Score

團結證券

http://www.unitedsecurities.com.hk/

Website

Rating Index

Brokerage Appraisal

Products

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 1 securities license(s)

China Hong Kong SFCSecurities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 02113

Brokerage Information

More

Company Name

United Securities Limited

Abbreviation

團結證券

Platform registered country and region

Company address

Company website

http://www.unitedsecurities.com.hk/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.15%

Minimum Deposit

$1,300

Funding Rate

3%

New Stock Trading

Yes

| United Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | HKD 0 |

| Fees | Pricing depends on the type of service |

| Account Fees | Free to open |

| Interests on uninvested cash | Penalty interest is calculated based on the prime rate plus 8% ( with a balance in the cash account) |

| Margin Interest Rates | Overdue interest rate 3%-5% |

| Mutual Funds Offered | No |

| App/Platform | Available on iOS, Andriod, and Web |

| Promotions | Yes |

What is United Securities?

United Securities, is a well-established online brokerage firm that provides lower transaction fees and convenient online trading platforms for individual investors, and its streamlined processes allow customers to easily buy and sell stocks. Unity Securities Limited mainly provides customers with securities trading, securities underwriting, securities financing, investment consulting, corporate mergers and acquisitions, securities research, financial consulting, fund management, investment consulting, special account management, and other services. United Securities Limited offers a full suite of trading services across multiple devices including iOS, Android, and web platforms. However, the limited investment options and research tools may not satisfy more sophisticated traders.

Pros and Cons of United Securities

United Securities Limited provides traders with diverse markets, account options, and accessible platforms, which can provide traders with diverse trading markets and account selections. Its main businesses include core securities businesses such as stock trading platforms, new stock subscriptions, and corporate action agents, as well as related banking products such as payment accounts and other auxiliary services. The broker supports various instruments through full-featured mobile and desktop apps. However, the broker's research is most suitable for beginners rather than advanced strategies, and the platform may not accommodate all the needs of active professional traders.

| Pros | Cons |

|

|

|

|

|

|

|

Is United Securities safe?

Yes, United Securities Limited is regarded as a very safe broker. United Securities Limited is approved by the Securities and Futures Commission of Hong Kong to engage in Type 1 (dealing in securities), Type 4 (advising on securities), and Type 9 (providing asset management) regulated activities in Hong Kong, and its license number is AFP229. United Securities Limited's strict privacy practices prevent unauthorized access or disclosure of personal trader details.

What are securities to trade with United Securities?

United Securities Limited customers have access to trade a diverse range of securities. It includes Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds.

Securities trading services: including Hong Kong stocks and US stock trading, providing manual and online trading, and charging relevant fees and taxes.

Physical stock and settlement processing services: including central clearing instructions, withdrawal and deposit of stocks, settlement of buy and sell orders, etc., and charging relevant fees.

New stock subscription services: providing new stock application and settlement services, and charging relevant fees.

Agency and corporate action services: such as dividend collection, rights issue subscription, transfer registration, etc., and charging relevant service fees.

Banking and lending services: such as cash accounts, margin accounts, checking business, and charging relevant interest and fees.

Other services: such as reprinting statements, asset certificates, etc., and charging relevant fees.

In general, Unity Securities mainly provides customers with securities trading, settlement and settlement, new stock subscription, and related agency and banking services, and clearly defines the charging standards for each service.

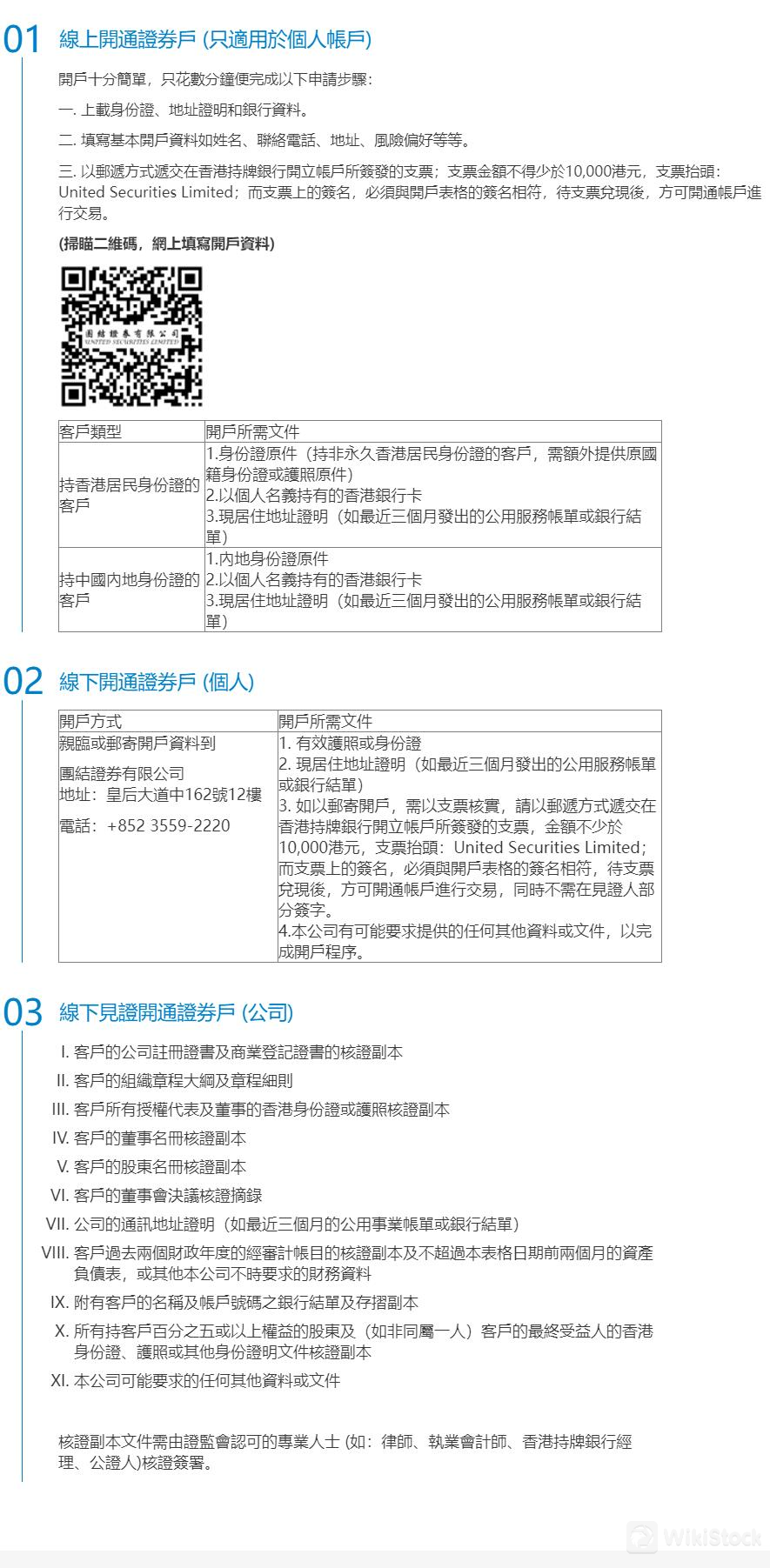

United Securities Accounts

United Securities Limited offers various account types to cater to different needs.

The account types provided by Unity Securities include:

Individual account:

No minimum deposit requirement for account opening. United Securities Limited requires identity documents for account opening, and it does not charge annual fees/account maintenance fees. There is no minimum deposit requirement for account opening.

Joint account:

No minimum deposit requirement for account opening, annual fees/account maintenance fees, but two or more joint applicants are required to provide identity documents for account opening.

Corporate account:

Company documents such as company registration certificates are required for account opening, and there are no requirements for minimum deposits, annual fees/account maintenance fees for account opening.

In total, Unity Securities does not require any fees to open an account.

United Securities Fees Review

United Securities Limited is known for its low-cost trading fees. They have no commissions for online stock, ETF, and options trades. Futures and forex trades are charged flat per contract rates. There are also no account maintenance or inactivity fees. This low-cost structure attracts many budget-minded, do-it-yourself traders.

Commissions and Fees:

Stocks trading commission: 0.25% for manual orders. The standard commission for manual trading is 0.25% of the transaction amount, with a minimum charge of HK$50. This applies to the manual trading of Hong Kong and US stocks. 0.15% for manual orders for US stocks, and 0.15% for electronic orders. The standard commission for electronic trading is also 0.25% of the transaction amount, with the same minimum charge as manual trading. This is a discount set to enhance the customer's online trading experience. The standard commission for manual and electronic trading of US stocks is slightly lower, at 0.15% of the transaction amount. This is in consideration of the relatively low transaction costs of US stocks.

Buy and sell order settlement fee: HK$50 per buy and sell order.

New stock application fee: HK$100 per application.

Cash dividend collection fee: 0.5% for cash dividends.

Agency company action fee: such as HK$2 per lot for rights issue subscription; HK$8 for registration transfer, etc. Others, such as HK$100 for reprinting statements, etc.

Margin Interest Rate:

Cash account overdue interest rate: prime rate + 8%

Margin account loan interest rate: prime rate + 3%

Margin account excess utilization interest rate: prime rate + 5%

In general, Unity Securities has set clear charging standards for various services, and also provides margin loans based on customer assets, and stipulates the relevant interest rate level. This can provide customers with trading and financing services while also playing a role in risk control.

United Securities App Review

United Securities Limited mobile app is a leading-edge, streamlined trading platform for the mobile investors. Available on both iOS and Android devices. It permits seamless access to markets from any location via a highly intuitive interface. The broker offers not only standalone mobile apps but also cross-platform compatibility through web-based trading modules. This wide selection of integrated platforms guarantees all clients, regardless of preferred hardware, can employ United Securities Limited's complete suite of services from any internet-connected device.

Research and Education

Educational Resources:

United Securities Limited provides a “Learn More About Stocks” section that introduces basic knowledge such as stock concepts and trading techniques.

The self-service investment tool allows fund analysis and self-selected stocks.

Third-Party Research:

United Securities Limited only provides a very basic introduction to investment education;

United Securities Limited mainly focuses on the online trading platform and product service introduction. The space for education and research resources can be strengthened.

Customer Service

Customer Service Methods:

Telephone support via a dedicated hotline during business hours

Online chat and messaging through the broker's website and app

Email support through a designated customer service address

Tel: (852) 3559 2228 Fax: (852) 2896 2988

Email: cs@unitedsecurities.com.hk

Customer service center operating hours are not specified, and it needs to email to inquire

In summary, United Securities Limited provides a telephone hotline, physical customer service centers, and online inquiry support, and it provides multiple customer service channels to suit different communication preferences and needs.

Conclusion

Overall, United Securities Limited presents a well-rounded online brokerage solution for moderately active individual traders seeking reliable mobile access combined with a trusted educational foundation to help navigate markets independently. Particularly for beginner or occasional investors, it can meet daily trading needs through highly accessible and user-friendly tools.

FAQs

Is United Securities Limited a good platform for beginners?

With its fundamental materials and intuitive interfaces, United Securities Limited provides an easy-to-use option for novice traders to gain experience and knowledge.

Is United Securities Limited legit?

Yes, United Securities Limited is a legitimate and properly regulated broker. It is approved by the Securities and Futures Commission of Hong Kongadhering to regulatory guidelines to protect clients.

Is United Securities Limited good for investing?

While ideal for basic investing, more advanced traders may find limited order/research options. Beginners can take advantage of no-fee IRAs and learn fundamental strategies, but active day traders seek pro-level platforms and tools.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

CIS Group

Score

電訊證券

Score

Prudential Brokerage

Score

中原證券

Score

天风国际

Score

國農證券

Score

Synerwealth

Score

雅景證券

Score

CS Wealth

Score

Plutus

Score