Welcome to ICM Capital, an international online Forex and CFD trading firm offering 24 hour access to a diverse range of trading products including foreign exchange, commodities, futures and indices. Through ICM Capital and the world renowned MetaTrader 4 trading platform you can take advantage of high liquidity, tight spreads, mobile trading, technical analysis and much more.

ICM Capital Information

ICM Capital, founded in 2009, is a global multi-regulated financial service provider headquartered in London. The broker offers the popular MetaTrader 4 (MT4) platform and a wide range of tradable securities, including Forex, precious metals, index futures, energy futures, and US stocks. It employs advanced security measures, such as encryption and multi-factor authentication, to safeguard client information.

However, there are some drawbacks, such as commission fees on the ICM Zero account and limitations on swap-free accounts for Muslim clients. Additionally, the lack of 24/7 customer support can be inconvenient for some traders.

Pros and Cons of ICM Capital

ICM Capital offers several advantages for traders. Firstly, the broker is regulated by the UK's Financial Conduct Authority (FCA), ensuring a high level of oversight and client protection. The broker provides popular trading platform(MT4) and employs advanced security measures such as encryption technologies, multi-factor authentication, and secure socket layer (SSL) protocols to protect clients' personal and financial information. The variety of tradable securities, including Forex, precious metals, index futures, energy futures, and US stocks, caters to different trading strategies and preferences.

On the downside, the commission fees on the ICM Zero account might be a drawback for some traders. Specifically, the ICM Zero account charges a commission of $7 per round lot for Forex and Metal trades. Another potential con is the broker's policy on swap-free accounts. Although ICM Capital provides swap-free accounts for clients following the Muslim faith, they reserve the right to discontinue this feature in cases of suspected abuse. This could be seen as a limitation for traders who rely on swap-free accounts. Additionally, despite the diverse customer service options, the lack of a 24/7 support line might be inconvenient for traders in different time zones.

Is ICM Capital safe?

Regulations

ICM Capital is officially licensed and regulated by The United Kingdom Financial Conduct Authority (FCA) under license number 520965.

Funds Safety

ICM Capital ensures the safety of client funds by maintaining segregated accounts. This means client funds are kept separate from the companys operational funds, protecting clients' money in the event of company insolvency. Additionally, the broker participates in the Financial Services Compensation Scheme (FSCS), offering further protection up to £85,000 per client.

Safety Measures

To protect clients' personal and financial information, ICM Capital employs advanced security measures including encryption technologies, multi-factor authentication, and secure socket layer (SSL) protocols. Regular security audits and compliance checks are conducted to mitigate potential threats. The firm adheres to stringent regulatory standards set by the Financial Conduct Authority (FCA), ensuring all trading activities are conducted fairly and transparently.

What are securities to trade with ICM Capital?

ICM Capital offers a wide range of securities for trading, catering to various investment strategies and preferences. Heres a detailed look at the available options:

- Forex: Clients can trade numerous currency pairs, including major, minor, and exotic pairs. The broker provides competitive spreads and deep liquidity pools, ensuring efficient and cost-effective trading. Forex trading is supported on all major platforms, including MT4 and WebTrader.

- Precious Metals: ICM Capital allows trading in precious metals such as gold, silver, platinum, and palladium. These markets offer opportunities for diversification and hedging against economic uncertainties. Clients can benefit from competitive pricing and leverage options, enhancing their trading potential.

- Index Futures: Investors can trade major global indices like the S&P 500, NASDAQ, FTSE 100, and DAX 30. Index trading provides exposure to broader market movements and helps diversify investment portfolios. ICM Capital offers tight spreads and flexible leverage options for index trading.

- Energy Futures: ICM Capital offers trading in energy commodities including crude oil, natural gas, and heating oil. Energy markets are known for their volatility, providing lucrative trading opportunities. Clients have access to real-time market data and advanced charting tools to make informed trading decisions.

- US Stocks: Clients can trade a variety of individual stocks listed on major global exchanges such as the NYSE, NASDAQ, and LSE. Stock trading allows investors to capitalize on company-specific news and events. ICM Capital provides competitive commissions and access to extensive research tools.

- Cash CFDs: ICM Capital offers Cash CFDs to enhance trading flexibility and diversity for their clients. These Cash CFDs allow traders to access a broader range of markets with optimal execution.

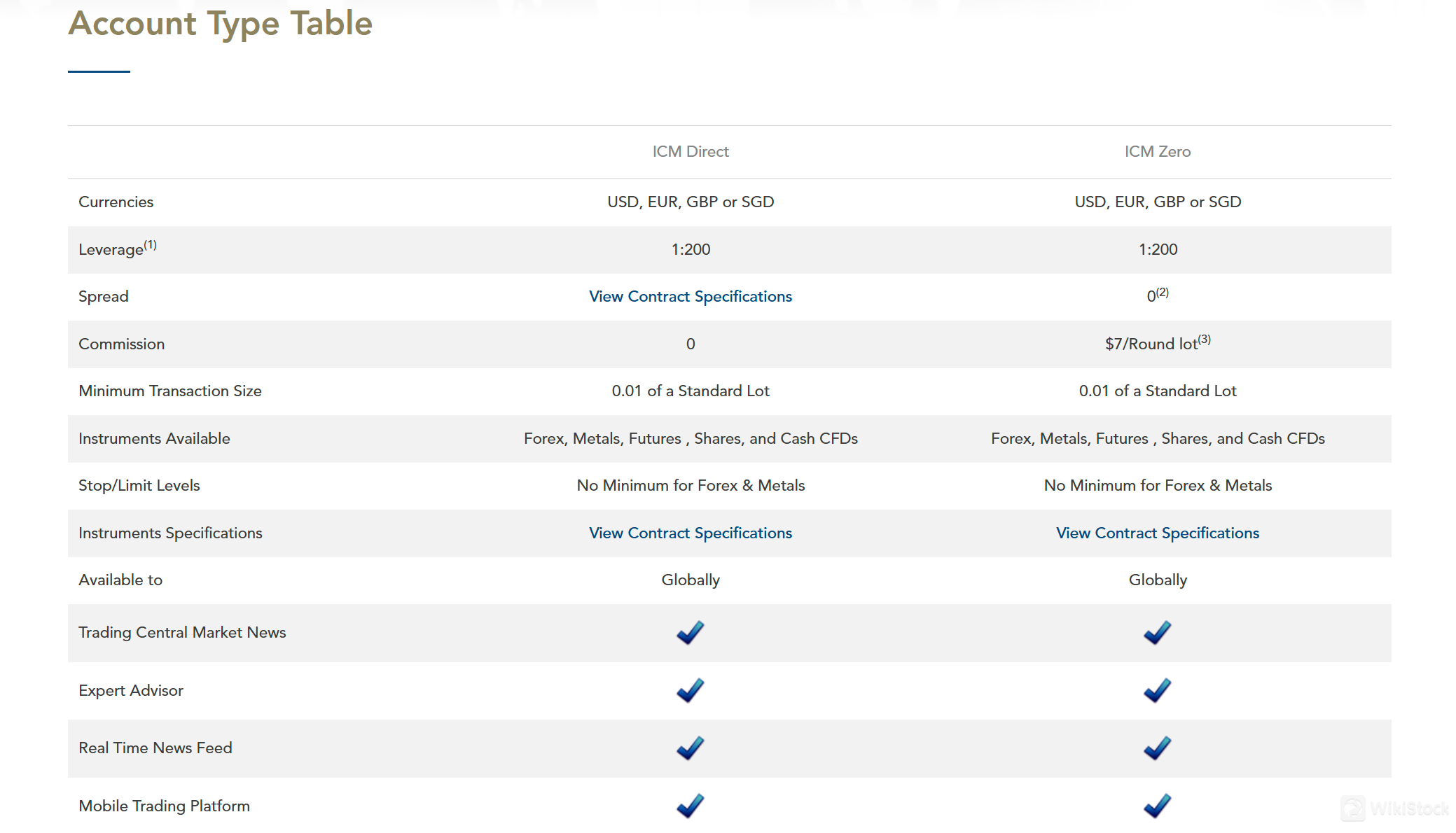

ICM Capital Accounts

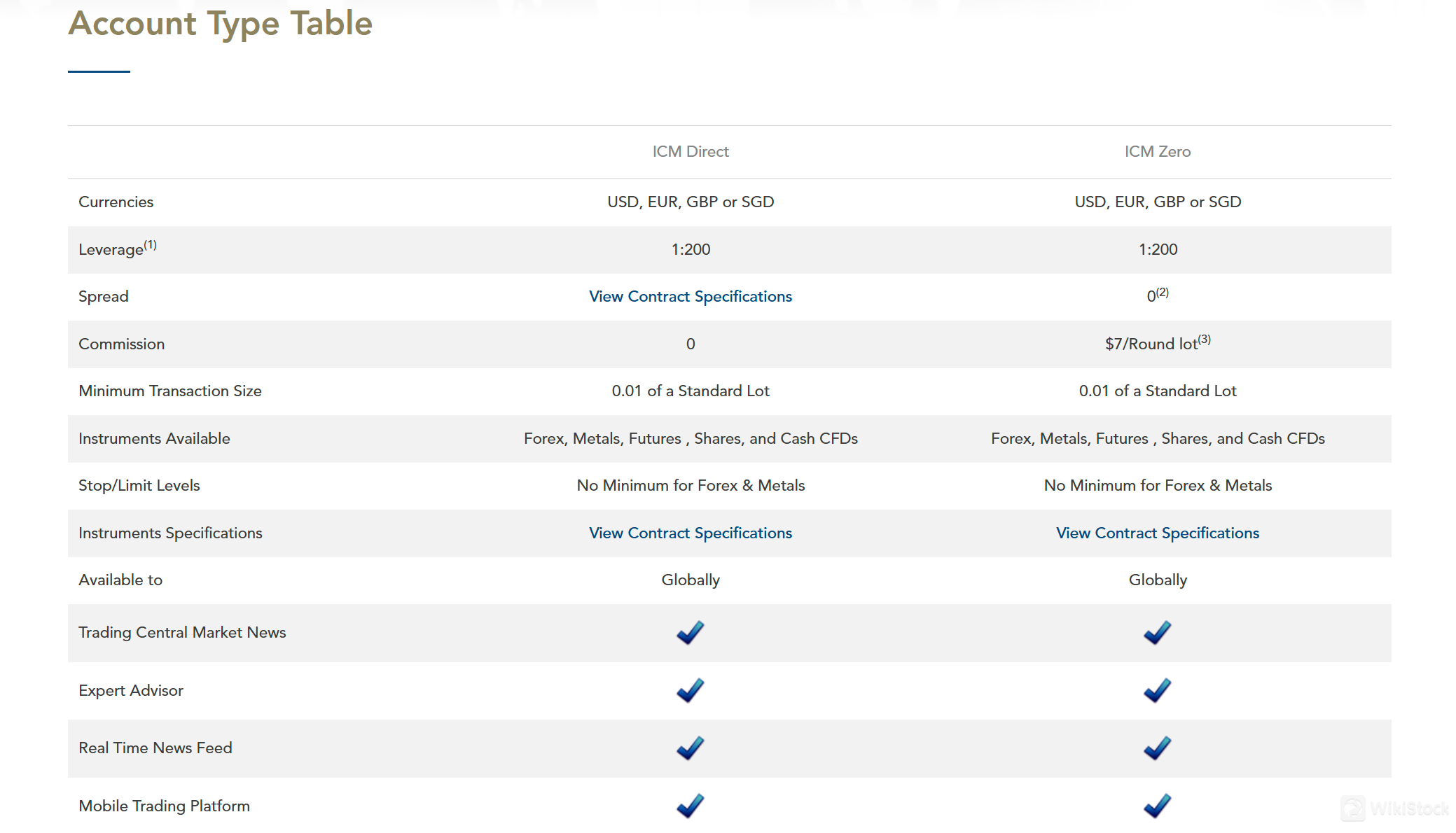

ICM Capital offers two main types of accounts: ICM Direct and ICM Zero. Both account types are available in USD, EUR, GBP, or SGD and provide a leverage of up to 1:200. The ICM Direct account features variable spreads and charges no commission, while the ICM Zero account offers a fixed spread starting from zero on major pairs like EUR/USD. Both account types provide access to a variety of instruments, including Forex, metals, futures, shares, and Cash CFDs.

Additionally, both account types support advanced trading tools and features such as market execution, expert advisors, mobile trading platforms, and more. There are no minimum stop/limit levels for Forex and metals, and both account types are globally accessible. They also provide swap-free accounts for clients following the Muslim faith, although they reserve the right to withdraw this feature in cases of suspected abuse.

ICM Capital Fees Review

ICM Capital offers two account types with different fee structures. The ICM Direct account has no commissionfees and variable spreads that can be viewed in the contract specifications. It supports multiple currencies (USD, EUR, GBP, or SGD), offers a leverage of up to 1:200, and allows trading across various instruments such as Forex, Metals, Futures, Shares, and Cash CFDs.

The ICM Zero account charges a commission of $7 per round lot for Forex and Metal trades while maintaining zero spreads starting from the EURUSD pair. Like the ICM Direct account, it supports multiple currencies, offers leverage up to 1:200, and includes similar trading instruments. Both account types have no minimum stop/limit levels for Forex and Metals and provide market execution, mobile trading platforms, and additional trading tools and services.

ICM Capital App Review

ICM Capital utilizes the MetaTrader 4 (MT4) platform, renowned for its reliability, speed, and security, to provide clients with a top-notch trading experience. MT4 supports Forex, precious metals, and CFDs trading, and offers the capability to use Expert Advisors (EAs) for automated trading. The platform is accessible on both PC (MS Windows) and Mac (OS X), and is available in 30 languages. Additionally, traders can manage their accounts on-the-go using free MT4 apps for iOS and Android devices, ensuring trading across multiple devices.

Research and Education

ICM Capital Securities offers a diverse suite of research and educational resources designed to support clients.

- Trading Central: ICM Capital provides clients with access to Trading Central, a premier technical analysis service that offers real-time trading opportunities for Forex, Precious Metals, and Oil. All clients can access daily market reports, while live account holders benefit from the Trading Central MetaTrader 4 (MT4) Indicator and News Portal, delivering award-winning research to aid in making informed trading decisions.

- FAQs: ICM Capital also offers a FAQ section to answer questions about market information and account management.

Customer Service

ICM Capital offers excellent customer service through various channels, including email (clientservices@ICMCapital.co.uk.), phone support (+44 207 634 9770), fax(+44 207 516 9137) and a message box on their website. The brokers support team is responsive and knowledgeable, assisting clients with any issues they may encounter. This high level of customer support ensures that clients can resolve their problems efficiently and continue trading with minimal disruptions.

Conclusion

ICM Capital is a secure and regulated broker, licensed by the UK's Financial Conduct Authority (FCA), ensuring robust client protection. The broker offers advanced security measures, including encryption and multi-factor authentication. While ICM Capital provides popular trading platforms like MT4 and a variety of tradable securities, it charges commission fees on the ICM Zero account, and its policy on swap-free accounts may pose limitations for some traders. Additionally, the lack of 24/7 customer support can be inconvenient for traders in different time zones.

FAQs

Is ICM Capital a regulated broker?

Yes, ICM Capital is regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

What types of securities can I trade with ICM Capital?

ICM Capital offers a variety of securities, including Forex, precious metals, index futures, energy futures, US stocks, and cash CFDs.

How does ICM Capital ensure the safety of client funds?

ICM Capital maintains segregated accounts to keep client funds separate from company funds and participates in the Financial Services Compensation Scheme (FSCS) for additional protection.

Risk Warning

WikiStock's expert assessment of the brokerage's website data is subject to change and should not be taken as financial advice. Online trading carries substantial risks, including the potential loss of all invested capital, and it's crucial to fully understand these risks before investing.

Obtain 1 securities license(s)