Astrum Capital Management Ltd. is a participant of The Stock Exchange of Hong Kong Limited and Hong Kong Futures Exchange Limited. We are licensed under The Securities and Futures Ordinance, Cap.571 to carry on regulated activities.

What is Astrum?

Astrum Capital Management Limited is a Hong Kong investment firm offering online brokerage, futures trading, and potentially asset management services. They have a mobile app for trading convenience. It operates under stringent regulations established by the Securities and Futures Commission (SFC) in Hong Kong, ensuring compliance with national financial laws and industry standards. However, its limited educational and analytical resources and unclear account fees limit its appeal to customers.

Pros and Cons of Astrum

Pros

Hong Kong Licensed Brokerage: Astrum Capital appears to be a licensed brokerage firm in Hong Kong, indicating a level of regulatory oversight by the SFC (Securities and Futures Commission).

Diversified Services: The company provides a range of services including securities trading and brokerage, placement and underwriting, corporate finance advisory, financing services, and asset management.

Mobile App Availability: They likely have a mobile app for trading on the go (details need confirmation).

Futures Trading: They offer futures trading, which can be a suitable option for experienced investors seeking advanced investment strategies.

Cons

Unknown Educational and Analytical Resources: It is unclear whether Astrum Capital provides educational and analytical resources. While many financial service providers offer such resources, this is an area that potential investors need to clarify.

Unclear Interest on Uninvested Cash: It's uncertain whether they offer interest on uninvested cash, which could be a disadvantage if you hold significant uninvested funds.

Unclear Account Fees: There's limited information on potential account maintenance fees or fees associated with different account types.

Is Astrum safe?

Regulations

Funds Safety

Based on the current information, there is hidden trouble about the funds safety of Astrum Capital Management Limited. Before making investment decisions, investors should thoroughly understand the company's background, business model, and risk profile, and carefully evaluate their own risk tolerance.

Safety Measures

The company claims that they respect the privacy of vast users, and will not collect the user data without the consent from the users. They undertake not to provide the user E-mail, information and address which are mastered due to the service requirements to any third party without the permission from the users.

What are securities to trade with Astrum?

Astrum Capital Management Limited offers trading services for various securities, including ETFs, Stocks, Mutual Funds, Futures and Investment Advisory Service. However, the broker does not provide trading in Bonds or Margin Loans.

ETFs (Exchange Traded Funds): Investment funds that track the performance of a specific index and are traded on a securities exchange.

Stocks: Ownership certificates issued by a company to its shareholders, representing their ownership rights and dividend entitlements.

Mutual Funds: Mutual Funds are investment vehicles that pool money from a group of investors and invest it in various assets such as stocks, bonds, and cash.

Futures: Futures are standardized financial contracts that enable investors to buy or sell an underlying asset at a predetermined price on a future date. These markets provide risk management and speculative trading opportunities and play a vital role in the modern financial system.

Securities Lending Fully Paid: A financial transaction where the owner of securities (lender) loans them to another party (borrower) for a fee (usually interest), with the securities being fully collateralized.

Furthermore, Astrum Financial Holdings Limited conducts its operations primarily through its operating subsidiary, Astrum Capital, which is licensed to carry out various regulated activities under the Securities and Futures Ordinance, including Type 1 (dealing in securities), Type 2 (dealing in futures contracts), Type 6 (advising on corporate finance), and Type 9 (asset management).

Astrum Fees Review

Transaction Fees

HK Stock Trade

Commission: 0.25% of the transaction amount

Minimum commission: HKD 80.00

Stamp duty: HKD 1.00 per HKD 1,000.00 of stock value (rounded up to the nearest dollar)

Transaction levy (Collected by SFC): 0.0027% of the transaction amount

Transaction levy (Collected by FRC): 0.00015% of the transaction amount

Trading fee: 0.00565% of the transaction amount

CCASS fee (HK Clearing Min: HKD 3.00 Max: HKD 300.00): 0.01% of the transaction amount

Withdrawal of Shares

Deposit of Physical Shares

Collection of Dividends

Bonus Shares Collection

Dividend/Bonus Shares Claim

Exercise Warrants / Rights

Share Registration Physical Scrip

Corporate Actions

Cash Offer

Privatisation & Takeover

IPO Application

Bounced Cheque

Copies of Monthly Statement

Annual Service Fee

Shanghai & Shenzhen - Hong Kong Stock Connect

Fees charged by: RMB

Handling Fee: 0.00487% of the consideration of an SSE, SZSE transaction per side

Securities management fee: 0.002% of the consideration of a CSRC transaction per side

Transfer fee: 0.001% of the consideration of each transaction HKSCC

Stamp duty: 0.1% of the consideration of a transaction on the seller

Overseas Stock

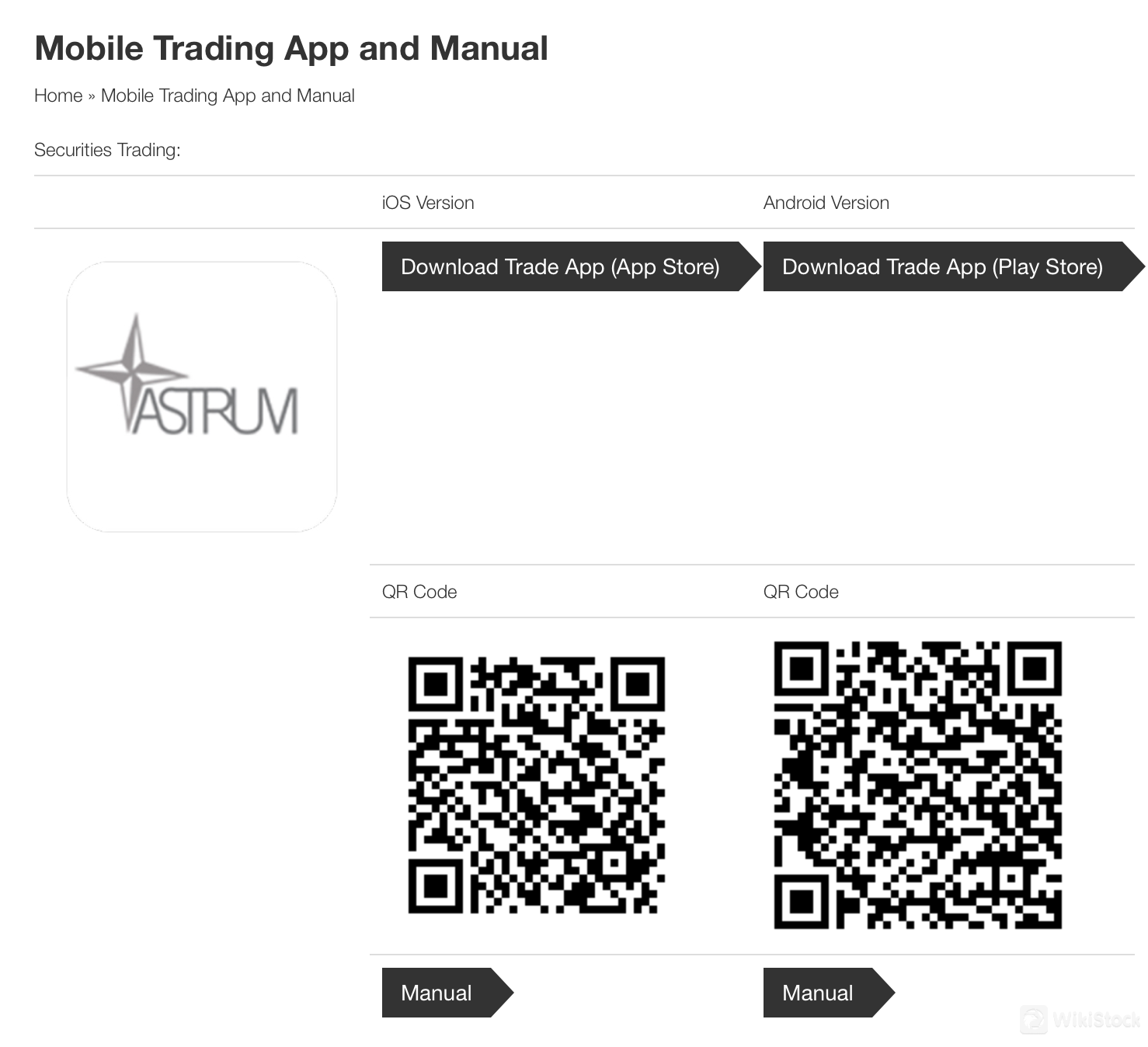

Astrum App Review

Astrum Financial Holdings Limited offers a mobile application. It has clearly reminded investors and the public that the companys official mobile app is available from the App Store and Google Play download.

Download link: The specific download link is:

Customer Service

Astrum is dedicated to providing exceptional customer service and support in various ways:

■ Address: Room 2704, 27/F, Tower 1, Admiralty Centre, 18 Harcourt Road, Admiralty, Hong

Kong.

■ Telephone: (852) 3665 8111

■ Fax: (852) 2559 2880, (852) 2559 7800

■ Email: info@astrum-capital.com.

■ Tickets: You can fill out the ticket below, including your name, email, subject and message.

Conclusion

Astrum Capital Management Limited, a Hong Kong-based brokerage firm, offers trading services for various securities, including ETFs, Stocks, Mutual Funds, Futures and Investment Advisory Service and good regulatory conditions. Astrum Capital may be suitable for experienced investors with a high risk tolerance who are seeking diverse financial services and have conducted detailed research on the firm. But its unclear account fee is a drawback to be considered.

FAQs

Is Astrum safe to trade?

Astrum is registered in Hong Kong and holds a license issued by the Hong Kong Securities and Futures Commission (SFC) with Central Code ALY555. This indicates it is subject to certain regulatory oversight.

Is Astrum a good platform for beginners?

Due to the risks, complexity, opacity, and investor protection considerations associated with Astrum Capital Management Limited, it may not be a platform suitable for beginners. For beginners, it may be more appropriate to choose an investment platform that is more transparent, easy to understand, and has lower risks.

Is Astrum good for investing/retirement?

As an investment platform, Astrum provides a wide range of investment services while also facing some compliance and financial transparency challenges. Therefore, when considering Astrum as part of retirement planning, investors should carefully evaluate its compliance, financial condition, risk management and investor protection measures.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China

ChinaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)