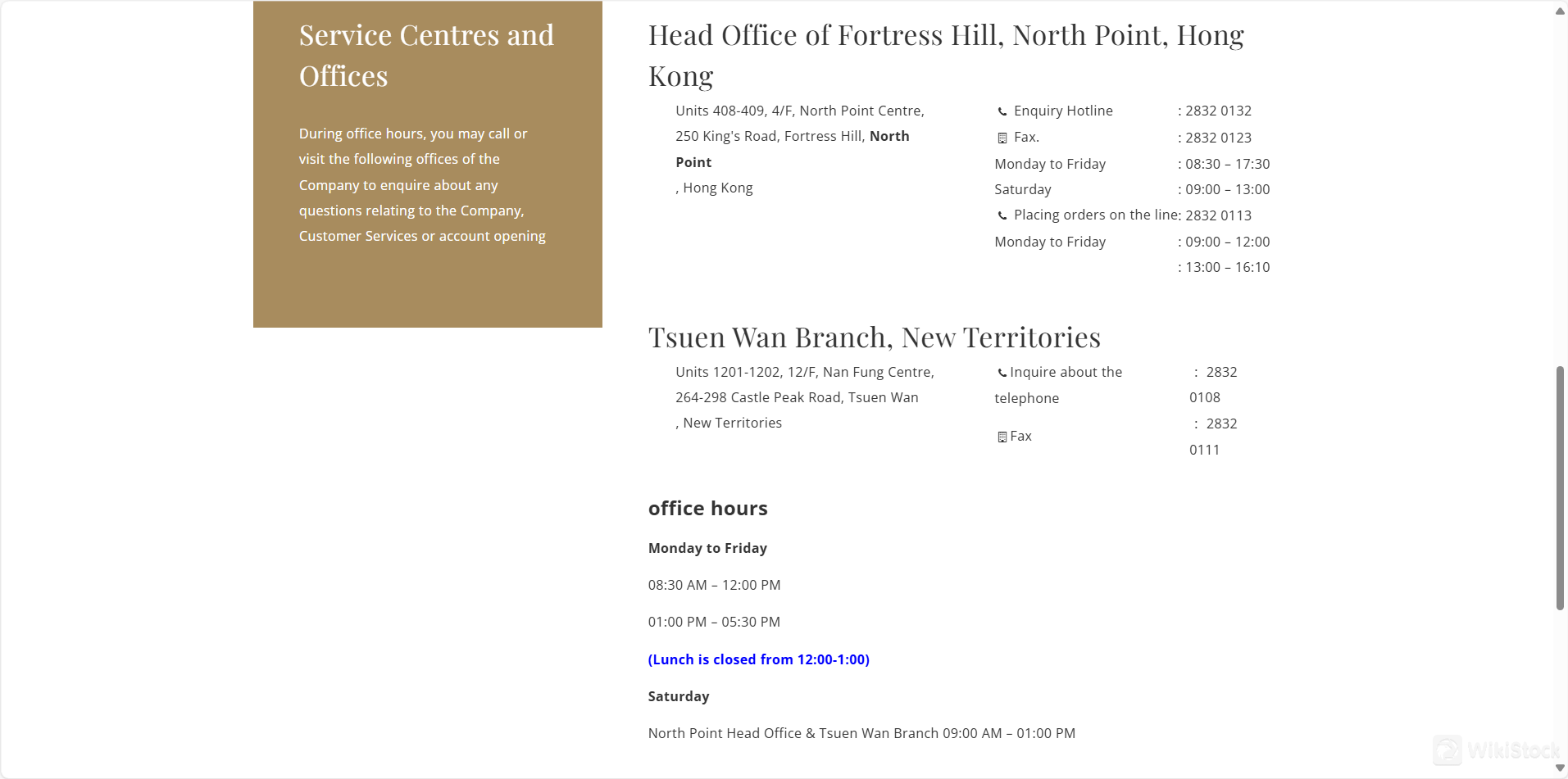

Address: Units 408-409, 4/F, North Point Town Centre, 250 King's Road, Fortress Hill, North Point, Hong Kong

Telephone: 2832 0132

Fax: 2832 0123

Office Hours: Monday to Friday: 08:30 – 17:30, Saturday: 09:00 – 13:00

Futures Trading Hotline: 2832 0113

Trading Hours: Monday to Friday: 09:00 – 12:00, 13:00 – 16:10

Address: Units 1201-1202, 12/F, Nan Fung Centre, 264-298 Castle Peak Road, Tsuen Wan, New Territories

Telephone: 2832 0108

Fax: 2832 0111

Office Hours: Monday to Friday: 08:30 – 12:00, 13:00 – 17:30 (Lunch break: 12:00 – 13:00), Saturday: 09:00 – 13:00

Futures Trading Hotline: 2832 0113 (Mon-Fri: 09:00–12:00, 13:00–16:10)

For Funds Trading,Concord Securities offers another two main types of trading accounts:

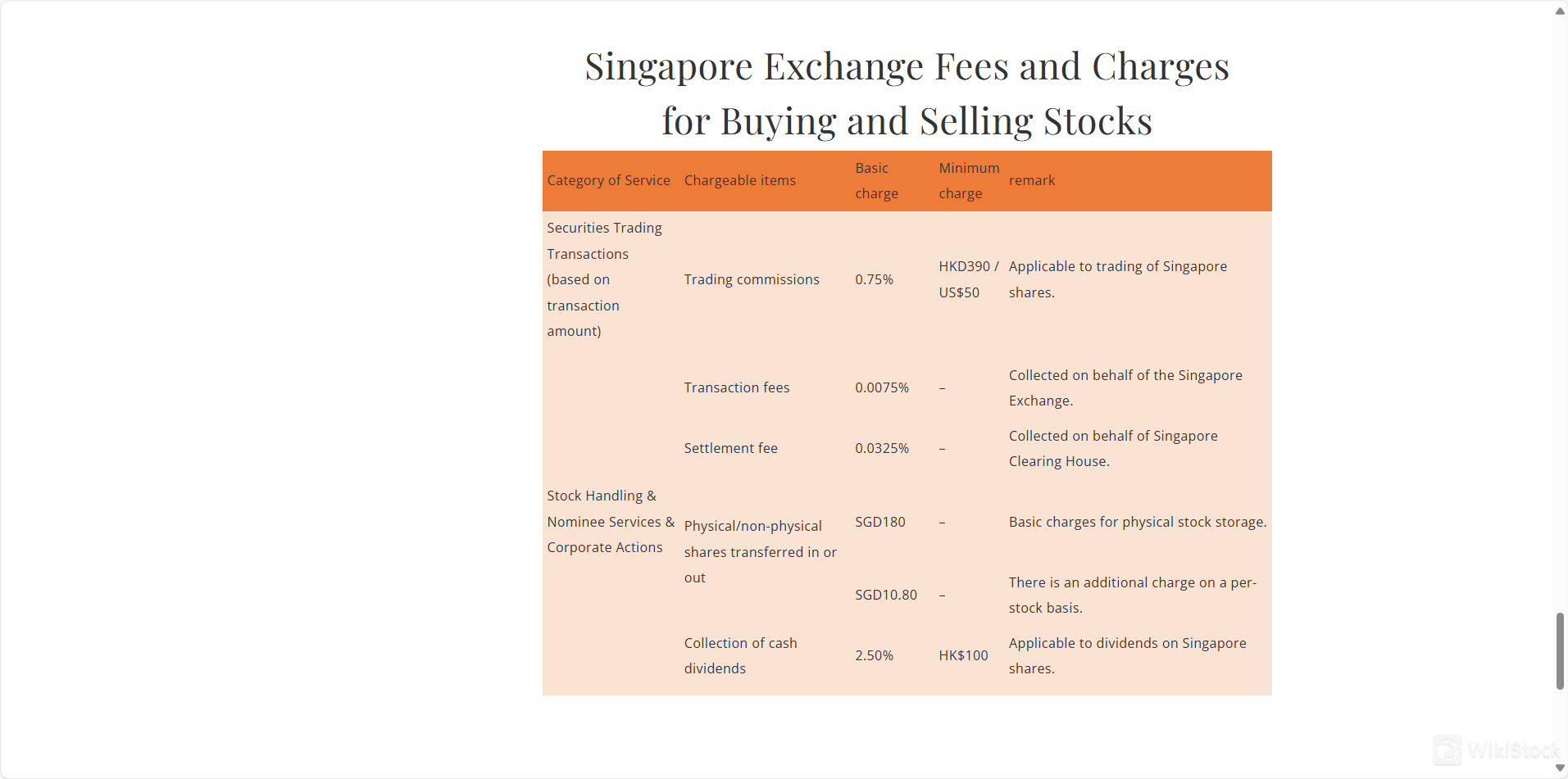

Corporate Brokers Fee Review

HKEX Securities Trading Transactions:

Physical Stock Handling and Settlement Services:

Securities Trading (Local Stocks/Stock Certificates):

Nominee Services (Local Stocks/Warrants):

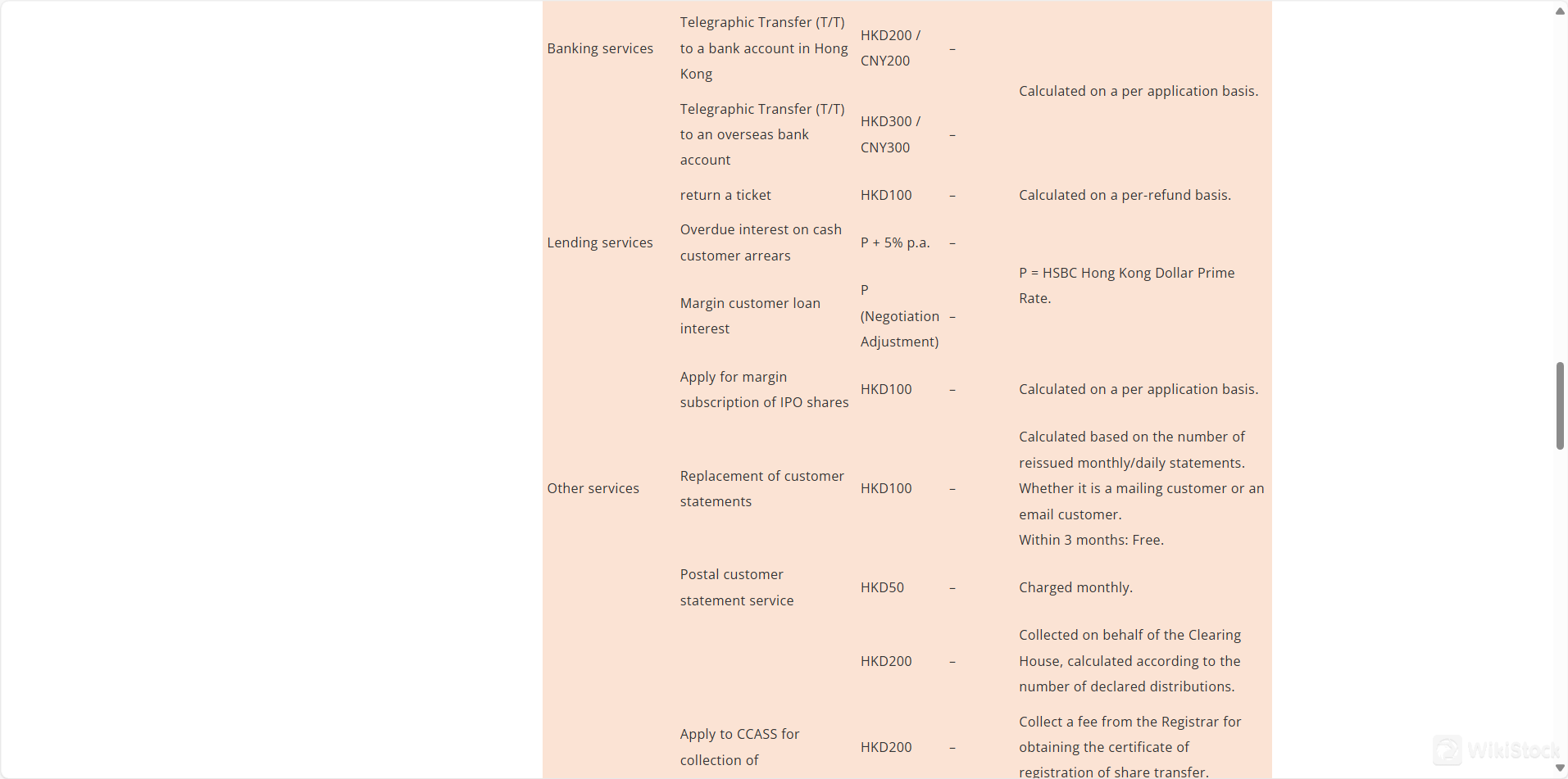

Banking Services:

| Category of Service | Chargeable Items | Basic Charge | Minimum Charge | Remark |

| Securities Trading Transactions | ||||

| Commission – placed by the trader | Negotiate | HKD100 / CNY100 | ||

| Commission – Orders placed via Internet/mobile | Negotiate | HKD50 / CNY50 | ||

| Stamp Duty on shares | 0.10% | – | Charged on behalf of the Hong Kong Government. | |

| Transaction fees | 0.01% | – | Collected on behalf of HKEX. | |

| SFC Transaction Levy | 0.00% | – | Collected on behalf of the Securities and Futures Commission of Hong Kong. | |

| FRC Transaction Levy | 0.00% | – | Collected on behalf of the Financial Reporting Council of Hong Kong. | |

| Settlement fee | 0.01% | HKD5 / CNY5 | Maximum Charge: HKD300.00 / CNY300.00, Share settlement fee levied by the Company. |

Nominee Services and Corporate Actions:

| Category | Chargeable Items | Basic Charge | Minimum Charge | Remarks |

| Securities Trading Transactions | Commission - Trader Initiated | Negotiate | RMB 100 | Negotiated per agreement |

| Commission - Internet Orders | Negotiate | RMB 50 | Negotiated per agreement | |

| Stamp Duty | 0.10% | - | Applicable to sellers, calculated by the transaction amount | |

| Handling Fee | 0.00% | - | Charged by Shanghai/Shenzhen Stock Exchange | |

| Securities Management Fee | 0.00% | - | Collected by the China Securities Regulatory Commission | |

| Closing Fees | 0.00% | - | Charged by ChinaClear and HK Securities Clearing | |

| Nominee Services and Corporate Actions | Combination Fee | 0.01% | - | Monthly, based on total daily value of position |

| Collect Cash Dividends | 0.50% | RMB 30 | Calculated based on the total cash dividend value per share | |

| Tax on Dividends | Net Dividend 10% | - | Collected by the State Administration of Taxation | |

| Other Nominee Services | RMB 0.80 | - | Per board lot, charged by the Clearing House | |

| Corporate Action Fee | RMB 100 | - | Additional to handling fee, per corporate action |

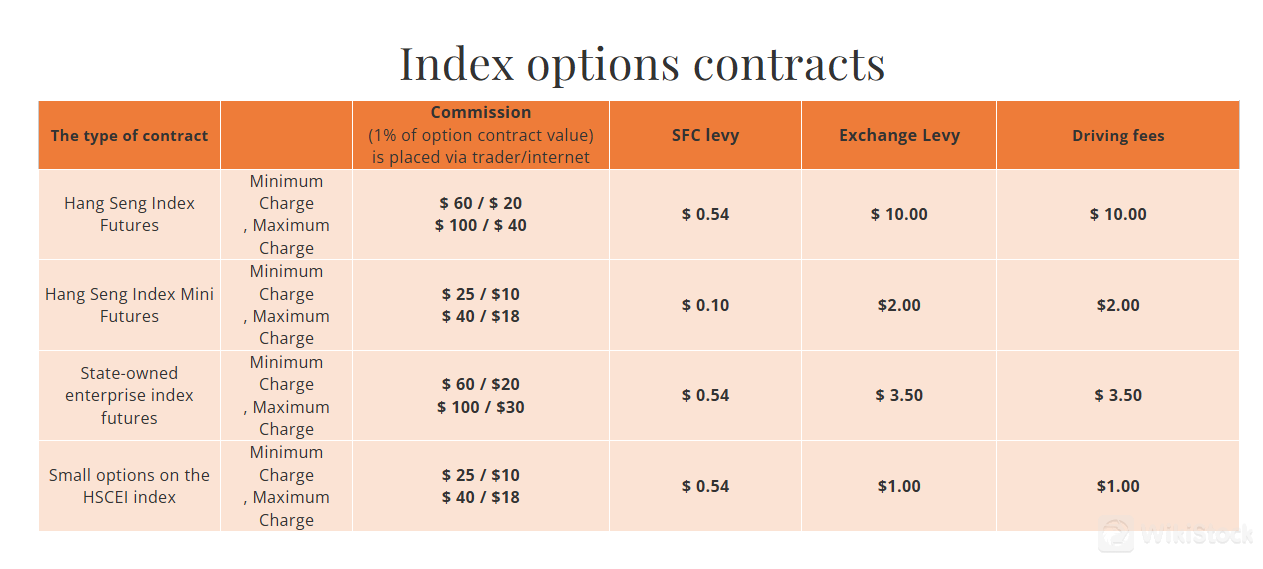

Index Futures Contracts Fee Structure:

Concord Securities charges a range of fees for trading index futures. For Hang Seng Index Futures, commissions are $60/$20 for intraday closings and $100/$50 otherwise, with an SFC levy of $0.54 and an exchange levy of $10.00. Mini Futures and other index futures like the State-owned Enterprise and HSCEI Mini Futures follow a similar structure but vary in specific fee amounts and levies, reflecting both the transaction scale and the instrument's market specifics.

Index Options Contracts Fee Structure:

Options trading on indices such as the Hang Seng involves commission charges that vary depending on whether the transaction is made intraday or not, with a range between $25/$10 and $100/$40. These transactions also incur an SFC levy and an exchange levy that correlate with the option's market position, alongside additional driving fees for operational handling.

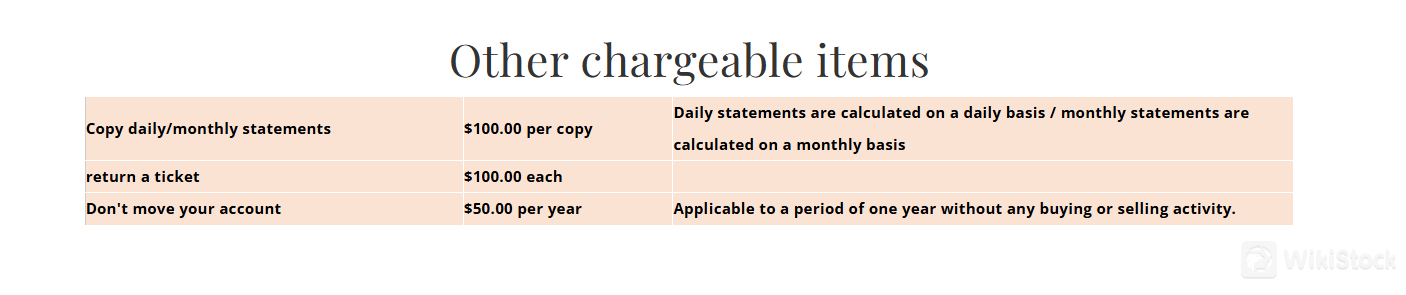

Additional Charges:

Beyond trading, Concord Securities imposes fees for ancillary services like statement issuance at $100 per copy for daily or monthly statements and a ticket return fee of $100 each. An inactivity fee of $50 per year is also levied on accounts without any trading activity, ensuring clients are engaged or close inactive accounts.

| Type of Contract | Commission (Intraday/Non-intraday Closing) | SFC Levy | Exchange Levy | Auto-Closing Fee and Settlement Fee |

| Index Futures (Hang Seng Index) | $60/$100, $20/$50 | $0.54 | $10.00 | $100/$50, $10 |

| Mini Futures (Hang Seng Index Mini) | $25/$40, $12/$20 | $0.10 | $3.50 | $40/$20, $3.5 |

| State-owned Enterprises Index Futures | $60/$100, $20/$30 | $0.54 | $3.50 | $100/$30, $3.5 |

| Index Options Contracts | Minimum Charge, Maximum Charge | |||

| $60/$100, $20/$40, $25/$10, $40/$18 | $0.54, $0.10 | $10.00, $2.00 | $10.00, $2.00 |

Corporate Brokers Trading Platform Review

Concord Securities provides a robust online trading platform that enables clients to engage in securities trading efficiently. This platform is accessible through both the internet and mobile devices, allowing for convenient trading on the go. The platform supports real-time trading and offers updated market information, making it a vital tool for both casual and serious traders.

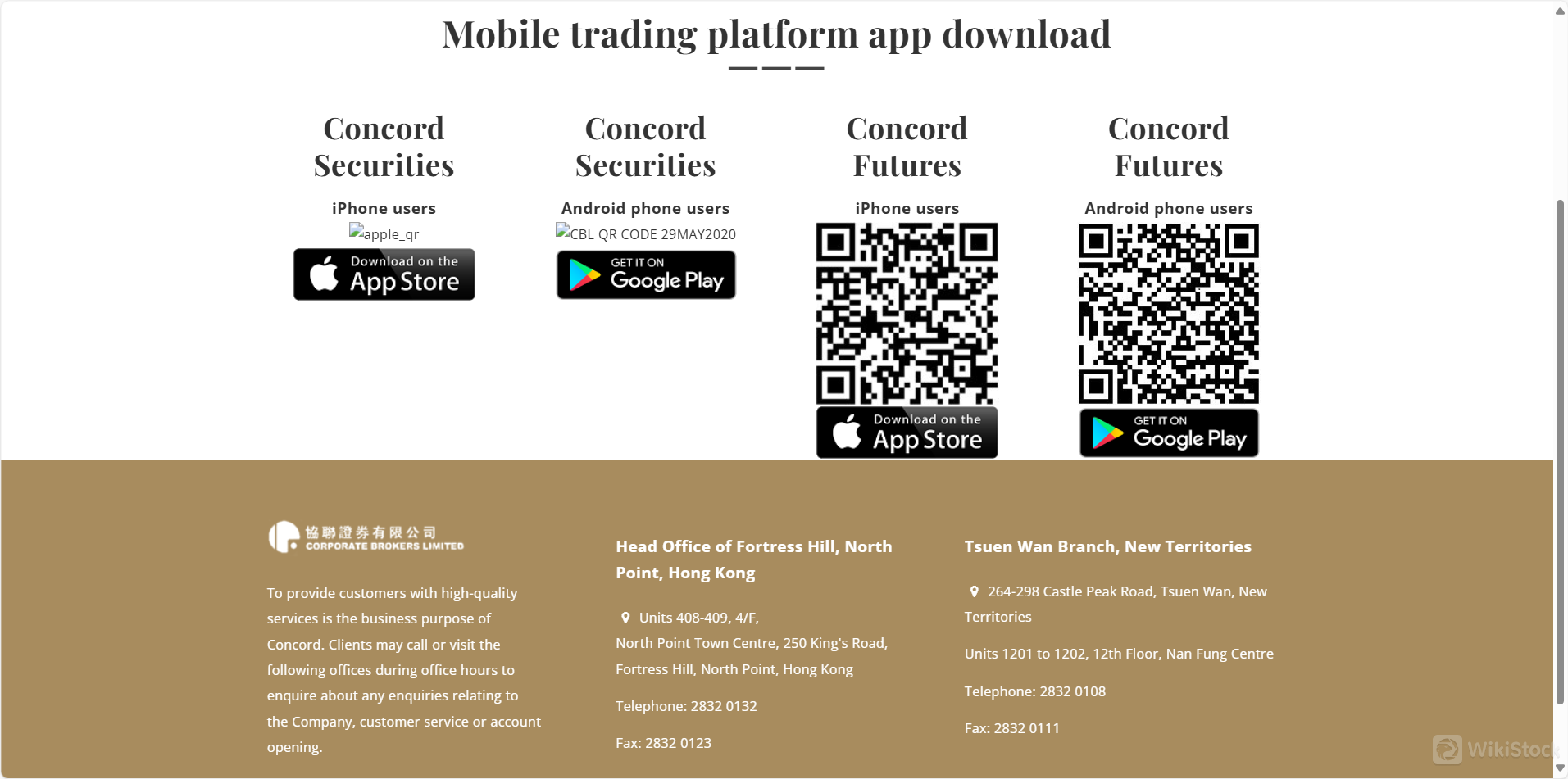

Concord Securities offers mobile trading applications for both securities and futures trading. iPhone and Android users can download these apps through specific QR codes provided for each platform. The apps are designed to provide a secure and user-friendly trading experience, ensuring that clients can manage their investments and execute trades efficiently from their mobile devices.

Promotion

Concord Securities offers a range of enticing promotions for mobile and online trading. Notably, they provide a perpetual waiver of platform usage fees, which can significantly reduce the cost for active traders.

Additionally, there are no depository fees or transaction processing fees, allowing for more cost-effective trading operations.

For clients interested in IPOs, Concord Securities also offers a grey market trading service, enabling trading of shares before their official listing, which can be discussed further by contacting Ms. Lam at their customer service hotline.

Research & Education

Concord Securities provides a range of research and educational resources tailored for investors:

Customer Service

Concord Securities is committed to providing high-quality services to its clients.

Head Office - Fortress Hill, North Point, Hong Kong

For future trading inquiries, please call:

Tsuen Wan Branch - New Territories

| Office | Address | Contact Number | Fax Number | Office Hours |

| Head Office - North Point | Units 408-409, 4/F, North Point Town Centre, 250 King's Road, Fortress Hill, North Point, Hong Kong | 2832 0132 | 2832 0123 | Mon-Fri: 08:30–17:30, Sat: 09:00–13:00 |

| Tsuen Wan Branch | Units 1201-1202, 12/F, Nan Fung Centre, 264-298 Castle Peak Road, Tsuen Wan, New Territories | 2832 0108 | 2832 0111 | Mon-Fri: 08:30–12:00, 13:00–17:30 (Lunch: 12:00–13:00), Sat: 09:00–13:00 |

Additional Contacts:

Conclusion

Corporate Securities stands out in the financial services industry with its robust offerings that cater to a diverse clientele. Regulated by the SFC, it provides a secure trading environment complemented by a unique online trading platform available for both desktop and mobile users.

Corporate Securities prides itself on offering a range of securities trading options, including stocks and futures, along with specialized services such as margin trading and IPO subscriptions, making it a versatile choice for both individual and corporate clients.

FAQs

1. What types of trading accounts does Corporate Securities offer?

Corporate Securities offers both Cash Trading and Margin Trading accounts to accommodate different investor needs and trading strategies.

2. How can I contact Corporate Securities for support?

You can reach their customer service via hotline at 2832 0132 or through their office locations in North Point and Tsuen Wan. They also provide WhatsApp support and a futures trading hotline for specific inquiries.

3. Are there any promotions currently offered by Corporate Securities?

Yes, Corporate Securities frequently offers promotions such as perpetual waivers of platform usage fees, no depository fees, and zero transaction processing fees for certain trading activities.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

More than 20 year(s)

Products

Futures

Relevant Enterprises

Countries

Company name

Associations

--

協聯期貨有限公司

Group Company

Review

No ratings

Recommended Brokerage FirmsMore

潮商金融控股有限公司

Score

弘业国际金融

Score

MGHL

Score

Open Securities

Score

DA International

Score

Bluemount Financial

Score

盛源

Score

Yunfeng Financial Group

Score

Forwin Holding Limited

Score

中國公平集團

Score