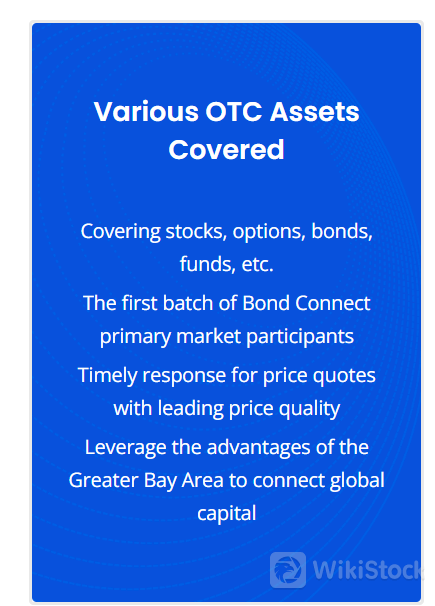

Covering stocks, options, bonds, funds, etc. The first batch of Bond Connect primary market participants. Timely response for price quotes with leading price quality. Leverage the advantages of the Greater Bay Area to connect global capital.

What is Aden?

Aden Financial Group is a financial services firm regulated by the Hong Kong Securities and Futures Commission (SFC). Aden provides a range of services, including technology-enhanced trading, coverage of various OTC assets, prime services, and wealth management solutions. It adheres to strict compliance standards and designated relationship managers for institutional clients. The company's funds are independently deposited with the Industrial and Commercial Bank of China (ICBC), ensuring safety and reliability for their clients.

Pros & Cons of Aden

Pros:

Experienced Team: Aden boasts a core team with extensive experience from prestigious institutions, which can provide clients with valuable insights and expertise.

Advanced Technology: The firm's proprietary technology platform, leveraging AI and big data, enhances risk control and efficiently aggregates OTC data for various assets.

Regulatory Compliance: Regulated by the Hong Kong Securities and Futures Commission (SFC), Aden adheres to strict compliance standards, ensuring a secure and trustworthy environment for investors.

Cons:

Limited Transparency: Some details such as account minimums and account fees are not clear, which makes it challenging for investors to assess the full cost of services.

Technology Risks: While Aden's advanced technology is a strength, there are inherent risks associated with reliance on technology, such as system failures or cybersecurity threats, which could impact clients' trading activities.

Is Aden Safe?

Aden is highly likely safe. It is regulated by the Hong Kong Securities and Futures Commission (SFC) with a license of No.BMO727, which imposes stringent standards and regulations on financial services firms operating in Hong Kong. This regulatory oversight helps ensure that Aden operates within legal boundaries and adheres to industry best practices, providing a level of assurance to its clients.

In terms of client funds, Aden states that they are independently deposited with the Industrial and Commercial Bank of China (ICBC), one of the largest and most reputable banks in the world. This arrangement is designed to protect client funds and provides a layer of security in case of any issues with the firm's operations.

What are Securities to Trade with Aden?

From stocks and options to bonds and funds, Aden offers a range of investment opportunities to help clients achieve their financial goals.

Stocks: Aden provides access to trading stocks, allowing investors to buy and sell shares of publicly listed companies.

Options: Options are financial derivatives that give investors the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specific timeframe. Aden facilitates options trading for investors seeking to hedge their portfolios or speculate on price movements.

Bonds: Aden offers trading in bonds, which are debt securities issued by governments, municipalities, corporations, or other entities to raise capital. Bonds pay interest over a specified period, and investors can buy and sell them in the secondary market.

Funds: Aden provides access to trading in mutual funds and exchange-traded funds (ETFs). Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities.

OTC Assets: Aden covers various over-the-counter (OTC) assets, including stocks, options, bonds, and funds. OTC trading occurs directly between parties, without the supervision of an exchange.

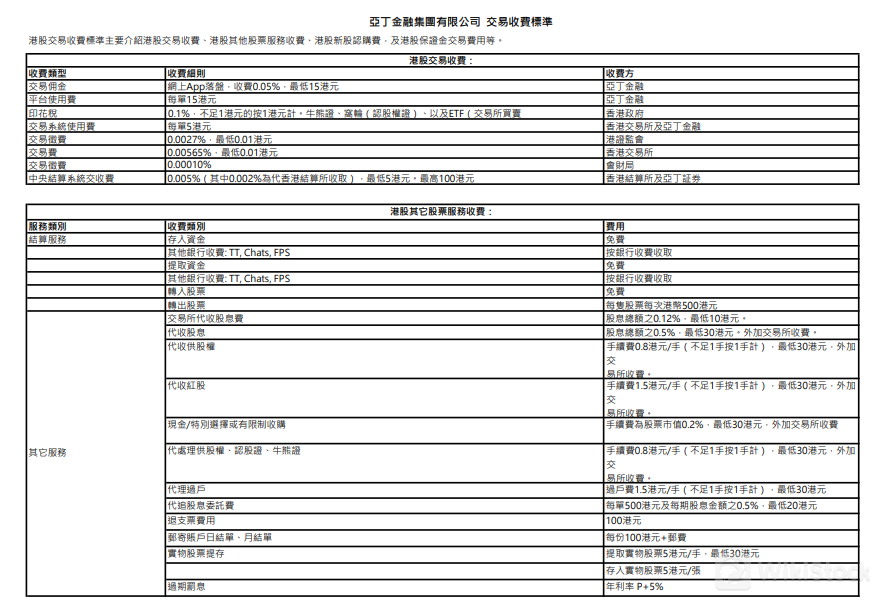

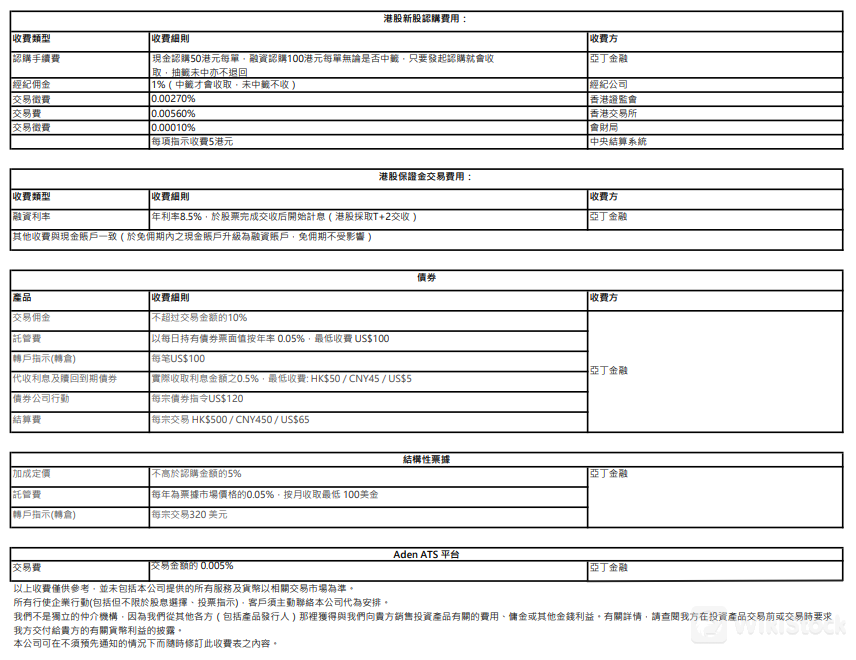

Aden Fees Review

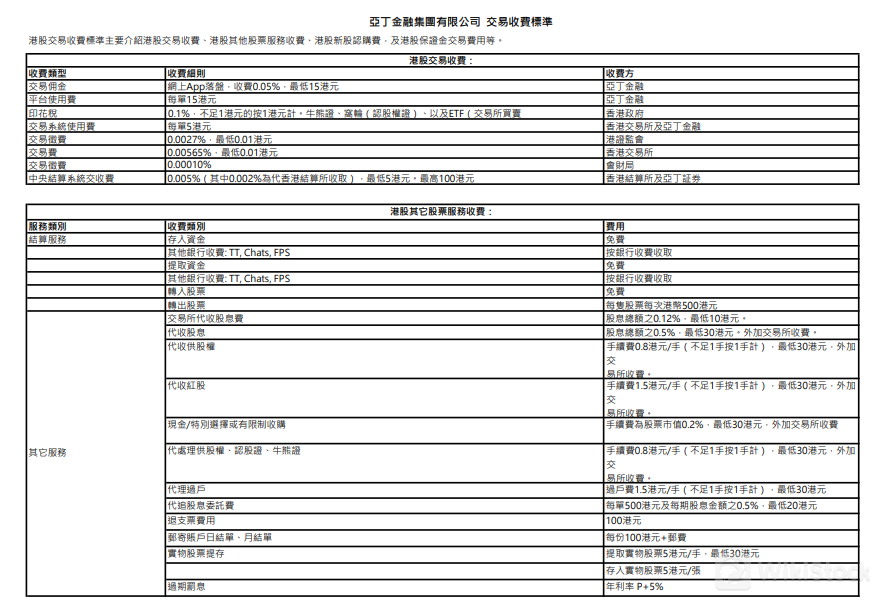

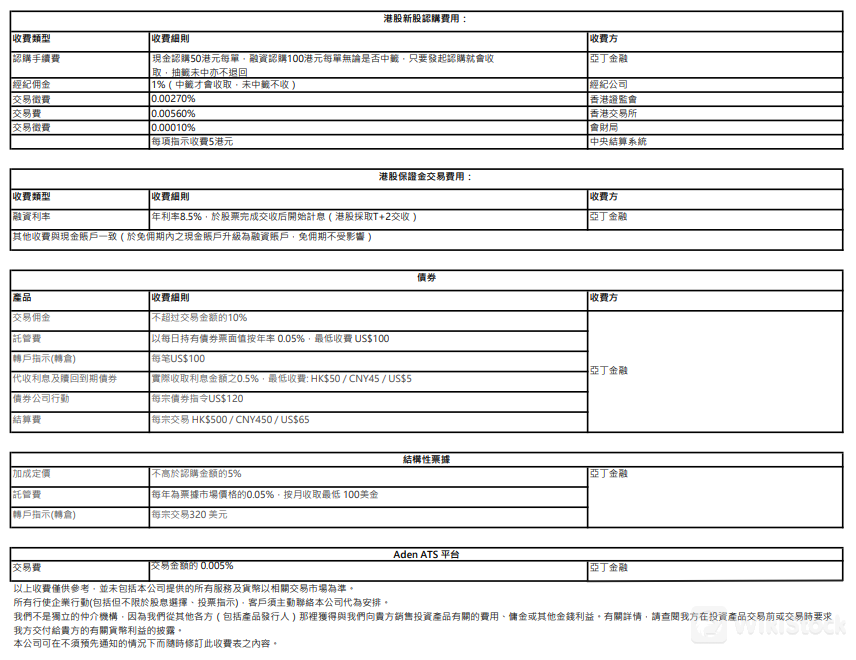

Aden charges several fees for its services, which can impact the overall cost of trading and investing.

Trading Fee: Aden charges a trading fee of $1.95. This fee is charged for buying or selling securities and can vary based on the type and size of the trade.

Platform Service Fee: Aden also charges a platform service fee of HKD 15.

Commission Rate: Aden's commission rate is 0.05%. This rate is applied to the value of trade and can impact the overall cost of trading.

Funding Rate: Aden charges a funding rate of 8.5%. This rate is applied to margin financing and securities lending services and can impact the cost of borrowing.

Aden App Review

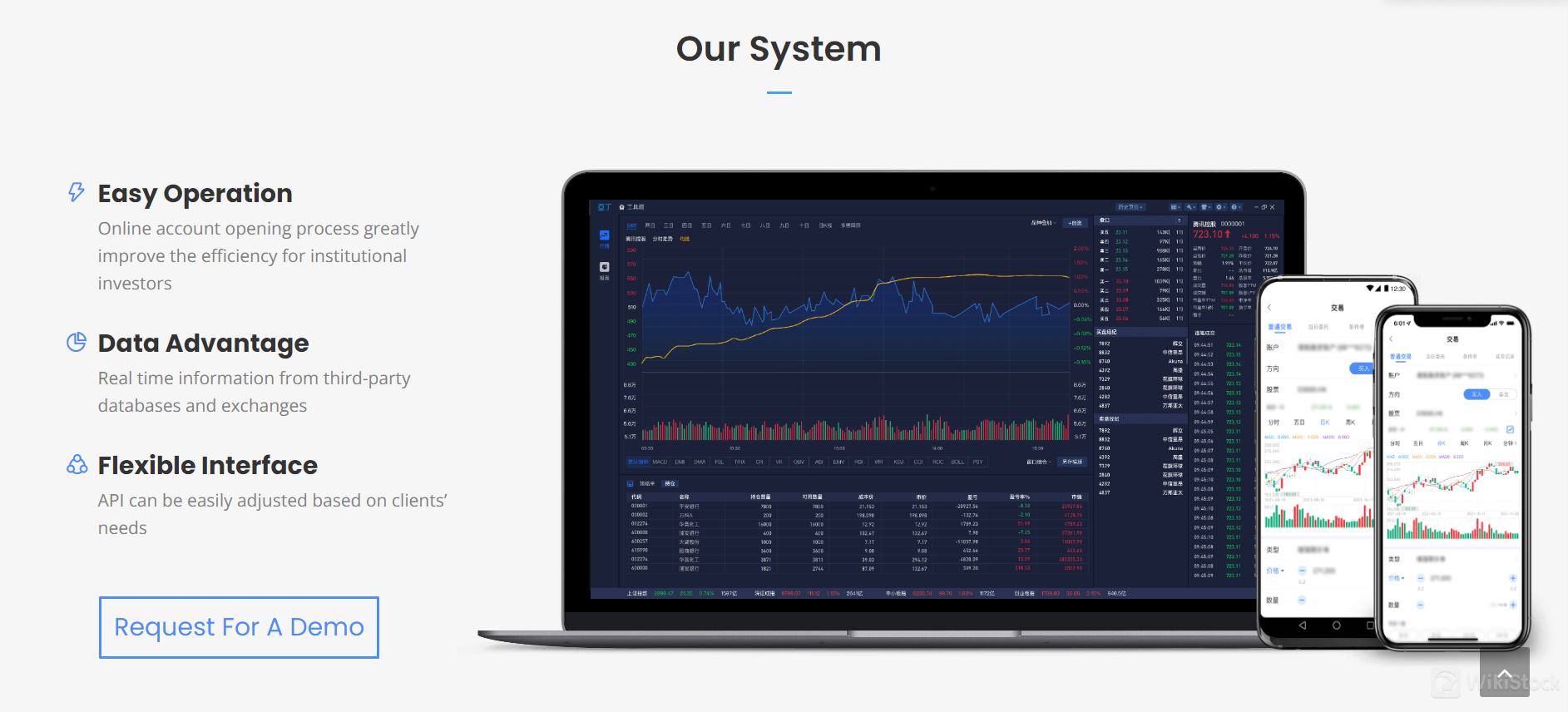

Aden's system is designed to provide a seamless and efficient experience for investors. The online account opening process is streamlined by reducing paperwork and processing times.

The platform also offers a data advantage, providing real-time information from third-party databases and exchanges. This access to timely and accurate data allows investors to make informed decisions and stay updated on market trends. Additionally, Aden's flexible interface allows for easy customization of APIs based on clients' needs, enhancing the overall usability of the platform.

You can request a demo through their website.

Aden Services Review

Aden Financial Group offers a range of services that cater to investors' needs, from technology-enhanced trading to wealth management solutions. These services are designed to provide clients with the tools and support they need to navigate the complexities of the financial markets.

One of Aden's key services is technology-enhanced trading, which leverages AI and big data to enhance risk control and aggregate OTC data for various assets. This advanced technology platform is optimized for the Chinese market and institutional investors, providing millisecond-level quantitative trading and direct line data connection. The platform also offers various intelligent interfaces and all-day technical support.

Aden also offers coverage of various OTC assets, including stocks, options, bonds, and funds. They are one of the first batch of Bond Connect primary market participants, allowing them to provide timely responses for price quotes with leading price-quality. Additionally, Aden leverages the advantages of the Greater Bay Area to connect global capital, providing clients with access to a wide range of investment opportunities.

In terms of prime services, Aden provides fund establishment, risk control, and full-process services. They also offer competitive margin financing and securities lending services, connecting with overseas asset owners and financial intermediaries to provide fundraising services and investment from Adens FoF.

For wealth management, Aden offers technical solutions for private bankers and a one-stop solution for trust, taxation, insurance, and more. They have partners in multiple markets, including Switzerland, Singapore, and New Zealand, and their EAM facilitates UHNW to access private banking products.

Customer Service

Aden provides multiple channels for clients to reach out for inquiries or assistance. The customer service hours are from 9:00 to 18:00 on trading days.

You can contact the firm through their service line at +852 2169 0818.

For non-urgent matters, you can also reach Aden's customer service team via email at cs@adenfin.com.hk.

Additionally, Aden's physical office is located at 14/F, Shanghai Commercial Bank Tower, 12 Queen's Road Central, Hong Kong. This address serves as a point of contact for clients who prefer face-to-face interactions or need to deliver documents or correspondence to the firm.

Conclusion

In summary, Aden is a regulated firm offering technology-enhanced trading and wealth management services. With a focus on compliance and advanced technology, Aden provides a secure and efficient trading environment for investors. However, there are some limitations, such as limited transparency on fees and technology risks. Overall, Aden's commitment to regulatory standards and innovative services makes it a good option for investors.

Frequently Asked Questions (FAQs)

Is Aden Financial Group regulated?

Yes, Aden Financial Group is regulated by the Hong Kong Securities and Futures Commission (SFC).

What services does Aden Financial Group offer?

Technology-enhanced trading, coverage of various OTC assets, prime services, and wealth management solutions.

What are the fees associated with trading with Aden Financial Group?

Aden Financial Group charges a trading fee of $1.95, a platform service fee of HKD 15, and a commission rate of 0.05%. They also charge a funding rate of 8.5%.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China

ChinaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)