Magic Compass Holding Co., Ltd. (Magic Compass Holding), formerly known as "Jintang International Securities Co., Ltd.", was established in Hong Kong, China in 2011. It was officially renamed Magic Compass Holding Co., Ltd. in 2020.

Magic Compass Holding is a securities broker registered with the Securities and Futures Commission (CE NO. AXT242) and a participant of Hong Kong Exchanges and Clearing Limited (4430, 4436, 4438, 4439). It is authorized to engage in Type 1 (Dealing in Securities), Type 2 (Dealing in Futures Contracts), Type 3 (Leveraged Foreign Exchange Trading), Type 4 (Advising on Securities), and Type 9 (Asset Management) regulated activities, mainly offering securities trading services to our clients.

What is Magic Compass Securities ?

Magic Compass Securities, a Hong Kong-based brokerage, excels in blending cutting-edge technology with extensive financial services, making it a strong choice for global Chinese investors. The firm stands out for its robust security protocols that protect client assets and its Magic Wealth App, which facilitates efficient real-time trading and rapid account setups. However, the lack of commodities, cryptocurrencies, or Bonds & Fixed Income within its product offerings may limit options for clients looking to diversify their investment portfolios through this traditional asset class. This could potentially restrict the firm's appeal to investors seeking comprehensive portfolio management solutions.

Pros and Cons of Magic Compass Securities

Magic Compass Securities blends advanced technology with financial services, appealing to global Chinese investors. The firm is known for its rigorous security protocols that safeguard client assets and the Magic Wealth App, which provides an efficient and real-time trading experience. However, Magic Compass Securities does not offer commodities, cryptocurrencies, or Bonds & Fixed Income, which restricts investors looking for diverse portfolio options through traditional asset classes. Additionally, the firm has limited educational resources, which could be a drawback for new investors seeking to deepen their market knowledge and trading skills.

Is Magic Compass Securities safe?

Magic Compass Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong (License No. AXT242), ensuring compliance with stringent financial and operational standards. Client funds are held in segregated accounts to ensure they are separate from the companys assets, providing an additional layer of security.

What are securities to trade with Magic Compass Securities

Magic Compass Securities offers a range of financial services including trading in stocks, futures contracts, leveraged foreign exchange, ETF,and providing asset management and advisory services on securities. However, it does not offer trading in commodities, cryptocurrencies, or Bonds & Fixed Income.

Magic Compass Securities Accounts

Magic Compass Securities offers two main types of accounts:

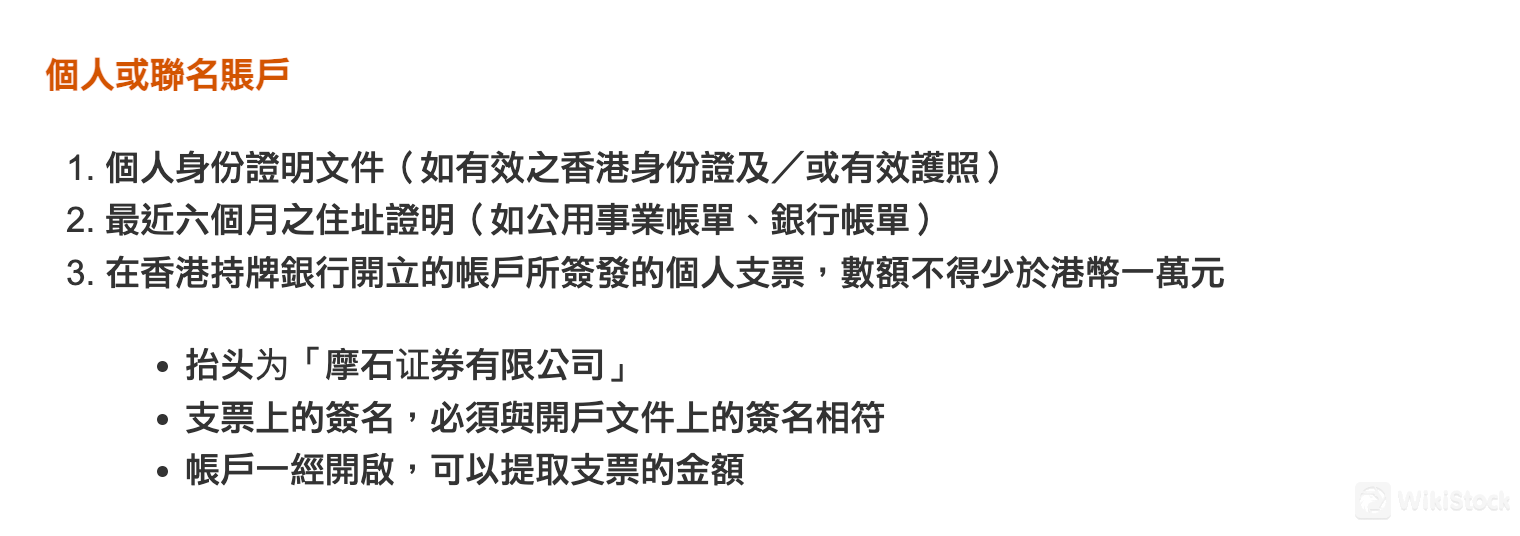

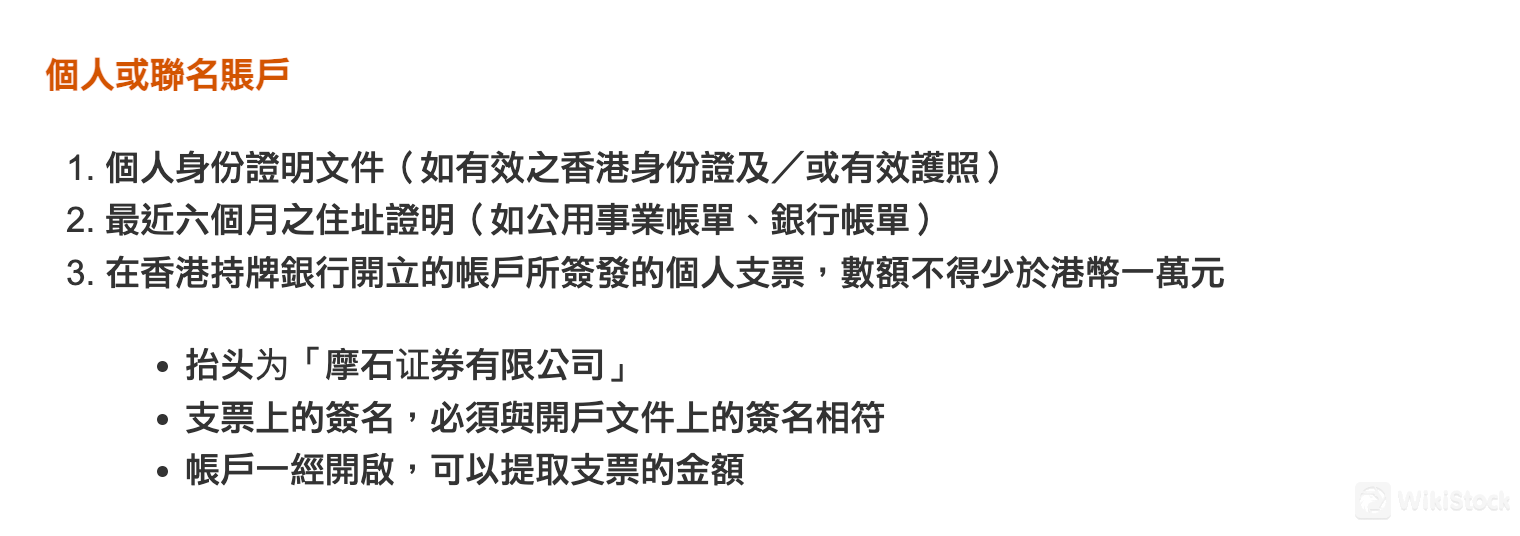

1. Personal or Joint Accounts:

- Require valid Hong Kong ID or passport.

- Recent six-month proof of address.

- Personal check from a Hong Kong licensed bank for at least HKD 10,000, payable to Magic Compass Securities Limited.

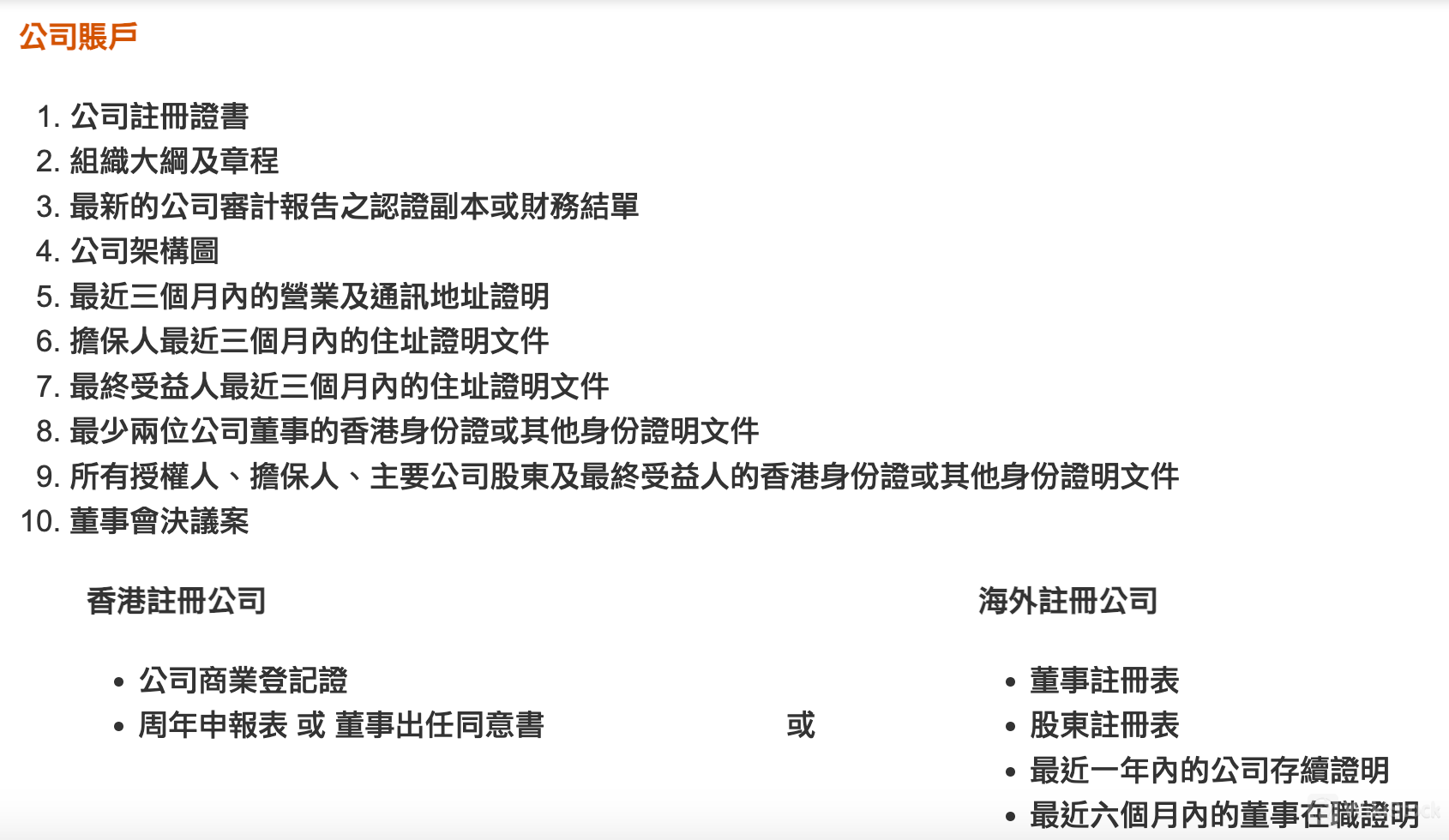

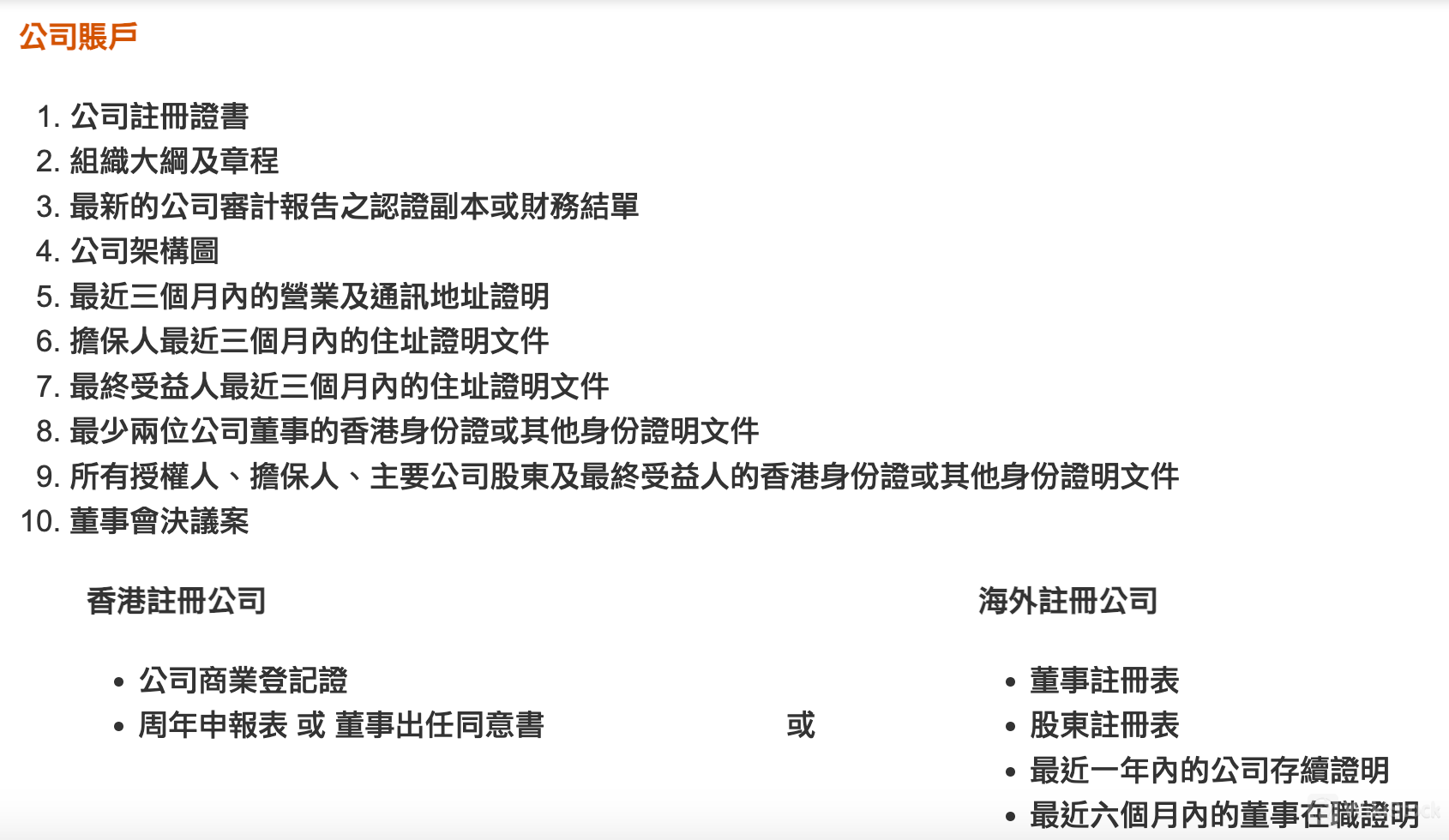

2.Corporate Accounts:

- Company registration documents, articles of association, and latest certified audit report.

- Proof of business address and identification for directors and major stakeholders.

- Board resolution and additional documents depending on whether the company is registered in Hong Kong or overseas.

Magic Compass Securities Fees Review

Magic Compass Securities charges fees based on the trading platform and type of transaction. For Hong Kong stocks, brokerage commissions are 0.15% for online trades and 0.25% for telephone trades, with a minimum fee of HKD 100. The Magic Wealth App charges 0.03% per transaction with a HKD 3 minimum and an additional HKD 15 platform fee. Stamp duties are set at 0.1% of the transaction value, and additional fees include a transaction levy of 0.0027%, a trading fee of 0.00565%, and a settlement fee of 0.002% per transaction. For U.S. stocks, online trading commissions start at USD 0.01 per share and telephone trades at USD 0.03 per share, with minimum charges and additional fees varying based on the transaction size and type. Shanghai-Hong Kong Stock Connect services offer similar structures but with additional fees specific to the region, such as a securities management fee of 0.002%. These fee structures were last updated in 2021 and 2022, highlighting an ongoing adaptation to market conditions.

Magic Compass Securities App Review

Magic Compass Securities' app is a sophisticated trading platform designed for global Chinese investors, featuring rapid account opening, enhanced trading experiences with features like real-time quotes and quick order placements, and professional financial insights. It supports a broad range of trading products including stocks from Hong Kong, A-shares, U.S. stocks, and funds. The app incorporates top-tier technology for security, such as bank-grade encryption and advanced risk management tools, alongside deep data analytics to aid in investment decisions.

Customer Service

Magic Compass Securities offers comprehensive customer service accessible through multiple channels. They provide a customer service hotline at +852 3575 8870 and can be reached via fax at +852 3753 5314. Their email for inquiries is info@magiccompasssec.com. They also support modern communication platforms like WhatsApp and WeCom for business communications. The company's registered and physical office is located in Room 905, 9/F, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong. The office operates from Monday to Friday, from 9:00 AM to 5:30 PM, and remains closed on weekends and public holidays in Hong Kong.

Conclusion

Magic Compass Securities is well-regarded for its integration of technology in financial services, attracting a broad base of investors, particularly from the global Chinese community. The firm's Magic Wealth App offers streamlined and secure trading functionalities that significantly enhance user experience. However, the absence of some securities and limited educational resources might not cater to all investors, especially those new to trading or seeking diversified investment avenues. Overall, Magic Compass Securities is a solid choice for those focused on stocks and derivatives, providing a secure and efficient trading platform, though it may fall short for those seeking more comprehensive investment options or educational support.

FAQs

Is Magic Compass Securities safe to trade?

Yes, Magic Compass Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong and employs robust security measures, including segregated client funds, to ensure a safe trading environment.

Is Magic Compass Securities a good platform for beginners?

While Magic Compass Securities offers a user-friendly trading platform, its limited educational resources might pose a challenge for beginners looking to learn about trading basics. New investors may need to seek additional learning materials elsewhere.

Is Magic Compass Securities good for investing/retirement?

Magic Compass Securities is suitable for investing, particularly in stocks and derivatives. However, its lack of commodities, cryptocurrencies, or Bonds & Fixed Income may limit its effectiveness for long-term retirement planning.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Germany

GermanyObtain 1 securities license(s)

Owns 1 seat(s)