Lapland Securities Limited (“Lapland”, CE. No. BJD139) holds SFC's Type 1, 4 and 9 license (Dealing in Securities, Advising on Securities and Asset Management) specialising in securities brokerage services, placing and underwriting services, research services, investment advisory services and investment management services. Our small but professional team provides tailor-made investment solution to our valued clients.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

What is Lapland?

Lapland is a reputable securities trading platform that offers investors a comprehensive suite of services to manage their investments effectively. Regulated by the Securities and Futures Commission of Hong Kong (SFC), Lapland ensures compliance with stringent standards, instilling confidence in its clients regarding the safety and integrity of their investments.

With designated securities accounts available through reputable banks like Bank of China (Hong Kong) and Bank of Communications (Hong Kong), Lapland provides clients with flexibility and convenience in managing their funds. Lapland offers a transparent fee structure, enabling cost-effective transactions.

Pros & Cons

Pros Regulated by SFC: Being regulated by a reputable authority like the SFC ensures that Lapland adheres to strict standards, providing a level of trust and security for investors.

Transparent fee structure: Lapland's transparent fee structure ensures that clients know exactly what they're paying for, promoting transparency and helping clients make informed decisions.

Comprehensive customer support network: Lapland provides a comprehensive customer support network, offering multiple channels for clients to reach out for assistance, enhancing overall client experience.

Cons Platform information not provided: There is no detailed information about the trading platform, including its features, usability, and accessibility. This can be a significant disadvantage for traders who rely on robust and user-friendly platforms for their trading activities.

No promotions available: The absence of promotions or incentives for new clients can make the brokerage less attractive compared to competitors who offer bonuses or reduced fees as part of promotional campaigns.

Is Lapland Safe?

Lapland is regulated by the oversight of the oversight of the Securities and Futures Commission of Hongkong (SFC), holding license No. BJD139. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, Lapland ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

Lapland Accounts

Lapland offers clients a streamlined process for managing their funds through designated securities accounts. Clients have the flexibility to choose from a range of bank options, including Bank of China (Hong Kong) and Bank of Communications (Hong Kong), each offering different account numbers and types to suit individual preferences.

Furthermore, Lapland's accounts cater to clients' diverse needs, offering both HKD savings and other account types to accommodate various financial preferences. With clear and accessible bank account details provided, clients can easily transfer funds to their designated Lapland accounts, enabling efficient and hassle-free transactions.

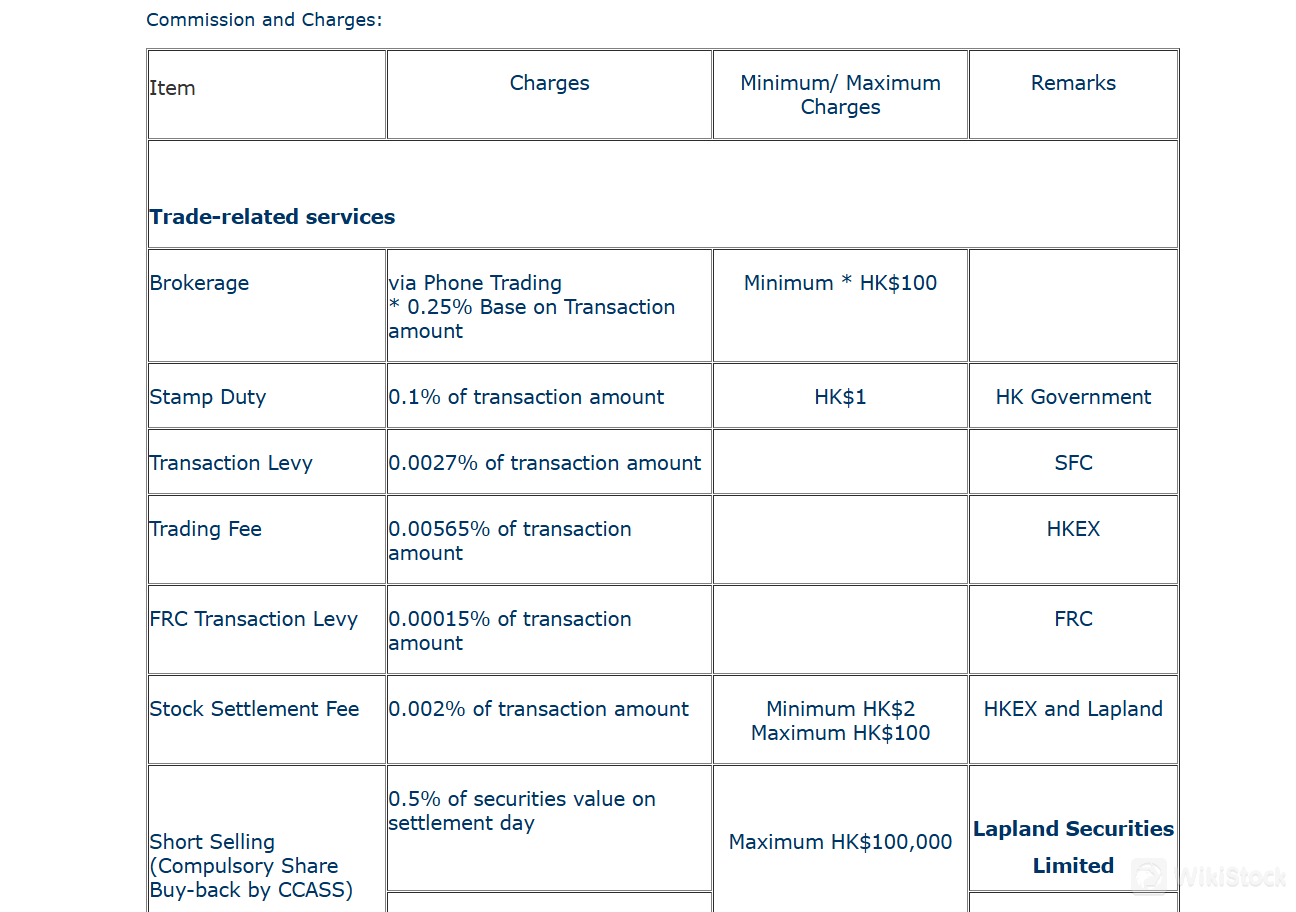

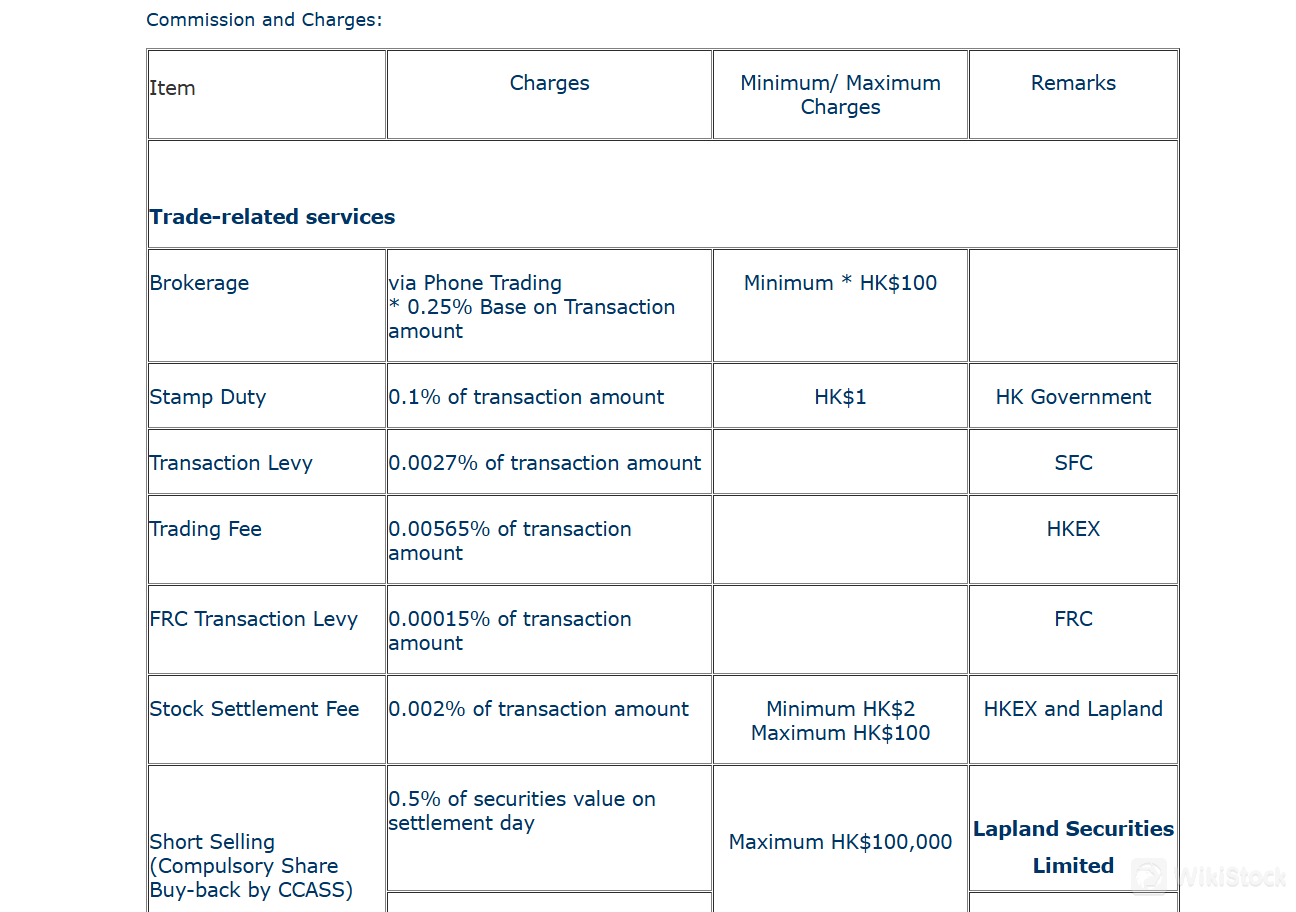

Lapland Fees Review

Lapland's fee structure is designed to provide transparency and cost-effectiveness for clients engaging in securities trading. When conducting trades via phone, clients incur a brokerage fee of 0.25% based on the transaction amount, with a minimum charge of HK$100.

Additionally, a trading fee of 0.00565% of the transaction amount is applied, along with a transaction levy of 0.0027%. Stamp duty, set at 0.1% of the transaction amount with a minimum charge of HK$1, is also levied on transactions. Stock settlement fees amount to 0.002% of the transaction amount, with a minimum charge of HK$2 and a maximum of HK$100. Moreover, a FRC transaction levy of 0.00015% of the transaction amount is applied.

More specific fee structures can be found on their official website through the provided link: http://www.lapland.com.hk/en/8-fee.html

Customer Service

Lapland provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Address: Lapland Securities Limited, Room 2705, 27/F., Winland House, 412-420 Castle Peak Road, Cheung Sha Wan, Kowloon, Hong Kong.

Office Hour: Monday to Friday, 09:00 to 18:00

Tel: +852 3106 4660

Email: info@lapland.com.hk

Conclusion

In conclusion, Lapland Securities Limited presents itself as a regulated brokerage firm under the oversight of the SFC, instilling confidence in clients regarding its adherence to stringent regulatory standards. While the platform offers a streamlined process for managing funds through designated securities accounts and provides transparent fee structures, there are notable drawbacks. The lack of detailed information about the trading platform's features and the absence of promotional incentives deter clients seeking comprehensive platform insights and enticing offers.

Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is Lapland suitable for beginners?

Lapland Securities is not the most suitable option for beginners due to its relatively complex fee structure and the requirement for phone trading, which is less intuitive for novice investors.

Is Lapland legit?

Yes, Lapland Securities is regulated by the Securities and Futures Commission of Hong Kong (SFC), holding license No. BJD139.

What types of accounts does Lapland offer?

Lapland offers clients a range of bank options, including Bank of China (Hong Kong) and Bank of Communications (Hong Kong), each offering different account numbers and types, such as HKD savings and other account types.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)