iFOREX was founded in 1996 and is one of the largest and most respected brokers in the industry. We generate mass trading volume and provide vast liquidity to numerous traders located around the world.

iFOREX Introduction

iFOREX, founded in 1996, stands as one of the industry's leading brokers, renowned for its advanced technology and comprehensive customer service. With over 750 tradable instruments across various markets, including shares, and ETFs, iFOREX caters to global traders with its user-friendly platforms and robust educational resources. Regulated by the CySEC, iFOREX prioritizes client security through measures like Negative Balance Protection and encryption services.

Pros & Cons of iFOREX

Pros: Regulatory Oversight and Security: Operates under the regulatory supervision of CySEC, ensuring compliance and providing protective measures like Negative Balance Protection and segregated client accounts.

Comprehensive Trading Platform: iFOREX offers user-friendly trading platforms for both web and mobile.

Educational Resources: Offers extensive educational resources including video tutorials and 1-on-1 training.

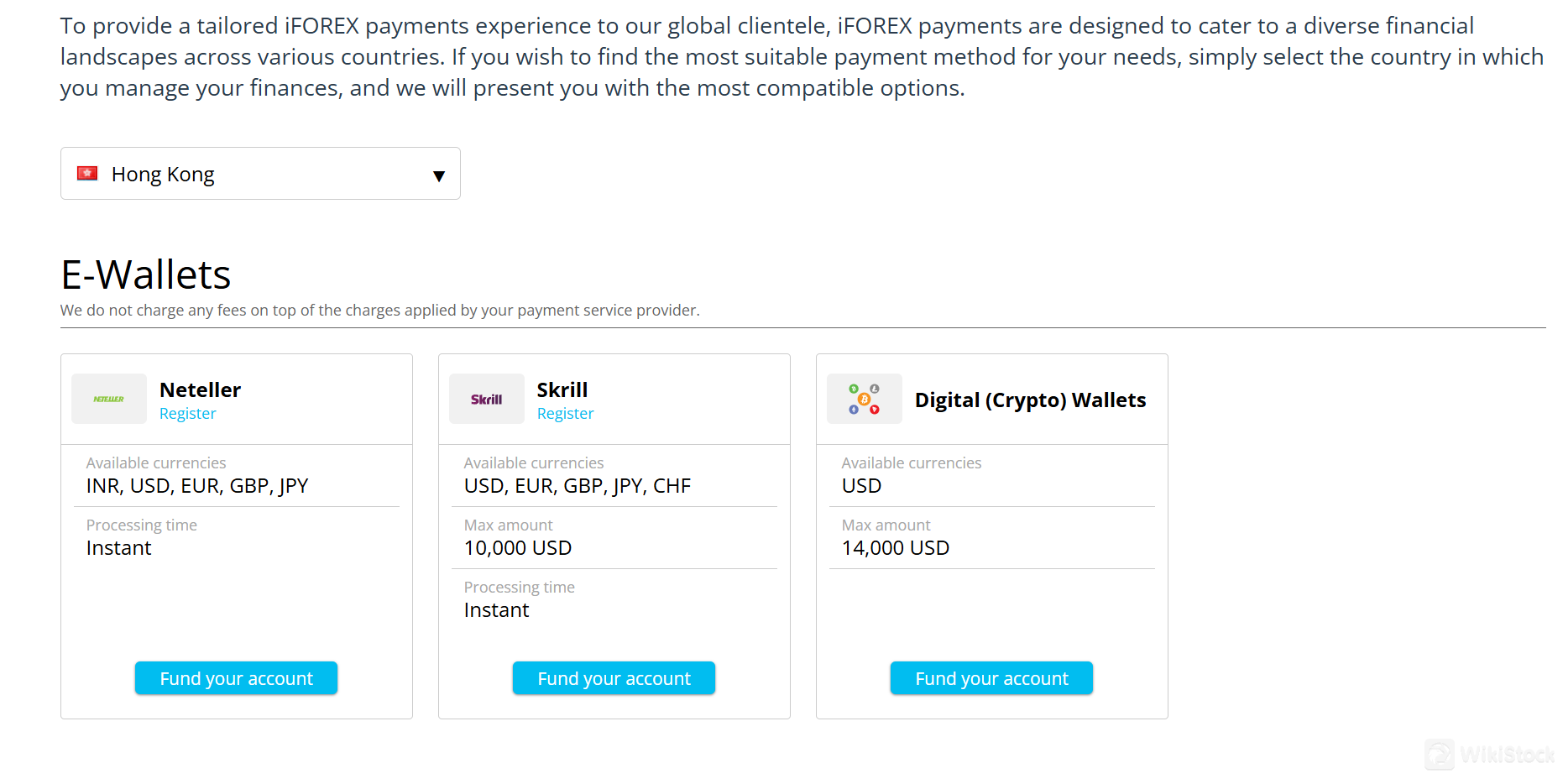

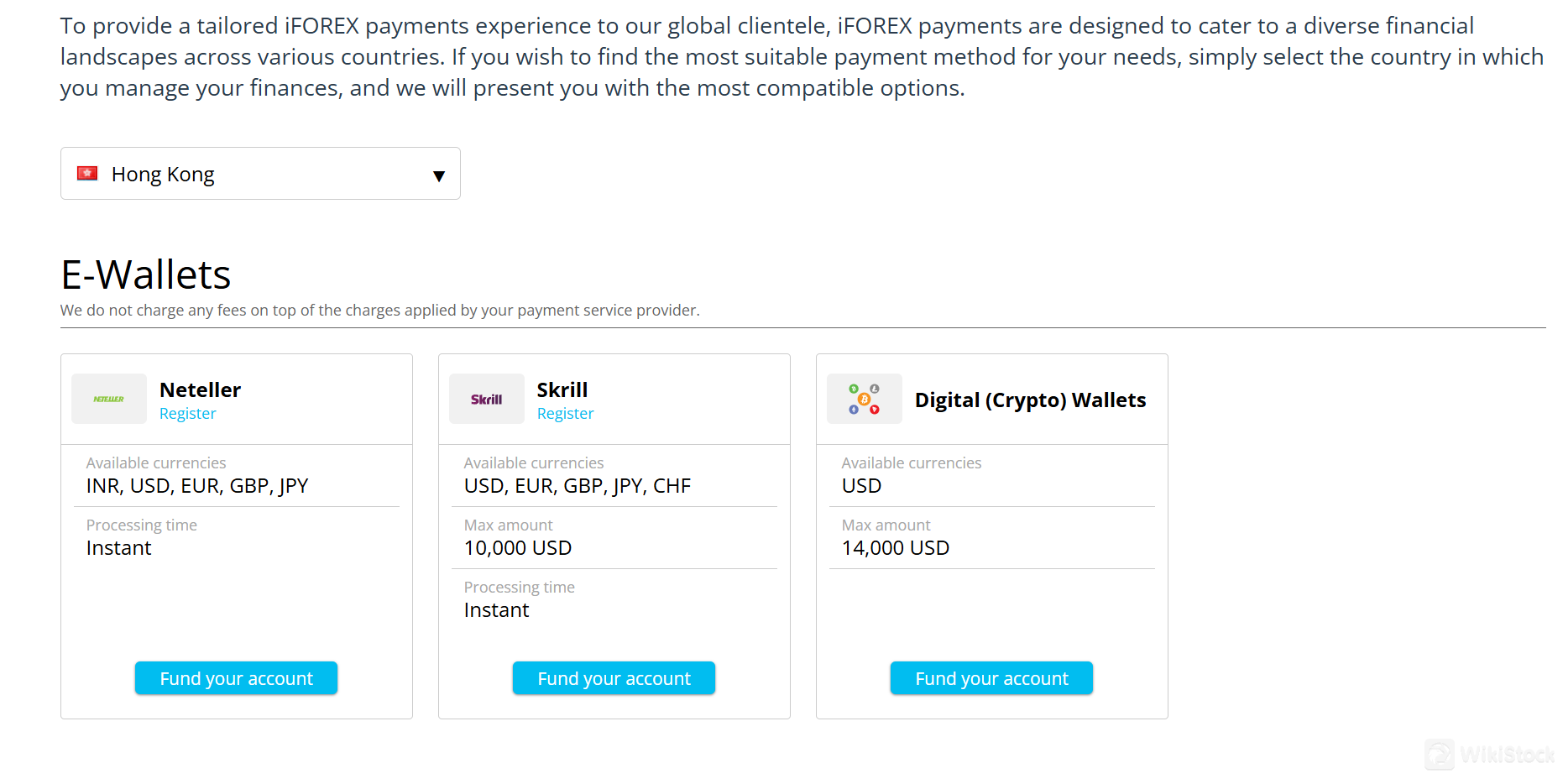

Multiple Payment Methods: Supports various payment methods including bank transfers, credit/debit cards, eWallets, and local payment options.

No Commission Fees: Does not charge commission fees on transactions, making trading cost-effective for clients.

Cons: Limited Securities Provided: iFOREX offers a limited range of securities or assets for trading, which restricts the choices available to investors.

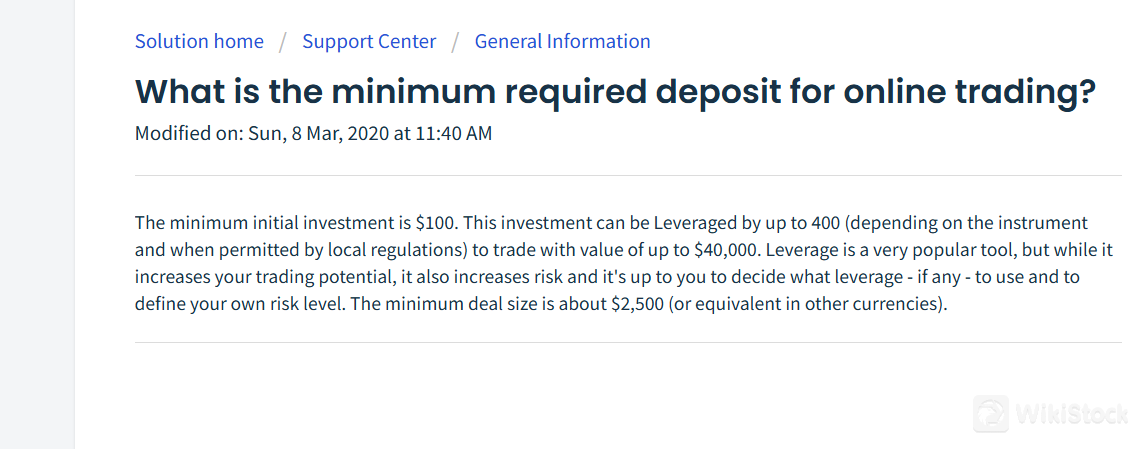

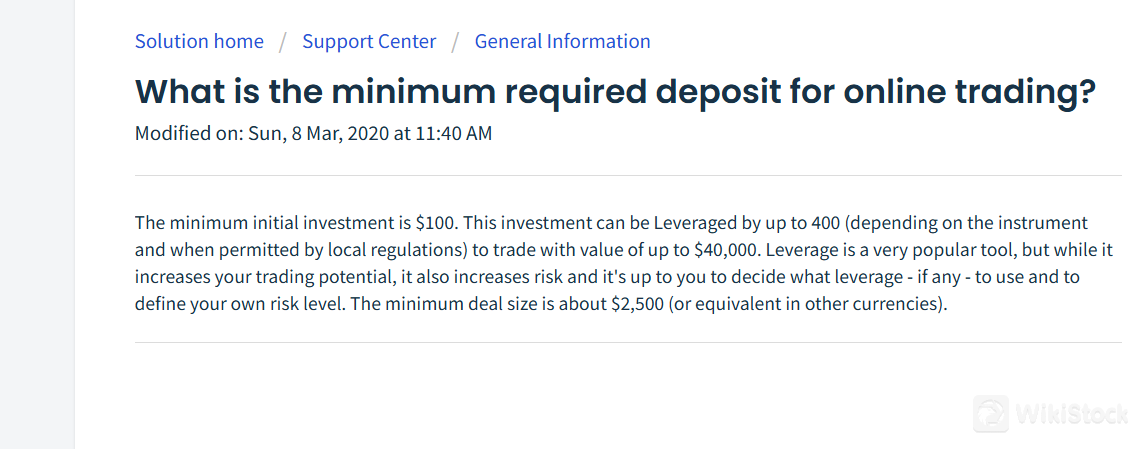

Minimum Deal Size: The minimum deal size of approximately $2,500 or its equivalent may not be suitable for all traders, especially those with smaller capital.

Limited Availability of Customer Support: Customer support is available only during specific hours (Monday-Friday, 04:00-20:00 GMT).

Is iFOREX Safe?

iFOREX operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC), holding License No.143/11. CySEC serves as an independent public supervisory authority tasked with overseeing the investment services market, transactions involving transferable securities within Cyprus, and the collective investment and asset management sectors.

In addition to regulatory compliance, iFOREX provides a range of protective measures and security features to enhance trader confidence. These include Negative Balance Protection, which shields traders from owing more than their deposited funds in the event of market volatility. Real-time margin protection mechanisms are also employed to monitor and manage trading risks effectively. Furthermore, encryption services are implemented to secure sensitive data and transactions. iFOREX further ensures client fund security through segregated bank accounts, segregating operational funds from client deposits.

What are Securities to Trade with iFOREX?

iFOREX offers shares, ETFs. Apart from securities, iFOREX also offers other asset classes to trade including currencies, commodities, indices, cryptocurrencies.

Shares: iFOREX enables trading in individual stocks of publicly listed companies. Investors can buy and sell shares to capitalize on the performance of specific companies across various sectors.

ETFs (Exchange Traded Funds): ETFs on iFOREX represent baskets of assets, such as stocks, commodities, or bonds, that are traded on stock exchanges. They provide investors with diversified exposure to a specific market or asset class.

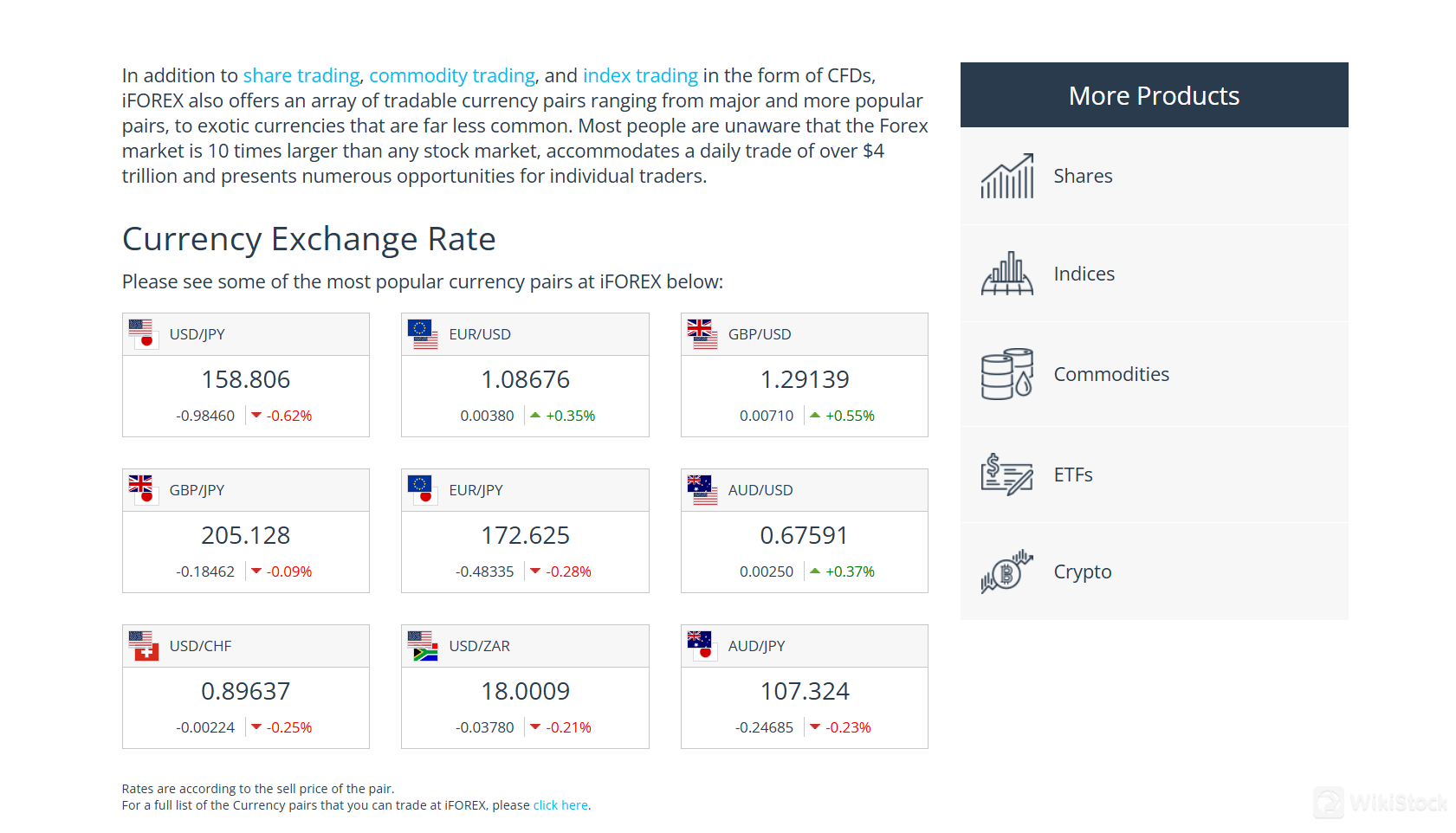

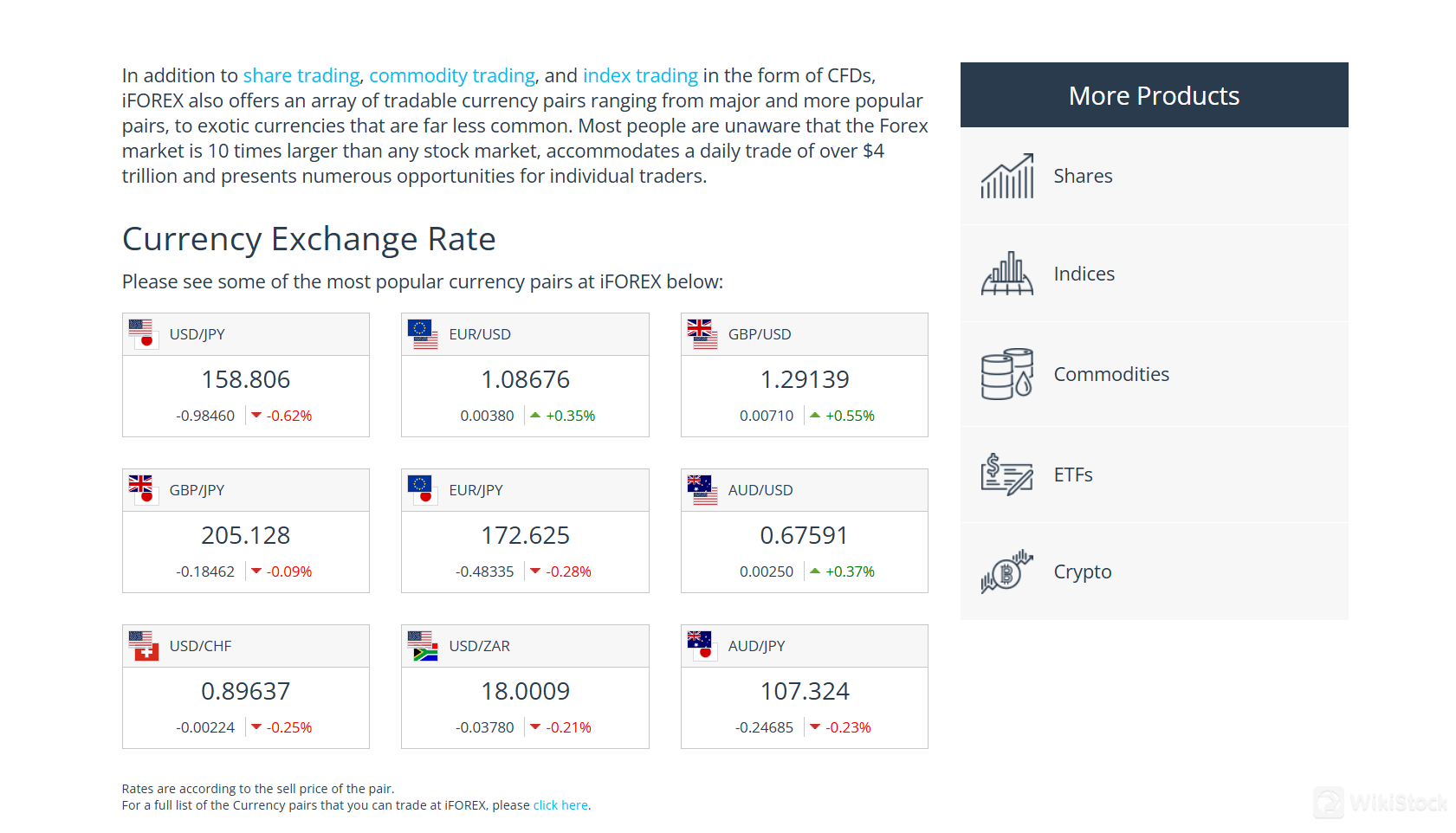

Currencies: iFOREX offers trading in currency pairs, allowing investors to speculate on the exchange rate movements between different currencies.

Commodities: This includes trading in commodities like gold, silver, oil, and other natural resources. Commodities are traded as futures contracts or spot contracts.

Indices: iFOREX provides trading in stock market indices, which track the performance of a group of stocks from a specific exchange or sector.

Cryptocurrencies: Trading is available for digital currencies such as Bitcoin, Ethereum, and other cryptocurrencies, which have gained popularity for their potential high returns and volatility.

iFOREX Deposits & Withdrawals Review

iFOREX provides many payment methods.

- Bank Wire Transfer: Traditional and reliable, allowing for direct transfers from your bank account to your iFOREX account.

- Credit and Debit Cards: Supports major credit and debit cards, making it easy for users to fund their accounts using their everyday payment cards.

- eWallets: Modern digital wallets are supported, providing a quick and efficient way to deposit funds.

- Local Payment Methods: iFOREX also caters to various local payment methods specific to different countries, ensuring that users can fund their accounts using the most convenient method available in their region.

iFOREX does not impose any commission fees on transactions. This means that even if your transferring provider charges a commission, iFOREX will not add any additional fees. Besides, the platform is designed to make the deposit process as straightforward as possible, allowing traders to focus more on their trading activities and less on the logistics of funding their accounts.

iFOREX Fees Review

iFOREX does not charge any fees for registering, opening, or closing an account, making it accessible for traders to get started without initial costs.

The platform allows a minimum initial investment of $100, leveraging up to 400 times depending on the instrument and local regulations, enabling trades valued up to $40,000. This flexibility in leverage empowers traders to enhance their trading potential, though it also increases risk, requiring careful consideration of individual risk tolerance levels. Additionally, the minimum deal size is approximately $2,500 or its equivalent in other currencies.

iFOREX Platforms Review

iFOREX provides iFOREX App. The iFOREX trading platform is designed to provide a secure and regulated trading environment. It features an Economic Calendar and Trading Signals to help traders make informed decisions based on market events. The platform includes advanced live charts and indicators for comprehensive technical analysis. It can be customized to meet individual trading preferences, offering a user-friendly and intuitive interface. Supporting trading from multiple devices, including mobile phones and computers, the iFOREX platform stands out as a proprietary solution developed over 25 years of market experience.

Research & Education

iFOREX provides a suite of research and education tools.

Online Trading Education: iFOREX offers extensive educational resources, including 1-on-1 training sessions and video tutorials.

Technical and Customer Support: Traders benefit from robust technical support available in multiple languages. The customer support team is equipped to address queries and provide guidance effectively.

FAQs Center:

The FAQs center serves as a valuable resource, offering answers to common questions and helping traders navigate the platform and trading process efficiently.

Tools for Analysis and Decision Making:

Economic Calendar: This tool provides a schedule of key economic events and indicators that could impact the financial markets.

Live Rates: Real-time updates on currency pairs, commodities, and other assets allow traders to monitor market movements closely.

Todays Opportunity: This feature highlights potential trading opportunities based on market conditions and trends.

Platform Tools: iFOREX provides a range of tools integrated into their platform, facilitating technical analysis, charting, and trade execution.

The Trading Expert: A resource designed to offer insights and strategies from experienced traders.

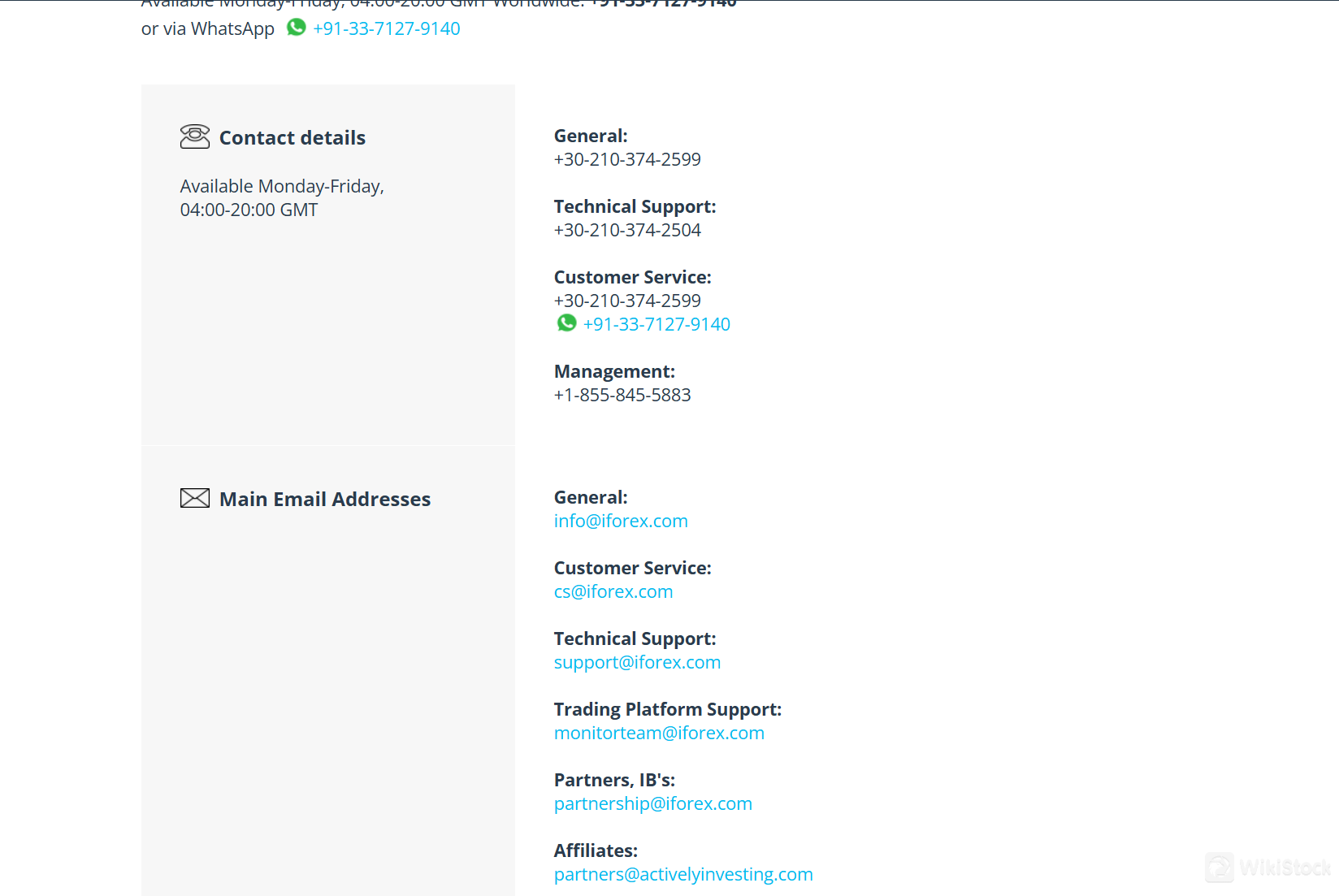

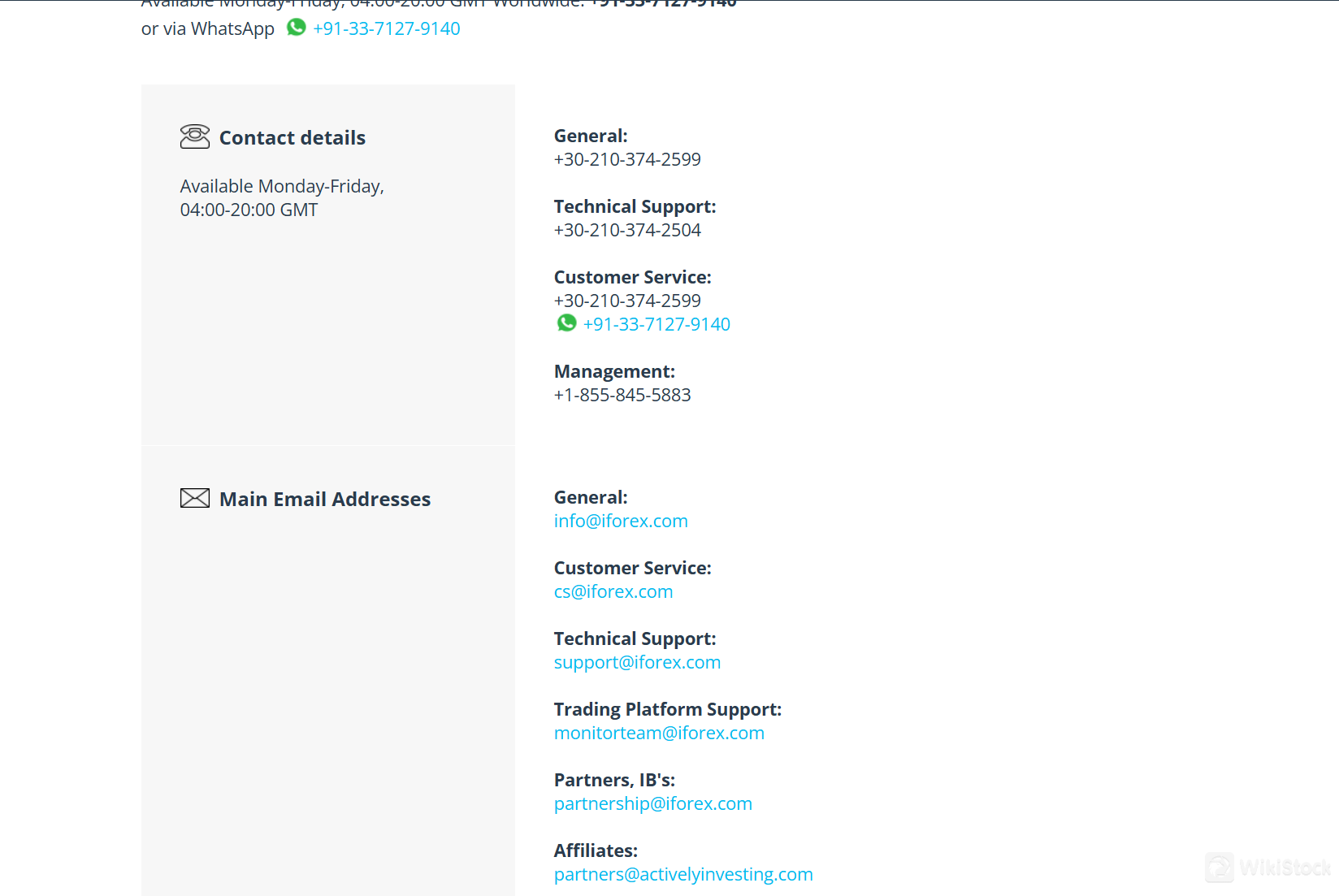

Customer Service

Customers can get in touch with customer service line using the information provided below:

Available Monday-Friday, 04:00-20:00 GMT

Telephone/ WhatsApp: +91-33-7127-9140 / +30-210-374-2599

Email: info@iforex.com, cs@iforex.com

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, YouTube, Tik Tok and Linkedin.

Conclusion

iFOREX appeals to traders looking for a robust trading platform with no commission fees and a variety of payment methods. It caters well to experienced traders who value comprehensive tools and features for managing investments efficiently. However, users should be aware of its lack of diverse securities and minimum deal sizes that is not suit all investors. Therefore, iFOREX is best suited for traders who prioritize platform features and cost-effectiveness over extensive asset variety and comprehensive support services.

Q&A

Is iFOREX regulated?

Yes. It is regulated by CySEC.

Does iFOREX offer mobile trading capabilities?

Yes, iFOREX does offer mobile trading capabilities. You can download the iFOREX trading app for iOS or Android devices to access your account and trade on the go.

Is there a demo account available for practice?

Yes.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 2 securities license(s)