Wealthy Securities Limited is a licensed corporation of the Securities and Futures Commission of Hong Kong with central entity number [BJH108] and has become a participant of the Stock Exchange of Hong Kong Limited and the Hong Kong Securities Clearing Company Limited.

What is Wealthy Securities?

Wealthy Securities Limited is a licensed corporation under the SFC of Hong Kong. It is a participant of the Stock Exchange of Hong Kong Limited and the Hong Kong Securities Clearing Company Limited. Wealthy Securities provides a range of financial services and charges various fees associated with general transactions, account services, and nominee services. Wealthy Securities offers two trading platforms: the Ayers China HK Mobile App and the AyersGTS online trading platform.

Pros & Cons of Wealthy Securities

Pros of Wealthy Securities: Regulated by SFC: Being regulated by the Securities and Futures Commission (SFC) of Hong Kong ensures that Wealthy Securities operates within legal boundaries and adheres to regulatory standards, providing investors with a sense of security and trust.

Transparent Fee Structure: Wealthy Securities maintains a transparent fee structure, allowing clients to understand and budget for the costs associated with their services, enhancing trust and clarity in financial transactions.

Technology Integration: With platforms like the Ayers China HK Mobile App and AyersGTS online trading platform, Wealthy Securities integrates technology to provide convenient and accessible trading experiences for clients.

Cons of Wealthy Securities: Limited Information Related to Specific Products: Wealthy Securities does not provide detailed information about specific financial products or investment options, which could be a drawback for investors seeking comprehensive information before making investment decisions.

No Social Media Presence: The lack of a social media presence may limit Wealthy Securities ability to engage with clients and potential investors, potentially affecting its visibility and market reach.

Is Wealthy Securities Safe?

Wealthy Securities is licensed and regulated by the Securities and Futures Commission (SFC) with License No. BJH108. Operating within Hong Kong, a renowned international financial hub, the SFC plays a pivotal role in enhancing and safeguarding the integrity and stability of the region's securities and futures markets. The SFC's regulatory framework encompasses stringent guidelines and oversight mechanisms aimed at maintaining market confidence and investor trust. By enforcing compliance with regulatory standards, the SFC ensures that market participants, including Wealthy Securities, adhere to ethical practices and operational transparency.

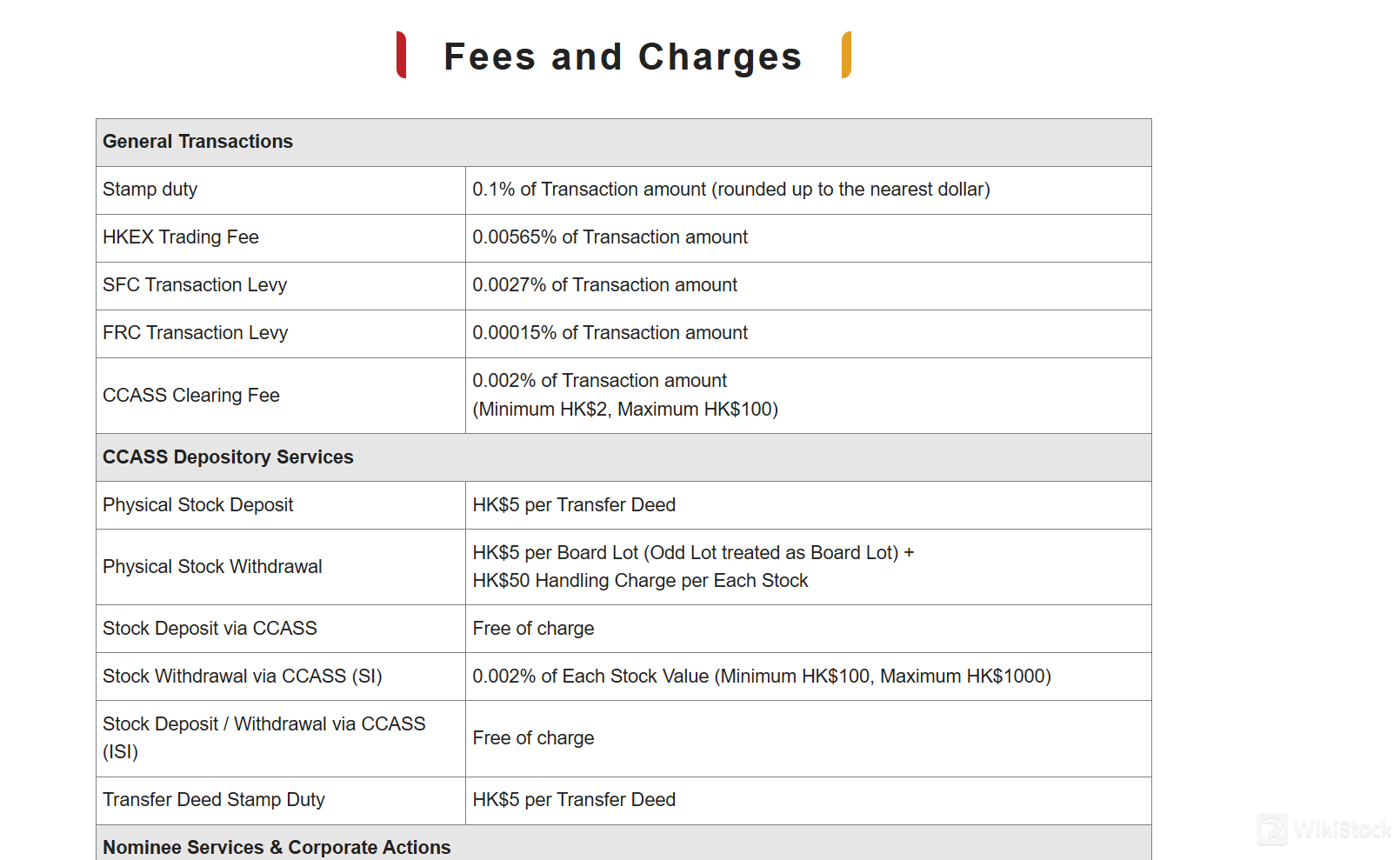

Wealthy Securities Fees Review

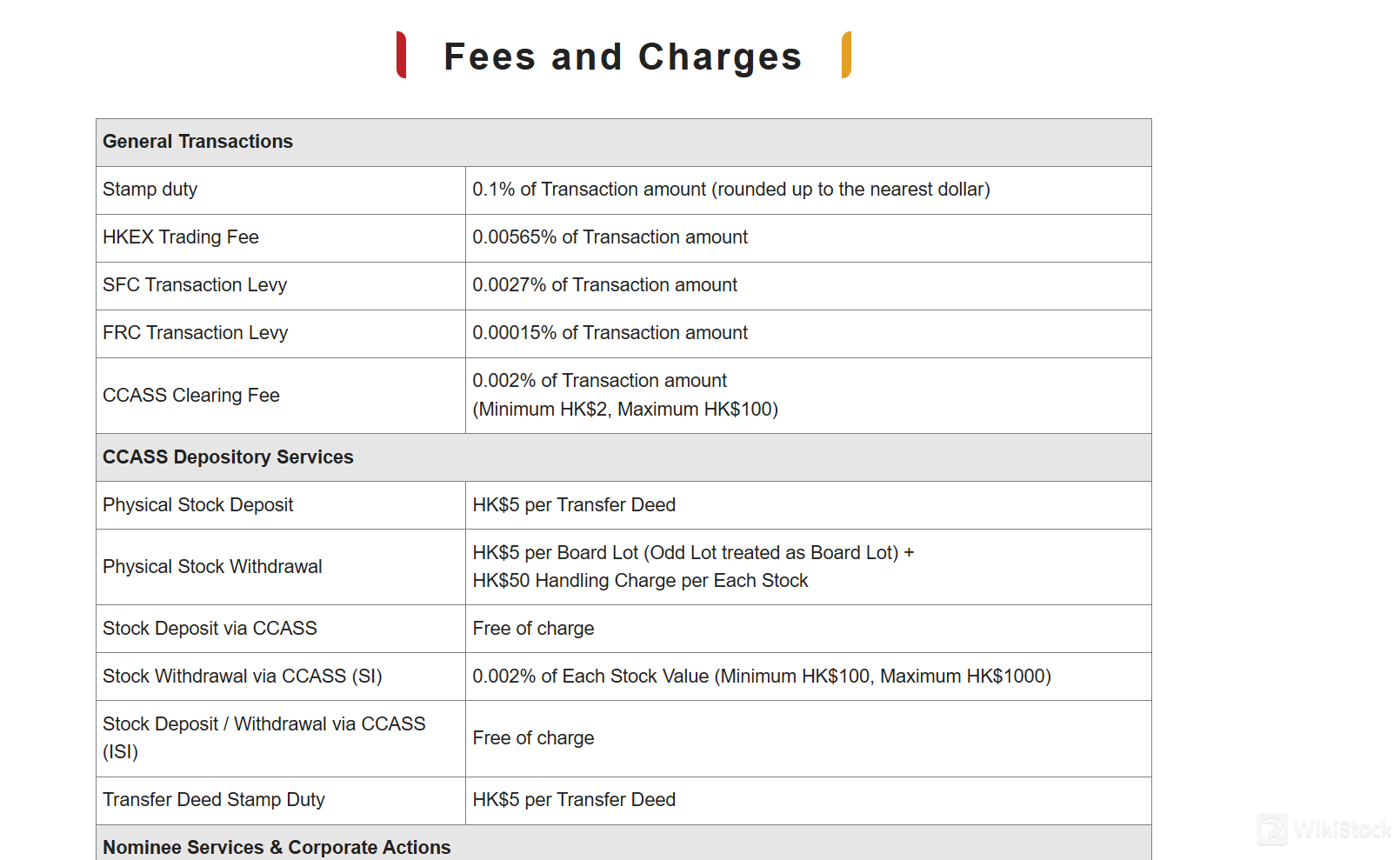

Wealthy Securities charges various fees associated with general transactions, account services, and nominee services.

General Transaction Fees:

Stamp Duty: 0.1% of the transaction amount (rounded up to the nearest dollar).

HKEX Trading Fee: 0.00565% of the transaction amount.

Regulatory Fees: Include SFC Transaction Levy (0.0027%), FRC Transaction Levy (0.00015%), and CCASS Clearing Fee (0.002% with minimum HK$2 and maximum HK$100).

CCASS Deposit/Withdrawal Fees:

Physical Stock Deposit: HK$5 per Transfer Deed.

Physical Stock Withdrawal: HK$5 per board lot + HK$50 handling charge per stock.

Stock Deposit/Withdrawal via CCASS (Free for SI and ISI).

Transfer Deed Stamp Duty: HK$5 per Transfer Deed.

Nominee Services & Corporate Action Fees:

Scrip Fee: HK$1.5 per board lot.

Dividend Collection: 0.5% of the dividend payment (minimum HK$20).

Collection of Bonus Shares/Rights/Offer: HK$5 per board lot (minimum HK$30, maximum HK$100).

Warrants/Covered Warrants Conversion: HK$30 per transaction.

Right Subscription/Offer Exercise/Cash Offer/Privatization Offer: HK$1 per board lot (minimum HK$30, maximum HK$100).

Stock Registration Fee: HK$5 per board lot + handling charge per stock (HK$200).

Handling Charges of Unclaimed Dividend: 0.25% of the dividend amount + handling charge per claim (HK$500).

Handling Charges for Cash Subscription of IPO: HK$30 per transaction.

Account Service Fees:

Paper Statement: HK$50 per month (physical delivery).

Statement Reclaim Fee: Varies depending on the timeframe (free within 3 months, HK$100 per statement over 3 months) for electronic statements and HK$100 each for post (both within 3 months and over 3 months).

Cash Withdrawal Fee: Waived for cheques, but bank charges and HK$200 handling fee apply for telegraphic transfers (TT) and bank charges with HK$250 handling fee for local transfers (CHATS).

Return Cheque: HK$200 per transaction.

Stop Cheque Payment: HK$300 per stop payment.

Inactive Account Service Fee: HK$200 per year (applicable to inactive accounts with cash balance only and less than HK$1,000).

Wealthy Securities Platforms Review

Wealthy Securities offers two trading platforms: the Ayers China HK Mobile App and AyersGTS online trading platform.

The Ayers China HK Mobile App provides investors with a streamlined and user-friendly interface for stock trading. It offers a seamless experience where users can effortlessly check their account balance, current positions, order statuses, and trade history. The app's intuitive design simplifies the process of researching stocks, adding them to watchlists and executing trades.

On the other hand, AyersGTS stands out as a comprehensive securities trading system tailored for front-office operations. The platform is highly adaptable, capable of interfacing seamlessly with back-office settlement systems, including in-house trading platforms and banking systems. AyersGTS leverages advanced technology to ensure scalability, accommodating the needs of both small brokerage houses and large international firms.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Tel: 2151 7780

Fax: 2151 7700

Email: cs@wealthysec.com

Address: Room 1206, 12/F, Far East Consortium Building, No. 121 Des Voeux Road, Central, Hong Kong

Conclusion

In conclusion, Wealthy Securities Limited presents itself as a regulated entity under the SFC of Hong Kong. It boasts a transparent fee structure, providing clarity for clients in financial transactions. With its technology integration through platforms like the Ayers China HK Mobile App and AyersGTS online trading platform, Wealthy Securities offers convenient and accessible trading experiences. However, it does not provides detailed information about specific products and the absence of a social media presence, which may impact visibility and client engagement in the market.

Frequently Asked Questions (FAQs)

Is Wealthy Securities regulated?

Yes. It is regulated by SFC.

What are platforms offered by Wealthy Securities?

It provides Ayers China HK Mobile App and AyersGTS online trading platform.

How can I contact Wealthy Securities?

You can contact via telephone: 2151 7780, fax: 2151 7700 and email: cs@wealthysec.com.

Is there any additional fees I should be aware of?

Yes, in addition to brokerage fees, clients incur other charges such as stamp duty, transaction levies and so on.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)