Score

大山日ノ丸証券

https://www.daisenhinomaru.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

大山日ノ丸証券株式会社

Abbreviation

大山日ノ丸証券

Platform registered country and region

Company address

Company website

https://www.daisenhinomaru.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

1.21%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| DAISENHINOMARU SECURITIES |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded | 1957 |

| Registered Region | Japan |

| Regulatory Status | FSA |

| Product & Services | Stock, investment trust, Japanese government bonds, foreign bonds |

| Fees | Stocks trading: 0.0165-1.21% + fixed rate depending on trading volume, min 2750 yen |

| New Corporate Bonds with Stock Acquisition Rights: 0.11-1.1% + fixed rate depending on trading volume, min 2750 yen | |

| Customer Service | Head office: 〒680-0841, 3-101 Yoshikata Onsen, Tottori City, Tottori Prefecture |

| TEL: 0857-21-1111; FAX: 0857-24-2222; FAQ |

DAISENHINOMARU SECURITIES Information

Established in 1957 with 5 offices across Japan, DAISENHINOMARU SECURITIES is a financial services firm offering a wide range of investment products, including stocks, investment trusts, Japanese government bonds, and foreign bonds. The firm actively publishes monthly and weekly investment reports and provides guidance for newcomers, ensuring investors have current information and analysis of the financial landscape to make informed decisions.

Regulated by the Japan Financial Services Agency (FSA) under license number Director General of the Finance Bureau of China (Jin Shang) No. 5, DAISENHINOMARU SECURITIES adheres rigorously to high standards of integrity and credibility in all its financial operations.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Limited Online Support |

| Long-standing Reputation | Complex Fee Structure |

| Educational Resources |

- Regulated by the FSA:DAISENHINOMARU SECURITIES is regulated by the Japan Financial Services Agency (FSA) ensuring adherence to stringent regulatory standards, providing a level of security and trust for investors.

- Long-standing Reputation: Established in 1957, bringing decades of experience in the financial services industry.

- Educational Resources: Provides seminars and educational events to help investors make informed decisions. Cons:

- Limited Online Support: DAISENHINOMARU SECURITIES lacks comprehensive online support options such as email, live chat, or social media customer service. This can be inconvenient for clients who prefer digital communication or require assistance outside of business hours.

- Complex Fee Structure: The company charges varying trading fees depending on the investment product and transaction size, which can confuse new investors.

- Stock and Equivalent Trading Fees

- New Corporate Bonds with Stock Acquisition Rights Trading Fees

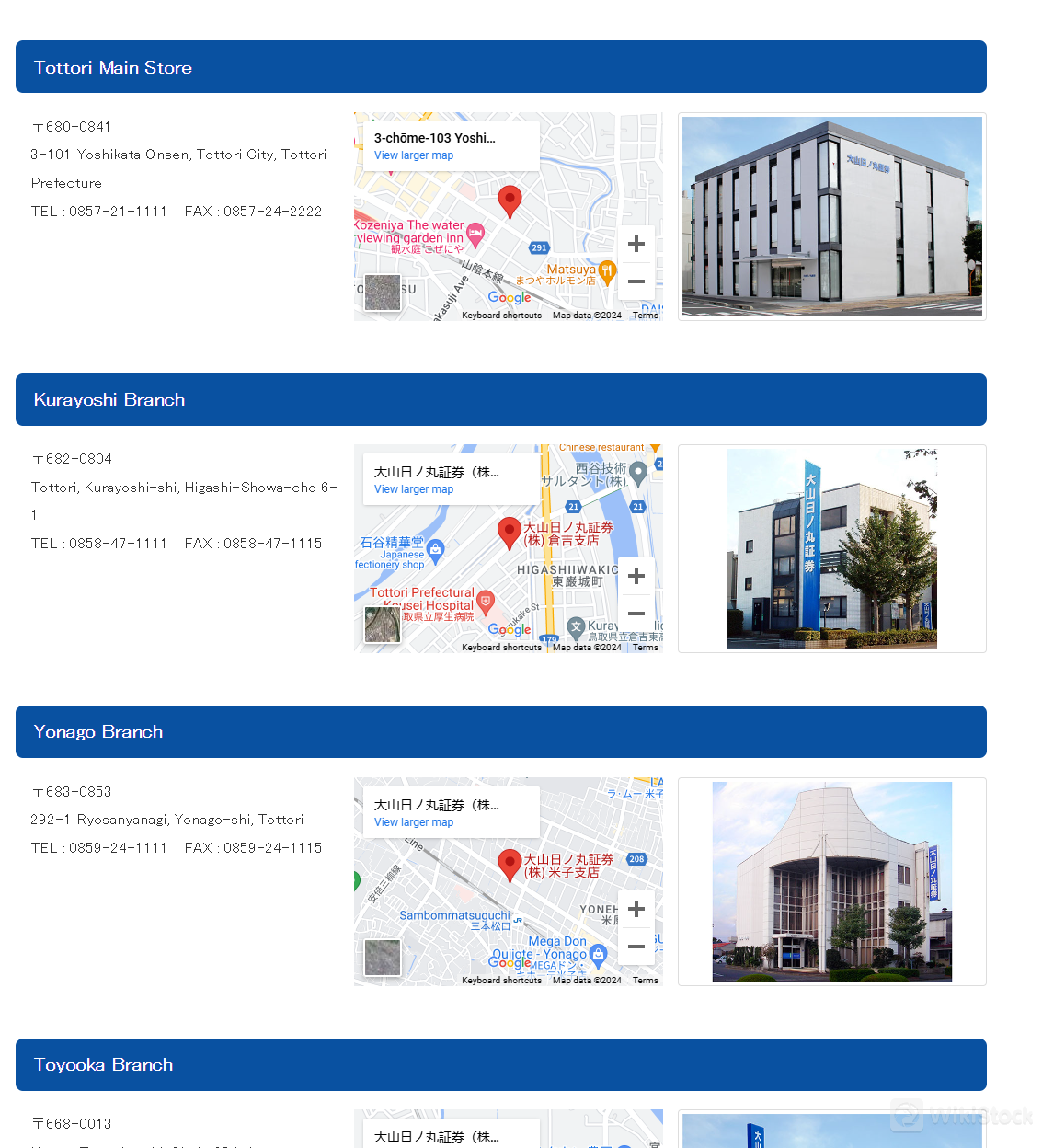

- Tottori head office: 〒680-0841, 3-101 Yoshikata Onsen, Tottori City, Tottori Prefecture

- Kurayoshi Branch: 〒682-0804, Tottori, Kurayoshi-shi, Higashi-Showa-cho 6-1

- Yonago Branch: 〒683-0853, 292-1 Ryosanyanagi, Yonago-shi, Tottori

- Toyooka Branch: 〒668-0013, Hyogo, Toyooka-shi, Chuin 634-1

- Kurashiki Branch: 〒710-0046, 1-4-5 Chuo, Kurashiki-shi, Okayama

- Is DAISENHINOMARU SECURITIES regulated by any financial authority?

- Yes, it operates under the regulatory oversight of the Japan Financial Services Agency (FSA), with license no. Director General of the Finance Bureau of China (Jin Shang) No. 5.

- What types of products does DAISENHINOMARU SECURITIES provide?

- Stocks, investment trusts, Japanese government bonds, and foreign bonds.

- Is DAISENHINOMARU SECURITIES suitable for beginners?

- Yes, it is well regulated by FSA and offers educational resources and guidance tailored for newcomers, helping them understand investment options and make informed decisions.

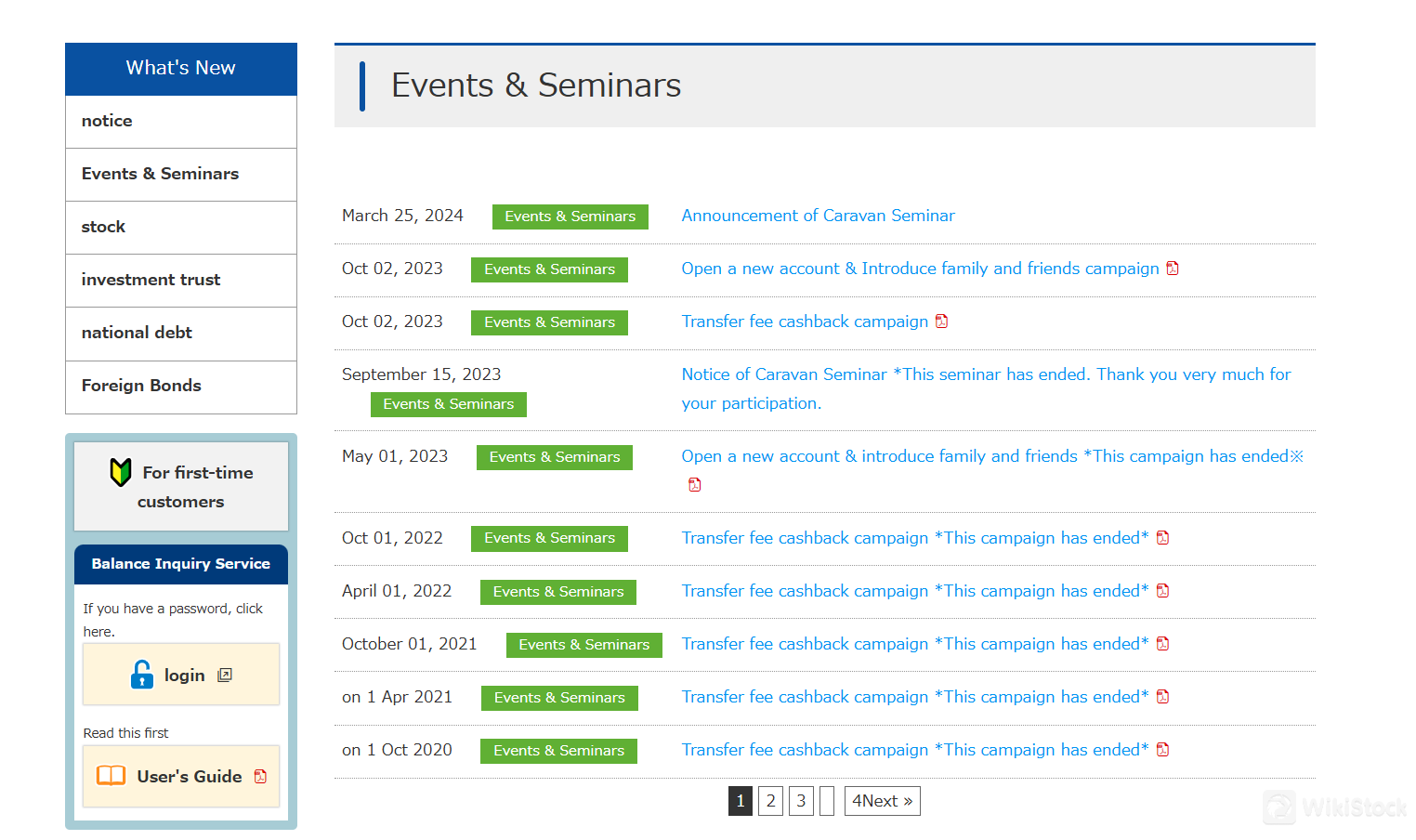

- Does DAISENHINOMARU SECURITIES provide seminars or events for investors?

- Yes, it organizes events and seminars periodically to educate clients about market trends, investment strategies, and product updates.

Is It Safe?

Regulation:

DAISENHINOMARU SECURITIES operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director General of the Finance Bureau of China (Jin Shang) No. 5, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores DAISENHINOMARU SECURITIES's commitment to integrity and credibility in its services.

Safety Measures:

So far, we have not found security measures of DAISENHINOMARU SECURITIES on their website. If you intend to trade with the company, seek for clarification about this to make sure your funds are protected before committing any actual capitals.

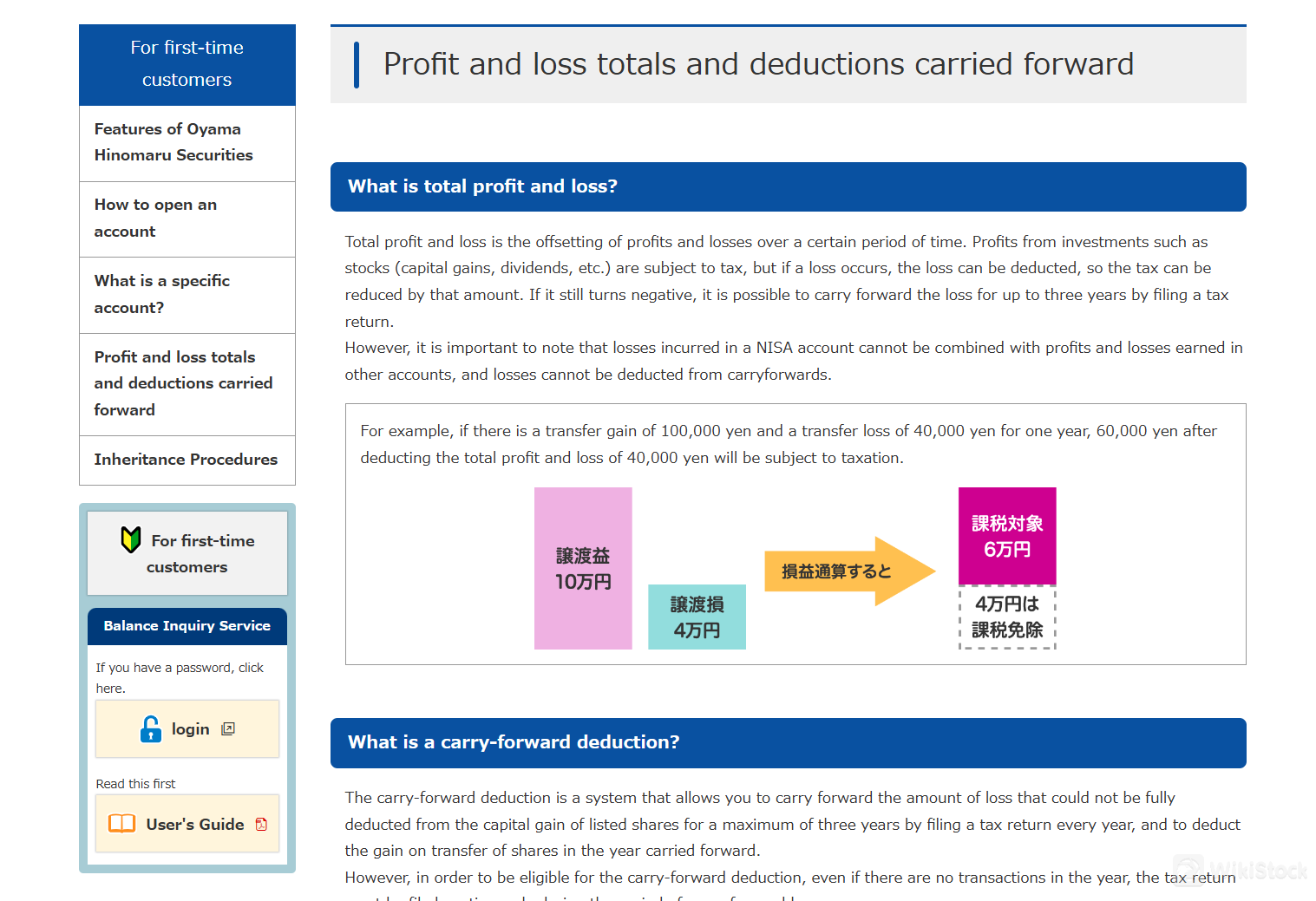

What are Securities to Trade with DAISENHINOMARU SECURITIES?

DAISENHINOMARU SECURITIES caters to a wide range of investment goals with their selection of stocks, investment trusts, government bonds, and foreign bonds.

If you're seeking direct ownership in companies and high returns, consider their individual stocks. They also offer investment trusts, a pooled investment vehicle in stocks, bonds, and real estate that provides diversification to manage risk.

For a safe and steady option, explore their government bonds, known for their reliability and guaranteed interest by the Japanese government. They even offer individual government bonds with a minimum guaranteed interest rate, purchasable in increments of 10,000 yen, making it accessible for everyone.

For those seeking higher yields, explore their foreign bonds, but you should be aware of currency exchange rate fluctuations.

Fees Review

DAISENHINOMARU SECURITIES offers transparent tiered fee structure for stock trading based on trading volume.

| Transaction Amount (JPY) | Commission Rate | Minimum Commission |

| Up to 1 million | 1.2100% + ¥0 | ¥2,750 |

| Over 1 million to 3 million | 0.8800% + ¥3,300 | ¥2,750 |

| Over 3 million to 5 million | 0.8250% + ¥4,950 | ¥2,750 |

| Over 5 million to 10 million | 0.6930% + ¥11,550 | ¥2,750 |

| Over 10 million to 30 million | 0.5720% + ¥23,650 | ¥2,750 |

| Over 30 million to 50 million | 0.2640% + ¥116,050 | ¥2,750 |

| Over 50 million | 0.0165% + ¥239,800 | ¥2,750 |

| Transaction Amount (JPY) | Commission Rate | Minimum Commission |

| Up to 500,000 | 1.1000% + ¥0 | ¥2,750 |

| Over 500,000 to 1 million | 0.9350% + ¥825 | ¥2,750 |

| Over 1 million to 5 million | 0.8800% + ¥1,375 | ¥2,750 |

| Over 5 million to 10 million | 0.7150% + ¥9,625 | ¥2,750 |

| Over 10 million to 30 million | 0.5170% + ¥29,425 | ¥2,750 |

| Over 30 million to 50 million | 0.3190% + ¥88,825 | ¥2,750 |

| Over 50 million | 0.1100% + ¥193,325 | ¥2,750 |

It's noteworthy that these fees are inclusive of tax and are subject to change, so you should always verify with DAISENHINOMARU SECURITIES for the most current rates when trading and learn details of trading fees for other products timely. These commission fees apply to transactions of stocks and new corporate bonds with stock acquisition rights.

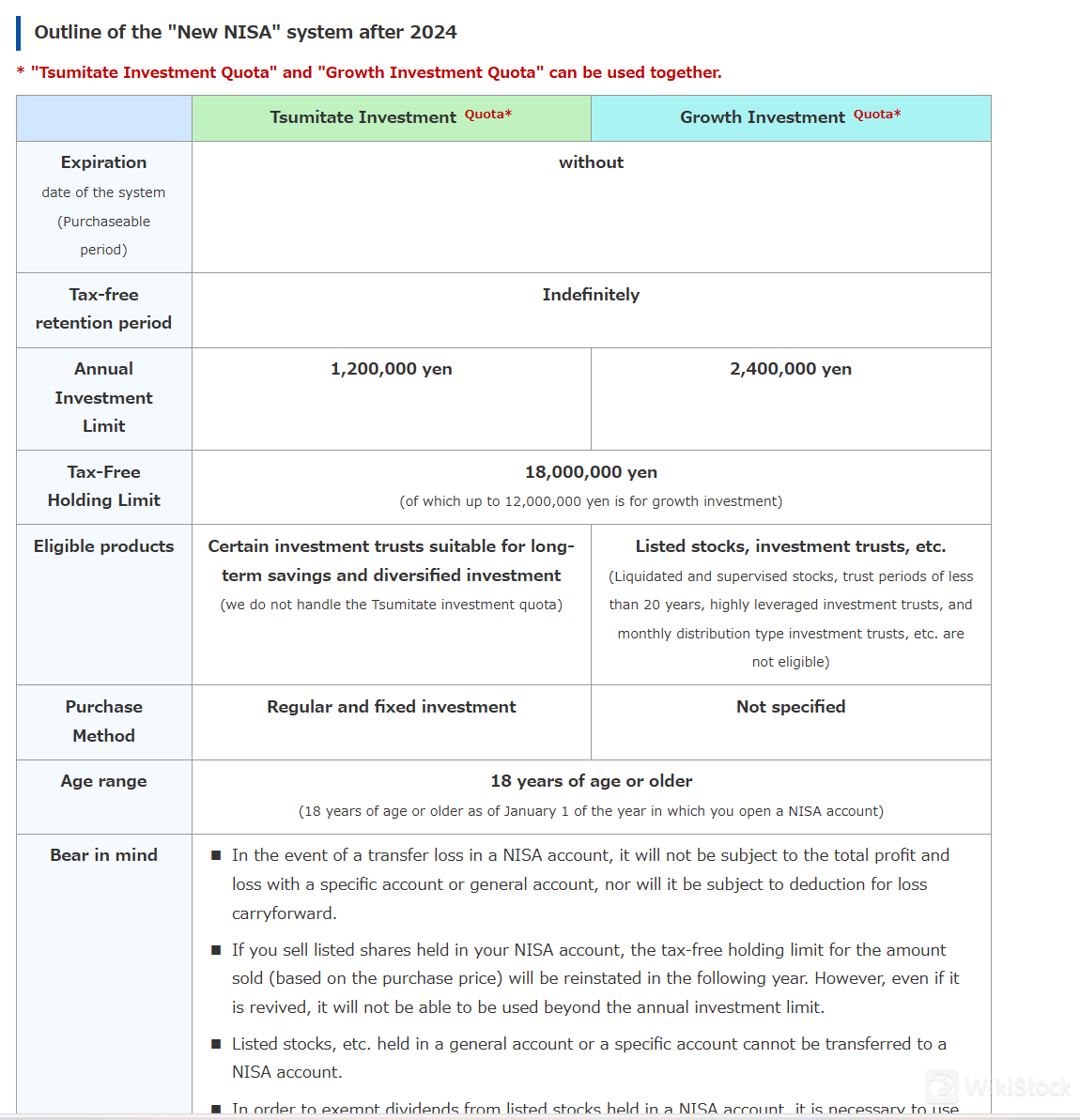

NISA System

DAISENHINOMARU SECURITIES offers the NISA (Nippon Individual Savings Account) system, a tax-efficient investment platform designed to help individuals build wealth through long-term savings and investments.

Introduced in 2014 and made permanent from 2024 onwards, NISA allows investors to hold certain investment products such as listed stocks and investment trusts with significant tax advantages. Under the revised system, investors can utilize both the “Tsumitate Investment Quota” and “Growth Investment Quota” simultaneously, with an annual investment limit of 2.4 million yen and a lifetime tax-free holding limit of up to 18 million yen, of which 12 million yen can be allocated to growth investments.

Profits, dividends, and distributions earned within a NISA account are exempt from taxes, providing a clear advantage over standard investment accounts.

Research & Education

DAISENHINOMARU SECURITIES provides robust research and educational resources tailored to support both seasoned investors and first-time customers.

Their comprehensive offerings include detailed market analysis, monthly investment reports, and seminars aimed at enhancing financial literacy and decision-making skills. Through events and seminars, the firm fosters a supportive environment for learning about stocks, investment trusts, government bonds, and foreign bonds

For first-time customers, they offer guidance on account opening procedures and the distinct features of specific accounts. Moreover, DAISENHINOMARU SECURITIES updates clients with the latest developments in inheritance proceduresand regulatory changes.

Customer Service

DAISENHINOMARU SECURITIES offers customer support through direct contact methods. They provide phone and physical address for inquiries and communication, including a central head office line and branch-specific contacts.

Additionally, they utilize fax services for document transmission, ensuring traditional but effective communication channels for their clients' needs.

Furthermore, FAQs on their website assist in addressing common queries efficiently.

TEL : 0857-21-1111; FAX : 0857-24-2222

TEL : 0858-47-1111FAX : 0858-47-1115

TEL : 0859-24-1111FAX : 0859-24-1115

TEL : 0796-22-1111FAX : 0796-29-1115

TEL : 086-425-1111FAX : 086-434-1115

Conclusion

DAISENHINOMARU SECURITIES, with its extensive history since 1957, provides a diverse array of investment options such as stocks, investment trusts, government bonds and foreign bonds, fostering a comprehensive approach to wealth management.

Regulated by the Japan Financial Services Agency, it assures investors of adherence to strict financial standards. With such a commitment to integrity and a wide range of financial products, DAISENHINOMARU SECURITIES remains a favorable choice for investors seeking reliable and trustworthy investment opportunities.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

15-20 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

静銀ティーエム証券

Score

丸近證券

Score

光世証券

Score

第四北越証券

Score

ニュース証券

Score

百五証券

Score

山形證券

Score

Tachibana Securities Co., Ltd.

Score

北洋証券

Score

リテラ・クレア証券株式会社

Score