Prudential Brokerage Limited (Prudential), established in 1985, is a participant of The Stock Exchange of Hong Kong Limited and Hong Kong Futures Exchange Limited. We have more than $2 billion value of net assets, and manage more than several billion assets value of our clients.

Prudential Brokerage Information

Prudential Brokerage, rated three stars by WikiStocks, offers a competitive commission rate of 0.125% of HK stocks.

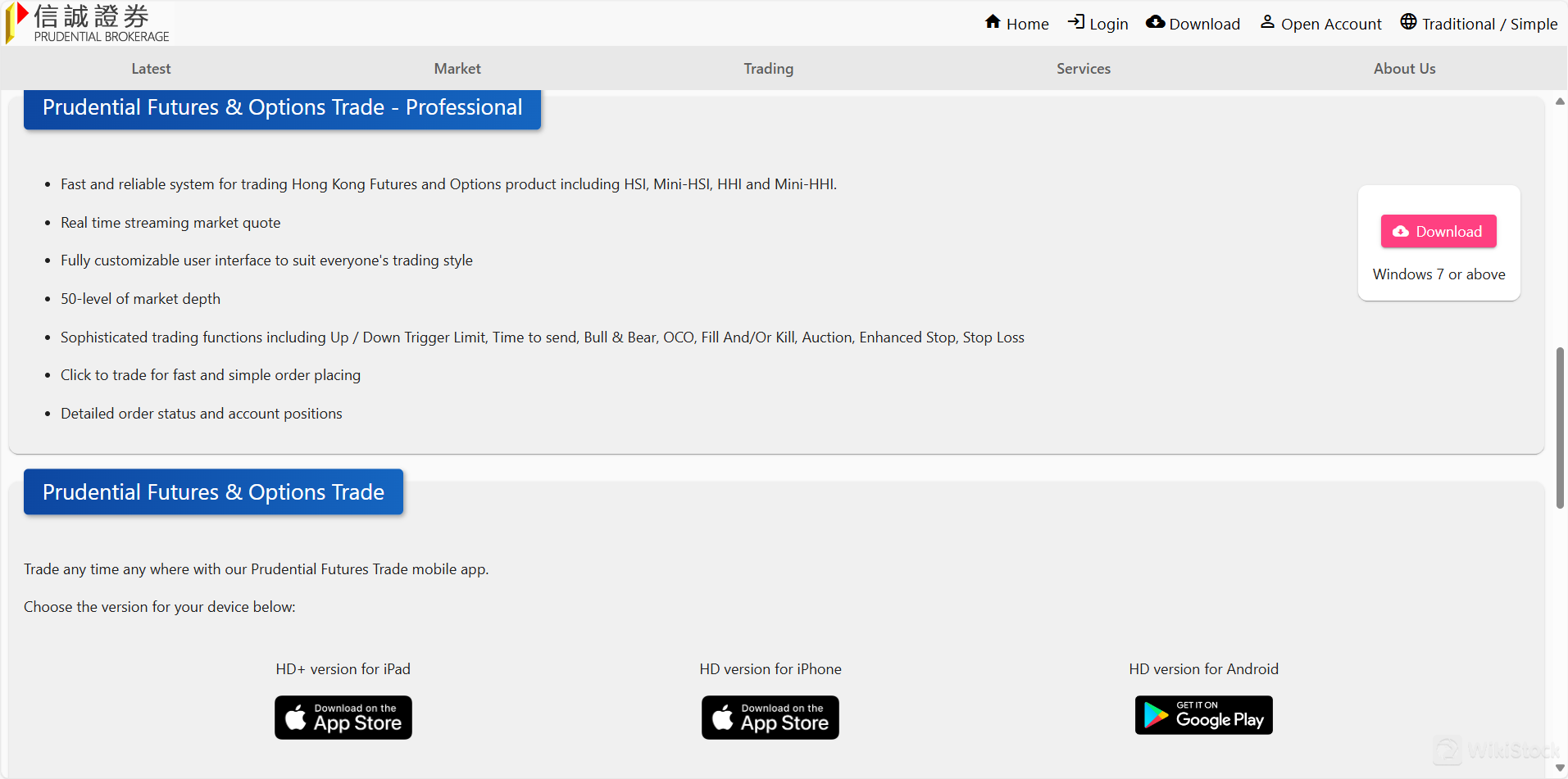

The brokerage supports a broad investment portfolio, including mutual funds, and provides a user-friendly trading experience through its Prudential Trade and Prudential Futures & Options Trade platforms, available on iOS, Android, and Web.

However, a potential drawback is the relatively modest interest rate of 1.65% on uninvested cash, which will not appeal to all investors seeking higher passive income from their unutilized balances.

Pros & Cons

Pros:

Prudential Brokerage is regulated by the SFC, ensuring reliable oversight and compliance with financial regulations. The Prudential Trade trading platform enhances user experience with accessibility across multiple devices. Additionally, Prudential Brokerage offers a variety of tradable securities, including stocks, futures, and warrants, supported by a detailed fee structure that provides transparency to its users.

Cons:

Despite its advantages, Prudential Brokerage has some drawbacks, including the imposition of trading fees for many of its products, which can add up and affect the overall cost-effectiveness. The brokerage also offers limited investment services, which will not satisfy the needs of more diverse or advanced investors looking for a broader range of investment opportunities and financial services.

Is Prudential Brokerage Safe?

Regulations:

Prudential Brokerage is regulated by the Securities and Futures Commission (SFC) of Hong Kong, under license number ABI439.

Established in 1989, the SFC is an independent statutory body with investigative, remedial, and disciplinary powers, derived from the Securities and Futures Ordinance and related legislation.

Funds Safety:

Being regulated by the SFC implies that Prudential Brokerage must comply with financial and operational conduct requirements, which typically include measures to safeguard client assets.

Clients can be reassured that their funds are managed with high standards of security due to these regulatory requirements.

Safety Measures:

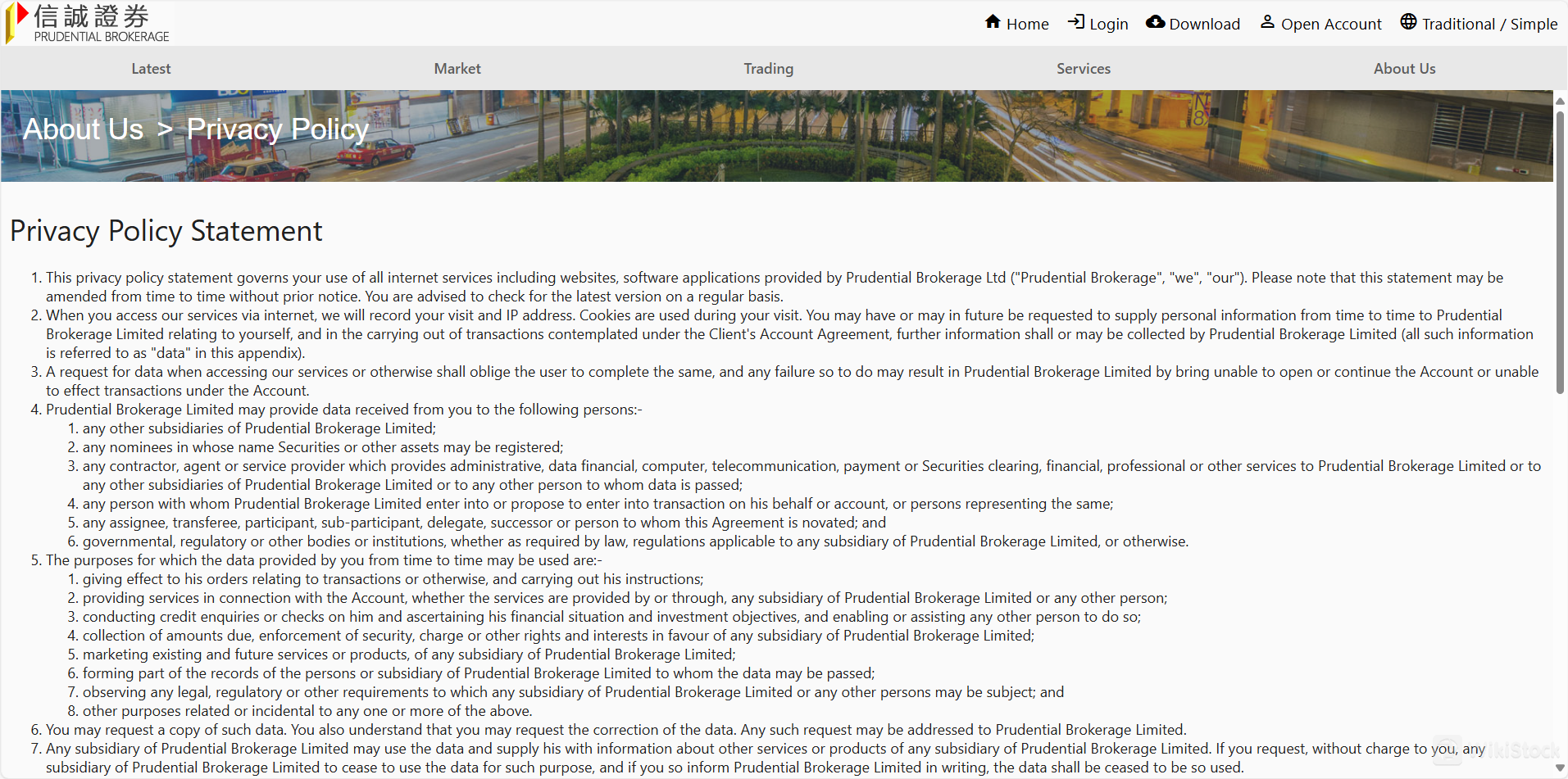

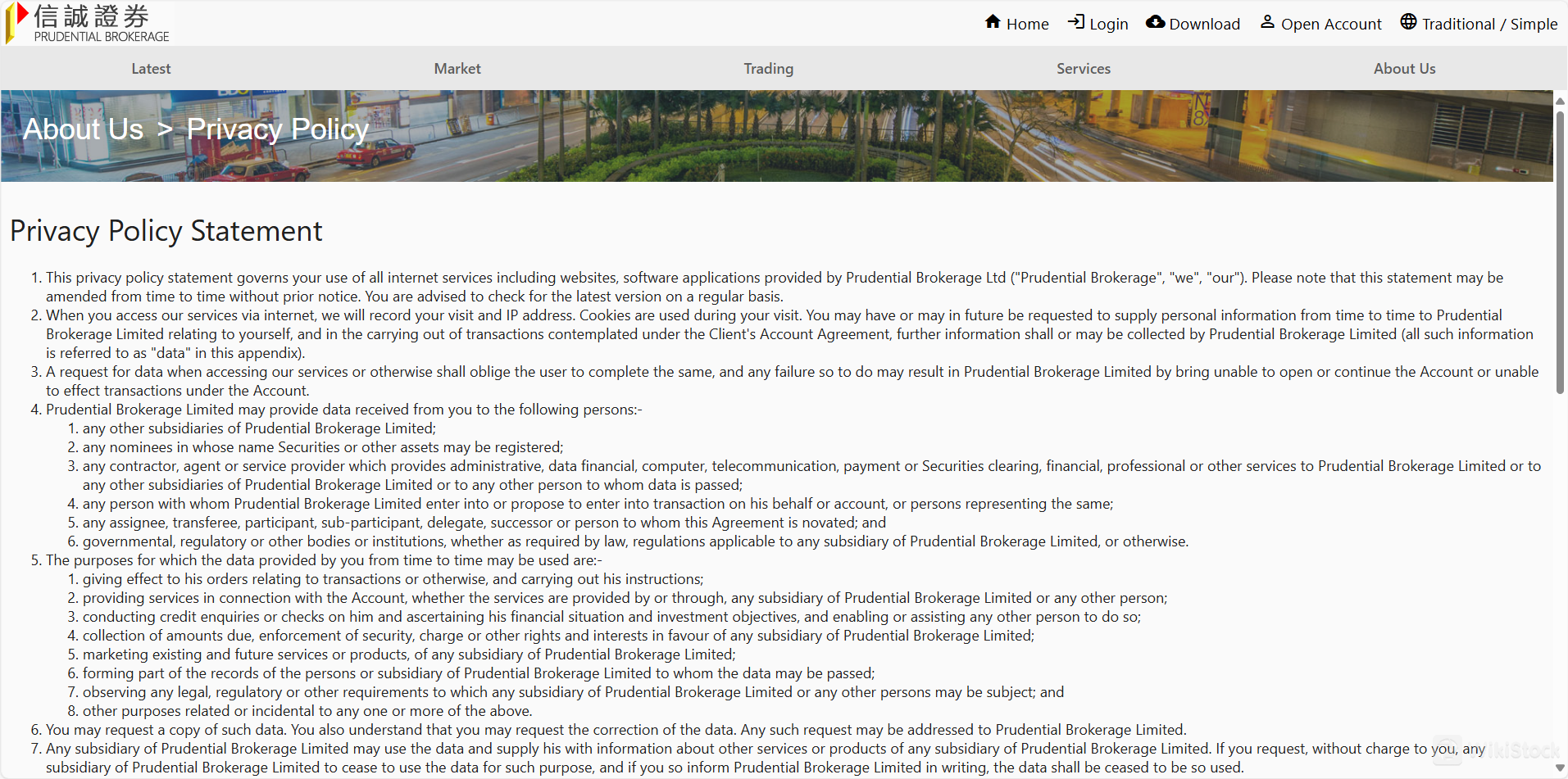

Prudential Brokerage employs various safety measures to protect client data and funds. Their privacy policy indicates the use of encryption technologies to secure client information during internet transactions. Additionally, data provided by clients is strictly controlled and will only be shared with subsidiaries, governmental, or regulatory bodies as required by law. This careful handling of data ensures that clients' information and assets are handled securely and with confidentiality, aligning with legal and regulatory requirements.

What are securities to trade with Prudential Brokerage?

At Prudential Brokerage, clients have access to a diverse range of securities and trading options. These include:

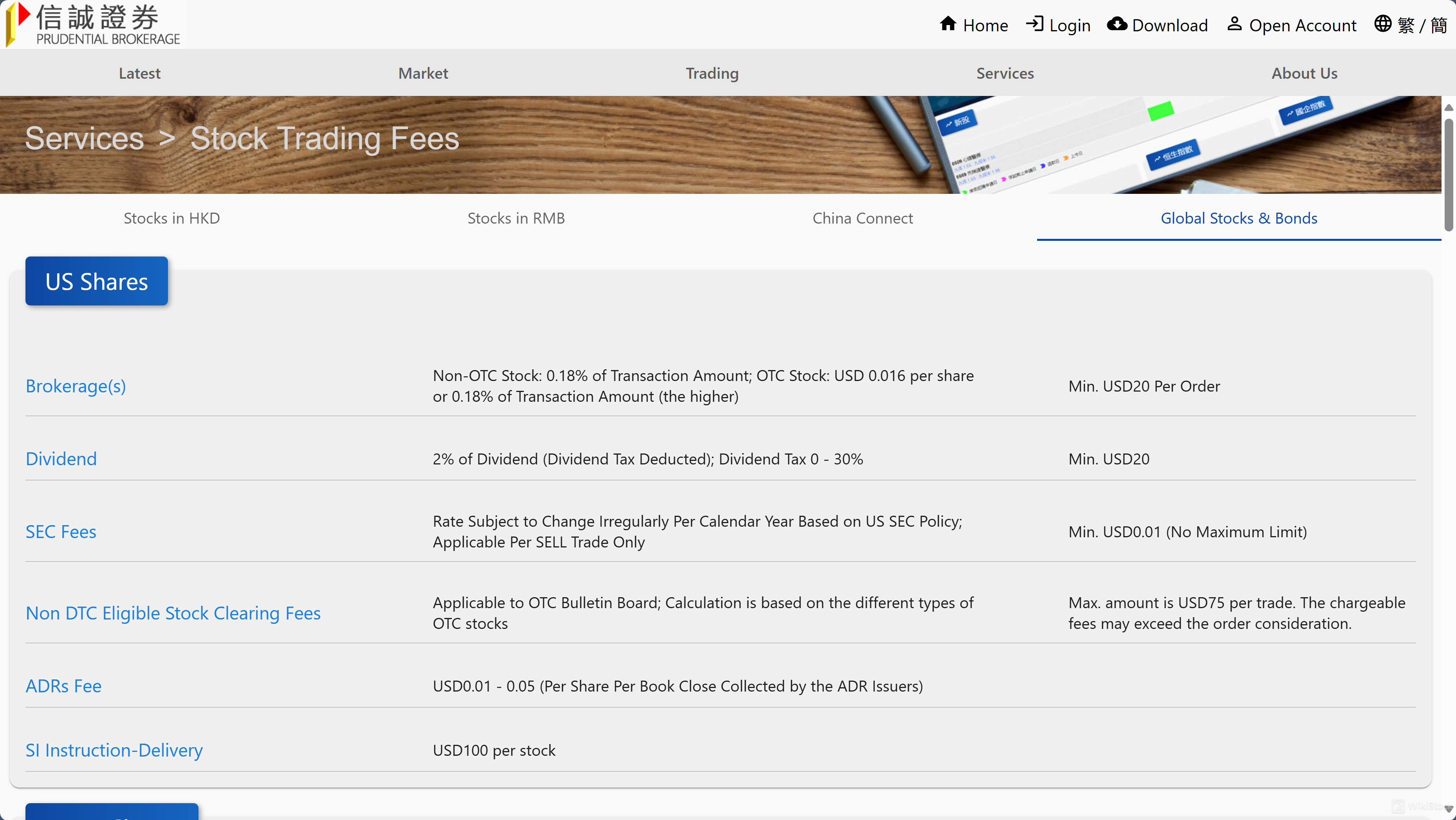

- Stocks: Both local (HK) and global stocks are available for trading, providing a broad market reach.

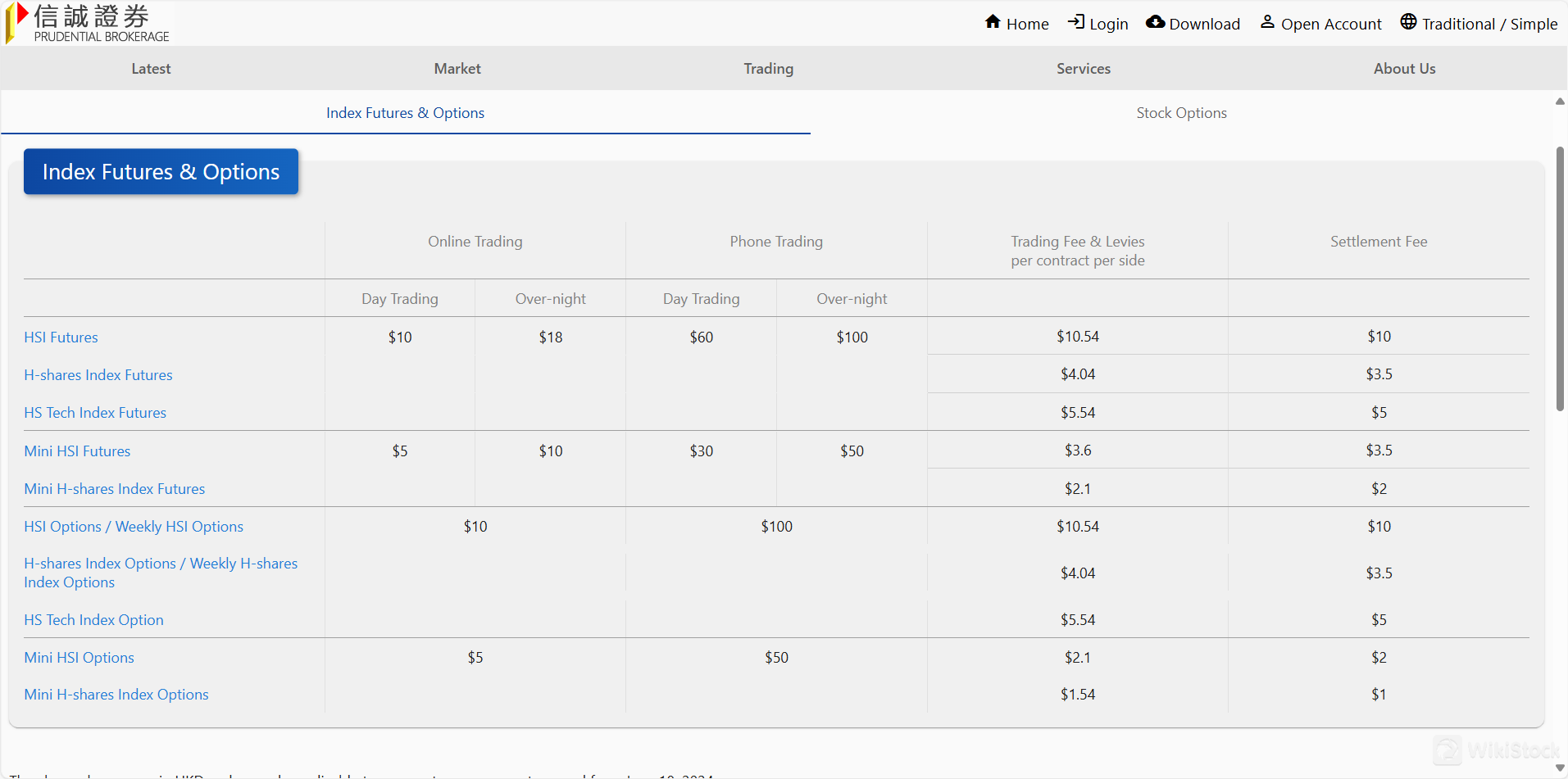

- Futures and Options: Clients can trade in index futures/options and stock futures/options, allowing for strategic investments based on market predictions and hedging.

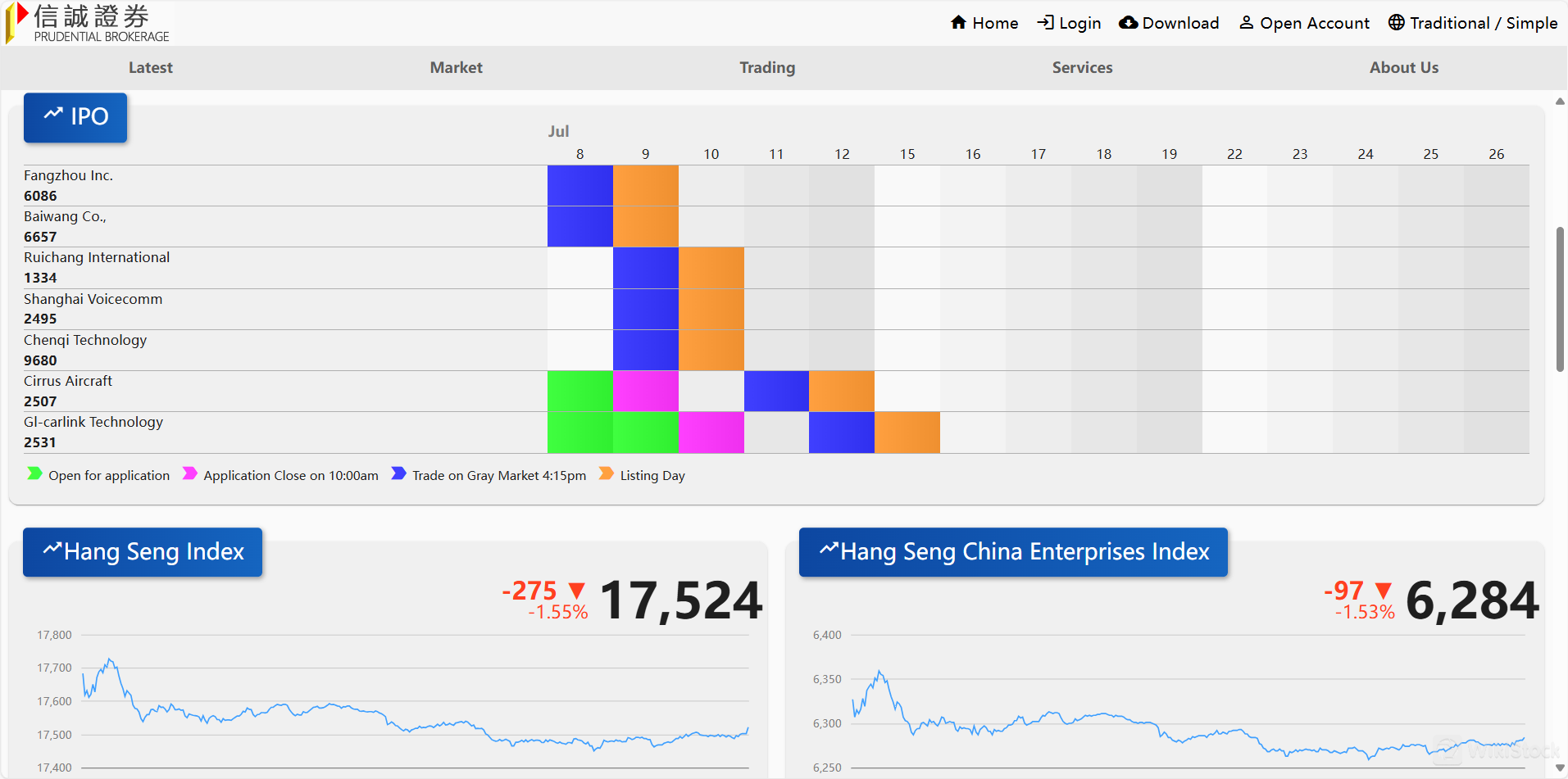

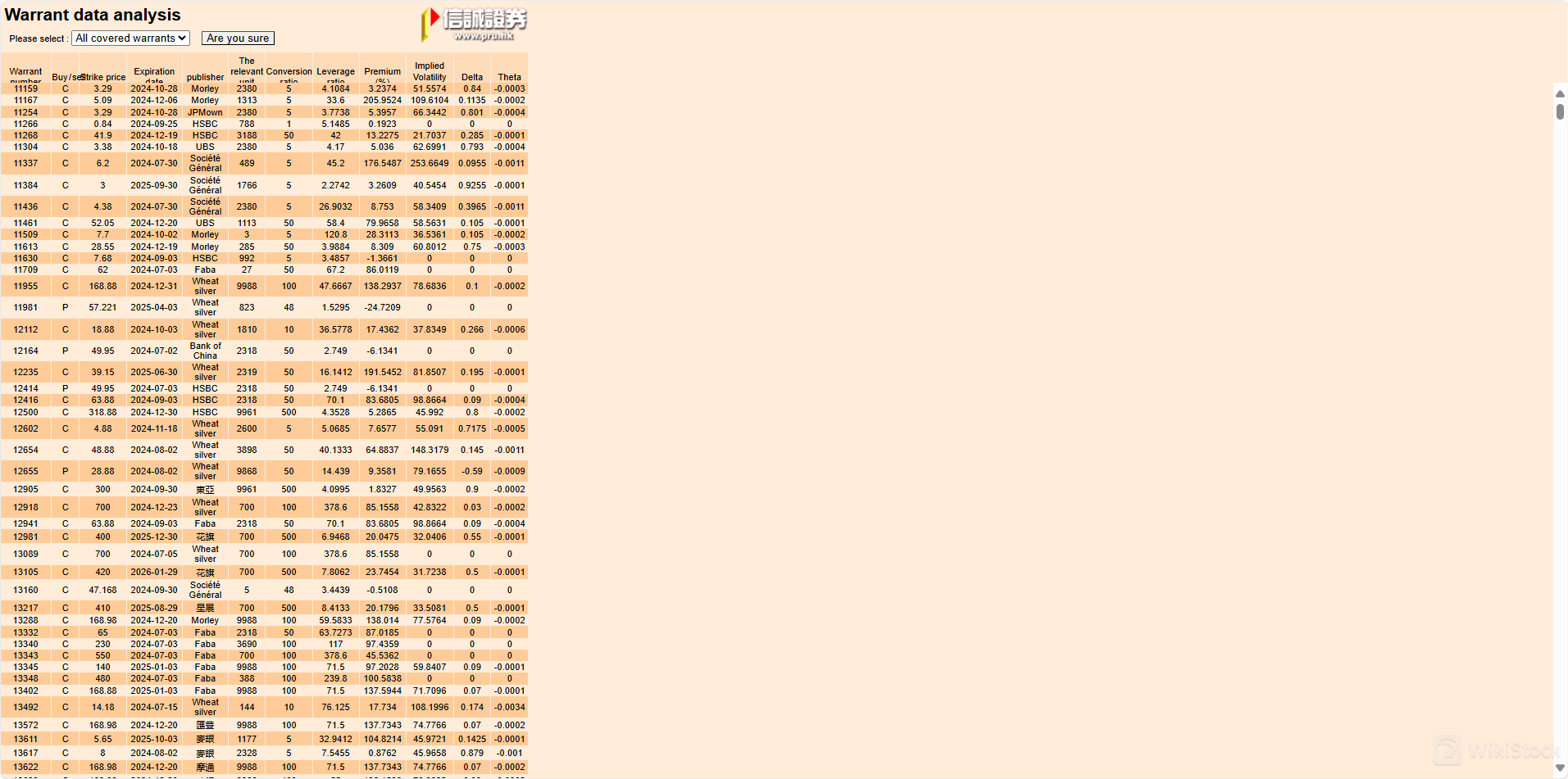

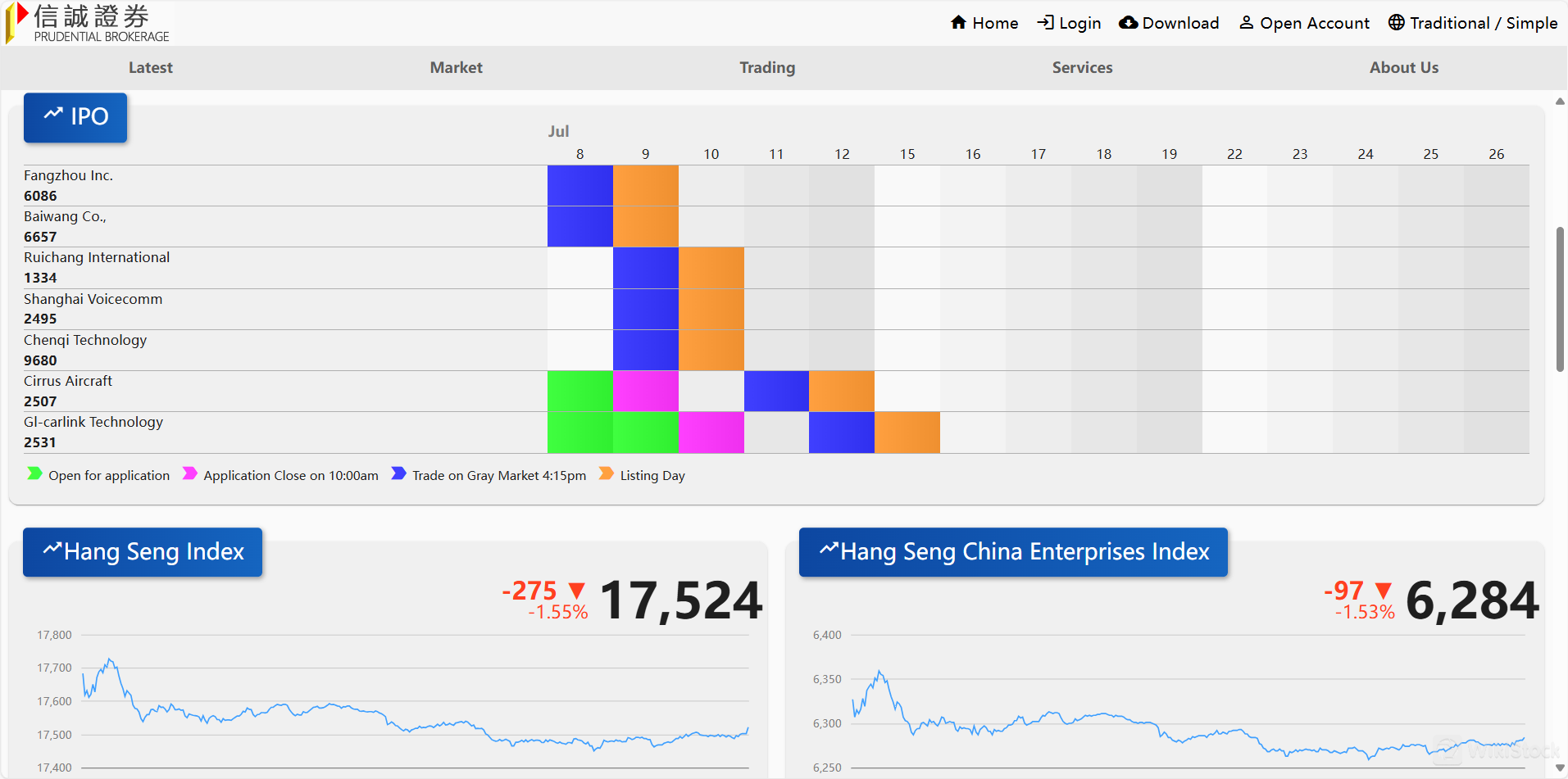

- Warrants and IPOs: Offers opportunities to invest in warrants and Initial Public Offerings (IPOs), which can appeal to different types of investors looking for growth or new market entries.

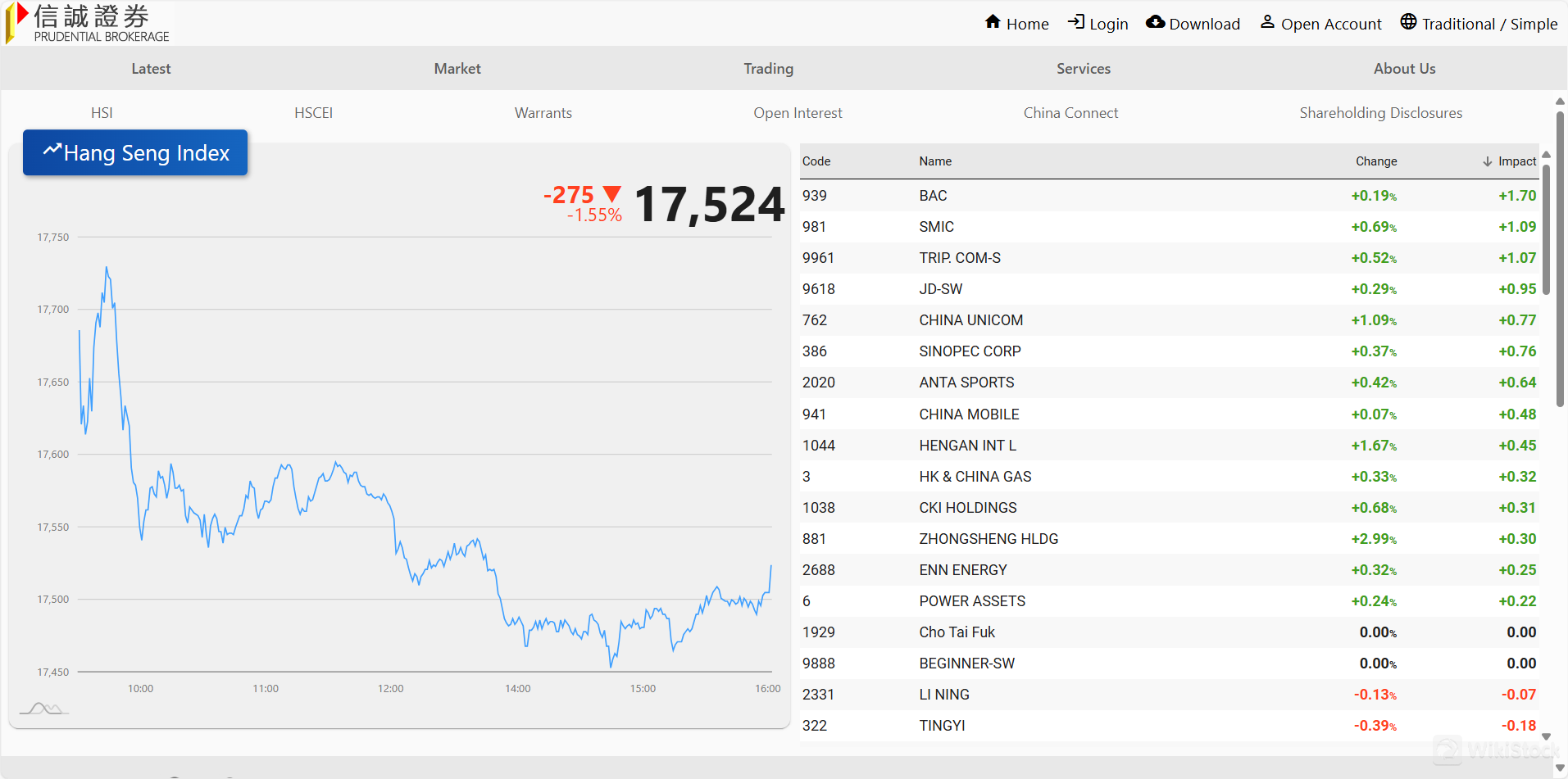

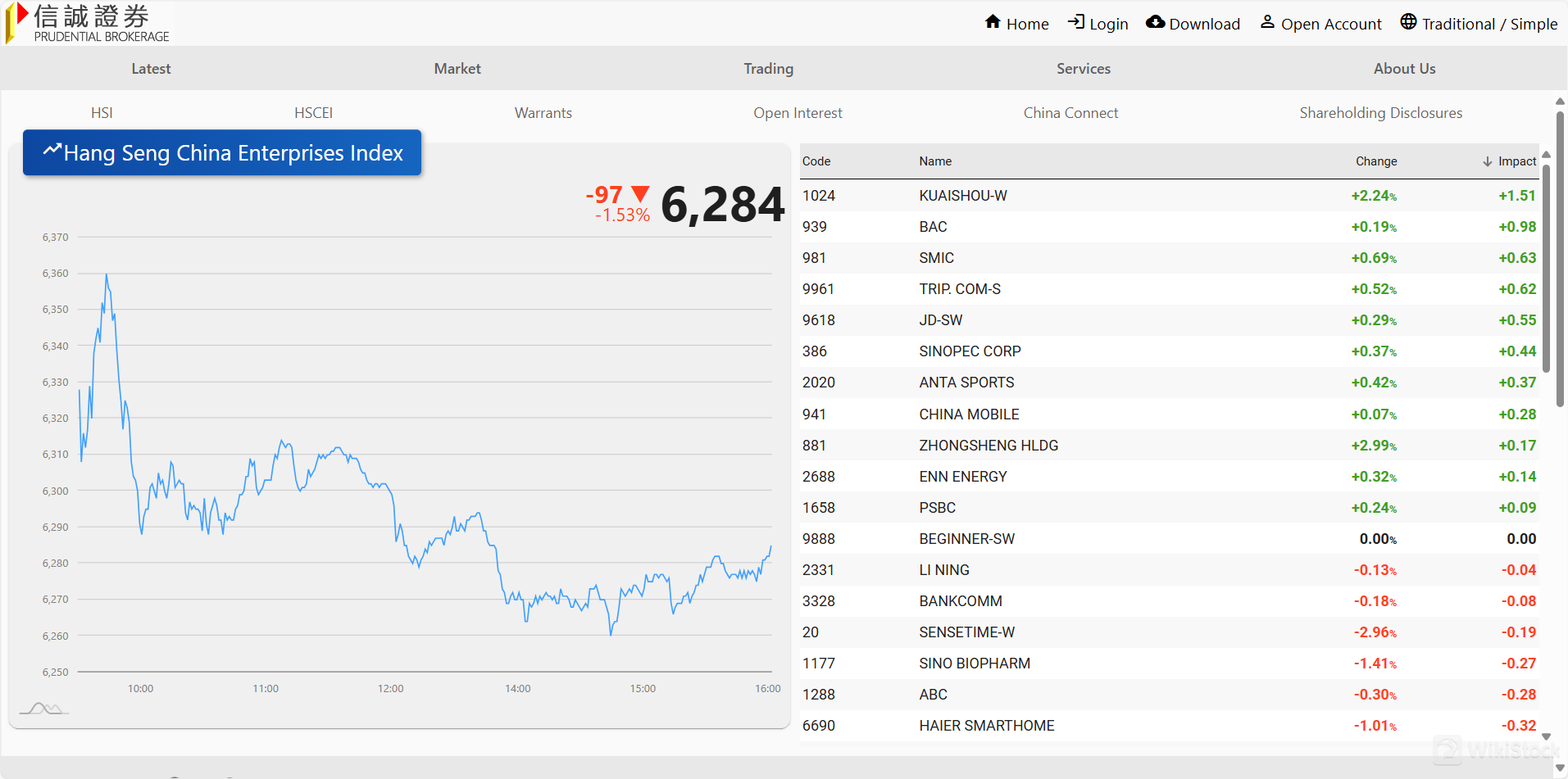

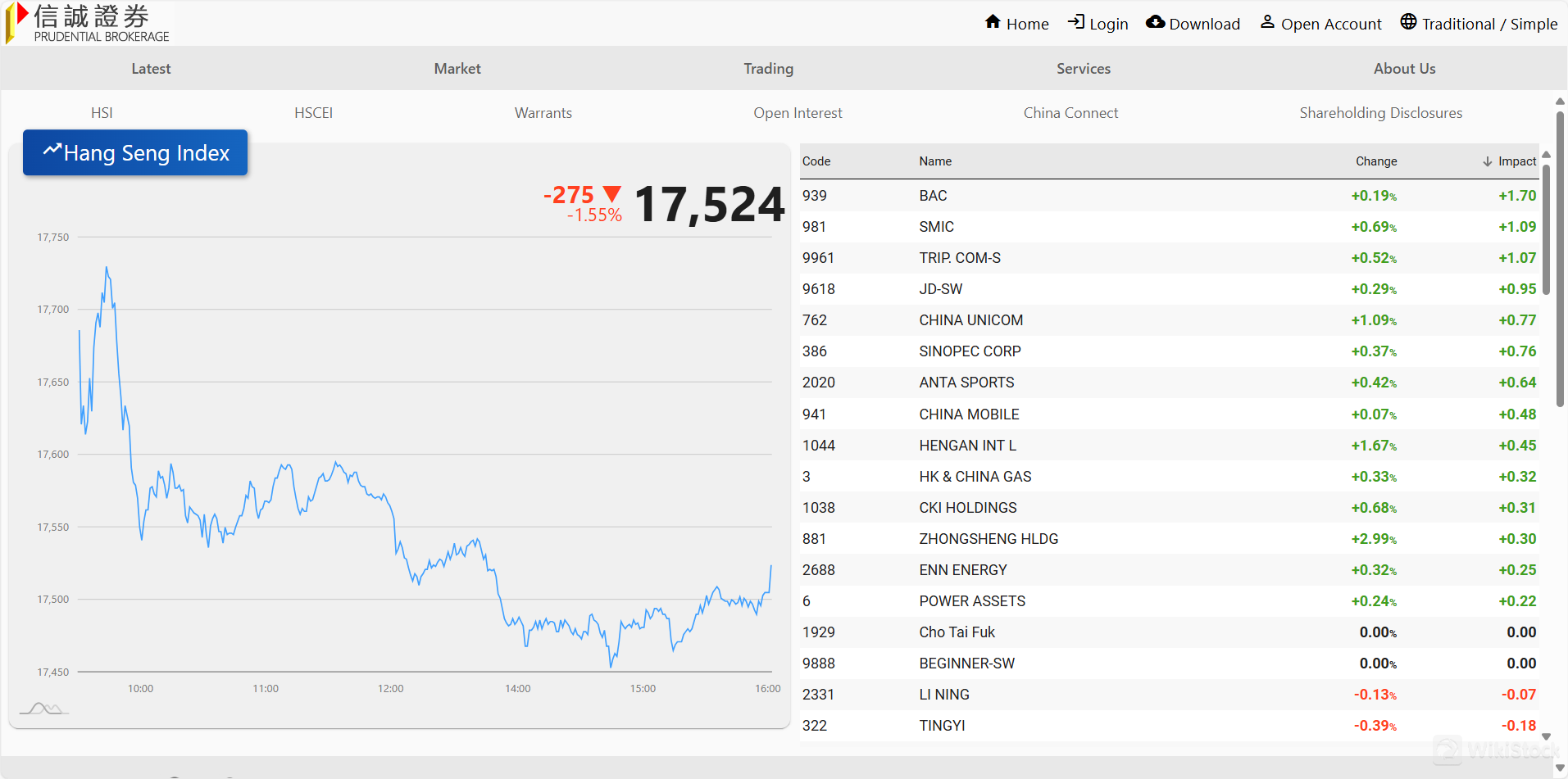

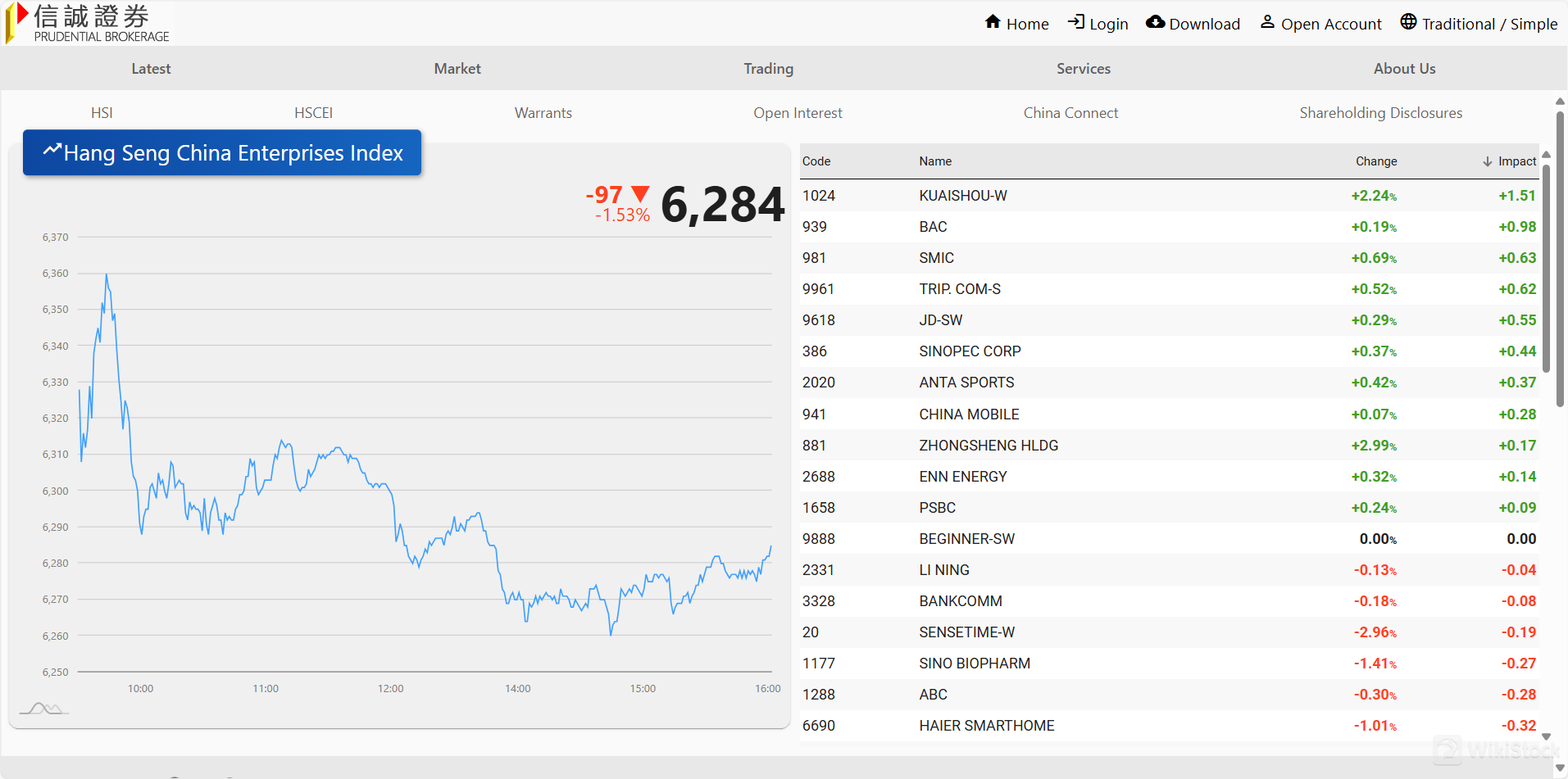

- HSI and HSCEI: Specific indexes such as the Hang Seng Index (HSI) and the Hang Seng China Enterprises Index (HSCEI) are also tradable, targeting key market segments.

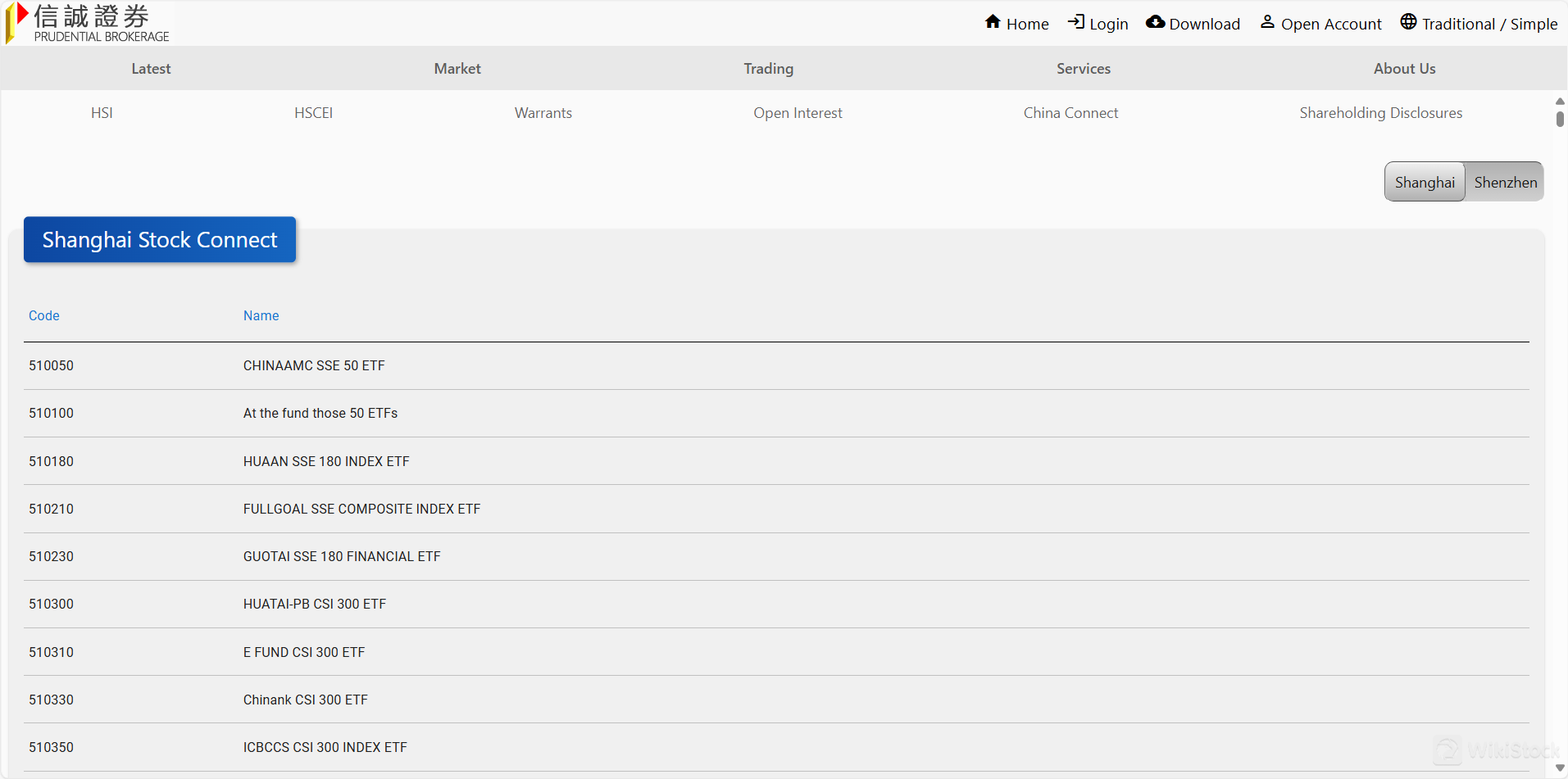

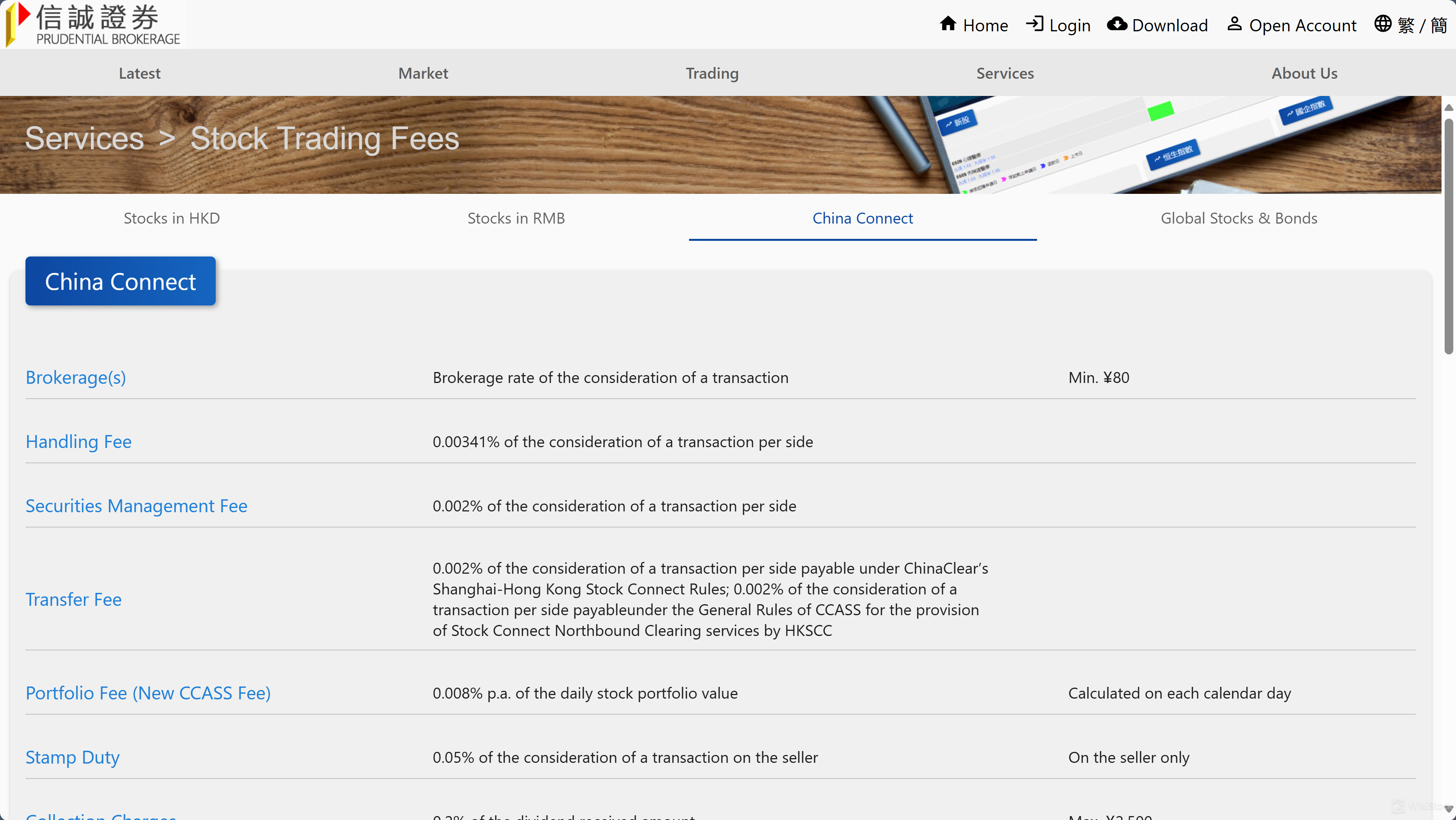

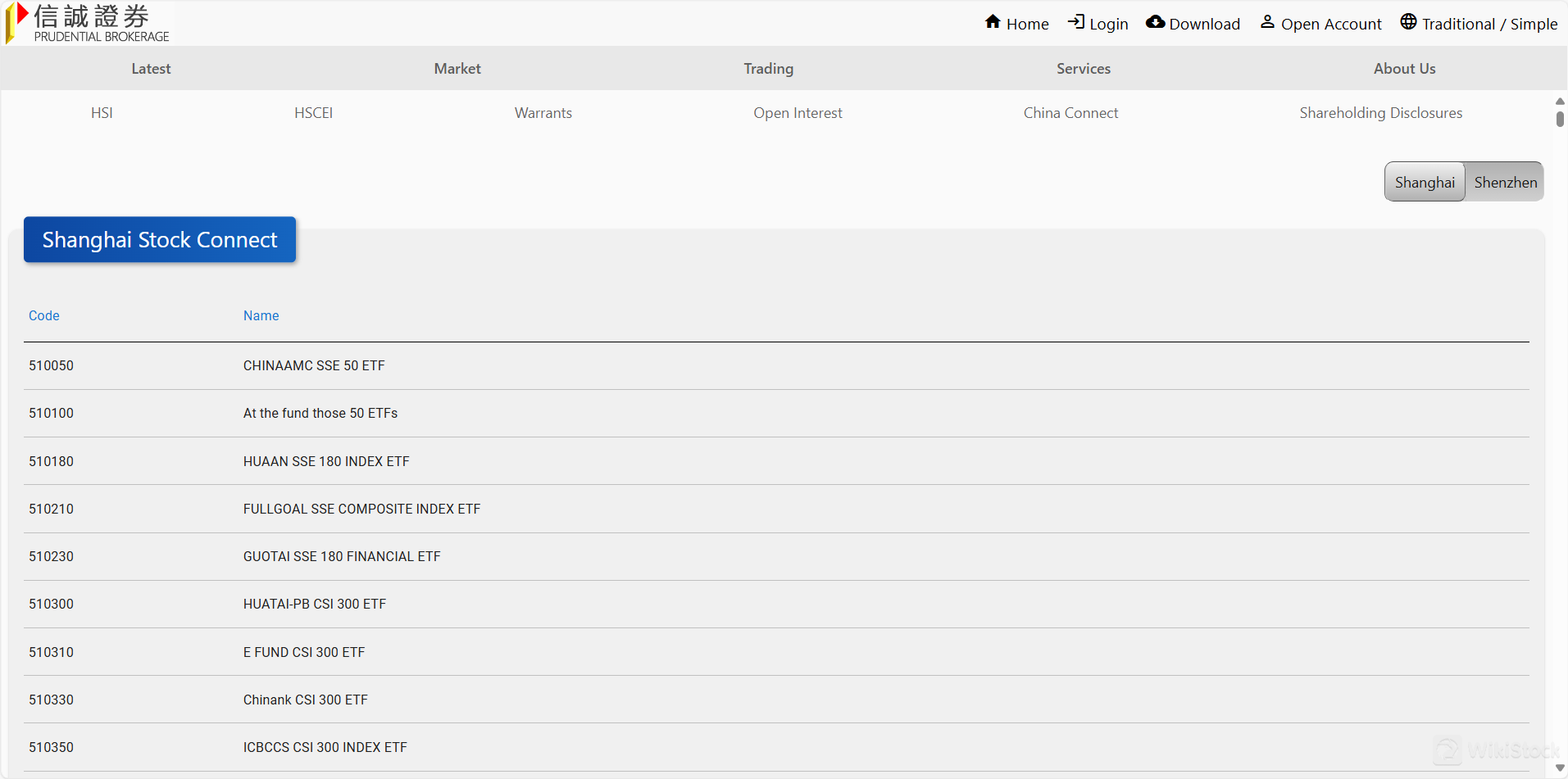

- China Connect: This service provides access to Mainland Chinas markets through the HK and China Connect program, enabling cross-border trading which expands the investment landscape for clients.

Prudential Brokerage Fee Review

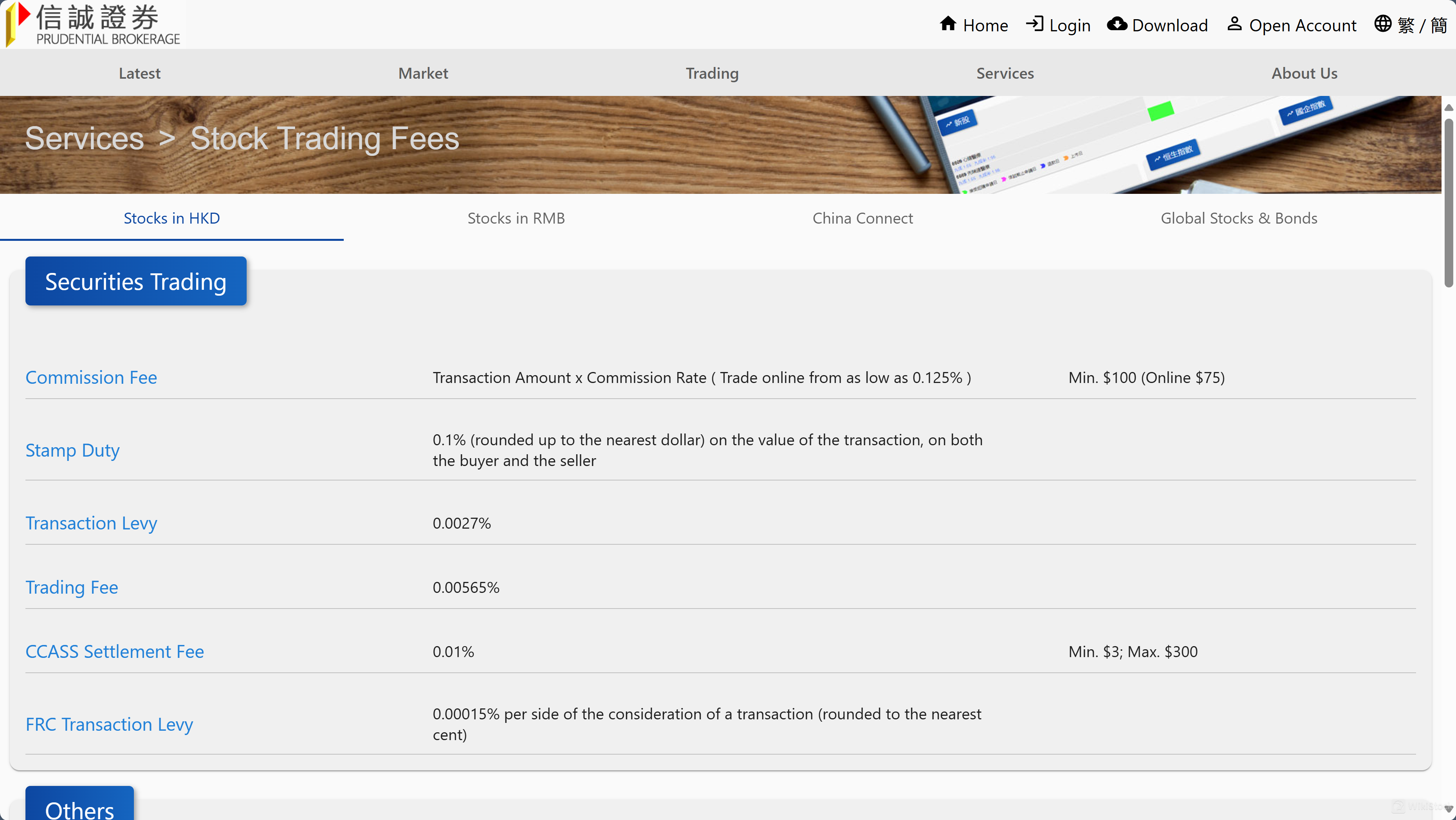

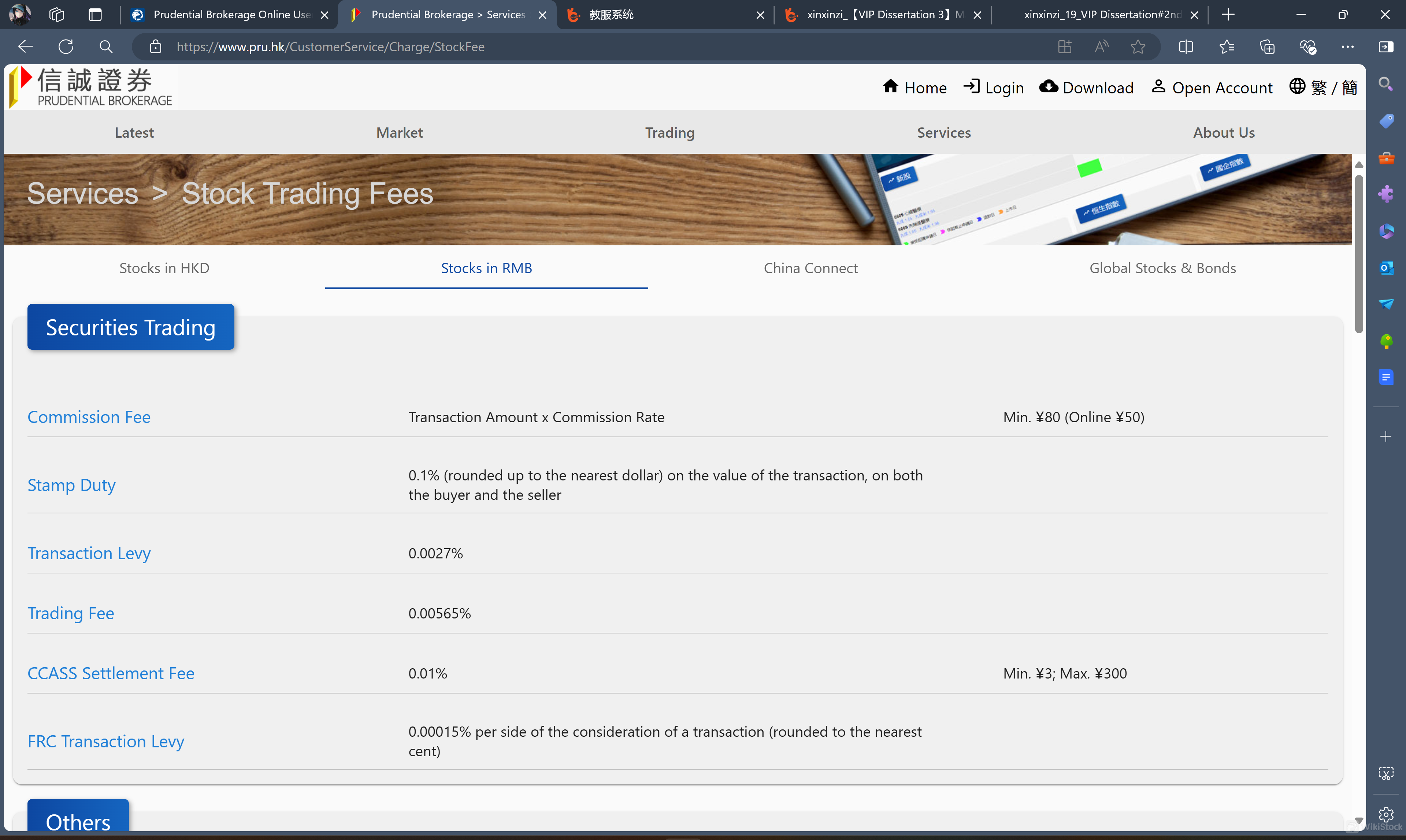

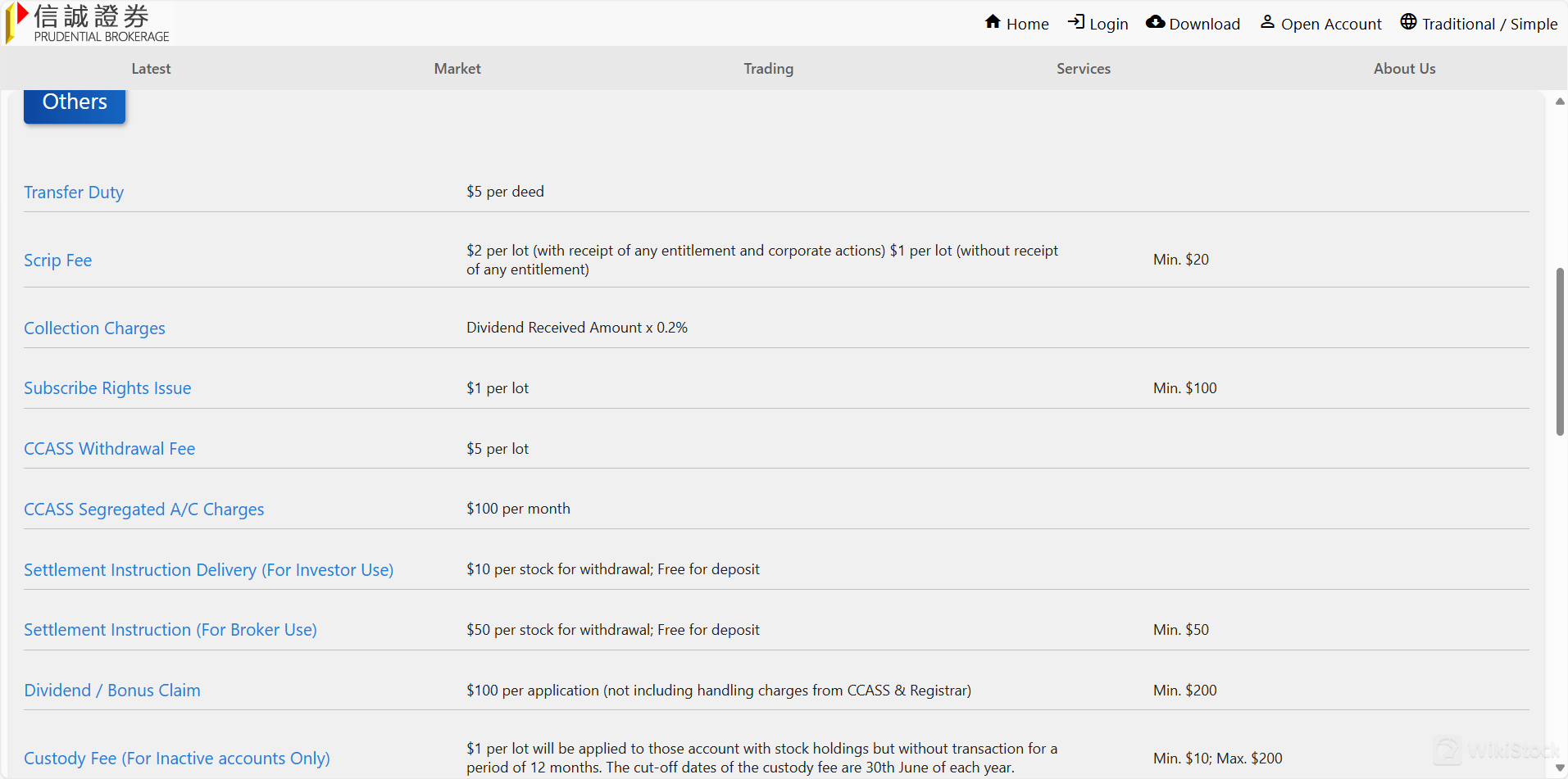

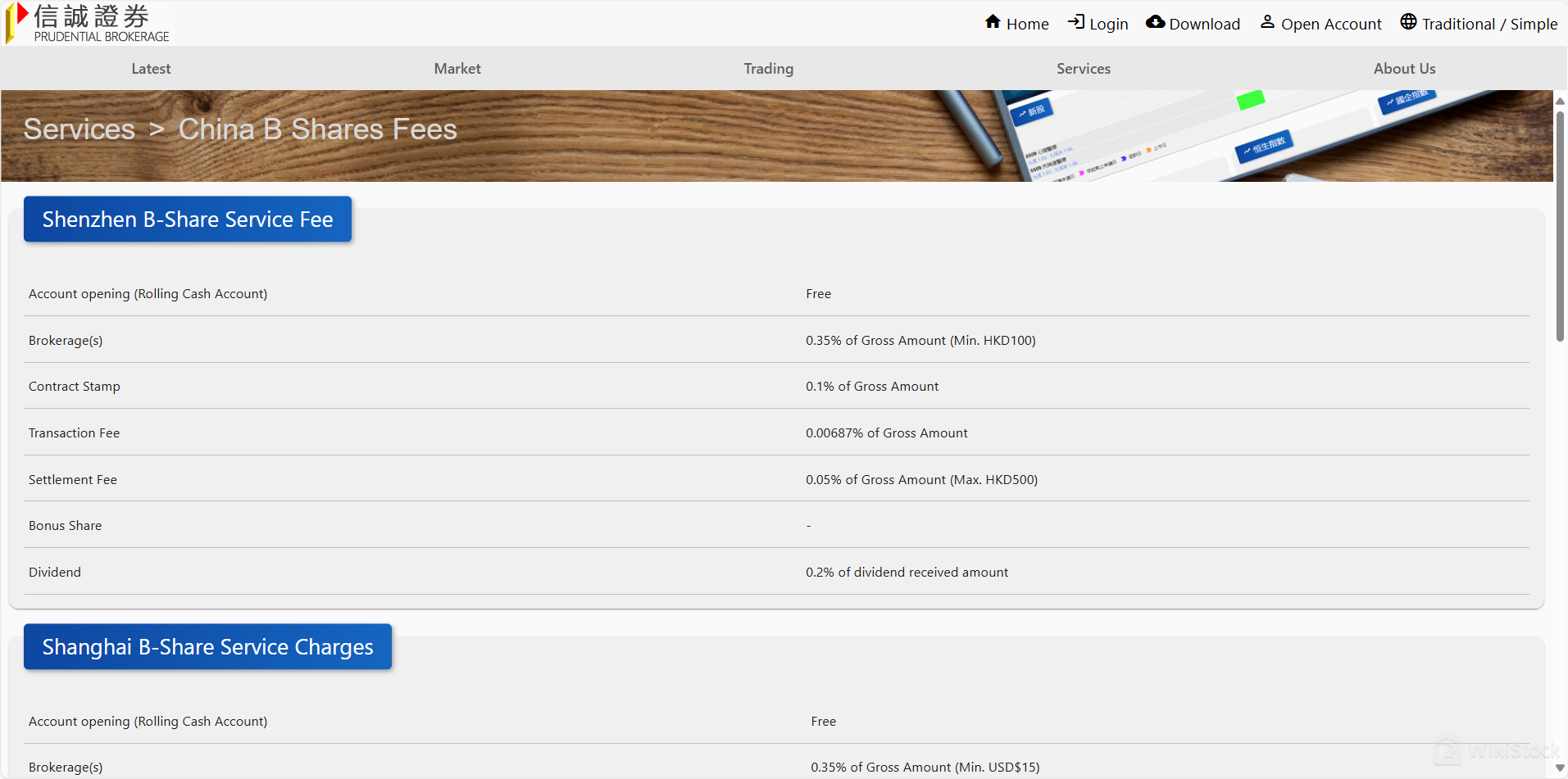

The fee structure of Prudential Brokerage is , designed to satisfy a wide range of trading activities, with detailed fees tailored to different securities, markets, and trading styles:

China Hong Kong

China Hong Kong Obtain 1 securities license(s)