Sino Grade Securities Ltd, a dealer registered with the Securities and Futures Commission of Hong Kong, was established in 1996. Its business includes dealing in securities, margin financing, initial public offering, listing underwriting and placement, etc. With an enterprising spirit, Sino Grade is committed to offering customers comprehensive and accurate investment services. It has thus established solid market standing in the community.

What is Sino Grade Securities?

Established in 1996, Sino Grade Securities Ltd is registered with the Securities and Futures Commission of Hong Kong, ensuring stringent regulatory oversight that fosters a secure trading environment. The brokerage distinguishes itself by providing investors with valuable access to initial public offerings (IPOs), presenting opportunities for substantial growth. However, it falls short in customer service responsiveness due to the absence of live chat support, which may affect immediate assistance for clients.

Pros and Cons of Sino Grade Securities?

Sino Grade Securities stands out as a reputable brokerage regulated by the Securities and Futures Commission (SFC) in Hong Kong, ensuring a secure and compliant trading environment for investors. While it offers valuable opportunities such as access to initial public offerings (IPOs), providing avenues for clients to participate in new market listings and potential growth opportunities, the absence of live chat support may limit immediate customer assistance. Additionally, the firm does not support crypto trading, which may deter investors seeking exposure to digital assets. Moreover, Sino Grade Securities lacks comprehensive educational resources, which limits investor access to market insights and trading strategies necessary for informed decision-making.

Is Sino Grade Securities safe?

Regulations

Sino Grade Securities is licensed and regulated by the Securities and Futures Commission (SFC) in Hong Kong under license number ADE715.

What are securities to trade with Sino Grade Securities?

Sino Grade Securities offers a comprehensive range of investment products and services through its securities trading operations. This includes trading in a diverse array of financial instruments such as stocks, funds, and warrants listed on the Hong Kong Stock Exchange.

For investors looking to amplify their investment capacity, Sino Grade Securities offers margin financing services. This allows clients to leverage their existing capital to increase their purchasing power and potentially enhance returns on their investments.

Moreover, Sino Grade Securities plays a pivotal role in the capital markets through its involvement in initial public offerings (IPOs).

However, Sino Grade Securities does not offer trading in commodities and cryptocurrencies.

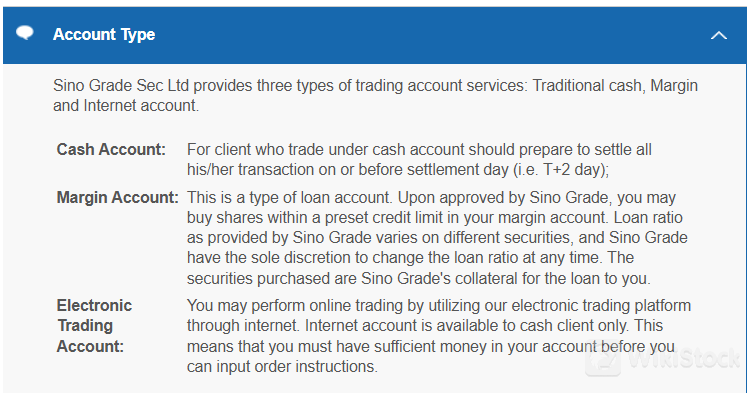

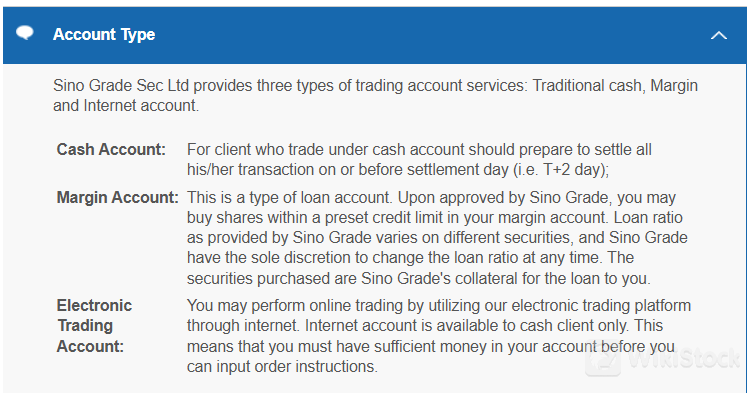

Sino Grade Securities Accounts

Sino Grade Securities offers three types of trading accounts tailored to meet diverse investor needs:

Cash Account: Designed for clients who prefer trading with available funds. Transactions conducted under a cash account must be settled by or before the settlement day (T+2 day).

Margin Account: This account type functions as a loan facility approved by Sino Grade Securities. Upon approval, investors can purchase shares using a predetermined credit limit. The loan ratio, varying by security, allows flexibility in leveraging investments. Securities purchased serve as collateral for the loan provided by Sino Grade, with the firm retaining the discretion to adjust the loan ratio as needed.

Electronic Trading Account: Exclusive to cash account holders, the electronic trading account enables online trading via Sino Grade's electronic trading platform. Investors can conveniently execute orders and manage their portfolios through internet access. This account type requires sufficient funds in the account before order instructions can be processed, ensuring secure and efficient online trading.

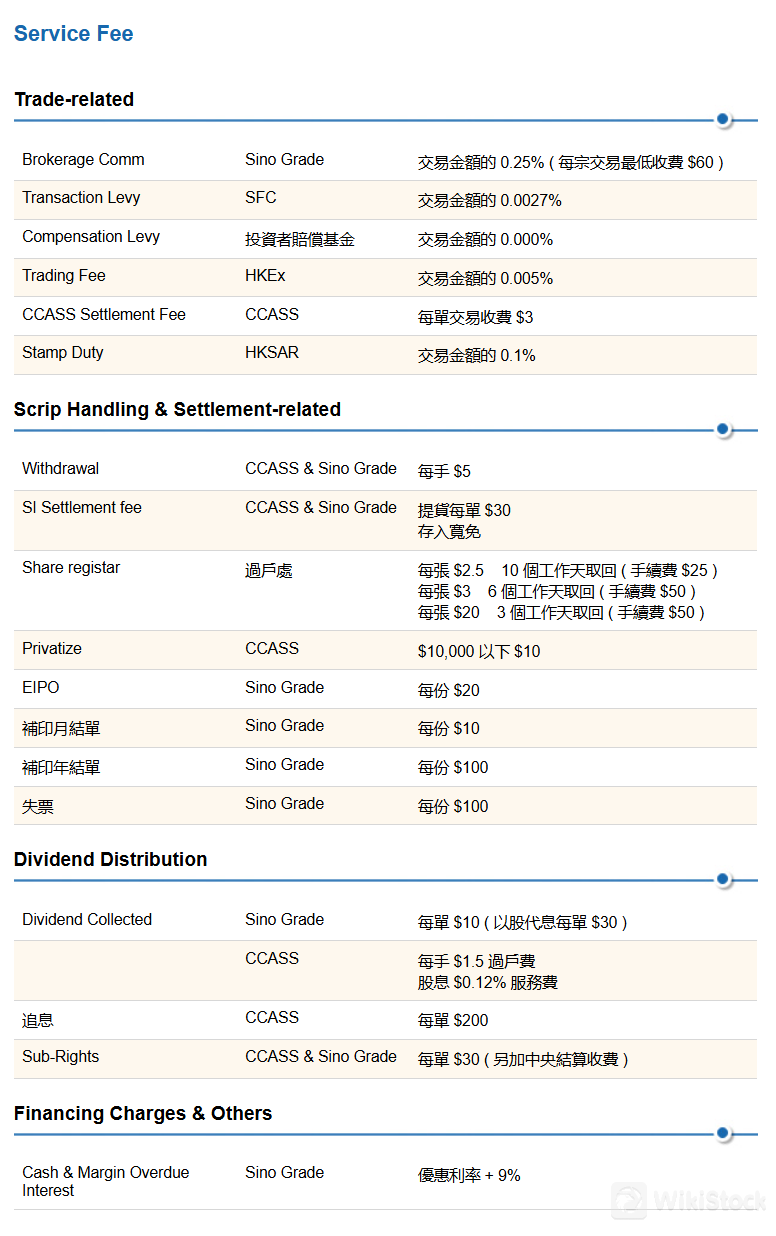

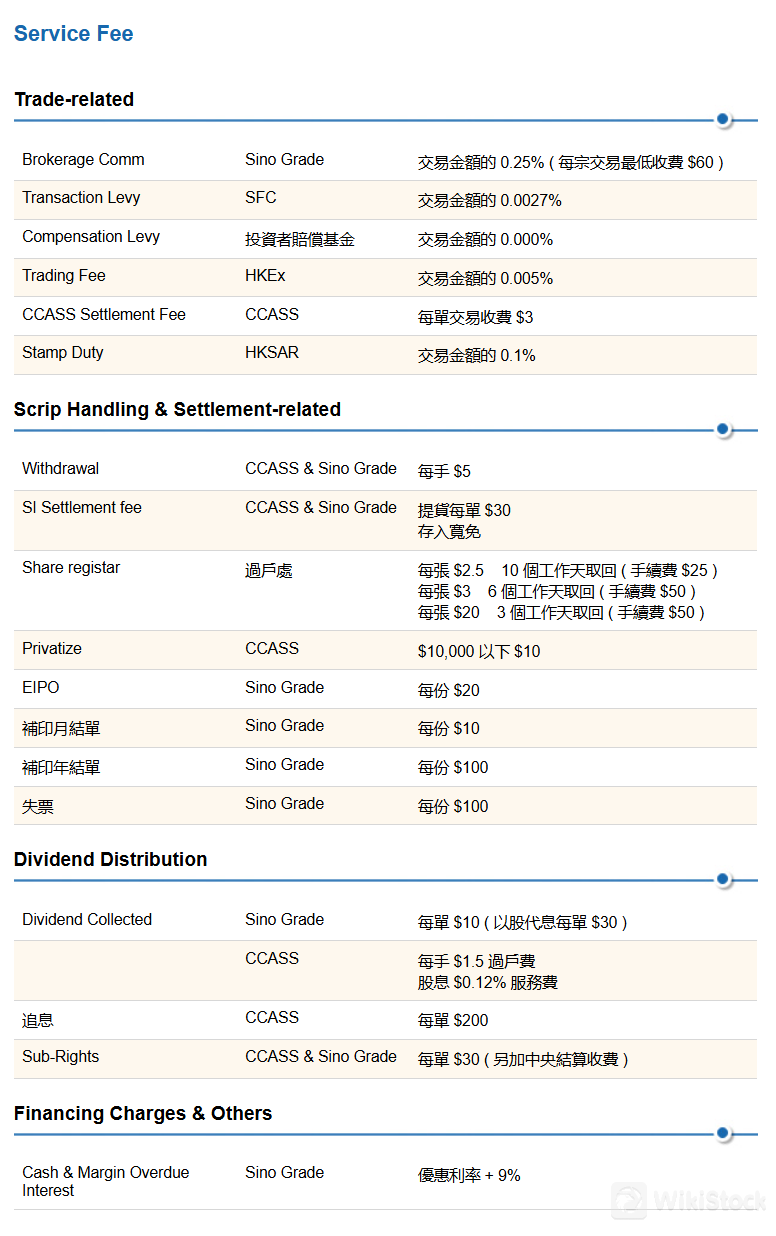

Sino Grade Securities Fees Review

Sino Grade Securities charges a brokerage commission of 0.25% of the transaction amount, with a minimum fee of $60 per trade. This commission ensures fair pricing relative to the transaction size. In addition, a transaction levy of 0.0027% and a trading fee of 0.005% are applied, contributing to regulatory and operational costs associated with trade execution. There is no compensation levy. For each transaction, a CCASS settlement fee of $3 facilitates efficient settlement through the Central Clearing and Settlement System. Finally, stamp duty is charged at 0.1% of the transaction amount, as mandated by regulatory requirements on eligible securities transactions.

Sino Grade Securities imposes several fees related to scrip handling, settlement, and dividend distribution. Withdrawals incur a charge of $5 per lot, while the SI settlement fee amounts to $30 per transaction for both CCASS and Sino Grade. Retrieval of shares through the share registrar involves fees of $2.5 per share for a 10-working-day process, with an additional $25 fee, $3 per share for a 6-working-day process with a $50 fee, and $20 per share for a 3-working-day process, also with a $50 fee. Privatization transactions under $10,000 via CCASS are subject to a $10 fee, and IPO shares cost $20 each through Sino Grade. Reprinting monthly statements costs $10 per copy, while annual statements are $100 per copy. In cases of lost certificates, Sino Grade charges $100 per copy. For dividend distribution, Sino Grade collects $10 per transaction and $30 per transaction for stock dividends, with CCASS charging $1.5 per lot for dividend handling.

Additionally, cash and margin overdue interest accrue at Sino Grade's preferential rate plus 9%.

Sino Grade Securities App Review

Sino Grade Securities offers the Portal2 online trading platform, designed to provide efficient and user-friendly trading experiences for investors.

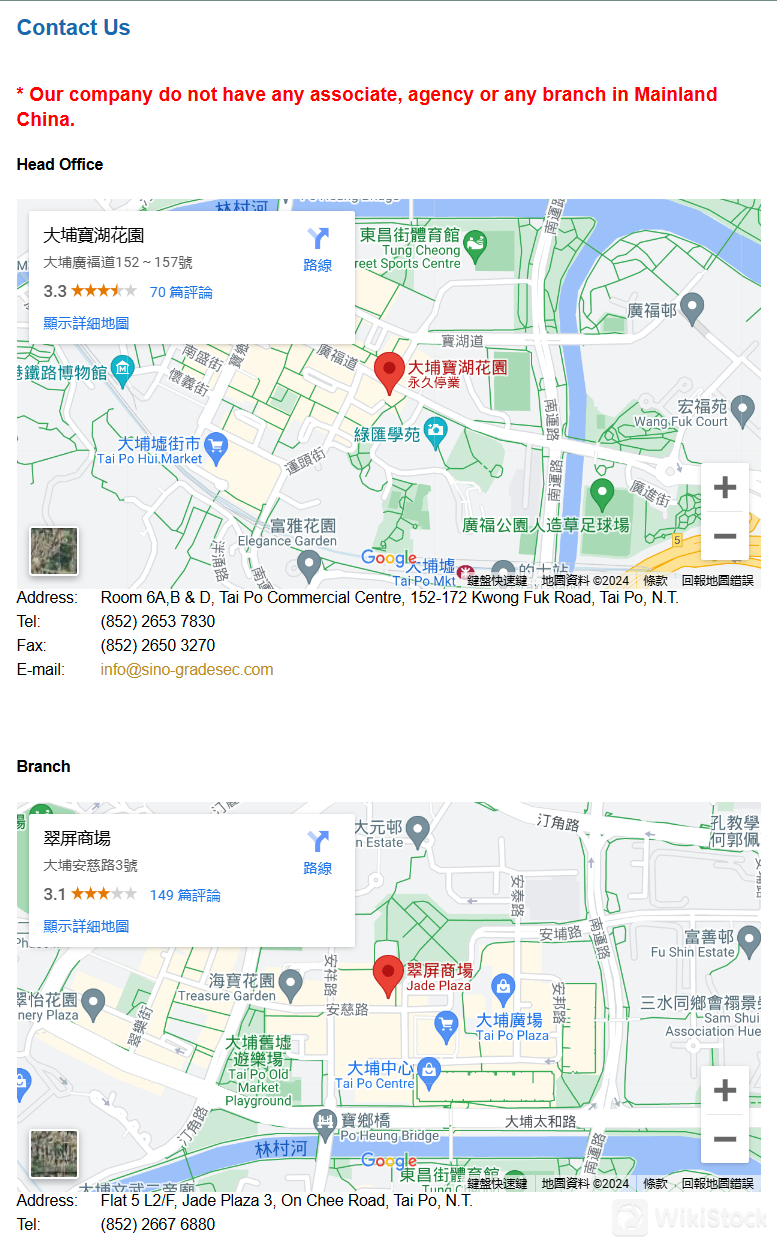

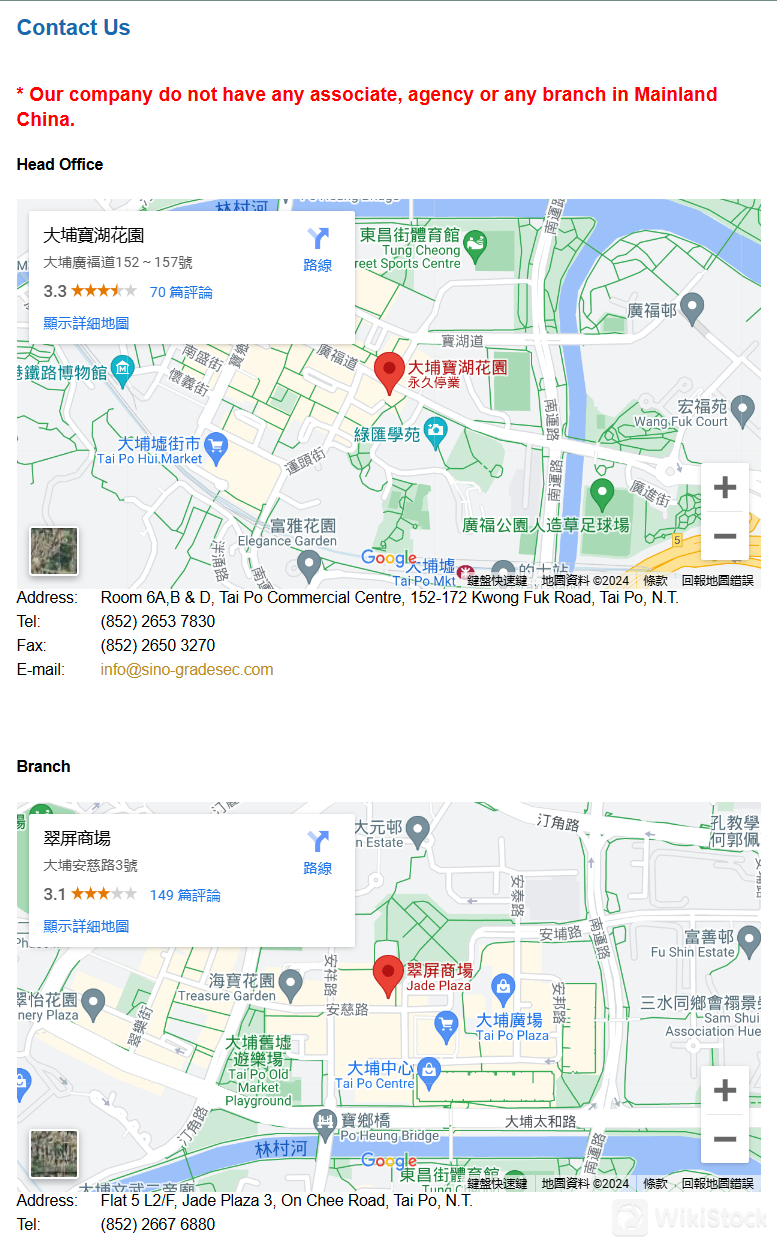

Customer Service

Sino Grade Securities provides comprehensive customer service from its head office located at Room 6A, B & D, Tai Po Commercial Centre, 152-172 Kwong Fuk Road, Tai Po, N.T. Clients can contact the main office via telephone at (852) 2653 7830 or through fax at (852) 2650 3270. For inquiries and support, the company can be reached via email atinfo@sino-gradesec.com. Additionally, Sino Grade Securities operates a branch office at Flat 5 L2/F, Jade Plaza 3, On Chee Road, Tai Po, N.T., with contact available at (852) 2667 6880.

Conclusion

Sino Grade Securities stands out for its robust regulation under the Securities and Futures Commission (SFC) in Hong Kong, ensuring a secure trading environment. The brokerage provides valuable access to initial public offerings (IPOs), making it suitable for investors interested in capitalizing on new market listings and growth opportunities. However, it faces challenges with the absence of live chat support, which could impact customer service responsiveness, and limited educational resources, potentially hindering investor education and strategy development.

FAQs

Is Sino Grade Securities safe to trade?

Sino Grade Securities is licensed and regulated by the Securities and Futures Commission (SFC). However, specific information regarding fund safety and additional safety measures is currently unavailable.

Is Sino Grade Securities a good platform for beginners?

While Sino Grade Securities offers convenient trading platforms, it lacks sufficient educational resources, which may present challenges for beginners seeking comprehensive guidance and learning opportunities.

Is Sino Grade Securities legit?

Sino Grade Securities is duly licensed and regulated by the Securities and Futures Commission (SFC) in Hong Kong under license number ADE715, affirming its legitimacy and compliance with regulatory standards.

Risk Warning

The information presented relies on WikiStock's thorough analysis of the brokerage's website data and is subject to updates. Engaging in online trading carries significant risks, including the potential for complete loss of invested capital. Therefore, understanding these risks thoroughly before participation is essential.

China Taiwan

China TaiwanObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)