Score

浙商国际

https://www.cnzsqh.hk/

Website

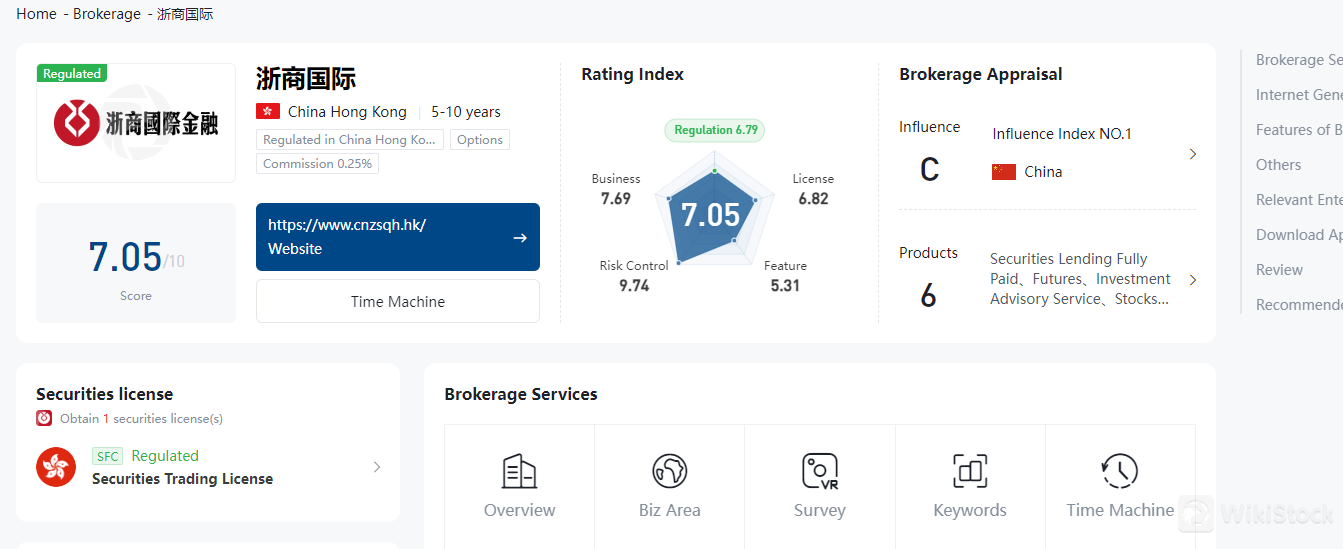

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China

ChinaProducts

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 02177

Brokerage Information

More

Company Name

Zheshang International Financial Holdings Co., Limited

Abbreviation

浙商国际

Platform registered country and region

Company address

Company website

https://www.cnzsqh.hk/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.25%

Funding Rate

3%

New Stock Trading

Yes

Margin Trading

YES

| Zheshang International Financial Holdings Co., Limited |  |

| WikiStock Rating | ⭐⭐⭐ |

| Fees | Zheshang International Financial charges trading commissions of 0.25% for Hong Kong and Shanghai-Hong Kong Stock Connect (minimum 50 HKD/RMB) and 0.098% for U.S. stocks (minimum 5.8 USD), with administrative fees and margin interest rates at the bank's prime rate plus 3-4% |

| Account Fees | Administrative fees, paper statement fees, reissue statement fees |

| Margin Interest Rates | Bank's prime rate + 3% for HKD and USD, + 4% for RMB |

| Mutual Funds Offered | Yes, with transaction fees up to 3% |

| App/Platform | Available on iOS, Android, Windows, Mac |

What is ZHENGSHANG INTERNATIONAL FINACIAL?

Zheshang International Financial Holdings Co., Limited is a well-regulated financial institution offering a wide range of investment services with competitive fees and user-friendly trading apps across multiple devices. The company is known for its comprehensive market research and robust investor education programs. However, some users may find the fee structures complex and corporate account opening procedures cumbersome.

Pros and Cons of ZHENGSHANG INTERNATIONAL FINACIAL

Zheshang International Financial Holdings is a reputable and secure platform for diverse investment needs, regulated by the SFC and providing comprehensive trading services. The company ensures client fund safety through insurance and advanced security measures while offering robust trading platforms and detailed market research. However, potential users should be aware of some complexities, including fee structures, account opening procedures, and the need for direct contact for detailed information on certain services.

| Pros | Cons |

| Regulated by SFC, ensuring high standards of compliance | Specific insurance coverage details are not readily available |

| Provides insurance for client funds, offering financial protection | Fees and charges for various services can be complex |

| Advanced encryption technologies to protect data | Some advanced trading features may require additional permissions |

| Comprehensive trading platforms for multiple devices (iOS, Android, Windows, Mac) | Complex account opening procedures for corporate clients |

Is ZHENGSHANG INTERNATIONAL FINACIAL safe?

Regulations

Zheshang International Financial Holdings Co., Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong. The SFC is a statutory body responsible for regulating the securities and futures markets in Hong Kong, ensuring that financial institutions operate in a fair, transparent, and efficient manner. Being regulated by the SFC means that Zheshang International adheres to strict regulatory standards and practices designed to protect investors and maintain market integrity.

Funds Safety

Zheshang International Financial takes the safety of its clients' funds very seriously. The company provides insurance for clients' account funds, offering a degree of financial protection in case of unforeseen events. The specific insurance coverage amount and details should be confirmed directly with the company to understand the extent of protection offered. This insurance helps assure clients that their investments are safeguarded against potential risks.

Safety Measures

To ensure the security of funds and personal information, Zheshang International Financial employs advanced encryption technologies. These technologies protect the storage and transmission of sensitive data, making it difficult for unauthorized parties to access or compromise client information. Additionally, the company implements robust account security measures to prevent data breaches and unauthorized access. These measures may include multi-factor authentication, secure login protocols, and regular security audits to maintain a high level of protection for user accounts and information.

Overall, Zheshang International Financial demonstrates a strong commitment to client safety through its regulatory compliance, insurance coverage for client funds, and the implementation of comprehensive security measures.

What are securities to trade with ZHENGSHANG INTERNATIONAL FINACIAL?

Zhengshang International Financial offers trading services for a wide range of securities across multiple global markets. Investors can trade Hong Kong stocks, which benefit from the unique position of being backed by Mainland China while facing international markets. This makes Hong Kong an attractive listing destination for companies worldwide. Notable companies listed only in Hong Kong include Tencent, Meituan, Xiaomi, and Haidilao. Additionally, international companies such as HSBC, AIA, and CK Hutchison Holdings are also listed on the Hong Kong Stock Exchange. The Hong Kong market offers T+0 trading, providing investors with greater trading flexibility.

In the U.S. market, Zhengshang International Financial provides access to some of the worlds leading companies. Investors can trade stocks of major global corporations like Facebook, Tesla, Apple, Google, and Amazon. The U.S. market also includes top Chinese internet companies such as Alibaba, Baidu, JD.com, and iQIYI. A notable feature of the U.S. stock market is the ability to buy as little as one share, which lowers the entry threshold for investors.

In addition to securities, Zhengshang International Financial offers comprehensive global futures and options trading services. The available futures include energy products like WTI crude oil, Brent crude oil, and natural gas. Precious metals such as gold, silver, platinum, and palladium are also available for trading. For those interested in base metals, Zhengshang International Financial offers trading in copper, nickel, aluminum, and zinc. Agricultural products, including soybeans, wheat, corn, soybean oil, and soybean meal, are also available for futures trading.

The company provides professional trading services in global indices, with options such as the Hang Seng Index, A50 Index, Nasdaq Index, and DAX Index. Additionally, currency trading includes offshore renminbi, the U.S. dollar index, British pound, and Japanese yen. Interest rate products available for trading include U.S. Treasury bonds, Japanese government bonds, and German government bonds. Through their advanced trading platforms, Zhengshang International Financial aims to meet the diverse investment needs and goals of their clients.

ZHENGSHANG INTERNATIONAL FINACIAL Accounts Opening Process

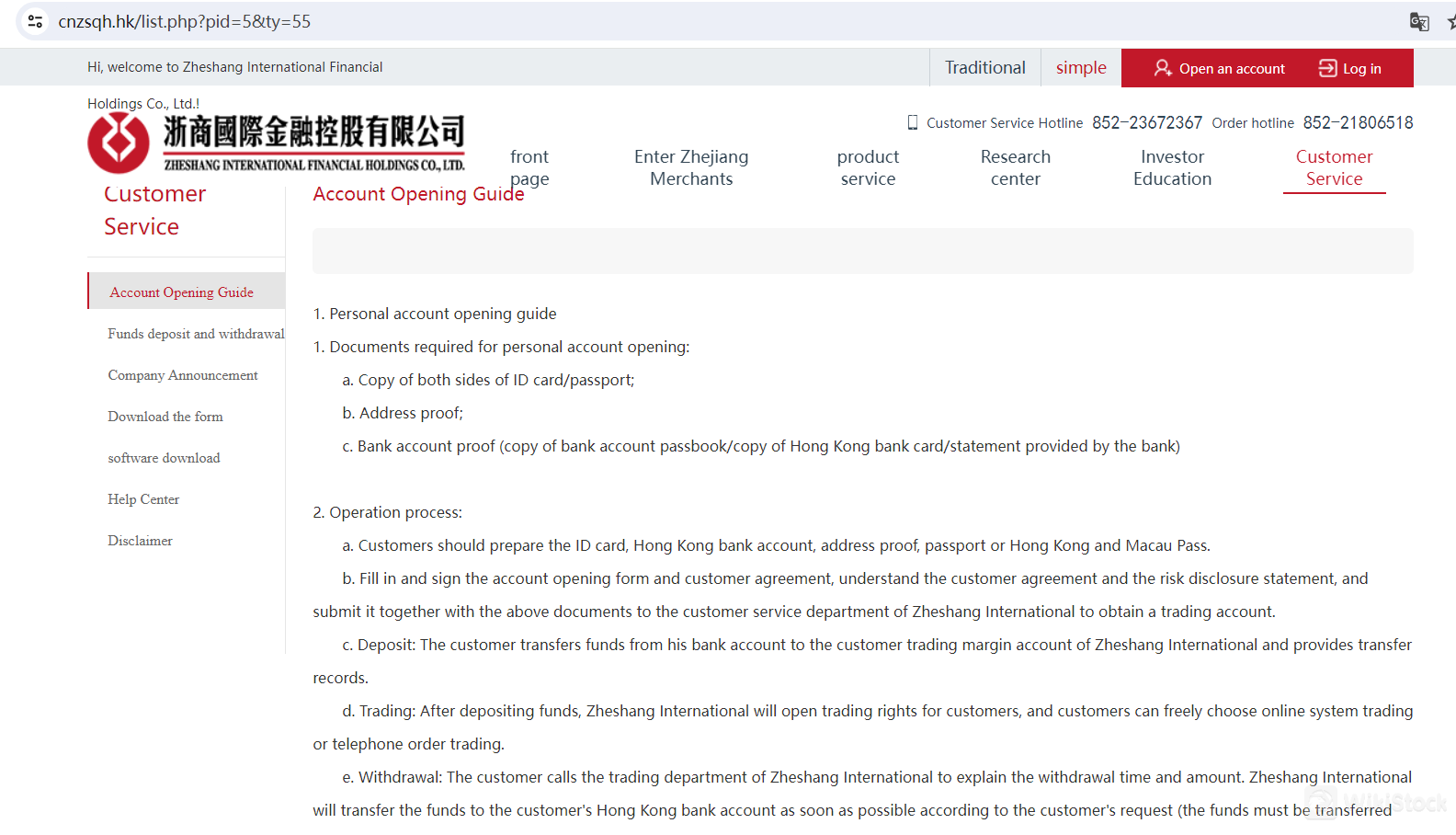

Zhengshang International Financial offers account opening services for both individual and corporate clients, each with specific requirements and procedures.

Individual Account Opening Guide

Required Documents:

Copy of ID card/passport (both sides).

Address proof.

Bank account proof (copy of bank book/bank card or statement from a Hong Kong bank).

Prepare necessary documents: ID card, Hong Kong bank account details, address proof, and proof of passport or Hong Kong-Macau travel permit.

Fill out and sign the account opening form and client agreement. Understand the client agreement and risk disclosure statement, then submit these forms along with the required documents to the Zhengshang International customer service department to obtain a trading account.

Fund the account: Transfer funds from your bank account to the Zhengshang International client margin account and provide the transfer record.

Trading: After funding, Zhengshang International will activate your trading permissions, allowing you to trade via the online system or by phone.

Withdrawal: Contact the Zhengshang International trading department to specify the withdrawal amount and time. Zhengshang International will transfer the funds to your Hong Kong bank account as requested, during bank working hours.

Minutes of the board meeting approving the opening of the trading account with Zhengshang International (with company seal).

ID proof of major shareholders (holding more than 25%): if an individual, a copy of the ID card (both sides); if a company, a copy of the business registration certificate or business license.

Copy of the ID card (both sides) of company directors.

Copy of ID proof of the authorized person (account opener, fund allocator, order placer).

Copy of the companys articles of association.

Copy of the company's valid business registration certificate.

Copy of the company's certificate of incorporation.

Copy of the companys annual financial report (for companies established for more than 18 months).

Copy of the company's bank account proof (bank card/bank book/bank letter with company name and bank account number).

Copy of the company registration form NC1 or the latest NAR1 (for Hong Kong-registered companies only).

Company address proof (if applicable).

Sign the contract and submit all the required documents to the Zhengshang International account opening department to obtain a trading account.

After obtaining the trading account, you can proceed with funding, trading, and withdrawals following the individual account operation procedures.

Both individual and corporate accounts require only one copy of the signed contract.

Copies of the contract have the same legal effect as the originals.

Funds can only be transferred between bank accounts bearing the same name as specified in the client agreement with Zhengshang International.

Procedure:

Corporate Account Opening Guide

Required Documents:

Procedure:

Additional Notes

ZHENGSHANG INTERNATIONAL FINACIAL Fees Review

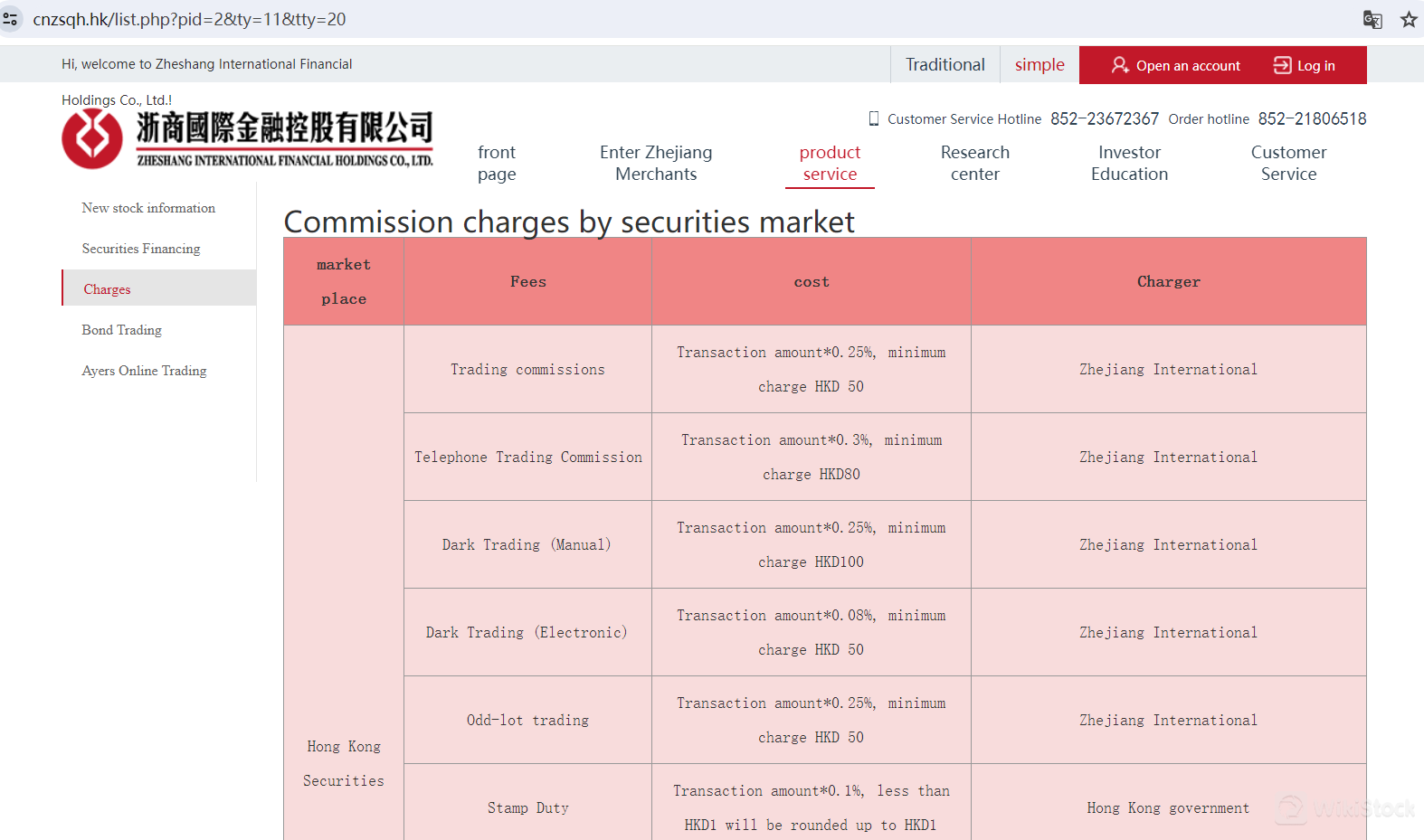

Hong Kong Securities

Trading Hong Kong securities involves several types of fees. Trading commission is charged at 0.25% of the transaction amount, with a minimum charge of 50 HKD by Zhengshang International. For phone transactions, the commission is 0.3%, with a minimum of 80 HKD. Dark pool trading commissions differ based on the method: 0.25% for manual trades (minimum 100 HKD) and 0.08% for electronic trades (minimum 50 HKD). Additionally, odd-lot trading is charged at 0.25%, with a minimum fee of 50 HKD. Government and exchange fees include a stamp duty of 0.1% (rounded up to the nearest HKD), a central clearing fee of 0.005% (with a minimum of 2 HKD), a trading fee of 0.00565%, a transaction levy of 0.0027%, and a financial reporting council transaction levy of 0.00015%.

Shanghai-Hong Kong Stock Connect

For trading through the Shanghai-Hong Kong Stock Connect, the trading commission is 0.25% of the transaction amount, with a minimum of 50 RMB. Other fees include a handling fee of 0.00341% (charged by the Shanghai and Shenzhen Stock Exchanges), a regulatory fee of 0.002% (charged by the China Securities Regulatory Commission), a transfer fee of 0.001% (charged by ChinaClear Shanghai/Shenzhen), and a transfer fee of 0.002% (charged by Hong Kong Securities Clearing Company). A trading stamp duty of 0.05% is also levied, but only on the seller, by the State Administration of Taxation.

U.S. Stocks

For trading U.S. stocks online, a commission of 0.098% of the transaction amount is charged, with a minimum of 5.8 USD. For phone orders, the commission is 0.15%, with a minimum charge of 14.8 USD. If the stock price is 10 USD or below, the commission is charged at 0.02 USD per share, with a minimum of 5.8 USD. The U.S. Securities and Exchange Commission charges a transaction fee of 0.0000278 USD per transaction value (minimum 0.01 USD), and the Financial Industry Regulatory Authority charges a trading activity fee of 0.000166 USD per share sold (maximum 8.30 USD per trade).

Additional Securities-related Fees

Additional services include fees for dividend collection, which is 0.5% of the dividend amount (minimum 30 HKD/RMB, 4 USD), plus a transfer registration fee of 1.5 HKD per share (charged by the Hong Kong Securities Clearing Company). Fees for handling bonus shares, rights issues, and the exercise of warrants are also applied, ranging from 30 HKD to 100 HKD per transaction, with additional action service fees charged per share.

Bonds and Other Services

For bond services, a custody fee of 0.05% (annualized, minimum 100 USD) is charged monthly. Collection of bond interest is charged at 0.5% of the interest amount, with a minimum fee of 600 USD. Fees for bond transfer instructions and corporate actions are 300 USD and 600 USD per transaction, respectively.

Fund and Physical Stock Services

Fees for fund transactions are up to 3% of the subscription/redemption amount. For physical stock services, depositing stock certificates incurs a fee of 5 HKD per certificate or transfer deed, while withdrawal fees are 5 HKD per share (minimum 100 HKD). Central Clearing System transfer-out instructions are charged at 5 HKD per share (minimum 100 HKD), while transfer-in instructions are free.

Margin and Other Lending Services

For overdue interest on cash accounts, an annual interest rate of the bank's prime rate plus 5% is charged daily and collected monthly. For margin accounts, financing interest rates are the bank's prime rate plus 3% for HKD and USD, and plus 4% for RMB. A fee of 200 HKD is charged for processing returned checks, and IPO financing applications incur a handling fee of 100 HKD.

Administrative Services

Special account administrative fees are 500 HKD or equivalent in RMB per account, and paper statements are charged at 50 HKD or equivalent foreign currency per statement. Reissuing statements costs 100 HKD or equivalent foreign currency per statement. Clients should ensure sufficient funds in their accounts to avoid interest charges on shortfalls.

These fees reflect the charges effective from June 1, 2023, for new account holders, while existing clients commission and platform fees remain unchanged unless otherwise negotiated.

Futures

Zhengshang International Financial offers futures trading across various international exchanges, each with specific fee structures. For Asia Pacific Exchange (APEX), trading fees are set at 6 USD per contract for natural palm oil and fuel oil, 4 USD for refined palm oil, and 1.8 USD for USD/CNH contracts. Bursa Malaysia Derivatives (BMD) charges 13 USD per contract for crude palm oil.

At the Chicago Board Options Exchange (CBOE), trading the VIX Volatility Index and the Mini VIX Volatility Index costs 10 USD per contract. The Chicago Board of Trade (CBOT) fees include 10 USD per contract for commodities like corn, wheat, oats, soybeans, and various Treasury bonds, with smaller contracts like mini corn and mini soybeans also set at 10 USD per contract.

The Chicago Mercantile Exchange (CME) imposes a 10 USD fee per contract for a wide range of futures, including currencies (like the Australian Dollar and Euro), indices (like the E-mini S&P), livestock (like feeder cattle), and other commodities (like lumber). The Commodity Exchange (COMEX) charges 10 USD per contract for precious metals like gold, silver, and copper, with micro and mini contracts also falling under this pricing.

For the New York Mercantile Exchange (NYMEX), trading fees for energy products like crude oil, heating oil, and natural gas are 10 USD per contract, with smaller micro and mini contracts similarly priced. Additionally, precious metals like palladium and platinum also incur a 10 USD fee per contract.

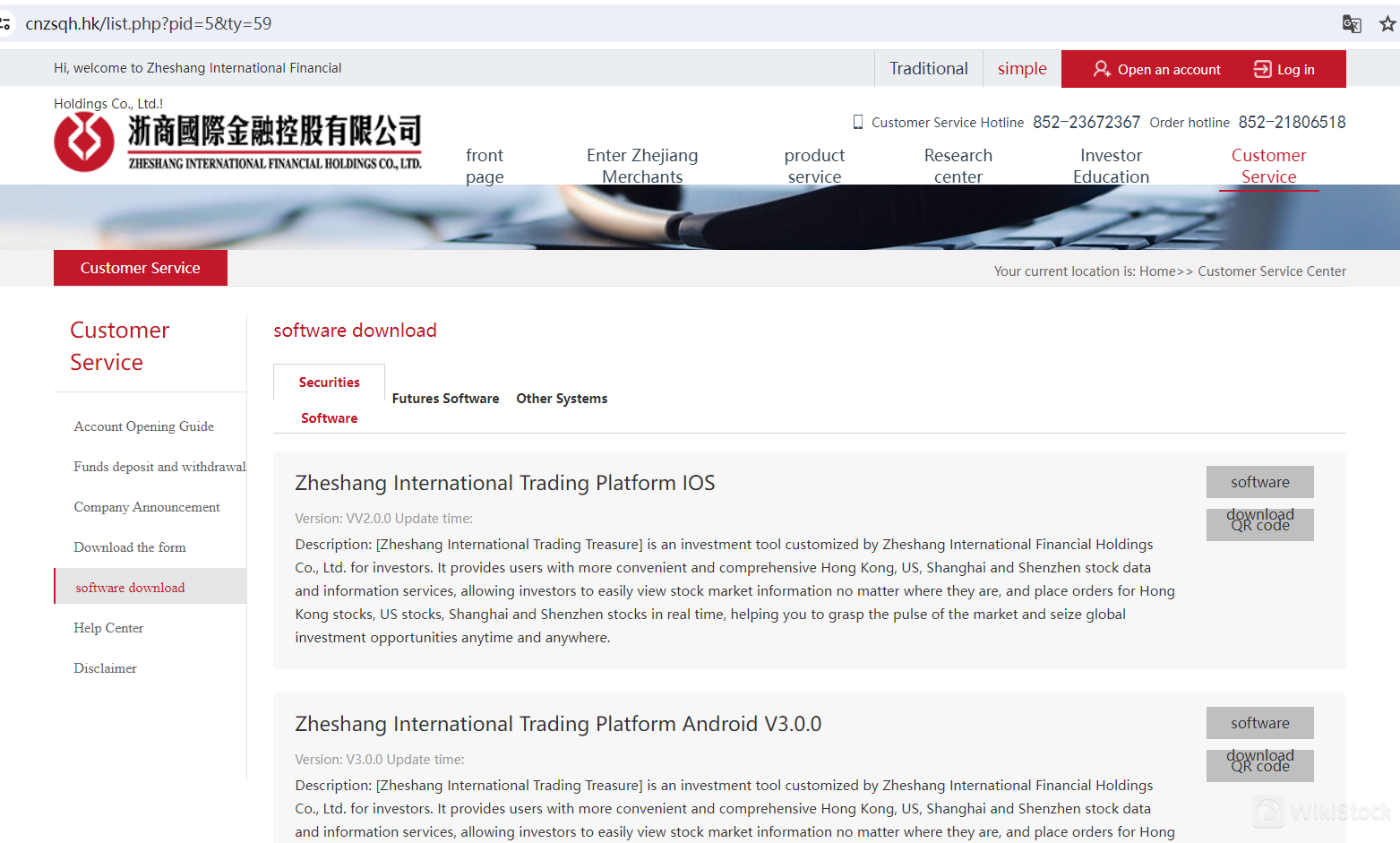

ZHENGSHANG INTERNATIONAL FINACIAL App Review

Securities Trading Software

Zhengshang International Trading Bao (iOS) The Zhengshang International Trading Bao for iOS, version VV2.0.0, is a powerful tool customized for investors by Zhengshang International Financial Holdings Co., Ltd. This app provides users with comprehensive and convenient access to Hong Kong, U.S., and mainland China stock information and news services. It allows investors to easily view market information and execute trades in Hong Kong, U.S., and Shanghai and Shenzhen stocks in real time, helping them stay in tune with the market pulse and seize global investment opportunities anytime, anywhere.

Zhengshang International Trading Bao (Android) The Android version of Zhengshang International Trading Bao, version V3.0.0, offers similar features to the iOS version, ensuring that Android users have access to the same comprehensive stock information and trading capabilities. The app facilitates real-time viewing of market data and the ability to place orders for Hong Kong, U.S., and mainland China stocks, making it an essential tool for investors on the go.

Zhengshang International Trading Bao (Windows) The Windows version, V10.80.22.00, is designed to provide the same robust trading capabilities and access to market information as the mobile versions. It caters to users who prefer trading on a desktop platform, offering a stable and feature-rich environment for managing investments and executing trades across multiple markets.

Zhengshang International Trading Bao (Mac) For Mac users, Zhengshang International Trading Bao version V1.1.0 provides similar functionalities to ensure seamless trading experiences across different operating systems. It offers comprehensive market data and the ability to trade Hong Kong, U.S., and mainland China stocks in real time.

Jieli Trading Bao Mobile The Jieli Trading Bao app, version V8.1.58, is a comprehensive financial application focused on global securities trading and investor interaction. It supports real-time or delayed quotes from the U.S., Hong Kong, and China markets and connects to multiple brokers for securities trading. Investors can view market data, learn investment strategies, and place trading orders through the app, available on both iOS and Android platforms.

Ayers Mobile Encoder The Ayers Mobile Encoder app is available in versions for both Android (V1.3) and iOS (V1.2.2). This tool enhances security for mobile trading, providing a secure way for users to encode transactions. It can be downloaded and installed via QR codes or direct download links.

Futures Trading Software

Yisheng Jixing 9.3.43 Client The Yisheng Jixing 9.3.43 Client is designed for ease of use, supporting both domestic and international arbitrage trading. It requires a minimum system configuration of 2GB RAM, a dual-core 1GHz processor, and a screen resolution of 1024x768, compatible with Windows 7 and above.

Yisheng Jixing 9.3.43 Arbitrage Edition The arbitrage edition of the Yisheng Jixing client, version V9.3.43, supports arbitrage trading and provides a user-friendly interface for easy operation. It shares the same system requirements as the standard client, ensuring a smooth trading experience for arbitrage traders.

Yisheng Jixing 9.3.43 Simulation System The simulation system of Yisheng Jixing, also version V9.3.43, offers a training platform for traders to practice and refine their strategies without financial risk. It supports the same hardware and software requirements as the other Yisheng Jixing clients.

Yisheng Yixing Mobile App The Yisheng Yixing Mobile App, version V2.6.23, is a new-generation mobile futures trading platform developed by Yisheng. It integrates market data and trading functions, allowing users to trade futures on the go using their Zhengshang trading accounts.

Tuishou Go (Android and iOS)Tuishou Go, version V1.56.47, is a versatile mobile trading application designed for both Android and iOS users. It offers global market data and basic chart analysis features, enabling users to stay informed and execute trades 24/7. The app supports lightning-fast order execution, ensuring that users can capitalize on market opportunities quickly and efficiently. Its user-friendly interface provides a seamless trading experience, making it easier for investors to manage their portfolios and stay ahead in the market.

Research and Eduation

Research Center

Zheshang International Financial Holdings Co., Limited boasts a comprehensive Research Center that provides valuable insights and analyses across various financial instruments and markets. The Securities Research segment offers in-depth studies and reports on equity markets, helping investors make informed decisions regarding stock investments. The Bond Research section delves into the fixed income market, analyzing bond yields, credit ratings, and market trends to guide investors in bond trading and investment strategies.

The Futures Research division provides detailed analyses of futures markets, offering forecasts and trading strategies based on market trends and economic indicators. Macro Research focuses on broader economic factors that influence financial markets, including economic policies, global economic trends, and macroeconomic data. This section helps investors understand the larger economic environment and its impact on various asset classes. Additionally, the New Stock Information segment keeps investors updated on upcoming initial public offerings (IPOs) and new listings, providing essential data and insights for potential investment opportunities.

Investor Education

Zheshang International Financial Holdings is committed to empowering its clients through robust Investor Education programs. The Securities Trading Rules section educates investors on the regulations and guidelines governing stock trading, ensuring that they are well-versed in compliance and best practices. Similarly, the Futures Trading Rules section provides comprehensive information on the rules and regulations specific to futures trading, helping investors navigate this complex market with confidence.

The Investor Suitability section focuses on helping investors assess their risk tolerance and investment suitability, ensuring that they make informed decisions that align with their financial goals and risk appetite. Lastly, the Market Entry Guide offers a step-by-step approach for new investors entering the market, covering essential topics such as account opening, market analysis, and trading strategies. This guide aims to equip new investors with the knowledge and tools necessary to begin their investment journey successfully.

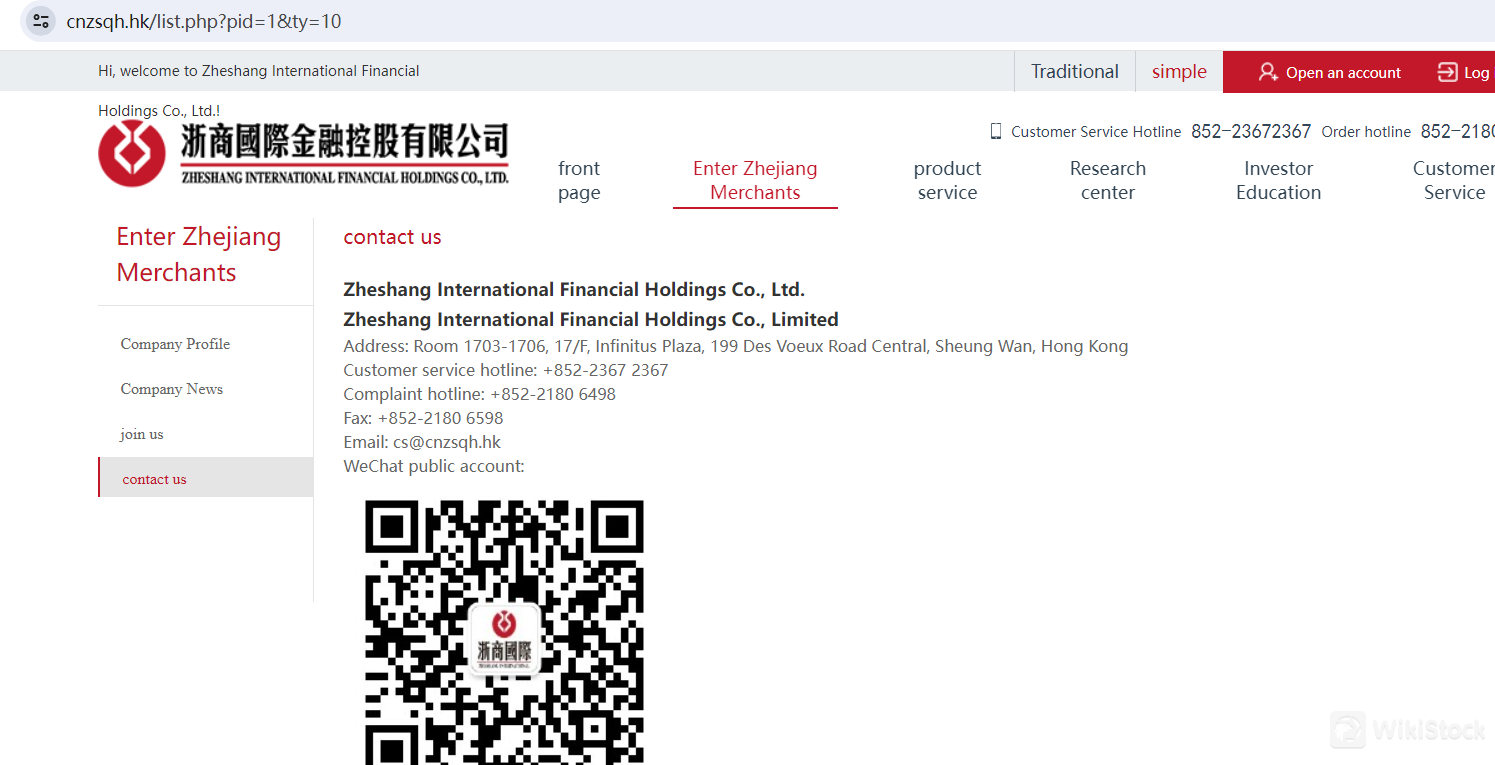

Customer Service

Zheshang International Financial Holdings Co., Limited offers comprehensive customer support to ensure that clients receive prompt and effective assistance. The customer service hotline is available at +852-2367 2367, providing a direct line for inquiries and support related to trading, account management, and other services. Additionally, a dedicated complaints hotline at +852-2180 6498 ensures that any issues or concerns can be addressed swiftly and professionally. Clients can also reach out via fax at +852-2180 6598 or email at cs@cnzsqh.hk for further support and documentation needs.

The company emphasizes accessibility and responsiveness in its customer support services. Located at 17/F, Infinitus Plaza, 199 Des Voeux Road Central, Sheung Wan, Hong Kong, the customer support team is positioned to provide timely and localized assistance to both local and international clients. Zheshang International Financial Holdings also maintains a presence on WeChat, allowing clients to stay updated with the latest information and connect with support through a popular social media platform. This multi-channel approach ensures that clients can choose the most convenient method to receive help and maintain seamless communication with the company's support team.

Conclusion

Zheshang International Financial Holdings Co., Limited is a well-regulated financial institution offering comprehensive investment services with competitive fees, robust security measures, and user-friendly trading platforms, though users should be aware of the complex fee structures and detailed account opening procedures.

FAQs

Is Zheshang International Financial safe to trade?

Yes, Zheshang International Financial is safe to trade as it is regulated by the Securities and Futures Commission (SFC) of Hong Kong and employs advanced security measures to protect client funds and data.

Is Zheshang International Financial a good platform for beginners?

Zheshang International Financial offers user-friendly trading platforms and robust investor education programs, making it a good option for beginners who want to learn and trade efficiently.

Is Zheshang International Financial legit?

Yes, Zheshang International Financial is a legitimate financial institution, fully regulated by the SFC, ensuring compliance with strict regulatory standards and market integrity.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

China

浙商期货有限公司

Parent company

Review

No ratings

Recommended Brokerage FirmsMore

OPSL

Score

偉祿亞太證券

Score

鴻昇金融集團

Score

东兴证券

Score

IISL

Score

Elstone

Score

Hooray Securities

Score

SBI China Capital

Score

Sorrento

Score

Sanston

Score